Transcription

CENTRAL BANK OF NIGERIAREVISED GUIDELINES FORFINANCE COMPANIES IN NIGERIAAPRIL 2014

Central Bank of NigeriaRevised Guidelines for Finance Companies in NigeriaGlossary of TermsAcronymDefinitionALMAsset and Liability ManagementBABanker’s AcceptanceBOFIABanks and Other Financial Institutions ActCACCorporate Affairs CommissionCBNCentral Bank of NigeriaCEOChief Executive OfficerCPCommercial PaperCRARCapital to Risk Assets RatioCVCurriculum VitaeELANEquipment Leasing Association of NigeriaFCFinance CompanyFSIFinancial Services IndustryFHANFinance Houses Association of NigeriaKYCKnow Your CustomerLPOLocal Purchase OrderMSMEMicro, Small and Medium EnterprisesNPLNon-Performing LoansOFISDOther Financial Institutions Supervision DepartmentSHFShareholders’ FundsSMESmall and Medium Enterprisesi

Central Bank of NigeriaRevised Guidelines for Finance Companies in NigeriaContents1Introduction12Scope of Permissible Operations for Finance Companies22.1Regulation of Leasing Business in Nigeria43Licensing Requirements63.13.23.3Requirements for the grant of licenceOther financial requirementsConditions Precedent to the Commencement of Operations6884Sources of Funds105Rendition of Returns115.15.25.3Periodic Returns (Quarterly/ Bi-annual)Submission and publication of Audited Financial StatementsPenalties for late or false/ inaccurate returns or other information1112126Prudential apital Funds AdequacyMaintenance of capital fundsPayment of dividendLimit of lending to a single borrowerBorrowing limitsProvision for classified assetsRatio of non-performing loans to total gross loansContingent itemsLimit of investment in fixed assetsRevaluation of fixed assetsRequirements for increase in share capital14141415151515151616167Risk Management187.17.27.37.4Enterprise Risk ManagementInternal ControlsBasic Information on BorrowersDisclosure of interest by Directors and Officers of FinanceCompanies181819Supervision and Compliance20819ii

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria9Corporate Governance219.19.29.39.4Compliance with the provisions of the Code of CorporateGovernance and the Approved Persons RegimeStructure of the Board of Directors of Finance CompaniesManagement requirementsAppointment or replacement of Principal Officers2121222310Other Regulatory 252510.810.9Opening/ closing of branches of Finance CompaniesRestructuring and Reorganization of Finance CompaniesSchemes of ArrangementDisplay of LicenceDisplay of Interest RatesConditions for revocation of LicenceKnow Your Customer (KYC) and Anti-Money LaunderingMeasuresOther prohibitionsCompetition, consumer protection and operational rules11Industry Support Initiatives2711.111.2Access to SME FundsCapacity Building Programmes272712Transitional Provisions28252626iii

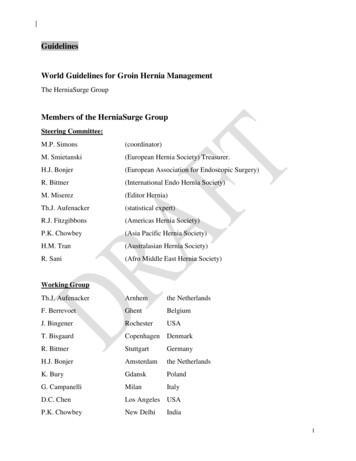

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria1IntroductionThe Finance Company sub-sector was envisioned to operate within the middle tier ofthe financial system, with a focus on the Micro, Small and Medium Enterprises(MSMEs) segment. The sub-sector was to play complementary roles to banks,bridging financing gaps and meeting the financial needs of its target customers.However, Finance Companies have not demonstrated the necessary capability tothrive in this space which has resulted in a largely underperforming sub-sector - asituation of concern to the Central Bank of Nigeria [hereinafter referred to as “theCBN” or “the Bank”] and other key industry stakeholders.As part of the initiatives to establish financial stability within the Financial ServicesIndustry and the Finance Company sub-sector in particular, the CBN undertook areview of the Guidelines for Finance Companies. These Revised Guidelines areissued by the CBN in exercise of the powers conferred on it by the Central Bank ofNigeria Act of 2007 [hereinafter referred to as “the CBN Act”] and the Banks andOther Financial Institutions Act of 2004 [hereinafter referred to Act “the BOFIA”]. TheRevised Guidelines are to regulate the establishment, operations and other activitiesof Finance Companies.The Revised Guidelines replace the existing Guidelines for Finance Companies andshould be read in conjunction with the provisions of the CBN Act, the BOFIA, as wellas written directives, notices, circulars and guidelines that the CBN may issue fromtime to time.1

