Transcription

2017ACTIVISTINVESTINGAn annual review of trends in shareholder activismI n a ssoc ia t ion w it h

POWERHOUSEPRACTITIONERS“Schulte Roth & Zabel [has] cometo dominate the activism market.”— REUTERS“ Schulte Roth & Zabel partners have established themselves asgo-to lawyers for activist investorsacross the United States.”— THE AMERICAN LAWYER“SRZ’s clients in the U.S. includeseveral of the highest-profileactivist managers ”— FINANCIAL TIMESSchulte Roth & Zabel is frequentlynamed one of the top law firmsfor providing legal advice toactivist funds.— ACTIVIST INSIGHT ANDTHE WALL STREET JOURNALThe contents of these materials may constituteattorney advertising under the regulations ofvarious jurisdictions.“With offices in New York,Washington D.C. and London,Schulte Roth & Zabel is a leadinglaw firm serving the alternativeinvestment management industry,and the firm is renowned for itsshareholder activism practice.”— THE HEDGE FUND JOURNAL“Dissident investors areincreasingly looking to deploydeep capital reserves outsidetheir bread-and-butter U.S. market,driving Schulte Roth & Zabel LLPto bring its renowned shareholderactivism practice to the U.K. —a jurisdiction experts say is onthe brink of an activism boom.”— LAW360

Editor’s letterJosh Black, Editor-in-Chief at Activist Insight.Ofthe four years I havewere liquidated. Their replacements incode after a scandal illuminated by anreviewed for Activist Insight,activist portfolios often underwhelmed,activist campaign.2016 seems the longest andwhether because of the tameness ofmost contradictory. If the years leadingthe investment theses, the durationAup to it were marked by the growingof the investment, or the size of theparallelambition of activists, leading to a risetargets. Atypically, Carl Icahn tookwith shareholder activism is activistin bigger demands, bigger targets andan approximately 820,000 positionshort selling – an expanding part ofbigger paydays, 2016 saw somethingin drug company Allergan, asked forour coverage here at Activist Insightof a stepdown. As this report highlights,nothing, and sold almost all his sharesfollowing our acquisition of Activisteconomic and governance activismquickly.Shorts Research. Activist short desis an increasingly diverse field, withhad a big year surfing volatility in 2016,the activity of specialist activist fundsand even ventured into new markets inslowing by some measures.And yet, in our mid-year surveyofactivists,ShareholderActivismInsight, 56% of respondents said theyexpected the volume of activism toAsia and Europe. They, too, seem likely“Even with Icahn ashis special adviser,what Trump’s electionheralds for activismremains to be seen.”to proliferate, especially given the lackof disclosure in many markets and theirability to publish anonymously online.This report showcases many of theremain the same. A sizable minoritydifferent strengths of our platform.– 32% – expected an increase. That2017 opens with Activist Insight officesseems hard to believe, given how busyAnotherhighlightingin three time zones, offering four great2016 felt, but it is certainly plausibleis that, for activists, 2016 was anthemeworthproducts and renewed ambition tothat 2017 will provide plenty of newinherently political year. Deals betweenprovideopportunities.Staples and Office Depot, and Bakercoverage of activism worldwide. TherethemostcomprehensiveHughes and Halliburton founderedis a growing team behind this reportOf course, dedicated activist investorson antitrust concerns, while in theand our flagship magazine, Activistwere hardly insignificant in 2016.latter case, the U.S. government suedInsight Monthly, to whom I am indebtedIndeed, they continued to break newValueAct Capital Partners for allegedfor their hard work.ground, picking up board seats thatnon-compliance with disclosure rules.would have been unthinkable yearsSeveral legislative attempts to regulateI also want to thank our sponsors,earlier. They finally pushed Yahoo to sellactiviststheespecially Schulte Roth & Zabel. Weits core business and continued to beelection of Donald Trump as presidentare grateful for all the support we’veinvolved in mergers and restructuringsin November. Even with Icahn as hisreceived over the years, leading up tothe world over. Activist Insight dataspecial adviser, what Trump’s electionthis exciting moment, and look forwardsuggest that the more central activismheralds for activism remains to beto working ever-more closely with ouris to an investor’s strategy, the moreseen.clients. The 12 months ahead of uswerefloatedbeforelikely it is that its demands will be met.may be filled with twists and turns, butElsewhere,Nonetheless,2016governmentsit will be quite the journey.beseem keen to promote the role ofremembered more for what activistsshareholders in corporate governance.P.S. Drop me an email to subscribe tosold than for what they bought. BigIn the U.K., the government seemedmy weekly newsletter on activism.stakes in Apple, Canadian Pacificeager to offer investors new powers,Railway,Restaurants,while South Korea may follow Japanjblack@activistinsight.comPepsiCo, Qualcomm, and Walgreensin adopting a corporate governance@activistinsightDardenmayhowever,3

