Transcription

Geisinger GoldClassic (HMO)Summary of Benefits

INTRODUCTIONTO SUMMARY OF BENEFITSThank you for your interest in Geisinger Gold Classic(HMO). Our plan is offered by GEISINGER HEALTHPLAN/Geisinger Gold, a Medicare Advantage HealthMaintenance Organization (HMO) that contracts withthe Federal government. This Summary of Benefits tellsyou some features of our plan. It doesn’t list every servicethat we cover or list every limitation or exclusion. To geta complete list of our benefits, please call Geisinger GoldClassic (HMO) and ask for the “Evidence of Coverage”.YOU HAVE CHOICES IN YOUR HEALTH CAREAs a Medicare beneficiary, you can choose from differentMedicare options. One option is the Original (fee-forservice) Medicare Plan. Another option is a Medicarehealth plan, like Geisinger Gold Classic (HMO). Youmay have other options too. You make the choice. Nomatter what you decide, you are still in the MedicareProgram.You may join or leave a plan only at certain times.Please call Geisinger Gold Classic (HMO) at the telephone number listed at the end of this introduction or1-800-MEDICARE (1-800-633-4227) for more information. TTY/TDD users should call 1-877-486-2048.You can call this number 24 hours a day, 7 days a week.HOW CAN I COMPARE MY OPTIONS?You can compare Geisinger Gold Classic (HMO) andthe Original Medicare Plan using this Summary ofBenefits. The charts in this booklet list some importanthealth benefits. For each benefit, you can see what ourplan covers and what the Original Medicare Plan covers.Our members receive all of the benefits that the OriginalMedicare Plan offers. We also offer more benefits, whichmay change from year to year.WHERE IS GEISINGER GOLDCLASSIC (HMO) AVAILABLE?There is more than one plan listed in this Summary ofBenefits. Please refer to the chart in the back of thisSummary for plan availability. If you move out of thestate or county where you currently live, you must callCustomer Service to update your information. If youdon’t, you may be disenrolled from Geisinger Gold.Please call Customer Service to find out if GeisingerGold has a plan in your new state or county.H3954 12256 4 File and Use 9/17/12WHO IS ELIGIBLE TO JOIN GEISINGER GOLDCLASSIC (HMO)?You can join Geisinger Gold Classic (HMO) if you areentitled to Medicare Part A and enrolled in MedicarePart B and live in the service area. However, individualswith End-Stage Renal Disease are generally not eligibleto enroll in Geisinger Gold Classic (HMO) unless theyare members of our organization and have been sincetheir dialysis began.CAN I CHOOSE MY DOCTORS?Geisinger Gold Classic (HMO) has formed a network ofdoctors, specialists, and hospitals. You can only use doctors who are part of our network. The health providers inour network can change at any time.You can ask for a current provider directory. For anupdated list, visit us at tsearch.cfm. Our customer servicenumber is listed at the end of this introduction.WHAT HAPPENS IF I GO TO A DOCTORWHO’S NOT IN YOUR NETWORK?If you choose to go to a doctor outside of our network,you must pay for these services yourself. Neither theplan nor the Original Medicare Plan will pay for theseservices except in limited situations (for example, emergency care).WHERE CAN I GET MY PRESCRIPTIONS IF IJOIN THIS PLAN?Geisinger Gold Classic (HMO) has formed a network ofpharmacies. You must use a network pharmacy to receiveplan benefits. We may not pay for your prescriptions ifyou use an out-of-network pharmacy, except in certaincases. The pharmacies in our network can change at anytime. You can ask for a pharmacy directory or visit us atwww.GeisingerGold.com. Our customer service numberis listed at the end of this introduction.DOES MY PLAN COVER MEDICARE PART B ORPART D DRUGS?Geisinger Gold Classic 1, Classic 3 and Classic 4 docover Medicare Part B prescription drugs. GeisingerGold Classic 1, Classic 3 and Classic 4 do NOT coverMedicare Part D prescription drugs. Geisinger GoldClassic 1 0 Deductible Rx, Classic 3 0 Deductible Rxand Classic 4 0 Deductible Rx do cover both Part Band Part D drugs.

