Transcription

THE INSTITUTE OF CHARTERED ACCOUNTANTSOF NIGERIAMAY 2015 SKILLS LEVEL EXAMINATIONSQuestion PapersSuggested SolutionsPlusExaminers’ ReportsSKILLS LEVEL EXAMINATIONS – MAY 2015I

FOREWORDThis issue of the PATHFINDER is published principally, in response to a growingdemand for an aid to:(i)Candidates preparing to write future examinations of the Institute of CharteredAccountants of Nigeria (ICAN);(ii)Unsuccessful candidates in the identification of those areas in which they lostmarks and need to improve their knowledge and presentation;(iii)Lecturers and students interested in acquisition of knowledge in the relevantsubjects contained herein; and(iv)The profession; in improving pre-examinations and screening processes, andthus the professional performance of candidates.The answers provided in this publication do not exhaust all possible alternativeapproaches to solving these questions. Efforts had been made to use the methods,which will save much of the scarce examination time. Also, in order to facilitateteaching, questions may be edited so that some principles or their application may bemore clearly demonstrated.It is hoped that the suggested answers will prove to be of tremendous assistance tostudents and those who assist them in their preparations for the Institute’sExaminations.NOTESAlthough these suggested solutions have been publishedunder the Institute’s name, they do not represent the viewsof the Council of the Institute. The suggested solutions areentirely the responsibility of their authors and the Institutewill not enter into any correspondence on them.SKILLS LEVEL EXAMINATIONS – MAY 2015II

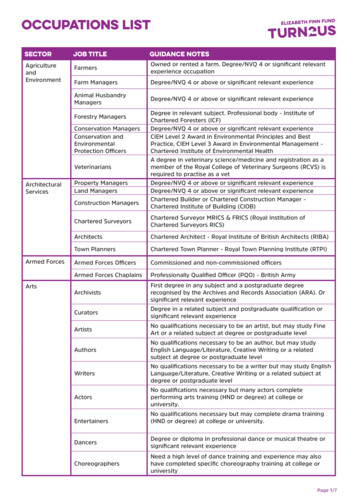

TABLE OF CONTENTSSUBJECTPAGEFINANCIAL REPORTING1TAXATION37PERFORMANCE MANAGEMENT69AUDIT AND ASSURANCE100PUBLIC SECTOR ACCOUNTING AND FINANCE123MANAGEMENT GOVERNANCE AND ETHICS140SKILLS LEVEL EXAMINATIONS – MAY 2015III

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF NIGERIASKILLS LEVEL EXAMINATIONS - MAY 2015FINANCIAL REPORTINGTime Allowed: 3 hoursATTEMPT FIVE QUESTIONS IN ALLSECTION A:COMPULSORY QUESTION(30 Marks)QUESTION 1UNITARISATON PLCUnitarisation Plc is a successful Nigerian Company which recently amended its objectsclause in the Memorandum of Association to include “programmes and activities thatwill promote National unity and encourage anti-terrorism compliance” as part of itssocial responsibilities. The company, therefore, acquired 60% of the equity sharecapital of Famous Plc a widely known and successful advertising company topropagate this mission.The summarised draft financial statements of the two companies are as follows:Statement of Profit or Loss and Other Comprehensive Income for the yearended 31 October, 2014.RevenueCost of salesGross profitDistribution costsAdministrative expensesFinance costsProfit before taxIncome tax ExpenseProfit for the 0)1,800)SKILLS LEVEL EXAMINATIONS – MAY 20151

