Transcription

ANZ BUSINESSONLINE SAVER ACCOUNTTERMS AND CONDITIONSANZ BUSINESS BANKING11. 2018

ANZ Business Online Saver Account ANZ Internet Banking (ANZ Business OnlineSaver Account version) ANZ Internet Banking for Business (ANZBusiness Online Saver Account version) ANZ Phone BankingIf you have registered for ANZ Internet Banking forBusiness then this document must be read inconjunction with the ‘ANZ Business BankingTransaction Accounts Fees and Charges’ booklet.Together they form the terms and conditions for yourANZ Business Online Saver Account.2–3This document contains terms and conditions for thefollowing:

Contents1. How to open an account72. Operating an ANZ account72.1Electronic access to ANZ Business OnlineSaver Account72.2Authority for account operation82.3Deposits82.4Withdrawing or transferring money892.5Processing of withdrawals and deposits2.6Payment procedures and insufficient funds 102.7Changes to Fees and Charges and InterestRates102.8Interest122.9Interest calculations and payments122.10 Provision of credit122.11 Statements132.12 Privacy and confidentiality142.13 Inactive accounts172.14 Disruption to service172.15 Anti-Money Laundering and Sanctions182.16 Financial Claims Scheme182.17 Problem Resolution Procedure192.18 GST202.19 No dealing in account202.20 Law and Jurisdiction213. Electronic Banking213.1Electronic Banking213.2Lost and stolen Card for linked account/s21

214.1Change of name and addressby signatories214.2ANZ’s right to combine accounts214.3Closing your account224.4Personal Advice on Business Accounts234.5Over the Phone Servicing235. Bank Fees and Charges236. Electronic Banking Conditions of Use24Contact Details554–54. Other things you need to know

IntroductionReferences to ANZIn this Terms and Conditions document, ‘ANZ’ meansAustralia and New Zealand Banking Group LimitedABN 11 005 357 522 and its related entities.Application of these Terms and ConditionsIf you are opening a new ANZ Business Online SaverAccount, these terms and conditions, including thoseimplied by law, apply. To the extent of anyinconsistency, these terms and conditions shall prevailto the extent permitted by law. You should read allrelevant terms and conditions material that areprovided to you and ask ANZ about any issues thatconcern you.Code of Banking PracticeIf you are an individual or a small business (as definedin the Code of Banking Practice) ANZ is bound by theCode of Banking Practice when it provides itsproducts and services to you.

Under Federal Government law, we must verify theidentity of all account holders, and anyone authorisedto act for them. For us to do this you and anyoneauthorised to act for you must satisfactorily meetANZ’s Customer Identification Process.Depending on your business and/or structure you willbe required to provide certain documents andinformation to ANZ.For information relating to the documents requiredplease contact any branch or speak to yourANZ Manager.If you, or signatories to the account, are not identifiedin terms of the law, the account will be blocked for allwithdrawals until the requirements are satisfied.If you are an existing customer, or account signatory,identification requirements may have previously beensatisfied so you don’t need to provide the informationagain, unless you are asked to do so by us.2. Operating an ANZ account2.1 Electronic access to ANZ Business OnlineSaver AccountYour ANZ Business Online Saver Account can only beoperated when linked to an approved ANZ account.For accounts opened on or after 5 May 2012,approved linked accounts include ANZ BusinessAdvantage, ANZ Business Extra and ANZ BusinessPremium Saver. Accounts opened prior to 5 May 2012which have been linked to accounts that are no longeravailable for sale can continue to be operatedthrough the linked account until such time that ANZdecides to close down that linked account (you will benotified in writing before the closure of the linkedaccount in accordance with the terms and conditionsof that account). When this happens, you need to linkyour ANZ Business Online Saver account to anapproved account at that time to be able to operateyour account.To be able to link your ANZ Business Online Saveraccount with an approved ANZ account on InternetBanking for Business both accounts need to be underthe same entity name.As your ANZ Business Online Saver Account can onlybe accessed electronically, you must always be able to6–71. How to open an account

