Transcription

AIO WirelessBrad Dolan 12/5/2012AIO Dealer Payment Processing GuideRQ4 v4.12.11-866-iQmetrix www.iQmetrix.com

Table of ContentsWelcome Message . 2Processing Options . 3Existing RQ4 Integrated Processing Customers .6RQ4 Payment Operations Guide .7How do I Set up a Workstation .7VeriFone Hardware .7RQ4 Signature Capture .7Payment Integration Settings .9Chase Paymentech Setup . 10Elavon Setup . 11Performing a swipe credit/debit signature sale . 12Performing a Pin Debit sale . 17Performing a Manual Entry Credit/Debit Signature Sale . 19Performing a Phone Authorization . 20Performing a Refund . 21Voiding a partially paid invoice. 21Closing and Reconciling your Batch (Paymentech, Heartland) . 23Column Overview: . 25Reconciling your Batch (Auto-batching) . 26Column Overview: . 26Glossary of Terms . 28Appendix A . 29Card Association and Assessment Fee Definitions. 29Additional information can be found in the following documents from Elavon: . 31AIO Dealer Payment Processing Guide Brad DolanPage 1

Welcome MessageHello and welcome to the AIO/RQ4 payment processing guide. The purpose of this document is to outline thechoices you have for your payment processing needs and proper operation of the RQ4 point of sale system. iQmetrixis integrated to several payment processing companies and is pleased to provide you with options for your merchantneeds. If you are a current RQ4 merchant you can continue using the processor and setup you enjoy today. If you arenew to RQ4 we have outlined the options for merchant processing in the Processing Options section of thisdocument.AIO Dealer Payment Processing Guide Brad DolanPage 2

Processing Options No Contract- Our Month-to-Month agreement ensures we earn your business month after month. Hardware Collection- Reduce your losses in equipment costs for broken service contracts (no cost for thisservice) Transparent Pricing- Our pass-through pricing processes your transactions at the lowest possiblequalifying rate. Resource Online- ROL is our Best-In-Class Award winning proprietary reporting tool designed directlyfrom our merchant’s recommendations. Our Resource Dashboard allows merchants to quickly and easilytrack their business activity. In House Support- From authorization to statement reconciliation, Chase Paymentech handles all yourneeds under one company without outsourcing. Single Point of Contact- Your account rep will walk you through every step of the setup process. Extremely low Cost Plus pricing- Interchange Pass-through plus 5bps (basis points) and 0.08 pertransaction. Free Hardware Collection Setup Free Resource Online Reporting No Application Fee No Monthly/Yearly PCI compliance feesFor setup or a comparison to your existing processor, contactJeff Hodge214-849-3665Jeff.Hodge@chasepaymentech.comAIO Dealer Payment Processing Guide Brad DolanPage 3

In an increasingly complex business landscape, Elavon is your global source for innovative paymentsolutions—the one company that clients and partners everywhere trust to securely and reliably manage theirpayments business. Whatever you need and wherever you need it, we deliver innovative and secure solutions tohelp you increase revenues, decrease costs, and sharpen your competitive edge.More than 1 million merchants trust Elavon to efficiently and securely manage their payments business. Weextend powerful payment solutions, flexible connectivity, and effective fraud monitoring tools to customersaround the globe—from smaller retail merchants to national retailers, as well as large organizations in segmentssuch as hospitality, healthcare, and the public sector.Elavon provides end-to-end payment processing services to merchants and financial institutions in the UnitedStates, Puerto Rico, Canada, Mexico, and throughout Europe. Our payment products are supported by the mostreliable network in the world. We handle every aspect of the acquiring relationship—transaction processing,risk and underwriting, settlement, equipment deployment, chargeback management, reporting, and customerservice. Our customers can also count on us to keep their payment processing compliant with changing paymentsecurity requirements.Contact:Denise AtkinsonDenise.Atkinson@elavon.com(800) 226-9332 ext. 8177AIO Dealer Payment Processing Guide Brad DolanPage 4

Elavon Service Transaction processing fees include:Interchange Pass-Thru Pricing: All Visa , MasterCard , Discover Card, Unionpay, American Express, anddebit network authorization and Interchange fees, assessments, dues and other fees and charges are passed toMerchant at Visa/Discover Rate0.00%MasterCard/Visa/Discover Auth Fee 0.090PIN Debit Rate Debit Network Fees0.00%PIN Debit Auth Fee Debit Network Fees 0.090American Express Auth Fee (Existing SE #’s) 0.100Voice Auth (touchtone) 0.750Voice – Operated Assisted 0.900Voice – AVS 0.900Voice – Bank Referral 4.000Set-Up Fee (one time per location) 35.00Monthly Min. Processing FeeWaivedChargeback Fee 15.00PCI Compliance Service Fee (per location) 4.000Non-validation PCI Compliance Fee 34.95Card Imprinter (optional) 22.00On-line with Case Management (OMC) 5.00Paper Statements (optional) 10.00Rush Fee (per relationship) 40.00Return Item (NSF) Fee 20.00American Express One Point ( 500K)Merchant SuppliesBy OrderSRS Annual Fee 1099 (per relationship)2.89% 0.10 34.00For more information on Elavon see Appendix AAIO Dealer Payment Processing Guide Brad DolanPage 5

