Transcription

November 2014SunGard’sHedge360:Meeting the institutionalchallengeManaged servicesRisk reportingBank debt

SunGard’s Hedge360Meeting the institutionalchallengeBy James WilliamsSunGard’s Hedge360, a cloud-based platformthat launched in 2012, puts the power ofinstitutional-grade controls firmly in the handsof hedge fund managers as they strive toachieve institutional-grade credibility. Theplatform supports the full lifecycle of a fund’sactivities front through back, seamlesslyintegrating its full range of solutions fromFront Arena, VPM, InvesTier through to riskmanagement via APT.Aside from the technology capabilitiesof Hedge360, which managers can availof either as an installed or hosted option,what is really driving uptake in the platform– largely because of institutional demand –is the managed services component. Thisallows firms to outsource their middle andback-office functions.In many respects, the concept of‘managed services’ is a sleeping giant thathas only recently awoken. As operationaland regulatory costs continue to rise,however, the need to better streamline theirbusinesses is something that managers willlikely focus on more intently.“We provide the technology, the software,the infrastructure and also the peoplewho understand the hedge fund market,”stresses SunGard’s Hedge360 COO DaeKim. “The idea of someone coming outHedgeweek Special Report Nov 2014of an Investment Management firm andrunning everything through MicrosoftExcel spreadsheets no longer holds water.You are seeing a high level of regulatoryrequirements being applied to hedge funds,a high degree of investor due diligence.Investors are no longer just looking at amanager’s investment thesis. Now, it’simportant to see that the manager has theinfrastructure to support scalability, that thereis a disaster recovery plan in place, that thirdparty administrators have been appointed tocheck the numbers.“A lot of hedge fund managers noware even looking to outsource their middleoffice functions. That means there aretwo independent sets of eyes reviewing ahedge fund’s business. When you see thesechanges taking place, you realise that theindustry is maturing. It’s the exact sameprocess that the mutual fund industry wentthrough 20, 25 years ago.”In a report published in January by AiteGroup entitled Hedge Fund Trends andChallenges: Achieving Institutional Credibility,over half of respondents said that theywere considering or intending to outsourceoperations over the next three years to helpthem focus on their core strengths (seefigure 1).www.hedgeweek.com 2