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria2Scope of Permissible Activities for Finance CompaniesA Finance Company unless otherwise stated, means a company licensed to carry onFinance Company business. Finance Company Business means the business ofproviding financial services to individual consumers and to industrial, commercial, oragricultural enterprises.Operators of a Finance Company shall be permitted to perform, amongst others, thefollowing activities:Permissible ServicesDescription Consumer Loans This includes the provision of consumer andbusiness loans to individuals and the Micro,Small and Medium Enterprises (MSMEs). Funds Management This entails the management of funds on behalfof customers/ clients based on agreed tenor andrate. Asset Finance Finance lease is a lease agreement with theoption of purchase by the lessee at the end ofthe lease period.- Finance Lease- Hire Purchase Hire purchase involves the acquisition of goodsthrough instalment payments over a given timeframe. Project Finance The financing of infrastructure/ industrial projectsvia a loan structure that relies primarily on theproject's cash flow for repayment. This covers the provision of finance for suchprojects promoted by small scale ventures,public/ private partnerships and concessions. Local and InternationalTrade Finance- LPO Finance- Import and Export Finance Local trade finance/ supply finance providescontractors and vendors with the financialsupport to execute local purchase orders (LPOs)and work orders for their client companies. International trade finance is designed tofacilitate the export and import of goods. Debt Factoring The business of purchasing debts/ receivablesfrom clients at a discount and making a profitfrom their collection.2

Central Bank of NigeriaRevised Guidelines for Finance Companies in NigeriaPermissible ServicesDescription Debt Securitization A process by which identified pools ofcontractual debt/ receivables are transformedinto marketable securities e.g. bonds throughsuitable repackaging of cash-flows that theygenerate. Debt Administration Provision of debt/ loan restructuring services toclients facing cash flow problems. This involvesthe alteration of the terms of the debt agreementto restore liquidity to the client’s business. Financial Consultancy Financial consultancy involves offering financialadvisory services to clients for a fee and/orcommission. Loan Syndication A practice in which a Finance Company inconjunction with other finance companies and/orother financial institutions each lend a specifiedamount of money to a borrower at the same timeand for the same purpose. The entitiesparticipating in the loan syndication cooperatewith each other for the duration of the project, asindividual FCs may not be able to afford thehuge funds involved. Warehouse Receipt Finance This involves a guarantee that a seller willdeliver specified quantity and quality of acommodity to a certain warehouse for storage. Covered Bonds Covered Bonds are similar in many ways toasset-backed securities created in securitization,but covered bond assets remain on the issuer’sconsolidated balance sheet. Issuing of vouchers,coupons, cards and tokenstamps This covers services related to paymentssystem.The scope of services for Finance Companies will include these and otherbusinesses as the CBN may, from time to time, designate.Non-Permissible ActivitiesFinance Companies shall not be permitted to carry out the following businessactivities:i.Deposit Taking;3

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeriaii.Non-financial activities such as trading, construction and project management;iii.Other financial services such as stock broking, issuing house business,registrars services, e.t.c;iv.Foreign Exchange transactions except through their correspondent banks/authorised dealersEvery company desiring to be licensed as a Finance Company shall be on a “standalone” basis and thus be strictly limited to solely engaging in Finance Companybusiness as defined above.2.1Regulation of Leasing Business in Nigeriai.A leasing company is defined as any company or financial institution carryingon, as its principal business, the financing of physical assets supportingproductive/ economic activity.a. “Leasing” means the business of letting or sub- letting movable property onhire for the purpose of the use of such property by the hirer or any otherperson in any business whatsoever and where the lessor is the owner of theproperty regardless of whether the letting is with or without an option topurchase the property (Banks and Other Financial Institutions Act of 2004).b. Finance lease is a lease involving rental payment over an obligatory periodsufficient in total to amortise the capital outlay of the equipment and alsogive the lessor some benefits. The lessee also has the option of purchasingthe leased equipment at the expiration of the lease agreement.ii.CBN shall regulate the operations of Finance Companies that render financeand operating lease services to their clients in as much as the finance leaseoperations could be separated from the operating lease engagement but CBNwill not regulate the operations of financial or corporate institutions whichrender only operating lease services.iii.Leasing companies outside the financial system that engage in finance leaseshall be expected to apply for Finance Company licence and be subjected tothe prudential/ regulatory requirements for Finance Companies as defined bythe CBN.4