dar year, it must send you a letter at least 90 days beforeyour coverage will end. The letter will explain your options for Medicare coverage in your area.As a member of Geisinger Gold Classic (HMO), youhave the right to request an organization determination,which includes the right to file an appeal if we denycoverage for an item or service, and the right to file agrievance. You have the right to request an organizationdetermination if you want us to provide or pay for anitem or service that you believe should be covered. If wedeny coverage for your requested item or service, youhave the right to appeal and ask us to review our decision. You may ask us for an expedited (fast) coveragedetermination or appeal if you believe that waiting for adecision could seriously put your life or health at risk, oraffect your ability to regain maximum function. If yourdoctor makes or supports the expedited request, we mustexpedite our decision. Finally, you have the right to filea grievance with us if you have any type of problem withus or one of our network providers that does not involvecoverage for an item or service. If your problem involvesquality of care, you also have the right to file a grievanceHOW CAN I GET EXTRA HELP WITH MY PREwith the Quality Improvement Organization (QIO)SCRIPTION DRUG PLAN COSTS OR GET EXTRA for your state. Please refer to the Evidence of CoverageHELP WITH OTHER MEDICARE COSTS?(EOC) for the QIO contact information.You may be able to get extra help to pay for your preAs a member of Geisinger Gold Classic (HMO), youscription drug premiums and costs as well as get helphave the right to request a coverage determination,with other Medicare costs. To see if you qualify for getwhich includes the right to request an exception, theting extra help, call:right to file an appeal if we deny coverage for a prescrip 1-800-MEDICARE (1-800-633-4227). TTY/TDDtion drug, and the right to file a grievance. You have theusers should call 1-877-486-2048, 24 hours a day/7right to request a coverage determination if you want usdays a week and see www.medicare.gov ‘Programs forto cover a Part D drug that you believe should be covPeople with Limited Income and Resources’ in theered. An exception is a type of coverage determination.publication Medicare You.You may ask us for an exception if you believe you need The Social Security Administration at 1-800-772-1213 a drug that is not on our list of covered drugs or believebetween 7 a.m. and 7 p.m., Monday through Friday.you should get a non-preferred drug at a lower out-ofTTY/TDD users should call 1-800-325-0778 orpocket cost. You can also ask for an exception to cost uti Your State Medicaid Office.lization rules, such as a limit on the quantity of a drug.If you think you need an exception, you should contactWHAT ARE MY PROTECTIONS IN THIS PLAN?us before you try to fill your prescription at a pharmacy.All Medicare Advantage Plans agree to stay in the program for a full calendar year at a time. Plan benefits and Your doctor must provide a statement to support yourexception request. If we deny coverage for your prescripcost-sharing may change from calendar year to calendaryear. Each year, plans can decide whether to continue to tion drug(s), you have the right to appeal and ask us toreview our decision. Finally, you have the right to file aparticipate with Medicare Advantage. A plan may congrievance if you have any type of problem with us or onetinue in their entire service area (geographic area wherethe plan accepts members) or choose to continue only in of our network pharmacies that does not involve coverage for a prescription drug. If your problem involvescertain areas. Also, Medicare may decide to end a contract with a plan. Even if your Medicare Advantage Plan quality of care, you also have the right to file a grievanceleaves the program, you will not lose Medicare coverage. with the Quality Improvement Organization (QIO)If a plan decides not to continue for an additional calen- for your state. Please refer to the Evidence of CoverageWHAT IS A PRESCRIPTION DRUGFORMULARY?Geisinger Gold Classic (HMO) uses a formulary. Aformulary is a list of drugs covered by your plan to meetpatient needs. We may periodically add, remove, ormake changes to coverage limitations on certain drugsor change