Transcription

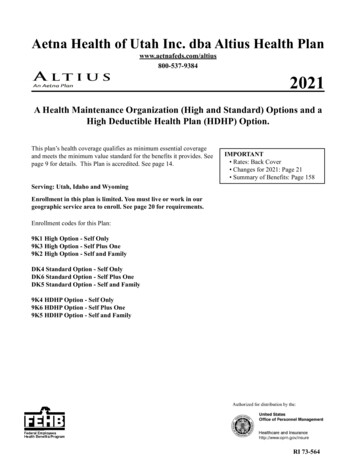

Altius Federal Plans2020 health plan highlights for federal employees19.02.324.1-FED D (9/19)aetnafeds.com/altius

Your health journey starts hereAltius is an Aetna company. So on top of some familiar plan features, you’ll also be ableto take advantage of some great plan perks. We invite you to browse this overview andchoose the plan that best fits your needs.High Option HMO plan Predictable costs with the health maintenanceorganization (HMO) plansStandard Option HMO plan Built-in dental on the High Option HMO planHigh-deductible health plan (HDHP) Extras to make the most of your planChoosing your care teamYou can feel good that you get access to the samedoctor and hospital networks you’ve been using.Chances are your doctor is in our network.To make sure, check our directory before signing up.Just go to aetnafeds.com/altius and click on “Findyour doctor now.”Visit doctors by phone, video orapp, tooFor added convenience, you can takeadvantage of the Teladoc networkof providers. For 40 or less,depending on your plan, you canconsult with doctors over the phone,via online video or Teladoc mobileapp. Teladoc physicians are board certified and available24 hours a day.They can also write a prescription if medically necessary.Once you become a member, just setup an account atteladoc.com/aetna.It all starts on your memberwebsiteAll your plan information and extras are in one place —your member website. It’s easy to sign up. Simplyregister at aetnafeds.com/altius. Then log in anytime.When you do, you can find ways to save on: Gym memberships and weight-loss programs Chiropractic care, acupuncture, massage therapyand morePlus, your member website has tools thathelp you: Find a doctor, hospital or walk-in clinic close tohome or out of state Create your own personal health record andreview claims Save money by comparing costs. Our cost estimatorprovides personalized cost informationWant to test drive the tools now?Log in at aetnafeds.com/altius. Use “federal3” asyour user name and password.Connect live with our teamChat with us online, watch webinars, schedule a one-on-oneappointment and more. Just visit AetnaFedsLive.com.

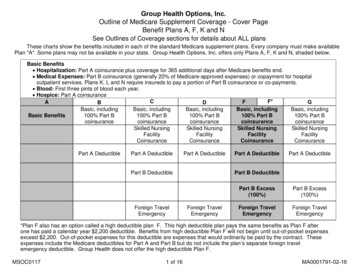

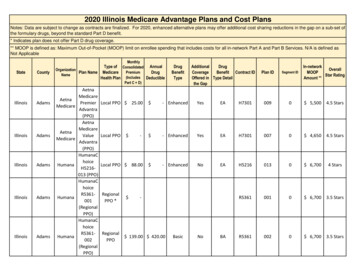

High Option HMOPredictible out-of-pocket costs and built-in dental and visionKey benefitsWhat you payDeductible 50 for self only 100 for self one or self familyPhysician servicesPreventive care (No deductible)Routine physical (No deductible)In office for diagnostic and treatmentTeladoc phone or video consult 0 0 (one per calendar year) 25 primary care after deductible; 40 specialist after deductible 30 after deductibleHospital servicesInpatientOutpatient 200 a day; up to 1000 maximum after deductible 450 copay after deductibleMaternityPhysician careHospital care 0 no deductible for prenatal care 200 a day; up to 1000 maximum after deductibleEmergency benefitsIn and out of area 250 for emergency room services after deductiblePrescription drugs (No deductible)30-day supply at retail pharmacy 7 preferred generic; 40 preferred brand name;40% up to 240 max nonpreferred generic or brand name90-day supply through mail-order service 7 preferred generic; 80 preferred brand name;40% up to 720 max nonpreferred generic or brand nameSpecialty drugs30% preferred; 50% nonpreferredVision care (No deductible)Annual routine eye exam 0 (Plus, you’ll get 100 every 24 months for eyewearreimbursement.)Built-in dental (No deductible)When you visit network dentists:Preventive (like cleanings and X-rays)Minor services (like fillings)Major services (like crowns) 040%60%See plan brochure for out-of-network coverage details.These rates do not apply to all Enrollees. If you are in a special enrollment category, please refer to the FEHB Programwebsite or contact the agency or Tribal Employer which maintains your health benefits enrollment.2020 High Option HMO rates (what you pay every other week)CodeNon-postalPostal 1Postal 2Self only9K1 229.95 226.67 216.85Self one9K3 515.61 508.61 487.60Self family9K2 483.46 475.87 453.11

