Transcription

BuildingCompanies &Communities2017 Annual Report1GBF 2017 Annual Report

Table ofContents24About Us5Our History6New Company Spotlights8New Learnings9Performance in FY1710Social Impact11GBF Team12Governing Board and Advisors13Donors to the NonprofitInvestors in the Fund14Financial StatementsGBF 2017 Annual Report

Dear Friends,We are pleased to present GBF’s Annual Report for Financial Year 2017, ending June 30, 2017.Since beginning in 2004 as a department within the International Finance Corporation (IFC),Grassroots Business Fund has learned and changed a great deal over the past 13 years.Now having evolved in key areas, we are a seasoned company of efficient, targeted impactinvestment professionals with local offices and staff on the ground near our portfoliocompanies, still approaching issues with youthful energy and creativity. Through our trialsand tribulations, however, we learned to tackle the issues we face in a much more efficientmanner. Through efficiency, we are able to focus more on our mission, clients and socialimpact than on administration.GBF has invested in more than 40 companies, the vast majority of which have succeededor are succeeding. After working with us, each of these companies have received follow-oninvestments from more traditional providers of financing, including banks and DevelopmentFinance Institutions. Our Business Advisory Services (BAS), sometimes provided even beforeinvestment, has been recognized by portfolio companies’ leaders as invaluable for theirbusinesses’ growth.This year we have committed investments to two more companies: SOKO in Kenya andPhoenix Foods in Peru. SOKO is an innovative artisanal company that connects low incomeartisans throughout Kenya into their supply chain through technology. Not only does thisempower the artisans to work on their own terms, but provides for a very quick turnaroundfrom product creation to the consumer. Phoenix Foods buys fresh fruits and vegetables fromsmallholder and medium farmers for processing and sale in export and local consumption.Phoenix differentiates itself by purchasing products from different regions of Peru to mitigateclimate and supply risks. You can see more on these new companies on pages 6 and 7.Through our evolution, we have learned a number of lessons, including the need to narrowour geographic and industrial scope to focus on what we do best. Please see these lessonsdiscussed on page 8.We are excited to continue to grow in our mission to generate sustainable earnings andsavings for people in developing countries.Sincerely,Harold Rosen Andrew AdelsonCHIEF EXECUTIVE OFFICER3GBF 2017 Annual ReportCHAIRMAN OF THE BOARD

About UsThe Grassroots Business Fund (GBF) aims to reduce poverty by building companies whichprovide sustainable incomes and cost-savings for poor populations in developing countriesGBF’s market-based approach to poverty alleviation focuses on building “High ImpactBusinesses” (HIBs)—sustainable and inclusive firms which benefit large numbers of peoplein our target communities by generating income or offering affordable, quality products andservices. Through a network of mostly field based investment and business professionals,GBF grows HIBs in two ways:1By providing tailored investment capital using a high-touch approach that itselfhelps build companies’ business fundamentals.%2Providing investees with “Business Advisory Services” (BAS), which connectcompanies to local industry experts.GBF’s experienced staff has built and refined this model for over a decade, based on direct,on-the-ground experience, investing in over 40 businesses in Africa, Asia, and Latin America.4GBF 2017 Annual Report

Our History20042008Grassroots Business Initiative (GBI)Originally created as a department within the World Bank’sInternational Finance Corporation (IFC), GBI is founded byHarold Rosen, who pioneered IFC’s SME and microfinanceactivities in seeking stronger social impact.Grassroots Business Partners (GBP)Following four years of incubation in the International FinanceCorporation, GBF became an independent non-profit organization in2008 to begin making financial investments in for-profit companies,utilizing 100% grant funding and delivering BAS.Based out of Washington, DC, GBP invested in agricultural andartisanal clients, as well as innovative finance companies.2011GBP Grassroots Business Investors Fund I (GBI-I)Launched 49M for-profit 10 year limited life fund, Grassroots BusinessInvestors Fund I.GBI-I invests in socially impactful businesses in Africa, Latin America andIndia, focusing on companies that engage smallholder farmers and artisansin their supply chains.GBF opens up offices in Lima, Peru; Nairobi, Kenya and NewDelhi, India to place a majority of staff on the ground in order tobest cooperate with portfolio companies.5GBF 2017 Annual Report

