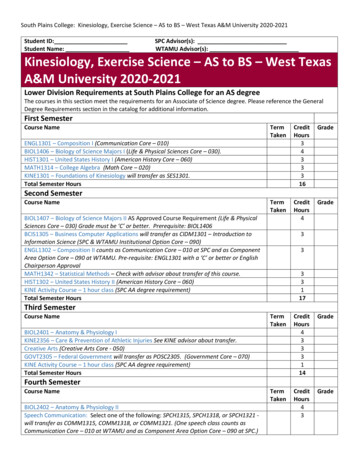

Transcription

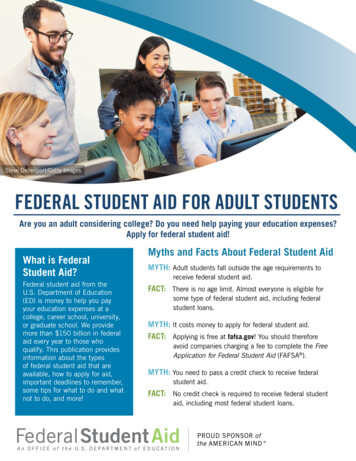

Steve Debenport/Getty ImagesFEDERAL STUDENT AID FOR ADULT STUDENTSAre you an adult considering college? Do you need help paying your education expenses?Apply for federal student aid!What is FederalStudent Aid?Federal student aid from theU.S. Department of Education(ED) is money to help you payyour education expenses at acollege, career school, university,or graduate school. We providemore than 150 billion in federalaid every year to those whoqualify. This publication providesinformation about the typesof federal student aid that areavailable, how to apply for aid,important deadlines to remember,some tips for what to do and whatnot to do, and more!Myths and Facts About Federal Student AidMYTH: Adult students fall outside the age requirements toreceive federal student aid.FACT: There is no age limit. Almost everyone is eligible forsome type of federal student aid, including federalstudent loans.MYTH: It costs money to apply for federal student aid.FACT: Applying is free at fafsa.gov! You should thereforeavoid companies charging a fee to complete the FreeApplication for Federal Student Aid (FAFSA ).MYTH: You need to pass a credit check to receive federalstudent aid.FACT: No credit check is required to receive federal studentaid, including most federal student loans.

Types of Federal Student AidApply for Federal Student AidThere are three categories of federal student aid:The quickest way to apply for federal student aidis online at fafsa.gov, where you will find the FreeApplication for Federal Student Aid or FAFSA .Learn more about completing your FAFSA atStudentAid.gov/fafsa. Grants—Student aid funds that do not have tobe repaid.* Most federal grants are based onfinancial need. Work-study—Money earned through a job on ornear campus while attending school. Loans—Borrowed money that must be repaidwith interest.For more information about federal student aid,including basic eligibility requirements, visitStudentAid.gov/eligibility.*Grants do not have to be repaid unless, for example,you are awarded funds incorrectly, you withdraw fromschool before the planned end of a term, or—if youhave a TEACH Grant—you do not meet the terms ofyour service obligation.Tip: Before starting to fill out your FAFSA, makesure to create your FSA ID—a username andpassword that is used to access ED’s websites.Your FSA ID is used to confirm your identityand electronically sign your federal student aiddocuments, including the FAFSA. To create anFSA ID, visit StudentAid.gov/fsaid.Did you know?In addition to using federal aid to pay for theusual expenses such as housing, transportation,books, tuition, and fees, you can use it to helppay for dependent care, the purchase of apersonal computer, costs related to a disability,and more.Steve Debenport/Getty Images

Mark Bowden/Getty ImagesImportant DeadlinesState and school financial aid deadlinesKnow the deadlines. If you miss a financial aiddeadline (federal, state, or school) you may miss outon aid.FAFSA filing deadlinesYou’ll need to apply for federal student aid everyyear. For example, if you are going to school duringthe 2016–17 school year (July 1, 2016–June 30,2017), then the last day you can submit your FAFSAis June 30, 2017. You will report income informationfrom the 2015 tax year.NEW: Starting with the 2017–18 school year youcan file your FAFSA as early as Oct. 1, 2016, ratherthan waiting until Jan. 1, 2017 to file. The chart onthis page provides a summary of the key dates forsubmitting the FAFSA depending on when you planto go to school.Many schools and states use your FAFSAinformation to award state and college or careerschool aid, and some have deadlines as early asFebruary for the following school year. To searchfor a state’s deadline, visit fafsa.gov. Remember,schools may use your FAFSA information todetermine your eligibility for scholarships.Note: If you file a federal tax return and youare using the online application or makingcorrections online, you have the option to haveyour income and tax information electronicallytransferred from the Internal Revenue Service(IRS) to your FAFSA.Year You Will beAttending College (School Year)Time Period forSubmitting Your FAFSAYear for Which Your IncomeInformation is RequiredJuly 1, 2016–June 30, 2017Jan. 1, 2016–June 30, 20172015July 1, 2017–June 30, 2018Oct. 1, 2016–June 30, 20182015July 1, 2018–June 30, 2019Oct. 1, 2017–June 30, 20192016