Standard Option HMOLarge network and built-in visionKey benefitsWhat you payDeductible 100 for self only 200 for self one or self familyPhysician servicesPreventive care (No deductible)Routine physical (No deductible)In office for diagnostic and treatmentTeladoc phone or video consult 0 0 (one per calendar year) 25 primary care after deductible; 45 specialist after deductible 40 after deductibleHospital servicesInpatientOutpatient15% coinsurance after deductible 650 copay after deductibleMaternityPhysician careHospital care 0 no deductible for prenatal care15% coinsurance after deductibleEmergency benefitsIn and out of area 250 for emergency room services after deductiblePrescription drugs (No deductible)30-day supply at retail pharmacy 7 preferred generic; 50 preferred brand name;50% up to 240 max nonpreferred generic or brand name90-day supply through mail-order service 7 preferred generic; 100 preferred brand name;50% up to 720 max nonpreferred generic or brand nameInjectable and intravenous therapy drugs30% preferred; 50% nonpreferredVision care (No deductible)Annual routine eye exam 0 (Plus, you'll get 100 every 24 months for eyewear reimbursement.)2020 Standard Option HMO rates (what you pay every other week)CodeNon-postalPostal 1Postal 2Self onlyDK4 115.60 112.32 102.50Self oneDK6 264.14 257.14 236.13Self familyDK5 229.48 221.89 199.13

HDHPOur lowest cost plan with a tax-free health savings account (HSA)Key benefitsWhat you pay in the network 1,400 for self only 2,800 for self one or self familyDeductibleHSA deposits — 750 for self only 1,500 for self one or self family You can use your HSA to help pay for yourhealth care. Or save it — even if you leave the plan — and use it for future health expenses.Physician servicesPreventive careRoutine physicalIn office for diagnostic and treatmentIn hospital, surgical center or other facilityTeladoc phone or video consult 0 0 (one per calendar year) 20 primary care after deductible; 30 specialist after deductible10% after deductible 30 after deductibleHospital servicesInpatientOutpatient10% after deductible 500 copay after deductibleMaternityPhysician careHospital care0% no deductible for prenatal care10% after deductibleEmergency benefitsIn and out of area 200 after deductibleMental health/substancemisuse treatmentOffice visitsInpatient services 20 copay after deductible10% after deductiblePrescription drugs30-day supply at retail pharmacyAfter deductible: 7 preferred generic; 25 preferred brand name; 50 nonpreferred90-day supply through mail-order service 21 preferred generic; 75 preferred brand name; 150 nonpreferredSpecialty drugs20% preferred; 35% nonpreferredVision careAnnual routine eye exam 0 (Plus, you’ll get 100 every 24 months for eyewear reimbursement.)2020 HDHP rates (what you pay every other week)CodeNon-postalPostal 1Postal 2Self only9K4 61.06 58.62 50.68Self one9K6 125.12 120.12 103.85Self family9K5 127.62 122.52 105.92

Need help choosing a plan?We’re here to help. Just call us at 1-800-837-0977.It’s easy to enrollStep 1: Choose a planReview thebrochure or visitAetnaFedsLive.comto find a plan thatfits your needs.Step 2: Find your plan’senrollment codeThey’re listed in the ratecharts in this brochure.You can also find themat aetnafeds.com.Step 3: Fill out the formCheck with your human resources departmentto see if you can enroll online, using an agencysystem like MyPay, Employee Express orPostalEASE. Or you may need to submit apaper 2809 form.Need a form? Go to aetnafeds.com/enroll.Connect live with our teamChat with us online, watch webinars, schedule a one-on-oneappointment and more. Just visit AetnaFedsLive.com.Aetna is the brand name used for products and services provided by one or more of the Aetna group ofsubsidiary companies, including Aetna Life Insurance Company and its affiliates (Aetna).This is a brief description of the features of this Aetna health benefits plan. Before making a decision, please read the plan’sapplicable federal brochure(s). All benefits are subject to the definitions, limitations and exclusions set forth in the federalbrochure. Information is believed to be accurate as of the production date; however, it is subject to change.There may be fees associated with a Health Savings Account (“HSA”). These are the same types of fees you may pay forchecking account transactions. Please see the HSA fee schedule in your HSA enrollment materials for more information.This material is for informational purposes only and is not an offer of coverage. It does not contain legal or tax advice.You should contact your legal counsel if you have any questions or if you need additional information. Information is believedto be accurate as of the production date; however, it is subject to change. PayFlex cannot and shall not provide any paymentor service in violation of any United States (U.S.) economic or trade sanctions. For more information about PayFlex, visitpayflex.com. Teladoc and the Teladoc logo are registered trademarks of Teladoc, Inc. and may not be used without writtenpermission. Teladoc is not available to all members and operates subject to state regulation. Teladoc and Teladoc physiciansare independent contractors and are neither agents nor employees of Aetna or plans administered by Aetna. For completedescription of the limitations of Teladoc services, visit Teladoc.com/Aetna. The cost estimator tool provides an estimate ofwhat would be owed for a particular service based on the plan at that very point in time. Actual costs may differ from anestimate, if, for example, claims for other services are being processed after the estimate is provided but before the claimfor this service is submitted. Or, if the doctor or facility performs a different service at the time of the visit. HMO memberscan only look up estimated costs for doctor and outpatient facility services. Providers are independent contractors and arenot agents of Aetna. Provider participation may change without notice. Aetna does not provide care or guarantee access tohealth services. Information is believed to be accurate as of the production date; however, it is subject to change. For moreinformation about Aetna plans, visit aetnafeds.com. 2019 Aetna Inc.19.02.324.1-FED D (9/19)aetnafeds.com/altius

Altius is an Aetna company. So on top of some familiar plan features, you’ll also be able to take advantage of some great plan perks. We invite you to browse this overview and choose the plan that best fits your needs. Choosing your care team You can feel good that you get access to