NewCompanySpotlightsSOKOK E N YAEstablished in 2014, SOKO is a company that designs, marketsand sells ethical fashion jewelry and accessories. SOKOdelivers affordable, fashionable styles of handcrafted jewelrycreated by artisans based in peri-urban areas of Nairobi.GBI-I committed to SOKO this fiscal year in a revolving creditline agreement. The company’s competitive advantage isits technology and operating platform which utilizes a large(1,000 ) artisan base in Kenya to produce just-in-time ordersfor customers globally.GBF and SOKOGBF’s investment will be used to fund SOKO’s growth aswell as to fulfill their orders. GBP has begun a BAS projectwith SOKO to improve supplier loyalty and productivity.This included building an app that the company and supplierscan use to manage work orders, provide and get feedbackon performance, and receive rewards for exemplary work.GBP also plans to work with SOKO in conducting aleadership and technical training for its staff.6GBF 2017 Annual Report1,000 Artisans125,000Products15–20%Value shared with artisans 650KIncome generatedsince 2014

Phoenix FoodsP ER UPhoenix Foods was founded in 1997. The agro industrialcompany buys fresh fruits and vegetables from smallholderand medium-sized farmers across Peru, processes and packsthe products for sale in the local and export markets.GBI-I made a long term investment in Phoenix Foodssplit between a loan and preferred equity. Phoenix Foods’purchases products from over 300 small farmers, directly andthrough intermediaries who are aligned with the company’smission. The company has three business lines: Frozen/Processed, Fresh Fruits, and Fresh Cuts. Small farmers andbigger suppliers in the company’s value chain in turn help togenerate income for over 2,000 farm-workers. In addition,Phoenix creates about 400 jobs at its processing plant.GBF and Phoenix FoodsGBF’s investment will be used to purchase productionequipment for working capital and to improve logistics toensure that fresh products are transported properly. GBF andPhoenix are also exploring a BAS project to train small farmerson better farming practices to increase their productivity.Another project aims to improve the logistics process tomove products along the supply chain.7GBF 2017 Annual Report306Small holder farmerfamilies2,700Workers and farmersdirectly employed4,460Family members supported400Jobs created duringhigh season52%Value shared with farmersand workers

NewLearningsxxxxxxxxGBF has embarked on the following program of learning and improving to ensure our focuson our mission, clients and social impact stays strong:Studying Exited ProjectsGBF has tried to continually assess its results, and internalizelessons learned in order to improve and to adapt to changingneeds. Within its constraints, GBF has also tried to share its resultswith the impact investing field, to help move the space forward.Management has recently interviewed our exited companies,with the goal to assess our successes as well as failures. Thecompanies with whom we began our relationship almost 10 yearsago hold the best information on the longer term impact that weprovide. After all, one of GBF’s ultimate goals is to improve thesustainability of investee companies, information that monitoringonly current portfolio companies does not necessarily provide.The goal for this exercise was to paint a fuller picture, flaws andall, of GBF effects on a partner company. We look forward topresenting the report soon.Tightening Geographic StrategyGBF originally spread across multiple regions to diversify risk;the company found it important to cast a wide net, a basicprinciple which it still employs. GBF is no longer booking newinvestments in Asia, and is more selective with companies inEast Africa and the Andean Region in Latin America. Utilizinglocal teams on the ground rather than viewing from afar inWashington has also increased success rate.Focusing on Agribusinessx8GBF 2017 Annual Reportxxxx xx xx x x xxxxxOur experience with companies in the agribusiness sectorhas proven to be successful as well as socially impactful. Theagribusiness companies that experience the most success arethose that operate in specialized markets such as organic and/or fair trade certified; additionally, many process and exportagricultural products, but some will distribute locally as well.GBF has collaborated with The African Guarantee Fund, OeEBand Partners in Food Solutions (PFS, in Kenya) to hire a foodtechnology expert for Technoserve, as a consultant for ouragribusiness strategy and companies. The food technologist hasbrought expertise in agribusiness to our Nairobi office, and willwork directly with companies in our portfolio and pipeline.

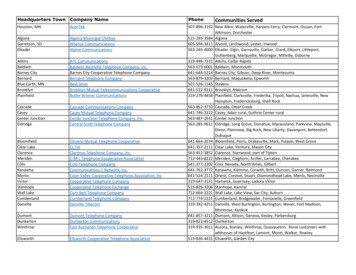

Performancein FY17G BF INVESTM E N T FUN D P E R FO R MA NCE 1Key Performance IndicatorActuals2Active Commitments 39.9MRealized Proceeds 16.9MDisbursed Portfolio Fair Value 25.5MNumber of Active Investees2027%Average companyrevenue growth58%Average EBITDAgrowthHandcraftedmanufacturingSouth Asia22%28%Investmentby Industry3South East AsiaProducts &Services7%Investmentby Region410%Africa25%AgribusinessLatin America62%46%G BP P ERFOR M A N C EGBF’s BAS program provides advisory services to portfoliocompanies (or those in advanced stages of pipeline) of GBF’sinvestment fund GBI-I. The assistance offered through BAS servesto enhance GBF provided capital and ensures that growth andsustainability are supported by improving business skills, supplychain management, social impact creation and tracking and more.BAS P ER FOR M A N C E 5 7MSpent on BAS activities79BAS by TypeStrategyFinancial Mgmt.Corp. GovernanceOperations27%HIBs supported4%24%35%Environ. & Social10%9GBF 2017 Annual Report1. See page 14 for GBF’s financial statements for the fiscal year ending June 30, 20172. As of June 30, 20173. Cumulative commitments since 20114. Ibid.5. Ibid.

