Transcription

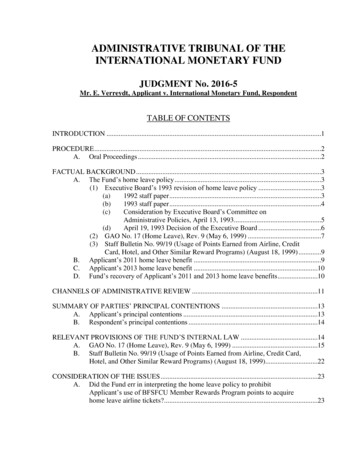

ADMINISTRATIVE TRIBUNAL OF THEINTERNATIONAL MONETARY FUNDJUDGMENT No. 2016-5Mr. E. Verreydt, Applicant v. International Monetary Fund, RespondentTABLE OF CONTENTSINTRODUCTION .1PROCEDURE .2A. Oral Proceedings .2FACTUAL BACKGROUND .3A. The Fund’s home leave policy .3(1) Executive Board’s 1993 revision of home leave policy .3(a)1992 staff paper .3(b)1993 staff paper .4(c)Consideration by Executive Board’s Committee onAdministrative Policies, April 13, 1993.5(d)April 19, 1993 Decision of the Executive Board .6(2) GAO No. 17 (Home Leave), Rev. 9 (May 6, 1999) .7(3) Staff Bulletin No. 99/19 (Usage of Points Earned from Airline, CreditCard, Hotel, and Other Similar Reward Programs) (August 18, 1999) .9B. Applicant’s 2011 home leave benefit .9C. Applicant’s 2013 home leave benefit .10D. Fund’s recovery of Applicant’s 2011 and 2013 home leave benefits .10CHANNELS OF ADMINISTRATIVE REVIEW .11SUMMARY OF PARTIES’ PRINCIPAL CONTENTIONS .13A. Applicant’s principal contentions .13B. Respondent’s principal contentions .14RELEVANT PROVISIONS OF THE FUND’S INTERNAL LAW .14A. GAO No. 17 (Home Leave), Rev. 9 (May 6, 1999) .15B. Staff Bulletin No. 99/19 (Usage of Points Earned from Airline, Credit Card,Hotel, and Other Similar Reward Programs) (August 18, 1999).22CONSIDERATION OF THE ISSUES .23A. Did the Fund err in interpreting the home leave policy to prohibitApplicant’s use of BFSFCU Member Rewards Program points to acquirehome leave airline tickets? .23

iiB.C.D.Given that the Fund did not err in interpreting the home leave policy inApplicant’s case, is the policy itself arbitrary in disallowing use of BFSFCUpoints to acquire home leave airline tickets? .26Was the decision to recover the amount of Applicant’s home leave benefitfor 2011 vitiated by the Fund’s failure to afford him a timely opportunity toremedy his non-compliance with the home leave policy? .29Did the Fund’s conduct of the administrative review or GrievanceCommittee processes cause Applicant compensable injury? .32CONCLUSIONS OF THE TRIBUNAL .33REMEDIES.33DECISION .35

