Transcription

ONEEXCHANGEHealth Coveragewith More Choicesa general agency of The United Methodist Church

Get ready for a different approach to health coverage—with flexibility to choose a plan that fits your needs.This brochure explains the health coverage for Medicare-eligible retirees andeligible disabled participants, their Medicare-eligible spouses and surviving spouses.When you become eligible, you will choosea health plan through Towers Watson’s OneExchange.OneExchange offers access to many Medicare supplemental plansfrom more than 85 health insurers nationwide.

Welcome to Towers Watson’s OneExchangeTable of ContentsWhy OneExchange. 2More About OneExchange. 3Steps Toward Enrollment. 4Become Familiar with Medicare. 5Medicare Summary Chart. eExchange.com/gbophbUnderstanding HRAs.11How an HRA Works.12www.wespath.org/cfhShortly before you become eligible for Medicare, you willreceive an Enrollment Guide from OneExchange that explainsin detail how to evaluate Medicare supplemental plan optionsand enroll in the plan that is right for you. Your plan sponsor hasselected OneExchange as their approved partner to help younavigate your options for a Medicare supplement plan andensure that you are well-equipped to make an informed andconfident selection of health care benefits.General Board ofPension and Health Benefitswas renamedWespath Benefits and Investments(Wespath) in July 2016.www.wespath.orgA OneExchange licensed benefit advisor will become youradvocate—helping you find and enroll in the plan that bestserves your medical needs and fits your budget. After yourEnrollment Guide arrives, you will work with a OneExchangebenefit advisor to select and enroll in a health plan.1

Why OneExchange?Confronting Soaring Health Care CostsLike many other employers across the United States, your annualconference or employer has worked to contain soaring health carecosts without sacrificing quality or coverage for its active and retiredclergy, lay employees, eligible dependents and surviving spouses.Offering health benefits through OneExchange addresses cost andcoverage concerns for Medicare-eligible individuals.Your annual conference or employer has chosen a solution thatgives you the ability to choose from a wide selection of Medicaresupplemental plans, allowing you to personalize your Medicarebenefits. Most plan sponsors also will provide eligible participantswith a health reimbursement account (HRA) that helps offset thecost of an individual Medicare supplemental plan.You will now be responsible for choosing and paying for yourown health coverage—but an HRA* may help cover the cost.The Center for Health understands that you will need to make importantchoices about your health care coverage. To help you make informeddecisions with confidence, we have partnered with OneExchange.OneExchange’s licensed benefit advisors will be your advocates andwill help you choose the Medicare coverage plan that best servesyour medical needs and fits your budget. These knowledgeable,objective advisors will be available to support and assist you in makingthese decisions. They will guide you through the entire process.OneExchange’s online (Internet) tools, as well as access to benefitadvisors, are provided at no cost to you and are offered in recognitionof your dedication and service. To date, OneExchange has helpedmore than 800,000 retirees evaluate and enroll in plans.* About HRAs (if offered by your plan sponsor)Health reimbursement accounts (HRAs, also called healthreimbursement arrangements) are tax-free accounts establishedand funded by employers and plan sponsors, such as annualconferences. You can use funds in the HRA to reimburse yourselfand your eligible dependents for eligible health care expenses,including your retiree health insurance premiums or otherout-of-pocket costs not paid for by your health plan.(See page 11 to learn more about HRAs.)2

More About OneExchangeYour Transition to Medicare Supplemental Health BenefitsOneExchange is dedicated to makingthe transition to your Medicare supplementalhealth coverage as easy and straightforward as possible.Towers Watson’s OneExchange is the nation’s leading provider of healthcare solutions for Medicare-eligible individuals. With OneExchange’sassistance, retirees and other Medicare-eligible individuals gainaccess to a marketplace of many different Medicare plans, includingthose offered by well-known national and regional insurance companies.OneExchange works as a portal, providing access to many insurancecarriers. Your insurance will actually be provided by the carrier youchoose in consultation with a OneExchange benefit advisor.You can learn more about OneExchange’s services and experienceat www.medicare.OneExchange.com/gbophb.Helping You Make an Informed SelectionOneExchange provides personalized assistance to you and yourMedicare-eligible spouse, if applicable. An experienced OneExchangebenefit advisor provides: Individualized telephone support to help you make an informedand confident enrollment decision for your Medicare supplementalcoverage; Education about the differences between various plans,and the costs of each of those plans; Advice and decision-making support, based on yourcurrent coverage and future needs; and Assistance with enrolling in medical, prescription drug,dental and vision plans.OneExchange also offers a customized website where you can learnabout plan options available in your area, begin evaluating those options,and get more details about the enrollment process. Your customizedwebsite is www.medicare.OneExchange.com/gbophb.Who Is Eligiblefor OneExchange?The information in this guidepertains to Medicare-eligibleretirees, Medicare-eligiblespouses of retirees, individualswho are Medicare-eligibledue to disability, Medicareeligible spouses of disabledparticipants, a small group ofindividuals who are Medicareeligible and still working, andsurviving spouses of individualswho are Medicare-eligibledue to age or disability.If your spouse is currentlynot Medicare-eligible, he orshe may be able to remainon your conference’s oremployer’s existing active plancoverage until he or shebecomes eligible for Medicare,depending on your plansponsor’s rules.3

