Transcription

January to March 2009, Volume 5, Issue #1(This Newsletter is a quarterly publication containing topics of interest to the categories ofMSBs regulated by the Georgia Department of Banking and Finance. We hope that you willfind this publication to be informative and valuable for providing information about theissues affecting your industry. If there are any issues you would like for the Departmentto highlight or address in future editions, please e-mail your questions or suggestions todbfmort@dbf.state.ga.us.)REGULATORY MATTERSGeorgia Regulatory IssuesNews Notes from the Desk of Teresa KoeppelAdministrative ExaminerSOCs and MTs‐ LOCATIONSIn This Issue:REGULATORY MATTERSDBF AdministrativeNotesMoney Transmitterand Seller of ChecksRenewalsSemi-AnnualReporting122BSA/FEDERAL NEWSWhen compiling information for the semi‐annual report (due March 1, 2009 forthe July through December 2008 reporting period), be sure that you include alllocations. Considering that you may have branches as well as agents, you mustinclude both. In addition, consider that your agents may have more than onelocation, so you must list each location. Remember, each location must beconsidered for your bond amount, and note that each location increases therequired bond by 5,000 to a maximum of 250,000 for the required amountbased on locations. If your average daily outstandings exceed 250,000, youmust increase your bond based on outstandings. Please refer to our frequentlyasked questions on our website (www.gadbf.org) and refer to Code Section 7‐1‐683.MSB RegistrationHB 4049- MoneyService Business Actof 2008FINANCIAL STATEMENTS/ACCOUNTING SYSTEMS and AUDITSDepartment ContactInformation33OTHER NEWSState Holidays-20094Customer Service Star5Action on ApplicationsDuring the PreviousQuarter/ClosedLicensees5to89One thing I noticed during renewals was that many of you do not include youroutstanding transactions on your balance sheet as either an asset or a liability.Outstanding transactions are those that are not completed in 24 hours andtherefore they are receivable as an asset, or payable as a liability. Completedtransactions are those that are paid to the intended recipient (not the bank oragent location). Your accounting system should reflect these amounts on yourbalance sheet as a receivable if it is coming to you and a payable if it is being sent.Sellers of Checks are required to have an annual audit performed and a copy of that audit is required to be provided tothe Department of Banking and Finance within 30 days of the date you receive it. All balance sheet items should beproperly categorized. In addition, all Sellers of Checks and Money Transmitters must maintain General Ledgers which shallbe posted at least monthly containing all assets, liabilities, capital, and income and expense accounts, as required by CodeSection 7‐1‐687.1(a)(2).MISCELLANEOUSLicensees must notify the Department when you move your main office or any other offices or when you close anylocation.-1-

When your owners or officers change, do the following: go to our website and print the Form MSB3 for each new officeror owner, send in with fingerprint cards and a recent credit report so that we can investigate and approve theseindividuals.Thank you to those who renewed in a timely manner. You should have received your license certificate by email. Be sureto keep your contact information current so that emailed notices reach the correct party.You should have received a notice by email telling you that Semi Annual Reporting began on January 2, 2009. Whencompleting this report online, you must include the name of any revoked agents, the reason revoked, and the amount ofany outstanding claims involved (Rule 80‐3‐1‐.01(4)).HAPPY NEW YEAR!Money Transmitter and Check SellerRenewalsLicensed Money Transmitters and Sellers ofChecks who had not completed their renewalby the midnight December 31, 2008 deadlinehave had their licenses expire and will have tocease money service business operations. Failureto properly RENEW a license will require aREINSTATEMENT of the license in order to conductcheck selling/transmission activity in Georgia.Those affected should please see the applicationon the internet at:http://dbf.georgia.gov/msbforms.Semi‐Annual Reporting:Check Sellers and Money TransmittersIt is time once again to submit Semi‐Annual Reportinformation. As with the last reporting period, thesereports must be made by the licensee on‐line. Noelectronic (CD/diskette) submissions to this office willbe accepted, with the exception of the initial filesubmitted when a licensee is first approved.Passwords to the system are provided in a letternotifying licensees of the new process. You maychange the password at any time.Quarterlynotifications are being sent to each licensee licenseeswill be notified by e‐mail only. Please make certainyour e‐mail on file is correct!Note this screen. Direct links are available fromthe Department’s MSB website:http://www.ganet.org/dbf/other forms.html-2-