SocialImpactIn an attempt to quantify the economic impact of its investees, GBF measures two keyindicators for its companies: economic value generated as income or cost-savings, andthe number of people affected.From April 1, 2016 to March 31, 2017, GBF provided over 30M in income to farmers,artisans and workers as well as 14M in cost savings to product users.SectorAgribusinessHandcrafted manufacturingProducts & ServicesActive Fund TotalIndividuals DirectlySupportedNet Income to Farmers &Workers from GBF Investee17,659 15.1M41,808 11.7M1,016,982 17.3M1,076,449 44.2MGBF also calculates an Economic Rate of Return for each investee, projecting economicflows to key stakeholders long-term. When feasible, social impact surveys help GBF adjustassumptions and better understand its beneficiary groups and to estimate the social andeconomic conditions.As a responsible business partner, GBF also helps companies promote sustainable,responsible practices. Environmental and Social Management (E&S) Programs for eachinvestment screen out companies with unsuitable practices or in potentially harmfulindustries, while each investee receives assistance developing and executing action plans tolimit any adverse environmental impact and promote social responsibility. As part of our BASprograms, GBF helps clients fund E&S programs and sets realistic, measurable targets.10GBF 2017 Annual Report

GBF Team7Companies 25.6MEconomic value provided to985,000Washington, DCBeneficiariesNew Delhi, India7Companies 17.1MNairobi, KenyaEconomic value provided toLima, Peru31,000Beneficiaries4Companies 1.49MEconomic value provided to60,000BeneficiariesWashington, DCNairobi, KenyaHarold Rosen, CHIEF EXECUTIVE OFFICERLilian Mramba, AFRICA REGIONAL DIRECTORJaime Ramirez, CHIEF INVESTMENT OFFICERNoel Wadaki, OPERATIONS MANAGER &Rose Galamgam, FINANCE OFFICERDaniel Kolender, OPERATIONS ASSISTANTLaila Kassam, GLOBAL PORTFOLIO ASSISTANT& COMMUNICATIONSKaran Sawhney, INVESTMENT OFFICERLima, PeruNew Delhi, IndiaNatasha Barantseva, LATIN AMERICAVijay Chandrashekar, INDIA PORTFOLIO MANAGERREGIONAL DIRECTORSahiba Chauhan, SENIOR INVESTMENT ANALYSTJulio Ayca, LATIN AMERICA PORTFOLIO MANAGERMayra Ramirez, PROGRAM OFFICEROlga Egorova, INVESTMENT ANALYSTFiorella Capristan ADMINISTRATIVE ASSISTANT11BAS COORDINATORGBF 2017 Annual Report

GoverningBoard andAdvisorsBoardGBF AdvisorsAndrew Adelson, CHAIRMAN, FORMER CHIEFINVESTMENT OFFICER, Alliance BernsteinAndrew Adelson, INVESTMENT COMMITTEEZoë Dean-Smith, SENIOR DIRECTOR OF GLOBALPROGRAMS, Vital VoicesAnnette Berendsen, FUND ADVISORY COMMITTEEGuillermo Ferreyros, CHIEF EXECUTIVE OFFICER,OlympicStephen Brenninkmeijer, FUND ADVISORYMary Houghton, CO-FOUNDER, ShorebankCorporationRafael Guillermo Ferreyros Cannock,Mwaghazi Mwachofi, GENERAL MANAGER,Aga Khan Agency for Microfinance (AKAM)Rupin Rajani, INVESTMENT COMMITTEE MEMBERMEMBER, BAS STEERING COMMITTEE MEMBERMEMBERCOMMITTEE MEMBERINVESTMENT COMMITTEE MEMBER, GBF ADVISORPradeep Kapse, GBF ADVISORHarold Rosen, CHIEF EXECUTIVE OFFICER,Grassroots Business FundThomas Klein, FUND ADVISORY COMMITTEEHolly Wise, WISE SOLUTIONS LLCSerge Kremer, INVESTMENT COMMITTEE MEMBERMEMBERSari Miller, GBF ADVISORHelmut Paul, INVESTMENT COMMITTEE MEMBERK.K. Rathi, GBF ADVISORSir David Scholey, GBF ADVISORJoachim Schwenke, GBF ADVISORHolly Wise, BAS STEERING COMMITTEE MEMBER12GBF 2017 Annual Report