ADMINISTRATIVE TRIBUNAL OF THEINTERNATIONAL MONETARY FUNDJUDGMENT No. 2016-5Mr. E. Verreydt, Applicant v. International Monetary Fund, RespondentINTRODUCTION1.On November 3-4, 2016, the Administrative Tribunal of the International MonetaryFund, composed for this case, pursuant to Article VII, Section 4 of the Tribunal’s Statute, ofJudge Catherine M. O’Regan, President, and Judges Andrés Rigo Sureda and Edith BrownWeiss, met to adjudge the Application brought against the International Monetary Fund by Mr.Eric Verreydt, a retiree of the Fund. Applicant represented himself in the proceedings.Respondent was represented by Ms. Diana Benoit, Senior Counsel, and Ms. Melissa Su Thomas,Counsel, IMF Legal Department.2.Applicant contests the decision to deduct from the separation payment he received uponhis retirement in 2014 the amount of the home leave benefit paid to him for 2011. That decisionwas taken on the ground that Applicant had failed to comply with the Fund’s home leave policyby using Bank-Fund Staff Federal Credit Union (BFSFCU) Member Rewards Program points toacquire airline tickets for his home leave travel. A similar deduction was made from Applicant’sseparation payment in respect of his home leave benefit for 2013, on the same basis. Applicantchallenged both decisions before the Grievance Committee. As to the 2011 benefit, theGrievance Committee upheld Respondent’s position that Applicant had failed to follow thegoverning rules, thereby disqualifying his home leave benefit. Regarding the 2013 benefit,however, the Grievance Committee recommended that the Fund repay Applicant the amountdeducted from his separation payment; the Committee found that the Fund had failed to giveApplicant timely notice that he had not met the applicable requirements in respect of the 2011benefit, thereby denying him the opportunity to avert repeating the practice of using BFSFCUpoints in 2013. Fund Management accepted the Grievance Committee’s recommendation to denyin part and sustain in part Applicant’s Grievance, and the Fund repaid Applicant the sumdeducted for the 2013 benefit while retaining the amount for the 2011 benefit.13.In his Application before the Administrative Tribunal, Applicant contests the decision todeduct from his separation payment the home leave benefit paid to him for 2011. Applicantcontends that decision was either: (i) inconsistent with the Fund’s home leave policy; (ii)consistent with the home leave policy, but that the policy itself represents an abuse of discretion;or (iii) in the circumstances of Applicant’s case, the decision to recover the amount of his homeRespondent asserts that, in accepting the Grievance Committee’s recommendation, it did not concede any of thepoints of law at issue in this case. See generally Ms. “BB”, Applicant v. International Monetary Fund, Respondent,IMFAT Judgment No. 2007-4 (May 23, 2007), paras. 60-66 (Grievance Committee’s recommendation is advisory toFund Management and Tribunal decides issues de novo even where Fund has accepted Grievance Committee’srecommendation).1

2leave benefit for 2011 was vitiated by the Fund’s failure to afford him a timely opportunity toremedy his alleged non-compliance with the home leave policy. Applicant additionally contendsthat the Fund caused him compensable harm in the administrative review and GrievanceCommittee processes by concealing from him a material fact during the administrative reviewand adopting an “excessively adversary undertone” in the Grievance Committee proceedings.4.Applicant seeks as relief rescission of the decision to deduct from his separation paymentthe amount of his 2011 home leave benefit and the return of the monies collected. Applicant alsoseeks monetary compensation for moral damage.5.Respondent, for its part, maintains that it was authorized to recover both the 2011 and2013 home leave benefits previously paid to Applicant. The home leave policy, submits theFund, is explicit in disallowing the use of all types of points or rewards earned through awardsprograms, including the BFSFCU points used by Applicant. The Fund additionally maintains thatthe rule is rationally related to the underlying purpose of home leave benefits. Respondentfurther asserts that the post-travel certification process made the governing law amply clear andApplicant either overlooked or ignored it in completing his certifications. Accordingly, the Fundmaintains that the travel that Applicant undertook in connection with his 2011 and 2013 homeleave benefits did not qualify as home leave travel and he should not be permitted to retain thebenefit payments. Respondent also denies Applicant’s allegation that the Fund caused himcompensable harm in the administrative review and Grievance Committee processes.PROCEDURE6.On December 9, 2015, Applicant filed an Application with the Administrative Tribunal,which was transmitted to Respondent on December 16, 2015. On December 28, 2015, pursuantto Rule IV, para. (f), the Registrar circulated within the Fund a notice summarizing the issuesraised in the Application.7.On February 1, 2016, Respondent filed its Answer to the Application. On February 25,2016, Applicant submitted his Reply. The Fund’s Rejoinder was filed on March 24, 2016.A. Oral Proceedings8.Article XII of the Tribunal’s Statute provides that the Tribunal shall “. . . decide in eachcase whether oral proceedings are warranted.” Rule XIII, para. 1, of the Rules of Procedureprovides that such proceedings shall be held “. . . if . . . the Tribunal deems such proceedingsuseful.” Neither party has requested oral proceedings in this case.9.The Tribunal had the benefit of the transcript of oral hearings held by the Fund’sGrievance Committee, at which Applicant and an official of the Fund’s Finance Department(FIN) testified. The Tribunal is “. . . authorized to weigh the record generated by the GrievanceCommittee as an element of the evidence before it.” Mr. M. D’Aoust, Applicant v. InternationalMonetary Fund, Respondent, IMFAT Judgment No. 1996-1 (April 2, 1996), para. 17. In view ofthe written record before it and in the absence of any request, the Tribunal decided that oralproceedings would not be useful to its disposition of the case.