BSA/FEDERAL NEWSFINCEN ‐ MSB RegistrationNEW BSA EXAMINATION MANUALRemember that it is time to renew yourregistration with FinCEN.FinCEN has released a manual for examiners ofmoney services businesses. The manual providespolicies and procedures to use to evaluate whetherand MSB’s anti‐money laundering program isadequate to comply with the requirements of theBank Secrecy Act.The manual includesinformation regarding what your program isrequired to include, BSA/AML risks, and soundpractices to use to mitigate those risks.For all entities required to register, renewal of thatregistration is due by December 31 of the secondyear from the registration date, and then due bi‐annually thereafter. For instance, if you firstregistered on October 3, 2007 then you shouldhave renewed that registration by December 31,2008.A copy of the manual is available at:FinCEN has as convenient RENEWAL CALCULATORto help you determine your renewal date. Goto:http://www.fincen.gov/news room/rp/msb exam materials.htmlhttp://www.msb.gov/guidance/msb calculator.phpFYI - House Bill 4049 - PendingAs we noted last quarter, House Bill 4049, the purpose of which is to amend section 5318 of Title 31, UnitedStates Code by eliminating regulatory burdens imposed on insured depository institutions and money servicesbusinesses and enhance the availability of transaction accounts at depository institutions for such business, hasbeen passed in the House.As of November 6, 2008, the bill is still pending a vote in the Senate. Licensees should keep in mind thatdebate may be taking place on a companion bill in the Senate, rather than on this particular bill. Last Action onthe bill was July 23, 2008 after being received in the Senate and read twice and referred to the Committee onBanking, Housing, and Urban Affairs. The next meeting of the Senate is Jan 2, 2009.RECAP: Known as the Money Service Business Act of 2008, this bill amends federal law governing anti-moneylaundering programs to provide that an insured depository institution has no obligation to review thecompliance with federal anti-money laundering requirements of a money transmitting business for whom itmaintains an account if such institution has on file specified mandatory self-certifications submitted by themoney transmitting business.The bill provides that money services businesses (MSBs) may self-certify their compliance with anti-money andcounter-terrorism regulations when establishing accounts with federally insured depository institutions. MSBsmust certify that they are in compliance with federal banking law and registered as such. Additionally, the MSB-3-

must certify that it maintains an anti-money laundering program as required by federal law, be licensed orregistered as an MSB by each State in which it operates, and meet such other regulations as the TreasurySecretary formulates to assure strong anti-crime regimes. The bill prescribes requirements for self-certification bya money transmitting businessThe MSB certification requirements under this bill also extend to agents of money transmitting businesses. Inaddition to the certification requirements for MSBs, agents of MSBs must provide that they are contract boundagents of an MSB, will comply with all applicable laws, and will notify any federally insured depository institutionof any material changes to their relationship with the MSB to which they are a contracted agent.The Bill also sets forth civil and criminal penalties for violations of this Act without regard to whether suchviolations were willful and shields such institution from liability for the non-compliance of a money transmittingbusiness and its agents with federal anti-money laundering requirements. The Bill directs the Secretary of theTreasury to prescribe implementing regulations.2009 State HolidaysIn accordance with O.C.G.A. §1‐4‐1, Governor Sonny Perdue proclaimed thefollowing dates as public and legal holidays for the year 2009.NOTEDEPARTMENT OFFICES WILL BE CLOSED THIS FIRST QUARTER ON JANUARY 19, 2009 INHONOR OF THE MARTIN LUTHER KING, JR. HOLIDAY.HOLIDAY DATEOBSERVANCE DATENew Year’s DayThursday, January 1Martin Luther King Jr.’s BirthdayMonday, January 19Confederate Memorial DayApril 26 will be observed Monday, April 27Memorial DayMonday, May 25Independence DayJuly 4 will be observed Friday, July 3Labor DayMonday, September 7Columbus DayMonday, October 12Veterans’ DayWednesday, November 11Thanksgiving DayThursday, November 26Robert E. Lee’s BirthdayJanuary 19 will be observed on Friday, November 27Washington’s BirthdayFebruary 16 will be observed on Thursday, December 24Christmas DayFriday, December 25E‐MAIL UPDATES!!! https://bkgfin.dbf.state.ga.us/MSBUpdate.htmlA reminder –make certain we have the correct e‐mail address for your license or registration so that you will receive allnotices and correspondence!-4-

