Transcription

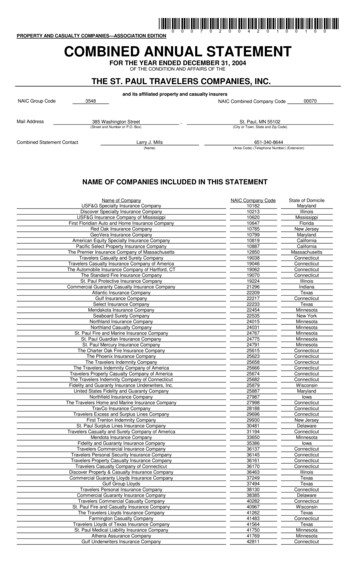

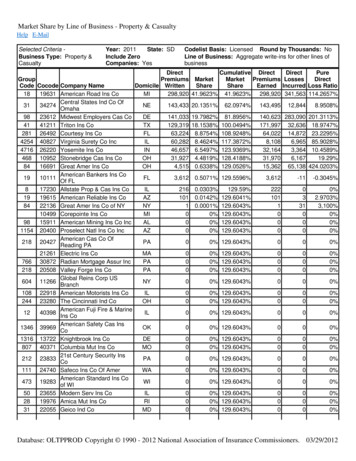

Frank E. CarbonaraGUILFORD SARVAS & CARBONARA LLP1 LumbermensMutual Companies UllicoCasualty Company Eachinvolves peculiar issues Deductiblesfrom 250,000 to 1 million Employerfunding and administrationagreements ProfessionalEmployer Organizations (PEOs)2Orders inSupplementalMaterials LumbermensCompaniesMutual Lumbermens Mutual Cas. Co. American Motorists Ins. Co. American Manufacturers MutualIns. Co. IllinoisInsurer IllinoisLiquidation 3separate liquidation orders Entered 5/8/13 Effective 5/10/1331

Memo inSupplemental Materials Lumbermenswent underKemper name until 2010 Kemperand Lumbermensare the same insurer4Certificates ofMerger inSupplementalMaterials Transferof all rights andliabilities Approved mergers Eagle Pacific Ins. Co.Into AmericanProtection12/31/03 American Specialty National Ins. Co.Into AmericanMotorists12/31/04 Pacific Protection Ins. Co.Into American Motorists12/31/04Eagle Ins. Co.Into American Motorists 8/31/045Order inSupplementalMaterials UllicoCasualty Co. DelawareInsurer DelawareLiquidation Orderof Liquidation Entered5/30/13and effective62

Receiver/liquidatorappointed Existingpolicies ordered canceled CIGA’sstatutory obligations triggered 45-daytolling period triggered (Ins. Code§1063.15)7 “Insolvency” Inability of the insurer to meet its financial obligations whenthey are due (Ins. C. § 985(a)(2))“Liquidation” Commissioner concludes it is futile to continue asconservator to rehabilitate insurer May request order to liquidate and wind up business ofinsurer (Ins. C. § 1016)Order appointing liquidator issued by court of competentjurisdiction -- examples Delaware – Court of Chancery (ULLICO) Illinois – Circuit Court of Cook County (Lumbermens) California – Superior Court (CA liquidations)8 Existingpolicies canceled Upon expiration date if within 30 days 30 days after order of liquidation if policy period longer Gives Ins. employers time to obtain new insuranceCode §1063.1(c)(1)(D)To meet the threshold definition of “covered claims”the obligations must have been “incurred prior to thedate coverage under the policy terminated and priorto, on, or within 30 days after the date the liquidatorwas appointed.” Youmay have claims with post-liquidation DOIs93