how much you pay for a drug. If we make anyformulary change that limits our members’ ability to filltheir prescriptions, we will notify the affected membersbefore the change is made. We will send a formularyto you and you can see our complete formulary on ourWeb site at https://www.thehealthplan.com/Gold/Landing Pages/Formulary/.If you are currently taking a drug that is not on our formulary or subject to additional requirements or limits,you may be able to get a temporary supply of the drug.You can contact us to request an exception or switch toan alternative drug listed on our formulary with yourphysician’s help. Call us to see if you can get a temporarysupply of the drug or for more details about our drugtransition policy.(EOC) for the QIO contact information.WHAT IS A MEDICATION THERAPY MANAGEMENT (MTM) PROGRAM?A Medication Therapy Management (MTM) Programis a free service we offer. You may be invited to participate in a program designed for your specific health andpharmacy needs. You may decide not to participate butit is recommended that you take full advantage of thiscovered service if you are selected. Contact GeisingerGold Classic (HMO) for more details.WHAT TYPES OF DRUGS MAY BE COVEREDUNDER MEDICARE PART B?Some outpatient prescription drugs may be coveredunder Medicare Part B. These may include, but are notlimited to, the following types of drugs. Contact Geisinger Gold Classic (HMO) for more details.Some Antigens: If they are prepared by a doctor andadministered by a properly instructed person (who couldbe the patient) under doctor supervision.Osteoporosis Drugs: Injectable osteoporosis drugs forsome women.Erythropoietin (Epoetin Alfa or Epogen ): By injectionif you have end-stage renal disease (permanent kidneyfailure requiring either dialysis or transplantation) andneed this drug to treat anemia.Hemophilia Clotting Factors: Self-administered clottingfactors if you have hemophilia.Injectable Drugs: Most injectable drugs administeredincident to a physician’s service.Immunosuppressive Drugs: Immunosuppressive drugtherapy for transplant patients if the transplant tookplace in a Medicare-certified facility and was paid for byMedicare or by a private insurance company that was theprimary payer for Medicare Part A coverage.Some Oral Cancer Drugs: If the same drug is availablein injectable form.Oral Anti-Nausea Drugs: If you are part of an anti-cancer chemotherapeutic regimen.Inhalation and Infusion Drugs administered throughDurable Medical Equipment.WHERE CAN I FIND INFORMATION ON PLANRATINGS?The Medicare program rates how well plans perform indifferent categories (for example, detecting and preventing illness, ratings from patients and customer service).If you have access to the web, you may use the webtools on www.medicare.gov and select “Health andDrug Plans” then “Compare Drug and Health Plans”to compare the plan ratings for Medicare plans in yourarea. You can also call us directly to obtain a copy of theplan ratings for this plan. Our customer service numberis listed below.Please call Geisinger Gold for more informationabout Geisinger Gold Classic (HMO).Visit us at www.GeisingerGold.com or, call us:Customer Service Hours for October 1 – February14:Sunday, Monday, Tuesday, Wednesday, Thursday,Friday, Saturday, 8:00 a.m. - 8:00 p.m. EasternCustomer Service Hours for February 15 – September 30:For information related to the Medicare AdvantageProgram, current members should call: Toll Free: (800)-498-9731 Locally: (570)-271-8771 TTY/TDD 711For information related to the Medicare Part D Prescription Drug Program, current members should call: Toll Free: (800)-988-4861 Locally: (570)-271-8771 TTY/TDD 711For information related to the Medicare AdvantageProgram or Medicare Part D Prescription Drug Program, prospective members should call: Toll Free: (800)-514-0138 TTY/TDD 711For more information about Medicare, please callMedicare at 1-800-MEDICARE (1-800-633-4227).TTY users should call 1-877-486-2048. You can call24 hours a day, 7 days a week.Or, visit www.medicare.gov on the web.This document may be available in other formats suchas Braille, large print or other alternate formats.This document may be available in a non-English language. For additional information, call customer serviceat the phone number listed above.