Statement of Financial Position as at 31 October, 2014Assets:Non-current assets:Property, plant & equipmentCurrent assetsTotal assetsEquity & Liabilities:Equity shares of N1 eachRetained earningsNon-current liabilities:12% loan notesCurrent liabilitiesTotal equity & liabilitiesUnitarisation Plc. Famous 2,82011,520Relevant additional information are presented below:(i)The shares of Famous Plc. was acquired on 1 May, 2014 and the issue of shareswas not recorded by Unitarisation Plc.(ii)There is cash in transit of N120,000,000 due from Unitarisation Plc. to FamousPlc. arising from intra-group trading.(iii)The non-controlling interests are valued at full fair value by the parentcompany. The fair value of the non-controlling interests in Famous Plc. at thedate of acquisition was N3,540,000,000. There is no goodwill impairment at theend of the accounting year.(iv)The fair value of Famous Plc. assets were equal to the carrying amounts at theacquisition date except for one equipment with a fair-value of N1,200,000,000over its carrying amount which has a five-year remaining life. Straight linedepreciation is adopted. Famous Plc. has not effected the adjustment in therecords.(v)The 60% of share capital of Famous Plc. acquired was settled through shareexchange of two shares in Unitarisation Plc. for three shares in Famous Plc. Themarket value of Unitarisation Plc. at the date of acquisition was N6 per share.(vi)In the post-acquisition period, Unitarisation Plc. bought goods from Famous Plc.amounting to N4,800,000,000. Famous Plc. had made a mark-up on cost of 40%on the transaction. As at the year end, Unitarisation Plc. had sold part of thesegoods worth N3,120,000,000.SKILLS LEVEL EXAMINATIONS – MAY 20152

(vii)Famous Plc’s trade receivables at 31 October, 2014 include N360,000,000 duefrom Unitarisation Plc.However, the amount did not agree with thecorresponding balance in Unitarisation Plc’s trade payable ledger.(viii) Assume that profits or losses accrue evenly over the period except otherwisestated.Required:a. Prepare Unitarisation Plc. Consolidated Profit or Loss and Other ComprehensiveIncome for the year ended 31 October, 2014.(10 Marks)b. Unitarisation Plc. Consolidated Statement of Financial Position as at 31 October,2014.(10 Marks)c.Consolidated Statement of Changes in Equity for the year ended 31 October, 2014.(6 Marks)d. In accordance with IFRS 3 on Business Combinations, what is Gain On BargainPurchase?(4 Marks)(Total 30 Marks)SECTION B: ATTEMPT TWO OUT OF THREE QUESTIONS IN THIS SECTION(40 Marks)QUESTION 2a.b.When a parent Company elects not to prepare consolidated financial statementsand instead prepares separate financial statements; what are the disclosurerequirements stipulated in IAS 27 on Separate Financial Statements?(6 Marks)Kerewanta Plc. acquired 60% of the equity shares of Orijinmi Plc. by means ofshare exchange of three shares in Kerewanta Plc. for four shares in Orijinmi Plc.The market value of the shares of Kerewanta Plc. at the date of acquisitionwhich is 1 April, 2013 was N10 per share.Kerewanta Plc. would make a deferred cash payment of 70k per acquired shareon 1 April, 2014. Kerewanta Plc. cost of capital is 12% per annum. None of theconsideration has been recorded in the books of Kerewanta Plc. The followinginformation was extracted from the financial statements of the two companiesas at 31 March, 2014.SKILLS LEVEL EXAMINATIONS – MAY 20153

Equity shares of N1 eachShare premiumRetained earnings 1 April, 2013Retained earnings for the yearended 31 March, 2014Property, plant and equipmentKerewanta Plc.N’m60,00015,00020,500Orijinmi Plc.N’m20,000NIL11,6009,80050,4006,70022,900The following is the additional relevant information:(i)An equipment had a fair value of N360,000,000 above its carryingamount. At the date of acquisition of Orijinmi Plc. the asset had aremaining life of four years. It is the group’s policy to depreciate suchasset using the straight line method.(ii)Orijinmi Plc. had deferred tax liability of N10,000,000 as at 31 March,2014 which had not been recorded. The company’s goodwill is notimpaired.(iii)Non-controlling interests are to be valued at fair value at the date ofacquisition of Orijinmi Plc. The fair value of the shares of Orijinmi Plc.held by non-controlling interests at the date of acquisition is N6 pershare.Required:Calculate the following as at 31 March, 2014:i.ii.iii.iv.EquityNon-controlling interestsConsolidated goodwillProperty, plant and equipment(14 Marks)(Total 20 Marks)SKILLS LEVEL EXAMINATIONS – MAY 20154

