Transcription

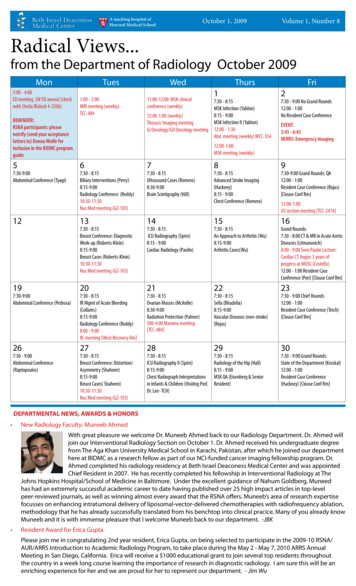

october 20093 Fried on executives’compensation: Are theyworth it?On his 70th birthday—andthe anniversary celebrationof the Constitution’ssigning—retired SupremeCourt Associate JusticeDavid Souter ’66 sharedsome perspectives on theConstitution and his plansfor retirement.On Constitution DayH A RVA R D U N I V E R S I T YFeldman and Souterdiscuss models ofjudicial decision-makinglTo view the conversation goto: law/23constitution.htmlDigital library or digitalbookstore?Introducing . Dean Minow!“[Martha] is someone who has won the admiration, both intellectual and personal, of a remarkable array of colleagues and students and alumni. Peoplespoke to me of her energy, her drive, her intellectual range and curiosity, herappreciation for different points of view, her caring and patience and worth,but also of her toughness and high standards and inner steel; her passion forthe law and for its ability to change people’s lives for the better; and, of heruncommon ability to bring people together for common goals,” said HarvardUniversity President Drew Faust, officially introducing Martha Minow to theHarvard Law School community as the new dean.Harvard Law TodayHarvard Law School125 Mount Auburn StreetCambridge, MA 02138M A R T H A S T E WA R TWHLS ProfessorLawrence Lessigwarns that theGoogle Booksettlement is toocomplex.Harvard University’sBerkman Center forInternet & Society,focused extensivelyon the ramificationsof the 2008 settlementreached by Google, theAuthors Guild and theAssociation of AmericanMinow welcomes incoming class a see story on page 6.H A RVA R D U N I V E R S I T YScholars look at fallout of Google Book settlement at HLShat willlibraries in2075 looklike? Can copyrightlaw be re-engineered?Should we trust Googleto make decisions inthe public interest?Those were some of thequestions discussed at“Alternative Approachesto Open DigitalLibraries in the Shadowof the Google BookSearch Settlement,” aconference which tookplace at Harvard LawSchool on July 31.Participants in theconference, whichwas sponsored bySouter offered his reflections in adiscussion with HLS Professor NoahFeldman, who once served as his lawclerk, at an Emerson Hall event.In response to criticisms of theConstitution—which were advancedby a panel of scholars just prior to hisappearance (see story p. 7)—Souteremphasized that the Constitutionwas intended by the framers to be adocument of “internal conflict.” Hehighlighted the fact that many of thebarriers to efficient governmentalaction were deliberately placed in theConstitution to prevent the excessiveconcentration of power at the highestlevels: “It is well,” he said, “forourselves to not let ourselves go toofar.”Because of the document’s inherentcompetition between values, theCourt’s doctrines cannot always beperfectly coherent, he said.When asked about the valueof originalism, Souter said theproblem with originalism is thatit’s “unlikely to provide you withvery specific answers to the kinds ofquestions that you are likely to ask.”Interpreting and understandinga certain text as it relates to theapplication of the law often requiresa reliance on outside references.One characteristic of a 8Minow with Faust at HLSreception on Sept. 2Publishers aboutcopyright infringementcaused by Google’s booksearch function.The massivesettlement devisesavenues for Google topay royalties to authorsthrough the 7Nonprofit Org.U.S. PostagePAIDBoston, MAPermit No. 54112INSIDE24678Cohen and Roin head Petrie-FlomLawyers in summerRepeat player: SG at HLSThe Constitution: Mixed reviewsDigital trial

