Transcription

MAZDA LOANPROTECTIONINSURANCEProduct Disclosure Statement and Policy Document

Preparation Date: 23/02/2016.

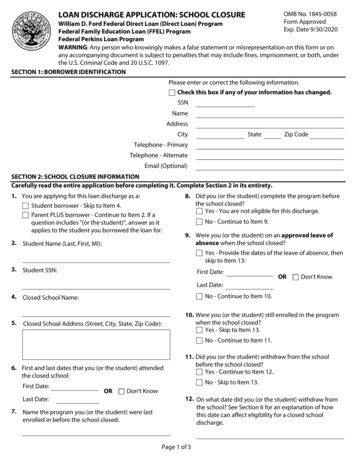

Table of contentspageSection A – About this insurance3Welcome3About the insurers3What is the purpose of this insurance?3Applying for cover8Section B – Your cover12What the policy consists of12Our agreement with you12Words with special meanings13Part 1 – Trauma and Death cover17What we will pay17When we will not pay18Part 2 – Disability cover20What we will pay20When we will not pay20Part 3 – Involuntary Unemployment cover24What we will pay24When we will not pay24Conditions of cover28Changes to your policy28Cancellation of the policy28When the policy ends291

pageHow to make a claim30How to make a death claim30How to make a trauma claim30How to make a disability claim30How to make an involuntary unemployment claim31Provision of information31Section C – Other important information32Your Duty of Disclosure32Privacy Notice34Complaints – Internal and External ComplaintsProcedure36General Insurance Code of Practice37General Product Disclosure Statement information 37Financial Claims Scheme38Phoning for assistance and confirmationof cover382

Section A – Aboutthis insuranceWelcomeAllianz and Allianz Life utilise local expertise,combined with global experience, to offer a range ofhighly featured products and services to our customers.As members of the worldwide Allianz Group, we arecommitted to the continuous improvement of ourproducts and services and strive to achieve this throughknowledge transfer within the Group, dedicatedtechnical research units, sharing globally new productdevelopments and a wide range of risk managementservices. We also aspire to Insurance Industry bestpractice procedures in all aspects of our business.About the insurersAllianz Australia Insurance Limited is the insurerof the disability cover (see Part 2) and involuntaryunemployment cover (see Part 3) and is onlyresponsible for these covers.Allianz Australia Life Insurance Limited is the insurerof the trauma and death cover (see Part 1) and is onlyresponsible for this cover. Allianz acts as Allianz Life’sagent in offering and administering the trauma anddeath cover.References to “we”, “our” or “us” only apply to Allianzand Allianz Life for the cover they are responsible for.What is the purpose of this insurance?This is consumer credit insurance and by way ofsummary, its purpose is to pay (up to the maximumpolicy benefits):3

part of your loan repayments if you are unable towork due to a defined injury or illness (we call thisdisability cover), part of your loan repayments if you becomeinvoluntarily unemployed (we call this involuntaryunemployment cover), the outstanding balance of your loan if you shoulddie or suffer a defined trauma (we call this traumaand death cover). The trauma and death cover doesnot have a surrender value and does not entitle youto participate in our profits.This insurance covers you for the period of insurancestated on the policy schedule or until the policy ends(see “When the policy ends”), whichever happens first.If there is a general increase in the interest rate chargedby your financial institution resulting in the term of theloan being extended, the expiry date shown on thepolicy schedule will be extended by up to 6 monthsin total, free of charge.While the policy is in force you are covered 24 hoursa day, 7 days a week, and 365 days a year.Choice of coverYou may choose any one of the following combinationsof cover: trauma and death, disability and involuntaryunemployment, disability and involuntary unemployment, trauma and death and disability, disability only, or trauma and death only.(See “Applying for cover” on how to apply).4

Benefit paymentsWe make all benefit payments directly to the financialinstitution you have your loan agreement with. They arecalculated by reference to the amount you owe underthe loan agreement to which your policy relates.Maximum benefitsThe maximum policy benefits we pay for the cover(s)you have been provided with, no matter how manypeople are covered or how many claims are made, areshown in the following table. The information is a basicsummary only and does not set out the full details ofthe benefits.CoverMaximum Policy BenefitsTrauma andDeathThe maximum benefit is the lesserof the net balance due and payableunder the loan agreement at the dateof your death or trauma or 100,000.We only pay one claim under traumaand death cover even if there is morethan one insured person. Otherlimitations apply (see Part 1 – Traumaand Death cover).DisabilityWe will pay a daily benefit at the rateof one-thirtieth of the minimummonthly repayment amount requiredunder your loan agreement for eachday you are totally disabled after the7 day elimination period up to amaximum monthly amountof 3,000.Our payment will continue for as longas you are totally disabled or until thepolicy ends, whichever happens first.5

