Transcription

Fiscal year 2021Covered EmployerProcedures Manual

Table of contentsChapter 1: Introduction .9About this manual . 10Chapters . 10Revisions . 10Address . 10Contact PEBA . 10Office hours . 10Social media. 10Employer resources and tools . 10Publications . 11Employer Services . 11Training resources . 11Events and presentations . 11Employer support line . 11Member Account Services . 11Benefits at Work conference . 11PEBA Update e-newsletter . 11Employer checklists . 11Electronic Employer Services. 11Obtaining or updating access . 12Updating contact information . 12Member resources and tools . 12Member Access . 12Navigating Your Benefits . 13Member publications . 13Member checklists . 13Chapter 2: Membership and enrollment . 14Plans that PEBA administers . 15Plan types . 15Membership eligibility . 15SCRS . 16State ORP . 17Covered Employer Procedures Manual 2

State ORP service providers . 17Annual open enrollment . 17PORS . 18Class Two and Class Three membership . 19Correlated systems . 19Assisting new employees. 19Enrollment process . 20Retiree return-to-work dates . 20Election of non-membership . 20Foreign teachers (e.g., H-1B visa, J-1 visa) . 20Member information changes . 21Required documents for a name change . 21Beneficiary designations. 21Beneficiary types . 22Primary beneficiary . 22Contingent beneficiary . 22Trustee designations . 22Incidental death beneficiary . 22State ORP active incidental death beneficiary . 22Changing beneficiaries . 23Chapter 3: Reporting process . 24Fiscal year 2021 active member contributions . 25Fiscal year 2021 employer contributions . 25Working retiree contributions . 26Contribution rate changes . 27Wages subject to contributions. 27Salary or wages . 27Used sick and annual leave . 27Unused annual leave (Class Two members only) . 27Unused general leave . 27Overtime and compensatory time . 28Other compensation. 28Wages not subject to contributions . 28Special payments . 28Covered Employer Procedures Manual 3

Lump-sum payments for unused sick leave . 28Benefits received for long-term disability . 28Member compensation limit . 28Unused annual leave for working retirees . 29Deposit and reporting process . 29Monthly deposits. 29Delinquent payments . 29Payroll inactivity . 30Quarterly payrolls . 30Delinquent payrolls . 30Errors: quarterly payrolls . 30Service credit reporting . 30Contract length . 31Months paid . 31Calculating service credit. 31Contract length chart . 34Supplemental contribution report . 35Corrections to past reports . 35Supplemental service report . 35Descriptions of leave types reported on a supplemental service report . 35Furlough uploads . 37Agencies on the Comptroller General’s (CG) payroll . 37Chapter 4: Service purchase . 38Purchasing additional service credit. 39Calculation of costs. 39Indexed service credit threshold . 39Descriptions of types of service. 39Public service . 39Educational service (K-12) . 40Military service . 40Leave of absence . 40Workers’ compensation . 40Previously withdrawn service . 40Non-qualified service. 40Covered Employer Procedures Manual 4

State ORP service. 41Transfer to PORS (PORS Only) . 41Convert Class One to Class Two (SCRS) . 41Convert Class One to Class Two (PORS) . 41How a member may request a service purchase invoice . 41Purchasing service to meet retirement eligibility . 42Installment Service Purchase Program . 42Interest rate . 43How to participate in the Installment Service Purchase Program . 43Reporting the installment payments . 43When the installment purchase nears maturity . 44Chapter 5: Death claims . 45Types of death claims . 46Active member . 46Inactive member. 46Working retired member. 46Non-working retired member . 47State ORP participant . 47Types of death claim payments . 47Refund of contributions . 47Monthly survivor annuity . 47Monthly survivor annuity and multiple beneficiaries . 48Incidental death benefit . 48Active member incidental death benefit.

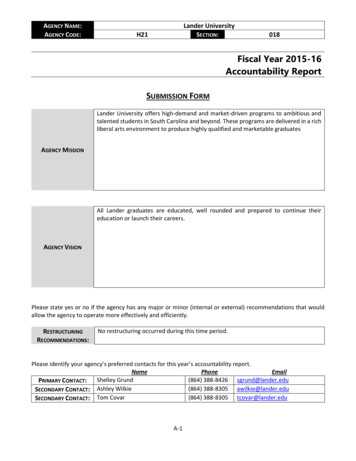

About this manual The Covered Employer Procedures Manual is designed to familiarize benefits and payroll personnel of employers covered by the South Carolina Retirement System (SCRS), State Optional Retirement Program (State ORP) and the Police Officers Retirement System (PORS) with PEA’s polici