Transcription

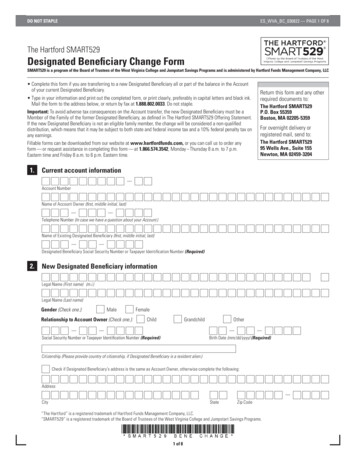

ES WVA BC 030822 — PAGE 1 OF 8DO NOT STAPLEThe Hartford Smart529 Offered by the Board of Trustees ofthe West Virginia College and Jumpstart Savings ProgramsThe Hartford SMART529Designated Beneficiary Change FormSMART529 is a program of the Board of Trustees of the West Virginia College and Jumpstart Savings Programs and is administered by Hartford Funds Management Company, LLC Complete this form if you are transferring to a new Designated Beneficiary all or part of the balance in the Accountof your current Designated Beneficiary. Type in your information and print out the completed form, or print clearly, preferably in capital letters and black ink.Mail the form to the address below, or return by fax at 1.888.802.0033. Do not staple.Important: To avoid adverse tax consequences on the Account transfer, the new Designated Beneficiary must be aMember of the Family of the former Designated Beneficiary, as defined in The Hartford SMART529 Offering Statement.If the new Designated Beneficiary is not an eligible family member, the change will be considered a non-qualifieddistribution, which means that it may be subject to both state and federal income tax and a 10% federal penalty tax onany earnings.Fillable forms can be downloaded from our website at www.hartfordfunds.com, or you can call us to order anyform — or request assistance in completing this form — at 1.866.574.3542, Monday – Thursday 8 a.m. to 7 p.m.Eastern time and Friday 8 a.m. to 6 p.m. Eastern time.1.Return this form and any otherrequired documents to:The Hartford SMART529P.O. Box 55359Boston, MA 02205-5359For overnight delivery orregistered mail, send to:The Hartford SMART52995 Wells Ave., Suite 155Newton, MA 02459-3204Current account informationAccount NumberName of Account Owner (first, middle initial, last)Telephone Number (In case we have a question about your Account.)Name of Existing Designated Beneficiary (first, middle initial, last)Designated Beneficiary Social Security Number or Taxpayer Identification Number (Required)2.New Designated Beneficiary informationLegal Name (First name) (m.i.)Legal Name (Last name)Gender (Check one.):MaleRelationship to Account Owner (Check one.):FemaleChildGrandchildSocial Security Number or Taxpayer Identification Number (Required)OtherBirth Date (mm/dd/yyyy) (Required)Citizenship (Please provide country of citizenship, if Designated Beneficiary is a resident alien.)Check if Designated Beneficiary’s address is the same as Account Owner, otherwise complete the following:AddressCityStateZip Code“The Hartford” is a registered trademark of Hartford Funds Management Company, LLC.“SMART529” is a registered trademark of the Board of Trustees of the West Virginia College and Jumpstart Savings Programs.1 of 8

ES WVA BC 030822 — PAGE 2 OF 8DO NOT STAPLE3.Transfer amount (Check and complete Section 3A or 3B.)A.E ntire balance. The Hartford SMART529 will change the Designated Beneficiary on your Account and will assign you a newAccount number if you do not already have an Account for the new Designated Beneficiary. Once the transfer is completed, theold Account will be closed.Do you already have an Account for the new Designated Beneficiary? (Check one.)Yes.No.B.If yes, go directly to Section 3C.Account NumberComplete Sections 4 and 5.P artial balance. The Hartford SMART529 will keep the Account for the current Designated Beneficiary’s Account open. Thedollar amount you specify below will be transferred to the new Designated Beneficiary’s Account.Dollar amountName of Investment OptionORTotal balance(For partial amounts.)(Check if applicable.) ,. ,. ,.Do you already have an Account for the new Designated Beneficiary? (Check one.)Yes.No. If yes, go directly to Section 3C.Account NumberComplete Sections 4 and 5.Note: If the amount you want transferred exceeds the maximum contribution limit, the excess will remain in the existingAccount for your current Designated Beneficiary.C.E xisting Account transfers. Complete this section if you have selected “Yes” in Section 3A or 3B. If an option is not selectedbelow, the transfer amount will be allocated according to the new Beneficiary’s existing Portfolio allocation election.(Check one.)I want to transfer the assets in-kind. (An “in-kind” transfer is moving the Units from the current Beneficiary’s Account tothe new Beneficiary’s Account without selling or buying Portfolios.) Go to Section 5.I want to transfer and allocate the assets according to the new Beneficiary’s current Investment Options. (By selectingthis option, the current investments will be liquidated, and the funds will be deposited into the new Beneficiary’s Accountaccording to the future allocation instructions on the new Beneficiary’s Account.) Go to Section 5.I want to transfer the assets into the new Investment Option(s) selected in Section 4. (This will not change the futurecontribution allocation of the new Beneficiary’s Account.) Go to Section 4.Important: If you have already established an Account for the new Designated Beneficiary and provided the Account numberabove, proceed directly to Section 5. Otherwise, complete all remaining sections.2 of 8