Ins. Code § 1063.2Pay and discharge “covered claims” Directly Through servicing facility (TPA) Reinsurance contract/assumption of liability through memberinsurer Contract with liquidator “Covered claims”Must meet definition under Ins. Code §1063.1(c)(1) –obligations of insolvent insurer, imposed by law, within thecoverage of the insolvent insurer’s policy etc.Must not be excluded from “covered claims” by anyother provision commencing with Ins. Code §1063.1(c)(3).10 “In any workers' compensation matter the association shall havethe same period of time within which to act or to exercise a rightas is accorded to the insurer by the Labor Code, and those timeperiods shall be tolled against the association until 45 days afterthe appointment of a domiciliary or receiver.” (Ins. C. § 1063.15) Applies to all periods of time to act or exercise right including Benefit payment obligations Petitions for reconsideration/answers Petitions for writ/answers Discovery demands, etc.Tolling period haspassed but stillrelevant to claims ofunreasonable delay.Tolling periods - from appointment of liquidator Lumbermens5/10/13 to Monday 6/24/13 Ullico5/30/13 to Sunday 7/14/1311 No time frame: Act required on specific date within tollingperiod – e.g. scheduled benefit payment Time frame commences before appointment of liquidator Must be done on or before 45th dayTime starts to run – stops during tolling period – balance runs aftertolling stops Time frame commences during tolling period Pending orders – no effect Time to act or start counting days – on the 45th day Time starts to run following end of tolling periodSee CIGA litigation memorandum re: Ins. Code § 1063.15124

CIGAis not bound by Insolventinsurer’s C&R agreements to paynoncovered claims Orderor F&A against insolvent to paynoncovered claim However,CIGA follows a simple rule CIGAnever places the IW in the middle of thedispute13 Unpaid Someliabilities subject to CIGA defensesexamples: C&R, Stips or F&A requiring insolvent insurer to payinsurer C&R, Stips or F&A requiring insolvent insurer to pay lienssubject to CIGA’s statutory defenses EDD liens Liens for which “other insurance” exists Liens involving unqualified assignments Etc.J&S award imposing liability on insolvent insurer and asolvent insurer or PSI employer14ULLICO – Policy terminationULLICO – Cut-through agreementsULLICO & Lumbermens – Deductible policies and“covered claims”Lumbermens – Employer funding andadministration on deductible policies155

16 “Covered claims” include obligations of insolvent insurerwhich are, among other requirements – Incurred prior to the date coverage under the policy terminatedand prior to, on, or within 30 days after the date the liquidatorwas appointed. (Ins. Code § 1063.1(c)(1)(D))30th day was 6/29/13! Liquidation order effective 5/30/13 Liquidation order terminated existing policies as of 6/30/13 One day beyond Ins. Code § 1063.1(c)(1)(D) Handling DOI’s on 6/30/13 If employer did not secure new WC policy, court mayimpose liability on CIGA Did employer obtain new policy covering injuries on6/30/13?17 ULLICOliquidation order mentions unspecifiedlawful and approved “cut-through” agreementsand endorsement under paragraph 7 “Cut-through” If(aka “assumption endorsement”) Reinsurance contract or endorsement Providing for reinsurer to pay loss covered byreinsurance contract Directly to the claimantreinsurer solvent, “other insurance” Nospecifics yet on the “cut-through”agreements186

19 Self-insuredemployer must obtain a certificate ofconsent to self-insure (Lab. C. §3700) Furnish proof of ability to self-insure and pay allcompensation that may become due (Lab. C. §3700(b)) Submit to administrative audit (Lab. C. § 129) Make substantial deposits of security (Lab. C. §3701(b)) Participate in the Self-Insurer’s Security Fund (SISF) (Lab. C.§ 3742(a)) Aninsured employer without a certificate is notself-insured A“deductible” does not make the employer selfinsured20 “Specificexcess” policies are issued toself-insured employers Reimburseself-insured employers for benefitspaid in excess of a “retention” Generallydo not require the insurer to paybenefits directly to the claimant Specificexcess policies are not “deductiblepolicies”217

