Transcription

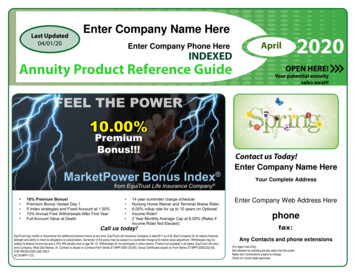

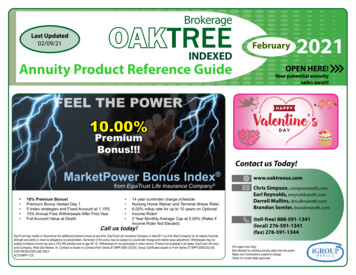

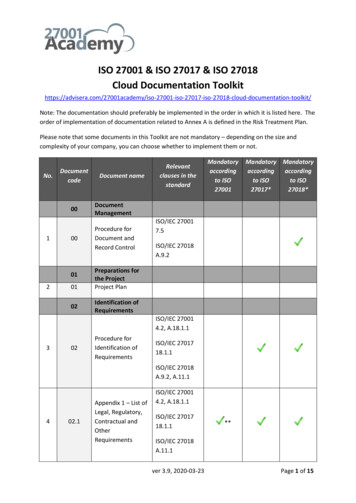

BrokerageTREELast Updated02/09/21INDEXEDAnnuity Product Reference GuideFebruary2021OPEN HERE!Your potential annuitysales await!FEEL THE POWER10.00%PremiumBonus!!!MarketPower Bonus Index from EquiTrust Life Insurance Company 10% Premium Bonus!Premium Bonus Vested Day 15 Index strategies and Fixed Account at 1.15%10% Annual Free Withdrawals After First YearFull Account Value at Death 14 year surrender charge scheduleNursing Home Waiver and Terminal Illness Rider6.00% rollup rate for up to 10 years on OptionalIncome Rider!2 Year Monthly Average Cap at 5.00% (Rates ifIncome Rider Not Elected)Call us today!EquiTrust may modify or discontinue the additional premium bonus at any time. EquiTrust Life Insurance Company is rated B by A.M. Best Company for its relative financialstrength and ability to meet its obligations to policyholders. Surrender of the policy may be subject to a surrender charge and market value adjustment. Withdrawals may besubject to federal income tax and a 10% IRS penalty prior to age 59 1/2. Withdrawals do not participate in index returns. Product not available in all states. EquiTrust Life Insurance Company, West Des Moines, IA. Contract is issued on Contract Form Series ET-MPP-2000 (02-05). Group Certificates issued on Form Series ET-MPP-2000C(02-05).FOR PRODUCER USE ONLY.AC18-MPP-1123Contact us Today!www.oaktreeus.comChris Simpson, csimpson@otfc.comEarl Reynolds, ereynolds@otfc.comDarrell Mullins, dmullins@otfc.comBrandon Semler, brandon@otfc.com(toll-free) 888-591-1341(local) 276-591-1341(fax) 276-591-1344(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.

APERFECT1010 Year Surrenderwith3.25%-4.50% InterestRate Caps allows captureof market gains withoutmarket risk.1ANNUITYOPTIONS}Guaranteed LifetimeWithdrawal Benefit available with 6.75%2 IncomeAccount Rate.3Waiver of withdrawalcharges for terminal illness,home health care and nursing home benefit. 4SELECT SERIES FIXED INDEXED ANNUITYDuration3-Year 5-Year 7-Year 10-YearFixed Rate 1.30%1.75%1.85%2.15%Cap3.25%4.00%4.10%4.50%1 This policy does not participate directly in any stock or equity investments. The cap is guaranteed for thefirst policy year. Thereafter, the cap may be changed annually by Oxford Life. Effective 01/01/2021 andsubject to change. 2 Rate applies to the first three, five, seven, or ten year policy years based upon rateat issue. 3 The income account value is not available for withdrawal or cash surrender and is only used tocalculate the guaranteed lifetime withdrawal benefit amount. The Guaranteed Lifetime Withdrawal Benefitis available at the time of application for an additional annual fee of 3/4% of the accumulation value of thebase contract. Rider form GLWB210 and state-specific variations where applicable. 4 For eligible qualifyingevent. Not available in all states. Rider form DA520Call us Today!800-842-9124www.oaktreeus.comO-AN1298C4THIS IS A SOLICITATION FOR ANNUITY PRODUCTSEquiTrust Life’sMarket Value Index 4 Index Strategies and a Fixed Account at 2.50% Accumulation Value at Death 2-Year Monthly Average Cap with 10% CAP No Cap option with 28.00% Participation rateFree Withdrawals; 10% after First YearMonthly interest optionNursing Home Waiver(Rates if income Rider Not Elected)BrokerageTREECall us Today for More Details!888-591-1341Market Value EIA, is issued by EquiTrust Life Insurance Company. Subject to availability. Refer to brochure and contract for more details. FOR BROKER USE ONLY.Not for public use. Withdrawals maybe subject to surrender charges, market valueadjustments, and/or federal income tax. A 10% federal income tax penalty mayapply to withdrawals taken before age 59½.