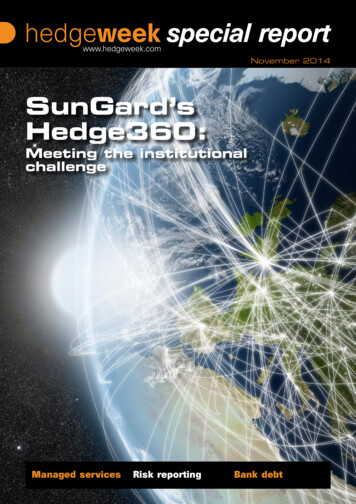

SunGard’s Hedge360Figure 1: What is the likelihood that your firm willoutsource your investment management to a third-partyvendor over the next three years?Not likely – 49%Likely – 23%Not sure, but underconsideration – 28%Source: Aite Group – Hedge Fund Trends and Challenges: Achieving Institutional CredibilityThere are two other drivers at work for theadoption of managed services: namely, theneed for more sophisticated risk reportingand the ability to access and effectively tradenew asset classes. Both tie in to the samenarrative of institutionalisation.“Hedge funds need to demonstrateinstitutional-grade standards to attract newmoney and grow and that’s being reinforcedwith every conversation we have,” saysDr Laurence Wormald, COO and head ofresearch, SunGard’s APT business. “They arealso moving into new areas such as bank debtto find higher yield opportunities. This requiresthem to think about whether they have thenecessary infrastructure and expertise in place,particularly when facing the regulators.“All of a manager’s technology and riskmanagement processes and resources needto be correctly aligned.”Reputation risk is now at the forefront ofthe minds of senior management within hedgefund firms. It’s not just about complying, “it’sabout having the right systems in place toadopt best practices because that’s whatinvestors want to see,” adds Wormald.Risk reporting has always been asignificant challenge for managers but thestakes today are higher than ever: regulatorsand investors alike want transparency andgranularity. That’s not easy if a managerdecides to launch multiple fund structures –offshore and onshore funds, UCITS, managedaccounts, etc. – and/or new fund strategies toharvest alternative sources of alpha.“It isn’t just about analytics and writingalgorithms. You’ve got to create engineereddata like volatilities, discount curves; itHedgeweek Special Report Nov 2014becomes an institutional-level problem toget your risk reports credible and intuitiveat the same time. That’s why managers aretaking a deep breath when diversifying theirstrategies because they need to ensure thatthey’ve got the risk reporting right,” saysWormald. “The problem of marshalling andanalysing the data needed for risk reportingis an exponentially rising one.”Scott Alintoff, COO of SunGard’s VPMsolution notes that one of the interestingdevelopments taking place today is the“commercialisation” of hedge funds.Increasingly, the media refers to wideradoption of liquid alternatives (’40 Act funds),of ETFs, of ways to hedge without needinghedge funds.“This puts pressure on hedge fundsbecause if the average investor thinks theyget exposure to hedge funds by buyingan ETF, for example, that’s a problem formanagers charging 2 and 20. They needto demonstrate that what investors aregetting on the traditional hedge fund sideis better than on the liquid alternative side.They need to be unique, to get into differentasset classes. At a macro level, thesekind of pressures are affecting hedge fundmanagers today,” comments Alintoff.Fee compression is a big driver of adoptionfor platforms like Hedge360, especiallyamong smaller and mid-sized managers. It’sa win-win situation: managers achieve aninstitutional infrastructure and at the sametime reduce their operating costs. This thengives them the confidence to diversify intonew asset classes such as bank debt.“Eight years ago they made up a small sliceof the hedge fund world. Now it seems likealmost everyone, to some degree, is tradingbank debt. Hedge funds are increasinglywilling to step in and take distressed loans offbanks and we give those managers everythingthey need from trading the loans to settlingthe loans. It makes it operationally appealing,knowing that managers have a platform thatis robust enough to help them manage thisasset class,” says Alintoff.In order to attract investment dollars,access new asset classes and meetthe regulatory risk reporting challenges,platforms such as Hedge360 are playing anincreasingly prominent role in helping hedgefunds achieve institutional credibility. nwww.hedgeweek.com 3

SunGard’s Hedge360SunGard’s Hedge360:Managed servicesEY (Ernst & Young) last year publishedan operational efficiency survey and in it,they found that 40 per cent of respondentshad already outsourced their middle officefunctions (26 per cent), or planned to overthe next two years (14 per cent). Asidefrom the cost benefits, managers haveto demonstrate that their operations areinstitutional-grade quality. Investors nowascribe the same level of importance to amanager’s operational infrastructure as theydo the investment thesis and track record.This is driving managers towards theadoption of managed services. One ofthe primary reasons for doing so is theregulatory environment managers must nowoperate in.Managers have to report under a swatheof regulations ranging from Dodd-Frankand CPO-PQR in the US, FATCA, AIFMDand EMIR in Europe, not to mention dailyshort selling reports to the Hong Kongfinancial regulator, the SFC, for thosemanagers trading Hang Seng stocks. Suchis the complexity of data management andaggregation to file these reports, it makesincreasing sense to rely on specialists whohave the solutions and knowledge in placeto cope in this new regulatory environment.“The in-built cost efficiency of usingmanaged services, and the fact that ourteam has exposure to so many strategiesand asset classes, means that hedgefund managers can rely on our extensiveexpertise to significantly improve theiroperations.“Consequently, we see more interestamong managers to outsource their middleoffice services. If I were an investor puttingmoney with a hedge fund manager not onlydo I have prime brokers and administratorslooking over the manager’s shoulder, now Ihave someone else taking care of the middleoffice. That makes the manager a far moreappealing proposition,” comments Dae Kim.Hedgeweek Special Report Nov 2014Dae Kim, COO of SunGard’sHedge360 businessAnother reason, as managers look tocontrol costs, is to use the appointedservice provider as an extension of theiroperations team. Take a small to mid-sizedhedge fund, they may have a COO and CFOwith a small team and this could potentiallyexpose themselves to ‘key man’ risk, if theoperational staff for example, were to leavethe firm. Managed services mitigates thisrisk by having the necessary resources andhedge funds’ expertise for a manager todraw upon, as and when needed.The ability to rely upon an outsourcedmiddle office team that is part of a fullycertified industrial-strength infrastructure,Hedge360, certainly puts the manager ina positive light. Outsourcing middle officefunctions to meet regulatory and investorreporting demands is a logical step and atrend that Kim expects to see grow.“We provide managed services fortechnology infrastructure, managed servicesfor middle office outsourcing, managedservices for risk reporting and we willcontinue to add more,” confirms Kim.One of the major appeals of managedservices is that hedge fund managers canbenefit from economies of scale. A firm likeSunGard has huge numbers of experiencedprofessionals that know how to interpretdata across different strategies and useSunGard’s hedge fund software effectively.Why would a manager want to burdenthemselves with expanding their operationsteam when they can use a specialist?“If you consider a client who choosesto use Hedge360 internally, just the traininginvolved in running the operation and beingproficient is a large undertaking. To becomean expert in using all the different softwarewould take months. When it’s outsourced,there is no training. The middle office peoplewe have on our staff are experts at usingSunGard software.“This is why hedge fund managers arewww.hedgeweek.com 4

