Transcription

Last Updated04/01/20Enter Company Name HereEnter Company Phone HereINDEXEDAnnuity Product Reference Guide2020AprilOPEN HERE!Your potential annuitysales await!FEEL THE POWER10.00%PremiumBonus!!!MarketPower Bonus Index from EquiTrust Life Insurance Company 10% Premium Bonus!Premium Bonus Vested Day 15 Index strategies and Fixed Account at 1.50%10% Annual Free Withdrawals After First YearFull Account Value at Death Contact us Today!Enter Company Name HereYour Complete Address 14 year surrender charge scheduleNursing Home Waiver and Terminal Illness Rider6.00% rollup rate for up to 10 years on OptionalIncome Rider!2 Year Monthly Average Cap at 8.00% (Rates ifIncome Rider Not Elected)Call us today!EquiTrust may modify or discontinue the additional premium bonus at any time. EquiTrust Life Insurance Company is rated B by A.M. Best Company for its relative financialstrength and ability to meet its obligations to policyholders. Surrender of the policy may be subject to a surrender charge and market value adjustment. Withdrawals may besubject to federal income tax and a 10% IRS penalty prior to age 59 1/2. Withdrawals do not participate in index returns. Product not available in all states. EquiTrust Life Insurance Company, West Des Moines, IA. Contract is issued on Contract Form Series ET-MPP-2000 (02-05). Group Certificates issued on Form Series ET-MPP-2000C(02-05).FOR PRODUCER USE ONLY.AC18-MPP-1123Enter Company Web Address Herephonefax:Any Contacts and phone extensions(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.

Table of Contents - Company Overviews3INDEXED ANNUITIES4GUARANTEE INCOME RIDER (BENEFIT LIVING) COMPARISON5-6AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 221-12346-7AMERICAN GENERAL LIFE COMPANIES*Policies issued by American General Life and United States Life (NY only)A.M. Best Rating* A (excellent) (888) 438-693314AMERICAN NATIONAL INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 835-53208-9ATHENE ANNUITY & LIFE ASSURANCE COMPANYA.M. Best Rating A (excellent) (855) 428-4363, option 110ATLANTIC COAST LIFE INSURANCE COMPANYA.M. Best Rating B (good) (844) 442-384711-12 EQUITABLE LIFE & CASUALTY INSURANCE COMPANYA.M. Best Rating B (good) (800) 352-512113EQUITRUST LIFE INSURANCE COMPANYA.M. Best Rating B (good) (866) 598-369414GLOBAL ATLANTIC FINANCIAL GROUPA.M. Best Rating A (excellent) (866) 645-244915-18 GREAT AMERICAN LIFE INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 438-3398 x1199918GUGGENHEIM LIFE & ANNUITY COMPANYA.M. Best Rating B (good) (800) 767-774919LINCOLN FINANCIAL GROUPA.M. Best Rating A (superior) (800) 238-625220-21 NASSAU RE COMPANYA.M. Best Rating B (good) 888-794-444722-25 NORTH AMERICAN COMPANY FOR LIFE AND HEALTHA.M. Best Rating A (superior) (877) 586-0242 x3567626OXFORD LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (800) 308-231827PROTECTIVE LIFE INSURANCE COMPANYA.M. Best Rating A (superior) (800) 421-561425SAGICOR LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 724-4267 x6180(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.*The most prominent independent ratings agencies continue to recognize AmericanGeneral Life Insurance Company in terms of insurer financial strength. For currentinsurer financial strength ratings, please consult our Internet Web page, www.americangeneral.com/ratings. See Advertising Disclosures for additional information.2