Table of Contents - Company Overviews4INDEXED ANNUITIES5GUARANTEE INCOME RIDER (BENEFIT LIVING) COMPARISON6-8AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 221-12348-9AMERICAN GENERAL LIFE COMPANIES*Policies issued by American General Life and United States Life (NY only)A.M. Best Rating* A (excellent) (888) 438-693318AMERICAN NATIONAL INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 835-532010-12 ATHENE ANNUITY & LIFE ASSURANCE COMPANYA.M. Best Rating A (excellent) (855) 428-4363, option 113ATLANTIC COAST LIFE INSURANCE COMPANYA.M. Best Rating B (good) (844) 442-384714EQUITRUST LIFE INSURANCE COMPANYA.M. Best Rating B (good) (866) 598-369415-16 F&G ANNUITIES AND LIFEA.M. Best Rating A- (good) (800)-445-675817GLOBAL ATLANTIC FINANCIAL GROUPA.M. Best Rating A (excellent) (866) 645-244918-21 GREAT AMERICAN LIFE INSURANCE COMPANYA.M. Best Rating A (superior) (800) 438-3398 x1199921GUGGENHEIM LIFE & ANNUITY COMPANYA.M. Best Rating B (good) (800) 767-774922LINCOLN FINANCIAL GROUPA.M. Best Rating A (superior) (800) 238-625223-24 NASSAU RE COMPANYA.M. Best Rating B (good) 888-794-444725-28 NORTH AMERICAN COMPANY FOR LIFE AND HEALTHA.M. Best Rating A (superior) (877) 586-0242 x3567629OXFORD LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (800) 308-231828SAGICOR LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 724-4267 x618030-33 SILAC LIFE INSURANCE COMPANYA.M. Best Rating B (good) (800) 352-512134SYMETRA LIFE INSURANCE COMPANYA.M. Best Rating A (excellent) (888) 802-9989(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.*The most prominent independent ratings agencies continue to recognize AmericanGeneral Life Insurance Company in terms of insurer financial strength. For currentinsurer financial strength ratings, please consult our Internet Web page, www.americangeneral.com/ratings. See Advertising Disclosures for additional information.3