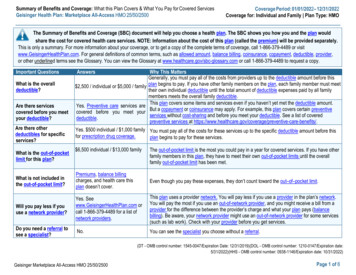

Summary of BenefitsBenefitIf you have any questions about this plan’s benefits or costs, please contact Geisinger Gold for details.OriginalMedicareClassic 1(HMO)Classic 1 0 Deductible Rx(HMO)Classic 3(HMO)Classic 3 0 Deductible(HMO)Classic 4(HMO)Classic 4 0 Deductible Rx(HMO)ʶʶIn 2012 the monthly PartB Premium was 99.90and may change for 2013and the annual Part B deductible amount was 140and may change for 2013.ʶʶIf a doctor or supplierdoes not accept assignment, their costs are oftenhigher, which means youpay more.ʶʶMost people will pay thestandard monthly PartB premium. However,some people will pay ahigher premium becauseof their yearly income(over 85,000 for singles, 170,000 for married couples). For more information about Part B premiums based on income, callMedicare at 1-800-MEDICARE (1-800-633-4227).TTY users should call1-877-486-2048. You mayalso call Social Security at1-800-772-1213. TTY users should call 1-800-3250778.GeneralʶʶPremiums range from 50 to 133 per month.Please refer to the PremiumTable located after this section to find out what thepremium is in your area.ʶʶYou also must continue topay your monthly Medicare Part B premium.ʶʶMost people will pay thestandard monthly Part Bpremium in addition totheir MA plan premium.However, some peoplewill pay higher Part B andPart D premiums becauseof their yearly income(over 85,000 for singles, 170,000 for marriedcouples). For more information about Part B andPart D premiums basedon income, call Medicareat 1-800-MEDICARE(1-800-633-4227). TTYusers should call 1-877486-2048. You may alsocall Social Security at1-800-772-1213. TTY users should call 1-800-3250778.In-Networkʶʶ 2,800 out-of-pocketlimit for Medicare-coveredservices and select NonMedicare SupplementalServices. Contact plan fordetails regarding Non-GeneralʶʶPremiums range from 88 to 171 per month.Please refer to the PremiumTable located after this section to find out what thepremium is in your area.ʶʶYou also must continue topay your monthly Medicare Part B premium.ʶʶMost people will pay thestandard monthly Part Bpremium in addition totheir MA plan premium.However, some peoplewill pay higher Part B andPart D premiums becauseof their yearly income(over 85,000 for singles, 170,000 for marriedcouples). For more information about Part B andPart D premiums basedon income, call Medicareat 1-800-MEDICARE(1-800-633-4227). TTYusers should call 1-877486-2048. You may alsocall Social Security at1-800-772-1213. TTY users should call 1-800-3250778.In-Networkʶʶ 2,800 out-of-pocketlimit for Medicare-coveredservices and select NonMedicare SupplementalServices. Contact plan fordetails regarding Non-Generalʶʶ 0 monthly plan premium in addition to yourmonthly Medicare Part Bpremium.ʶʶMost people will pay thestandard monthly Part Bpremium in addition totheir MA plan premium.However, some peoplewill pay higher Part B andPart D premiums becauseof their yearly income(over 85,000 for singles, 170,000 for marriedcouples). For more information about Part B andPart D premiums basedon income, call Medicareat 1-800-MEDICARE (1800-633-4227). TTY usersshould call 1-877-4862048. You may also call Social Security at 1-800-7721213. TTY users shouldcall 1-800-325-0778.In-Networkʶʶ 1,300 annual deductible. Contact the plan forservices that apply.ʶʶ 2,000 out-of-pocketlimit for Medicare-coveredservices and select NonMedicare SupplementalServices. Contact plan fordetails regarding NonMedicare SupplementalServices covered under thislimit.Generalʶʶ 41 monthly plan premium in addition to yourmonthly Medicare Part Bpremium.ʶʶMost people will pay thestandard monthly Part Bpremium in addition totheir MA plan premium.However, some peoplewill pay higher Part B andPart D premiums becauseof their yearly income(over 85,000 for singles, 170,000 for marriedcouples). For more information about Part B andPart D premiums basedon income, call Medicareat 1-800-MEDICARE (1800-633-4227). TTY usersshould call 1-877-4862048. You may also call Social Security at 1-800-7721213. TTY users shouldcall 1-800-325-0778.In-Networkʶʶ 1,300 annual deductible. Contact the plan forservices that apply.