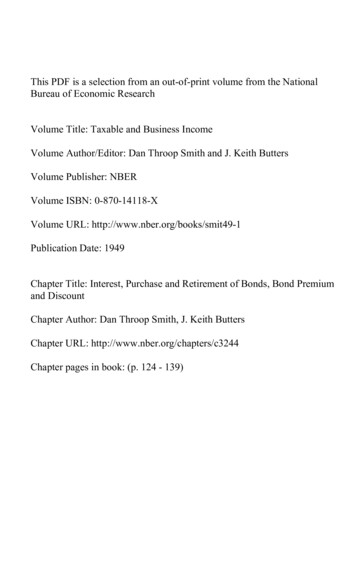

Indexed AnnuitiesUpdated April 1, 2020BonusDesignCapFixedRateS&P 500ParticipationRateMinimumSurrender ValueSurrenderChargePeriodAmerican Landmark 5Series .65%100% First Year100% First Year100% First Year1.00% on 100%1.00% on 87.5%1.00% on 87.5%5 years5 years5 yearsProtective Asset Builder0.00%23.90%1.40%100% First Year1.00% on 100%6 yearsTeton Bonus 7Strategy Plus - 7Performance Elite - 7Choice Accumulation %1.90%1.50%1.15%100% First Year100% First Year100% First Year100% First Year1.00% on 87.5%1.00% on 87.5%1.00% on 100%1.00% on 100%7 years7 years7 years7 yearsPerformance Choice 80.00%23.25%1.60%100% First Year1.00% on 87.5%8 yearsSage Select - 94.00%14.00%2.00%100% First Year3.00% on 87.5%9 yearsPerformance Elite- 10HighlanderTeton Bonus 10Market Value EIAStrategy Plus - 10Safe ReturnCharter Plus - 10VersaChoiceChoice Accumulation IIMarket 10 BonusRoyal Select3.00%4.00%7.00%0.00%1.00%0.00%6.00% for %1.20%0.90%1.15%1.50%1.05%1.10%100% First Year100% First Year100% First Year100% First Year100% First Year100% For Term100% First Year100% First Year100% First Year100% First Year100% First Year1.00% on 87.5%1.00% on 100%1.00% on 87.5%2.00% on 87.5%1.00% on 87.5%1.00% on 100%1.00% on 87.5%1.00% on 100%1.00% on 100%1.00% on 100%1.00% on 87.5%10 years10 years10 years10 years10 years10 years10 years10 years10 years10 years10 years10.00%7226.00%2.50%4.25%1.15%1.10%2.10%100% First Year100% First Year100% First Year2.00% on 87.5%1.00% on 87.5%1.00% on 87.5%14 years14 years14 yearsCompany5 year termSagicor LifeGreat American LifeOxford Life6 year termProtective Life7 year termEquitable LifeAmerican NationalAthene AnnuityGlobal Atlantic8 year termNorth American9 year termSagicor Life10 year termAthene AnnuityGuggenheimEquitable LifeEquiTrust LifeAmerican NationalGreat American LifeNorth AmericanNorth AmericanGlobal AtlanticEquiTrust LifeOxford Life14 year termEquiTrust LifeNorth AmericanEquitable Life(Lower Band Rates Shown)Product NameSage Secure 5( 25,000 - 100,000)Market Power BonusCharter Plus - 14Teton Bonus 14(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.3.00% for 7 yrs0.00%0.00%5.00% for 7 yrs10.00%(A) 6.00% day 1, 2.00% 1st anniversary yr., 2.00% 2nd anniversary yr.,2.00% 3rd Anniversary Yr.(B) 4.00% year 1, 2.00% 1st anniversary yr., 1.00% 2nd anniversary yr.31 Monthly Average Annual Reset 2 Annual Point to Point Reset 3 Point to Point 4 Monthly Point to Point Annual Reset 5 Monthly CapAnnual Reset 6 High Water Rolling for Monthly Term7 2 year Monthly Average8 Trigger Point 9 18 Monthly Average*RATES AND COMMISSIONS SUBJECT TO CHANGE. CHECK INDIVIDUALCOMMISSION SCHEDULES FOR GUARANTEED ACCURACY AND DESCRIPTIONS !!!* Call for state approvals.