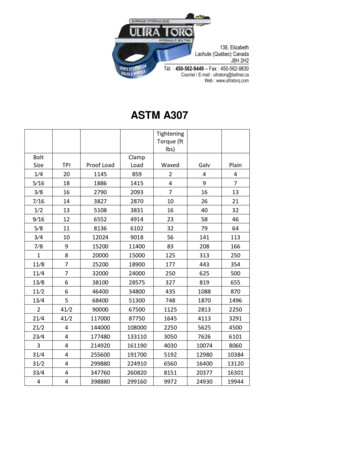

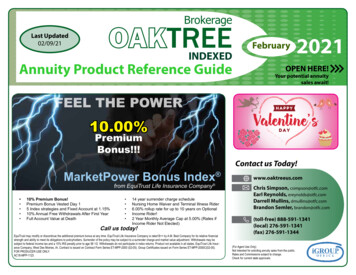

Updated February 9, 2021(Lower Band Rates Shown)BonusCapFixedRateS&P 500ParticipationRateMinimumSurrender ValueSurrenderChargePeriodCommission(less at OlderAges)American Landmark 5Select SeriesRetirement Plus 2.00%100% First Year100% First Year100% First Year1.00% on 87.5%1.00% on 87.5%1.00% on 100%5 years5 years5 years3.75%3.50%6.15%Teton Bonus 7Strategy Plus - 7Performance Elite - 7Choice Accumulation IIDenali 7MarketSeven 2.20%5.00%4.00%1.25%2.15%1.30%1.05%2.50%2.25%100% First Year100% First Year100% First Year100% First Year100% First Year100% First Year1.00% on 87.5%1.00% on 87.5%1.00% on 100%1.00% on 100%1% on 87.5%1% on 87.5%7 years7 years7 years7 years7 years7 years5.50%5.00%5.00%5.00%5.50%5.50%Performance Choice 80.00%3.00%1.40%100% First Year1.00% on 87.5%8 years4.75%Performance Elite- 10HighlanderTeton Bonus 10Market Value EIAStrategy Plus - 10Safe ReturnCharter Plus - 10VersaChoiceChoice Accumulation IIMarket 10 BonusRoyal %1.50%2.50%2.25%1.20%1.00%1.15%1.10%1.10%1.30%100% First Year100% First Year100% First Year100% First Year100% First Year100% For Term100% First Year100% First Year100% First Year100% First Year100% First Year1.00% on 87.5%1.00% on 100%1.00% on 87.5%2.00% on 87.5%1.00% on 87.5%1.00% on 100%1.00% on 87.5%1.00% on 100%1.00% on 100%1.00% on 100%1.00% on 87.5%10 years10 years10 years10 years10 years10 years10 years10 years10 years10 years10 6.00%6.50%2.25%2.50%4.00%1.15%1.10%1.75%100% First Year100% First Year100% First Year2.00% on 87.5%1.00% on 87.5%1.00% on 87.5%14 years14 years14 years8.00%6.50%9.00%Company5 year termGreat American LifeOxford LifeAtlantic Coast Life7 year termSILAC LifeAmerican NationalAthene AnnuityGlobal AtlanticSILAC LifeEquiTrust8 year termNorth American10 year termAthene AnnuityGuggenheimSILAC LifeEquiTrust LifeAmerican NationalGreat American LifeNorth AmericanNorth AmericanGlobal AtlanticEquiTrust LifeOxford Life14 year termEquiTrust LifeNorth AmericanSILAC LifeIndexed AnnuitiesProduct NameMarket Power BonusCharter Plus - 14Teton Bonus 146.00% for 7 yrs0.00%0.00%6.00% for 5yrs8.00%10.00%8.00% for 7 yrs10.00%Cap S&P 1 Year Point to Point with CAP(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.4

Guarantee Income Rider (Living Benefit) uityAtlanticCoast LifeAtlanticCoast LifeAtlanticCoast Nassau REOxford LifeLifetimeIncomePlus FlexStrategyPlusIncomeRiderAscentIncomeRiderOption 1ACL 75% for 10years7.20% 10years or4.20% plusinterest for10 years7% incomebase bonus10% Simpleyrs 1-105% Simpleyrs 11-207% for 10yearsPlus anadditional1% in firstyear8.00%5.00%10% IncomeBase Bonus4% Roll UpPlus CreditedRate for 10Years6.50% for 10years7.00% for 7years7.00% for 7yearsPlus a 7%Benefit BaseBonus!5% IncomeBase Bonus,4% roll-up stackingcredits for 10years14.00%SimpleInterest for10 years7.15%annuallyfor first tenpolicy yAnnuallyNoNoNoYes Based onADL’sYes Based onADL’sYes Based onADL’sYes Based %0.95%1.00%1.25%1.25%0.90%0.95%0.95%Roll-up Rate inAccumulation PeriodInterest CreditedIncome W/D Multiplier Confinement Feature(See Contract for Qualifying Confinement Criteria)NoNoYes180 days ofconfinement,Not availablein all statesStart Stop OptionYesYesYes1.00%0.90%0.60% withstacking1.00%1.05%1.25% feeyears 1-5,1.60% feeyears 6-10(10 yearcontract)Increasing Benefit OptionYesNoYesNoNoNoNoNoNoNoNoNoNoGuaranteed Payments drawal Phase WaitingPeriod1 Year and 60year old1 year and 50year oldAge 50Age 55ImmediateImmediate1 Years and50 year old1 Years and50 year old1 Years and50 year old1 Years and50 year old1 Year and 60year oldAge 501 Year and50 year oNoYesYesYesYesYesYesYesYesYesYesYesYesYesYesAll except:NYAll except:CA, NYAll except:NYAll except:NJ, NY, WAAll except:SDAll except:FLAll except:NYAll except:NYAll except:NY, ORAll except:CA, DE, NYAll except:NYSee Page 22All except:AL, NY, VT,WV (MT &CA for 040-8540-7550-800-8050 Rider Charge(calculated annually against the IAV,deducted monthly from AV)Rider Charge RefundAccount Available at DeathJoint Lifetime WithdrawalOption availableState AvailabilityIssue AgesOptionto add 10more yearsavailable!For Agent Use Only.Not for Use with the Public.5

