Transcription

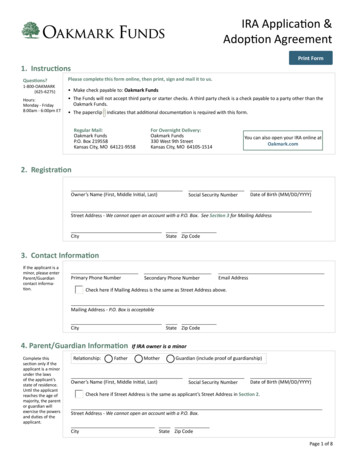

IRA Distribution FormPrint Form1. :Monday - Friday8:00am - 6:00pm ETPlease complete this form online, then print, sign and mail it to us. Use this form to redeem from your Oakmark traditional, Roth, SEP or SIMPLE IRA account. Use this form to transfer or redeem IRA assets due to death. To redeem from your Oakmark regular, taxable account, use the Redemption Request Form. To take a Required Minimum Distribution (RMD), use the IRA Required Minimum Distribution (RMD) Form. The paperclip indicates that additional documentation is required with this form.Regular Mail:Oakmark FundsP.O. Box 219558Kansas City, MO 64121-9558For Overnight Delivery:Oakmark Funds330 West 9th StreetKansas City, MO 64105-1514You can also redeem from your IRAaccount at Oakmark.com2. Existing Account InformationPlease see anaccount statementfor this information.To redeem fromanother account,please completeand attach anadditional form.Account NumberSocial Security Number/Tax Identification NumberDate of Birth (MM/DD/YYYY)Account Owner’s Name (First, Middle Initial, Last)3. Contact InformationPrimary Phone NumberSecondary Phone NumberEmail Address4. Type of DistributionIRA redemptions can havetax implications.Please consult a taxadvisor to ensureyou have a fullunderstanding ofthe tax implicationsand IRS regulationsprior to initiatinga redemption. Formore information,consult IRS Publication 590.*If you are age 70 ½or older, you musttake your RMD inconjunction with arollover if you havenot already fulfilledyour annual RMD.Select one:Normal DistributionIRA owner is age 59 ½ or older. Go to Section 5.Early Distribution, No Exception AppliesIRA owner is under age 59 ½ and no exception to the age 59 ½ rule applies. Go to Section 5.Early Distribution, Exception AppliesIRA owner is under age 59 ½ and the distribution is for certain expenses, including, but not limited to: a first-timehome purchase, qualified higher education expenses, medical insurance, disability, or unreimbursed medicalexpenses exceeding 7.5% of your adjusted gross income. Go to Section 5.Participant Rollover*IRA owner is rolling over the proceeds to another qualified retirement plan within 60 days after receipt of the distribution. The distribution will be reflected as Early or Normal on IRS Form 1099-R. The receiving IRA custodianshould reflect the rollover contribution on IRS Form 5498. Go to Section 5.Page 1 of 9

4. Type of DistributionContinuedSubstantially Equal Periodic Payments (SEPP)IRA owner is under age 59 ½. Distributions are to be made at least annually using a life expectancy methodin Section 5, and payments must generally continue for at least five full years, or if later, until age 59 ½. Go toSection 5.Excess Contribution(s)IRA owner is removing excess contribution(s) and associated earnings, if any. To avoid a penalty tax, excess contribution(s) and earnings must be withdrawn before the due date, including extensions, of your federal incometax return for the tax year of the excess contribution.Are you removing the excess contribution(s) and earnings before your tax-filing deadline?YesNoSelect one:Removeand earnings fromRemoveand earnings fromRemove all contributions and earnings undSqNameforTax YearTax Year.Tax YearSelect one:Invest the excess contribution(s) and earnings in the same IRA for the current year. The amount must beequal to or less than your annual IRA contribution limit. Go to Section 9.Investof the excess contribution(s) and earnings in the same IRA for the current yearand redeem the balance. Go to Section 6.Redeem the excess contribution(s) and earnings. Go to Section 6.IRA RecharacterizationIRA owner is recharacterizing IRA contribution(s) or conversion(s) and associated earnings, if any, to a differenttype of IRA.Are you recharacterizing the contribution(s) and earnings before your tax-filing deadline?YesNoSelect one:Recharacterizeand earnings fromRecharacterizeand earnings fromRecharacterize all contributions and earnings undSqNameforTax YearTax Year.Tax YearSelect one:Recharacterize the contribution(s) and earnings to my existing Oakmark IRA accountGo to Section 9.Recharacterize the contribution(s) and earnings to my new Oakmark IRA. Complete and attach the IRA Application & Adoption Agreement or SIMPLE IRA Application & Adoption Agreement. Go to Section 9.Page 2 of 9