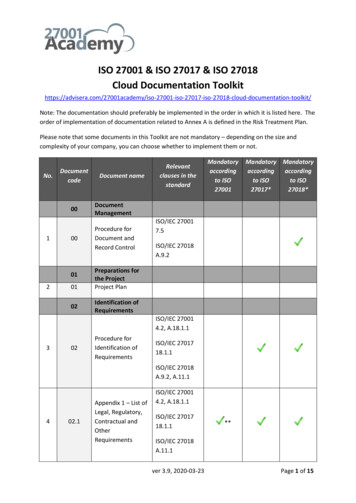

Guarantee Income Rider (Living Benefit) sau REOxford LifeLifetimeIncomePlus FlexStrategyPlusIncomeRiderAscentIncomeRiderOption 1AscentIncomeRiderOption eIncomeEdgeIncomeStrategyTomorrowGLWB5.75% for 10years7.20% 10years or4.20% plusinterest for10 years20% incomebase bonus10% Simpleyrs 1-105% Simpleyrs 11-205% Incomebase bonus8.00% Simpleyears 1-104% yrs 11-206.50% for 10years7.00% for 7years6.00% for 10years7% SimpleInterest for 10years10% IncomeBase Bonus,4% roll-up stackingcredits for 20yearsStep-upBenefitfactor*5% minimumfor 10 years14.00%SimpleInterest for10 years7.15%annuallyfor first tenpolicy yearsPar rate 200%10% IncomeBase Bonus4% Roll UpPlus CreditedRate for llyNoYes180 days ofconfinement,Not availablein all statesNoYes Based onADL’sYes Based onADL’sYes Based onADL’sYes Based onADL’sNoNo10% ofIncome BaseAnnuallyCheck StateAvailabilityNoYesRoll-up Rate inAccumulation PeriodInterest CreditedIncome W/D Multiplier Confinement FeatureAnnually(See Contract for Qualifying Confinement Criteria)NoStart Stop 0.90%0.60% 0%0.95%0.95%0.95%Increasing Benefit OptionYesNoYesYesNoNoNoNoNoNoNoNoNoGuaranteed Payments drawal Phase WaitingPeriod1 Year and 60year old1 year and 50year oldAge 50Age 501 Years and50 year old1 Years and50 year old1 Years and50 year old1 Years and50 year old55 year old1 Year and 60year oldAge 50Age 501 Year and50 year NoNoYesYesYesYesYesYesYesYesYesYesYesYesYesYesAll except:NYAll except:CA, NYAll except:NYAll except:NJ, NY, WAAll except:NYAll except:NYAll except:NY, ORAll except:CA, DE, NYAll except:NY, WAAll except:NYAll except:NYSee Page 22All except:AL, NY, VT,WV (MT &CA for -7545-8545-8035-850-8050 Rider Charge(calculated annually against the IAV,deducted monthly from AV)Rider Charge RefundAccount Available at DeathJoint Lifetime WithdrawalOption availableState AvailabilityIssue AgesFor Agent Use Only.Not for Use with the Public.*BonusAscent Proproductsonly, othervariationsavailable4

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (AEI)CurrentInterestINDEXEDBonus Gold10% PremiumBonus on all 1st yearpremiumsNEWGuaranteedInterestCapPRAsset FeePTS&P 500 Annual Monthly Avg w/PR-14%--S&P 500 Annual Monthly Avg w/Cap2.25%-0%--10%--S&P 500 Annual Pt to Pt w/PRS&P 500 Annual Pt to Pt w/Cap2.25%-0%-Dow Annual Monthly Avg w/Cap2.25%-0%-Dow Annual Pt to Pt w/Cap2.25%-0%-S&P 500 Monthly Pt to Pt w/Cap1.60%---10 Yr. U.S. Treasury Bond w/Cap2.50%-0%-S&P 500 Performance TriggerBond Yield w/CapS&P 500 Dividend Aristocrats DRC 5%---1.50%5.15%-2.00%---4.75%-Minimum GuaranteedInterest:Currently 1.75%MGIR is set at issueand guaranteed forthe life of the contract.80% of 1st yearpremium pluspremium bonusplus 87.5%additional premium,less withdrawalproceeds, at ovisionsMinimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00010% of ContractValue Annually, Starting Yr 2.Systematic W/D &RMD Immediatelyfrom Fixed Value.3Rates Effective as of 03-30-2020SurrenderCharges16 years(20, 19.5, 19, 18.5,18, 17.5, 17, 16, 15,14, 12, 10, 8, 6, 4,2, 0%)DE - 17 yearIssueAgesMVAY YesN NoStates NotAvailableNAK, CA, CT,DE, MN, MT,NV, NY, OH,OK, OR, PA,SC, TX, UT,WA, NJNAK, CA, CT,DE, FL, MN,NJ, NV, NY,OH, OK, OR,PA, SC,TX, UT, WA18-80 