Transcription

CUNA2016 AWARD WINNERS// DESJARDINSADULT AND YOUTH FINANCIALEDUCATION AWARD// D ORA MAXWELLSOCIAL RESPONSIBILITYRECOGNITION AWARD// L OUISE HERRINGPHILOSOPHY-IN-ACTION AWARDiStock

2CUNAAWARDWINNERS

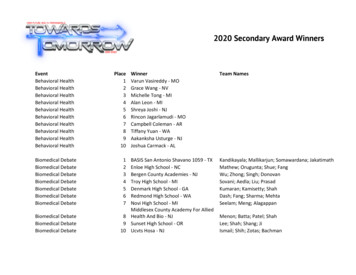

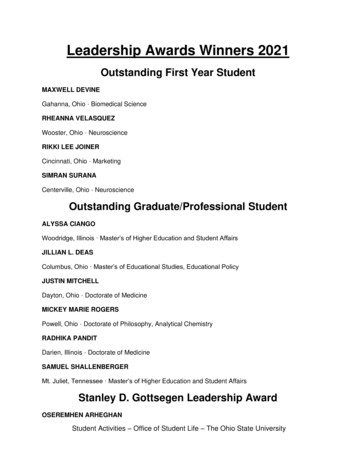

CUNA2016 AWARD WINNERSDESJARDINSDESJARDINSD O R A MAXW EL LLOUISE HERRINGAdult FinancialEducation AwardYouth FinancialEducation AwardSocial ResponsibilityRecognition AwardPhilosophy-in-ActionAwardLess than 50 millionLess than 50 millionLess than 50 millionLess than 50 millionFirst PlaceCommunity CULewiston, MaineFirst placeCommunity CULewiston, MaineFirst placeCommunity CULewiston, MaineFirst placeNueva Esperanza Community CUToledo, OhioSecond placeNorth Star CUCook, Minn.Second placeWashtenaw FCUYpsilanti, Mich.Second placeCommunity CULewiston, MaineHonorable mentionTallahassee-Leon FCUTallahassee, Fla.Honorable mentionLion’s Share FCUSalisbury, N.C. 50 million to 250 million 50 million to 250 million 50 million to 250 millionFirst place (tie)CORE FCUEast Syracuse, N.Y.First placeAppalachian Community FCUGray, Tenn.First placeUnited CUMexico, Mo.Second placePoint West CUPortland, Ore.Second placeMembers Choice Financial FCUDanville, Pa. 250 million to 1 billion 50 million to 250 millionFirst placeCarolina Foothills FCUSpartanburg, S.C.Second placeElectro Savings CUSt. LouisHonorable mentionUnited Educators CUApple Valley, Minn. 250 million to 1 billionFirst placeFinancial Center First CUIndianapolisSecond placeFirst Commerce CUTallahassee, Fla.Honorable mentionTown and Country FCUScarborough, MaineMore than 1 billionFirst placeFirefly CUBurnsville, Minn.Second placePSECUHarrisburg, Pa.Honorable mentionMunicipal CUNew York, N.Y.ChapterRocky Mountain Chapter of CUsColoradoFirst place (tie)DOCO CUAlbany, Ga.Second placeEducation CUAmarillo, TexasHonorable mentionVirginia Educators CUNewport News, Va. 250 million to 1 billionFirst placeCommonWealth One FCUAlexandria, Va.Second placeIdeal CUWoodbury, Minn.More than 1 billionFirst placeAltra FCUOnalaska, Wis.Second placeTeachers CUSouth Bend, Ind.Honorable mentionWEOKIE CUOklahoma CityBECUTukwila, Wash.Honorable mentionSoutheastern CUValdosta, Ga.First placeEducational Systems FCUGreenbelt, Md. 250 million to 1 billionSecond placeRio Grande CUAlbuquerque, N.M.First placeSan Mateo CURedwood City, Calif.Honorable mentionFreedom First FCURoanoke, Va.Second placeSPIRE CUFalcon Heights, Minn.More than 1 billionFirst placeAssociated CUNorcross, Ga.Honorable mentionPoint Breeze CUHunt Valley, Md.More than 1 billionSecond placeRoyal CUEau Claire, Wis.First placeHanscom FCUHanscom AFB, Mass.Honorable mentionBECUTukwila, Wash.Second placeAmerican Heritage CUPhiladelphiaHonorable mentionGeorgia United CUDuluth, Ga.LeagueMaine CU LeagueWestbrook, MaineCUNAAWARDWINNERS3