ContentsThe Activist Investing Annual Review 2017.3Editor’s letterJosh Black, Activist Insight5Onward and upwardsMarc Weingarten and Eleazer Klein, Schulte Roth & Zabel7Hype and humilityTrends in shareholder activism10Activism gravitates to the middle marketDuncan Herrington, Raymond James1218The activist top tenWhat now?Cas Sydorowitz, Georgeson20 Activism booms outside the USShareholder activism around the world22 2016: The year in numbers24 Runaway marketAn interview with Marc Weingarten, Eleazer Klein and Jim McNally, Schulte Roth & Zabel26 Diminishing returnsSettlements and proxy fights in 201628 Reflecting and anticipatingAn interview with Bob Marese and Paul Schulman, MacKenzie Partners30 Spread bettingA review of activist short selling in 201632 The short top five34 Behind the callsWho are the activist short sellers?36 Down and upHow activists performed in 201638 Who’s vulnerable now?Predictions for 2017’s next targets40 Rote reliance out of fashionAn article from Proxy InsightAll rights reserved. The entire contents of The ActivistInsight Activist Investing Review 2017 are the Copyrightof Activist Insight Limited. No part of this publication maybe reproduced without the express prior written approvalof an authorized member of the staff of Activist InsightLimited, and, where permission for online publication isgranted, must contain a hyperlink to the publication.The information presented herein is for informationpurposes only and does not constitute and shouldnot be construed as a solicitation or other offer, orrecommendation to acquire or dispose of any investmentor to engage in any other transaction, or as advice of anynature whatsoever.MANAGING EDITOR:Josh BlackActivist Insight wishes to thank all contributors and those whomade themselves available to be interviewed for this report.ACTIVIST INSIGHT CONTRIBUTORS:Paolo Frediani, Ben Shapiro, Claire Stovall, James Martin,Husein BekticPUBLISHED BY:Activist Insight Limited26 York Street,London, W1U 6PZ 44 (0) 207 129 1314WITH SPECIAL THANKS TO:Marc Weingarten & Eleazer Klein at Schulte Roth & ZabelLLP; Duncan Herrington at Raymond James Financial,Inc; Cas Sydorowitz at Georgeson; Bob Marese & PaulSchulman at MacKenzie Partners.1350 Avenue of the Americas,Floor 3, New York, NY, 10019 1 646 475 mTwitter: @ActivistInsightImage credits: (All images provided by Shutterstock) p13, Yahoo: jejim;p13, AIG: Evan El-Amin; p14, Viacom: Northfoto.

Onward and upwardsMarc Weingarten and Eleazer Klein, co-chairs of SchulteRoth & Zabel’s global Shareholder Activism Group.A change in the mixexceptions). The uncertainty resultingEpiq Systems to a sale, typifiedfrom the “Brexit” bombshell and thethe sector. And 2016 saw severalWhile activist campaigns may not haveU.S. election also slowed activity.more traditional managers turn intocommandednewspaperBut much of that macroeconomicoccasional activists, like Neubergerfront pages in 2016 as they have inasmanyuncertainty has now been resolved,Berman at Ultratech and T. Rowerecent years, this reflected more of awith Brexit going “hard” and the TrumpPrice at NetSuite.down-market shift in activist targetsadministration firmly in place, and withand not any retreat by shareholders.more positive returns for the majorMany activists focused on smalleractivists during the balance of 2016targets during the year, while some ofand their investor base stabilizing, weIn 2016, the Securities and Exchangethe largest and most-feared activistsare expecting more action in the largeCommission released a long-awaitedhad a quieter year retrenching in thecap space this year. With the newly-proposal for universal proxies at theaftermath of lesser performances inensconced Paul Hilal pursuing CSX,behest of our client, the Council of2015. Nonetheless, the number ofthis trend is already underway.Institutional Investors.Rise of the occasional activistThe proposal would require the use ofRedefining proxies in the United Statesactivist investments across the globeactually slightly increased versus theprevious year, although there wasuniversal proxies in election contests,a slight decline in North AmericanAsbeenin order to enable shareholders tovolume.emboldened by the success of activistvote for the combination of boardinvestors, the occasional activist isnominees of their choice and replicatebecoming a more familiar sight. Morethe action they could take by attendingand more investors who would nevera shareholder meeting in person.call themselves activists have enteredWhile activist defense advisers havethe“More and moreinvestors who wouldnever call themselvesactivists have enteredthe activism eactively decried universal proxiesactivists are almost always long-termarena.as tilting the playing field to favorinvestors in their targets and typicallyactivists, which in fact is not thehave engaged with management forcase, they would certainly change themany months – if not years – beforedynamics in proxy contests. With theresorting to the activist playbook.change in administrations, and at theInvestment managers fed up with aSEC, it remains to be seen whetherThere were a myriad of contributorsportfoliothis proposal has legs.to this pause in the growth ofand lack of progress have recognizedshareholder activism. Many of thethat activist engagements can be amajor activist funds had their firstuseful tool to catalyze the changesdown years in 2015, led in some casesneeded to deliver returns. TheseSo following a bit of a pause last year,by the collapse of Valeant’s stock andfunds often believe that their rolewe see the activist sector returning topoorly-timed energy bets, and theirasinvestorsits historic growth trajectory, not justlosses continued into the first quarterrequires them to sometimes pursuein the United States but on a moreof 2016. As a result, they were morean activist strategy, instead of simplyglobal basis as well. And preparingfocused on investor relations anddisinvesting.Altimeterfor that growth, we welcome our newincreasing liquidity than taking onCapital, with a successful campaignpartner, Aneliya S. Crawford, to ournew large cap campaigns (with Elliottat United Airlines, and St. Denis J.activist team at Schulte Roth & Zabel.and Starboard Value being majorVillere & Company, which ttheirclientsBack on the growth track5