Q andNQFL ONLY18-64 Q &NQ75-80 750,000Current Fixed Value Rate 1.30%Retirement Gold8% Premium Bonus on all1st year premiumsIN ( 8% ages 18-73, 5%ages 74-78)CapPRAsset FeePTS&P 500 Annual Monthly Avg w/PR-12%--S&P 500 Annual Monthly Avg w/Cap2.00%----10%--S&P 500 Annual Pt to Pt w/PRS&P 500 Annual Pt to Pt w/Cap2.00%---S&P 500 Monthly Pt to Pt w/Cap1.50%-0%----1.50%4.65%-2.00%---5.25%-S&P 500 Performance TriggerNEWBond Yield w/CapS&P 500 Dividend Aristocrats DRC 5%Minimum GuaranteedInterest:Currently 1.75%MGIR is set at issueand guaranteed forthe life of the contract.87.5% of premiumspaid less withdrawalproceeds, at MGIR,compounded annuallyMinimum: 5,000Maximum:18-69 1,500,00070-74 1,000,00075-80 750,00010% of ContractValue Annually,Starting Yr 2. Systematic Withdrawalof interest onlyfrom the FixedValue, availableafter 30 days10 years(12.5,12,12,11,10,9,8,7,6,4,0%)8% bonus fully vestedafter year 1418-78 Q andNQCurrent Fixed Value Rate 1.15%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change. Check for current state approvals.5

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY (AEI)CurrentInterestINDEXEDChoice Series6 year, 8 year, and 10 yearoptions(Optional MVA Rider Available)Choice 6GuaranteedInterestCapPRSpreadS&P 500 Annual Pt to Pt w/PR-11%-S&P 500 Annual Pt to Pt w/Cap2.75%--S&P 500 Monthly Pt to Pt w/Cap1.80%----4.00%CapPRSpreadS&P 500 Annual Pt to Pt w/PR-14%-S&P 500 Annual Pt to Pt w/Cap3.00%--S&P 500 Monthly Pt to Pt w/Cap1.80%----3.75%CapPRSpreadS&P 500 Annual Pt to Pt w/PR-15%-S&P 500 Annual Pt to Pt w/Cap3.00%--S&P 500 Monthly Pt to Pt w/Cap1.90%----3.50%S&P 500 Dividend Aristocrats DRC 5%MinimumPremiumCurrent Fixed Value Rate 1.90%Choice 8S&P 500 Dividend Aristocrats DRC 5%Minimum GuaranteedInterest:Currently 1.75%Minimum GuaranteedSurrender Value:90% of premiumspaid, less withdrawalproceeds, at MGIR,compounded annuallyCurrent Fixed Value Rate 1.75%Choice 10S&P 500 Dividend Aristocrats DRC 5%WithdrawalProvisionsMinimum: 10,000Maximum:18-69 1,500,00070-74 1,000,00075-80 750,000Rates Effective as of 03-30-2020SurrenderChargesIssueAges9.20, 8.00, 7.00, 5.50,4.00, 2.50, 0% (6 yrs.)10% of ContractValue Annually, Starting Yr 2.Systematic W/D &RMD Immediatelyfrom Fixed Value.3Choice 618-859.20, 8.25, 7.25, 6.50,5.50, 4.50, 3.50, 2.50,0% (8 yrs.)9.20, 8.25, 7.25, 6.50,5.50, 4.50, 3.50,2.50, 1.50, 0.50, 0%(10 yrs.)MVAY YesN NoChoice 818-85States NotAvailable10 YearCA, NYN7, 8 YearNYChoice 1018-80 Q andNQCurrent Fixed Value Rate 1.80%AMERICAN GENERAL LIFE COMPANIES (AGLC)CurrentInterestINDEXEDAG Power Protector - 5AnnuityGuaranteedInterest 100K 100KS&P 500 Annual P-t-P Cap3.75%3.00%S&P 500 Annual P-t-P Par.20.00%14.00%S&P 500 5-Year P-t-P Cap23.00%17.00%Russell 2000 Annual P-t-P3.00%2.50%MSCI EAFE Index AnnualP-t-P3.25%2.60%PIMCO Global Optima Index1 Year P-t-P Par.35.00%26.00%ML Strategic Balanced IndexAnnual P-t-P Par.60.00%50.00%1 Year Fixed Account1.25%1.25%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change. Check for current state approvals.MinimumPremiumRates Effective as of AgesMVAY YesN NoStatesNotAvailable5 