3FACTUAL BACKGROUND10.The key facts, some of which are disputed between the parties, may be summarized asfollows.11.Applicant began his career with the Fund in 1991 and retired in 2014. The controversy inthis case concerns home leave benefits paid to Applicant in 2011 and 2013.A. The Fund’s home leave policy12.Home leave is one of several “expatriate benefits” afforded to qualifying staff members.As this Tribunal has recognized, such benefits are “. . . designed to compensate staff membersfor the additional costs of maintaining associations with their home countries during theiremployment and to facilitate their repatriation thereafter. This policy benefits both theinternational civil servants, who incur certain disadvantages in taking employment away fromtheir home countries, and the organizations for which they work by sustaining their internationalcharacter and outlook.” Ms. “G”, Applicant and Mr. “H”, Intervenor v. International MonetaryFund, Respondent, IMFAT Judgment No. 2002-3 (December 18, 2002), para. 41 (upholdingExecutive Board decision to allocate expatriate benefits on the basis of visa status).13.The controversy in this case emerges from the Executive Board’s 1993 revision of thehome leave policy and the regulations that followed that revision.(1) Executive Board’s 1993 revision of home leave policy14.The Fund’s home leave policy underwent a major revision in 1993. Under the preexisting policy, home leave airline tickets were purchased directly by the Fund and issued to thestaff member. Under the policy adopted in 1993, a cash allowance is paid to the staff member attwo-year intervals, based on the cost of business class travel to and from the home leavedestination;2 the staff member is responsible for selecting his or her own travel options. Thelegislative history of the Board’s decision is elaborated below.(a) 1992 staff paper15.In 1992, the Fund’s Administration Department identified home leave as one of fiveemployment benefits for which there was “potential for major simplification.” (See CommitteeSecretary to Members of the Committee on Administrative Policies, EB/CAP/92/9 (August 19,1992), attaching “The Simplification of Benefits,” prepared by the Administration Department2In order to provide an accurate account of the law that governed during the relevant period, the Tribunal notes that,following the initial issuance of this Judgment, the Fund brought to the Tribunal’s attention for the first time that,beginning in 2006, per Staff Bulletin No. 06/13 (Changes to Home Leave Policy) (July 25, 2006), the home leavetravel allowance has been calculated based on full-fare economy class travel rather than business class. Additionally,by the same revision in rules, staff have the option to take home leave at 18-month (rather than 24-month) intervals,with a reduced home country expense allowance. The Tribunal hereby amends the Judgment to incorporate thisinformation. At the same time, it observes that the Fund should take care in each case to brief the Tribunal fully onthe governing internal law. In this case, the Tribunal has concluded that neither the outcome of the Judgment, nor itsconsiderations in reaching that outcome, are affected by this additional information.