Weneed to understand them because: ManyLumbermens and Ullico deductiblepolicies Impact Resultsin erroneous arguments by the otherside on insurer‘s liability not well-understoodCIGA has heard them before – Legion & Reliance CIGA‘sattorneys must guide WCJs andArbitrators Ligitationover employer administration underLumbermens deductible policies22 Someside: of the erroneous arguments from otherCIGA can‘t raise its “other insurance“ defense withindeductible of insolvent‘s policy because the employeris liableThe insured employer under the insolvent‘s policy is“other insurance“ within the deductible – solvent insurerclaims no obligation to pay“Other insurance“ has no obligation to administer withinthe deductible of the insolvent‘s deductible policybecause deductible is the employer‘s liability“Other insurance“ has no obligation to reimburse CIGAfor benefits paid within the deductible because theemployer owes the deductible23 Whatis a deductible policy? Employeragrees to assume some portion ofthe loss covered by the policy Greaterdeductible smaller premium Normallysee deductibles from 250K up to 1 million on WC policies248

AllWC policies – Insurer CAliable from dollar-onelaw – EveryWC policy conclusively presumed tocontain certain clauses (Ins. C. § 11650) Oneclause – that WC insurer will be directlyand primarily liable to the claimant for allcompensation for which the employer is liable(Ins. C. § 11651)25 WC CAdeductible policieslaw – Must contain deductible endorsement approved byInsurance Commissioner Endorsement must state That nonpayment of the deductible does not relieve theinsurer from the payment of compensation (Ins. C. §11735(e)(2)) NoInsurer must pay all benefits even if the employer refuses to paythe deductible!That “notwithstanding the deductible, the insurer shall pay allof the obligations of the employer for workers' compensationbenefits for injuries occurring during the policy period.” (Ins.C. § 11735(e)(3))change in insurer‘s dollar one liabilty Insurer’sobligation pay the benefits Employer’s We26obligation reimburse insurerwill talk about “side agreements” later279

Dodeductibles alter the insolvent insurer’sobligations to pay all benefits to theclaimant?NO!28 CIGAmust pay and discharge “coveredclaims” CIGA’s“covered claims” Obligations of the insolvent insurerSatisfying all requirements of 1063.1(c)(1)(A)-(G); andNot excluded by any provision of (c)(3) – (c)(12) and1063.2(h) Deductibledoes not alter CIGA’s obligationto pay and discharge “covered claims”29 “Otherinsurance” exists where solvent insurer isjointly and severally (J&S) liable for benefits (e.g.general – special employment) Deductible J&Sordoes not affectliability of “other insurance” for benefits, CIGA’sright to reimbursement, or Theamount of CIGA’s reimbursement if it haspaid a noncovered claim3010

Doesthe insolvent insurer’s deductiblealter the J&S liability of “other insurance?”NO!31oneIf you remember onlything about theeffect of deductibles on the insurer’s liability underthe policy, remember thatDeductibleschange nothing!32 Srabian– general-special case Legioninsured general employer Deductible FFICpolicy – 350,000insured special employer CIGApetitioned for reimbursement3311

Arbitrator (well known) found FFIC only had liability if the IW exceeded the 350K deductible Error – Legion’s deductible could not eliminate special’s J&S liability withindeductible FFIC was not “other insurance” until 350K Legion deductibleexceeded – take nothing on reimbursement Legion deductible policy did not cover general employer “at all”within deductible Yet arbitrator ordered CIGA to administer all benefits Error – FFIC was “other insurance” due to J&S liabilityError – Arbitrator incorrectly analyzed the policyError – not only was FFIC “other insurance” but IF the Legion policy did notcover general within deductible, then claim would not be “within thecoverage” of a policy of the insolvent insurer and not a “covered claim”34 CIGA filed Petition for ReconsiderationResult – Arbitrator promptly rescinded Findings and Orderunder Regulation § 1085935 Relevantto reimbursement claims Deductiblepayment shows up as credit onCIGA benefit printout Claimthat CIGA is collecting from “otherinsurance” and employer for the same claim “YourHonor, CIGA is double-dipping!” CIGAis not entitled to keep and does notkeep the deductible once the claim isdetermined to be noncovered CIGAdoes not “double-dip”3612