2BRIEFSThe low-down on downloadingProfessors submit open letter to SECAcademic work by HLS faculty is downloaded morefrequently from the Social Science Research Network’sonline database than the work of any other law faculty,according to the law blog “Brian Leiter’s Law SchoolReports.” Scholarship by Lucian Bebchuk LL.M. ’80 S.J.D.’84 was downloaded more (23,416 times) than the work ofany other law author. Cass Sunstein ’78 and Vivek Wadhwa,a senior research associate at the HLS Labor and WorklifeProgram, were ranked fourth and seventh, respectively, with12,413 and 9,050 downloads. Allen Ferrell ’95 came in 14thwith 6,572 downloads.In August, a group of Harvard LawSchool and Harvard Business Schoolprofessors submitted a letter to theU.S. Securities and ExchangeCommission arguing for changes in anSEC policy proposal. HLS ProfessorsRobert Clark ’72, John C. Coates, Reinier Kraakman, MarkRoe ’75 and Guhan Subramanian ’98, along with fiveHarvard Business School professors, signed the letter,which recommended an increase in the percentage ofshareholders required to nominate a corporate director,from 1 percent to 5-10 percent. The group also suggestedan “opt-out” clause, allowing companies to bypass thethreshold rule if a majority of shareholders agree.Scott and Coates testify before SenateIn July, following the Treasury Department’sunveiling of the administration’s regulatoryoverhaul plan, Professor Hal Scott testifiedbefore the Senate Banking Committee onthe improvement of regulation in theinsurance sector. Scott called for reformingregulation of the insurance industry through optionalfederal charters, as opposed to the current system of statecharters. On July 29, Professor John C.Coates testified before the Senate BankingCommittee’s Subcommittee on Securities,Insurance and Investment at a hearing titled“Protecting Shareholders and EnhancingPublic Confidence by Improving CorporateGovernance,” offering recommendations for corporategovernance reform.Supreme clerksOf the 38 clerks to U.S. Supreme Court justices for the2009-2010 term, nine are Harvard Law School graduates:Adam Jed ’08Steven Lehotsky ’02Daniel Epps ’08Elizabeth (Petrela) Papez ’99Elizabeth (Barchas) Prelogar ’08John Rappaport ’06Andrew Crespo ’08h a r va r d l aw t o d ayoctober 2009Christopher Fonzone ’07Eloise Pasachoff ’04,,,,,,,,,Justice StevensJustice Scalia ’60Justice Kennedy ’61Justice ThomasJustice Ginsburg ’56-’58Justice Ginsburg ’56-’58Justice Breyer ’64Justice Breyer ’64President Barack Obama ’91 nominatedHLS Dean Martha Minow to the board ofthe Legal Services Corp., a bipartisan,government-sponsored organization thatis the single largest provider of civil legalaid for low-income Americans. John Levi’72 LL.M. ’73, a partner in the Chicago office of SidleyAustin, and Gloria Valencia-Weber ’86, a professor at theUniversity of New Mexico School of Law, were alsonominated. David Hall LL.M. ’85 S.J.D. ’88 and ThomasMeites ’69 currently serve on the board.HLS financial columnistsProfessors Lucian Bebchuk LL.M. ’80 S.J.D.’84, director of the Program on CorporateGovernance, and Professor Hal Scott,director of the Program on InternationalFinancial Systems, have begun writingmonthly financial commentaries for onlinepublications. Bebchuk is a columnist for Project Syndicate,an international association of 425 newspapers in 150countries. His commentaries, titled “The Rules of theGame,” focus on finance and corporate governance. Scott isa columnist for Financial News online, a source of news,analysis and commentary for the investment banking, assetmanagement and securities industry.Million-dollar missJustice SotomayorHARVARD LAW TODAYAssistant Dean forCommunicationsRobb London ’86EditorChristine PerkinsManaging EditorLinda GrantDesign DirectorRonn CampisiContributorsEmily Dupraz, Emily Newburger,Lia Oppedisano, Lori Ann Saslav,Colleen Walsh, Jeri ZederMinow named to Legal Services BoardEditorial OfficeHarvard Law Today125 Mount Auburn St.Cambridge, MA 02138617-495-3118today@law.harvard.eduSend change of address toAlumni Records125 Mount Auburn St.Cambridge, MA 02138alumrec@law.harvard.eduVolume 9 Number 1Harvard Law Today is publishedby Harvard Law School 2009 by the President andFellows of Harvard CollegeSelf-described as “the guy who lost 475,000 in three minutes,” Ken Basin ’08was a contestant on the ABC networkprogram “Who Wants to Be a Millionaire?”in August. Basin lost almost a half milliondollars in prize winnings when heincorrectly