access your ANZ Business Online Saver Account byeither ANZ Phone Banking, ANZ Internet Banking orANZ Internet Banking for Business. Should such accesscease for any reason, ANZ may close the accountunder clause 4.3 of these Terms and Conditions.2.2 Authority for account operationAt the time of opening your ANZ Business OnlineSaver Account, you nominate the persons who areauthorised to operate the account.Except where expressly provided, ANZ can act at alltimes on the basis that the authorised users can actfully and effectively in all dealings, matters andtransactions in respect of the account.Except where you and ANZ otherwise agree inwriting, each signatory will be able to operate (andenter into agreements to operate), the account alone.You are responsible to ANZ for all liability that isincurred as a result of operations on the account. Ifyou hold your account jointly with one or more otherpersons then each of you is jointly and severallyresponsible to ANZ for any liability.If you wish to alter the account authorisationinstructions then you must notify ANZ in writing.2.3 DepositsYou may make deposits to your account: By transferring funds from any ANZ account/selectronically using ANZ Internet Banking, ANZInternet Banking for Business or ANZ PhoneBanking; or By arranging an electronic credit via anotherfinancial institution; or By transferring funds electronically from anapproved linked ANZ account to your ANZBusiness Online Saver, using an ANZ ATM inAustralia, if your Business Online Saver accountis linked to your ANZ ATM card.Please note that cash deposits cannot be made toyour ANZ Business Online Saver Account.2.4 Withdrawing or transferring moneyYou may withdraw money from your account: By transferring funds to an approved linkedANZ account to your ANZ Business Online Saver

By ANZ ATM transfer only to an approved linkedANZ account to your ANZ Business Online SaverAccount (except in circumstances where morethan one person is required to authorise atransfer).Please note, you cannot withdraw money from yourANZ Business Online Saver Account via electronicDirect Debit , Branch, BPAY Payment, transferring tonon linked ANZ Accounts, transferring to non ANZBank Accounts, multipays or Periodical Payment.2.5 Processing of withdrawals and depositsGenerally, any transaction at an ANZ ATM (excludingan envelope deposit), ANZ EFTPOS, ANZ PhoneBanking, Mobile Banking, ANZ Internet Banking orANZ Internet Banking for Business will be processedto your account on the same day, provided they aremade before the following times on the followingprocessing days: 9:45pm Melbourne time Monday to Friday(excluding national public holidays) for ANZATM transactions (excluding an envelopedeposit); 10pm Melbourne time Monday to Friday(excluding national public holidays) for ANZEFTPOS transactions; 10pm Melbourne time Monday to Friday(excluding national public holidays) for fundstransfers made through ANZ Phone Banking,Mobile Banking, ANZ Internet Banking or ANZInternet Banking for Business; and 6pm Sydney time on Banking Business Days (asdefined in the Electronic Banking Conditions ofUse) when using BPAY Payments1.Any transaction made after these cut-off times may beprocessed on the next processing day.1BPAY Payments means the BPAY Payments service provided by BPAY Pty Ltd.8–9–Account electronically using ANZ InternetBanking, ANZ Internet Banking for Business orANZ Phone Banking. Each transfer mustcomprise a single debit to your ANZ BusinessOnline Savings Account and a single credit to aLinked Account; or

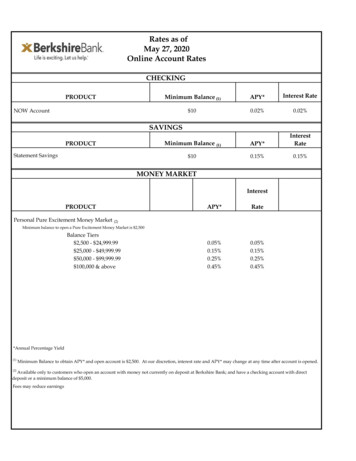

If a funds transfer is eligible to be processed throughthe New Payments Platform2, including throughOsko 3 it may be processed in near real time. If theNew Payments Platform cannot be used for anyreason, we will try to make the funds transfer throughother available payments systems, which willgenerally be processed as set above. You shouldalways allow sufficient time for funds transfers to bereceived if they cannot be made using the NewPayments Platform or Osko .If we receive a message through the New PaymentsPlatform that a payment will be made to you, we maytreat the payment as made even if we have not yetreceived the payment. If the payment is not receivedfor any reason, we can reverse the transaction, and thecredit and debit will be shown on your statement.Under these terms and conditions, ANZ will notusually process a transaction made at an ANZ ATM(including a deposit via an envelope). If ANZ agrees topermit a transaction made at an ANZ ATM, a cashdeposit made via an envelope at an ANZ ATM willusually take one to three business days to beprocessed to your account and a cheque depositmade via an envelope at an ANZ ATM may take up toseven business days to be processed to your account.Withdrawals conducted via another financialinstitution will be processed in accordance with thecut-off time agreed between ANZ and that financialinstitution (or their representative), and may bedifferent to the above.2.6 Payment procedures and insufficient fundsANZ reserves the right to pay transactions presentedfor payment in any order that we choose.2.7 Changes to Fees and Charges and Interest RatesThe table below sets out how and when ANZ willnotify you of changes to your account. You agree thatANZ may notify you of certain changes byadvertisement in major daily or national newspapers.New Payments Platform means the new payments platform operated by NPPAustralia Limited.Osko means the Osko payment service provided by BPAY Pty Ltd using theNew Payments Platform.23

