Transcription

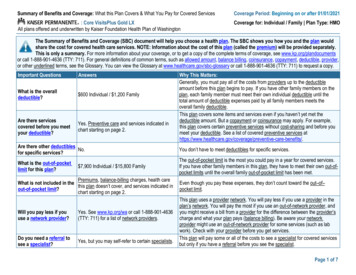

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered ServicesCoverage Period: Beginning on or after 01/01/2021: Core VisitsPlus Gold LXAll plans offered and underwritten by Kaiser Foundation Health Plan of WashingtonCoverage for: Individual / Family Plan Type: HMOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, see www.kp.org/plandocumentsor call 1-888-901-4636 (TTY: 711). For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider,or other underlined terms, see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary or call 1-888-901-4636 (TTY: 711) to request a copy.Important QuestionsAnswersWhat is the overalldeductible? 600 Individual / 1,200 FamilyAre there servicescovered before you meetyour deductible?Yes. Preventive care and services indicated inchart starting on page 2.Why This Matters:Generally, you must pay all of the costs from providers up to the deductibleamount before this plan begins to pay. If you have other family members on theplan, each family member must meet their own individual deductible until thetotal amount of deductible expenses paid by all family members meets theoverall family deductible.This plan covers some items and services even if you haven’t yet met thedeductible amount. But a copayment or coinsurance may apply. For example,this plan covers certain preventive services without cost-sharing and before youmeet your deductible. See a list of covered preventive services are-benefits/.Are there other deductiblesNo.for specific services?You don’t have to meet deductibles for specific services.What is the out-of-pocketlimit for this plan?The out-of-pocket limit is the most you could pay in a year for covered services.If you have other family members in this plan, they have to meet their own out-ofpocket limits until the overall family out-of-pocket limit has been met. 7,900 Individual / 15,800 FamilyPremiums, balance-billing charges, health careWhat is not included in thethis plan doesn’t cover, and services indicated inout-of-pocket limit?chart starting on page 2.Will you pay less if youuse a network provider?Yes. See www.kp.org/wa or call 1-888-901-4636(TTY: 711) for a list of network providers.Do you need a referral tosee a specialist?Yes, but you may self-refer to certain specialists.Even though you pay these expenses, they don’t count toward the out–of–pocket limit.This plan uses a provider network. You will pay less if you use a provider in theplan’s network. You will pay the most if you use an out-of-network provider, andyou might receive a bill from a provider for the difference between the provider’scharge and what your plan pays (balance billing). Be aware your networkprovider might use an out-of-network provider for some services (such as labwork). Check with your provider before you get services.This plan will pay some or all of the costs to see a specialist for covered servicesbut only if you have a referral before you see the specialist.Page 1 of 7

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.Common MedicalEventServices You May NeedPrimary care visit to treatan injury or illnessIf you visit a healthcare provider’soffice or clinicIf you have a testSpecialist visitWhat You Will PayNetwork ProviderNon-Network Provider(You will pay the least)(You will pay the most) 15 / visit, deductible does notNot coveredapply 35 / visit, deductible does notNot coveredapplyPreventive care/screening/ No charge, deductible doesnot apply.immunizationNoneNot coveredNoneX-ray services: 20 / visit,deductible does not applyOther lab services: 20 / visit,deductible does not applyNot coveredImaging (CT/PET scans,MRIs)25% coinsuranceNot coveredPreferred generic drugs 15 (retail); 10 (mail order) / prescription,deductible does not apply.Not covered 45 (retail); 40 (mail order) / prescription,deductible does not apply.Not coveredNon-preferred drugsNoneYou may have to pay for services that aren’tpreventive. Ask your provider if the servicesneeded are preventive. Then check what yourplan will pay for.Diagnostic test (x-ray,blood work)If you need drugs totreat your illness orconditionMore informationPreferred brand drugsabout prescriptiondrug coverage isavailable atwww.kp.org/waLimitations, Exceptions, & Other ImportantInformation40% coinsurance (retail);35% coinsurance (mail order) / Not coveredprescriptionPreauthorization required or will not becovered.Up to a 30-day supply (retail); up to a 90-daysupply (mail order). Subject to formularyguidelines. After the first fill, maintenance drugsare required to be filled at a KFHPWA Clinic orthrough KFHPWA mail order.Up to a 30-day supply (retail); up to a 90-daysupply (mail order). Subject to formularyguidelines. After the first fill, maintenance drugsare required to be filled at a KFHPWA Clinic orthrough KFHPWA mail order.Up to a 30-day supply (retail); up to a 90-daysupply (mail order). Subject to formularyguidelines, when approved through theexception process. After the first fill,maintenance drugs are required to be filled at aKFHPWAO Clinic or through KFHPWAO mailPage 2 of 7

