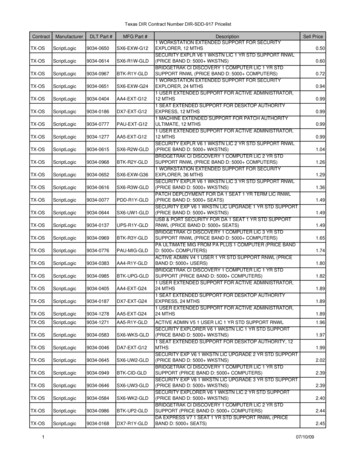

Transcription

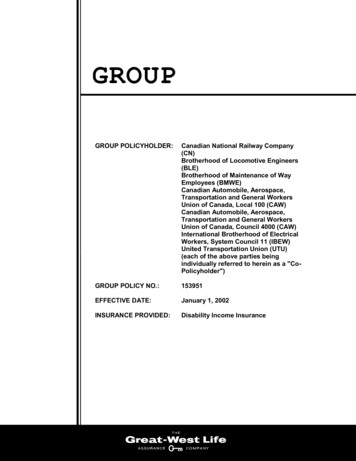

GROUPINSURANCEGROUP POLICYHOLDER:Canadian National Railway Company(CN)Brotherhood of Locomotive Engineers(BLE)Brotherhood of Maintenance of WayEmployees (BMWE)Canadian Automobile, Aerospace,Transportation and General WorkersUnion of Canada, Local 100 (CAW)Canadian Automobile, Aerospace,Transportation and General WorkersUnion of Canada, Council 4000 (CAW)International Brotherhood of ElectricalWorkers, System Council 11 (IBEW)United Transportation Union (UTU)(each of the above parties beingindividually referred to herein as a "CoPolicyholder")GROUP POLICY NO.:153951EFFECTIVE DATE:January 1, 2002INSURANCE PROVIDED:Disability Income Insurance

APPLICATION FOR GROUP POLICYCanadian National Railway Company (CN), Brotherhood of Locomotive Engineers(BLE), Brotherhood of Maintenance of Way Employees (BMWE), CanadianAutomobile, Aerospace, Transportation and General Workers Union of Canada,Local 100 (CAW), Canadian Automobile, Aerospace, Transportation and GeneralWorkers Union of Canada, Council 4000 (CAW), International Brotherhood ofElectrical Workers, System Council 11 (IBEW) and United Transportation Union(UTU).(the Applicants) apply to The Great-West Life Assurance Company for Group PolicyNo. 153951 in the attached form. The Applicants have approved this Group Policy andhave accepted its terms.Dated at this day of ,Canadian National Railway Company (CN)WitnessByAgent or Consultant of RecordTitleBrotherhood of Locomotive Engineers(BLE)WitnessByAgent or Consultant of RecordTitle

Brotherhood of Maintenance of WayEmployees (BMWE)WitnessByAgent or Consultant of RecordTitleCanadian Automobile, Aerospace,Transportation and General Workers Unionof Canada, Local 100 (CAW)WitnessByAgent or Consultant of RecordTitleCanadian Automobile, Aerospace,Transportation and General Workers Unionof Canada, Council 4000 (CAW)WitnessByAgent or Consultant of RecordTitle

International Brotherhood of ElectricalWorkers, System Council 11 (IBEW)WitnessByAgent or Consultant of RecordTitleUnited Transportation Union (UTU)WitnessAgent or Consultant of RecordByTitle

TABLE OF CONTENTSPAGEAGREEMENTA1TABLE OF BENEFITSB-TB 1Schedule of UnionsSchedule of Affiliated CompaniesB-SU 1B-SC 1INSURING PROVISIONSEmployerUnionInsurance ClauseInsurable EmployeeEligibility ConditionsEffective Date of InsuranceChanges in InsuranceActively at Work RequirementUnderwriting ProvisionTermination of an Employee's InsuranceReinstatement of an Employee's InsuranceC1C1C1C1C3C4C4C4C5C6C7BENEFIT PROVISIONSAssessment ResponsibilityDisabilityDuring the Initial Assessment PeriodAfter the Initial Assessment PeriodDisability PeriodWaiting PeriodBenefit PeriodRecurrenceIncome BenefitsAmount PayableOffset ProvisionCoordination ProvisionRehabilitation IncomeLTDD1D1D1D1D2D2D3D3D4D4D6D7D9(i)

