Transcription

2017PLATFORMSTRATEGYSUMMIT

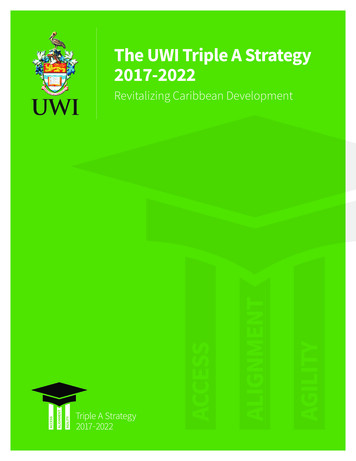

CONTENTS03OVERVIEW04THE PLATFORM YEAR IN REVIEW06BUILDING AND RUNNING DIGITAL PLATFORMS08DEVELOPER ECOSYSTEMS IN THE AGE OF PLATFORMS10THE SEARCH FOR THE VALUE GENOME12AI, MACHINE LEARNING, AND PLATFORMS14FROM SERVICES TO PLATFORMS: DEUTSCHE BANK18THE VC VIEW OF THE PLATFORM MARKET20THE FUTURE OF PAYMENTS IN THE PLATFORM ECONOMY22A PLATFORM FOR DIGITAL EDUCATION24DIGITAL INDUSTRIAL PLATFORMS: INTEGRATING EDGE, CLOUDS, AND APPS26SMART CONNECTED DEVICES AND THE INTERNET OF THINGS28REDEFINING THE INTERNET OF THINGS WITH PLATFORM INNOVATION30SUMMARY: FOUR BIG IDEAS31THANKS AND ACKNOWLEDGMENTSThe MIT Platform Summit was launched in 2013 by Geoffrey Parker and Marshall Van Alstyne to explorethe phenomenon of platforms in public and private organizations, and to better understand how to manage,govern, and regulate platforms. The Summit brings together thought leaders from industry and academiato share their experiences, engage in robust discussion, and to help chart a path forward for private andpublic-sector leaders who seek better understanding and more efficient regulation.

PLATFORMSTRATEGYSUMMIT 2017On July 14, 2017, a global community of 300 visionaries—including business andIT executives, public-sector leaders, and academics—convened at MIT in Cambridge,MA, for the 2017 Platform Strategy Summit. Hosted by the MIT Initiative on the DigitalEconomy (IDE) the conference featured keynote speakers and discussion focused onthe implications of platform-centered economics and management. The Summit wassponsored by KPMG, Global Payments, BearingPoint, and Tencent Holdings.THE PLATFORM REVOLUTIONThe “age of platforms” is firmly established.As outlined in the 2016 book, PlatformRevolution (www.platformrevolution.com),platforms are no longer restricted to retailor high-tech, but are visible across multipleindustries. As 2017 progresses, the trendis accelerating rapidly.The business impact of platform marketsis far-reaching—and there’s data to prove it.Research from Boston University’s MarshallVan Alstyne and MIT IDE postdoctoralassociate Seth Benzell, along with GuillermoLagarda, shows that on average, companiesthat open their application programinterface (API) experience a 4% rise inmarket capitalization. Likewise, companiesthat open their developer portals tend tosee lower research and development costsalong with increased sales.The shift taking place in the global market isjolting: the top 50 platform companies nowhave a combined market capitalization ofnearly 5 trillion. Just consider that in 2001,2006, and 2011, the top publicly tradedcompanies by market capitalization werein finance, energy, and industrials. In 2016,these traditional industries were displacedby companies that manage digital platforms.MIT INITIATIVE ON THE DIGITAL ECONOMY03