ES WVA BC 030822 — PAGE 3 OF 8DO NOT STAPLE4. Investment Option selection Before choosing your Investment Option(s), see the Offering Statement (available at www.hartfordfunds.com) for completeinformation about the Investment Options offered. Effective February 28, 2011, Class B shares are only available for existing accounts/allocations. Effective March 6, 2017 Class B shares are closed to all new investments. Contributions to Class C Shares that have been in an Account for at least four years, together with any earnings associated withthose contributions, automatically transfer to the Class A fee structure within approximately a month of the four year anniversary ofthe Account holding such shares.Note: See the Offering Statement (available at www.hartfordfunds.com) for complete information on the Investment Option(s)you are considering.Customized Portfolio Option: The Customized Portfolio Option offers you the ability to design a Customized Portfolio that will remain consistent with yourpredetermined investment objectives over time. Selecting this option will automatically rebalance your portfolio on a quarterly basis in accordance with the target allocations on file. Adding, stopping, or restarting the Customized Portfolio Option at any time after enrollment, will count as your once per calendaryear allowable investment strategy change. Changes to underlying fund selections within your Customized Portfolio will also count as your once per calendar year allowableinvestment change. These changes would include adjusting the percentage assigned to each investment option. When electing the Customized Portfolio option you may select only one class of shares.I wish to select the Customized Portfolio Option.(The investment allocations that make up your customized portfolio may be selected on the following page).3 of 8

ES WVA BC 030822 — PAGE 4 OF 8DO NOT STAPLEAge-Based Portfolio:The asset allocation of money invested in the Age-Based Portfolio is automatically adjusted over time to become more conservative asthe Designated Beneficiary approaches college. The Hartford SMART529 Age-Based Portfolio consists of the following Options: 0-3,4-6, 7-9, 10-11, 12-13, 14-15, 16, 17, and 18 .Class A SharesClass C SharesClass E Shares*%The Hartford SMART529 Age-Based Portfolio%%Static Portfolios:The assets will remain in the portfolio(s) you select until you exchange them into a new Investment Option.The Hartford SMART529 Aggressive Growth Portfolio%%%The Hartford SMART529 Growth Portfolio%%%The Hartford SMART529 Balanced Portfolio%%%The Hartford SMART529 Conservative Balanced Portfolio%%%The Hartford SMART529 Checks and Balances Portfolio%%%Individual Portfolios:The assets will remain in the portfolio(s) you select until you exchange them into a new Investment Option.The Hartford Small Company 529 Fund%%%The Hartford MidCap Value 529 Fund%%%The Hartford Growth Opportunities 529 Fund%%%The Hartford International Opportunities 529 Fund%%%The Hartford MidCap 529 Fund%%%MFS Global Equity 529 Fund%%%The Hartford Dividend and Growth 529 Fund%%%The Hartford Equity Income 529 Fund%%%The Hartford Balanced Income 529 Fund%%%The Hartford High Yield 529 Fund%%%The Hartford Inflation Plus 529 Fund%%%The Hartford Total Return Bond 529 Fund%%%The SMART529 Stable Value Fund%%%100 %100 %100 %* E Shares: Restricted to employees of The Hartford, Affiliated Individuals, and authorized Registered Investment Advisors. Although you maytransfer Class B Shares from one beneficiary to another, as of March 6, 2017 the Plan will not longer accept new investment in Class B Shares.4 of 8