Inflation ProtectionAssessmentRecalculationCanada and Quebec Pension Plan BenefitsConsumer Price Index FactorChanges to the Consumer Price IndexVocational Rehabilitation BenefitsParticipation CommitmentTime CommitmentEmployment IncomeExpense BenefitLimitationConversion PrivilegeGeneral LimitationsD 10D 10D 10D 10D 11D 11D 12D 13D 13D 13D 13D 14D 14D 15CLAIM PROVISIONSNotice of ClaimProof of ClaimNotice of AssessmentNotice of Benefit TerminationLegal ActionsOverpaymentSubrogation and Right of RecoveryE1E1E1E2E2E2E2GENERAL PROVISIONSCurrencyFurnishing of Information: Access to RecordsMedical and Vocational AssessmentsMisstatement of AgeDisclosure ProvisionsAppealsConformity to LegislationNon-ParticipatingGenderRepresentation and NoticeAnnual EarningsLTDF1F1F2F2F3F4F4F4F4F4F5(ii)

PREMIUM PROVISIONSPaymentGrace PeriodCalculation: Premium RateAdjustmentsRate ChangesTERMINATION OF THE POLICYG1G1G1G1G2H1TRANSFER PROVISIONSTransfer of InsuranceTransfer of ClaimsLTDI1I2(iii)

AGREEMENTGreat-West Life agrees to pay the benefits provided by thispolicy to the persons entitled to receive them. Thisagreement is made in consideration of the GroupPolicyholder's payment of the required premiums.This policy takes effect at 12:01 a.m. Central Standard timeon the Effective Date.The following pages and any riders or amendments are apart of this policy.Signed at The Great-West Life Assurance Company, Montréal, QuébecSecretaryPresident andChief Executive Officer5TH DRAFTFor the ActuaryLTDA1

TABLE OF BENEFITSThis table must be read in conjunction with the rest of this policy.ELIGIBLE CLASSES:Union employees working in Canada,represented by a bargaining agent of a union andunder age 65, except:- employees under Canadian National RailwayPolice Association (CNRPA) collectiveagreements;- employees who are on bridging status;- employees older than 54 years and 11 weeksand for which the sum of their age and yearsof pensionable service equals at least 83 and22 weeks;- full time representatives of a union that arecovered under another long term disabilityplan;- employees covered under the employer'slong term disability plan for non-unionemployees.WAITING PERIOD:period equal to the "Elimination period", asdefined in the employer's weekly indemnitybenefit plan, and the benefit period of such plan,plus any benefit period for which the person isentitled to benefits under the EmploymentInsurance Act of Canada.INITIALASSESSMENT PERIOD:the waiting period plus the next 24 months ofdisabilityINITIALASSESSMENT LEVEL:60%SUBSEQUENTASSESSMENT LEVEL:60%BENEFIT FORMULA:50% of monthly earningsGROSS BENEFIT:the amount derived from the benefit formula. Themaximum monthly gross benefit is 1,875.LTDB-TB 1

INCOME BENEFIT:the lesser of the gross benefit and thecoordination levelCOORDINATION LEVEL:85% of take-home payMAXIMUM BENEFIT PERIOD:36 monthsTAX STATUS:non-taxableLTDB-TB 2

Schedule of UnionsBrotherhood of Locomotive Engineers (BLE)Brotherhood of Maintenance of Way Employees (BMWE)Canadian Automobile, Aerospace, Transportation and General Workers Union of Canada,Local 100 (CAW)Canadian Automobile, Aerospace, Transportation and General Workers Union of CanadaCouncil 4000 (CAW)International Brotherhood of Electrical Workers, System Council 11 (IBEW)United Transportation Union (UTU)UnionsB-SU 1