FROM THE CHAIROn behalf of the CUNA Awards Committee, I would like to congratulateall of the 2016 CUNA Award winners. We had an impressive number ofsubmissions this year, and the quality of the ideas and projects creditunions have put in place in their communities once again impressedthe committee.When you read this awards program, you’ll learn all about the amazinginitiatives credit unions across the country are implementing to spreadfinancial literacy, increase social responsibility, and demonstrate thecredit union philosophy of “people helping people.”Please join the committee in congratulating this year’s winners, enjoyyour time at the 2017 CUNA Governmental Affairs Conference, andremember: It’s never too early to start thinking about submitting yourown entry for this year.Winona Nava, CCUE, ICUDEAwards Committee ChairPresident/CEOGuadalupe CU, Santa Fe, N.M.4CUNAAWARDWINNERS

AWARDS COMMITTEE MEMBERSWinona Nava—Guadalupe CU, ChairElisabeth Hadler—Great Basin FCUSandy Lingerfelt—Clinchfield FCU, Vice ChairChristine Haley—PostCity Financial CULisa Brown—Tallahassee-Leon FCUCarla Hedrick—Denver Community CUShirley Cate—Providence FCUSandy Smith—Texas FCUKathy Chartier—Members CUMichael Tobler—Albany Firemen’s FCUSuzanne Chism—Texas Health Resources CUDavid Whitehead—Merck Sharp & Dohme FCUJohn DiNofrio—Jersey Shore FCUJim Yates—First Educational FCUSally Dischler—Heartland CUPaula Nihoff—HealthCare First CUJohn Graham—Kentucky ECUCUNAAWARDWINNERS5

