Transcription

The Future of RetirementA balancing actGlobal Report

Contents4Foreword by HSBC6Key findings8Executive summary10A life less comfortable14Making sacrifices16Ready – or not20Juggling priorities22Looking back, starting sooner24Enough in the pot?26Confidence returns for some, but retirement savings still affected28Generating income for retirement30Practical steps towards a better retirement32The research34The Future of Retirement programme3

Foreword by HSBCAt HSBC, our purpose is to help customers fulfil their hopes and dreams andrealise their ambitions, by enabling them and their families to manage theirfinancial affairs today, while planning their long-term financial future.I am therefore delighted to introduce the latest report in The Future of Retirementseries of global research studies, commissioned by HSBC. A balancing act is ourtenth report, examining the thoughts and expectations not only of people workingtowards their retirement but also of those who have already reached this stage intheir lives.For many working age people, saving enough for a comfortable retirement isdifficult. The global economic downturn has hit retirement saving hard. Manypeople have had to rethink their retirement plans and there are other priorities too- families to support and mortgages to pay.A healthy and prosperous retirement is still the goal, yet there are concerns abouthow to achieve it. Adequate preparation requires long-term planning, but manyworking age people are not sure about when to start saving or even how muchthey will need. As for those already retired, many regret not having started to saveearlier, and wish they had saved more.One size does not fit all in retirement planning. However, many people around theworld are facing similar challenges as they prepare for retirement. Today’s retireesalso have useful experiences of their own to share.Preparing for a comfortable retirement continues to be a challenge, and yet it isessential. We hope these research insights and practical ideas will help people toplan for a better retirement.Charlie NunnGroup Head of Wealth Management, HSBC4The Future of Retirement A balancing act

5

Key findings1234566More than two-thirds (69%) of working age people are worried about running out ofmoney in retirement, while 66% are concerned about having enough money to liveon day-to-day in later life.Retirement is not the main savings priority for 85% of working age people.Paying off their mortgage and/or other debts (46%) is the biggest barrier preventingworking age people from preparing adequately for a comfortable retirement. Thisburden of debt places a greater pressure on the retirement savings of working agepeople than it did on those who are already retired. Just 22% of retirees who did notadequately prepare said it was because of mortgage and/or other debt repayments.Almost three in ten (29%) of retirees who did not prepare adequately for acomfortable retirement were not aware of how much they needed to save.Almost two thirds (65%) of retirees who did not prepare adequately for a comfortableretirement did not realise this until they had retired.The majority (81%) of working age people have had their ability to continue saving forretirement significantly impacted by a life event, including losing their job (26%) andan illness or accident stopping them or their spouse from working (20%).The Future of Retirement A balancing act

7With the benefit of hindsight, more than a third (36%) of retirees say they wouldhave started saving at an earlier age and a similar proportion (34%) say they wouldhave saved more, to improve their standard of living in retirement.8Retirees know better than working age people that you need to start planning earlyto maintain a similar standard of living in retirement. While almost two in five (38%)of retirees say that people need to start retirement planning by age 30 at the latest,worryingly, only a quarter (26%) of pre-retirees think you need to start planning soearly in life.9101112Almost two in five (38%) working age people are not or do not intend to startsaving for retirement. Even more concerning, almost a third (32%) of those nearingretirement (age 45 and over) are not saving or do not intend to save for retirement.More than two fifths (45%) of working age people say that the cost of living isincreasing faster than their income.More than a quarter (26%) of working age people say the global economic downturnhas significantly impacted their ability to save for retirement.In addition to more conventional ways of funding their retirement, many pre-retireesown or plan to own a second property in their home country (65%) or overseas(32%), while more than half (52%) own or plan to own jewellery, gold or diamonds.In addition to this global report, country reports highlighting the key findings in each of the 15countries surveyed are available.7