Minimumnumber ofdays noticeMethod ofnoticeIntroduce anew fee30 daysIn writing.Increase anexisting feeor charge30 daysIn writing orby pressadvertisement.Change themethod bywhich interest iscalculated or thefrequency withwhich interest isdebited orcredited30 daysIn writing.Change theinterest ratethat applies toyour accountDay of changeIn writing orby pressadvertisement.Change thename of interestrates, accountsor publicationsDay of changeIn writing orby pressadvertisement. Registered to BPAY Pty Ltd ABN 69 079 137 518The rights mentioned above should be read as if theyare each a separate right of ANZ even though they areset out in the one table.Changes to Other Terms and ConditionsANZ may make any other change by giving youreasonable notice of the change, which may includenotice on the day the variation takes effect if that isreasonable in the circumstances.For example it will be reasonable in the circumstancesto give notice on the day of the change if ANZreasonably considers the change:i.has a neutral effect on your obligations;ii.reduces your obligations or;iii.is required to comply with any lawbut these examples do not limit the circumstancesin which it may otherwise be reasonable.Despite this clause, ANZ will always give you notice inaccordance with any applicable laws or industry10 – 11ANZ may make the following changes:

codes (such as the Code of Banking Practice) whichrequire any minimum notice periods or specificmethods of notification.Small Business CustomersThis clause will apply to you if you are a small business(as defined by the Code of Banking Practice) and ANZmakes a change only to your terms and conditions,but not to the terms and conditions of other smallbusiness customers.Where this clause provides that the minimum noticeperiod is the day of change, if ANZ reasonablyconsiders the change will be materially adverse toyou, it will provide you with reasonable notice of thechange (not less than 10 business days) unless itconsiders a shorter notice period is necessary to avoidor reduce an increase in credit risk to ANZ.2.8 InterestDetails of current interest rates applicable to youraccount are available: By contacting the Rate Inquiry Line Freecall on1800 033 888 8am to 8pm, Monday to FridayMelbourne time; or On ANZ Internet Banking.2.9 Interest calculations and paymentsInterest will be calculated on the daily closing balanceof your Account, provided your daily closing balanceis 5,000 or more, and is paid monthly on the lastbusiness day of the calendar month.The daily interest rate is the annual rate divided by thenumber of calendar days in the year.2.10 Provision of creditANZ does not agree to provide any credit in respect ofyour account.If you request a wtithdrawal or payment from youraccount which would overdraw your account, ANZmay, in its discretion, allow the withdrawal orpayment to be made on the following terms: Interest will be charged on the overdrawnamount at the ANZ Retail Index Rate plus amargin (refer to the fees and charges in section5 below for details);

The overdrawn amount and any interest on thatamount will be debited to your account; and You must repay the overdrawn amount and payany accrued interest on that amount withinseven days of the overdrawn amount beingdebited to your account.You should inform ANZ as soon as possible if you arein financial difficulty.2.11 StatementsANZ will issue statements for your account at leastevery three months or more often if you request. ANZcan arrange for statements to be sent to a nominatedthird party (e.g. your accountant).Your ObligationsYou must review and reconcile your records in respectof each account held with ANZ within sixty (60) daysafter you should have received the relevant statementof account (the ‘account reconciliation period’) andnotify ANZ immediately if: There has been any alleged omission from, ordebits wrongly made to, an account, or Any unauthorised transaction has been effectedin respect of an account.Subject to the Electronic Banking Conditions of Use,ANZ will only be responsible for investigating any suchtransactions during the account reconciliation period.ANZ requires you to take reasonable care andprecautions to prevent unauthorised or fraudulentnon-bank transactions occurring on your account(s)including, but not limited to:(a)reconciliation systems and procedures fromwhich you can promptly ascertain whetherunauthorised amounts have been debited toyour account(s) or expected payments have notbeen received;(b)regular verification of transactions on youraccount(s) by suitably qualified and/orexperienced people;(c)unless it is impractical, proper segregation ofduties, that is, the person responsible for thematters described in subclauses (a) and (b) is aperson other than that responsible for writingand/ or authorising transactions.12– 13