QUESTION 3Galadanci Plc. is a telecommunications company operating in Nigeria.Themanagement of the company presented the following summarised financialstatements for the years ended 31 December, 2013 and 2014.Statements of Profit or Loss and Other Comprehensive Income for the year ended:RevenueCost of salesGross profitAdministrative costsDistribution costsFinance costsProfit before taxationIncome tax expenseProfit for the 52(102)250Statements of financial position as at 31 ent assets:Property, plant & equipmentIntangible assetsInvestment in shares of Papanga Plc. atcostCurrent assets:InventoryTrade receivablesOther receivablesTotal assetsEquity & liabilities:Equity shares of N1 eachRetained 225270495SKILLS LEVEL EXAMINATIONS – MAY 20155

Non-current liabilities:10% secured loan notes12% secured loan notesCurrent liabilities:Bank short term loanTrade payablesIncome tax payableTotal equity & 54829The following additional information is relevant for the year ended 31 December,2014:(i)Galadanci Plc. acquired 60% interests in the equity shares of Papanga Plc.which is into commercial rice production in order to diversify its businessportfolio and take advantage of the favourable incentives in agriculturerecently announced by the Federal Government of Nigeria.(ii)Galadanci Plc. increased its mobile telephone subscriber based and averagerevenue per user.(iii)No dividends were received from Papanga Plc. and the value of its shares hadnot increased during the year ended 31 December, 2014.Required:a. Calculate the following ratios and use them to analyse Galadanci Plc’s operatingperformance during the year ended 31 December, 2014 and comment on anyrelevant qualitative factors that may impact on the company’s performance.i.ii.iii.iv.v.vi.Gross profit percentageReturn on capital employed (where capital employed Total Asset lesscurrent liabilities)Net profit (PBIT) percentageAsset turnoverGearing ratioDebt/Equity ratio(16 Marks)b. Prepare Galadanci Plc’s Cash Flows from operating activities using the indirectmethod in accordance with 1AS 7 on Statement of Cash Flows.(4 Marks)(Total 20 Marks)SKILLS LEVEL EXAMINATIONS – MAY 20156

QUESTION 4a. The following information is extracted from the financial statements of Kubua Plc. forthe year ended 30 September, 2014.N’00020,0004,000Ordinary Share Capital (fully paid at 1.25 kobo each)Operating profit before taxOther relevant information:(i)(ii)(iii)The companies income tax rate is 30%The average fair value of one ordinary share during the year was N5.00.During the year, the company issued share options of 2.5million ordinaryshares to existing shareholders at an exercise price of N4.00.Required:Calculate the basic and diluted Earnings Per Share for the year ended 30September, 2014. Show all workings(5 Marks)b.Extract from the Statements of Profit or Loss and Other Comprehensive Incomeof Bajulaye Plc. for the years 002,800Profit Before Interest and Taxes (PBIT)2,5001,200Extract from the Statements of Financial Position as at30/9/2014Issued Share Capital:N’000Ordinary Shares at 50k each3,00012% Redeemable Preference Shares1,500Total Equity4,50030/9/2013N’0003,0001,5004,500Other relevant information:-On 1 January, 2013 the entity issued convertible loan notes ofN2,000,000 with effective interest rate of 10% per annum.-The loan notes are convertible at nominal values of N100 each into thefollowing number of ordinary shares:SKILLS LEVEL EXAMINATIONS – MAY 20157

30 September, 201830 September, 201930 September, 202030 September, 2021-130 shares125 shares114 shares105 sharesCompanies Income tax rate is 30%.Required:i.Calculate the basic and diluted Earnings Per Share for the year ended 30September, 2014.(8 Marks)ii.SECTION C:Write a short memo to the Board of Directors of Bajulaiye Plc. explainingFOUR advantages and THREE limitations of Earnings Per Share as aperformance indicator to users of financial statements.(7 Marks)(Total 20 Marks)ATTEMPT TWO QUESTIONS IN THIS SECTION(30 Marks)QUESTION 5IAS 38 - Intangible Assets, specifies the criteria that must be met before an intangibleasset can be recognised by an entity in its Financial Statements. Intangible assets areidentifiable non-monetary assets without physical substance and include goodwill,brands, copyright and research and development expenditure. They could bepurchased and/or internally generated.Required:a.Identify any TWO characteristics of goodwill which distinguish it from otherintangible assets?(2 Marks)b.Explain THREE differences between purchased goodwill and non-purchasedgoodwill.(3 Marks)c.Identify any THREE conditions that must be met under IAS 38 for developmentexpenditure to be recognised as an intangible asset.(3 Marks)State any FOUR factors to be considered when determining the useful life of anintangible asset.(4 Marks)d.e.Calculate the goodwill on consolidation from the information below:SKILLS LEVEL EXAMINATIONS – MAY 20158