ʶʶ 2,000 out-of-pocketlimit for Medicare-coveredservices and select NonMedicare SupplementalServices. Contact plan fordetails regarding NonMedicare SupplementalServices covered under thislimit.Generalʶʶ 0 monthly plan premium in addition to yourmonthly Medicare Part Bpremium. Most people will pay thestandard monthly Part Bpremium in addition totheir MA plan premium.However, some peoplewill pay higher Part B andPart D premiums becauseof their yearly income(over 85,000 for singles, 170,000 for marriedcouples). For more information about Part B andPart D premiums basedon income, call Medicareat 1-800-MEDICARE (1800-633-4227). TTY usersshould call 1-877-4862048. You may also call Social Security at 1-800-7721213. TTY users shouldcall 1-800-325-0778.In-Network 1,600 annual deductible. Contact the plan forservices that apply. 2,300 out-of-pocketlimit for Medicare-coveredservices and select NonMedicare SupplementalServices. Contact plan fordetails regarding NonMedicare SupplementalServices covered under thislimit.Generalʶʶ 45 monthly plan premium in addition to yourmonthly Medicare Part Bpremium. Most people will pay thestandard monthly Part Bpremium in addition totheir MA plan premium.However, some peoplewill pay higher Part B andPart D premiums becauseof their yearly income(over 85,000 for singles, 170,000 for marriedcouples). For more information about Part B andPart D premiums basedon income, call Medicareat 1-800-MEDICARE (1800-633-4227). TTY usersshould call 1-877-4862048. You may also call Social Security at 1-800-7721213. TTY users shouldcall 1-800-325-0778.In-Network 1,600 annual deductible. Contact the plan forservices that apply. 2,300 out-of-pocketlimit for Medicare-coveredservices and select NonMedicare SupplementalServices. Contact plan fordetails regarding NonMedicare SupplementalServices covered under thislimit.IMPORTANTINFORMATION1 - Premium and OtherImportant Information67

Summary of BenefitsBenefitOriginalMedicareʶʶYou may go to any doc2 - Doctor andtor, specialist or hospitalHospital Choicethat accepts Medicare.(For moreinformation, see Emergency Care - #15 and Urgently Needed Care - #16.)Classic 1(HMO)Classic 1 0 Deductible Rx(HMO)Classic 3(HMO)Classic 3 0 Deductible(HMO)Classic 4(HMO)Classic 4 0 Deductible Rx(HMO)Medicare SupplementalServices covered under thislimit.Medicare SupplementalServices covered under thislimit.In-NetworkʶʶYou must go to networkdoctors, specialists, andhospitals.ʶʶReferral required for network specialists (for certainbenefits).In-NetworkʶʶYou must go to networkdoctors, specialists, andhospitals.ʶʶReferral required for network specialists (for certainbenefits).In-NetworkʶʶYou must go to networkdoctors, specialists, andhospitals.ʶʶReferral required for network specialists (for certainbenefits).In-NetworkʶʶYou must go to networkdoctors, specialists, andhospitals.ʶʶReferral required for network specialists (for certainbenefits).In-Network You must go to networkdoctors, specialists, andhospitals. Referral required for network specialists (for certainbenefits).In-Network You must go to networkdoctors, specialists, andhospitals. Referral required for network specialists (for certainbenefits).In-NetworkʶʶNo limit to the numberof days covered by the planeach hospital stay.ʶʶFor Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper dayʶʶ 0 copay for additionalhospital daysʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkʶʶNo limit to the numberof days covered by the planeach hospital stay.ʶʶFor Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper dayʶʶ 0 copay for additionalhospital daysʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkʶʶNo limit to the numberof days covered by the planeach hospital stay.ʶʶ 750 out-of-pocket limitevery year.ʶʶ 0 copayʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkʶʶNo limit to the numberof days covered by the planeach hospital stay.ʶʶ 750 out-of-pocket limitevery year.