answered the million-dollar question: “LBJinstalled four buttons for drinks in the Oval Office, labeled‘coffee,’ ‘tea,’ ‘Coke,’ and what?” (Basin chose “Yoo-hoo”;the correct answer was “Fresca.”) On his blog, Basin, anassociate at Greenberg Glusker in Los Angeles, took the longview: “In real life, most people have to risk bankruptcy totake their shot at a million dollars, and all I had to do wasmake a calculated wager with found money.”Cohen and Roinnamed co-directorsof Petrie-FlomCenterAssistant professors of Law I.Glenn Cohen ’03 and Benjamin Roin’05 are the new co-directors of thePetrie-Flom Center for Health Law Policy,Biotechnology, and Bioethics at HLS.Cohen and Roin both joined the Petrie-FlomCenter as inaugural academic fellows in 2006.They were appointed assistant professors in2008.Cohen is currently working on projectsrelating to reproductive technology andmedical tourism. His past work has includedprojects on end-of-life decision-making,FDA regulation, research ethics andcommodification.A 2003 graduate of HLS, Cohen received theSears prize for the highest1L grades and was aneditor of the Harvard LawReview. Before joining theHLS faculty, he clerkedI. GLENN COHEN ’03for Chief Judge MichaelBoudin ’64, United StatesCourt of Appeals for the1st Circuit. He also servedas an appellate attorneyfor the United StatesDepartment of Justice,BENJAMIN ROIN ‘05Civil Division, AppellateStaff, where he acted as lead counsel in morethan 12 Circuit Court cases and representedthe United States in the U.S. Supreme Court, inconjunction with the solicitor general’s office.Roin, the Hieken Assistant Professorof Patent Law, works on issues involvingpharmaceutical innovation, FDA regulationsand the patent system. His previousscholarship includes work on why the patentsystem fails to achieve one of its functions—thedisclosure of patented ideas to others. Roin hasmultiple research interests, including patentlaw, trade secrecy, copyright law, trademarklaw, health law, food and drug law, andproperty law.Roin graduated from HLS in 2005, afteralso earning the Sears prize and serving as aneditor of the Harvard Law Review. After HLS,he clerked for Judge Michael McConnell onthe United States Court of Appeals for the 10thCircuit.The center was founded thanks to a generousgift from Joseph H. Flom ’48 and the PetrieFoundation in order to respond to the need forleading legal scholarship in the fields of healthcare, biotechnology and bioethics. ProfessorEiner Elhauge ’86, who has served as facultydirector since the center’s founding in 2005,will remain associated with the researchprogram as its founding director. ø

P H I L FA R N S WO R T HHaving a“say on pay”Jesse Fried ’92, a leading expert in executivecompensation, corporate governance, bankruptcy andventure capital, joined the HLS faculty in the fall fromthe University of California at Berkeley.In your 2004 book, “Pay withoutPerformance,” with Lucian Bebchuk,you described problems that have sincebecome widely recognized in the wake ofthe financial crisis. What caused theseproblems?We identify a number of ways in whichpay arrangements in public companieshave not served shareholders’ interests.Many executives are overpaid, andcompensated in ways that fail to givethem incentives to create shareholdervalue. Indeed, pay arrangementsfrequently reward managers fordecisions that destroy firm value. Oneof the main problems we highlight isexecutives’ ability to profit from shortterm results, even when those resultsare later reversed.The root of these problems, we argue,is that directors have been more attunedto the interests of the CEO than theinterests of shareholders, especiallywhen it comes to things like the CEO’sown pay. This is not surprising. CEOshave played a much more important rolethan shareholders in selecting directors.If directors wish to be renominated tothe board, or invited to serve on otherboards, there may be a cost to hagglingwith the CEO over his pay. At the sametime, directors reap little benefit fromreining in the CEO’s pay