Parent’s cost of investment in subsidiaryNet asset at acquisition date (parent)Net asset at acquisition date (subsidiary)Fair value of non-controlling interest at acquisition dateNet asset at reporting date (subsidiary)Impairment of goodwillParent has 80% interests in 0062,200(3 Marks)(Total 15 Marks)QUESTION 6a.IAS 28 - Investments in Associates and Joint Ventures permits, the application ofequity method when accounting for investments in associates and jointventures.Required:Explain briefly the Equity Method and state the circumstances under which anentity can discontinue the use of equity method under IAS 28.(5 Marks)b.Agbantara Plc. acquired equity shares from Odinma Plc. and Dangari Limited.The following are the Statements of Profit or Loss and Other ComprehensiveIncome for the year ended 31 December, 2014 for the three companies:RevenueCost of salesGross profitAdmin expensesFinance incomeFinance costsProfit before taxIncome tax expensesProfit for the yearAgbantara 50Odinma Plc.N’m1,350(720)630(180)90540(135)405Dangari LtdN’m630(270)360(135)(90)135(45)90SKILLS LEVEL EXAMINATIONS – MAY 20159

Other comprehensive income:Gains on property revaluation,net of taxTotal comprehensive income forthe year1809045630495135The following information is also relevant:(i)Agbantara Plc. acquired 72 million ordinary shares in Odinma Plc. out ofits 120,000,000 ordinary shares of N1 each par value for N160,000,000.The shares were acquired four years ago when it had N15,000,000 creditbalance on its retained earnings. During the year, Odinma Plc. soldgoods costing N38,000,000 to Agbantara Plc. for N45,000,000. Thesegoods were yet to be sold as at 31 December, 2014.(ii)Agbantara Plc. acquired 35,000,000 ordinary shares in Dangari Limitedout of 100,000,000 ordinary shares. The shares were acquired threeyears ago when the company had a credit balance on its retainedearnings of N10,000,000.(iii)Agbantara Plc’s group policy is to measure non-controlling interests (NCI)at fair value. NCI at acquisition date in Odinma Plc. at fair value wasN48,000,000. Impairment test carried out on the goodwill relating toOdinma Plc. and investment in Dangari Limited at year end resulted inN10,000,000 and N15,000,000 losses respectively.You are required to:Prepare Agbantara Plc. Consolidated Statement of Profit or Loss and OtherComprehensive Income for the year ended 31 December, 2014.(10 Marks)(Total 15 Marks)SKILLS LEVEL EXAMINATIONS – MAY 201510

QUESTION 7a.There is usually a lead time between the end of an entity’s accounting year andwhen the financial statements are approved and signed off by the directors. Inbetween this period, there are two types of events according to IAS 10-EventsAfter The Reporting Period, which may require consideration when preparingfinancial statements.You are required to:Identify and explain these events and state how they are treated in the financialstatements.(4 Marks)b.Company A is indebted to company B to the tune of N50,000,000. The financialyear-end of company B is 30 June, 2014. On 30 July 2014, company B receiveda letter from a liquidator advising it that company A has gone into insolvency.The letter revealed that company A ceased operations a month ago and thatcompany B is only likely to receive a liquidation dividend of 20k for every nairaowed by company A. It is the normal practice of company B’s board to approvethe audited financial statements three months after the financial year end.Required:i.Explain how the above transactions should be treated in the financialstatements of company B in accordance with IAS 10-Events After TheReporting Period.(2 Marks)ii.Prepare journal entries that are required to adjust company B’s financialstatements to account for the above event.(2 Marks)State what would have been the treatment in the financial statementsassuming it was fire that destroyed company B’s factory building on 30July, 2014.(3 Marks)iii.c.The directors of XYZ Plc declared that a dividend of N1 per ordinary share bepaid to shareholders on the company’s register as at 15 April, 2014. Thefinancial statements were approved by the company’s board on 30 May, 2014.The shareholders, at the company’s annual general meeting held on 15 June,2014, approved the payment of the dividend to eligible shareholders on 1 July,2014.Required:Explain how the dividend proposed by the Directors should be treated in thefinancial statements of XYZ Plc in accordance with IAS 10.(4 Marks)(Total 15 Marks)SKILLS LEVEL EXAMINATIONS – MAY 201511