Deductible Managed CIGApaymentsand controlled by liquidatoris not the liquidator! CIGAdoes not own, manage or controlthe deductible37 WhenCIGA pays a “covered claim” itbecomes creditor of the estate CIGAmay pay and later determine therewas no “covered claim”(e.g. generalspecial employment) Deductiblepayments may be included inpayments from estate to fund what werethought to be “covered claims”38 Whatif CIGA determines a claim is not a“covered claim” (e.g. general-special)? CIGAnotifies estate Amountreceived by estate is backed-outand accounted for CIGAis not entitled to keep and does notkeep the value of any amount received fromthe estate based on payment of anoncovered claim.3913

40 March18, 2013 notice to insureds from LMGSpecial Deputy Receiver Mayelect to continue self-funding andadministration by agreement CIGAexpects that many employers haveopted will opt to continue funding andadministration41 UnderIllinois law – Employerswith deductible policies arepermitted to contractually agree with insurer tofund and administer and pay claims withindeductible By“side agreement” Contracts Betweenseparate from the policyinsurer and employer Permittingemployer to fund and administerwithin deductible4214

IllinoisLaw – 215 ILCS 5/205.1(e) Permitspolicyholders to continue funding andadministering claims post-liquidation Directly Through a third-party administrator Requiresliquidator to enforce agreements “whereapplicable” and “to the fullest extent possible” Fundingof claims by policyholder within thedeductible extinguishes liability of guarantyassociations (215 ILCS 5/205.1(e))43 Similarto Illinois statute Allowspolicyholders to continue administration andfunding Directly Through a third-party administrator Notspecific to WC policies LikeIllinois statute, requires liquidator to enforceagreements “where applicable” and “to the fullestextent possible” Fundingof claims by employer within the deductibleextinguishes liability of CIGA and other guarantyassociations44 CIGAwould not have to administer claimswithin deductible Insuredemployer pays all the benefits withindeductible Insuredemployer pays cost of administration CIGA’sliability extinguished withindeductible4515

CIGA’sobligations controlled by CAGuarantee Act, not the IL statute CIGAinterprets CA statute as not applyingto non-CA liquidations CAemployers who are not permissibly selfinsured cannot lawfully administer CIGAcould be required to administer noncovered claims after deductible reached46 CAInsurance Code strictly defines the scope ofCIGA’s powers, duties and protections (Isaacson v.California Ins. Guarantee Assn. (1988) 44 Cal. 3d 775, 786.) ILstatute cannot redefine CIGA’s obligations CIGAmust pay and discharge covered claims (Ins.C. § 1063.2) Includes CIGA’s obligation to administer “coveredclaims” Itself Through a TPA, etc. CIGAcannot permit insured employer toadminister47 CAInsurance Code §1033.5 Applicableto deductible agreement enteredinto between Policyholder, and “[A]n insurer subject to liquidation proceedings underthis article [14 of the CA Ins. Code].” (Ins. C. §1033.5(a)) CIGAinterprets this statute as applying only toCA liquidations Lumbermensliquidations NoMutual Companies are ILancillary CA liquidations4816