Schedule of Affiliated CompaniesShawinigan Falls Terminal RailwayLTDB-SC 1

INSURING PROVISIONSEMPLOYEREmployer means Canadian National RailwayCompany (CN) and the companies listed in theSchedule of Affiliated Companies.UNIONUnion means the unions listed in the Schedule ofUnions.INSURANCE CLAUSETo become insured under this policy a personmust:1.2.3.4.5.6.INSURABLE EMPLOYEEbe employed by the employer;be a member in good standing of a union;be an insurable employee;be in an eligible class;satisfy the eligibility conditions; andsatisfy the effective date of insuranceprovisions.An employee is insurable if:1.2.3.he is under age 65;he is employed:(a) on a permanent and non-seasonalbasis; and(b) for at least 20 hours each week; andhe is a member in good standing of aunion.An employee is not insurable if:1.2.3.4.Insuring Provisions - LTDhe is under age 65 when he becomeseligible but will reach age 65 by the end ofa period equal to this policy's disabilitywaiting period;he is under Canadian National RailwayPolice Association (CNRPA) collectiveagreements;he is on bridging status;he is older than 54 years and 11 weeksand the sum of his age and years ofC1

INSURING PROVISIONS5.6.- pensionable service andbridging statusInsuring Provisions - LTDpensionable service equals at least 83 and22 weeks;he is a full-time representative of a unioncovered under another long term disabilityplan; orhe is covered under the employer's longterm disability plan for non-unionemployees.Pensionable service and bridging status are usedas defined in the employer's pension plan.C2

INSURING PROVISIONSELIGIBILITY CONDITIONSAn employee member of the UnitedTransportation Union (UTU) and the Brotherhoodof Locomotive Engineers (BLE) (excludingmembers covered under the Rail Canada TrafficControllers collective agreement), is eligibleimmediately if he is insurable on the effectivedate of this policy. Otherwise he is eligible on thefirst day of the month next following the firstmonth in which he performs compensatedservice. If he does not satisfy the actively at workrequirement on that day, he will be eligible on theday he satisfies that requirement, provided heperformed compensated service in the precedingmonth.Any other employee is eligible immediately if heis insurable on the effective date of this policy.Otherwise he is eligible on the first day of themonth next following the date he completes 60days of continuous employment as an insurableemployee, ending after the effective date.- continuous employmentAn employee is considered continuouslyemployed only if he satisfies the actively at workrequirement throughout the eligibility waitingperiod.- eligibility limitationAn employee is only eligible for the benefitsprovided for his class in the Table of Benefits.Insuring Provisions - LTDC3

INSURING PROVISIONSEFFECTIVE DATE OFINSURANCEInsurance takes effect on the date the employeebecomes eligible, subject to the actively at workrequirement.Changes in InsuranceChanges in insurance take effect as they occur,except that:Actively at Work Requirement1.all increases are subject to the actively atwork requirement.2.no change will take effect during a disabilityperiod.To satisfy this requirement, an employee must:1.not be disabled according to this policy'sdefinition of disability; and2.be either:(a)(b)(c)Insuring Provisions - LTDactually working at the employer'splace of business or a place wherethe employer's business requires himto work;absent due to vacation, weekends,statutory holidays, or shift variances;orabsent due to general holidays orassigned rest as defined by theemployer.C4

INSURING PROVISIONSUnderwriting ProvisionIf an employee wishes to obtain insurance that issubject to this provision, he must apply for it andsupply the information Great-West Life requests.Great-West Life will then assess the informationaccording to its underwriting rules. Theapplication will be approved if it meetsunderwriting standards.- substandard offerIf the employee's application for insurance is notapproved, Great-West Life may offer to provideinsurance on a restricted basis.Insuring Provisions - LTDC5

