Transcription

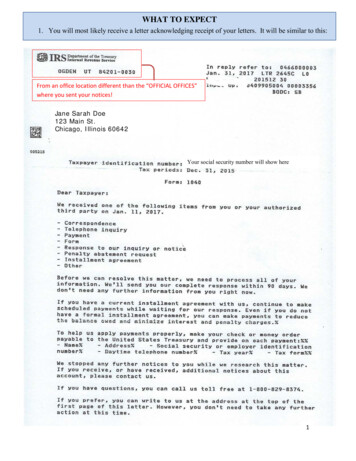

TCSI VAO N HEAL A N N UIYTHATION PENHow You Can Reach UsAt the Fund Office, we welcome your questions orrequests for information. There are a number ofways to reach us.WINTER 2010/2011VOLUME 5 ISSUE 1DROP IN. We’re located on the third floor at417 Fifth Avenue, between 37th and 38th Streets.CALL US. In New York, the number is 212-580-9092.The toll-free number is 1-800-456-FUND (3863).from the executive directorSEND US A FAX.the passing of the comprehensive national health care reform known as theAs 2010 draws to a close, we look back on a busy year—particularly withOur main fax number212-787-3607Affordable Care Act. Since President Obama signed it into law in March,Benefits212-730-7706federal agencies have been issuing detailed regulations that clarify how theContracts & Contributions212-792-8322new law will impact our Health & Welfare Plans. While many of the newFinance212-792-8321rules won’t take effect for several years, a few will become effective for bothPension212-792-8323Plan A and Plan C as soon as we turn the page on the new year.Executive Director212-792-8320EMAIL US via our Web site (www.iatsenbf.org).One of the first changes to take effect is the extension of benefits to childrenup to age 26. This applies to all children, regardless of where they livePlease note that the Fund Office will be closed inobservance of the following holidays:and whether or not they are students, married or financially dependent onChristmas EveFriday, December 24enrollment statement and proof of relationship (e.g., birth certificate,New Year’s DayFriday, December 31adoption papers) to reenroll any dependent under age 26 for coverageMartin Luther King DayMonday, January 17beginning January 1, 2011.President’s Dayyou. Remember, you have until December 15, 2010, to submit your annualMonday, February 21In addition, a couple of Plan provisions that limit benefits are beingGetting Better All the TimeWe continually update and enhanceour Web site. If you log on towww.iatsenbf.org, you can makePlan C self-payments, change youraddress, monitor employercontributions, review plan informationand link to service vendors tofind a doctor. You can even connectto Prudential to check on yourretirement savings. Local unionsalso now have access to a separateportal to view and request reportsabout work in their area. Have abenefits question? Try the Web site.You may be surprised byhow quickly and easilyyou can find the answer.eliminated in 2011. First, the 1 million cap on out-of-network lifetimebenefits under Plan A and Plan C will go away. Starting next year, lifetimebenefits for all covered services will be unlimited—whether you use inor out-of-network providers. (However, certain annual limits will apply until2014.) In addition, if you’re enrolled in Plan C-3, there’s more good news.The 2,000 limit on how much the Plan pays each year for prescriptiondrugs is being eliminated.For other good news, turn to page 2 of this issue of Behind the Scenes.You’ll see that we expect to pretty much hold the line on CAPP charges forHealth & Welfare Plan C through at least the third quarter of 2011.As we remind all participants this time each year, please read all notices thatyou receive from the Fund. The more you know, the better you can manageyour accounts and take advantage of your benefits. Of course, if you havequestions, you can contact the Fund Office by email, phone or fax.Happy holidays from all of us at the Fund Office. We wish you a healthy andprosperous new year.Anne J. Zeisler