years(8,7,6,5,4)18-85Q & NQYNYPenalty Free Withdrawal After the first contract year, 10% of the previous contractanniversary contract value (which includes any interest credited on that date). Note:Penalty-free withdrawals are not permitted during the first contract year, unlessit is a withdrawal of the RMD (some states require that the 10% penalty-free withdrawal be available in the first contract year).1.00% on87.5%of premium 25,000Q & NQThe Minimum Withdrawal Value is equal to: 87.5% of premiums (90% in New Jersey)less any withdrawals (excluding any withdrawal charges or any applicable MVA associated with those withdrawals) (excluding any withdrawal charges or any applicable MVAassociated with those withdrawals) (excluding any withdrawal charges or any applicableMVA associated with those withdrawals) accumulated at a rate specified in the contract.Note 1.) 1.00%, as of 7/1/19 2.) For non-MVA states, “any applicable MVA” wouldnot applyMarket Value Adjustment Applies to any withdrawal subject to a withdrawal charge andannuitization that occurs during the withdrawal charge period. The MVA is applied toamounts withdrawn and is not applied to remaining contract value. Note: MVA does notapply in the following states: AK, MN, MO, OR, PA, UT and WA.6

AMERICAN GENERAL LIFE COMPANIES (AGLC)CurrentInterestINDEXEDAG Power Protector - 7AnnuityAG Power Protector - 7Plus AnnuityNEWAG Power Protector - 10AnnuityNo Living Benefit Rider 100K 100KS&P 500 Annual P-t-P3.85%3.10%PIMCO Global Optima Index1 Year P-t-P Par.35.00%27.00%ML Strategic Balanced IndexAnnual P-t-P Par.64.00%52.00%MSCI EAFE Index AnnualP-t-P3.30%2.75%1 Year Fixed Account1.30%1.30%W/Lifetime Income Plus 100K 100KS&P 500 Annual P-t-P2.50%2.00%PIMCO Global Optima Index1 Year P-t-P Par.25.00%20.00%ML Strategic Balanced IndexAnnual P-t-P Par.40.00%30.00%MSCI EAFE Index AnnualP-t-P2.30%2.10%1 Year Fixed Account1.25%1.25%No Living Benefit Rider 100K 100KS&P 500 Annual P-t-P3.95%3.15%PIMCO Global Optima Index1 Year P-t-P Par.36.00%28.00%ML Strategic Balanced IndexAnnual P-t-P Par.65.00%53.00%MSCI EAFE Index AnnualP-t-P3.40%2.85%1 Year Fixed .00% on87.5%of premium 25,000Q & NQ1.00% on87.5%of premium 25,000Q & NQ1.00% on87.5%of premium 25,000Q & NQ 100K 100KS&P 500 Annual P-t-P2.60%2.00%PIMCO Global Optima Index1 Year P-t-P Par.26.00%20.00%ML Strategic Balanced IndexAnnual P-t-P Par.42.00%32.00%MSCI EAFE Index AnnualP-t-P2.40%2.20%1 Year Fixed Account1.25%1.25%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change. Check for current state approvals.SurrenderChargesIssueAgesMVAY YesN NoStatesNotAvailableFree withdrawals: After the first contract year, you can take out up to 10% of yourcontract value without incurring any withdrawal charges or MVA. These riders may notbe available in all states. Please see your agent and refer to the Owner Acknowledgment and Disclosure Statement for more info. No Guaranteed Living Benefit Rider isavailable.7 years(8,7,6,5,4,3,2)0-85Q & NQYNYFree withdrawals: After the first contract year, you can take out up to 10% of your contract value without incurring any withdrawal charges or MVA. These riders may not beavailable