SECTION ASOLUTION 1(a)UNITARISATION PLC.CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVEINCOME FOR THE YEAR ENDED 31 OCTOBER, 2014Revenue (51,000 (25,200 xCost of sales (Wk 2)Gross profit6) – 4,800 (Wk 3)12Distribution costs (1,200 (1,200 xAdmin. Costs (3,600 (1,920 xFinance costs (180 (240 xProfit before ,560)6)12(300)8,9406Income tax (2,820 (840 x)12(3,240)Profit for the yearOther comprehensive incomeTotal comprehensive income5,700Nil5,700Profit attributable to:Owners of the parentNon-controlling interest (wk 1)5,5801205,700Workings:N’mWk 1 Non-controlling interests:Statement of profit or lossPost acquisition profit (Famous) (1,800 xUnrealised profitFair value adjustment movementNCI post acquisition share (40% x 300)6)12900(480)(120)300120SKILLS LEVEL EXAMINATIONS – MAY 201512

Wk 2 Cost of salesN’mUnitarisation Plc37,8006Famous Plc (19,200 x)129,600Movement of fair value adjustment (Wk 1)Intragroup purchases (Wk 3)Unrealised profit (Wk 3)120(4,800)48043,200Wk 3 Intragroup Trading:RevenuePurchasesBeing removal of intragroup sales and purchasesRetained earnings/cost of sales (4,800 – 3,120) x 40/140InventoriesBeing elimination of unrealised ON PLC.CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 OCTOBER, 2014ASSETSNon-current assetsProperty, plant & equipment (24,360 7,560 1,080) (Wk 5)Goodwill (Wk 3)Current assets (Wk 8)EQUITY AND LIABILITIESEquity attributable to owners of parent company:Share capital (6,000 960) (wk 6)Share premium (Wk 6)Retained earnings (Wk 2)Shareholders fundNon-controlling interest (Wk 2033,1803,66036,840Non-current liabilitiesSKILLS LEVEL EXAMINATIONS – MAY 201513

12% loan notes (1,800 2,400)Current liabilities(4,920 2,820 – 240) (Wk 7)WorkingsWk 14,2007,50048,540Group structureUnitarisation Plc.60% (1/5/2015)Famous PlcThe subsidiary was acquired during the year (middle of the accounting Year)Wk 2 Retained earnings:As in the questionFair value adjustment movement (Wk 5)Unrealised profit (Wk 3)Pre-acquisition profitRetained earnings of subsidiaryGroup share of subsidiary (60% x 300)Consolidated retained sPlc.N’m3,900)(120)(480)(3,000)300Wk 3 Goodwill:N’mConsideration transferredFair value of non-controlling interestLess: Net asset fair value at acquisition:Share capitalRetained earningsFair value ,600)2,700Wk 4 Statement of Financial Position:SKILLS LEVEL EXAMINATIONS – MAY 201514

N’m3,5401203,660NCI at acquisitionShare of post acquisition retained earnings (40% x 300)Wk 5 Fair Value Adjustments:Movement in equipmentæ 1,200 6 öx ç12 øè 5Acquisition1/5/14N’mMovement(6/12)N’mYear end31/10/14N’m1,200(120)1,080Wk 6 Share exchange:No of share issued (2,400 x 60% x 2/3) 960Consideration transferred (960 x N6)Unitarisation share capital (960 x N1)Unitarisation share premium (960 x N5)DRN’m5,760CRN’m9604,800Wk 7 Cash in transit:ReceivablesPayablesGroup cashWk 8 Current asset:Unitarisation Plc.Famous Plc.Unrealised profitIntercompany receivables (State in the question)Cash in transit (WK 1202,840c)SKILLS LEVEL EXAMINATIONS – MAY 201515