Executive summaryA life lesscomfortableThe reality of retirement todayis complex. Working age peopleaspire to enjoy well-earned yearsof rest and recreation, but areconcerned about how they willfund their retirement years.Ensuring a good standard of livingin retirement is a big concern.Over a third (34%) of workingage people doubt that they willbe able to maintain a comfortablestandard of living in retirement.Many are worried about runningout of money (69%) and abouthaving enough money to live onday-to-day (66%).In addition, nearly a quarter(23%) expect their standard ofliving in retirement will be worsethan their standard of livingtoday, with working age peoplefeeling particularly gloomy in thedeveloped economies of France(54%), the UK (40%), Hong Kong(40%) and Australia (39%).Ready - or notMany pre-retirees think thatthey are not doing enoughto adequately prepare for acomfortable retirement. Globally,almost two in five (37%) thinktheir financial preparations areinadequate, a sentiment matchedby retirees, 37% of whomsay they were not preparedadequately or at all.8The Future of Retirement A balancing actReasons for this lack ofpreparedness are varied. Payingoff mortgages and/or other debts(46%) is the biggest barrierpreventing working age peoplefrom preparing adequately. Notstarting to save early enoughwas the main barrier for retirees,with almost two in five (38%)acknowledging that they startedsaving too late to build anadequate retirement savings pot.to save for retirement. This risesto nearly two in five (39%) inMexico and around a third in HongKong (34%) and Malaysia (32%).In addition, one in five (20%) preretirees around the world say thattheir retirement saving has beensignificantly affected by an illnessor accident stopping them or theirspouse from working, while 10%say they have had to stop work tolook after someone.Other barriers to preparing for acomfortable retirement includenot being able to afford to putenough money aside, cited by35% of working age people andaround 26% of retirees, and alack of awareness of how muchto save, acknowledged by 29% ofretirees.Looking back,starting soonerJuggling prioritiesRetirement is not the main savingpriority for 85% of working agepeople. The majority (81%) ofworking age people have alreadyexperienced life events whichsignificantly impacted theirability to save for retirement.While some of these events canbe planned for, such as buyinga home/paying a mortgage(32%) or saving for children’seducation (24%), many peoplealso experience unplanned eventswhich hamper their ability to savefor later life.A quarter (26%) of working agepeople across the world say theglobal economic downturn hassignificantly impacted their abilityWhen asked what they wouldhave done differently to improvetheir standard of living inretirement, over a third (36%) ofretirees across the world say thatthey would have started savingat an earlier age. This regret isgreatest in Malaysia – where overhalf (53%) of retirees think theyshould have started saving earlier– followed by Mexico (48%) andIndia (47%).Across the world, almost two infive (38%) of retirees say thatyou need to start planning forretirement by age 30 at the latestto maintain a similar standardof living to the one you enjoywhen working. This number issignificantly higher in the UK(62%), Australia (57%), the USA(47%) and Canada (45%). Farfewer retirees in Indonesia (12%),Taiwan (21%), Malaysia (21%) andTurkey (21%) recognise the needfor people to start retirementplanning so early in life.

Enough in the pot?Globally, working age peopleexpect that their retirementsavings and investments(excluding pensions) will run out11 years into their retirement.With retirees on average fullyretiring at age 60 and with anaverage life expectancy of 781years, pre-retirees typically facea seven year gap when they willbe solely reliant on any state,employer or personal pensionprovisions they may have.Almost two in five (38%)working age people are not ordo not intend to start saving forretirement. The USA and HongKong buck this trend, where threequarters (75%) of working agepeople are saving for retirement.Even more worryingly, almosta third (32%) of working agepeople over the age of 45 are notcurrently saving for retirement ordo not intend to do so at all.Pre-retirees who are not savingfor retirement may regret notCurrent life expectancy - World HealthOrganisation, US Central IntelligenceAgency1starting to save sooner, as almosttwo-thirds (65%) of retirees whofailed to prepare adequately for acomfortable retirement say thatthey did not realise this until theyhad fully retired.Confidence returnsfor some, butretirement savingsstill affectedThe shadow of the globaleconomic downturn still loomslarge on the financial horizonof working age people. While48% feel more confident abouttheir future financial prospectscompared with a year ago, foralmost half (45%), the costof living is increasing faster thantheir income.Compared with before theglobal downturn, two in five(40%) pre-retirees have eitherstopped or reduced their savingfor retirement, whether throughinvestments (25%), cash deposits(24%), annuities (21%), employerpension schemes (19%), personalpensions (19%) or insurancepolicies (19%).Generating incomefor retirementWhen retirees are asked aboutdifferent ways to fund retirement,property features highly, with40% owning or planning to owna second home in their homecountry or 15% overseas. Inaddition, around a third (32%) ofretirees worldwide own or plan toown jewellery, gold or diamonds,while a smaller proportion own orplan to own antiques (15%), art(14%), classic cars (11%) and finewines (10%).For working age peopleworldwide, the idea of generatingretirement income throughthese alternative methods ismore popular than for today’sretirees. Two thirds (65%) planto fund their retirement througha second domestic property andhalf (52%) through jewellery, goldor diamonds. Others are turningto overseas property (32%),antiques (24%), art (22%), classiccars (22%) and fine wines (19%).9