in all states. Please see your agent and refer to the Owner Acknowledgmentand Disclosure Statement for more info. Guaranteed Living Benefit Rider is available.7 years(8,7,6,5,4,3,2)0-80Q & NQYNY10 years(10,9,8,7,6,5,4,3,2,1)0-75Q & NQYNY10 years(10,9,8,7,6,5,4,3,2,1)0-75Q & NQYNYWithdrawalProvisionsFree withdrawals: After the first contract year, you can take out up to 10% of yourcontract value without incurring any withdrawal charges or MVA. Easy access to yourmoney in times of need or illness: The withdrawal charge and MVA may be waived ifyou: Are diagnosed with a terminal illness, Have extended care needs, Are confined toa nursing home or an assisted living facility. Restrictions and limitations apply. Theseriders may not be available in all states. Please see your agent and refer to the OwnerAcknowledgment and Disclosure Statement for more info.No Guaranteed Living Beneit Rider is available.AG Power Protector - 10Plus AnnuityW/Lifetime Income PlusRates Effective as of 3-30-20201.00% on87.5%of premium 25,000Q & NQDeath Benefit: Upon death, the beneficiary receives the greater of the contract value (excluding withdrawalcharges and MVA or the Minimum withdrawal value. Free Withdrawals: After the first contract year, clientsmay withdraw up to 10% of the annuity value (based on the previous contract anniversary) without withdrawal charges or MVA. No Free Withdrawals are allowed in the first contract year (unless required by statelaw or taken under Lifetime Income Plus or as Required Minimum Distributions). If Lifetime Income Plus iselected, clients may take out up to the maximum annual withdrawal amount (MAWA) without any companyimposed charges. A withdrawal in excess of the MAWA will reduce future income under the benefit, even ifit is a Free Withdrawal. Terminal Illness, Extended Care and Activities of Daily Living Riders: The withdrawalcharge and MVA may be waived if the contract owner: Is diagnosed with a terminal illness, has extendedcare needs or requires assistance with activities of daily living.These riders are no available in all states.Required Minimum Distributions (RMDs): If clients purchase their annuity under a qualified plan (e.g., anIRA), the Internal Revenue Code directs that a minimum amount of retirement income must be paid eachyear beginning in the year the owner turns to age 70 1/2. These payments are known as RMDs. Withdrawalcharges and MVA will not apply to RMDs attributable to a Power Index Plus contract at any time after issue,including the first contract year. RMD amounts do count against the 10% Free Withdrawal amount, therebyreducing or possibly eliminating the ability to take other Free Withdrawals within a contract year. Failure tosatisfy the RMD requirements may result in a tax penalty. Clients should consult their tax advisor for moreinformation. Annuitization Choices: Clients can choose from five options, AKA Income plans: 1) Life income;2) Joint and

A.M. Best Rating A- (excellent) (888) 221-1234 6-7 AMERICAN GENERAL LIFE COMPANIES* . Annuity Athene Annuity EquiTrust EquiTrust EquiTrust EquiTrust Great American Guggenheim Lincoln Financial Group Nassau RE Oxford Life Li