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (AEI)CurrentInterestINDEXEDBonus Gold10% PremiumBonus on all 1st yearpremiumsNEWGuaranteedInterestCapPRAsset FeePTS&P 500 Annual Monthly Avg w/PR-14%--S&P 500 Annual Monthly Avg w/Cap2.25%-0%--10%--S&P 500 Annual Pt to Pt w/PRS&P 500 Annual Pt to Pt w/Cap2.25%-0%-Dow Annual Monthly Avg w/Cap2.25%-0%-Dow Annual Pt to Pt w/Cap2.25%-0%-S&P 500 Monthly Pt to Pt w/Cap1.60%---10 Yr. U.S. Treasury Bond w/Cap2.50%-0%----1.75%5.15%-2.00%---4.75%-S&P 500 Performance TriggerBond Yield w/CapS&P 500 Dividend Aristocrats DRC 5%MinimumGuaranteedInterest:Currently 1.75%MGIR is set at issueand guaranteedfor the life of thecontract.80% of 1st yearpremium pluspremium bonusplus 87.5%additional premium,less withdrawalproceeds, at ovisionsMinimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00010% of ContractValue Annually,Starting Yr 2.Systematic W/D& RMD Immediately from FixedValue.3Rates Effective as of 02-08-2021SurrenderCharges16 years(20, 19.5, 19, 18.5,18, 17.5, 17, 16, 15,14, 12, 10, 8, 6, 4,2, 0%)DE - 17 yearIssueAgesMVAY YesN No7.00%Ages 18-7518-80 Qand NQFL ONLY18-64 Q &NQCommissionN5.00% ages 76-80Florida7.00%Ages 18-6475-80 750,000States NotAvailableAK, CA, CT,DE, MN, MT,NV, NY, OH,OK, OR, PA,SC, TX, UT,WA, NJCurrent Fixed Value Rate 1.30%Retirement Gold8% Premium Bonus onall 1st year premiumsIN ( 8% ages 18-73, 5%ages 74-78)CapPRAsset FeePTS&P 500 Annual Monthly Avg w/PR-12%--S&P 500 Annual Monthly Avg w/Cap2.00%---S&P 500 Annual Pt to Pt w/PR-10%--S&P 500 Annual Pt to Pt w/Cap2.00%---S&P 500 Monthly Pt to Pt w/Cap1.50%-0%----1.50%4.65%-2.00%---5.25%-S&P 500 Performance TriggerNEWBond Yield w/CapS&P 500 Dividend Aristocrats DRC 5%Current Fixed Value Rate 1.15%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change. Check for current state approvals.MinimumGuaranteedInterest:Currently 1.75%MGIR is set at issueand guaranteedfor the life of thecontract.87.5% of premiumspaid less withdrawalproceeds, at MGIR,compoundedannuallyMinimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00075-80 750,00010% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days7.00% ages 18-7810 years(12.5,12,12,11,10,9,8,7,6,4,0%)8% bonus fullyvested after year 1418-78 Qand NQNIN(7.00% ages18-75)FL(7.00% ages18-64)AK, CA, CT,DE, FL, MN,NV, NY, NJ,OH, OK, OR,PA, SC,TX, UT, WA6