Cultivate your expertiseActivist Insight MonthlySign up for a free trial by emailing info@activistinsight.comwww.activistinsight.com

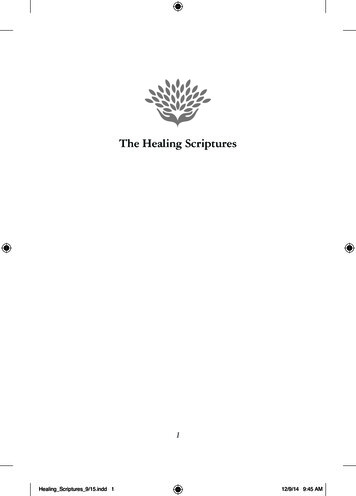

Hype and humilityShareholder activism proliferated in 2016, but dedicated activistswere responsible for fewer than half of global campaigns thanksto volatility and smaller war chests, reports Josh Black. Gettingheard above the crowd may be harder in 2017.The juggernaut of shareholder engagement kept rolling in 2016 as a surge of one-offcampaigns, governance-related proposals and remuneration crackdowns made for abusy year. 758 companies worldwide received public demands – a 13% increase on2015’s total of 673 – including 104 S&P 500 issuers and eight of the FTSE 100.Yet for dedicated activist investors, it was a more muted affair. Investors deemed byActivist Insight to have a primary or partial focus on activism targeted fewer and smallercompanies, accounting for just 40% of the total which faced public demands, and 10%fewer companies in North America. Turbulent markets, redemptions and competitionall played a part in reducing the volume of activist investing. By contrast, shareholderengagement flourished.

“Investors deemed by Activist Insight to have a primary or partial focus onactivism targeted fewer and smaller companies, accounting for just 40% of thetotal which faced public demands.”With hangovers from poorly timedthe highest volume, making demandslaunched new ones, while Hudsoninvestmentsat 311 companies.Executive Capital and Marcato ave had some success with priorandNot all of these demands troublelaunches. Co-investment, meanwhile,upmanagement equally. Only 58% ofremains a favored strategy for bothdeals on which activists had betresolved demands initiated in 2016new and old activists.substantially,activistswere at least partially successful,enjoyed a particularly poor start to thededicatedwith the rate of achievement risingMajoryear in the U.S. Jason Ader, the CEOwith the focus level of the activist.preoccupied – Icahn by bearishness,of SpringOwl Asset Management, toldThat rate may yet fall as campaignsTrianActivist Insight for this report that 2016are resolved, with 2014 and 2015positions taken a year previously, andmight be “the year that activists wereboth posting around 53% at leastPershing Square Capital Managementhumbled.”partially successful.by turning around Valeant, ewAckman’s fund did participate inDownsizingMexican Grill late in the year. If all three“Co-investment,meanwhile, remainsa favored strategyfor both new and fOne of the most notable trends ofbecome more prolific in 2017, largethe year was the strengthening ofcaps could yet face renewed scrutiny.small cap activism, at the expenseof the large targets activists havenewlyTowards ompaniesActivism in the technology sectorvalued at more than 10 billion rosewas proportionately flat for the thirdmarginally overall, amongprimarystraight year, this despite activity thatofthetheand partial focus activists it fell fromensured it remained one of the mostfeeling is not widespread. According44 in 2015 to 30 last year. Indeed,publicized areas, including Starboardto Activist Insight, 51 primary, partialin 2016, the sub- 2 billion marketValue’s brief threat of a full boardor occasional focus U.S. investorscap arena accounted for 78% of allcontest at Yahoo before a settlementfounded since 2009 launched theirtargets, up from 72% in 2015 andwas reached. M&A continued tofirst U.S. campaign in 2016, up from70% in 2014. After mixed results,provide activists with an exit strategy38 the year before. Although the dataAder says he is unlikely to repeat hisin the sector, including for ElliottincludeactivistPR-heavy campaigns at Viacom orManagement targets EMC, Infobloxfirms, the universe of activists isYahoo, where SpringOwl publishedand Qlik and other companies suchexpanding rapidly.lengthy presentations in 2016.as Epiq Systems (Villere & Co) andIndeed, engagement activists, typicallyThat may continue to be a trendinstitutions or individuals that pushthis year, unless activist fundraisingMoreover,for governance changes, targetedpicks up substantially. Assets undernotwithstanding, activists that have155 companies worldwide in 2016management of primary focus fundsmade their living focusing on buyouts– up 24% after three years in whichglobally fell from 194 billion in 2015in the sector – Elliott and Viex Capitalactivity had remained flat. But it wasto 176 billion – still higher than inamong them – are unlikely to suffer a“occasional” activists – which do2014, but their first drop in five years.drought, according to Evercore’s Billrecentlysuggestsoverhauling the board of ChipotlefoundedOuterwall (Engaged Capital).not include activism as part of theirapost-electionrallyAnderson.regular investment strategy but whichDespite the tough climate, activistsmake infrequent public criticisms ofare still raising funds – SpringOwl andFinancial stocks have also beenportfolio companies – that account forlong/short specialist Spruce Pointfacing the heat, with volume up 28%8

