Transcription

Asset & WealthManagement Revolution:Embracing ExponentialChangeReportwww.pwc.com/assetmanagement

2 PwC Asset & Wealth Management Revolution: Embracing Exponential Change

ContentsExecutive Summary4Landscape6Set for rapid, if uneven, growth6Pressures intensify from all anglesTransparency becomes absoluteFour transforming trends810121Buyers’ market142Digital technologies: do or die173Funding the future204Outcomes matter22Conclusion26Appendix27Contacts29Asset & Wealth Management Revolution: Embracing Exponential Change PwC 3

Executive SummaryChange in the asset and wealth managementindustry (the ‘AWM industry’) is now acceleratingat an exponential rate. Although the industry is setfor growth over the next ten years, asset and wealthmanagers must become business revolutionaries,even disruptors, if they’re to survive and prosper.Now is the time for action. Asset and wealth management has been in aperiod of upheaval globally since the 20082009 Global Financial Crisis (GFC) that’sintensifying. The modern-day industry hasremained fundamentally the same since thelast decade of the 20th Century; over the nextten years it will be substantially reinvented.There will be major changes to fees, products,distribution, regulation, technology andpeople skills.1 All views in this documentare based on PwC opinions,supported by third-partyverified information. Assets under management (AuM) will continueto grow rapidly. We1 estimate that by 2025AuM will have almost doubled – rising fromUS 84.9 trillion in 2016 to US 145.4 trillionin 2025.2 This growth will likely be uneven inconsistency and timing: slowest in percentageterms in developed markets and fastest indeveloping markets. But there are risks. Risingpopulism in Europe, Brexit negotiations,China’s transition to a consumer-driveneconomy, Asian geopolitics and the potentialchanges in US policies on regulation, tax andtrade all create uncertainty.2 PwC AWM ResearchCentre.4 PwC Asset & Wealth Management Revolution: Embracing Exponential Change Four interconnected trends will drive the AWMindustry’s revolution. Between them, they willsqueeze industry margins, making scale andoperational efficiency far more important,and meaning that all firms need to integratetechnology in all areas of the business anddevelop a clear strategy for the future.1. Buyers’ market. Fees are being pusheddown by investors and regulators. Increasedregulation, competition and new entrantsare disrupting traditional value chains andrevolutionising wealth managers’ raisond’être. Regulations are being introducedworldwide to prevent asset managers frompaying commissions to incentivise distributors,leading to lower cost retail products.Meanwhile, institutional investors have thetools to differentiate alpha and beta – they willpay more for alpha but not for beta. As low-costproducts gain market share, and larger playersbenefit from scale economies, there will befurther industry consolidation and new formsof collaboration. Asset and wealth managersmust be ‘fit for growth’ or they can expecteither to fail or to become acquisition targets.They must act now.2. Digital technologies: do or die. The AWMindustry is a digital technology laggard.Technology advances will drive quantumchange across the value chain – including newclient acquisition, customisation of investmentadvice, research and portfolio management,middle and back office processes, distributionand client engagement. How well firmsembrace technology will help to determinewhich prosper in the years ahead. Technology