DESJARDINSADULT AND YOUTH FINANCIAL EDUCATION AWARD WINNERSThe Desjardins Adult and Youth Financial Education Award programs recognizeleadership within the credit union movement on behalf of financial literacy for membersand nonmembers of all ages. The award, named after credit union pioneer AlphonseDesjardins, emphasizes the movement’s long-time commitment to financial education.A DULT C ATE GORYLess than 50 million in assetsFirst Place: Community CU IsGo-To Financial Literacy ResourceCommunity Credit Union in Lewiston,Maine, is the area’s resource for financialliteracy.The credit union has partnered withthe Chamber of Commerce, libraries,and educational institutions—and usessocial media and special events—toprovide information and education ona variety of consumer and personalfinance topics. In addition, the creditunion has three CUNA-certified financial counselors on staff to meet oneon-one with members and to providecommunity instruction.Community dedicates a large portionof its social media presence on Facebookand Twitter to financial literacy for adults.The credit union provides a daily financialtip on a wide range of topics—includingbudgeting, car buying and leasing, andinexpensive family fun options—and postslinks to articles, tips, and infographics.In the 2013-14 school year, Community opened The Parent Resource Centerwithin its adopted school, WashburnElementary, upon learning that 40% ofstudents’ parents are illiterate and 80%are unemployed. The Center, funded withassistance from an Office of Small CreditUnions Initiatives grant, offers a computer with online access for parents toapply for jobs, create a résumé, completefinancial literacy training, and more. TheCenter also offers a selection of financialeducation materials for checkout.In 2015, the credit union participatedin “Open Door Wednesdays,” invitingparents to experience school with theirstudents. The program aims to overcomethe negative stigma some adults associate with school. During Open Door6CUNAAWARDWINNERSWednesdays, the credit union conducteda financial literacy session and highlighted the availability of the Center.Community’s three certified financial counselors continue to help adults“Refresh” their finances. The “Refresh”program provides one-on-one personalized instruction for members on budgeting, credit report review, and financialsituation analysis, as well as financialgoal-setting and achievement. The counselors also provide a Keys to FinancialSuccess program to area organizations.The credit union can tailor the presentation to meet the needs of a specificCommunity CU’s three certified financialcounselors work with adults to “Refresh”their finances by providing one-on-one,personalized instruction for members onbudgeting, credit report review, and financialsituation analysis, as well as financial goalsetting and achievement.audience, from highlighting the basics—such as walking through financial instruments, including checks and debit andcredit cards—to an in-depth look atcredit scores: how they’re determined,how members can improve their scores,and how the score impacts a consumer’sability to obtain financing.Community also established a partnership with the New England Collegeof Business that allows credit unionmembers and staff to take discountedonline college courses on a variety oftopics. The credit union maintains itspartnership with Central Maine Community College, where every first-yearstudent must attend a financial literacysession taught by credit union staff. 50 million to 250 million in assetsFirst Place: Through CarolinaFoothills FCU, Latinos AchieveFinancial LiteracyA conversation with the Spartanburg(S.C.) Hispanic Alliance revealed a partnership opportunity for Carolina Foothills Federal with Arcadia ElementarySchool, which developed a program totransition Latino students and their parents to South Carolina’s public schools.Of the 458 children attending Arcadia,75% identify themselves as Hispanic ormultiracial, and 90% are eligible for subsidized lunches.To meet the needs of the Latino community, the school created the ArcadiaAdult Learning Center. More than 200adults enrolled for classes that meet twonights per week. As a subgroup of theAdult Learning Center, the school started Esperanza or H.O.P.E. (Hands-OnParent Engagement).As a result of meetings with the Hispanic Alliance, the credit union enrolled anew member from the Latino community who became the “bridge” betweenEsperanza and the credit union. Thenew member had offered to presenteducational sessions on parenting for theLearning Center, and asked if the creditunion would provide some financial literacy instruction—in Spanish.Twice per year, participants attendedthe two-hour classes every Wednes-

ADULT CAT EGORY 50 million to 250 million in assetsCarolina Foothills FCU created a workshop for Latinas at Arcadia Elementary, with thesole intention of offering educational outreach and no expectations about recruiting newmembers. But after the first presentation, attendees insisted they be allowed to join theCU and sign up their children, too.day for a six- to eight-week period.Women of all ages attended—manywith infants in arms.Carolina Foothills Federal soonrecognized it could have the mostimpact with this group. The creditunion learned that many Latinasbelieve they can’t contribute to theirfamily’s financial stability, and theydesperately want their children tolearn to save.Initially, people in the communityasked Carolina Foothills Federal toprovide one, or possibly two, presentations on credit-related topics. Butafter further deliberation, the creditunion scheduled six weekly sessions,creating a workshop for Latinas atArcadia Elementary.The planned sessions included:// What is a credit union?;// Banking basics;// Budgeting;// Understanding credit;// Mortgages; and// A closing session that tied togetherthe earlier topics.The Latinas had so many questionsregarding the basics that CarolinaFoothills Federal opted to discuss thattopic over two sessions, and postponethe conversation about mortgages. Thecredit union plans to add a seventhsession in the next cycle to addressmortgages.Twenty women attended eachweek. The credit union aimed onlyto offer educational outreach, withno expectations about recruiting newmembers. But after the first presentation, the attendees insisted they beallowed to join Carolina FoothillsFederal and sign up their children,too. The credit union asked the women to bring required informationafter the last session and graduationcelebration so it could open accountsat that time.Second Place: Electro SavingsCU, St. LouisKnowledge is power, and Electro Savings Credit Union uses a number oftools and programs to improve thefinancial knowledge and well-being ofmembers—especially those who mightfall prey to predatory lenders.Greenpath University, a free, secure,online tool, allows members to assessfinances, evaluate budgets, and understand the use of credit. Through bothonline and in-person sessions, members receive education and counselingon the long-term dangers of paydaylending and its impacts on creditworthiness.Certified financial counselorsinstruct members how to pay off existing payday loans and look for ways torestructure debt and improve financialsituations.The credit union’s Bridge to Prosperity loan program provides membersliving in poverty with credit buildingoptions, payday lending alternatives,and auto loans.Honorable Mention:United Educators CU,Apple Valley, Minn.United Educators Credit Unionfocused its financial literacy efforts ontwo vulnerable population segments:senior citizens and young adults withlearning disabilities.The credit union collaborated withthe Minnesota Department of Commerce and Lutheran Social Services tohost “Senior Fraud—Stopping Scamsand Staying Safe.” The event was sowell-received, the credit union wasasked to work with local law enforcement officials to share the informationwith the general public.The credit union also partneredwith Minnesota Life College—a schooldevoted to helping post-high schoolstudents learn independent livingskills—to teach various financial literacy topics. These included identity theft,budgeting, credit cards, and “What is acredit union?”CUNAAWARDWINNERS7