HEALTH & WELFAREANNUALENROLLMENT 2011Plan C Annual Enrollment2011 is underway, andyou have until December 15to review your optionsfor coverage in 2011.If you haven’t received yourenrollment materials,contact the Fund Officeimmediately. All paymentsand/or changes for Januarymust be received by theFund Office no later thanDecember 15, 2010.Boomers Listen Up!Plan A and C both provide retiree health benefitsto eligible participants. If you’re eligible, youmust request and complete an application.If you’re enrolled in retiree coverage underPlan C and you return to work for anemployer that contributes to theHealth & Welfare Fund, your retireecoverage will end if employercontributions made on your behalfequal at least one quarter of PlanC-3 single coverage. If you're in Plan A,your retiree benefits will end if youwork at least 60 days in coveredemployment over six consecutive months.WeApologize If your retiree coverage ends, you will have tofile a new application to restart it.if the newHealth &NALNATIO ELFAREWWelfare FundCTH &HEAL ND PLANFUPlan C SummaryPlan Description(SPD) was crammedinto your mailbox.We combined two bookletsinto one for easierreference. So now you haveall the information youneed in one place. We evenincluded a pocket in theback for rate letters andother important informationyou receive from theFund Office.On Medicare? Plan C-MRPMay Not Be an OptionIf you are in Plan C and permanently stopworking in covered employment (retire) afteryou become eligible for Medicare, Medicarewill become your primary source of healthinsurance. In this situation, because Medicarequalifies as “other coverage,” you are allowedto enroll in the Medical Reimbursement Program(Plan C-MRP) on a standalone basis. What’smore, unlike other Plan C-MRP participants,you are not required to submit proof of othercoverage each year. However, the 150 annualadministrative fee still applies.CAPP RatesHold SteadyDespite continuingincreases nationwidein medical, hospitaland prescription drugcosts, CAPP chargesfor Plans C-1 and C-3are not changing—at least through mostof 2011. Plan C-2charges will increaseby 45 for individualand family coveragestarting April 1.2However, if you continue to work (or return towork) after you become Medicare eligible,you may lose your eligibility for Plan C-MRP.That’s because, under federal law, Medicarecannot be your primary source of healthinsurance if insurance is available through youremployer or an employer-sponsored plan likeours. You lose your eligibility for Plan C-MRPduring a coverage quarter if: employer contributions were made to yourCAPP account during the three monthsknown as the contribution test period, andyour CAPP account balance is sufficient tocover the cost for one quarter of Plan C-3single coverage.If you are Medicare-eligible, the Fund tests youreligibility for Plan C-MRP each quarter. Yourchoices for coverage each quarter will depend onthe results of the test. If you lose your eligibilityfor Plan C-MRP and fail to elect another PlanC option, you will be enrolled automaticallyin Plan C-3 single coverage. Be sure to reviewyour statement each quarter to make sure youunderstand your options.Plan C-MRP without MedicareIf you are enrolled in Plan C-MRP, you mustprovide valid proof each year between mid-Novemberand December 15 that you have other medicalcoverage along with your Annual Enrollmentstatement. If you do not, you will be enrolledautomatically for individual coverage in Plan C-2or C-3 (depending on your CAPP accountbalance) and a 150 administrative fee will bededucted from your account. If there’s not enoughfunding in your CAPP account for Plan C-3individual coverage, you will not have anycoverage under Plan C.2011 QUARTERLY CAPP COST TO YOUEffectiveJanuary 1, 2011EffectiveApril 1, 2011EffectiveJuly 1, 2011Plan C-1IndividualFamily3,549 (no change)7,770 (no change) 3,549 (no change) 7,770 (no change) 3,549 (no change) 7,770 (no change)Plan C-2IndividualFamily 1,542 (no change) 2,598 (no change) 1,587 2,643 1,587 (no change) 2,643 (no change)Plan C-3IndividualFamily 1,086 (no change) 2,058 (no change) 1,086 (no change) 2,058 (no change) 1,086 (no change) 2,058 (no change)

VACATIONImportant RemindersYou have certain rights as a participant in PlanC that are protected by law. Here is a reminderof 1. your right to privacy with respect to healthinformation, 2. a woman’s rights related toa mastectomy and 3. a student child's right toextended coverage in the event of a medicalleave of absence.1. PrivacyThe Health Insurance Portability andAccountability Act of 1996 (HIPAA)established standards to guarantee the privacyof personal health information. The intent ofHIPAA is to make sure that private healthinformation that identifies (or could be used toidentify) you is kept private. This individuallyidentifiable health information is known as“protected health information” (PHI). Yourhealth care plans will not use or disclose yourprotected health information without yourwritten authorization except as necessary fortreatment, payment, plan operations and planadministration, or as permitted or required bylaw. For details about the IATSE NationalHealth & Welfare Fund’s policy, you can findour Privacy Notice on our Web site atwww.iatsenbf.org, or you can request a copyfrom the Fund Office.2. Protections for Mastectomy PatientsThe Women’s Health and Cancer Rights Act of1988 (WHCRA) includes importantprotections for mastectomy patients who electbreast reconstruction in connection with amastectomy. Under WHCRA, group healthplans offering mastectomy coverage must alsoprovide coverage for certain services relating tothe mastectomy in a manner determined inconsultation with the attending physician andthe patient. Required coverage includes allstages of reconstruction of the breast on whichthe mastectomy was performed, surgery andreconstruction of the other breast to producea symmetrical appearance, prostheses andtreatment of physical complications of themastectomy, including lymphedema. Coverageof breast reconstruction is subject to the samecoinsurance and other plan provisions asother benefits under the plan.3. Dependent Children in SchoolIf a dependent child enrolled in Health &Welfare Plan A or Plan C is on a medicallynecessary leave of absence from a postsecondaryschool, coverage may be continued under thePlan for up to one year.In order to be eligible for this extension ofcoverage, the Plan must be provided with awritten certification from the child’s treatingphysician that: Check In for Time OffSince the work you’reperforming now in 2010 countstoward the vacation benefitcheck you’ll receive next May,it’s a good idea to make sureyour time is being reportedcorrectly. Simply log on to ourWeb site (www.iatsenbf.org)and check your work history.And, if you haven’t alreadysigned up for direct depositfor your vacationbenefit check, youcan downloada form thatauthorizes theFund to send yourbenefit check directly to yourbank account. You’ll needto provide your bank name,account number and bankrouting number.the child is suffering from a serious illness orinjury, andthe leave of absence from the postsecondaryinstitution is medically necessary.Coverage may continue for up to one year fromthe first day of the medically necessary leaveunless the dependent child would otherwise losecoverage (e.g., because he or she reaches age 25).If you have any questions about any ofyour rights, contact the Fund Office.Just for FunSee if you can match the song with the movie in which it was performed.Answers appear below.1. Baby It’s Cold OutsideA. The Lemon Drop Kid3. Silver BellsC. The Muppet Christmas Carol2. Somewhere in My Memory4. One More Sleep ‘Til Christmas5. What’s This?6. All I Want For Christmas Is YouB. Love ActuallyD. ElfE. Home AloneF. The Nightmare Before Christmas1.D 2.E 3.A 4.C 5.F 6.B3