giants will enter the sector, flexing theirdata analytics and distribution muscle.The race is on .3. Funding the future. Asset and wealthmanagers have been filling the financinggaps that have emerged since the GFC. Theyhave been first movers, providing capitalin areas short of funding due to banks’regulatory and capital limitations, as well asinvesting in real asset classes. To generatealpha, their involvement in niche areas suchas trade finance, peer-to-peer lending andinfrastructure will dramatically increase.Equipping individuals to save for old age,as governments step back, will also supportgrowth in AuM. Action is needed to capitaliseon the gaps.4. Outcomes matter. Investors have spokenloudly. They want solutions for specific needs– not products that fit style boxes. Active,passive and alternative strategies have becomebuilding blocks for multi-asset, outcomedriven solutions (which will increasinglyinclude environmental, social and governanceoutcomes). Demand for passive and alternativestrategies will grow quickly. While activemanagement will continue to play animportant role, its growth over the near termwill be slower than passive. Firms must eitherhave the scale to create multi-asset solutionsor be content as suppliers of building blocks.Managers must deeply understand theirinvestors’ needs, tailor solutions and focuson optimising distribution channels. Theymust also focus on their core differentiatingcapabilities and move to outsource non-corefunctions, such as tax compliance. Investorshave great choice; they will move to optimalsolutions regardless of prior loyalties. These four trends will transform theindustry’s nature and structure. Scale, price,diverse people and technology capabilitieswill characterise the largest firms. Smaller,specialist firms will prosper if they offerexcellent investment performance and service.The industry must act in three areas:Strategy Firms should reorganise the business structureto support their differentiating capabilities andto cut costs elsewhere.Technology Every firm must embrace technology as itimpacts all functions.People Different skills are needed, backed by newemployment models. Firms must find anddevelop people with new skills and adapt theiremployment models to nurture and retain them.Asset Management 2020: back to the futureThese transforming trends have evolved from the six game changers we identified in our AssetManagement 2020 paper, published in 2014:1. Asset management moves centre stage2. Distribution is redrawn – regional and global platforms dominate3. Fee models are transformed4. Alternatives become more mainstream, passives are core and ETFs proliferate5. New breed of global managers6. Asset management enters the 21st Century.Looking forward to 2020, the paper successfully forecast the rapid growth in industry assets undermanagement. It also predicted the shift from active management to passive, the rise of ETFs andcontinued expansion in alternative asset management. Notably, it also anticipated that regulationssuch as the Retail Distribution Regime (RDR) introduced in the UK in 2012 would be mirroredby regulators in other geographies, with a significant impact on asset management and wealthmanagement revenue models. Since 2014, these changes have accelerated and evolved. They’re in theprocess of revolutionising the sector.Asset & Wealth Management Revolution: Embracing Exponential Change PwC 5

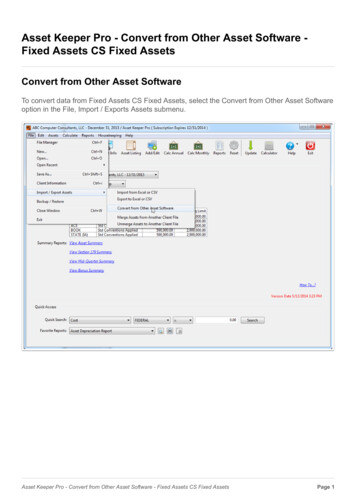

LandscapeSet for rapid, if uneven, growthThe burgeoning wealth of high-net worthindividuals and the mass affluent, as well asa pronounced shift to defined contributionretirement saving, are propelling huge growth inthe industry. By 2025, we anticipate that AuMwill almost double in size.If interest rates remain relatively low globally andeconomic growth is sustained, our projectionsforesee AuM growing from US 84.9 trillion in2016 to US 111.2 trillion by 2020, and thenagain to US 145.4 trillion by 2025 (see figure1). Retail (mutual) funds (including ETFs) willalmost double assets by 2025 and institutionalmandates will expand similarly. What’s more,we think alternative asset classes – in particular,real assets, private equity and private debt – willmore than double in size, as investors diversify toreduce volatility and achieve specific outcomes.3Personal wealth is accumulating fast, mainly indeveloping countries, and individual retirementand pension funds are expanding. The industryis set to manage a greater share of this wealth.If current growth is sustained, the industry’spenetration rate (managed assets, as a proportionof total assets) will expand from 39.6% in2016 to 42.1% by 2025.3 Growing individual3 PwC AWM ResearchCentre.6 PwC Asset & Wealth Management Revolution: Embracing Exponential Changeinvestor wealth, and comfort with entrustingfinancial assets to professional managers, willcounterbalance a move by the largest pensionfunds and sovereign wealth funds (SWFs) tomanage more assets internally.But growth has challenges. Geopolitics,normalisation of interest rates, Brexit, China’stransition to a consumer-driven economy and thepotential changes in US policies on regulation, taxand trade all create uncertainty. Should thingsplay out badly, there could be consequencesfor financial markets, especially fully valuedbond markets, and US equity markets which arecurrently at a 15-year high on cyclically adjustedprice-earnings ratios. Our most conservativescenario still projects growth althoughsubstantially slower, resulting in AuM of US 93.4trillion by 2020 and US 107.8 trillion by 2025.3Highest growth rates in Asia,Latin AmericaGrowth will be uneven; on a percentage basis,it’s slowest in developed markets and fastest indeveloping markets (see figure 2). Even so, weanticipate assets growing at 5.7% a year in NorthAmerica from 2016 to 2020, slowing to 4.0% from2020 to 2025, lifting assets from US 46.9 trillionto US 71.2 trillion over the nine years. Similarly,Europe is projected to grow at 8.4% and 3.4%respectively over the two periods, with assetsrising from US 21.9 trillion to US 35.7 trillion.3