Steps Toward EnrollmentA Step-by-Step Guide to Enrollingin a Medicare Supplemental PlanOneExchange will help you enroll in the individual Medicare supplementalplan that best fits your needs. OneExchange has identified three stepsin completing this process: Education, Evaluation and Enrollment. Youwill be fully supported through each of these steps by benefit advisorsfrom OneExchange and through use of OneExchange’s online toolsand services.1. Education—You will receive an Enrollment Guide from OneExchangecontaining instructions about how to evaluate and enroll in the planthat is right for you. This guide will include comparisons of planoptions, helpful information on eligibility, and additional informationabout working with OneExchange.2. Evaluation—Using the Enrollment Guide and OneExchange’sonline tools, you will review the options available to you beforespeaking with a benefit advisor. Before or during your dedicatedcall-in time, you will provide medical background and other basicinformation to a licensed benefit advisor and will learn how yourbackground and specific information shapes future choices.(You can complete this information online or by phone before yourenrollment appointment with your benefit advisor—a recommendedstep that will ensure your advisor has all the information he or sheneeds to help you find the best plan for your particular situationand to reduce your time on the phone.)Your OneExchange benefit advisor will make recommendationsbased on this data in order to help you determine which optionsmake sense for you. You’ll be able to compare your options anddecide what level of coverage you require to best meet yourmedical needs and budget.Your discussion with the OneExchange benefit advisoris confidential.3. Enrollment—Your licensed benefit advisor will expedite the processof enrollment, and will help you apply for and enroll in the Medicareplan(s) you choose. Using OneExchange’s customized tools, yourbenefit advisor will help you make informed decisions and providesupport throughout the entire process. Once you select a plan,the OneExchange benefit advisor will handle your enrollment—you won’t need to fill out applications yourself.4

Become Familiar with MedicareHow the Parts Combine to Give You Comprehensive CoverageMedicare benefits are divided into several component “parts.” To decide how to best meet your medical needsand budget, it helps to understand how these parts work together. The table below will familiarize you withthe parts of Medicare and the decisions you must make. You can learn more about Medicare online atwww.medicare.gov and www.socialsecurity.gov (click on “Medicare”).What You Get Through the Government-Provided Medicare ProgramMedicare consists of Part A and Part B. If you are Medicare-eligible, you automatically receive Part A.You become eligible for Part B when you qualify for Medicare either due to age or disability.There is no cost to you for Medicare Part A if you paid into Social Security during your working years.You pay a monthly premium for Medicare Part B.Note: If you opted out of Social Security early in your career, you must enroll in Medicare now in order toapply for coverage through OneExchange. You will have to pay premiums for Medicare Parts A and B.Part APart A covers inpatient hospital stays, stays inskilled nursing facilities, home health care andhospice care.Part BPart B provides you with outpatient careand covers physician fees and other medicalservices not requiring hospitalization. You mustenroll in Part B to receive this coverage.More information on Medicare supplemental plans is on the next four pages.5