PANELTHE PLATFORMYEAR IN REVIEWGEOFFREY PARKER Professor, Dartmouth, and MIT IDE FellowMARSHALL VAN ALSTYNE Professor, Boston UniversityPETER C. EVANS Principal, KPMGAt this year’s event, Summit leaderspresented diverse viewpoints onkey trends as well as contextualframeworks for their thinking.South Korea has blocked Google Maps andTurkey has banned access to Wikipedia.And while Uber has been barred in Italy,India is just getting around to approvingride-sharing apps.Most notably, the co-chairs set the stage byemphasizing the strong focus on globalization,platform consolidation, and the rise of theindustrial Internet. They also noted thatcompetition for talent is heating up, andplatforms are becoming key drivers of internalbusiness innovation and external collaboration.Monetization strategies are beginning to geland software developers have clout.In the EU, Google was recently fined 2.7billion for antitrust violations, and the clockis ticking on the General Data ProtectionRegulation (GDPR), which goes into effect inMay of 2018. Cumulatively, this represents theinterplay of platforms with political systems.When you examine the largest global platforms,you discover several “super-major platforms”—such as Apple, Google, Microsoft, and Facebook—leading the way with a combined marketcapitalization of 3.5 trillion. China is advancingits efforts with platforms such as Alibaba, andTencent is also taking hold. Beijing has becomean epicenter for platform innovation andstartups and has a tremendous user base.PLATFORMS MEET POLITICSThe rising influence of platforms is attractingattention—and in some cases, opposition—from all corners of the globe.In Barcelona, for example, the city councilhas cracked down on unlicensed apartmentswith Airbnb. In Germany, courts have orderedFacebook to stop collecting fine-grained data.04From left, 2017 Platform Strategy Summitco-chairs, Van Alstyne, Evans, and Parker.PLATFORM STRATEGY SUMMIT 2017There is also a noticeable rise in mergersand acquisitions in many parts of the world—totaling about 36 billion so far this year.Amazon’s successful bid for Whole Foods isperhaps the most watched merger. Observersare still analyzing how this will disrupt theonce-quiet, 600 billion U.S. grocery industry.As platforms grow in size and scale, theyare also contributing in significant ways tonational systems of innovation and sparkingmeaningful growth in patents and investment intechnologies, such as artificial intelligence.At the same time, regulatory scrutiny ofplatforms is growing, with uncertain outcomes.The platform landscape is far from evenlydistributed. There are great geographicdifferences and new questions about oldmodels in play. And while businesses arebecoming very aware of the issues, no onehas cracked the code of how to balance datarights and unfettered digital marketplace growth.SIX LIDATION3INCREASEDREGULATION4PLATFORMSGO INDUSTRIAL5COMPETITIONFOR DEVELOPERTALENT6DRIVERS OFINNOVATION

Platforms have progressed frombeing a novel and interestingbusiness model to a disruptiveforce in every industry sector.6US vs EUROPE:KEY SUMMIT TOPICSThe Platform Strategy Summit addressed someof the most pressing challenges concerningthe adoption, development, and investment inplatform markets. Here are just some of thetopics covered at the Summit: Building and running digital platforms The evolution of the developer ecosystemin the Age of Platforms The connection between AI and machinelearning and platforms How VCs view the platform market The future of payments in a platformeconomy What digital industrial platforms need toknow about integrating edge, clouds, and apps Smart connected devices and the Internetof Things Redefining the Internet of Things withplatform innovationHOW PLATFORMS STACK UP75%UNITED STATESAt least 75% of major platformsare located in the United States.3%EUROPEAcross Europe, platform technologiesare lagging and regulatory issues areheating up.Of the world’s top 50 public platforms, seven companies —or supermajors — hold a combined 3.5 trillion of market cap.The other 43 companies make up 1.4 trillion of market cap.MIT INITIATIVE ON THE DIGITAL ECONOMY05

