Transcription

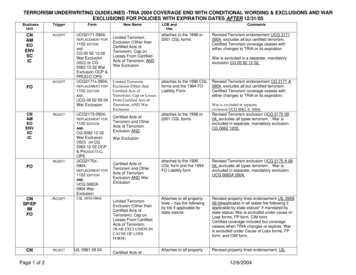

TERRORISM UNDERWRITING GUIDELINES -TRIA 2004 COVERAGE END WITH CONDITIONAL WORDING & EXCLUSIONS AND WAREXCLUSIONS FOR POLICIES WITH EXPIRATION DATES AFTER UCG2171-0904,REPLACEMENT FOR1102 EDTIONANDACCEPTFOCG 00 62 12 02War Exclusion(ISO) or CG0063 12 02 WarExclusion OCP &PROD/C OPSUCG2171A-0904,REPLACEMENT FOR1102 EDITIONANDUCG 00 62 09 04War NT FOR1102 EDITIONANDREJECTFOCG 0062 12 02War Exclusion(ISO) OR CG0063 12 02 OCP& PRODUCTS C.OPSUCG2175A0904,REPLACEMENT FOR1102 EDITIONANDCNSP/EPIMFOACCEPTUCG 0062A0904 WarExclusionUIL 0959 0904CNREJECTUIL 0961 09 04Page 1 of 2New NameLimited TerrorismExclusion (Other thanCertified Acts ofTerrorism); Cap onLosses From CertifiedActs of Terrorism; ANDWar ExclusionLimited TerrorismExclusion (Other thanCertified Acts ofTerrorism); Cap on LossesFrom Certified Acts ofTerrorism; AND WarExclusionCertified Acts ofTerrorism and OtherActs of TerrorismExclusion ANDLOB andUseattaches to the 1998 or2001 CGL formsCommentsRevised Terrorism endorsement UCG 21710904, excludes all but certified terrorism.Certified Terrorism coverage ceases witheither changes to TRIA or its expiration.War is excluded in a separate, mandatoryexclusion CG 00 62 12 02.attaches to the 1996 CGLforms and the 1994 FOLiability Formattaches to the 1998 or2001 CGL formsRevised Terrorism endorsement CG 2171 A0904, excludes all but certified terrorism.Certified Terrorism coverage ceases witheither changes to TRIA or its expiration.War is excluded in separate,exclusion UCG 0062 A 0904.Revised Terrorism exclusion UCG 2175 0904, excludes all types terrorism. War isexcluded in separate, mandatory exclusionCG 0062 1202.War ExclusionCertified Acts ofTerrorism and OtherActs of TerrorismExclusion AND WarExclusionLimited TerrorismExclusion (Other thanCertified Acts ofTerrorism); Cap onLosses From CertifiedActs of Terrorism;(WAR EXCLUSION INCAUSE OF LOSSFORM)Certified Acts ofattaches to the 1996CGL form and the 1994FO Liability formRevised Terrorism exclusion UCG 2175 A 0904, excludes all types terrorism. War isexcluded in separate, mandatory exclusionUCG 0062A 0904.Attaches to all propertylines – has fire followingby lob if applicable bystate statuteRevised property lines endorsement UIL 095909 04applicable in all states fire following ifapplicable by state statute* if mandated bystate statue; War is excluded under cause ofLoss forms, FP form, CIM formCertified coverage included but coverageceases when TRIA changes or expires. Waris excluded under Cause of Loss forms, FPform, and CIM form.Attaches to all propertyRevised property lines endorsement, UIL12/6/2004

WAR & TERRORISM UNDERWRITING GUIDELINES -TRIA 2004 COVERAGE END WITH CONDITIONAL WORDING & EXCLUSIONS ANDWAR EXCLUSIONS FOR POLICIES WITH EXPIRATION DATES AFTER 12/31/05BusinessUnitTriggerFormNew NameTerrorism and OtherActs of actAutoREJECTUCA 2358 09 04AND CA 00 38WAR EXCLUSIONUCA 2361 09 04AND CA 00 38WAR EXCLUSION(WAR EXCLUSION INCAUSE OF LOSSFORM)Limited TerrorismExclusion (Other thanCertified Acts ofTerrorism); Cap onLosses from CertifiedActs of Terrorism ANDISO War ExclusionCertified Acts ofTerrorism and OtherActs of TerrorismExclusionAND ISO businessauto War Excl.* SFP states – require coverage for ensuing fire even if terrorism is excludedStatesCIMStatesCIMStatesCIMwith SFP exemption with SFP exemption with SFP JxHIxMOORIDxNCxPAILxNDRIPage 2 of 2LOB andUseCommentslines – has fire followingif applicable by statestatue0961 09 04 in all states with fire followingexceptions if mandated by state statue*;War is excluded under cause of Loss forms,FP form, CIM form.Contract Auto Liability& PDThis endorsement provides terrorismcoverage for certified only, coverageceases when TRIA changes or expires.War is excluded in separate mandatoryexclusion CA 00 38.SameExcludes all types terrorism. War isexcluded in separate mandatoryexclusion.Stateswith SFPStatueWAWVWICIMexemptionxx10/20/2004