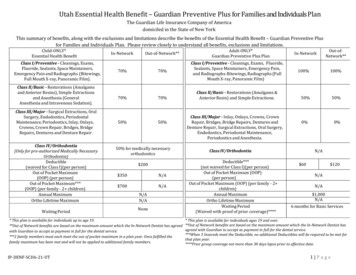

Become Familiar with MedicareWhat You Choose Through OneExchangeYou can choose between these three different types of supplemental plans, which add coverage whereMedicare may have less than you require.Medicare AdvantageMedicare Advantage is a plan offered bya private company to provide you with allyour Medicare Part A and Part B benefitsplus additional benefits. There are twoversions of Medicare Advantage plans:Medicare Advantage Prescription Drug(MAPD), which includes prescriptiondrug coverage, and Medicare Advantage(MA), which does not include prescriptiondrug coverage. Within these twoMedicare Advantage types there arethree doctor networks: HMO, PPO, andPrivate Fee-for-Service plans (PFFS).Medicare Advantage is also sometimescalled “Part C.”How to DecideYou may combine the supplementalplans above to get a package thatcovers all of your needs. Choosingthe best combination requires someeducation and some comparisonof plan features and costs. Foradditional details on the optionsavailable, please review thefollowing pages for a more completedescription of each plan type.6MedigapMedigap is supplementalinsurance sold by privateinsurance companies tofill “gaps” in Medicare plancoverage. Medigap plansdo not include prescriptiondrug coverage.Part DPart D refers to optionalprescription drug coverage,which is available to allpeople who are eligible forMedicare. Part D prescriptiondrug plans are offeredthrough private insurancecompanies.

Medicare Summary ChartUnderstand Your Medicare OptionsUnderstanding the various components of Medicare is important as you make choices for health carebenefits and coverage. The tables below and on pages 8 and 9 summarize specific information aboutMedicare plans in more detail than the previous pages. If you’re unfamiliar with the terms used in thesecharts, refer to the glossary on page 10 of this guide.Part APart BWhat doesit cover?Hospital InsurancePart A covers hospice care,home health care, skilled nursingfacilities and inpatient hospital stays.Medical InsurancePart B covers physician fees andother medical services not requiringhospitalization.How do I enroll?Enrollment is automatic whenyou become Medicare-eligible.You must choose to enroll.Is there apremium?There is no premium for Part Aif you have more than 10 yearsof Medicare-covered employment.Yes. The monthly premium for Part Bvaries depending on when you werefirst enrolled in Part B and if youare subject to a premium surchargedue to your income level. For 2016,the Part B premium is 104.90per month (but could be higher basedon higher-income surcharges).What is thedeductible?In 2016, the Part A deductible is 1,288for the first 60 days of inpatient care.The 2017 deductible will be determinedby the Centers for Medicare and MedicaidServices (CMS) later in 2016.In 2016, the Part B deductible is 166.The 2017 deductible will be determinedby the CMS later in 2016.Is thereco-insurance?There is no co-insurance for your first60 days of inpatient care.Part B covers 80% of medicallynecessary services. You areresponsible for the remaining 20%.Part B covers 50% of approvedoutpatient mental health services.7

Medicare Summary ChartUnderstand Your Medicare OptionsMedicare Advantage is a plan offered by a private company to provide you with Part A and Part B benefitsplus additional benefits. There are two versions of Medicare Advantage Plans: MAPD, which includesprescription drug coverage, and MA, which does not include prescription drug coverage. Medicare Advantageplans vary by the type of doctor network they provide: PFFS, PPO and HMO.Medicare Advantage/Part C8Private Fee-for-Service(PFFS)Preferred ProviderOrganization (PPO)What doesit cover?PFFS plans cover visits toany primary care doctor,specialist or hospital thataccepts the terms of theplan’s payment. PFFSplans usually include aprescription drug plan.PPO plans cover visitsto any physician, whetherthey are in or out of theplan’s network. However,you will pay less if youuse primary care doctors,specialists and hospitalsin the plan’s network.A PPO usually includesa prescription drug plan.How do I enroll?You can choose to enroll in a Medicare Advantage plan.(This is a one-time enrollment, unless you decide to change plans in the future.)Is there apremium?Each Medicare Advantage plan sets its own premium, deductible and co-insurance.In addition, you will continue to pay your Medicare Part B premiums.What is thedeductible?Determined by carrier.Is thereco-insurance?Determined by carrier.Health MaintenanceOrganization (HMO)Except for emergencies,an HMO only coverscare that is provided byprimary care doctors,specialists or hospitalsin the plan’s network.