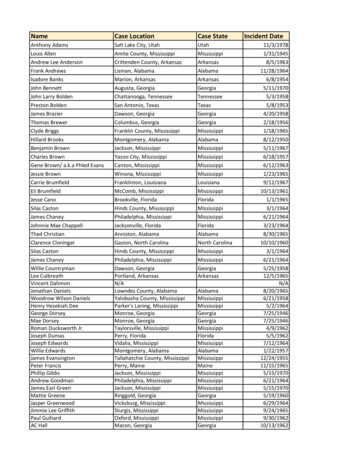

CUSTOMER SERVICE GEORGIAGovernor Sonny Perdue’s campaign is to put new emphasis on customer service, emphasizing easier access to governmentservices, faster processes so customers can get business done quickly, and friendlier service in a customer-focused, goaloriented culture. It is the Department’s goal to provide excellent customer service, meeting and exceeding theexpectations of our customers. Along those lines, we would like to recognize the following individual for going above andbeyond in serving our customers.Applications Analyst Susan Nelson (NDFI Division‐MSBs): The Department received surveycomments from three different customers regarding Susan's overall quality of service: ".inprocessing the application and background checks.excellent and direct." ".Mrs. Susan Nelson'scourtesy and how fast the application was processed." "Prompt e‐mail responses and updates. Mycontact Ms. Susan Nelson (has) always been knowledgeable and helpful.""CONGRATULATIONS AND GREAT JOB!!The Department is the state agency that regulates and examines banks, credit unions, and trust companies chartered by the State.The Department also has regulatory and/or licensing authority over mortgage brokers, lenders, and processors, money servicebusinesses, international banking organizations, and bank holding companies conducting business in Georgia.Our MISSIONis to promote safe, sound, competitive financial services in Georgiathrough innovative, responsive regulation and supervision.Z Z ZOur VISIONis to be the best financial services industry regulator in the countryProgressive. Proactive. Service-Oriented.ACTION ON APPLICATIONS DURING THE PREVIOUS QUARTERAPPROVED CHECK CASHERS (License/Registration) – Fourth Quarter 2008Lic 0-5-Company NameDoraville Food Mart, Inc.Kiran, Inc.Sadhi Krupa, Inc.HNG Enterprises, Inc.Shree Prabhu Krupa, Inc.Purity Enterprise, Inc.Elias Investments, Inc.Carniceria La Superior, Inc.Kynn, Inc.Jai Bhole, Inc.DBA NameDoraville Food MartMini Mart #2Clean Scene LaundryHNG Check CashingABC Convenience StorePurity EnterpriseBig John's PackageCarniceria La SuperiorChevronMinit taStone 10/20/0810/22/0810/27/0810/27/0810/29/08

Lic #2367123672Company NameEagles Landing, Inc.Golden Pond, 746237472374823750Mera Enterprise, Inc.Gul and Sons CorporationBlocker's Convenience Market, Inc.Krisha Investment, Inc.P&C Check Cashing, Inc.Won & Kim Investment, Inc.Sri Khalsa Inc.DS Convenience Store, Inc.Stop 5, LLCCarniceria Potosina, Inc.R Mohan CorporationNarcisa LeonardoPatricia Waddell PurvisDC Stores, Inc.Riley's Cellar, LLCAzkar, Inc.Henil Alma CorporationBig O's Package Store, Inc.Danneman's Supermarket, Inc.Felton's Red & White, Inc.Jay Santram, Inc.DYYU, Inc.Deano's Outlet, Inc.Shinhan Enterprise, Inc.Larry's Check Cashing, LLCShree Siya, Inc.Catalina Supermarket, Inc.LBN Enterprises, LLCAli & Ali Business, Inc.Fresco MartinLibaas Town, LLCHR Beverage, IncAKN Enterpises, Inc.KAN Investments, Inc.American Family Tax Service Corp.Xpand Petroleum, Inc.C.W.O Enterprises, Inc.SAEE, Inc.Moultrie Package Store, Inc.Song's Curb Market, Inc.Jeeba, LLCGane, Inc.R.R.P. Enterprises, Inc.-6-DBA NameB2E Mobile Financial ServicesGood Spirits PackageTexaco Food MartBlocker's Convenience MarketDiscount Tobacco #5P&C Check CashingRedan Package StoreBest Value OnePhillips 66 Food MartCarniceria PostinaQuick Stop #2Abarrotes Emanuel 2Quality Pawn & SalesExxon MarketThe Check CompanyShell Food MartQuick StopSouthside Package ShopForsyth PackageMoe's OutletCurley's OutletLarry's Check CashingCordele Food MartCatalina SupermarketLBN EnterprisesParker GroceryAmerica's Mail CenterMcleod's Food StoreDixie Food MartSigman Road BPA&E Check CashingChevron Food MartG's Package StoreRoc's Corke AmericusAtlantaStone MountainStone evilleByronRed orsythMorrowEllenwoodUnion CityCordeleHapevilleCollege cial CircleMabletonRomeRoswellMoultrieAugustaLocust 0812/10/0812/16/0812/16/0812/16/0812/11/08