4. Type of DistributionContinuedDeath Distribution to the Spouse or Non-spouse BeneficiaryEach beneficiary must complete one form. You must provide your signature in Section 9 and obtain a medallionsignature guarantee in Section 10.I am the spouse beneficiarySelect one:Transfer my portion of the IRA assets to my existing Oakmark IRA accountComplete RMD Election section below, if applicable. Go to Section 9.Transfer my portion of the IRA assets to a new Oakmark IRA. Complete and attach the IRA Application & Adoption Agreement. Complete RMD Election section below, if applicable. Go to Section 9.Redeem my portion of the IRA assets. An IRA account will be established in your name in order toredeem the assets. Provide your name, SSN and mailing address below. Go to Section 6.Name (First, Middle Initial, Last)Social Security NumberMailing AddressCityState Zip CodeRMD ElectionComplete this section if you are transferring the shares to your own IRA and your spouse was requiredto take RMDs. Unless noted below, we will take the full RMD from the account prior to performing thetransfer. The amount will be reported in your name and SSN.Select one:Distribute RMD ofprior to transferring.Distribute full RMD prior to transferring.Do not distribute RMD. RMD will be fulfilled from another IRA or IRA owner has already fulfilled hisor her RMD for the year.I am a non-spouse beneficiarySelect one:Transfer my portion of the IRA assets to a new Oakmark Decedent (DCD) IRA.the IRA Application & Adoption Agreement. Go to Section 9.Complete and attachRedeem my portion of the IRA assets. An IRA account will be established in your name in order toredeem the assets. Provide your name, SSN and mailing address below. Go to Section 6.Name (First, Middle Initial, Last)Social Security NumberMailing AddressCityState Zip CodePage 3 of 9

4. Type of DistributionIf mandated by thestate, the executormust provide a taxwaiver.ContinuedDeath Distribution to an Estate Beneficiary or the EstateThere is no beneficiary named on the IRA account. The estate executor must provide a signature in Section 9 andobtain a medallion signature guarantee in Section 10.Transfer to new Oakmark Decedent (DCD) IRA(s)Complete and attach an IRA Application & Adoption Agreement for each estate beneficiary. Go toSection 9.Percent%Estate Beneficiary Name (First, Middle Initial, Last)%Estate Beneficiary Name (First, Middle Initial, Last)%Estate Beneficiary Name (First, Middle Initial, Last)%Estate Beneficiary Name (First, Middle Initial, Last)Distribute to an Estate BeneficiaryEach estate beneficiary must complete one form. A conduit account will be established in the beneficiary’s name in order to redeem the assets. Provide the beneficiary name, SSN and address below. Both theexecutor and beneficiary must provide their signatures in Section 9. The executor must obtain a medallionsignature guarantee in Section 10. Go to Section 6.Beneficiary Name (including Trusts or Charities)Social Security Number/TINName of Trustee/Authorized Party (First, Middle Initial, Last) If beneficiary is a trust or charityMailing AddressCityState Zip CodeDistribute to the EstateA conduit account will be established in the estate’s name in order to redeem the assets. Provide the estatename, TIN, and address below. The executor must provide a signature in Section 9 and obtain a medallionsignature guarantee in Section 10. Go to Section 6.Estate NameTax Identification NumberMailing AddressCityState Zip CodePage 4 of 9

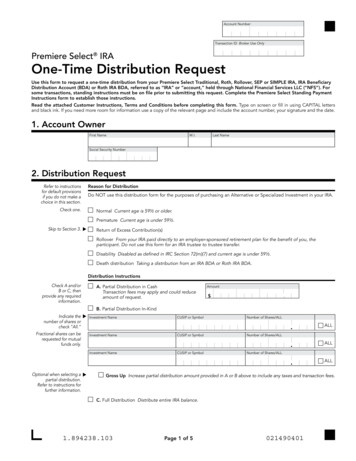

4. Type of DistributionContinuedDivorceIRA owner must provide a signature in Section 9 and obtain a medallion signature guarantee in Section 10.Select one:Transfer% of the IRA assets to the existing Oakmark IRA accountGo to Section 9.Transfer% of the IRA assets to a new Oakmark IRA.Application & Adoption Agreement. Go to Section 9.Complete and attach the IRARedeem% of the IRA assets. An IRA account will be established in the ex-spouse’s name inorder to redeem the assets. Provide the name and SSN below. Go to Section 6. Both you and yourex-spouse must sign in Section 9.Name (First, Middle Initial, Last)Social Security NumberMailing AddressCityState Zip Code5. Distribution Amount & FrequencySelect one:One-time DistributionRedeem the following amounts from the Funds listed below. Go to Section 6.Fund NameShare ClassRedemptionAmountDollars, Sharesor PercentOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesOngoing Systematic Withdrawal PlanRedeem the following amounts from the Funds listed below. Proceeds will be sent according to the payment schedule you specify below. If you choose more than one month, Oakmark will divide the amount into equal payments forthe months chosen.RedemptionDollars, SharesAmountor PercentFund NameShare ClassOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesOakmark lobalFundFundFundSmallFund Cap FundPercent х р ʨSharesPercentDollarsSharesRedemptions will occur on the 15th of the month or the next business day, unless otherwise specified below.When choosing a month and date, please allow at least 10 business days from receipt of this form to set up theplan.Transaction should occur on theAll Monthsorday of the month.31st ɏ ɏ ɏ ɏ h4th5th3rd4th2nd3rd1st2ndJan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecPage 5 of 9