CoverMaximum Policy BenefitsThe maximum total benefit payableduring the entire period of insurance,no matter how many times youbecome totally disabled and forclaims by all insured personscombined, is 100,000. No amount ispaid for the 7 day elimination period.Other limitations apply (see Part 2 –Disability cover).InvoluntaryUnemploymentWe will pay a daily benefit at therate of one-thirtieth of the minimummonthly repayment amount requiredunder your loan agreement for eachday you are involuntarily unemployedafter the 7 day elimination period upto a maximum of 4,000 per claim.Our payment will continue for as longas you remain involuntarilyunemployed up to a maximum periodof 120 days or until the policy ends,whichever happens first.The maximum amount payableduring the entire period of insuranceis 10,000 for claims by all insuredpersons combined. No amount is paidfor the 7 day elimination period.Other limitations apply (see Part 3 –Involuntary Unemployment cover).6

Make sure you understand what is andis not coveredSection B of this document sets out the cover(s) weare able to provide you with. You need to decide if thelimits, type and level of cover(s) are appropriate for youand will cover your potential loss. If they are not, youmay be underinsured and have to bear part of any lossyou are not covered for yourself.Not everything is covered by this insurance and thereare limitations. It is important that you read thisdocument carefully, so that you can understand whatwe cover and the limitations.Read “Words with special meanings” to ensure youunderstand what we mean by terms used in relation tothe cover we provide. For example “total disablement”,“involuntary unemployment” and “net balance due andpayable” are defined terms that affect what we coveryou for.Read each cover part which will tell you the events wecan cover. For example: your death, trauma, total disability or involuntaryunemployment must occur during the period ofinsurance; your total disability and involuntary unemploymentmust be for longer than the 7 day eliminationperiod; and no benefits are payable from the time the policy ends.Make sure you understand what we specifically exclude.Each cover has specific exclusions that apply to it.For example, we do not cover you for certainpre-existing illnesses or injuries, or for self-inflictedinjuries (including suicide). See “When we will not pay”for each cover Part 1 – Trauma and Death cover, Part 2 –Disability cover and Part 3 – Involuntary Unemploymentcover for full details of the exclusions that apply.7

Make sure you comply with the relevant conditions ofyour policy. If you don’t we may refuse to pay or reduceany claim and/or cancel the policy.For full details of what we do and do not cover pleaseread this document together with your policy scheduleonce issued.Applying for coverEligibilityYou are eligible to apply for this insurance if you: are at least 16 years of age at the effective date andnot more than 64 years of age during the period ofinsurance, and are in good health and not aware that you have anysickness or disability that a reasonable person in thecircumstances would be aware of, and have no knowledge or warning of any proposed oractual termination or decrease in work availableto you and are actively employed in a paidpermanent occupation for not less than 20 hoursper week if you wish to apply for disability coveror involuntary unemployment cover, and are not self-employed and are in permanentemployment if you wish to apply for involuntaryunemployment cover, and are applying for the insurance to cover a new loan.Other eligibility criteria may apply and we will tell youwhat they are when you apply.No medicalYou do not need a medical examination to apply for thisinsurance. All we require is your confirmation that theinformation and answers given by you in yourapplication are true and accurate.8

Not compulsory and free choice of insurerThe purchase of this insurance is not compulsory,nor is it a condition of your loan agreement approval.You should also be aware that you can arrange similarinsurance (often known as consumer credit insurance)through different insurers if you wish.Your premiumWe advise what the premium is and the method ofpayment acceptable to us, either before or at the timethe insurance is issued. The policy schedule containsthe details of the premium.The premium amount varies depending on certainfactors, such as our costs, the level of cover you select,your loan amount and other information you provideto us when applying for this insurance. The premiumamount also includes amounts that take into accountour obligation to pay any relevant compulsorygovernment charges, taxes or levies (for example,Stamp Duty and GST where applicable) in relationto your policy.The application and acceptance processBefore you make a decision and buy this insuranceyou must: read this document to ensure you are eligible and todecide whether the insurance is right for you, and answer all questions in your application truthfullyand accurately and provide it to the motor vehicledealer or broker acting as our agent. Please refer toyour Duty of Disclosure set out in “Section C – Otherimportant information”. If you fail to comply withyour Duty of Disclosure, we may be entitled toreduce our liability under the policy in respect of aclaim or we may cancel your policy. If you have toldus something which is fraudulent, we may cancelyour policy from its commencement.9