ʶʶ 0 copayʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-Network No limit to the numberof days covered by the planeach hospital stay. 750 out-of-pocket limitevery year. 0 copay Except in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-Network No limit to the numberof days covered by the planeach hospital stay. 750 out-of-pocket limitevery year. 0 copay Except in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.INPATIENT CARE3 - InpatientHospital Care(includes Substance Abuseand RehabilitationServices)ʶʶIn 2012 the amounts foreach benefit period were:ʶʶDays 1 - 60: 1156 deductibleʶʶDays 61 - 90: 289 perdayʶʶDays 91 - 150: 578 perlifetime reserve dayʶʶThese amounts maychange for 2013.ʶʶCall 1-800-MEDICARE(1-800-633-4227) forinformation about lifetimereserve days.ʶʶLifetime reserve days canonly be used once.ʶʶA “benefit period” startsthe day you go into ahospital or skilled nursingfacility. It ends when yougo for 60 days in a rowwithout hospital or skillednursing care. If you gointo the hospital after onebenefit period has ended, anew benefit period begins.You must pay the inpatienthospital deductible for each89

Summary of BenefitsBenefitOriginalMedicareClassic 1(HMO)Classic 1 0 Deductible Rx(HMO)Classic 3(HMO)Classic 3 0 Deductible(HMO)Classic 4(HMO)Classic 4 0 Deductible Rx(HMO)benefit period. There is nolimit to the number of benefit periods you can have.4 - Inpatient MentalHealth CareʶʶIn 2012 the amounts foreach benefit period were:ʶʶDays 1 - 60: 1156 deductibleʶʶDays 61 - 90: 289 perdayʶʶDays 91 - 150: 578 perlifetime reserve dayʶʶThese amounts maychange for 2013.ʶʶYou get up to 190 daysof inpatient psychiatrichospital care in a lifetime.Inpatient psychiatric hospital services count toward the 190-day lifetimelimitation only if certainconditions are met. Thislimitation does not applyto inpatient psychiatric services furnished in a generalhospital.In-NetworkʶʶYou get up to 190 daysof inpatient psychiatrichospital care in a lifetime.Inpatient psychiatric hospital services count toward the 190-day lifetimelimitation only if certainconditions are met. Thislimitation does not applyto inpatient psychiatric services furnished in a generalhospital.ʶʶFor Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper dayʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkʶʶYou get up to 190 daysof inpatient psychiatrichospital care in a lifetime.Inpatient psychiatric hospital services count toward the 190-day lifetimelimitation only if certainconditions are met. Thislimitation does not applyto inpatient psychiatric services furnished in a generalhospital.ʶʶFor Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper dayʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkYou get up to 190 days ofinpatient psychiatric hospital care in a lifetime. Inpatient psychiatric hospitalservices count toward the190-day lifetime limitationonly if certain conditionsare met. This limitationdoes not apply to inpatient psychiatric servicesfurnished in a Generalhospital.ʶʶFor Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper dayʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkYou get up to 190 days ofinpatient psychiatric hospital care in a lifetime. Inpatient psychiatric hospitalservices count toward the190-day lifetime limitationonly if certain conditionsare met. This limitationdoes not apply to inpatient psychiatric servicesfurnished in a Generalhospital.ʶʶFor Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper dayʶʶExcept in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkYou get up to 190 days ofinpatient psychiatric hospital care in a lifetime. Inpatient psychiatric hospitalservices count toward the190-day lifetime limitationonly if certain conditionsare met. This limitationdoes not apply to inpatient psychiatric servicesfurnished in a Generalhospital. For Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper day Except in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.In-NetworkYou get up to 190 days ofinpatient psychiatric hospital care in a lifetime. Inpatient psychiatric hospitalservices count toward the190-day lifetime limitationonly if certain conditionsare met. This limitationdoes not apply to inpatient psychiatric servicesfurnished in a Generalhospital. For Medicare-coveredhospital stays:ʶʶDays 1 - 5: 100 copayper dayʶʶDays 6 - 90: 0 copayper day Except in an emergency,your doctor must tell theplan that you are going tobe admitted to the hospital.5 - Skilled Nursing Facility(SNF)(in a Medicare-certifiedskilled nursing facility)ʶʶIn 2012 the amounts foreach benefit period after atleast a 3-day covered hospital stay were:ʶʶDays 1 - 20: 0 per dayʶʶDays 21 - 100: 144.50per dayʶʶThese amounts maychange for 2013.