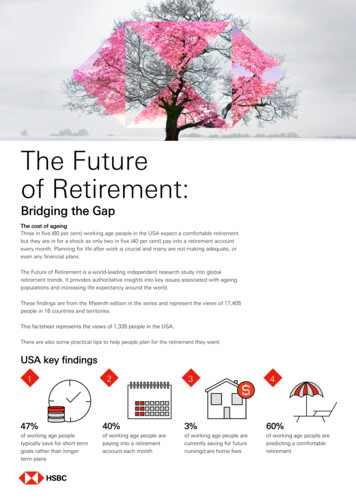

A life less comfortableRetirement can mean differentthings around the world. Somemay view it as a time to relaxafter a life of work. Some may dothings they never had the chanceto do when they were younger.Others may see retirement asan opportunity to support theirchildren as they take importantsteps in their adult lives - buyingtheir first home or having childrenof their own. However, for manypeople around the world, theseaspirations may not be easy toachieve. For many, the financialreality of life after work is less rosy.When asked what fears orconcerns they have about theirretirement, almost half (47%)of working age people say theyfear financial hardship. This fearis strongest amongst 25-44 yearolds (49%) and in Australia (56%),Canada (51%), Singapore (51%)and France (51%).One in ten (10%) working agepeople globally expect they willnever be able to fully retire. Thisview is particularly strong inAustralia (16%), Canada (15%),Singapore (15%), India (14%) andthe USA (13%).10The Future of Retirement A balancing actThe reasons for not retiring areoften financial. Two in five (40%)working age people around theworld who think they will neverfully retire say it is because theycannot afford to, while over athird (35%) believe they will needto keep working to maintain acomfortable lifestyle. Not beingable to afford to retire is the mainreason people believe they willnever fully retire in developedcountries, such as Canada (66%),Australia (64%), UK (61%) and theUSA (61%).Financial considerations are notthe only reasons and some peoplesee the benefit in continuing towork as they get older. Globally,almost half (47%) of workingage people who believe they willnever fully retire say it is becausethey want to keep active/keeptheir brain alert, with even higherproportions in India (70%), theUAE (61%) and Brazil (60%).Over a third (34%) worldwidewho believe they will never fullyretire say this is because they likeworking.Despite a minority choosing tokeep working into their lateryears, maintaining a comfortablestandard of living duringretirement is a real concernacross the world. Over a third(34%) of working age people arenot confident that they will beable to support a comfortablelifestyle in retirement. For womenthis figure rises to 38% comparedwith 31% of men.Pre-retirees in France are theleast confident, with three in five(60%) claiming they will not beable to maintain a comfortableretirement. In Taiwan (56%) andTurkey (54%) more than half ofworking age people share thisconcern.However, in some countriesconfidence is high. Less thanone in ten working age peoplein India (8%) and Indonesia(9%) say they are not confidentabout maintaining a comfortablestandard of living in retirement.

Many working age people are not confident in their ability tomaintain a comfortable ada40%UK39%Singapore39%Hong of working agepeople fearfinancial hardship inretirement54%AustraliaIndonesia47%20%9%8%Women are less confident than menFemaleMale38%31%11

men and therefore having moreyears of retirement to fund.A major concern for working agepeople is having enough moneyin retirement. While 66% areconcerned about having enoughmoney to live on day-to-day, morethan two-thirds (69%) are worriedabout running out of moneycompletely.These concerns are similar theworld over. Working age peoplein Asia and Brazil are the mostworried about running out ofmoney in retirement, with 81% inMalaysia, 81% in Singapore, 80%in Brazil and 77% in Hong Kongconcerned about this. Similarly,pre-retirees in Malaysia (88%),Hong Kong (83%), Brazil (81%)and Singapore (78%) are the mostworried about having enoughmoney to live on day-to-day inretirement.Women (74%) are generally moreconcerned than men (66%) aboutrunning out of money once theyhave stopped working. They arealso more concerned about havingenough money to live on day-today (71%) than men (62%). Thesedifferences between men andwomen are no doubt partly due towomen typically living longer thanRetirees are worried too, withhalf (50%) concerned aboutrunning out of money during theirretirement. A similar proportion(48%) is concerned about havingenough money to live on dayto-day. Working age people inAsia and Brazil may be right tobe concerned, with the majorityof retirees in Malaysia (83%),Hong Kong (65%), Brazil (64%)and Singapore (61%) concernedabout running out of moneyin retirement. The majority ofretirees in Malaysia (88%) andHong Kong (78%) are alsoconcerned about having enoughmoney to live day-to-day inretirement.Working age people have significant concerns about funding their retirement66%Average69%88%Malaysia81%83%Hong 5%53%68%72%Having enough money to live on day-to-dayRunning out of moneyQ. To what extent are you concerned about the following in your retirement? A. Very concerned or somewhat concerned.(Base: Pre-retirees)12The Future of Retirement A balancing act