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeriaiv.A Leasing Company with a valid Finance Company licence shall not beprecluded from offering other permissible services defined under the scope ofoperations for Finance Companies.v.Self Regulatory Organisations such as the Finance Houses Association ofNigeria (FHAN) and the Equipment Leasing Association of Nigeria (ELAN) shallcollaborate with the CBN to identify companies to be licensed and supervised.5

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria3Licensing Requirements3.1Requirements for the grant of licenceAny company seeking a licence for a Finance Company business in Nigeria shallapply in writing to the Governor of the Central Bank of Nigeria. Such application shallbe accompanied by the following:i.A non-refundable application fee of N100,000 (One hundred thousand nairaonly) in bank draft, payable to the Central Bank of Nigeria.ii.Deposit of the minimum capital of N100 million (One hundred million naira only)in bank draft made payable to the Central Bank of Nigeria. The capital thusdeposited together with the accrued interest will be released to the promoterson the grant of the final licence.iii.Satisfactory, verifiable and acceptable evidence of payment by the proposedshareholders of the minimum capital of N100 million.iv.Detailed business plan or feasibility study, including:a. The objectives and aims of the proposed Finance Company.b. The need for the services of the Finance Company.c. The special services that the Finance Company intends to provide.d. A five-year financial projection for the operation of the Finance Company,indicating its expected growth and profitability.e. The branch expansion programme [if any] within the first five (5) years.f.The proposed training programme for staff and management succession.g. Details of the assumptions upon which the financial projection has beenmade.h. The organizational structure of the Finance Company, setting out in detail,the functions and responsibilities of the top management team.i.v.The conclusions based on the assumptions made in the feasibility report.A copy of the draft Memorandum and Articles of Association. The objectives ofthe Company as disclosed in its Memorandum and Articles of Associationshould agree with the services listed under the scope of permissible operationsfor Finance Companies.vi.A letter of intent to subscribe to the Finance Company, signed by eachsubscriber.6

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeriavii.A copy of the list of proposed shareholders in tabular form, showing theirbusiness and residential addresses [not post office addresses] and the namesand addresses of their bankers.viii.Names and curriculum vitae (CV) of each of the proposed members of theBoard of directors including other directorships held. The CVs must bepersonally signed and dated. The promoters would also be required to submitthe names and curriculum vitae of the proposed management team.ix.Thereafter, the Governor of the CBN may grant a licence to a FinanceCompany. The Bank may at any time vary or revoke any condition of a licenceor impose additional conditions.x.Where a licence is granted subject to additional conditions, the FinanceCompany shall comply with those conditions to the satisfaction of the CBNwithin such period as the CBN may deem appropriate in the circumstances.Any Finance Company that fails to comply with such conditions shall be guiltyof an offence under BOFIA, 1991 [as amended].xi.No proposed Finance Company shall incorporate/register its name with theCorporate Affairs Commission until a written approval has been communicatedto the promoters by the CBN, a copy of which shall be presented to theCorporate Affairs Commission.xii.Licences shall be renewed within the first quarter of each year at a nonrefundable fee to be stipulated by the Bank from time to time, subject to theoperations of the Finance Company being satisfactory to the Bank. Failure torenew a licence would attract severe sanctions, including revocation.7

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria3.2Other financial requirementsThe other financial requirements, which may be varied whenever the Central Bank ofNigeria considers them necessary, are as follows:i.Non-refundable Licensing fee-N250,000ii.Non-refundable Annual Licensing Renewal fee-N20,000(Payable within the first quarter of each calendar year)iii.3.3Change of Name fee-N20,000Conditions Precedent to the Commencement of Operationsi.The promoters of a Finance Company shall submit the following documents tothe Central Bank of Nigeria before such Finance Company is permitted tocommence operations:a. A copy of the shareholders’ register in which the equity interest of eachshareholder is properly reflected [together with the original for sighting].b. A copy of the share certificate issued to each shareholder.c. A certified true copy of Form C02 [Return of Allotments] filed with theCorporate Affairs Commission.d. A certified true copy of Form C07 [Particulars of Directors], and writtenconfirmation that the Board of Directors approved by the Central Bank ofNigeria has been installed.e. A certified true copy of the Memorandum and Articles of Association filedwith the Corporate Affairs Commission.f.The opening statement of affairs audited by an approved firm ofaccountants practising in Nigeria.g. A certified true copy of the certificate of incorporation of the company[together with the original for sighting purposes only].h. A copy each of the letters of offer and acceptance of employment bymanagement staff and a written confirmation that the Management teamapproved by the Central Bank of Nigeria has been put in place.i.A letter of undertaking to comply with all the rules and regulations guidingthe operations of Finance Companies.j.Evidence of registration with the Finance Company’s association umbrellabody.8