We enter into a policy with you when you are issuedwith a policy schedule confirming the applicablecover(s), who is insured, the period of insurance, coverrestrictions and other important information. It will beissued by us or the motor vehicle dealer or broker actingas our agent. See “Section B – Your cover” for details ofwhat makes up your policy with us once issued and thebasis on which we insure you.Any new or replacement policy schedule you mayreceive from us, detailing changes to your policy or theperiod of insurance will become the policy schedule.Non-RenewableThis is non-renewable insurance, and the period ofinsurance will not continue beyond 8 years. Please beaware that all benefits will cease when the policy endsirrespective of the amount already paid or the date onwhich you become totally disabled or involuntarilyunemployed (see “When the policy ends”).Cooling off and cancellation rightsYou can cancel your insurance or any of the coverschosen for any reason within 14 days of receivinga policy schedule from us (we call this the coolingoff period).To exercise this right you must return the policyschedule to us, together with a cancellation letterwithin the above period. We will refund the premiumpaid in full unless an incident has occurred which mayresult in a claim.In addition to cooling off you have cancellation rights(see “Cancellation of the policy” for full details of yourcancellation rights).10

CommissionOur agents receive a commission for arranging thisinsurance. In arranging this insurance an agent isacting as our agent and not as your agent. Theaggregate commission payable to all agents is 20% ofthe total premium amount payable, excluding StampDuty and government charges.11

Section B – Your coverWhat the policy consists ofWhere we have agreed to cover you (as described in“The application and acceptance process” in Section A),your policy will consist of: this printed Product Disclosure Statement andPolicy Document, which sets out details of yourcover and its limitations; and a policy schedule approved by us which sets outwho is insured, the cover selected, the period ofinsurance, the limits of cover and other importantinformation.You should carefully read and retain this document andyour policy schedule. These documents should be readtogether as they jointly form the contract of insurancebetween you and us. Any new or replacement policyschedule we may send you detailing changes toyour insurance or the period of insurance will becomethe policy schedule which you should carefully readand retain.Our agreement with youWhere we have agreed to cover you (as described in“The application and acceptance process” in Section A)we will insure you for the cover(s) specified on thepolicy schedule for the period of insurance on the basis: that you have paid, or agreed to pay us the premiumfor the cover(s) you selected when you applied forthis insurance and which the policy scheduleindicates are in force, of the verbal and/or written information providedby you which you gave having been advised of yourDuty of Disclosure either verbally or in writing.12

If you failed to comply with your Duty of Disclosure,we may be entitled to reduce our liability under thepolicy in respect of a claim or we may cancel yourpolicy. If you have told us something which isfraudulent, we also have the option of avoiding yourpolicy from the effective date stated on the policyschedule.For your assistance we have provided a full explanationof your Duty of Disclosure and the consequences ofnon-disclosure under the heading “Your Duty ofDisclosure”.Words with special meaningsThe following words have the meaning set out belowwhen they appear in this document and your policyschedule.“cancer” means the presence and diagnosis of one ormore internal malignant cells or tumours, includingLeukaemia, Lymphoma and Hodgkin’s Disease, that isconfirmed by pathology tests and requires treatmentby surgery, radiotherapy, hormone therapy orchemotherapy. Included are any malignant tumoursconsidered too advanced or too serious for specifictreatment to be warranted. Excluded are: tumours classed as carcinoma in situ, includingcervical dysplasia classified CIN 1, CIN 2 or CIN 3,or pre-malignant tumours; or tumours treated by endoscopic procedures alone; or prostatic or bladder cancers which are historicallydescribed as TNM classification T1 (including T1aor T1b) or another equivalent or lesser classification;or all hyperkeratosis or basal cell carcinomas of theskin and all squamous cell carcinomas of the skinunless there is evidence they have spread to otherorgans; or13