SunGard’s Hedge360starting to ask themselves, ‘Why are wedoing this?’ It adds no value to their firm.Investing is the only reason they get paid.These guys are top of the food chain whenit comes to trading markets but they’re notoperations experts,” says Kim.Managed services, and what it means,tends to differ depending on the size ofthe manager and where they are in theirlife cycle.A hedge fund that’s been in business forfive or 10 years and managing more thanUSD5bn will have already built out a largeproportion of their operational framework.Consequently, these clients tend to requiremore technology-based managed servicessays Kim: “Where we handle technologyintegration, we handle their hostingrequirements by running a data centreon their behalf; for example, technologyoutsourcing is much more appealing tolarger established managers.”Middle market managers, thoserunning between USD1-5bn of assets,will have operations and technology staffbut recognise that in order to get to thenext stage of growth they need to createscale. Areas such as system redundancyneed to be addressed. “From a costefficiency perspective, they are lookingfor an outsourced provider who can domiddle office processing and technologyoutsourcing.“Start-up and emerging managers wantthe least amount of operational headaches.They are willing to consider a total managedservices offering where we take care ofeverything operationally, leaving them tofocus purely on the investment strategy,”explains Kim.Another benefit to using managedservices, especially for start-up managers,is time to market. The idea of having to hireand train operations staff is less palatablethan going directly to an outsourced providerwho already has all the controls andprocedures in place.One point that Kim likes to remind theHedge360 team is that the environment theyare trying to create should mirror the type ofinstitutions that managers have spun out of,i.e. Goldman Sachs or Morgan Stanley, whereIT and Operations teams are at their beckand call and the resources are first class.Hedgeweek Special Report Nov 2014“They need to feel like we have everythingfor them, that we can fully support theirneeds. That’s been a big factor for us withour managed services offering and that’swhy middle office outsourcing has becomeso important to us.“Five years ago, a manager asking forSSAE 16 certification for infrastructurenever happened, now it’s becoming thenorm. They want certification for our datacentres to provide to their institutionalinvestors because without those independentcertifications they won’t invest as theoperational risks are perceived to betoo high.“The same outsourcing trend that we sawwith technology and hosting a manager’sdata centre is now being applied to themiddle office,” says Kim.In that sense, managed services ishelping managers achieve institutionalcredibility. nwww.hedgeweek.com 5

SunGard’s Hedge360SunGard’s Hedge360:Risk reportingHedge360’s Risk Reporting Service, as partof the platform’s managed service offering,equips managers with the tools needed tomanage and effectively report risk to aninstitutional standard.Laurence Wormald identifies this growinglevel of institutionalisation, coupled withregulatory requirements, which under AIFMDin Europe are akin to the UCITS regime,as two primary drivers for enhanced riskmanagement.“Hedge fund managers essentially need tomirror the same levels of risk managementthat institutional managers have been doingfor many years. We’re very familiar with that.SunGard has over 175 institutional clientsusing our risk solution; we know whatinstitutions want. We can provide a reallyserious level of risk reporting to satisfy thedemands of institutional investors.“With respect to regulation, we haveextensive experience in what is required toproduce a risk report for a UCITS fund. Forany hedge fund that is thinking about movingonshore to become regulated as an AIFM,we know exactly what needs to be done,”says Wormald.Until recently, hedge fund managersregarded risk management as a secondaryexercise. But as the nature of investors post2008 has changed a far more disciplinedapproach to risk management has evolved.Indeed, such are the risks to non-complianceunder regulation that no manager can leavethemselves exposed to a catastrophicdrawdown. Staying on top of volatility, VaR,liquidity and collateral limits are vital.“Investors want more regular risk reportsto get real insights into a manager’sstrategy. They want to understand the risksassociated with it,” says Wormald. “Thishas forced everyone to up their game toreport on risk across the board: market risk,liquidity risk, counterparty risk, regulatory riskand so on.Hedgeweek Special Report Nov 2014Dr Laurence Wormald,COO and head of research,SunGard’s APT business“Hedge360 has always had a strong riskcapability but in the last couple of years it’sbeen adopted with real enthusiasm by ourclients.”To illustrate just how much risk reportinghas changed, Atreaus Capital LP, a NewYork-based global macro manager, startedto use the Hedge360 Risk Reporting Serviceto be able to deliver fully customised riskreports to their investors on a daily basis;something that was previously taking toomuch time and money to produce.“We’ve solved two problems for themat once: first, to create customisablereports that are integrated with the desklevel information they get on their optionsstrategies, and second they are savingmoney,” states Wormald.Another driver for outsourcing riskreporting is that it avoids having to integratemultiple systems. Aite Group’s survey foundthat fragmentation of technologies was citedas the key roadblock to risk managementsuccess (see figure 2).As to what constitutes an institutionalgrade risk reporting system, there are threemain pillars to consider. These include:headline numbers, attribution of risk andFigure 2: Which of the following do you consider to bemajor obstacles to effectively managing market risk?Need to integrate simulation systems withrisk-factor models and risk reporting73%Getting a complete view of riskfrom multiple risk systems67%Lack of front-to-back integrations amongsystems, for example portfolio management,risk, performance measurementLack of capability for morefrequent and timely reporting48%24%Source: Aite Group – Hedge Fund Trends and Challenges: Achieving Institutional Credibilitywww.hedgeweek.com 6