INSURING PROVISIONSTERMINATION OF ANEMPLOYEE'S INSURANCEAn employee's insurance terminates on theearliest of the following dates:1.the date this policy terminates;2.the due date of the first premium to whichhe has not made a required contribution;3.the date he ceases to be in an eligibleclass. If he ceases to be in an eligible classbecause he moved to a position that is notrepresented by a bargaining agent, thisdate will be extended to the first day of themonth following the position changeeffective date;4.the date he ceases to be an insurableemployee;5.the date he ceases to satisfy the actively atwork requirement. If he is not at workbecause of disease or injury, temporarylay-off, leave of absence, strike or lock-out,this date will be extended to the earliest of:(a)the date the employer stops payingpremiums or otherwise determinesthat insurance has terminated. Thisdate must be determined on thesame basis for all employees in likecircumstances.(b)the date he starts to work in anotherjob more than 20 hours per week,except in an approved rehabilitationplan or program.- for a disabling disease orinjury(c)31 days after he first ceases to beeligible for income benefits.- for a non-disabling disease orinjury(d)for disease or injury for which hedoes not qualify for income benefits,31 days after the number of weeks ofthe waiting period.Insuring Provisions - LTDC6

INSURING PROVISIONS- for lay-off or leave of absenceother than maternity orparental leave(e)for temporary lay-off or leave ofabsence other than maternity orparental leave, 31 days after the layoff or leave starts, plus any furtherperiod the employer is required bylaw to extend insurance.- for maternity or parental leave(f)for maternity or parental leave, theend of the leave.- for legal strike or lock-out(g)for legal strike or lock-out, 60 daysafter the strike or lock-out starts.REINSTATEMENT OF ANEMPLOYEE'S INSURANCEAn employee's insurance will be automaticallyreinstated if:1.it terminated because of disease or injury,leave of absence, or temporary lay-off; and2.he returns to work within 12 months after itterminated, or within any period for whichthe employer is required by law to reinstatethe insurance.If an employee does not qualify for automaticreinstatement, he will be treated as a newemployee unless the insurance terminatedbecause he stopped making required premiumcontributions. If it did, reinstatement is subject tothe underwriting provision.Insuring Provisions - LTDC7

BENEFIT PROVISIONSASSESSMENTRESPONSIBILITYSubject to appeal process agreed upon by theGroup Policyholder and Great-West Life, GreatWest Life has full responsibility for theassessment of a person's entitlement to benefits.DISABILITYThe benefits under this policy are for disabilityperiods that start while a person is insured.During the Initial AssessmentPeriodDuring the initial assessment period shown in theTable of Benefits, disability is assessed on thebasis of the duties a person regularly performedfor the employer before disability started. He isconsidered disabled if, because of disease orinjury, there is no combination of duties he canperform that regularly took at least 60% of histime at work to complete.If disease or injury prevents a person fromperforming a duty, it will also be considered toprevent him from performing:1.2.others that are performed only in order tocomplete that duty; andothers that can only be performed after thatduty is completed.After the Initial AssessmentPeriodAfter the initial assessment period, a person isconsidered disabled if disease or injury preventshim from being gainfully employed.- gainful employmentGainful employment means work:1.2.3.4.a person is medically able to perform;for which he has at least the minimumqualifications;that provides income of at least 60% of hismonthly earnings; andthat exists either in the province or territorywhere he worked when he becamedisabled or where he currently lives.The availability of work will not be considered inassessing disability.Benefit Provisions - LTDD1

BENEFIT PROVISIONSDISABILITY PERIODA disability period is:1.2.WAITING PERIODthe waiting period; plusthe benefit period.The waiting period starts when the employee firstbecomes disabled and lasts, if disability iscontinuous, for the period shown in the Table ofBenefits.If disability is not continuous, the days the personis disabled will be accumulated to satisfy thewaiting period as long as:1.2.no interruption is longer than 2 weeks; andthe disabilities arise from the same diseaseor injury.However, should the employee stopsreceiving benefits under the employer'sweekly indemnity benefit plan or under theEmployment Insurance act of Canada (EI),the waiting period automatically ends onthe latest of the date the weekly indemnitypayments end or the date the EI paymentsend.If benefits are still being paid under theemployer's weekly indemnity benefit plan orunder the Employment Insurance Act of Canada(EI) when the waiting period would otherwiseend, it will be extended to the latest of:1.2.Benefit Provisions - LTDthe date the weekly indemnity paymentsend; andthe date the EI payments end.D2