orensuring it creates properincentives—directors paythe CEO with shareholders’money, not their own.A simple cost/benefitcalculation naturally leadsdirectors to refrain frombargaining aggressively overCEO pay.The recent financial crisishighlighted what can go wrong whenpay arrangements are not properlystructured. There is now mountingevidence that badly designed bonusesplayed a major role in bringing downmany large financial institutions. EvenWall Street executives have admittedthat there were serious flaws in their payarrangements, and have begun takingsteps to fix them. Unfortunately, thisrecognition is coming a little too late formany of these firms and the taxpayerswho were called upon to bail them out.In June, the Obama administrationunveiled a plan to help rein in executivecompensation. How do you assess its likelyeffectiveness?The administration’s June statementdid not really offer a comprehensive“plan” for dealing with executive pay.Rather, it indicated Obama’s intent topropose or support legislation in twospecific areas: (1) making compensationcommittees more “independent,” in partby ensuring that they hired their owncompensation consultants and (2) givingpublic shareholders a nonbinding “sayon-pay” vote.I am skeptical that legislationtargeted at compensation committeeswill do much to improve executivepay arrangements. The thinkingis that compensation consultantshave an incentive to recommend payarrangements favorable to the CEObecause the consultants are oftenselected by management or withtheir input. Having the compensationcommittee itself select and hire payadvisers, it is argued, will give directorsaccess to better information and therebylead to more shareholder-serving payarrangements.But requiring compensationcommittees to use their own consultantsdoes not alter directors’ continuingincentive to favor the CEO on pay issues.Suppose the consultants hired by thecompensation committee propose ashareholder-serving pay arrangement,but the CEO rejects it. The compensationcommittee will simply go back to theconsultants and tell them to come upwith “Plan B”—an arrangement morepalatable to the CEO. The consultantswill promptly comply. Otherwise, theywon’t be rehired by the committee nextyear. Most consultants will simplystart with Plan B. As long as directorsfail to bargain aggressively with CEOsover pay, legislation requiring directorsto hire pay consultants directly islikely to have little effect on the payarrangements emerging out of thisprocess.I am more hopeful about the secondarea of legislation, “say-on-pay.” Oneimportant constraint on executive pay isdirectors’ fear of negative publicity andshareholder outrage. Say-on-pay shinesa spotlight on a board’s compensationdecisions, and provides shareholderswith an efficient mechanism forindicating their approval or disapprovalof these decisions. Because disapprovalis embarrassing to directors, enactmentof say-on-pay should make directorspush harder for pay arrangementsthat better serve shareholders’interests. Indeed, say-on-pay in theUK has led to more communicationbetween boards and shareholders overpay arrangements, and an improvedlink between pay and corporateperformance. I expect it to yield similarresults here. øl To read the full interview, go to: -law/02 fried.htmlh a r va r d l aw t o d ayFACULTY Q& AHow can executive compensationarrangements be improved?First, equity arrangements should focusexecutives’ attention on the long term.Currently, executives are free to cashout their equity once it vests, typicallyone to three years after the grant date.Instead, firms should require executivesto hold most of each equity grant fora fixed number of years after vesting.This would better tie executive’s equitypayoffs to long-term shareholder value.Some compensation reformers haveadvocated executives holding theirequity until retirement. I think thiswould be a mistake. Such arrangementswould perversely give the most effectiveexecutives an incentive to retireprematurely. In addition, the abilityto cash out all of