CASE STUDYBUILDING AND RUNNINGDIGITAL PLATFORMSJAN GILG Head of Enterprise Architecture & IT Strategy, SAPWhen Jan Gilg joined SAP in the early2000s, the world was emerging fromthe Internet bubble and there wasa realization that the standard SAPplatform was not robust enough forour enterprise customers. The ideaof connecting one of SAP’s EnterpriseResource Planning (ERP) systems tothe Internet was a foreign concept. Thefollowing summary of Jan’s presentationshows that times have surely changed.By 2010, SAP articulated a new strategy tobecome the most innovative cloud company—which required significantly different ways ofbuilding, marketing, and selling software. Duringthe past decade, we’ve transformed from beinga single product ERP vendor for large enterprises,to becoming a cloud company with a hugeportfolio and a growing platform business.Today, SAP not only connects systems to thecloud. We’re building systems in the cloud.Disruptive technologies have put our customersin the driver’s seat and increased expectationsfor the products and services they desire. Ourbusiness partners—as well as our own lines ofbusiness—began asking, “What business modelsand platforms can we create?”SAP is continuously evolving toward digital platforms,Jan Gilg told attendees.SAP is a long-established German softwarecompany with more than 350,000 customersin over 180 countries around the world.06PLATFORM STRATEGY SUMMIT 2017With the disruptions, there’s also been a shiftin mindset to think far beyond cloud offerings.With openSAP, we moved away from proprietarytechnology and established quite a significantecosystem. We promote our own platform, theSAP Community Network (SCN), where we invitedevelopers from our customer community,which totals more than one million members.Our new SAP Cloud Platform is based on openstandards and open technologies, as well.

It’s not necessarily the biggestcompanies that win marketshare. It’s the most agile ones.When we combined our platform with newtechnologies such as artificial intelligence andIoT, we also built those services into our SAPCloud Platform. We believe this is an integralpart of the future for SAP.NEW COMPETITORS, NEW STRATEGIESUber, Airbnb, and Facebook share a commonquality: they’re all platform companies.Together, just these three companies arevalued at 60% of the total market cap of theDAX, or German Stock Index. The companiesrepresent a prime example of supply economyof scale versus demand economy of scale.The German Stock Index is still primarilycomprised of the traditional industrialheavyweights, such as BMW and Siemens—even though Siemens is a platform companynow, as well. But the valuation for companiesthat are rigorously pursuing platform businessmodels are much, much higher, explainingsomewhat why it’s possible that thosenewcomer companies already make uptwo-thirds of the DAX.In order to react quickly, SAP acquireda handful of successful B2B cloud companies,and suddenly the cost of deals and marginsbecame extremely important.The challenge is how to become a cloud/platform company and stay profitable.You also have to reduce overhead if you sella piece of software for a 50 subscription,or it’s not profitable anymore.The goal is to minimize the number oftouchpoints in the sales cycle and become anecosystem based on self-services. For SAP, thatmeans allowing customers to test softwarebefore they buy it through an online platform.Monetization is difficult. You can monetize theplatform, as Microsoft does with Azure. But forSAP, what’s more interesting is taking revenueshares from the applications that are beingbuilt by partners, or even monetizing the usageby APIs instead of offering whole pieces ofsoftware end-to-end.The challenge is how to becomea cloud/platform company andstay profitable. You also haveto reduce overhead if you sella piece of software for a 50subscription, or it’s notprofitable anymore.We have an API marketplace where we publishstandard APIs for our products, and we usethose same APIs to implement SAP software.It’s a profitable way to leverage the APIs webuild within IT for the marketplace and forpartners, and helps us to build out an ecosystemof developers. We are still experimentingwith these monetization models, trying tobalance that with the equally important goalsof building platforms, creating mindshare, andencouraging communities.Platform development is helping us forge betterconnections with customers and suppliers, andnew opportunities to collaborate within our ownworkforce. The end goal is to make our platforma competitive differentiator in the market and tooffer ease and services for our customers. Andwe’re still building toward that goal.THE DIGITALECONOMY ISTHE NEWREALITY88%FORTUNE 500COMPANIESDISAPPEARED,MERGED, ORCONTRACTED70%NUMBER OFNEW COMPANIESIN TOP 10 LISTOF LARGESTGLOBAL FIRMS66NEW VENTUREBACKED STARTUPSWITH 1BVALUATIONS,UP FROM 11 IN 2012MIT INITIATIVE ON THE DIGITAL ECONOMY07