5. Distribution Amount & FrequencyContinuedLife Expectancy DistributionsSelect one:* Oakmark uses thefollowing formulato calculate the lifeexpectancy distribution: Value of IRA/ Life ExpectancyFactor Withdrawal Amount.The IRA value usedto calculate thedistribution is equalto the value as ofDecember 31st ofthe year precedingthe distributionyear.Distribute based on the Uniform Lifetime Table (for use by unmarried owners, married owners whose spouses are not more than 10 years younger, and married owners whose spouses are not the sole beneficiaries oftheir IRAs).*Distribute based on the Single Life Expectancy Table (for use by beneficiaries).*Distribute based on the Joint Life and Last Survivor Expectancy Table (for use by owners whose spouses aremore than 10 years younger and are the sole beneficiaries of their IRAs).*My spouse’s birth date is:MM/DD/YYYYSelect one:One-time DistributionGo to Section 6.Ongoing Systematic Withdrawal PlanProceeds will be sent according to the payment schedule you specify below. If you choose more than onemonth, Oakmark will divide the amount into equal payments for the months chosen.Redemptions will occur on the 15th of the month or the next business day, unless otherwise specifiedbelow. When choosing a month and date, please allow at least 10 business days from receipt of this formto set up the plan.Transaction should occur on theAll Monthsorday of the month.31st ɏ ɏ ɏ ɏ h4th5th3rd4th2nd3rd1st2ndJan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec6. Income Tax WithholdingIncome tax withholding does notapply to Roth IRAdistributions.If you do not make an election below, we are required to withhold 10% from the amount distributed for payment offederal taxes.If you elect not to have withholding apply, you will still be liable to pay federal income tax on the taxable portion of thedistribution and may be required to pay estimated taxes. You may incur penalties if your withholding and estimatedtax payments are not sufficient. If applicable, we will also withhold your required state tax if you have elected to havefederal taxes withheld. Your election will remain in effect until you revoke it by notifying us in writing. Any election orrevocation will be effective no later than 30 days after such notice has been received.Select one:Do not withhold taxesWithhold taxes at the rate of%Page 6 of 9

7. Delivery InstructionsA. Invest ProceedsSelect one:Invest the proceeds in my existing non-retirement account:Fund NameShare ClassAccountNumberDollar Amount or Percent%Oakmark lobalFundFundFundSmallFund Cap Fund%Oakmark lobalFundFundFundSmallFund Cap Fund%Oakmark lobalFundFundFundSmallFund Cap Fund%Oakmark lobalFundFundFundSmallFund Cap FundInvest the proceeds in a new, non-retirement account:Complete and attach the Oakmark New Account Registration Form.B. Send Proceeds Via MailSelect one:Via Regular Mail. Proceeds should be received 7-10 business days after receipt of your request in good order.Via Overnight Mail. A 25.70 overnight fee will be deducted from your account. Proceeds should be received2-3 business days after receipt of your request in good order.Select one:Make check payable to current name and address on file. All Oakmark account owners must obtain a medallionsignature guarantee in Section 10 if the address on file has changed within the last 15 days.Make check payable to name and address provided in Section 4. You must obtain a medallion signature guarantee in Section 10.Make check payable to another name and address or send check to another name and address. All Oakmarkaccount owners must obtain a medallion signature guarantee in Section 10. Please provide the payee and mailinformation:Payee NameAddressCityState Zip CodeCityState Zip CodeMailing Recipient (if different)Mailing Address (if different)Page 7 of 9

7. Delivery InstructionsContinuedC. Send Proceeds ElectronicallySelect one:Via Automated Clearing House (ACH). Proceeds should be received 2-3 business days after receipt of yourrequest in good order.Via Federal Funds Wire. A 5 wire fee will be deducted from your account. Proceeds should be received 1-2business days after receipt of your request in good order.Select one:Send the proceeds to my bank account on file.Send the proceeds to a bank account I wish to add on file. All Oakmark account owners must obtain a medallion signature guarantee in Section 10. Please see Section 8 for additional requirements.Send the proceeds to a bank account that I do NOT wish to add on file. All Oakmark account owners must obtain a medallion signature guarantee in Section 10. Please provide the bank information:Bank NameBank Account Owner Name(s)Bank Routing NumberBank Account Number8. Bank InformationYou must attacha voided checkwith pre-printedrouting andaccount numbers.Complete this section if you would like to establish banking information and electronic transfers to and from your bankaccount or change your banking information. We will not accept starter checks or mutual fund money market checks. All Oakmark account owners must sign this form in Section 9 and obtain a Medallion Signature Guarantee (MSG)stamp in Section 10. If there is no name in common between the Oakmark account owners and the bank account owners, ALL Oakmarkaccount owners and bank account owners must sign this form in Section 9 and obtain a Medallion Signature Guarantee (MSG) stamp in Section 10. For custodial accounts, including UGMA/UTMA and ESAs, only the custodian or responsible individual is consideredthe Oakmark account owner.Please note that this banking information will be added to all account

IRA owner is rolling over the proceeds to another qualified retirement plan within 60 days after receipt of the dis- tribution. The distribution