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (AEI)CurrentInterestINDEXEDIncomeShield 77% Premium Bonus onall 1st Year PremiumsIncomeShield 77% Premium Bonus onall 1st Year PremiumsINCOMESHIELD 10WITH LIBR7% Premium Bonus onall 1st Year PremiumsMinimum: 5,000CapPRMinimum Guaranteed2.75%N/AInterest: Currently 1.00%S&P 500 Annual Pt to Pt w/ PRN/A10%MGIR is set at issue andguaranteed for the life ofthe contract.S&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ Cap4.50%S&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ PRN/AN/A87.5% of premiumspaid less withdrawalproceeds, accumulatedat the MGIR,60%CapPRS&P 500 Annual Pt to Pt w/CapIncomeShield 101.75%N/AS&P 500 Monthly Pt to Pt w/ Cap1.50%N/AN/A10%S&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ Cap2.50%N/AS&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ PRN/A35%S&P 500 Dividend Aristocrats Daily Risk Control 5%ER Index 2-Year Pt to Pt w/ PRN/A55%S&P 500 Annual Pt to Pt w/ PRMinimum GuaranteedInterest: Currently 1.00%MGIR is set at issue andguaranteed for the life ofthe contract.87.5% of premiumspaid less withdrawalproceeds, accumulatedat the MGIR,Maximum:50-69 1,500,00070-74 1,000,00075-80 750,000Minimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00075-80 750,000WithdrawalProvisions10% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days.10% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days.SurrenderChargesIssueAgesMVAY YesN No50-80Y18-80Y50-80Y7 yearsIssue Ages 50-80:9.20, 9, 8, 7, 6, 4,2, 0%10 yearsIssue Ages 18-80:9.10, 9, 8, 7, 6, 5, 4,3, 2, 1, 0%CommissionAges 50-75:5.00%Ages 76-80:3.75%Ages 18-75:6.25%Ages 76-80:4.70%States NotAvailableCA, NYCA, NYCurrent Fixed Value Rate 1.10%INCOMESHIELD 10 WITH LIBRCapPRS&P 500 Annual Pt to Pt w/Cap1.75%N/AMinimum Guaranteed1.40%N/AInterest: Currently 1.00%N/A10%MGIR is set at issue andguaranteed for the life ofthe contract.S&P 500 Monthly Pt to Pt w/ CapS&P 500 Annual Pt to Pt w/ PRS&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ Cap2.25%N/AS&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ PRN/A30%S&P 500 Dividend Aristocrats Daily Risk Control 5%ER Index 2-Year Pt to Pt w/ PRN/A45%87.5% of premiumspaid less withdrawalproceeds, accumulatedat the MGIR,Current Fixed Value Rate 1.00%Destinations 10Destinations 10Minimum GuaranteedPRBofA Destinations IndexTM Annual Point to Point with PR82%BofA Destinations IndexTM 2-Year Point to Point with PRS&P 500 NeXt Monthly Pt to Pt w/ Replacement Rate RRRIRRN/A43%116%N/A61%N/A1.10%N/ACurrent Fixed Value Rate 1.90%Destinations 9(CA ONLY)MinimumPremiumS&P 500 Annual Pt to Pt w/CapCurrent Fixed Value Rate 1.70%IncomeShield 10GuaranteedInterestRates Effective as of 02-08-2021Interest: Currently 1.00%MGIR is set at issue andguaranteed for the life ofthe contract.87.5% of premiumspaid less withdrawalproceeds, accumulatedat the MGIR,Minimum GuaranteedDestinations 10PRRRRIRRInterest: Currently 1.00%N/A36%MGIR is set at issue andguaranteed for the life ofthe contract.BofA Destinations IndexTM Annual Point to Point with PR74%BofA Destinations IndexTM 2-Year Point to Point with PR106%N/A52%S&P 500 NeXt Monthly Pt to Pt w/ Replacement Rate N/A0.90%N/ACurrent Fixed Value Rate 1.75%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change. Check for current state approvals.87.5% of premiumspaid less withdrawalproceeds, accumulatedat the MGIR,Minimum: 5,000Maximum:50-69 1,500,00070-74 1,000,00075-80 750,000Minimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00075-80 750,000Minimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00075-80 750,00010% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days.10% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days.10% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days.10 yearsIssue Ages 50-80:9.10, 9, 8, 7, 6, 5, 4,3, 2, 1, 0%10 yearsIssue Ages 18-80:9.20, 9, 8, 7, 6, 5, 4,3, 2, 1, 0%18-80Y9 yearsIssue Ages 18-80:8.25, 8, 7, 6, 5, 4, 3,2, 1, 0%18-80YAges 18-75:6.25%Ages 76-80:4.70%Ages 18-75:6.00%Ages 76-80:4.50%CA, NYCA, NYAges 18-75:6.00%Ages 76-80:4.50%7