Existing RQ4 Integrated Processing CustomersCustomers who are already using RQ4 and integrated payment processing may continue to leverage existingrelationships with integrated processors. You will need to obtain new MID’s for each physical location and aterminal ID for each workstation where you will take payments. Contact the representatives listed below to discussyour options for carrying over your agreements:Elavon Contact: Denise AtkinsonDenise.Atkinson@Elavon.com(800) 226-9332 ext. 8177Paymentech Contact: Jeff rtland Contact: Bob PayneRobert.Payne@e-hps.com866-752-4489AIO Dealer Payment Processing Guide Brad DolanPage 6

RQ4 Payment Operations GuideHow do I Set up a WorkstationVeriFone HardwareDownload and unzip VeriFone’s USB Drivers.zip from iQmetrix support site (http://support.iqmetrix.com).Make sure the device is NOT plugged in to the computer.In the unzipped folder you will find 2 folders:For 32 bit operating system:a. Win7-Vista-XP-(Embedded) 32bit USB Driveri. Inside you will find usb installvfi 3 1.zip, unzip this file1. After unzipping the file go to that folder and run usb installvfi 3 1.msi5) For 64 bit operating system:a. Win7-Vista-XP-(Embedded) 64bit USB Driveri. Inside you will find usb installvfi64 1 0.zip, unzip this file1. After unzipping the file go to that folder and run usb installvfi64 1 0.msi1)2)3)4)6) After successful installation of the driver plug in the device and wait for Windows to complete theinstallation.RQ4 Signature CaptureAfter installing the hardware drivers you will need to setup your RQ4 workstation to use the device. Proceed toSettings\WorkstationSettings\Signature Capture.Select the VeriFone MX915from the drop down. Checkoff Enable Magnetic StripeReader and then proceed tothe pin pad settings section.AIO Dealer Payment Processing Guide Brad DolanPage 7

Pin pad settings will load the defaults except for the com port. This is determined when you connect the VeriFonedevice for the first time. To check on the com port setting, navigate to Device Manager in Windows. The VeriFonedevice will be listed as MX800 Family POS Terminal with the com port number next to it as seen in the imagebelow.Set the com port setting in RQ4 to match what is listed here and save the settings. Once this is completed the test pinpad button will enable and you can check on connectivity. If the test is successful move to the next section and loadthe forms to the device by clicking the Load Device Forms button (image 1). This process may take a few minutes.Once the process has completed you can then click the Test button to capture a signature.Your device is now configured!AIO Dealer Payment Processing Guide Brad DolanPage 8

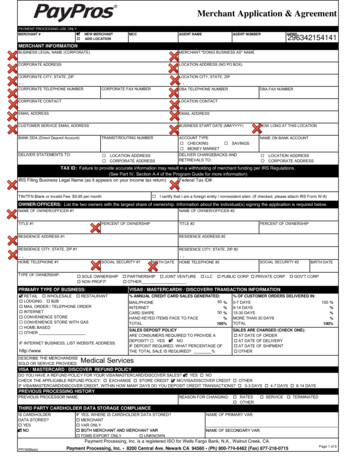

Payment Integration SettingsOnce you receive your merchant account from one of the processors at the start of this document you will need toenter the information into RQ4. The processor will give you a “VAR” or “tear” sheet for each physical location withyour account details. This tells the RQ4 system where funds should be directed. The processor maintains the linkbetween your merchant account batch and your bank account. Your processor representative can help you whenentering the credentials in RQ4. Because the processors produce the account detail sheets we cannot guarantee theywill always have the same appearance or order for information.To enter the credentials proceed to Settings/Workstation Settings/Payment Integration. Check off the enabled checkbox to activate the workstation. Select your payment provider (Paymentech, Elavon, or Heartland) from the dropdown to reveal the settings for that provider. For all providers ensure that the swipe device selected is the VeriFoneMX 915.AIO Dealer Payment Processing Guide Brad DolanPage 9

Chase Paymentech SetupThere are 2 options for Chase Paymentech as a provider, “Paymentech” and “Paymentech Auto Batching” are theoptions and there are subtle differences between them:Paymentech (US) No Pin Debit support Terminal capture setup for the merchant account Batch data is held at iQmetrix until rep closes the terminal and batches out from RQ4 Payments that are missing invoices are automatically dropped when the batch is closed Batches will not close without rep intervention, authorizations not batched can be lost after 3-5 daysAIO Dealer Payment Processing Guide Brad DolanPage 10

Paymentech Auto Batching Full Pin Debit support Host capture is setup for the merchant account Batch data is held at Paymentech until a set time each night when the batch closes Reconciliation is required for overages (payments without linked invoice)o User will need to verify the batch total at Paymentech matches RQ4No extra work required to close out the batchElavon SetupElavon has a single setup selection and is configured for auto batching. Each terminal must have a unique numberand the RQ4 system will enforce this. If you need to re-use a terminal number the system will ask for manageroverride permissions and record the override for reporting. If you use the same terminal number on multiplemachines transactions may overwrite each other and cancel the payments!AIO Dealer Payment Processing Guide Brad DolanPage 11