BENEFIT PROVISIONSBENEFIT PERIODA benefit period is:1.2.the period of time after the waiting periodduring which the person is continuouslydisabled; plusif the disability is not continuous, any periodof time during which the disability isconsidered to be a recurrence.A benefit period will not continue:1.2.3.for more than 36 months;past a person's attainment of age 55 if thesum of such person's age and years ofpensionable service equals at least 85; orpast a person's 65th birthday,whichever comes first.RECURRENCEBenefit Provisions - LTDAfter the waiting period, a disability is considereda recurrence if it arises from the same disease orinjury and starts within 6 months after theprevious disability ends.D3

BENEFIT PROVISIONSINCOME BENEFITSA disabled person is entitled to income benefitsafter the waiting period ends and for as long asthe benefit period lasts. No income benefits arepayable for the waiting period itself.Amount PayableThe amount payable is the income benefit lessthe reductions, if any, required under the offsetand coordination provisions. The income benefitis payable to the disabled person monthly inarrears. A proportionate amount is payable forany period less than a full month.- other incomeThe income used in the offset and coordinationprovisions is the income payable for the sameperiod as the income benefit under this policy.Except for retirement benefits, all income isconsidered payable when a person is entitled toit, whether or not it has been awarded orreceived. If it has not been awarded, Great-WestLife will have the right to estimate it according tothe terms of any plans or legislation involved.Retirement benefits are considered payable whenthey are actually received.If income is payable in a lump sum, the amountused will be the portion payable for loss ofincome during the benefit period.- special treatment of taxableincomeBefore the amount payable is calculated, taxableincome will be reduced by multiplying it by theratio of the person's take-home pay to hismonthly earnings. This does not apply to Canadaor Quebec Pension Plan benefits.- monthly earningsMonthly earnings are 1/12 of annual earnings.Benefit Provisions - LTDD4

BENEFIT PROVISIONS- take-home payTake-home pay means the person's monthlyearnings less deductions for federal andprovincial income taxes, Canada and QuebecPension Plan contributions, and federalEmployment Insurance premiums. Thedeductions are the amounts an employer wouldbe required to withhold from a person's monthlyearnings assuming:1.2.3.his taxable income equals 12 times hismonthly earnings;his deductions equal those shown for hisincome level in the payroll deduction tablesproduced by Canada Customs andRevenue Agency and equivalent provincialtables; anddeductions for taxes reflect the benefit ofpersonal tax credits, Canada and QuebecPension Plan tax credits, and federalEmployment Insurance tax credits.Where a person’s income level exceeds themaximum for Canada or Quebec Pension Plandeductions or federal Employment Insurancedeductions, the Canada or Quebec Pension Plancontributions and federal Employment Insurancepremiums used will be his annualized deductionsdivided by 12.The tables and tax credits used are those ineffect the day before the disability started.Benefit Provisions - LTDD5

BENEFIT PROVISIONSOffset ProvisionUnder this provision, the person's income benefitis reduced by the following income:1.92.5% of any disability benefits to which heis entitled on his own behalf under:(a)(b)(c)2.Retirement benefits to which he is receivingon his own behalf under:(a)(b)(c)3.the Canada Pension Plan;the Quebec Pension Plan; ora plan in another country for whichthere is a reciprocal agreement withthe Canada or Quebec Pension Plan.Benefits under any Workers' CompensationAct or similar law except for:(a)(b)Benefit Provisions - LTDthe Canada Pension Plan;the Quebec Pension Plan; ora plan in another country for whichthere is a reciprocal agreement withthe Canada or Quebec Pension Plan.permanent partial disability awardsthat were payable for each of the 12months before a disability period;andbenefits related to employment withanother employer.4Where permitted by law, loss of incomeautomobile insurance benefits availablethrough legislation to which he or anothermember of his family is entitled on thebasis of his disability.5.40% of the earnings received from anapproved rehabilitation plan or program.D6

BENEFIT PROVISIONSCoordination ProvisionUnder this provision, the person's income benefitis reduced if the tota

United Transportation Union (UTU) (each of the above parties being individually referred to herein as a "Co-Policyholder") GROUP POLICY NO.: 153951 EFFECTIVE DATE: January 1, 2002 INSURANCE PROVIDED: Disability Income Insurance GROUP INSURANCE