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (AEI)CurrentInterestINDEXEDAssetShield SeriesAssetShield 55 year, 7 year, and 10year optionsCapPRRRRIRRS&P 500 Annual Pt to Pt w/Cap3.00%N/AN/A1.00%S&P 500 Monthly Pt to Pt w/ Cap1.90%N/AN/A0.50%S&P 500 Annual Pt to Pt w/ PRN/A21%N/A10%S&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ PRN/A80%N/A10%S&P 500 NeXt Monthly Pt to Pt w/ Replacement RateN/AN/A1.10%N/ACurrent Fixed Value Rate 1.75%AssetShield 7S&P 500 Annual Pt to Pt w/CapS&P 500 Monthly Pt to Pt w/ 3%N/A10%S&P 500 Annual Pt to Pt w/ PRS&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ PRN/A85%N/A10%S&P 500 NeXt Monthly Pt to Pt w/ Replacement RateN/AN/A1.20%N/ACurrent Fixed Value Rate 1.90%AssetShield 10*Call for California rates*CapPRRRRIRRS&P 500 Annual Pt to Pt w/Cap3.50%N/AN/A1.00%S&P 500 Monthly Pt to Pt w/ Cap2.10%N/AN/A0.50%S&P 500 Annual Pt to Pt w/ PRN/A25%N/A10%S&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex Annual Pt to Pt w/ PRN/A90%N/A20%S&P 500 Dividend Aristocrats Daily Risk Control 5% ERIndex 2-Year Pt to Pt w/ PRN/A125%N/A30%S&P 500 NeXt Monthly Pt to Pt w/ Replacement ently 1.00%Minimum: 5,00010% of ContractValue Annually,Starting Yr 2.SystematicWithdrawal ofinterest only fromthe Fixed Value,available after 30days.MGIR is set at issueand guaranteedfor the life of thecontract.MinimumGuaranteedSurrender Value:87.5% ofpremiums paid,less withdrawalproceeds,accumulated at theMGIR.Maximum:18-69 1,500,00070-74 1,000,00075-80 750,00081-85 500,000Riders:ICC19 R-NCRICC19 R-TIRICC16 R-MVAICC18 R-WSCRates Effective as of 02-08-2021SurrenderChargesIssueAgesMVAY YesN NoCommission5 year18-75: 3.75%76-80: 2.81%81-85: 1.88%18-85: 9.20, 9, 8,7, 6, 0% (5 yrs.)18-85: 9.20, 9,8, 7, 6, 4, 2, 0%(7 yrs.)States NotAvailable18-857 year18-75: 4.50%76-80: 3.38%81-85: 2.25%Y18-80: 9.20, 9, 8,7, 6, 5, 4, 3, 2, 1,0% (10 yrs.)CA, NY10 ye

EquiTrust may modify or discontinue the additional premium bonus at any time. EquiTrust Life Insurance Company is rated B by A.M. Best Company for its relative financial . 21 GUGGENHEIM LIFE & ANNUITY COMPANY A.M. Best Rating B (good) (800) 767-7749 22 LINCOLN FINANCIAL GROUP A.M. Best Rating