Underwriting BulletinDate:To:October 18, 2004All Colony Contract AgentsFrom:Phone:Contract Division – East800-577-6614Contract Division - West877-251-3422Updates to Terrorist Risk Insurance Act (TRIA) EndorsementsWe have updated the TRIA endorsements to implement two changes:(1) The War exclusion has been removed from the TRIA wording and will nowbe on a separate endorsement.(2) The TRIA coverage, if purchased, will end if the federal backstop ends. (Asof today, TRIA is scheduled to expire on 12/31/05.) The new endorsementscan be used whether or not Congress extends TRIA.DocuCorp users will receive a new library (which will include these newendorsements) in mid-November. A CD with the new endorsements in Wordformat will be mailed to those not using DocuCorp for policy issuance in earlyNovember. Please note that all policies issued with effective dates of January 1,2005 or later must have these new endorsements attached. Accordingly, all newbusiness quotes issued on or after November 30 should reflect theseendorsements.A table demonstrating the endorsement changes follows. If you have anyquestions regarding the changes and/or the implementation of the new forms,please contact your Colony underwriter.Thank you for your assistance!9201 Forest Hill Avenue, Suite 200Richmond, VA 23235(800) 577-6614www.colonyins.com7272 E. Indian School Rd., Suite 500Scottsdale, AZ 85251(877) 251-3422www.colonyins.com

Underwriting BulletinUpdates to Terrorist Risk Insurance Act (TRIA) Endorsements - Continued(1) New Mandatory Endorsement – War ExclusionCoverage FormAttach2001 CGL CG 00 62 1202OCP . CG 00 63 12021994 Farm Liability. .UCG 00 62a 0904Garage .CA 00 40 0203Contract Auto Physical Damage .CA 00 38 1202Storage Tank Pollution .E 091 0904(2) New TRIA EndorsementsCurrent EndorsementsCoverage FormAcceptsRejectsNew EndorsementsAcceptsRejects2001 CGL1994 Farm LiabilityUCG 2171 1102UCG 2171a 1102UCG 2175 1102UCG 2175a 1102UCG 2171 0904UCG 2171a 0904UCG 2175 0904UCG 2175a 0904Inland Marine, CommercialProperty and Crime coverage partsUIL: 0954, 0964,0974, 0969, 0959(11/02 eds)UIL: 0956, 0966,0976, 0961, 0971(11/02 eds)UIL 0959 0904UIL 0961 0904UCA 2358 1102UCA 2361 1102UCA 2358 0904UCA 2361 0904EU 163a 1102EU 163b 1102EU 163a 0904EU 163b 0904GarageContract Auto Physical DamageStorage Tank Pollution9201 Forest Hill Avenue, Suite 200Richmond, VA 23235(800) 577-6614www.colonyins.com7272 E. Indian School Rd., Suite 500Scottsdale, AZ 85251(877) 251-3422www.colonyins.com