Performing a swipe credit/debit signature saleOnce you have completed adding items you will progress to the tender screen. The system will display the invoicetotal to the user on the signature capture device.The consumer/customer must acknowledge the total before the system will allow you to proceed to payment. If thecustomer is unable to accept you can click the “Get verbal approval” link on the status window. This will be loggedwith your employee information for reporting and security purposes.AIO Dealer Payment Processing Guide Brad DolanPage 12

Once the customer has agreed to the invoice products and cost you must select a payment type for the invoice.Multiple payment types can be used to complete the invoice. Select the credit payment type and the full remainingamount of the invoice will appear next to the selected type. You can chose to leave this amount or adjust it whenusing multiple payment types.If you need to fix the payment amounts you can click the grey X next to the payment amount to remove it. Thencontinue to add payments until the full amount of the invoice is entered. When a credit or debit card payment hasbeen approved the grey X button will disappear. At that point you must cancel the invoice to refund the money tothe customer. (See Voiding a Partially Paid Invoice)Once the amount is set click the Tender button to proceed to the next step. For a credit or debit signature paymentthe system will present the swipe screen below as well as light up the signature capture device to show the customerthat they should now swipe their card.AIO Dealer Payment Processing Guide Brad DolanPage 13

The system will show you information about the device connection and card information on the status window.The display will show the information below:ooConnecting to deviceWhen the card holder should swipeooConfirmation of the card numberProcessing screen is shownoNext paymentooCustomer to sign for paymentApprove the signature (verify the signature matches the back of the card) (click OK)ooTendering Invoice displays (invoice is being saved)Print/email the receiptRQ4 Screen DisplayVeriFone MX915 DisplayOnce the customer swipes the card you must click OK to proceed. The screen below gives you a chance to verify thename on the card matches the data read from the magnetic stripe. The card holder name and last four digits of thecard are displayed.AIO Dealer Payment Processing Guide Brad DolanPage 14

After clicking OK the system will process the card showing thepin wheel while the system waits for a response.The signature device will show the customer the responsethe system receives either approved or declined.If the payment is approved the system will ask the customer to sign the device for each different card/amountentered on a particular sale. This signature is captured and secured in the system for later reference.AIO Dealer Payment Processing Guide Brad DolanPage 15

When the customer has finished signing the device they willclick continue and the signature will present in the statuswindow. You must verify that the signature they providedmatches the signature on the back of the card. If you believeit matches click Confirm. If you want them to sign againclick Reset and the system will present the customer withanother signature window.Once you have confirmed the signature for the final payment the invoice will save to the database you should see theimage below.When the invoice has completed the status window will present you with options for the invoice. You can choose toemail, print the invoice or exit the sale.AIO Dealer Payment Processing Guide Brad DolanPage 16

Performing a Pin Debit saleA Pin Debit transaction will operate is the same manner as a credit sale. The only change is that the customer mustenter their debit pin code on the signature device. In order to process a pin debit payment you must select the Debitpayment type. The full amount of the invoice will appear next to the debit payment type. You can adjust this amountfor multiple payment types. Following the credit sale flow the user will swipe their card and then system will thenask the user to input their pin. The following screens will appear after the customer has swiped their debit card.The customer has now swiped the pin debit card and the systemis waiting for you to click OK. You should confirm the last fourdigits and name are the same as the front of the card.After clicking the OK button the system will display a prompt the customer to enter their pin on the signaturedevice. The system will wait for the user to either enter the pin or cancel the request.oAIO Dealer Payment Processing Guide Brad DolanPage 17

Once the customer has entered the pin number the system willdisplay the pin wheel while it waits for a response from theprocessor.When the response is returned the signature device willdisplay the approved or declined message.Once all payments are approved the system will save the invoice and display the invoice print selection screen in thesame way as noted in the credit sale section of this document.AIO Dealer Payment Processing Guide Brad DolanPage 18

Performing a Manual Entry Credit/Debit Signature SaleIf the signature device is not working or a card will not swipe properly you may have to manually enter the cardinformation to process a transaction. Manual card entry is not as secure as swipe so this process should only be usedif you are sure the card is not lost or stolen. Additional step must be taken to prove the card was at the locationduring the sale. An imprint must be taken of the card front in order to prove the card was at the location should thecard holder wish to fight the charges. If you are unsure about this process you should speak to your manager beforemanually entering cards.Once you have completed adding items you will progress to the tender screen. You must select a payment type forthe invoice. Multiple payment types can be used to complete the invoice. Select the credit payment type and the fullremaining amount of the invoice will appear next to the selected type. You can chose to leave this amount or adjustit when using multiple payment types. After entering all payment click the Tender button to proceed.

Apr 25, 2013 · Hello and welcome to the AIO/RQ4 payment processing guide. The purpose of this document is to outline the choices you have for your payment processing needs and proper operation of the RQ4 point of sale system. iQmetrix is integrated to several payment processing companies and is ple