DESJARDINSADULT AND YOUTH FINANCIAL EDUCATION AWARD WINNERS 250 million to 1 billion in assetsFirst Place: Financial Center FirstCU’s Outreach Fills Knowledge GapResearch indicates a majority of Americans can’t answer basic financialquestions about interest calculations,mortgage payments, and investments.Meantime, financial options grow morecomplex and diverse.Financial Center First Credit Unionstrives to bridge the knowledge gap.The Indianapolis credit union believesthat although consumers can easily findfinancial concepts and budgeting toolsonline, personal interaction providesthe meaningful application of thosetools to an individual’s financial circumstances.To make that happen, Financial CenterFirst employs two full-time staff membersto lead its financial education efforts,with a goal of reaching as many peopleas possible.The credit union’s member seminarsattract an average attendance of 25 people, with more than 450 attendees thisyear. The seminars also generate one-onone appointment requests and insuranceor investment referrals.To encourage good financial management habits, the credit union offers a 50incentive to members who attend moreFinancial Center First CU holds weeklyseminars in cooperation with the MexicanConsulate to introduce immigrants to the U.S.banking system, and cite the documentationneeded to obtain an account and beginbuilding a credit rating.than three seminars.Financial Center First’s public outreachefforts include connecting with community centers and other not-for-profit organizations, churches, and schools, HealthSavings Act business partners, and immigrants in Indiana.The credit union has relationships withcredit union professionals teach theworkshops. The credit union’s MyWaySecond Place: First CommerceChecking program for 18- to 29-yearJamesDavidsonwithCU, Tallahassee, Fla.includes a savings incentive feature:Congressman Andre oldsCarsonTo celebrate its 75th anniversary in 2015,Each debit card transaction is roundedFirst Commerce Credit Union launched aup to the nearest dollar, with the fundsnonprofit foundation to take its financialtransferred into a high-earning savingsliteracy efforts to the next level.account.Its first major initiative was a series ofHonorable Mention: Town andSmartMoney workshops targeting areaCountry FCU, Scarborough, Mainecollege students. First Commerce nowreaches nearly every institution of higherTown and Country Federal Creditlearning in its 23-county field of memberUnion sponsored a half-day Moneyship with financial education sessions.Conference to the southern Maine comTo ensure the audience of youngmunity.adults will relate to the material, youngThe keynote speaker was Jean Chatzky, 250 million to 1 billion in assets8CUNAAWARDWINNERSMarco Dominguez speaking tothe MexicanConsulatemore than 50 communityorganizations,reaching nearly 2,800 adults with a widevariety of financial education programs.Programs include:// Wealth Builder seminars (an averageof two per month on various financialtopics);// Lunchtime seminars at local busi-financial editor for the “Today” show. Tomake her presentation even more relevant,prior to the conference Chatzky workedwith two members on their financial challenges and presented their stories duringher session.The conference included seven breakouts on topics such as budgeting, credit,car buying, saving, retirement, and estateplanning, and created an exhibit areawith local financial resources.In 2015, Town and Country Federalalso introduced SavvyMoney, an onlinemoney management tool designed tohelp people gain knowledge and improvetheir financial skills.