Colony Insurance CompanyPreferredColony National Insurance CompanyColonyFrontSpecialtyRoyal Insurance CompanyDecember 26, 2002To:All Colony AgentsFrom: Doug Grant, Vice PresidentRe:Terrorism Risk Insurance Act of 2002As you are aware, President Bush recently signed into law the Terrorism Risk Insurance Act. This Actprovides for federal reinsurance of certified terrorist acts and mandates that all commercial insurers providecoverage for certified acts and notify existing and potential insureds of the cost of providing this coverage.We have been working diligently since 11/26/02 to implement this Act, and we feel that we have made everyeffort to keep this process as simple as possible for everyone. We have not had a change in wording orprocedures from NAIC or ISO since yesterday; however, considering the rapidly changing situation there maybe further changes in the future.Our intention is to fully comply with the act by implementing procedures in stages.Stage I -- New and Renewal Non-Admitted BusinessEffective January 2, 2003 all Colony quotes will include a separate charge for certified terrorism coverage,which the insured may elect or decline to purchase. A form has been developed for this purpose – TRIA2002Notice-1202 – which we refer to as the Acceptance/Rejection form. This form will show the premium chargefor certified terrorism coverage and include check boxes that Insureds will use to indicate whether coverage iselected or rejected.Company-issued quotes (Brokerage business) will include the Certified Terrorism Acceptance/Rejection form. To bind coverage, you will need to return a copy of the quote, indicate whethercertified terrorism coverage is desired, and provide the signed Acceptance/Rejection form. Nocoverage will be bound if the Company does not receive a signed Acceptance/Rejection form at thesame time as the request to bind.All binders issued by the Company will include an Acceptance/Rejection form. This form will showthe premium quoted; check whether certified terrorism coverage was accepted or rejected; and show“Signature on File”.This form also will be attached to all policies we issue. In the overall process, insureds will beprovided with the Acceptance/Rejection form three times: once when quoted; again when coverage isbound; and finally when the policies are issued.Agency-issued quotes (Contract Binding business) also will need to include the Acceptance/Rejectionform and follow the same procedures. The Acceptance/Rejection form must be signed by the insuredprior to binding and a copy attached to the company copy of the policy. No coverage may be bound ifyou do not receive a signed Acceptance/Rejection form at the same time as the request to bind.Richmond, Virginia and Scottsdale, Arizonawww.colonyins.comMembers of

Colony Insurance CompanyPreferredColony National Insurance CompanyColonyFrontSpecialtyRoyal Insurance CompanyAll binders issued by you for Colony policies also must include a copy of the Acceptance/Rejectionform signed by the Insured, or a completed Acceptance/Rejection form showing “Signature on File”.The form must show an “X” in the appropriate box and include the premium quoted for the coverage.The “Signature on File” approach allows for automation of policy issuance, however, a copy of thecompleted Acceptance/Rejection form signed by the insured must be attached to the Company copy ofthe policy.Outstanding quotes issued prior to 1/2/03 will be treated as in-force business. An Acceptance/Rejection form is not required.Pricing Certified Terrorism CoverageThe premium charge for Company-Issued quotes will be calculated as a percentage of the total premium,subject to a 100 minimum. For Agency-Issued quotes, a flat charge will apply. (The following are initialguidelines and are subject to change):Type of BusinessMinimum ChargeCompany-Issued policies (Brokerage business):5% of the policy premium ( 100 minimum)Agency-Issued policies (Contract Binding business): 100 per policy (flat charge)No Coverage is Provided for Non-Certified TerrorismCoverage is not available for Non-Certified Terrorism losses. This includes, in part, non-foreign terrorism,terrorism losses below certain thresholds and nuclear, chemical or biological attacks. According to the Act,the Secretary of the Treasury certifies losses. If an insured opts to purchase coverage for certified terrorismlosses, an exclusion for non-certified losses will be attached to their policy. If an insured opts not to purchasecertified terrorism loss coverage, an exclusion for certified and non-certified losses will be attached to theirpolicy.Forms and EndorsementsForms and endorsements attached to this email include: Acceptance/Rejection form Schedule of endorsements to be used, by stateThe endorsements will follow shortly in a subsequent email. Please let us know if you have difficultiesopening up or reading any of these documents.Terrorism Coverage and Policy IssuancePolicies must clearly show whether certified terrorism coverage has been purchased or rejected.Company-Issued policies There will be a separate line item on all Common Policy dec pagesshowing Certified Terrorism Coverage. If coverage is accepted, the premium is shown here andtotaled at the bottom of the page. If coverage is rejected, the premium line will show “Not Taken”.Richmond, Virginia and Scottsdale, Arizonawww.colonyins.comMembers of