Common MedicalEventServices You May NeedSpecialty drugsIf you haveoutpatient surgeryIf you needimmediate medicalattentionIf you have ahospital stayWhat You Will PayNetwork ProviderNon-Network Provider(You will pay the least)(You will pay the most)40% coinsurance (retail)Facility fee (e.g.,25% coinsuranceambulatory surgery center)Physician/surgeon fees25% coinsuranceNot coveredorder.Up to a 30-day supply (retail). Subject toformulary guidelines, when approved throughthe exception process.Not coveredNoneNot coveredNoneYou must notify Kaiser Permanente within 24hours if admitted to a Non-network provider;limited to initial emergency only.Emergency room care25% coinsurance25% coinsuranceEmergency medicaltransportation25% coinsurance25% coinsuranceUrgent care 15 / primary care visit or 35 /specialty visit, deductible does 25% coinsurancenot applyFacility fee (e.g., hospitalroom)25% coinsuranceNot coveredPhysician/surgeon fees25% coinsuranceNot coveredIf you need mental Outpatient serviceshealth, behavioralhealth, or substanceInpatient servicesabuse servicesLimitations, Exceptions, & Other ImportantInformation 15 / visit, deductible does notNot coveredapply25% coinsuranceNot coveredOffice visits25% coinsuranceNot coveredChildbirth/deliveryprofessional services25% coinsuranceNot coveredIf you are pregnantNoneNon-Network providers covered whentemporarily outside the service area.Preauthorization required or will not becovered.Preauthorization required or will not becovered.NonePreauthorization required or will not becovered.Cost sharing does not apply for preventiveservices. Maternity care may include tests andservices described elsewhere in the SBC (i.e.ultrasound.)You must notify Kaiser Permanente within 24hours of admission, or as soon thereafter asmedically possible. Newborn services costshares are separate from that of the mother.Page 3 of 7

Common MedicalEventServices You May NeedChildbirth/delivery facilityservices25% coinsuranceNot coveredHome health care25% coinsuranceNot coveredRehabilitation servicesOutpatient: 35 / visit,deductible does not applyInpatient: 25% coinsuranceNot coveredOutpatient: 35 / visit,deductible does not applyInpatient: 25% coinsuranceNot covered25% coinsuranceNot coveredDurable medical equipment 25% coinsuranceNot coveredIf you need helprecovering or haveother special health Habilitation servicesneedsSkilled nursing careNo charge, deductible doesnot applyNo charge for refractive exam,Children’s eye examdeductible does not apply.No charge, deductible doesChildren’s glassesnot apply.Children’s dental check-up Not coveredHospice servicesIf your child needsdental or eye careWhat You Will PayNetwork ProviderNon-Network Provider(You will pay the least)(You will pay the most)Not coveredNot coveredNot coveredNot coveredLimitations, Exceptions, & Other ImportantInformationYou must notify Kaiser Permanente within 24hours of admission, or as soon thereafter asmedically possible. Newborn services costshares are separate from that of the mother.130 visit limit / year. Preauthorization requiredor will not be covered.Outpatient: 25 visit limit / year. Inpatient: 30day limit / year. Services with mental healthdiagnoses are covered with no limit.Inpatient: Preauthorization required or will notbe covered.Outpatient:25 visit limit / year. Inpatient: 30day limit / year. Services with mental healthdiagnoses are covered with no limit.Inpatient: Preauthorization required or will notbe covered.60-day limit / year. Preauthorization requiredor will not be covered.Subject to formulary guidelines. Preauthorizationrequired or will not be covered.Preauthorization required or will not becovered.Limited to 1 exam / 12 months.Limited to one pair of frames and lenses orcontact lenses / year.NonePage 4 of 7

Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Bariatric surgery Hearing aids Private-duty nursing Cosmetic surgery Infertility treatment Routine foot care Dental care (Adult and child) Long-term care Weight loss programs Non-emergency care when traveling outside the U.S.Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture (12 visit limit / year) Chiropractic care (10 visit limit / year) Routine eye care (Adult)Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for thoseagencies is shown in the chart below. Other coverage options may be available to you, too, including buying individual insurance coverage through the HealthInsurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, orassistance, contact the agencies in the chart below.Contact Information for Your Rights to Continue Coverage & Your Grievance and Appeals Rights:Kaiser Permanente Member Services1-888-901-4636 (TTY:711) or www.kp.org/waDepartment of Labor’s Employee Benefits Security Administration1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreformDepartment of Health & Human Services, Center for Consumer Information & Insurance Oversight1-877-267-2323 x61565 or www.cciio.cms.govWashington Department of Insurance1-800‑562‑6900 or www.insurance.wa.govDoes this plan provide Minimum Essential Coverage? Yes.Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid,CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.Does this plan meet the Minimum Value Standards? Yes.If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Page 5 of 7

Language Access Services:[Spanish (Español): Para obtener asistencia en Español, llame al 1-888-901-4636 (TTY: 711).][Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-888-901-4636 (TTY: 711).][Chinese (中文): 如果需要中文的帮助, 请拨打这个号码 1-888-901-4636 (TTY: 711).][Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-888-901-4636 (TTY: 711).]To see examples of how this plan might cover costs for a sample medical situation, see the next section.Page 6 of 7

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be differentdepending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharing amounts(deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion of costs you mightpay under different health plans. Please note these coverage examples are based on self-only coverage. Peg is Having a BabyManaging Joe’s Type 2 DiabetesMia’s Simple Fracture(9 months of in-network pre-natal care and ahospital delivery)(a year of routine in-network care of a wellcontrolled condition)(in-network emergency room visit and follow upcare)The plan’s overall deductibleSpecialist copaymentHospital (facility) coinsuranceOther (blood work) copayment 600 3525% 20 The plan’s overall deductibleSpecialist copaymentHospital (facility) coinsuranceOther (blood work) copayment 600 3525% 20 The plan’s overall deductibleSpecialist copaymentHospital (facility) coinsuranceOther (x-ray) copayment 600 3525% 20This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostTotal Example CostTotal Example Cost 12,700In this example, Peg would pay:Cost SharingDeductibles 600In this example, Joe would pay:Cost SharingDeductiblesCopayments 100CopaymentsCoinsurance 2,200Coinsurance 20 2,920What isn’t coveredLimits or exclusionsThe total Joe would pay isWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 5,600 2,800In this example, Mia would pay:Cost SharingDeductibles 600 1,100Copayments 200 0Coinsurance 400 0 0 1,100What isn’t coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services. 0 1,200Page 7 of 7

1r rx grq¶w kdyh wr phhw ghgxfwleohv iru vshflilf vhuylfhv :kdw lv wkh rxw ri srfnhw olplw iru wklv sodq" ,qglylgxdo )dplo\ 7kh rxw ri srfnhw olplw lv wkh prvw \rx frxog sd\ lq d \hdu iru fryhuhg vhuylfhv ,i \rx kdyh rwkhu idplo\ phpehuv lq wklv sodq wkh\ kdyh wr phhw wkhlu rzq rxw ri