25%of retirees say theirstandard of living isworse today thanbefore they retiredMany retirees say their standard of living is worse today than beforethey g KongPre-retirees’ concerns are likely tobe well founded, with a quarter(25%) of retirees saying that theircurrent standard of living is worsethan the period immediately priorto their retirement. This dropin living standard is particularlyprevalent in Turkey where almosthalf (49%) of retirees say theirliving standard is worse now,as well as in France (41%) andAustralia (31%).Similarly, 23% of working agepeople expect their standard ofliving in retirement to be worsethan their standard of living today.In France, more than half (54%)believe this, while people in UK(40%), Hong Kong (40%) andAustralia (39%) are almost a15%11%Q. Compared with the period immediately prior to your retirement, do you havea better or worse standard of living now you are retired? A. A little worse ormuch worse(Base: Retirees)13

Making sacrificesWorking age people around theworld are resigned to makingsacrifices when they retire, withalmost half (49%) foreseeinghaving to cut down on theireveryday spending. Pre-retireesin Singapore (58%), Hong Kong(57%) and Australia (56%) are themost likely to say they will haveto cut down on their everydayspending when they retire.More than a third (36%) say theywill eat out less often. This risesto almost half of pre-retirees inSingapore (48%) and Hong Kong(47%). Some 30% say they willtravel less and a similar proportion(29%) expect that they will not beable to treat themselves or othersas much.to cut down on their everydayspending after they retired.Over a third (36%) of retirees areeating out less often and retireesin France (51%), Malaysia (43%),Turkey (43%) and Australia (40%)are the most likely to eat out lessnow that they have retired. Inaddition, around a third (31%) donot treat themselves or others asmuch and 30% travel less thanthey did before they stoppedworking.Pre-retirees expect to make more sacrifices in retirement than currentretirees have49%41%36% 36%31%29%30% 30%25%Globally, a quarter (25%) ofworking age people say they willhave to move to a smaller homeonce they retire, with those inSingapore (43%), Australia (39%),UK (35%) and Canada (34%) themost likely to recognise the needto downsize.Pre-retirees are right to think theywill need to make cutbacks, as41% of retirees have had to cutdown on everyday spending sincethey retired. This rises to morethan half of retirees in France(54%) and Malaysia (52%). Evenin Indonesia, where working agepeople are the most optimistic,with 81% thinking their standardof living will be better inretirement than today, more thana third (36%) of retirees have had14The Future of Retirement A balancing act10%Cut down onmy everydayspendingRetireesEat outlessWon’t/don’ttreat myselfor others asmuchTravellessMove/movedto a smallerhomePre-retireesQ. Have you had to make any sacrifices since you retired? (Base: Retirees)Q. Do you envisage having to make any sacrifices when you retire? (Base: Preretirees)A. Top 5 sacrifices are shown

41%of retirees havehad to cut down oneveryday spendingsince they stoppedworking15

Ready - or notFinancially, many workingage people are not preparingadequately for a comfortableretirement. Almost two in five(37%) pre-retirees around theworld say that their financialpreparation is inadequate for acomfortable retirement, withthose in Turkey (61%) and Taiwan(60%) the least prepared.This preparation shortfall is all tooreal globally, with 37% of retireesadmitting they did not prepareadequately for a comfortableretirement. Retirees in Turkey(61%), France (47%), Mexico(44%) and Singapore (44%) werethe least prepared.In some countries, workingage people feel noticeablyless prep

money in retirement, while 66% are concerned about having enough money to live 1 on day-to-day in later life. 2 Retirement is not the main savings priority for 85% of working age people. 3 Paying off their mortgage and/or other debts (46%) is the biggest barrier preventing working a