Donors andInvestorsDonors to the NonprofitAdelson Family FoundationHarold Rosen and Susan WedlanArnold & PorterLaura DevereCecilia ChanNORAD - The Norwegian Agency for DevelopmentCooperationCharly & Lisa Kleissner (KL Felicitas Foundation)The Dutch Ministry of Foreign Affairs (fundingmanaged by FMO)Government of Canada (funding managed by IFC)OeEB - Development Bank of AustriaOmidyar NetworkStephen BrenninkmeijerInvestors in the FundAndrew Adelson (Adelson Family Foundation)Maurizio CaioBarend van der VormMontpelier FoundationCalvert Social Investment FoundationMwaghazi MwachofiChary and Lisa Kleissner(KL Felicitas Foundation)Overseas Private Investment CorporationDalip PathakPrashant JhawarDavid Dunn and Tamara DunietzRobert J. Caruso (The Kantian Foundation)DEG - German Development BankRon and Marty Cordes(The Cordes Foundation)Deutsche Bank Americans FoundationFMO (The Netherlands Development FinanceCompany)Sari Miller (Trust)Harold Rosen and Susan WedlanSeth MeiselJane EddySir David ScholeyJim Hornthal (Hornthal Investment Partners)Stephen BrenninkmeijerJoshua Mailman(Joshua Mailman Foundation)Sudhir and Sangeeta Maheshwari(AIM to ZERO Foundation)Judson BerkeySuzanne Biegel and Daniel MaskitKen Inadomi and Melinda WolfeT&J Meyer Family Foundation LtdLeah and Jeffrey KronthalWolfensohn & Company, LLCLuisa and Laurence NewmanAnonymous InvestorsLuxembourg Ministry of FinanceMarty Kahn13Peter Braffman and Liz WedlanGBF 2017 Annual ReportSerge Kremer

FinancialStatementsUnaudited Statement of Financial Position:GBP and SubsidiariesYear ending as of June 30, 2017ASSETSMission Related Investments (GBI-I)Cash and Cash EquivalentsDonor Contributions ReceivableOther Accounts ReceivableOther current assets1 25,558,467 4,951,503 372,927 64,404 654,092Fixed Assets 19,437Total Assets 31,620,830LIABILITIES AND NET ASSETSShort-term Liabilities2Notes Payable3Securities DepositNoncontrolling interest in GBINet Assets (Unrestricted)Net Assets (Temporarily Restricted)4Total Liabilities and Net Assets 511,662 9,846,000 7,275 19,524,025 464,537 1,267,331 31,620,830SUPPORT AND REVENUEContributionsIn-Kind ContributionsInvestment LossOther Sources5Total Support and Revenue 130,501 360 (95,324) 1,794,653 1,830,190EXPENSESProgram Expenses6Administrative and General Expenses7Fundraising Expenses 2,190,918 692,763 360,334Total Expenses 3,244,015CHANGE IN NET ASSETS (1,413,825)Notes to Financial Statements:1. Includes interest receivable from mission investments and security deposits2. Includes accounts payable, accrued interest, accrued expenses (including accrued vacation)3. Represents Lender to GBI-I4. Includes contributions from individuals, foundations, bilateral institutions, etc.5. Includes bank interest, mission related loan interest, and mission related loan activation fees, and exchange rate fluctuations6. Includes mission related expenses such as technical assistance (direct and grants) and due diligence expenses, as well asinternal programs such as monitoring and evaluation, and communications. This also includes losses/gains related to GBI-I activities7. Includes operational expenses, etc14GBF 2017 Annual Report

G BF H Q OFFI CE1875 K Street NW4th floorWashington, DC 20006USATel: 202-518-6865Fax: 202-986-4729G BF NAI ROBI OF F IC E3rd Floor, Western HeightsP.O. Box 52621- 00100Karuna Road ClWestlands, Nairobi -KENYAG BF LI MA OFFIC ECalle Paseo de la República 6010Oficina 101MirafloresLima, PeruG BF NE W DE LHI O F F IC E3rd Floor, 6, Basant LokVasant ViharNew Delhi - 100 057India

Grassroots Business Fund has learned and changed a great deal over the past 13 years. Now having evolved in key areas, we are a seasoned company of efficient, targeted impact investment professionals with local offices and staff on the ground near our portfolio companies, stil