Transcription

Your guide to theHSBC Security Device HSBC Bank USA, N.A. 2014.All rights reserved.

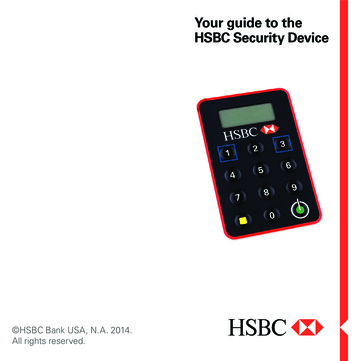

Welcome to the nextstep in the evolutionof online securityProtecting your money and personalinformation is our top priority. TheHSBC Security Device providesan extra level of protection foryour online personal informationand certain types of transactions.It’s easy to use and will keep yourmoney even safer while meetingyour evolving online banking needs.HSBC is one of the first majorbanks in the U.S. to bring you thisenhanced level of security.Follow the instructions inside toactivate and begin using your newHSBC Security Device today. ForFrequently Asked Questions andadditional information about yourHSBC Security Device, visitus.hsbc.com/securitydevice.

Step 3Activating yourHSBC Security DeviceLog on to HSBC PersonalInternet Banking as younormally would and followthe 3 steps below to activateyour HSBC Security Device.Step 1Enter the activation code receivedvia email as per the instructions onthe screen.Create your HSBC Security DevicePersonal Identification Number (PIN).a. Press and hold thebutton for2 seconds to turn on your HSBCSecurity Device.Step 2b. When prompted with “NEW PIN”Enter the 10-digit serial numberfound on the back of your HSBCSecurity Device on the PersonalInternet Banking screen as perthe instructions.on the screen, create and enter anew Personal Identification Numberbetween 4-8 digits on your device,then press the button.Note: You will have 5 seconds tostart typing in your PIN. If you donot begin typing your pin within 5seconds you must repeat Step 3a.

Please note: only strong PINs willbe accepted by your HSBC SecurityDevice. Weak PINs with consecutive(1234) or repetitive (1111) numberswill not be accepted.Step 4Generate a Security Code.Remember your PIN and do notdisclose it to anyone.Note: You will need this PIN eachtime you need to generate a SecurityCode using the HSBC Security Device.With your Security Device turned onand “HSBC” displayed on the screen,press the button to generate aSecurity Code.Congratulations, you have nowsuccessfully activated your HSBCSecurity Device and it is ready to use.PIN CONFIRMATION:c. The words “NEW PIN CONF” willappear on the screen of your HSBCSecurity Device. Confirm your PINby re-entering it into your HSBCSecurity Device. Once your PIN isconfirmed, the word “HSBC” willdisplay on the screen.If you make an error entering your PIN,you can use the button to deletethe digit(s) you entered. You can alsowait for your device to turn off andthen restart the activation process.The HSBC Security Device doesnot have an “off” button. After 30seconds of inactivity, the device willautomatically turn off.

Logging on to HSBCPersonal InternetBanking with yourHSBC Security Device“PIN” in the top right corner. Enterthe HSBC Security Device PIN youselected on your device.Step 2Once your HSBC SecurityDevice is activated, you shoulduse it each time you log on toHSBC Personal Internet Banking.Log on to HSBC Personal InternetBanking as you normally would andfollow the on-screen instructions togenerate a Security Code that willbe entered into Personal InternetBanking.Step 1Press and hold the button for2 seconds to turn on your HSBCSecurity Device. Once it is on,the screen will display the wordIf an incorrect PIN has been entered,a “FAIL 001” error code will appearon the screen. Each time you attemptto enter an incorrect PIN, an errorcode will appear on screen as “FAIL002, FAIL 003” etc. On entering thecorrect PIN “HSBC” will display onthe screen.Once “HSBC” is displayed, pressthe button again. This will generatea 6-digit Security Code.

Step 3Enter the 6-digit code shown on yourHSBC Security Device into the “SecurityCode” field on the Personal InternetBanking page and click “Continue.”Congratulations, you are now loggedon to your Account Summary pageof HSBC Personal Internet Bankingwith access to full internet banking.Using your HSBCSecurity Device toauthorize transactionsCertain transactions warrant a higherlevel of security such as addinga new payee. To complete suchtransactions, you will need to log onto Personal Internet Banking usingyour Security Code and authorize thetransaction by generating a secondunique code called a “TransactionSigning Code.” This code will verifythe authenticity of the new payeeand prevent any unauthorized userfrom changing where your moneyshould be sent to.To authorize certain transactionssuch as adding or modifying a payee,log on to Personal Internet Bankingand follow the on-screen instructions.

Step 1Step 3Enter your PIN: Press and hold the bottomright button for 2 seconds Enter your HSBC Security Device PIN Press the bottom leftbuttonand a dash will appear on display(Note: this is a different button thanthe one you use to log on to PIB withyour HSBC Security Device.)Enter the Transaction Signing Codewithin the Personal Internet Bankingscreen where indicated and then clickon an option to proceed.Step 2Enter the information as requested onthe Personal Internet Banking screen. Press the bottom leftbutton again togenerate a Transaction Signing CodeHints and tips The keypad consists of buttons0 through 9. This matches thestandard telephone layout design The button is colored green andcan be found at the bottom righthand corner of the keypad

You’re on your wayto an even moresecure online bankingexperienceLearn moreYour HSBC Security Device is agreat way to keep your moneyeven safer in an ever-changing,digital world. Once you’ve activatedand begun to use your HSBCSecurity Device, you can have thepeace of mind that comes withknowing you have an even greaterlevel of privacy and security foryour online personal informationand transactions.For more information about yourHSBC Security Device, includingFrequently Asked Questions anda Troubleshooting Guide, visitus.hsbc.com/securitydeviceor contact us at 866.537.4722.If you are calling from outside theUnited States, please call us collectat 716.841.7172.

the one you use to log on to PIB with . You’re on your way to an even more secure online banking experience Your HSBC Security Device is a great way to keep your money even safer in an ever-changing, digital world. Once you’ve activated a Troubleshooting Guide, visit and begun to use you