UNITARISATION PLC.CONSOLIDATED STATEMENT OF CHANGES IN EQUITYFOR THE YEAR ENDED 31 OCTOBER, 2014As at 1 November, 2013Profit for the yearOther comprehensive income:Transactions with owner’sequity:Addition paid-in capitalAddition on acquisition ofFamous Plc.As at 31 October, 3,54036,840Gain on Bargain purchase arises when the aggregate of the considerationtransferred (which is usually measured at fair value), the non-controllinginterest and the fair value of the previously held equity interest is less than theacquisition date amount of the identifiable assets acquired and the liabilitiesassumed.EXAMINER’S REPORTThe question tests candidates’ knowledge of Preparation of Consolidated Statement ofProfit or Loss and other Comprehensive Income Statement of Financial Position,Statement of Changes in Equity and explanation of Gain on Bargain Purchase.About 98% of the candidates attempted the question and performance was belowaverage.Most of the candidates could not correctly explain the Gain on Bargain Purchase inaccordance with IFRS 3 on Business Combination, while candidates who were unableto correctly prepare the consolidated final accounts properly lost some marks, becauseN’m symbol in their solutions. (For example recording N5m as N51,000). Also majorityof the candidates could not correctly prepare Statement of Changes in Equity.Candidates are advised to note that future Chartered Accountants should pay specialattention to denominations and should correctly reflect this in their solution toquestions.SKILLS LEVEL EXAMINATIONS – MAY 201516

Similarly, they should pay attention to relevant International Financial ReportingStandards (IFRS) that affect preparation of consolidated and separate financialstatement for better performance in future examinations of the Institute.SOLUTION 2a)DISCLOSURE REQUIREMENTS STIPULATED IN IAS 27 WHERE A COMPANY ELECTSNOT TO PREPARE CONSOLIDATED FINANCIAL STATEMENTSWhen a parent company elects not to prepare consolidated financial statementsand instead prepares separate financial statements, IAS 27 on Consolidated andSeparate Financial Statements states that it shall disclose in those separatefinancials.(i)The fact that financial statements are separate financial statements.(ii)A list of significant investment in subsidiaries, joint venture andassociates including:§The name of those investees§The principal place of business (and country of incorporation, ifdifferent) of those investees§Its proportion of ownership interest (and its proportion of the votingrights, if different) held in those investees.(iii)A description of the method used to account for the investment listed under (ii).(i)Equity as at 31 March, 2014b)Share capital of Kerewanta Plc.Share premiumRetained earnings (Wk 1)N’m69,00096,00033,360198,360SKILLS LEVEL EXAMINATIONS – MAY 201517

(ii)Non-controlling interests as at 31 March, 2014N’m48,0002,680(4)(36)50,640Added on acquisition at 1 April, 201340% post acquisition on profit (40% x N6,700)Deferred tax expenses (N10million x 40%)Additional depreciation (1/4 year x N360 x 40%)(iii)Consolidated Goodwill as at 31 March, 2014Purchase consideration of Kerewanta Plc.Share considerationDeferred n- controlling interestCost of business combinationFair value of identifiable net asset at 1 April, 2013Share capitalPre-acquisition reservesFair value adjustmentsFull perty, plant and equipment as at 31 March, 2014Kerewanta Plc.Orijinmi Plc.Fair value AdjustmentLess: Additional depreciation (1/4 years x :Wk 1Retained earnings as at 31 March, 2014Kerewanta Plc. retained earnings (N20,500 N9,800)60% post-acquisition profit (60% x N6,700)Finance cost (12% x N7,500million)Deferred tax expense (N10million x 60%)Additional depreciation (1/4 years x N360million x 60%)N’m30,3004,020(900)(6)(54)33,360SKILLS LEVEL EXAMINATIONS – MAY 201518

EXAMINER’S REPORTThe question tests the disclosure requirement necessary for the computation of itemsin the Consolidated Statement of Financial Position, such as equity, property, plantand equipment.About 50% of the candidates attempted the question and performance was poor.The commonest pitfalls observed include the following:·····Inadequate knowledge of the disclosure requirement required for calculating some of thebasic Consolidated Statement of Financial Position (CSFP) items highlighted above.Failure to show necessary workings as to how the figures were arrived at.Omission of N’m configuration in their solution thus, reducing the figures that areexpected in million naira to thousand naira.Failure to recognize deferred tax liability in their solution as required by the examiner.It is apparent that most candidates lack the requisite knowledge of IFRS, hence they couldnot correctly calculate the relevant items of SFP as required by the examiner.They are therefore advised to pay more attention to this section of the syllabus as itcould feature regularly at this level of the Institute’s examinations.SOLUTION 3(a)(i)Ratio AnalysisGross profit %Grossprofitx100%Re venue / sales(ii)Return on capital employed (ROCE)()100%20142013729x100%2,430655x100%1,638 30% 39.98% (40%)175 36x100%1,359 - 289352 6x100%829 - 254 211x100%1,070 19.72% 20% 358x100%575 62.26% 62%SKILLS LEVEL EXAMINATIONS – MAY 201519