CASE STUDYDEVELOPER ECOSYSTEMSIN THE AGE OF PLATFORMSSAM RAMJI VP Product Management, GoogleOne of Sam Ramji’s favorite expressions is,“Don’t ask a fish about the ocean.” That is to say,it’s often difficult to grasp the larger picturearound us. We say that developers are developers,and that’s why you need them. But, he told Summitattendees, we need to understand this more.The following are highlights of his presentation.In some platforms, one essential side of your multisided market is developers. And in that case, you havevery different network effects, and you have to managethat differently.Google aims to build great developer tools becausewe are a company of platform businesses. Think aboutsearch and ads. Think about YouTube. Think about Androidand Play. When the platform’s content is built by developers,we have to win those developers and enable them to buildhigh-quality content.We’re at a moment now where we can see developerecosystems taking root and having an impact. From adeveloper standpoint, this is certainly the best time inhistory. We’re in an era of rising demand.Software developers are the new pharmaceutical inventors,because AI is creating new drugs through simulation andmolecular analysis. So the field of software development isexpanding dramatically. But, in fact, software developersaren’t magical. They’re people who use code to producemeaningful outcomes and they find joy in the process.THE EXPANDING, CONNECTED UNIVERSESam Ramji, VP Product Management at Google,told the audience that “this is the best time inhistory” for developers.08PLATFORM STRATEGY SUMMIT 2017What’s invisible is the shift of the cost of sharing networksand data. Google has about 37 million websites and appsthat connect to our infrastructure to process geo-data.You don’t have to be a digital native, though, to achieve greatdigital breakthroughs. Phillips is adding programmabilityto light. So light hasn’t just gotten cheaper, it’s gottenprogrammable. Nike is creating wearables, and so on.

PRODUCTSPRODUCTSUBSYSTEMSUPPLIERSCONTENT SUPPLIERSMATERIALS SUPPLIERS5THE PRODUCT PYRAMID, INVERTEDFor all of us born and raised in the 20th Century,the classic product pyramid is how companies werebuilt. Ideally, that was the place of most power; mostintimacy with customers; pricing control. But in 2007,my colleagues and I designed a diagram [above] whichhas been very durable. Literally, it’s firm-inversion; goodplatform companies are inverted pyramids.From a 20th Century mindset, this inversion seemsinsane. Why would you want to give up all that customerintimacy? But here’s the secret: In the first packagedsoftware era of platforms, you didn’t have APIs. Themagic came when platforms started to have APIs, andnow every time a customer uses something built by athird-party developer, the data comes back to you, andthe revenue can sometimes come back to you as well.THE POWER OF DEVELOPER NETWORKSThrough this looping cycle, there’s an almost magicaleffect; when digital platforms have developerson one side, you see breakaway outcomes and thepower law shifts.More developers yield more meaningful outcomes;more data goes into the platform that can then routeback to the platform.There’s another part to it as well. Developers, as people,have a network effect with code. We’re in an open-sourceera. So the more developers that join the platform, themore they will generally share code with each other andcreate open-source frameworks. This diminishes thefuture costs of new developers coming in, and it makesthe developers on your platform better because thatshared code is a cognitive asset.We’re entering an era where empathy is a competitiveadvantage. Developers have agency, they have choice,interest and values. Empathize with their outcomes.I offer this challenge: Community management is productmanagement for an ecosystem. When this concept is wellunderstood, these will be your most valuable and highlyleveraged employees. Companies and academia need toshine a light so we are not a fish asking about the ocean,but we actually have a map of where to go.6EMERGING COMPONENTS OF PLATFORM DEVELOPMENT1OPENSOURCEThe modern developer’s basicexpectation. This is how we licensesource code. The more that weenable open source in our platforms,the more developers can benefit.2OPENDEVELOPMENTOpen development improvesefficiency and mandates a certainset of outcomes. It is fueled by anexplosion of third party, open-sourced,source-code controlled systems.3FOCUS ONCOMMUNITYLao Tzu said, “All streams flow to thesea because it is lower than they are.Humility gives it its power. If you wantto govern the people, you must placeyourself below them.”MIT INITIATIVE ON THE DIGITAL ECONOMY09

CASE STUDYTHE SEARCH FORTHE VALUE GENOMEBARRY LIBERT CEO and Founder, OpenMattersBarry Libert, CEO and Founder of OpenMatters, describes his value genome theory.10PLATFORM STRATEGY SUMMIT 2017