Lic #2376023761237622376323764237652377023771Company NameMoreland Bottle Shop, Inc.MPV Inc.Charania Investment, Inc.K & C Foods, LLCKeith M. WallThe Shipping Center, Inc.Columbia Crossing Partners, LLCSouthern Creations DevelopmentGroup, LLCS&S Bottleshop, LLC23775DBA NameY&T Check CashingMarket Place #6Papa's Market PlaceSuper Thrift Food StoreWall to Wall PackageFive Boroughs Check CashingRock Chapel leeLTOTAL12/23/0864R Registrant L Full ServiceEXPIRED/CLOSED CHECK CASHERS (License/Registration)Lic #138512194321987224752341223624CompanyJIA UN'S CorporationMS&J, Inc.B&K Group, Inc.Kritika Investment, Inc.All Pro Financial Services of MariettaLLCLocal Check Cashing, Inc.DBA NameQuick Mini MarketDon TreeBig John's PackageDiscount Check CashingCityColumbusNorcrossStone MountainAmericusAll Pro Financial Services of MariettaLocal Check CashingMariettaDoravilleTypeRDLDLDLDDate 31/0810/22/086APPROVED NAME CHANGE: CHECK SELLERS/ MONEY TRANSMITTERSLic #Company NameApproved Money Transmitters/SOC NamesNONEDBA NameCityTotal-7-STApproved0

APPROVED/EXPIRED CHECK SELLERS/ MONEY TRANSMITTERSLic #Company NameApproved Money Transmitters23569DBA NameCityTempo Financial U.S. CorporationGV Financial Corp.11/20/200823711Google Payment Corp.12/22/2008Closed Money TransmittersGlobal FX, Inc.18930 Orlandi Valuta18939 Vigo Remittance Corp.20502 iKobo, Inc.22768 Aaran Financial Services, Inc.21262Kim Dinh Vinh Phat, Inc.Closed Seller of Check Licensees902218675Travellers Cheque Associates LTDGolden Pantry Food Stores, Inc.DBA NameCOFLCA3STGlobal FX(Merger)12/31/08MiamiFLOrlandi ValutaVigo COFLGAMNGASTDBA NameTravellers Cheque Associates,Ltd.Golden Pantry Food StoresCheck Casher Upgrades/Downgrades in Third QuarterDowngraded from Full License to Registration –0 Total for 2008 - 31Upgraded from Registration to Full License – 3 Total for 2008 - /08NAGA8

Department Contact InformationNAMEE-MAIL ADDRESSPHONE#Melinda Kinard, Director of Money Service Businesses andMortgage Licensingmkinard@dbf.state.ga.us770-986-1649Joel Byers, Supervisory Manager - Money Service eter Lisowski, Financial Examinerlisowski@dbf.state.ga.us770-986-1315Teresa Koeppel, Administrative Examinertkoeppel@dbf.state.ga.us770-986-1639Susan Nelson, Applications Analystnelson@dbf.state.ga.us770-986-1652Mailing Address: Department of Banking and Finance2990 Brandywine Road, Suite 200Atlanta, GA 30341-5565Website: http://dbf.georgia.govPhone & Fax Numbers: Phone:(770) 986-1633 orToll Free: (888) 986-1633Fax: (770) 986-1655 or (770) 986-1029E-MAILING THE DEPARTMENTThe Department would like to encourage you to correspond with us using e-mail. Providing written details inthe e-mail regarding any questions or concerns you may have allows the Department to forward the requestto the appropriate person who handles that area, and if sufficient details are included in the request, thatperson can then more efficiently provide you an answer.The main Division e-mail address isdbfmort@dbf.state.ga.usIn the event you still need additional information or you do not receive a timely response to your e-mail,please contact us by phone.NOTE: This publication is delivered to interested parties via e-mail and is alsoavailable from the Department’s website at: http:// dbf.georgia.gov underNews/Press Releases. If you would like to be added to our distribution list,please send an e-mail to dbfcorp@dbf.state.ga.us and indicate your name, thecompany you are with, license or registration # (if applicable), and phonenumber. Also, please indicate which publication(s) you would like to receive.See the list under PUBLICATIONS on our home page.-9-

FINCEN ‐ MSB Registration Remember that it is time to renew your registration with FinCEN. For all entities required to register, renewal of that registration is due by December 31 of the second year from the registration date, and then due bi‐ annually thereafter. For instance, if you first