(iii) Net profit (PBIT) percentagePBITx100%Re veue / sales(iv)(v)Asset Turnover(Gearing RatioDebtx100% Debt Equity) 211x100%2,430Debit/Equity RatioDebitx100%Equityii.358x100%1,638 8.68% 9% 21.86% 222,4301,3591,638829 1.79 times 1.98 times80 260x100%730 340340x100%1,07080x100%495 8080x100%575 31.78% 32%(vi) 389x100%730 53.29% 13.91% 14%90x100%495 18.18%ANALYSIS OF OPERATING PERFORMANCE OF GALADANCI·There is increase in revenue from N1,638bn to N2,430bn (2014) with arising cost of sales from N983bn (2013) to N1,701bn (2014) which leadsto decrease in gross profit % from 40% to 30%.·Profit before interest and tax dropped from N358bn to N211bn, whilecapital employed increased from N575bn to N1,070bn as a result of theincrease in the level of production and non-current asset to meet thelevel of increase in demand.·The capital expended on non-current asset is long-term in nature andcan only be recouped on a spread over a number of years, hence thereduction in Net Profit percentage of 22% (2013) to 9% (2014). Therefore,it will take some time for the profit to rise synergistically.·The immediate effect of the increase in non-current asset also led to thedecrease in asset turnover of 1.98 times (2013) to 1.79 times (2014).·The financing effect is reflected in increase in the gearing ratio from 14%(2013) to 32% (2014) as a result of the increase in the long-term debtSKILLS LEVEL EXAMINATIONS – MAY 201520

from N80bn (2013) to N340bn (2014) and capital employed fromN575bn to N1,070bn. This is also reflected in increase in the Debt/Equityratio from 18.18% (2013) to 53.29% (2014) which is a very high level ofdifference/increase.·The company, in a bid to increase revenue, might have incurredexcessive cost which is higher in proportion to the increase in therevenue generated through increase in customers’ base.·The company’s investment in the subsidiary (Papanga Plc.) might havebeen financed by debt which has equally contributed to significantincrease in finance cost and high gearing ratio, without anycommensurate return from the same investment.·Other inefficiencies that may be attributed to the company’s businessmodel and strategy.Comment on Qualitative Analysis(i)The measure in non-current asset and capital employed may lead to synergisticeffect in the next few years because it works like the cyclical movement in thecompany’s performance at the peak and if the level of activities are not increasedby injecting more capital funds, it may lead to serious problem that may lead thecompany exiting the market if it gets to saturated point, becausetelecommunication is a dynamic and complex industry.(ii)Investment in shares of Papanga Plc. is futuristic in terms of yielding profit becausethe industry is at the infant stage which will yield high level of profit in the verynear future.It could be a very good product in the investment portfolio of the company.SKILLS LEVEL EXAMINATIONS – MAY 201521

b)GALADANCI PLC.STATEMENT OF CASHFLOWS FORTHE YEAR ENDED 31 DECEMBER, 2014 (INDIRECT METHOD)OPERATING ACTIVITIES:Profit before taxesAdjustment for non-cash and non-operating itemsDepreciation of property, plant & equipmentAmortisation of intangible assetsFinance costMovement in working capital:Increase in inventory N (120 – 100)Increase in trade receivables N(150 – 70)Decrease in other receivables N(110 – 0)Increase in trade payables N(190 – 140)Cash flows from operating activitiesInterest paidTax paid (Wk 1)(Wk 7Wo

skills level examinations may 2015 1 the institute of chartered accountants of nigeria skills level examinations - may 2015 financial reporting time allowed: 3 hours attempt five questions in all section a: compulsory question (30 marks) question 1 unitarisaton plc