Figure 1: Total client assets in USD 2025ePension funds21.329.433.938.353.164.66.0%Insurance companies17.721.224.129.438.444.74.8%Sovereign wealth funds 3.4119.95.8%Mass affluent42.155.859.567.284.4102.24.8%Total client assets120.9159.7175.1214.6279.3345.05.4%Global .6%39.8%42.1%0.7%Penetration rateSources: PwC AWM Research Centre analysis. Past data based on Lipper, ICI, Preqin, Hedge Fund Research, EFAMA, City UK, Insurance Europe, Financial StabilityBoard, Credit Suisse, Towers Watson, OECD and World Bank.Note: Foundations and Endowments assets were not included as their total global assets represent less than 1% of all client assets.Developing Asia-Pacific’s dynamism is set tospur growth of 8.7% a year from 2016 to 2020,accelerating to 11.8% from 2020 to 2025. Thiswill lift regional assets from US 12.1 trillion toUS 29.6 trillion. Latin America is likely to grow atsimilarly rapid rates of 7.5% in the former period,accelerating to 10.4% in the latter. From a lowbase of US 3.3 trillion, the region’s assetsare projected to increase to US 7.3 trillion.4The continued introduction of individualretirement accounts and defined contributionpension plans across the globe is democratisinginvesting, opening people’s eyes to itspossibilities.Figure 2: Global AuM by region in USD trillion Base 07201220160.73.3n Asia-Pacific n Europe n Latin America n Middle East and Africa n North %9.5%10.4%1.67.335.73.4%11.8%29.62025eCAGRSources: PwC AWM Research Centre analysis. Past data based on Lipper, ICI, EFAMA, City UK, Hedge Fund Research and Preqin4 PwC AWM ResearchCentre.Asset & Wealth Management Revolution: Embracing Exponential Change PwC 7

Pressures intensify from all anglesEven as continued growth in asset prices (especiallyequity index levels) serves as a tailwind, assetand wealth managers are under margin pressure,and regulators are zeroing in on the industry’scompetitive profile. Just as regulation andtransparency requirements add to costs, so pricingpower is being squeezed across the board. Thisis happening at a time when firms must investin building outcome-based solutions, applyingnew technologies and investing in more diversepeople and related skills (see people in a time oftechnology, page 19). Already, this is leading tomergers as managers scramble for scale.5 Financial ConductAuthority; AssetManagement MarketStudy; Profitability Analysis;November 2016.8 PwC Asset & Wealth Management Revolution: Embracing Exponential ChangeProfit margins are falling globally. We estimate thatthey have declined by approximately 10% sincethe GFC due to the pressures exerted by passiveplayers on pricing and flows, rising regulationand technology costs, and this will continue.The heydays of 30% profit margins will not besustainable in the new world order. As one of thelargest asset and wealth management centres,the UK is reasonably representative of the globalindustry. A recent study by the UK’s FinancialConduct Authority estimated that UK profitmargins averaged 34-39% from 2010 to 2015.Although the study covered only a small sampleof firms, it shows that margins remain higher thanin other industries.5 The average reported in theUK masks a broad spectrum. In fact, we estimatethat margins vary globally from as little as 5% fora small retail asset manager up to 60% for some ofthe world’s largest institutional managers.