“Among primary and partial focus activists, the sub- 2 billion market cap arenaaccounted for 78% of all targets, up from 72% in 2015 and 70% in 2014.”in the U.S. and 15% globally. Proxycontests at FBR & Co and Banc ofCalifornia stand out, while a rallyCompanies publicly subjectedto activist demands worldwidesince 2013758in such stocks after the Novemberelection of Donald Trump to thepresidency of the U.S. may portendmore M&A among small banks andpropertyandcasualtyinsurers,Anderson added in an interview forthis report.520258673 456572 366Sector breakdown of globalactivist targets in 20161% Conglomerates2% Utilities7% Ind. Goods7% Healthcare23%292Services8%Cons. Goods16%The next frontierTechnologyBullish M&A markets have allowedactivists to play “bumpitrage” byseeking higher offers from previously307 302262 28021%16%FinancialBasicMaterialsannounced deals. After Britain votedto leave the European Union, a hostGlobal active activists byfocus level in 20162016Poundland in the U.K. In Europe,2015shareholders, as at SABMiller and2014calls for re-evaluations by disgruntled2013of such mergers were exposed toEngagement(9%)Elliott Management took up holdoutPrimary focus(10%)stakes in XPO Europe and Ansaldo,Companies publicly subjected to demandsfrom primary and partial focus activistswhile Paris-based Charity alsoPartial focus(13%)Companies publicly subjected to demandsfrom engagement, occasional andconcerned shareholder group focus activistsminorityConcernedshareholder group(15%)investors in controlled companies.Occasional focus(54%)Getting a hearing became easier inEurope in 2016, with Rolls-RoyceHoldings becoming the first FTSE100 company to cede a board seat toan activist (ValueAct Capital Partners)Market cap breakdown of global activist targets since 201330%and Active Ownership Capital winninga seat at Stada in a rare Germanproxycontest.Whethersimilar20%trends emerge in regions wherethe culture of shareholder activismremains underdeveloped, such as10%Asia and Australasia, remains to beseen. Back in the U.S., if securing ahearing becomes more of a challengeagain, it will be due to the spread ofactivism, not the lack of it.0%2013Large cap2014Mid cap2015Small capMicro capN.B. 1. All percentages are given to the nearest whole number, and may cause rounding errors2016Nano cap

Activism gravitates to the middle marketSmaller companies are unprepared for greater levels of activism than larger firms, saysDuncan Herrington, Head of the Activism Response and Contested Situations Practice atRaymond James.Activism in the middle marketa proxy fight. As a result, nearly alltargeted, it is critical for managementcontinued to grow in 2016,situations that developed into boardteams and boards at all publicas top-tier activists lookedcontests in the U.S. last year involvedcompanies, but especially in thenewlycompanies with a market cap ofmiddle market, to proactively thinklaunched, smaller funds sought outaround

focused on investor relations and increasing liquidity than taking on new large cap campaigns (with Elliott and Starboard Value being major exceptions). The uncertainty resulting . Price at NetSuite. Redefining proxies in the United States In