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeriaii.The Finance Company shall inform the Central Bank of Nigeria of the locationand address of its Head Office.iii.The Finance Company shall be informed in writing by the Central Bank ofNigeria that it may commence business after physical inspection of itspremises.iv.The Finance Company shall inform the Central Bank of Nigeria in writing of thedate of commencement of business.9

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria4Sources of FundsThe sources of funds of a Finance Company shall consist of the following:i.Shareholders’ Fundsii.Borrowings:iii.iv.a.Borrowings from members of the publicb.Inter-corporate borrowingsc.Borrowings from banks and other financial institutionsSecuritiesa.Commercial papersb.Debentures / investment notesSME Funds:a.Finance Companies can access SME funds subject to compliance withminimum prudential norms, as defined by the CBNb.Finance Companies may assist clients access SME funds throughvehicles such as the SME Credit Guarantee Scheme, MSMEDevelopment Fund and the Nigerian Incentive-Based Risk SharingSystem for Agricultural Lending (NIRSAL) funds (for clients in the Agricvalue-chain business)c.In addition to the specific requirements defined for the SME funds, thesefunds may only be accessed for asset finance, working capital and exportfinance transactionsv.Foreign funding arrangements:a.FCs shall be allowed to raise funds from foreign investors or partiessubject to CBN approval10

Central Bank of NigeriaRevised Guidelines for Finance Companies in Nigeria5Rendition of Returns5.1Periodic Returns (Quarterly)In compliance with the provisions of section 58[2]b of BOFIA 25, 1991 [as amended]the following quarterly returns are to be submitted by every Finance Company:i.Statement of Financial Positionii.Schedule of Other Assetsiii.Schedule of Other Liabilitiesiv.Statement of Profit or Lossv.Schedule of Investmentsvi.Schedule of balances held with banksvii.Returns on Borrowings from other Finance Companiesviii.Returns on Borrowings from other financial institutionsix.Returns on Borrowings from individuals and non-financial institutionsx.Returns on credits to other Finance Companiesxi.Returns on credits to other financial institutionsxii.Returns on credits to individuals/non-financial institutionsxiii.Returns on other creditsxiv.Returns on credits to affiliatesxv.Returns on non-performing creditsxvi.Returns on off-balance sheet engagementsxvii.Returns on non-performing other assetsxviii.Returns on credits, off-balance sheet engagements, assets and liabilitiesalong the defined scope of servicesxix.Other returns as may be specified by the Central Bank of NigeriaAll quarterly returns must reach the Director of Other Financial InstitutionsSupervision Department (OFISD) not later than the 14th day of the monthimmediately following the end of the quarter. The Managing Director/Chief Executive11

Central Bank of NigeriaRevised Guidelines for Finance Companies in NigeriaOfficer and the Chief Accountant [or its equivalent] of the Finance Company shallsign and attach to every return made to the Central Bank of Nigeria a declaration ofauthenticity of its contents.5.2Submission and publication of Audited Financial StatementsEvery Finance Company shall submit its audited financial statements and theabridged version of the accounts to the Director of Other Financial InstitutionsSupervision Department for approval not later than four (4) months after the end ofthe company’s financial year.The Report on the Accounts from the External Auditors should be forwarded to theDirector, Other Financial Institutions Supervision Department (OFISD) not later thanthree months after the end of the accounting year. After approval, the FinanceCompany shall publish the accounts in at least one national daily newspaper. Everypublished account shall disclose in detail the penalties paid as a result of thecontravention of BOFIA

public/ private partnerships and concessions. . Debt Factoring The business of purchasing debts/ receivables from clients at a discount and making a profit from their collection. . Leasing companies