RETIREMENTPUMP UP YOUR SAVINGSNow that the 401(k) Planhas been merged into theAnnuity Fund, administrativefees for former 401(k) Planparticipants are reducedsignificantly. Considerincreasingyour salarydeferral bythe amount ofthe savings. Yourtake-home pay willremain the same, and you’ll bebuilding income for the future.To make a change in howmuch you’re deferring, log onto www.prudential.com/online/retirement or call Prudentialtoll-free at 1-877-778-2100.The 401(k) Feature ofthe IATSE Annuity PlanThis is an important notice for participants receiving anemployer contribution of at least 3% of compensation.Individuals employed under Pink Contractsbetween IATSE and the League of AmericanTheatres and Producers (the “Pink Contract”)and certain other agreements providing for401(k) participation are eligible to participate inthe 401(k) feature of the IATSE Annuity Plan,which permits you to make tax-deferredcontributions to the Plan. For the 2011 Plan year,you may contribute up to 85% of your salary(subject to certain limitations) earned while youare a participant in the 401(k) portion of theAnnuity Plan on a tax-deferred basis, subject tothe IRS maximum ( 16,500 for 2011). Thiscontribution, called a deferred salary contribution,is completely voluntary and does not affectyour employer’s obligation to contribute to theAnnuity Fund. If you are age 50 or older asof December 31, 2011, you may contribute upto an additional 5,500 in 2011, as a catch-upcontribution for a total maximum allowabledeferral of 22,000.Note: Salary, as currently defined in the PinkContract, does not include overtime, penalties,per diem or any other additional payments.You may elect to start or change these contributionsat any time while you are employed under thePink Contract or other agreement providing forAnnuity Plan 401(k) participation. Any changewill take effect as soon as practicable afterthe Fund Office receives a revisedDeferred Salary Agreement.PARTICIPATIONParticipation in the Annuity Plan’s 401(k)option is available to Plan participants whoseemployers contribute at least 3% of compensationto the Annuity Fund on their behalf, as requiredby a collective bargaining or participationagreement, provided that the employer hasagreed in its collective bargaining or participationagreement to participate in the Annuity Plan’s401(k) option.Currently, the Pink Contract requirescontributing employers to contribute an amountin excess of 3% of salary (as defined above) tothe Annuity Fund on behalf of eligible employees.Other employers participating in the 401(k)feature contribute to the Annuity Fund (eitherweekly or monthly) the amounts set forth in theapplicable contract, which will be no less than3% of compensation. This employer contributionis called a non-elective contribution. Both yourdeferred salary contribution and the employer’snon-elective contribution are 100% immediatelyvested and non-forfeitable and are subject to acombined annual limit set each year by the IRS(for example, 49,000 in 2011). Catch-upcontributions for those who are age 50 or olderas of December 31, 2011, are not included in thecombined annual limit.Other participants employed under certain collectivebargaining agreements in the motion picture industry maybe eligible for salary deferrals even though their employerdoes not contribute 3% or more of compensation. Thisnotice does not apply to such participants. Please reviewthe Summary Plan Description or contact the Fund Officefor more information.Your Right to a Pension StatementHardship Made a Little EasierIf you participate in the IATSE NationalPension Fund, your benefit grows overtime as you continue to work in covered employment.When you receive your pension, the amount will bedetermined by the pension credits you’ve earned, youremployers’ contributions and your age at retirement.If you want to know the pension credits you’ve alreadyearned, simply send a written request for a pensionbenefit statement to the Fund Office. (Sorry, no phonecalls for this request.)In the event of a financial hardship (such as needing moneyfor the purchase of a principal residence, tuition for highereducation, major medical expenses, preventing evictionand other circumstances as defined by the IRS), you may beable to withdraw a portion of your Annuity Fund balance.Available funds include your own salary deferrals and certainemployer contributions received by the Fund on or afterJanuary 1, 2010. Employer contributions available forwithdrawal depend on whether your collective bargainingagreement allows salary deferrals and/or require a 3%employer contribution. No salary deferrals or employercontributions received by the Fund prior to January 1, 2010,are eligible for a hardship withdrawal.4