This pressure on profitability is increasing at atime when firms need to invest in new talent,developing the products and technologies theywill want as the industry moves towards a newparadigm.In Europe, the MiFID II directive, to beimplemented in 2018, will push up asset managers’costs and ban wealth managers’ retrocessions.Most managers are now committing to absorbingresearch costs, historically borne by investors.This will have a knock-on impact on the researchproviders in investment banks.In the US, the new administration has committedto grant some relief to the new regulations thathave proliferated since the GFC, but this remains awork in progress. The Department of Labor (DOL)Fiduciary Rule is under attack and likely to changewith the Securities and Exchange Commissionbecoming more engaged in developing a uniformfiduciary standard. Whatever the final approach,the US is heading towards ensuring that highcommissions do not influence advice, carrying onthe initiative started by the UK Retail DistributionReview (RDR) in 2012. Most major asset managersand distributors have already made changes totheir product shelves, pricing, revenue-sharingarrangements, advisor compensation anddisclosure policies.In developing Asia-Pacific, by contrast, regulationis priming new opportunities. Pan-Asian fundpassports are slowly being introduced, althoughdelayed by national interests, aiming to foster theregional industry.When combined with a shift to outcome-basedsolutions and the expanding market share ofpassive strategies, this is relentlessly drivingdown the overall revenue pool. Passive strategiesform the foundation of outcome-based investing,with active management (whether traditional oralternative) acting as an important component.To gain scale, several international asset managershave merged. Some asset managers, mainly inEurope, have been acquiring wealth managers asthey seek to control distribution. This also helpsto protect margins as distribution fees appearmore resilient to the factors described above, butmay not be a long-term solution as regulationincreasingly focuses on open-architecturedistribution and pushes wealth managers towardsgreater disclosure and a fiduciary standard of care.As if these pressures were not enough, Brexit iscausing further uncertainty. Brexit appears tobe manageable for asset managers and wealthmanagers with sufficient ‘substance’ in Europe,although the European Securities and MarketsAuthority’s recent focus on preventing regulatoryarbitrage may challenge their assumptions aboutsubstance and outsourcing to third countries.Depending on where the Brexit negotiationslead, there could be significant disruption to thecurrent European industry (and beyond). Thereis uncertainty around access to clients, the futuremodel for delegation of asset management fromEU funds to UK-based asset managers (and viceversa), the continued equivalence or possibledivergence of regulation post Brexit, and attractionand retention of key talent into the right locations.In summary, firms are facing uncertainty and amargin squeeze at a time when they need to investin developing new products, new technology andnew skills to compete in a new age. Analysts havecommented publicly on the need for investment,despite revenue pressures. Firms will succeed ifthey focus on being “fit for growth” in terms ofinvesting in their areas of strength while cuttingcosts elsewhere.Asset & Wealth Management Revolution: Embracing Exponential Change PwC 9

Transparency becomes absoluteInvestors and regulators are asking for completedisclosure of costs and fees. They’re alsoincreasingly differentiating alpha and beta. What’smore, offshore jurisdictions worldwide have signedup to tax disclosure agreements.A new era of full transparency is still evolving. Regulators are forcing thepace on fees and costs. In Europe, for example, MiFID II not only bansasset managers from paying opaque retrocession commissions to wealthmanagers, but also requires them to disclose research costs, which will leadto further pressure on profitability. In the US, the pressure on disclosuresfrom regulations such as the DOL Fiduciary Rule is being reinforced byactions taken by some leading firms to increase disclosures and voluntarilymake statements more self-explanatory.Investors, too, are seeking clarity as inexpensive forms of beta becomeeasier to access. Greater transparency is revealing where asset managersadd value, allowing institutional investors to more aggressively negotiatedown fees for specific outcomes and retail investors to benefit from feecompetition. What’s more, millennial generation investors not only distrustopacity but also prefer transparent ETFs.Turning to tax, over 50 countries have signed up to the Common ReportingStandard (CRS), agreeing to share information on residents’ assets andincomes automatically. CRS, which is being introduced from 2016 to 2018,effectively outsources responsibility for reporting on tax affairs to financialinstitutions. With the spotlight firmly on them, and threats of a blacklistby governments and international organisations, many offshore financialcentres have joined.10 PwC Asset & Wealth Management Revolution: Embracing Exponential Change

Asset & Wealth Management Revolution: Embracing Exponential Change PwC 11

Four transforming trendsFour trends that will incessantly revolutionise assetand wealth managementHow can firms adapt to the changing landscape? We believe that theymust understand, analyse and act on four powerful trends, all of theminterlinked, which are likely to revolutionise the sector from within.These four transforming trends are:1Buyers’ market2Digital technologies: do or die3Funding the future4Outcomes matterIt’s difficult to predict how quickly these trends will play out. But they’ve been under way for sometime and are accelerating. The difference is that firms must act now to fully understand them andadapt their business strategies accordingly.Against a background of uneven growth:Assets under management are set to growfrom US 84.9 trillion in 2016 to US 145.4 trillionby 2025.12 PwC Asset & Wealth Management Revolution: Embracing Exponential Change

Change in asset and wealth management is accelerating. Although the industry looks set for rapidgrowth over the next ten years, asset and wealth managers must become business revolutionaries, evendisruptors, if they’re to increase profits and prosper.Now is the time for action.Four trends will revoluntionise the industry:Buyers’ marketFees are being pushed down by investors and regulators. Increased regulation, competitio

investing in real asset classes. To generate alpha, their involvement in niche areas such as trade finance, peer-to-peer lending and infrastructure will dramatically increase. Equipping individuals to save for old age, as governments step back, will also support growth in AuM. Action