Medicare Summary ChartUnderstand Your Medicare OptionsMedigapPart DPrescription Drug CoverageWhat doesit cover?Medigap is Medicare supplemental insurancedesigned to fill “gaps” in Medicare plancoverage. Sold by private insurers, these10 plans—labeled Plans A, B, C, D, F, G,K, L, M and N—offer standardized menusof benefits. (Massachusetts, Minnesota andWisconsin have their own versions of theseplans.) Medigap policies only work inconjunction with a Medicare plan. Generally,there is no prescription drug coverage.Part D covers generic andbrand-name drugs included inthe plan’s formulary, which is alist of drugs the plan will pay for.How doI enroll?You can choose to enroll.(This is a one-time enrollment,unless you decide to change plansin the future.)You can choose to enroll. A premiumpenalty is applied if you do not enrollwhen you first become Medicareeligible. (This is a one-time enrollment,unless you decide to change plans inthe future.) Is there apremium?If you choose to enroll, you will paya monthly premium to the insurancecompany you select. In addition, you willcontinue to pay your Medicare Part Bpremiums and you are responsible forPart B deductibles and co-insurance.There are no deductibles or co-insurancespecific to Medigap plans.Whether you pay a Part D premium,deductible or co-insurance depends onthe plan you choose, as each Part Dplan has a different cost-sharingstructure. Depending on the plan, youmay pay both a monthly premiumand a share of the cost of yourprescriptions (co-insurance orco-payment) in a Part D plan. What is thedeductible? Is thereco-insurance?Vision, Behavioral Health and Dental CoverageYou will have the opportunity to elect and purchase dental and/or vision coverage through OneExchange.This coverage is optional. A OneExchange benefit advisor can explain your options.9

GlossaryImportant Medicare TermsCo-Insurance: A set percentage of covered expenses that a Medicareuser must pay out-of-pocket.Co-Payment (Co-Pay): A set charge collected at the time of serviceand paid by the Medicare user for certain services, includingprescription drugs. Co-payments are not applied toward the deductiblesand out-of-pocket maximum.Deductible: The amount paid out-of-pocket toward covered medicalexpenses before the plan begins paying.Gap or Donut Hole: Medicare drug plans may have a “coverage gap,”sometimes called the “donut hole.” After your total yearly drug costsin 2016 reach 3,310, you will pay 45% of the cost of brand-nameprescription drugs until your out-of-pocket drug costs for the yearreach 4,850. Most plans offer generic drug coverage in the gap,and your maximum co-pay on generic drugs will be 58% of the costof the drug. The discount inside the gap will grow by a few percentagepoints each year until it reaches 75% in 2020.Out-of-Pocket Maximum: The maximum you will pay each year fordeductibles and/or co-insurance.Medicare Advantage Plans: Health plan options that are approvedby Medicare but run by private companies. Medicare Advantage plansvary by the type of doctor network they provide: Health MaintenanceOrganizations (HMOs), Preferred Provider Organizations (PPOs)and Private Fee-for-Service (PFFS).Medigap (Medicare Supplement Insurance) Policies: These policiesare sold by private insurance companies to fill gaps in Medicareplan coverage. In general, Medigap policy participants receivehelp paying for some of the health care costs not covered by theMedicare plan.Part D (Medicare Prescription Drug Plans): These stand-aloneplans add prescription drug coverage to the Medicare supplementalplan. Medicare prescription drug plans are offered by insurancecompanies and other private companies approved by Medicare.10

Understanding HRAsInstead of receiving medical, prescription drug, dental and visioncoverage through your annual conference or employer, you will nowbe responsible for choosing your own health coverage throughOneExchange and paying your monthly premiums directly to thecompany you select for health care coverage (i.e., health insurance).If your spouse will also be covered through OneExchange, you willalso pay your spouse’s monthly premiums directly to the companyyou select for health care coverage. If your spouse remains in yourconference’s/employer’s active plan, your spouse’s monthly premiumsmay continue to be deducted from your pay or retirement benefits,depending on your plan sponsor’s rules.Your annual conference or employer is committed to keeping yourhealth care costs as affordable as possible, and therefore may offerand fund a health reimbursement arrangement (also called a healthreimbursement account or HRA). If eligible, you can use funds inthe HRA to help pay your retiree health monthly premiums and anyeligible health care costs. You will be reimbursed for these expensesfrom the HRA to the extent that funds are available in your HRA.Establishing DirectDepo

selected OneExchange as their approved partner to help you navigate your options for a Medicare supplement plan and ensure that you are well-equipped to make an informed and confident selection of health care benefits. A OneExchange licensed benefit advisor will become your