nesses on basic financial concepts suchas budgeting, understanding credit, andbuying a home; and// Budgeting and credit building workshops for domestic violence shelters,churches, and other organizations.The credit union recently broadenedits seminar topic offerings to includeunderstanding health care options, estateplanning, and fraud protection.Financial Center First reaches out tothe Latino community through participation in numerous events.It holds weekly seminars in cooperation with the Mexican Consulate tointroduce immigrants to the U.S. banking system and cite the documentationneeded to obtain an account and beginto build a credit rating. The seminarsat the Consulate reach 50 to 200 peopleeach week.The credit union recently added aneducation outreach emphasis on helpingpeople transition from homelessness toindependence. That targeted outreachstarted with a partnership with Prevail,an organization assisting domestic abusesurvivors. Financial Center First providedfinancial literacy seminars and one-onone counseling, reaching more than 100of Prevail’s clients.The program often coaches individuals to rework their debt and to put intoMore than 1 billion in assetsSecond Place: PSECU,Harrisburg, Pa.Pennsylvania State Employees CreditUnion (PSECU) developed its financialliteracy program, WalletWorks, in-houseto ensure the materials directly meet thespecific needs of the organizations, selectemployee groups, and campuses withwhich it works.In 2015, the credit union looked forways to supplement its classroom-styleeducational efforts to engage individualsin interactive events or informal ways.PSECU integrated financial litera-In addition to teaching personal finance through its Learn at Work program, Firefly CUprovides health and wellness education through an exercise program, which one of itspartner companies requested. Between exercises, staff offer financial wellness tips.practice basic budgeting skills. The creditunion now works with 11 domestic violence shelters.More than 1 billion in assetsFirst Place: Firefly CU OverhaulsIts Learn at Work ProgramTo ensure its Learn at Work initiativeaddresses changing demographics andcurrent personal finance issues, the Burnsville, Minn.-based Firefly Credit Unionconducted a comprehensive overhaul ofthe program.cy into social media, creating weekly“Financial Friday” posts on Facebookand/or Twitter, and piloted interactivefinancial literacy games such as “BetYour Assets” and “Team Trivia.”PSECU launched “Dough,” a newsletteroffering practical financial tips such asaffordable recipes, ways to save moneyat work, and how to avoid scams.Honorable Mention: MunicipalCU, New York, N.Y.The credit union offers a Financially Fiteducational seminar series as a free service to its select employee groups, members, and community audiences.Refurbishing and reintroducing Firefly’s Learn at Work program (created in2001 to bring financial education to theworkplace for employees’ convenience)solidified existing relationships withemployer groups, drove new partnerships, and allowed Firefly to educatemore members than ever before.The program offers free courses onmany personal finance topics. The recentprogram redesign makes the topics moreinteresting, engaging, and relevant totarget segments, such as millennials.Municipal tailors the presentationsto each audience and makes the sessions as relevant as possible by usingworksheets, situational analysis, andtakeaway materials, and encouragingattendees to actively participate.The credit union provides opportunities for personal consultations foranyone who attends a Financially Fitseminar. Topics include credit scores,basic budgeting skills, and identitytheft. Municipal also emphasizes theimportance of saving, providing aworksheet that demonstrates how evensmall amounts saved each pay periodcan add up.CUNAAWARDWINNERS9

DESJARDINSADUL

Nueva Esperanza Community CU. 4 CUNA AWARD WINNERS FROM THE CHAIR . nership with the New England College of Business that allows credit union . Esperanza and the credit union. The new member had offered to present educational sessions on parenting for