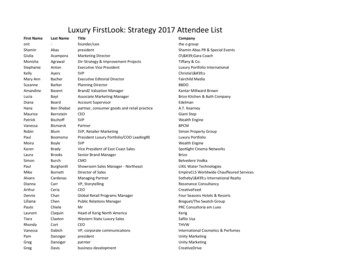

If you want to be part of the platformeconomy, you have to pre-allocatecapital and measure what matters.BARRY LIBERTIn 2001, Craig Venter discovered the humangenome based on four billion single lettercombinations of AATG, AACT, ACTG. In short,all of us are made up of just four letters ofcode. In his presentation, Barry Libert speaksto how he applied this concept to the economy.For a deeper understanding of what’s happeningin economics today, I created The Genome Codeof platforms and networks. If we can define what’shappening in the world as an economic genome,we can map and understand the underpinnings ofwhat people are talking about today.For instance, using a machine learning algorithmthat looks at each and every one of your organizations,I can design, develop, and decipher the corporategenome of your organization based on that algorithm.In 1975, 83% of all assets were made up of tangiblethings. Over the next four decades, the allocation ofcapital dramatically shifted. In fact, by 2013, only 15%of the world’s economy was now in tangible itemsThe first innovation we developed was called FeatureSelection. We started with assets, also known asthings and money, then searched for features, suchas human capital and intellectual capital. We alsoexamined relationships, such as the ones betweencustomers and employees.By 1999, we filed patents for Feature Selection forthe Global Economic Genome. We examined 11,000companies and ended up with four classifications ofcompanies from the underlying features set.As a result, we can map the genome of every companyand every country, once you get the feature selectionright and if all the data sets are available.6THE ROI OF THE VALUE GENOMENetwork companies trade at eight to 15 times revenue because the economic valueof the genome of the organization dictates the outcome of its economics.2xMANUFACTURING COMPANIESBoeing, Walmart, Ford3xSERVICE COMPANIESH&R Block, Bank of America6xTECHNOLOGY COMPANIESMicrosoft, Salesforce15xNETWORK COMPANIESUber, Airbnb, FacebookMIT INITIATIVE ON THE DIGITAL ECONOMY11

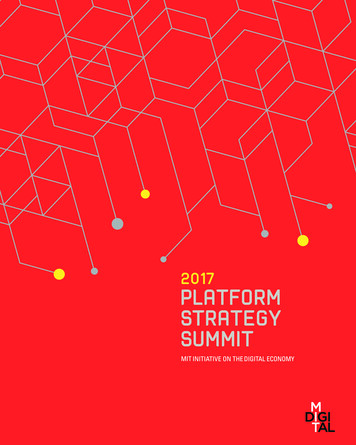

PANELAI, MACHINE LEARNING,AND PLATFORMSMARSHALL VAN ALSTYNE Professor, Boston UniversityWALID ALI Senior Director, AI & Cloud Solutions, Intel CorporationSTEVE HILL Global Head of Innovation & Investments, KPMGRUCHIR PURI Chief Architect, IBM WatsonXIANGYU WANG VP, Tencent / Enterprise ProductOur first panel of industry leaders discussed howthe concentration of “information wealth” isincreasingly driven by artificial intelligence (AI)and machine learning. Panelists made the casefor the growing interconnectedness of platformsand AI. Read on for excerpts from the panel.The opportunity to traina machine how to interactwith humans is amongthe best applications of AI.XIANGYU WANGMarshall Van Alstyne, (far right), leads panelists (from left) Xiangyu Wang, Ruchir Puri, Steve Hill, and Walid Ali.12PLATFORM STRATEGY SUMMIT 2017

Xiangyu Wang: The growth of WeChat and QQ InstantMessenger platforms in China demonstrate the rapidgrowth of AI capabilities, especially in social media.Tencent is among those enablin

MA, for the 2017 Platform Strategy Summit. Hosted by the MIT Initiative on the Digital Economy (IDE) the conference featured keynote speakers and discussion focused on the implications of platform-centered economics and management. The Summit was sponsored by KPMG, Global