What to Do and What Not to DoDO: Talk to an admissions counselor. Get to knowthe staff at the financial aid office at theschool you plan to attend; they can help youwith aid applications and explain the types ofaid available. Know the difference between federal studentloans and private loans. Federal student loansoffer low, fixed interest rates and flexiblerepayment options, including income-basedmonthly payments. Generally, repayment ofa federal student loan does not begin untilafter you leave school. To read more about thedifferences between federal and private loans,visit StudentAid.gov/federal-vs-private. Look into taking a high school equivalency testif you didn’t graduate high school. Differenttesting options include the General EducationalDevelopment (GED) certificate, the HighSchool Equivalency Test (HiSET), and theTest Assessing Secondary Completion (TASC).Explore your options by searching online for“high school equivalency” along with yourstate’s name. Ask employers to recommend trade schools thatprovide training in the skills you will need for thecareer you choose. Be an informed consumer. Make sure theschool you are planning to attend is accredited,and learn how to avoid being scammed. Toget a basic understanding of accreditation inthe United States and to learn more aboutfraudulent diploma mills, DON’T: Use all your retirement and emergency savingsor risk losing your home with multiple homeequity loans. Assume the answer to your question is “no.”Ask questions. Borrow more than you need. Miss important deadlines.Research CareersIf you are searching for a career or a school, or ifyou would like more information about careers andtraining, visit the following websites: Find a career that fits your goals and your life byusing the career search tool at StudentAid.gov/careersearch. Find out about the training you will need for aparticular job at www.careeronestop.org. Research careers and the demand for jobs in theOccupational Outlook Handbook atwww.bls.gov/ooh.If you have been convicted for the possession orsale of illegal drugs and the offense occurredwhile you were receiving federal student aid, youwill be ineligible for a period of time based onthe type and number of convictions. For moreinformation on drug-related convictions andfederal aid, visit StudentAid.gov/eligibility/criminal-convictions.If you are incarcerated you have limited eligibilityfor federal student aid. If you are incarceratedin a federal or state institution, you are ineligiblefor Federal Pell Grants and for federal studentloans. If you are incarcerated elsewhere, youcan get a Pell Grant but not loans. For morehelp, check with the financial aid office at theschool you plan on attending, or contact theFederal Student Aid Information Center (FSAIC).See “Contact Us” on the back cover of thispublication.For more information, see the fact sheet FederalStudent Aid Eligibility for Students Confined inAdult Correctional or Juvenile Justice Facilitiesavailable at StudentAid.gov/resources.

Important TipsReduce Your Education ExpensesYou can reduce your education expenses using thefollowing resources: Scholarships–Check with the college youare planning to attend to find out if it offersscholarships. Also, search for scholarships forfree at StudentAid.gov/scholarships. Tax benefits–Read IRS Publication 970, TaxBenefits for Education, to see how you mightbenefit from federal income tax credits foreducation expenses. Your employer–Talk with your employer abouttuition assistance. Some employers offerbenefits to cover education expenses. Community college–Check into attending acommunity college, where tuition can besignificantly lower than at four-year colleges,especially for in-state students. Choosing a program–Assess your needs beforeyou apply for admission or register for courses.Make sure your classes fit your goals and counttoward your degree or certificate. Part-time enrollment–Consider part-timeenrollment if you are having difficulty paying fora full-time program, or if you have other work orfamily obligations that limit the time you haveavailable to attend class and study. However,part-time enrollment may impact your eligibilityfor some types of federal student aid. Receiving military benefits. If you are a memberof the U.S. armed forces or have a familymember in the service, go to StudentAid.gov/military to find out more about grants and loanrepayment options for military personnel. Researching schools. Make sure to researchyour school options. The College Scorecard atcollegescorecard.ed.gov provides an interactivetool to help you find and compare colleges. Thisinformation will help you select a school thatbest meets your needs. Transferring credits from one school to another.If you plan to take classes with the goal oftransferring your credits to another school, checkwith the registrar’s office at that school to makesure those credits are transferable. Returning to school after a break. If you havepreviously earned college credits, check with theregistrar’s office at the school you plan to attendabout transferring those credits. Receiving credit for life experience. Manyschools offer credit for life and work experiences.Check with the school to find out if this optionis available. Taking admissions tests. Most colleges inthe U.S. require that you submit scores fromstandardized tests as part of your applicationpackage. Contact the individual collegeadmissions offices to find out which tests youshould take for admission to each of thoseschools. For information about admissions tests,explore StudentAid.gov/prepare. Expecting to receive federal student aid. Makesure the school you plan to attend participates inthe federal student aid programs if you want touse federal aid to pay for your education.

ResourcesFederal Student Aid’s WebsiteStudentAid.govGet detailed information about federal student aidand learn more about preparing for college. You’llfind information about the types of postsecondaryschools in the U.S., the kinds of degrees andcredentials they offer (associate degree, bachelor’sdegree, master’s degree, etc.), and how to manageyour federal student loans.For details about education costs covered by federalstudent aid, visit StudentAid.gov/collegecost.More Information to ExploreStudentAid.gov/resourcesFor consumer protection information, read thefollowing fact sheets: Choose a Career School Carefully Don’t Get Scammed on Your Way to CollegeFor more information about money for college and tohelp you determine which loans to accept and howmuch to borrow, you may want to read the following: Do You Need Money for College? The Guide toFederal Student Aid Federal Student Loans: Be a ResponsibleBorrowerHero Images/Getty ImagesContact UsU.S. Department of EducationFederal Student Aid Information Center (FSAIC)P.O. Box 84Washington, DC 20044-00841-800-4-FED-AID (1-800-433-3243)TTY users can call 1-800-730-8913.Callers in locations without access to 1-800numbers may call 334-523-2691 (this is not a tollfree number).Stay ConnectedAccess your federal loan information atStudentAid.gov/login/FederalStudentAid/FAFSA Federal Student Loans: Repaying Your LoansYou can order printed copies of many of ourpublications at www.edpubs.gov./FederalStudentAidThe information in this guide was compiled inSpring 2016. For changes to federal student aidprograms since then, visit StudentAid.gov.Printed: September 2016

Types of Federal Student Aid There are three categories of federal student aid: Grants—Student aid funds that do not have to be repaid.* Most federal grants are based on financial need.