ES WVA BC 030822 — PAGE 5 OF 8DO NOT STAPLE5.ACCOUNT CERTIFICATION AND AUTHORIZATION — YOU MUST SIGN BELOW I nvestments in the SMART529 College Savings Plan are not mutual funds, or deposits or obligations of, or guaranteed or endorsedby, the State of West Virginia, the Board of Trustees of the West Virginia College and Jumpstart Savings Programs, Hartford FundsManagement Company, LLC or its affiliates, or any other financial institution. They are not insured by the Federal Deposit InsuranceCorporation (FDIC), the Federal Reserve Board, or any other agency. They involve risk, including the possible loss of principal. I understand that The Hartford SMART529 Program and/or the Program’s manager may change in accordance with the terms ofthe Offering Statement and Participation Agreement.W-9 Certification - Under penalty of perjury, I certify that:1. The number shown on this form is my correct Taxpayer Identification number, and2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by theInternal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends,or (c) the IRS has notified me that I am no longer subject to backup withholding, and3. I am a U.S. person (including a U.S. resident alien).Certification Instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subjectto backup withholding because you have failed to report all interest and dividends on your tax return.BY SIGNING BELOW, YOU ARE AGREEING TO THE TERMS OF THE OFFERING STATEMENT, THE PARTICIPATION AGREEMENT ANDTHE TERMS OF THIS APPLICATION. YOU SHOULD CONSULT A FINANCIAL OR LEGAL ADVISOR IF YOU HAVE ANY QUESTIONSABOUT THE TERMS AND CONDITIONS OF THIS AGREEMENT.MY SIGNATURE BELOW INDICATES I HAVE READ THE OFFERING STATEMENT AND PARTICIPATION AGREEMENT FOR THEHARTFORD SMART529 PROGRAM AND AGREE TO THE TERMS. THIS APPLICATION, TOGETHER WITH THE OFFERING STATEMENTAND THE PARTICIPATION AGREEMENT, CONSTITUTES MY CONTRACT WITH THE WEST VIRGINIA SAVINGS PLAN TRUST (AND ITSDESIGNEES) WITH RESPECT TO AMOUNTS INVESTED PURSUANT TO THIS APPLICATION.I UNDERSTAND THAT CONTRIBUTIONS TO THIS ACCOUNT ARE SUBJECT TO INVESTMENT RISK AND ARE NOT FDIC INSURED NORGUARANTEED BY A DEPOSITORY INSTITUTION. I FURTHER UNDERSTAND THAT THE STATE OF WEST VIRGINIA AND HARTFORDFUNDS MANAGEMENT COMPANY, LLC AND ITS AFFILIATES DO NOT INSURE OR GUARANTEE THIS ACCOUNT, AMOUNTSCONTRIBUTED TO THE ACCOUNT OR INVESTED RETURN.The Internal Revenue Service does not require your consent to any provision of this document other than the certifications requiredto avoid backup withholding.S I G NAT U R ESignature of Account OwnerDate (mm/dd/yyyy)The Board of Trustees of the West VirginiaCollege and Jumpstart Savings ProgramsHARTFORDFUNDS5 of 8

ES WVA BC 030822 — PAGE 6 OF 8DO NOT STAPLE[PAGE LEFT BLANK INTENTIONALLY]6 of 8

ES WVA BC 030822 — PAGE 7 OF 8DO NOT STAPLE[PAGE LEFT BLANK INTENTIONALLY]7 of 8

ES WVA BC 030822 — PAGE 8 OF 8DO NOT STAPLE[PAGE LEFT BLANK INTENTIONALLY]8 of 8

The Hartford High Yield 529 Fund % % % The Hartford Inflation Plus 529 Fund % % % The Hartford Total Return Bond 529 Fund % % % The SMART529 Stable Value Fund % % % 1 0 0 % 1 0 0 % 1 0 0 % * E Shares: Restricted to employees of The Hartford, Affiliated Individuals, and authorized Registered Investment Advisors. Although you may

![Pageflex Server [document: A0580431 00001] - Capital Insurance Agency, Inc.](/img/29/dor-hartford-group-term-life-brochure.jpg)