Permitted “claims administrators” under CA WC law –traditional view Each admitted insurer Each properly self-insured employer Each TPA when administering “for an insurer, a selfinsured employer, a legally-uninsured employer or ajoint powers authority.” (Regulation § 10100.1. Italicssupplied.)Insured employer cannot administer either directly orthrough TPABoth IL and CA statutes only apply where policyholderadministration agreements are “applicable” and will beenforced to the “fullest extent possible”In CA – not “applicable” and cannot be enforced49 Limitation of insurer liability only by Insurance Commissionerapproved Limited policy (Ins. C. § 11657) or Limiting endorsement (Ins. C. § 11659) Otherwise, policies are unlimited (Ins. C. § 11660) Lumbermens policies – no known proper limitingendorsements Employer administration by “side-agreement” That relieve insurer of obligation to fund and administer withindeductible Contract between insurer and policyholder outside of approvedpolicy documents “Side-agreements” generally void (Ceradyne v. Argonaut Ins. Co.(2009) Fourth App. Dist. Unpublished – provided for court’s reasoning)50 Theemployer is not CIGA Employercannot raise CIGA defenses Therewill be F&As and stipulated awardsthat could not have been made againstCIGA CIGAmay have to administer afterdeductible exceeded5117

CA Dept. of Ins. has requested that IL Special DeputyDirector instruct employers’ attorneys to clearly stateappearances at WCAB As required by Coldiron v. Compuware Corp. (2002) 67 Cal.Comp. Cases 289 (WCAB en banc)Attorneys appearing are required to properly disclose theidentity of the party(ies) they represent, and, if they are"representing an insurance carrier, whether the policy includesa high self-insured retention, a large deductible, or any otherprovision that affects the identity of the entity or entitiesactually liable for the payment of compensation."Requires attorneys to state that They represent the adjuster (TPA), not CIGA, under deductibleagreement Not appearing on behalf of CIGA Not authorized to bind CIGA in any way, “including any claimsin excess of the funded deductible.”52Insupplementalmaterials CIGA will not receive copy of the Special Deputy’s letter oneach employer-administered claimCopies of letters to each employer with administration53agreement provided CIGAcannot predict the response to disclosure ofemployers’ administration and funding from The Board May not agree with employer administration – even through TPA May conclude that CIGA is necessary party The IW Other parties May want to join CIGA for any number of reasons IfCIGA is not joined, it will not involve itself with theclaim But,there is a good chance someone will join CIGA5418

Ifjoined, CIGA’s position CIGAmust administer the “covered claim”within the deductible Employermust cease administration and Employermust surrender claims file and datafundingto CIGA CIGAwill seek control over administrationof the claim55In supplementalmaterials CIGA’s Formdemandletter to employer Demandthat employercease administration Demandtransfer ofclaim file to CIGA within2 weeks56 Ifemployer ceases administration anddelivers file – no further action needed Ifemployer refuses or fails to respond within2 weeks CIGAto take steps to compel employer to ceaseadministration Petitionfor Order of Change of Administratorand to deliver claims file to CIGA FileTemplate to be provided to the firmsDOR with petition to request hearing Litigateto conclusion5719

CIGAhas not stopped pursuing PJI Key,Colamaria and Anson fact patternshave not produced WCAB success orappellate review Voluntarypayment of benefits followed by proofof “other insurance” liability and request forreimbursement and PJI Colamaria– Review denied (Court of Appealand Supreme Court) Anson– Review denied (Court of Appeal – noSupreme Court petition) BothColamaria and Anson landed in the 2ndDistrict, Division 5 both summarily denied58 Thereis still potential for Key, Colamaria and Ansonfact patterns 2nd District – but other than Division 5 Different Appellate District altogether Newpotential fact pattern to test (preliminarythoughts) CIGA compelled to pay under award Issue of “other insurance” deferred CIGA later prevails on “other insurance” and obtainsreimbursement Start looking for cases with these facts Litigation memo to follow596020

1 Frank E. Carbonara GUILFORD SARVAS & CARBONARA LLP 1 Lumbermens Mutual Companies Ullico Casualty Company Each involves peculiar issues Deductibles from 250,000 to 1 million Employer funding and administration agreements Professional Employer Organizations (PEOs) 2 Lumbermens Mutual Companies Lumbermens Mutual Cas. Co. American Motorists Ins. Co.