4(August 18, 1992), p. 10.) At the time, consideration was given to the possibility of substituting a“generalized expatriate allowance,” which would have provided a simple cash payment toexpatriate staff. That approach, however, was seen as a “very significant departure” from the two“targeted” expatriate benefits of home leave and education allowances: “As compared with U.S.staff, expatriate staff would be receiving what would be, in effect, additional disposable incomethat could be used in whatever way an expatriate staff member wished.” This was seen asproblematic because it would permit some expatriate staff to “apply the extra income to purposesunrelated to their expatriate status.” (Id., pp. 10-11.)16.Accordingly, instead of endorsing a “non-targeted allowance,” the AdministrationDepartment recommended a less radical departure from the then-existing home leave policyunder which the Fund purchased and provided home leave travel tickets directly to staffmembers. “The approach presently being considered is . . . to provide instead a single cashpayment every two years on the date when a staff member becomes eligible for home leave. Thepayment would be based on business class travel and on the composition of the family on theeligibility date.” Included in this recommendation was that the staff member would have tocertify that home leave trips were “. . . not financed by sources other than the cash provided bythe Fund (e.g., trips made by the staff member in conjunction with official travel, or by ‘frequentflyer’ programs, would not qualify).” (Id., pp. 12-13.)17.The staff paper observed: “Certain questions of principle arise in connection with a newcash-based system. First, it will undoubtedly provide opportunities for staff who are able to findcheaper fares than the standard on which the cash payment is based to put money in theirpockets.” The paper further noted: “[A]s compared with the present system, which is generallyequitable in providing tickets to staff members, the provision of cash instead of tickets will createa benefit that could vary appreciably from staff member to staff member. These variations willtake the form of more frequent trips or a surplus cash benefit.” (Id., p. 13.)(b) 1993 staff paper18.In 1993, reform of the home leave policy was explored in a further staff paper. (SeeCommittee Secretary to Members of the Committee on Administrative Policies, “Home Leave,”EB/CAP/93/1 (March 30, 1993), attaching “Simplification of Home Leave Policy,” prepared bythe Administration Department (March 30, 1993).) The recommendation was to replace a“central feature of the system [i.e.] that the Fund approves specific travel plans and provides staffand family members with tickets” with a “system of cash payments for home leave transportationcosts on a two-year cycle.” (Id., p. 2.) (Emphasis in original.) The proposal was developed “inclose consultation with the Staff Association Committee, the Personnel Committee of seniorstaff, and the World Bank.” (Id., p. 1.)19.The paper noted: “There are, of course, a series of subsidiary regulations that govern thepresent procedures for home leave. The great majority of these are implementing regulations thathave been approved by management and promulgated in successive revisions of the GeneralAdministrative Order.” Therefore, “[n]o attempt is made in this present paper to detail all thevarious changes that will need to be made if a system of cash payment for home leavetransportation is adopted; rather, attention is focused, and endorsement sought, on the mainfeatures of the proposed system.” (Id., p. 2.)

520.The staff paper recognized: “It is to be expected that some staff and their families willcontinue to travel business class and use their cash entitlement for that purpose. Others . . . willdowngrade the class of travel in order to take more trips to maintain closer contact with the homecountry and with their families of origin.” Furthermore, the paper recognized: “There will also besome staff members who will reap a financial benefit by travelling at less than business class andmaking the minimum trip required.” The paper justified this possibility as follows: “It should berecognized, however, that the maintenance of contact with the home country and preservingfamily ties can typically involve expatriate staff in other forms of travel expenses . . . . Mostexpatriate staff encounter unexpected needs to travel to their home countries, often at shortnotice, which typically makes it difficult to obtain cheaper fares. Thus, although for some staffthe change will yield a financial benefit, this has to be seen in the context of a range of problemsthat arise for most expatriate staff.” (Id., p. 3.)21.The paper additionally noted: “By substituting a single system that provides cash to staffmembers on a standard basis, and leaving the travel options in the hands of staff members,considerable administrative simplicity can be achieved, to the advantage of those who administerthe benefits and those who use them.” (Id., p. 3.)22.The paper suggested the following certification requirement:Certification. Staff members who have received payments underthe home leave policy will be required to submit a certification ofthe home leave travel they have taken, together with appropriateproof of travel, for all family members for whom the paymentswere made. The certification will need to confirm that the staffmember has paid for the tickets and not received them as part of a“frequent flyer” program. The documentation will be subject toreview for compliance with the home leave policy. Any materialmisrepresentation regarding the certified information orcompliance with the applicable policies will be subject toappropriate disciplinary action, including dismissal, in accordancewith General Administrative Order No. 33.(Id., p. 6.) (Emphasis added.)(c) Consideration by Executive Board’s Committee on Administrative Policies, April13, 199323.The proposal was considered by the Executive Board’s Committee on AdministrativePolicies at its meeting of April 13, 1993. (See Minutes of Committee on Administrative Policies,Meeting 93/1 (April 13, 1993.)) The issue of the use of frequent flyer miles in the acquisition ofhome leave airline tickets surfaced in that discussion. The Minutes reflect that a Board member“. . . wondered what th

by using Bank-Fund Staff Federal Credit Union (BFSFCU) Member Rewards Program points to acquire airline tickets for his home leave travel. A similar deduction was made from Applicant’s separation payment in respect of his home leave benefit for 2013, on the same basis. Applicant challenged both decisions before the Grievance Committee.