SunGard’s Hedge360scenario analysis/stress testing. If managerscan generate reports that cover these threeareas, they are in good shape.The first step is getting the headlinenumbers in a timely and accurate fashion.These numbers, depending on the fundstrategy, will typically include volatility,the greeks (delta, gamma and vega) iftrading options, and value at risk (VaR). Amore recent parameter that clients haveincreasingly started to ask for, says Wormald,is liquidity-adjusted VaR.Next, managers need to report on theattribution of risk. A trader might see that thefund’s VaR has climbed from 2.3 per cent to2.9 per cent, but why?“They can then use a set of risk attributionanalytic tools within Hedge360 to determinethe contributions of every position to theoverall risk profile and understand why thatnumber might have changed. The analogyhere is with performance attribution, whicheverybody understands.“How does a manager achieve 10 percent returns? Maybe 3 per cent is derivedfrom Europe, 2 per cent from Japan, 5 percent from the US: that’s useful post-tradeinformation. Risk attribution is saying: ‘Okay,we don’t know the future for sure but theVaR number can at least be attributed to theportfolio’s current composition’,” commentsWormald.Hedgeweek Special Report Nov 2014The third reporting element covers the‘what if ?’ scenario analysis and stresstesting. This is where the trader shocks theportfolio under periods of different marketstress, or wants to see the impact a newhedging position will have on VaR.“Institutions expect managers to have allthree parts of this regularly and automaticallygenerated in risk reports so that investors,regulators and senior management get aclear view across the strategy. That’s whatwe provide with our risk reporting service,”confirms Wormald.He adds that clients have the ability togenerate risk reports on demand as well asreceive them on a daily basis: “On demandmeans I’m sat in the office thinking, ‘ShouldI hedge this position? Should I buy a rateswap?’ If I decide to do the trade I want toknow how it will impact the portfolio’s riskso I generate a risk report on demand. Wesupport both daily reporting and on demandreporting with our managed service.”Aside from the automation capabilitiesthat Hedge360 provides to produce in-depthrisk reports, it crucially supports managersacross all asset classes. This is importantas hedge funds evolve and adjust theirstrategies to tap into new sources of alpha.“Our Global MAC (Multi Asset Class)model is very useful for hedge fundsbecause it allows them to achieve thenecessary coverage. If they want to tradenew asset classes, or derivatives, then theyknow they are going to get a coherent viewof risk,” explains Wormald.Not only that, but the SunGard team hasa deep understanding of risk which they arekeen to impart to clients. Getting a secondopinion on why the VaR number has risen orfallen can be empowering to the manager.In that sense, Hedge360 is more than just apowerful system; there’s a human element toit also.“Risk is about complying with theregulators and also about demonstratingto investors and senior management thatthe best practices are being applied. Youneed the right process, the automation andthe methodology: we provide all of these.Manage

SunGard’s Hedge360, a cloud-based platform that launched in 2012, puts the power of . Investing is the only reason they get paid. These guys are top of the food chain when it comes to trading markets but they’re not operations exp