one’s equity uponretirement would give executives on theverge of retiring an incentive to focuson the short-term rather than longterm. Both of these problems would beavoided if equity must be held for a fixednumber of years after vesting, ratherthan until retirement.Second, compensation should bestructured to reduce executives’ abilityto use inside information to time equitytransactions as well as to manipulate thestock price around these transactions.Consider stock sales. Executivesroutinely use inside information totime large sales of stock, and oftenmanipulate the stock price shortlybefore the sale. In a paper published lastyear, I urged firms to use “hands-off”arrangements under which each equitygrant must be cashed out gradually on aseries of dates specified when the grantis made.Hands-off equity would leave theexecutive no discretion overwhen her equity is cashedout. It would not just reduceexecutives’ ability to use insideinformation to boost theirsale profits, but eliminate italtogether. I also showed thatthe gradual unwinding under ahands-off arrangement wouldensure that executives havelittle incentive to manipulatethe price around each disposition oftheir stock.october 20093

4Yoon Suk ChooWYoon Suk Choointerned with theCitizens‘ Alliancefor North KoreanHuman Rights, inSeoul, South Korea.hen YoonSuk Choo’11 was inmiddle school, hisfather brought homea documentary aboutNorth Korean childrenorphaned by parentswho starved to death orwere forced by povertyto abandon them. In thevideo, the children fedthemselves by pickingseeds from the ground.“This was my firstcontact with these NorthKorean refugees,” Choosays. “Ever since, I havemaintained an interestin them. At law school,I finally had a chanceto get involved lastsummer.”That involvementcame through aninternship in Seoul,South Korea, with theDominiqueWintersh a r va r d l aw t o d ayoctober 2009TDominique Wintersspent the summerwith the PublicDefender Servicefor the District ofColumbia.he clientwas on trial fordouble homicide.Dominique Winters ’10wrote a winning pretrialmotion that excludeda witness’s hearsaytestimony. On theday the verdicts camedown, Winters held ittogether until the juryforeperson uttered: “Notguilty.” “I was cryingat the end of that trialbecause I was nervoushe would be foundguilty,” says Winters,who steadfastly believedin her client’s innocence.“The murders happenedover a decade ago. Hehad gone and lived hislife, and then they hithim with this.”Citizens’ Alliance forNorth Korean HumanRights, an NGO thathelps bring NorthKorean escapees toSouth Korea. Among itsmany projects, NKHR istrying to establish thatthe U.N. ConventionRelating to the Status ofRefugees protects theseescapees from beingturned back by Chinato North Korea, wherethey face imprisonmentand worse. The legalhurdle is whether theirhardship is economicor political in nature;if it’s economic, theconvention does notapply. Choo’s researchsupports the case thattheir plight is political:“North Korea classifiesall its citizens intothree classes—loyal,wavering, hostile—and51 subcategories. If yourancestor fought withthe national founderKim II Sung in the warof independence, thenyou are at the top,”Choo explains. “Peoplesuffering the brunt ofthe hardship are, ofcourse, those in the lowclass.”Choo first becameinterested in international law afterreading about WoodrowWilson’s vision of lawreplacing realpolitikas a way of resolvinginternational conflicts.But he also feels aspiritual pull: “I feel thathuman rights work is avery worthwhile place tobe because this is wherepeople are caring foreach other. People whowork in human rightsare not out to achievetheir own purposes.They are trying to helpother people. I could feelthis strongly over thesummer.”Winters spent thissummer with th

TY HLS Professor Lawrence Lessig warns that the Google Book settlement is too complex. MA RT HA S TEW A RT On his 70th birthday—and the anniversary celebration of the Constitution’s signing—retired Supreme Court Associate Justice David Souter ’66 shared some persp