Kaposi’s Sarcoma or other tumours caused by orassociated with Human Immunodeficiency Virus(HIV) or Acquired Immune Deficiency Syndrome(AIDS) as defined by the World Health Organizationfrom time to time, or in the absence of any suchdefinition, by any other recognised governmentalhealth organisation selected by us.“coronary artery by-pass” means coronary artery by-passgrafting surgery performed via a thoracotomy.“date of your trauma” means the date on which, in ouropinion, the trauma has been conclusively diagnosedfor the first time.“effective date” means the effective date shown on thepolicy schedule.“elimination period” means the first 7 days of any claimcommencing on the first date you are totally disabledor involuntarily unemployed in respect of a claim.We pay no benefits for or during this period.“financial institution” means the financial institutionshown on the policy schedule.“heart attack” means death of a portion of heart muscleas a result of inadequate blood supply to the relevantarea. The basis for diagnosis shall include:a. new and permanent electrocardiographic (ECG)changes associated with a Myocardial Infarction;b. elevation to at least twice the upper normal levelof cardiac enzymes consistent with a MyocardialInfarction.“illness” means illness, sickness or disease whichmanifests itself during the period of insurance anddoes not include any injury.“injury” means bodily injury caused solely by accidental,external and visible means which occurs during theperiod of insurance and does not include any illness.14

“involuntary unemployment” and “involuntarilyunemployed” means a period during which you areregistered and certified as unemployed by Centrelinkor such other equivalent Commonwealth GovernmentAuthority following a termination of your employmentwhich was not by your choice.“loan agreement” means the written agreementbetween you and the financial institution shown on thepolicy schedule, under which the financial institutionprovides you the finance upon you making regularspecified payments to the financial institution fora specified term.“major stroke” means any infarction of brain tissue asa result of a cerebrovascular incident that is associatedwith evidence of neurological dysfunction that causespermanent functional impairment of at least 25% ofwhole person function, which is confirmed by aconsultant neurologist. It excludes any: infarction of brain tissue as a result of bodily injurycaused by accidental, external and visible means, or vascular disease affecting the nerve(s), or transient ischaemic attacks, or cerebral symptoms due to migraine.“net balance due and payable” means the amountoutstanding under the loan agreement at the date ofyour death or date of trauma (where trauma and deathcover applies) or the date you are totally disabled(where disability cover applies) plus any credit chargesaccrued for up to 2 months after that date. This amountdoes not include any arrears in loan repayments inexcess of 2 months.“period of insurance” means the period of timebeginning on the effective date shown on the policyschedule and ending on the earlier of the expiry dateshown on the policy schedule or the date the policyends (see “When the policy ends”). If there is a general15

increase in the interest rate charged by your financialinstitution resulting in the term of the loan beingextended, the expiry date shown on the policy schedulewill be extended by up to 6 months in total, free ofcharge. The period of insurance will not continuebeyond 8 years from the effective date.“permanent employment” means being employed on aregular basis for a period of not less than 20 hours perweek for remuneration or reward.“premium” means the amount paid or payableby you for the cover(s) shown as applicable on thepolicy schedule.“registered medical practitioner” means a person whois legally entitled to practice medicine by virtue ofappropriate registration with the appropriate authorityin the relevant State or Territory in which they areproviding the relevant medical advice.“totally disabled”, “total disability” and “total disablement”means where a registered medical practitioner hasadvised that you are unable to attend or engage in yourusual profession, business or occupation because youhave suffered an injury or an illness and whererequested by us, this advice has been verified by aregistered medical practitioner chosen by us.“trauma” means cancer, coronary artery bypass surgery,heart attack or major stroke.“we”, “our” or “us” means: Allianz Australia Insurance Limited, AFS LicenceNo. 234708, ABN 15 000 122 850 in respect of thedisability and involuntary unemployment coversunder Parts 2 and 3 of the policy, Allianz Australia Life Insurance Limited, AFS LicenceNo. 296559, ABN 27 076 033 782 in respect of thetrauma and death cover under Part 1 of the policy.“you” or “your” means the insured person or personsnamed o

This insurance covers you for the period of insurance stated on the policy schedule or until the policy ends (see When the policy ends ), whichever happens first. If there is a general increase in the interest rate