2.12 Privacy and confidentialityANZ will collect and use information about you duringthe course of your relationship with ANZ. We explainbelow when and how ANZ may collect, use anddisclose this information.It is important that the information ANZ holds aboutyou is up to date. You must let ANZ know wheninformation you have provided ANZ has changed.Unless otherwise stated, this clause applies toindividuals and non-individuals (e.g. companies).Collection, use and disclosure of informationANZ may use and disclose the information we collectabout you for the following purposes: to assist in providing information about aproduct or service; to consider your request for a product orservice; to enable ANZ to provide a product or service; to tell you about other products or services thatmay be of interest to you; to assist in arrangements with otherorganisations (such as loyalty partners) inrelation to the promotion or provision of aproduct or service; to manage accounts and perform otheradministrative and operational tasks (includingrisk management, systems development andtesting, credit scoring, staff training, collectingdebts and market or customer satisfactionresearch); to consider any concerns or complaints youraise against ANZ and/or to manage any legalaction involving ANZ; to identify, prevent or investigate any fraud,unlawful activity or misconduct (or suspectedfraud, unlawful activity or misconduct); to identify you or establish your tax statusunder any Australian or foreign legislation,regulation or treaty or pursuant to anagreement with any tax authority; and as required by relevant laws, regulations, codesof practice and external payment systems.

Information required by law etc.ANZ may be required by relevant laws to collectcertain information from you. Details of laws thatrequire us to collect information about individuals(personal information) and why these laws require usto collect personal information are contained in ANZ’sPrivacy Policy and at www.anz.com/privacy.Providing your information to othersANZ may provide your information to: any related entity of ANZ which may use theinformation to: carry out ANZ’s functions andactivities; promote its own products andservices; assess your application for one of itsproducts or services; manage your product orservice; perform administrative and operationaltasks (including debt recovery); or comply withregulatory requirements and prudentialstandards; an organisation that is in an arrangement withANZ to jointly offer products and/or has analliance with ANZ to share information formarketing purposes (and any of its outsourcedservice providers or agents), to enable them orANZ to: provide you with products or services;and/or promote a product or service; any agent, contractor or service provider ANZengages to carry out or assist its functions andactivities (for example, mailing houses or debtcollection agencies); an organisation that assists ANZ to identify,prevent or investigate fraud, unlawful activity ormisconduct; regulatory bodies, government agencies, lawenforcement bodies and courts; other parties ANZ is authorised or required bylaw or court/tribunal order to discloseinformation to; participants in the payments system (includingpayment organisations and merchants) andother financial institutions (such as banks);14 – 15Absence of relevant informationIf you do not provide some or all of the informationrequested, ANZ may be unable to provide you with aproduct or service.

other credit providers; mortgage insurers and any reinsurer of any suchmortgage insurer; your guarantors (and intending guarantors) andany person who has provided security for your loan any person who introduces you to ANZ; your referee(s); your employer; your joint borrower(s) or account holder(s) and your authorised agents; your executor,administrator or trustee in bankruptcy; yourlegal representative; your attorney; or anyoneacting for you in connection with your account.If you are an individual and do not want us to tell youabout products or services, phone 13 13 14 or yourANZ Manager to withdraw your consent.ANZ may disclose information to recipients (includingservice providers and ANZ’s related entities) which are(1) located outside Australia and/or (2) not establishedin or do not carry on business in Australia. You canfind details about the location of these recipients inANZ’s Privacy Policy and at www.anz.com/privacy.Credit ReportingIf you are an individual, you agree that ANZ mayobtain information about your credit history andcredit worthiness, including credit liabilities,repayments and defaults, from a credit reportingbody (including a body that provides information oncommercial activity and commercial creditworthiness) and use it to assess any application forcredit, to manage your credit and for the purposes ofdebt collection. ANZ may also disclose informationabout you to credit reporting bodies.Information about credit reporting, including thename and contact details of these credit reportingbodies, when ANZ may disclose your personalinformation to them to include in a report about yourcredit worthiness, and how you can requ

2.1 Electronic access to ANZ Business Online Saver Account Your ANZ Business Online Saver Account can only be operated when linked to an approved ANZ account. For accounts opened on or after 5 May 2012, approved linked accounts include ANZ Business Advantage, ANZ Business Extra and ANZ Business Premium Saver. Accounts opened prior to 5 May 2012File Size: 404KB