anyone receivingFOR RETIREES (ora pensioncheck)Distribution of AccountYou are eligible to receive a distribution fromthe Annuity Plan if: you retire on or after normal retirement age (65),you separate from service with all contributingemployers (there is a two-month waitingperiod if you are between age 55 and 65 anda six-month waiting period if you are underage 55) and have not returned to service witha contributing employer, orDON’TTFORGEIf you’re receiving apension, this is the timeof year to make surethat your informationand our records are upto date. Here are a few reminders ofwhat you need to know (and do).1. You must complete the annual PensionVerification Form that you receivedfrom us. Sign it, have it notarized andreturn it to us immediately. Otherwise,your pension will be put on hold.you are permanently and totally disabled(as defined by the Plan).You may also withdraw salary deferrals at age59-1/2 even if you are still employed. The Fundalso allows hardship withdrawals of certain moniescontributed to and received by the Fund on or afterJanuary 1, 2010; the 3% non-elective contributionis not eligible for hardship withdrawal.Note: You are not eligible for a distribution ifyou cease to be eligible to make deferred salarycontributions but you remain employed by acontributing employer to this Plan.If you die, the Plan will distribute the balanceof your account as a death benefit under therules of the Plan.For more information about contributionsor how to make deferrals, refer to yourSummary Plan Description (available onlineat www.iatsenbf.org or from the Fund Office).2. Are you receiving a pension and stillworking? If so, you must notify theFund Office about any work you’re doingfor which contributions are made tothe National Funds under a collectivebargaining agreement.3. If you want, you can change the amountof tax that is being withheld from yourpension by notifying the Fund Office.4. If you’re under age 65 and receiving adisability benefit from the Pension Fund,you must submit proof each year thatyou continue to be disabled.5. If you’re eligible for Medicare, youSupportingCastHere’s a list of the organizationsthat support and administerour programs. You can findcontact information in the SPDsor link to their Web sites fromours (www.iatsenbf.org).Hospital and HealthEmpire Blue Cross Blue ShieldTriple-S (Puerto Rico only)Prescription DrugCaremarkVisionDavis VisionDentalDelta DentalA.S.O./S.I.D.S.Medical ReimbursementProgram (Plan C)A.S.O./S.I.D.S.Physical Exam andHearing Aid BenefitA.S.O./S.I.D.S.Life InsuranceULLICOAnnuityPrudentialshould have received a letter about yourprescription drug coverage and whetherit is considered creditable coverage.There’s no need to take immediateaction, but you may need the letter inthe future, so put it in a safe place.Reminder: Participation in the Annuity Plan’s401(k) feature is voluntary. Whether or not youparticipate, your employer must continue tomake any non-elective contributions requiredby the collective bargaining agreement.Board of TrusteesUNION TRUSTEESEMPLOYER TRUSTEESHealth & Welfare Fund (H&W)Pension Fund (PF)Annuity Fund (AF)Matthew D. LoebBrian J. LawlorJames B. WoodDaniel E. DiTollaJohn V. McNamee, Jr.Patricia A. WhiteMichael F. Miller, Jr. (H&W only)Ronald Kutak (PF and AF only)Christopher BrockmeyerHoward S. WelinskyCarol A. LombardiniDean FerrisPaul LibinSean T. QuinnKeith HalpernVacation FundJames B. WoodRonald KutakChristopher BrockmeyerKeith HalpernWe’ve summarized importantplan rules in this newsletter,but we don’t intend for thesesummaries to replace oramend the official plandocuments of each of theplans. We will follow the rulesof the official plan documentsif those rules differ from thesummaries in this newsletter.EXECUTIVE DIRECTORAnne J. Zeisler5

SUMMARY ANNUAL REPORTSSet forth below are summary annual statements for each of four*IATSE N

IATSE 401(k) Fund, EIN 74-3038452, Plan No. 001 IATSE National Health & Welfare Fund, EIN 23-7333434, Plan No. 501 IATSE National Vacation Fund, EIN 23-7345994, Plan No. 501 IATSE Annuity Fund