ʶʶA “benefit period” startsthe day you go into a hospital or SNF. It ends whenyou go for 60 days in a rowwithout hospital or skilledGeneralʶʶAuthorization rules mayapply.In-NetworkʶʶPlan covers up to 100days each benefit periodʶʶNo prior hospital stay isrequired.ʶʶFor SNF stays:ʶʶDays 1 - 6: 0 copayper dayʶʶDays 7 - 44: 75 copayper dayʶʶDays 45 - 100: 0GeneralʶʶAuthorization rules mayapply.In-NetworkʶʶPlan covers up to 100days each benefit periodʶʶNo prior hospital stay isrequired.ʶʶFor SNF stays:ʶʶDays 1 - 6: 0 copayper dayʶʶDays 7 - 44: 75 copayper dayʶʶDays 45 - 100: 0GeneralʶʶAuthorization rules mayapply.In-NetworkʶʶPlan covers up to 100days each benefit periodʶʶNo prior hospital stay isrequired.ʶʶ 0 copay for SNF servicesʶʶ 1,000 out-of-pocketlimit every year.GeneralʶʶAuthorization rules mayapply.In-NetworkʶʶPlan covers up to 100days each benefit periodʶʶNo prior hospital stay isrequired.ʶʶ 0 copay for SNF servicesʶʶ 1,000 out-of-pocketlimit every year.General Authorization rules mayapply.In-Network Plan covers up to 100days each benefit period No prior hospital stay isrequired. 0 copay for SNF services 1,000 out-of-pocketlimit every year.General Authorization rules mayapply.In-Network Plan covers up to 100days each benefit period No prior hospital stay isrequired. 0 copay for SNF services 1,000 out-of-pocketlimit every year.1011

Summary of BenefitsBenefitOriginalMedicareClassic 1(HMO)copay per daynursing care. If you gointo the hospital after onebenefit period has ended, anew benefit period begins.You must pay the inpatienthospital deductible for eachbenefit period. There is nolimit to the number of benefit periods you can have.Classic 1 0 Deductible Rx(HMO)Classic 3(HMO)Classic 3 0 Deductible(HMO)Classic 4(HMO)Classic 4 0 Deductible Rx(HMO)copay per dayGeneralʶʶAuthorization rules mayapply.In-Networkʶʶ 0 copay for Medicarecovered home health visitsGeneralʶʶAuthorization rules mayapply.In-Networkʶʶ 0 copay for Medicarecovered home health visitsIn-Networkʶʶ 0 copay for Medicarecovered home health visitsIn-Networkʶʶ 0 copay for Medicarecovered home health visitsIn-Network 0 copay for Medicarecovered home health visitsIn-Network 0 copay for Medicarecovered home health visitsʶʶYou pay part of the costfor outpatient drugs andinpatient respite care.ʶʶYou must get care from aMedicare-certified hospice.GeneralʶʶYou must get care from aMedicare-certified hospice.Your plan will pay for aconsultative visit beforeyou select hospice.GeneralʶʶYou must get care from aMedicare-certified hospice.Your plan will pay for aconsultative visit beforeyou select hospice.GeneralʶʶYou must get care from aMedicare-certified hospice.Your plan will pay for aconsultative visit beforeyou select hospice.GeneralʶʶYou must get care from aMedicare-certified hospice.Your plan will pay for aconsultative visit beforeyou select hospice.General You must get care from aMedicare-certified hospice.Your plan will pay for aconsultative visit beforeyou select hospice.General You must get care from aMedicare-certified hospice.Your plan will pay for aconsultative visit beforeyou select hospice.8 - Doctor Office Visitsʶʶ20% coinsuranceIn-Networkʶʶ 10 copay for eachMedicare-covered primarycare doctor visit.ʶʶ 20 copay for eachMedicare-covered specialistvisit.In-Networkʶʶ 10 copay for eachMedicare-covered primarycare doctor visit.ʶʶ 20 copay for eachMedicare-covered specialistvisit.In-Networkʶʶ 10 copay for eachMedicare-covered primarycare doctor visit.ʶʶ 25 copay for eachMedicare-covered specialistvisit.In-Networkʶʶ 10 copay for eachMedicare-covered primarycar

a complete list of our benefits, please call Geisinger Gold Classic (HMO) and ask for the "Evidence of Coverage". . Geisinger Gold Classic 1 0 Deductible Rx, Classic 3 0 Deductible Rx and Classic 4 0 Deductible Rx do cover both Part B and Part D drugs. H3954 12256_4 File and Use 9/17/12