Colony Insurance CompanyPreferredColony National Insurance CompanyColonyFrontSpecialtyRoyal Insurance CompanyOn the Schedule of Forms and Endorsements (U001), the Acceptance/Rejection form (TRIA2002Notice-1201) will be listed, as will the applicable acceptance or rejection endorsement(s) for eachcoverage part.Agency-Issued policies As per Company-issued policies, the policy premium should be listed on theCommon Policy dec page with the U001 form including the Accceptance/Rejection form andapplicable endorsement(s). Until a new DocuCorp library is issued in the first quarter of 2003, theseparate line item for the Certified Terrorism Coverage premium must be manually inserted on theCommon Policy dec page.Stage II – In-Force Non-Admitted BusinessIn compliance with the Act, we will mail to all current policyholders a notification advising them of theirrights under the Act. To make this effort as easy for you as possible, it is currently our intention to providecoverage for certified terrorism acts for all in-force policies and to waive the pro-rated additional premium forthe coverage. (Renewals will contemplate charges.)As such, Acceptance/Rejection forms and the collection, accounting for and distribution of additionalpremiums and surplus lines taxes will not be required. We will provide you with sample copies of thedisclosure notice that we send directly to our insureds.Additional information about our procedures, forms and endorsements for in-force business will followshortly.Stage III – Admitted BusinessAdditional information on the appropriate processes and procedures for admitted business will follow shortlyin separate correspondence.Our goal in implementing the Terrorism Risk Insurance Act of 2002 is to fully comply with the Act whilemaking the procedures as painless to you, our partners, as possible. These procedures and forms are subject tochange as we receive updated information and guidelines from the U.S. Department of Treasury.We appreciate your patience and understanding. If you have any questions or comments, please send them tomy e-mail address indicated below.Sincerely,Douglas M. GrantVice President, Marketingdgrant@colonyins.com804-327-1773Richmond, Virginia and Scottsdale, Arizonawww.colonyins.comMembers of

POLICYHOLDER DISCLOSURENOTICE OF INSURANCE COVERAGE FOR CERTIFIED ACTS OF TERRORISMYou are hereby notified that, under the Terrorism Risk Insurance Act of 2002, effective November 26, 2002, you now havea right to purchase insurance coverage for losses arising out of acts of terrorism, as defined in Section 102(1) of the Act.The term “act of terrorism” means any act that is certified by the Secretary of the Treasury, in concurrence with theSecretary of State and the Attorney General of the United States: to be an act of terrorism; to be a violent act or an actthat is dangerous to human life, property, or infrastructure; to have resulted in damage within the United States, oroutside the United States in the case of an air carrier or vessel or the premises of a United States mission; and to havebeen committed by an individual or individuals acting on behalf of any foreign person or foreign interest, as part of aneffort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the UnitedStates Government by coercion.Coverage under your policy may be affected as follows:You should know that coverage provided by this policy for losses caused by certified acts of terrorism is partiallyreimbursed by the United States under a formula established by federal law. Under this formula, the United States pays90% of covered terrorism losses exceeding the statutorily established deductible paid by the insurance company providingthe coverage. The premium charged for this coverage is provided below and does not include any charges for the portionof loss covered by the federal government under the Act.You should also know that your policy does not provide coverage for acts of terrorism that are not certified by theSecretary of the Treasury.Election or Rejection of Certified Terrorism Insurance CoverageYou must elect or reject this coverage for losses arising out of certified acts of terrorism, as defined in Section 102(1) ofthe Act, before the effective date of this policy. Your coverage cannot be bound unless our representative has receivedthis form signed by you on behalf of all insureds with all premiums due.Coverage election.I hereby elect to purchase coverage for certified acts of terrorism, as defined in Section 102(1) of the Act for aprospective annual premium of . I understand that I will not have coverage for losses arisingfrom any non-certified acts of terrorism.ORCoverage rejection.I hereby elect not to purchase coverage for certified acts of terrorism, as defined in Section 102(1) of the Act. Id t d th t I ill t hfli i ftifi dtifi d t f tiPolicyholder/Applicant’s Signature-Insurance CompanyMust be person authorized to sign for all Insureds.Print NamePolicy NumberNamed InsuredSubmission NumberDateProducer NumberProducer NameStreet AddressCity, State, ZipThe producer shown above is the wholesale insurance broker your insurance agent used to place yourinsurance coverage with us. Please discuss this Disclosure with your agent before signing.TRIA2002 Notice-1202Page 1 of 1

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.LIMITED TERRORISM EXCLUSION(OTHER THAN CERTIFIED ACTS OF TERRORISM)This endorsement modifies insurance provided under the following:COMMERCIAL GENERAL LIABILITY COVERAGE PARTLIQUOR LIABILITY COVERAGE PARTOWNERS AND CONTRACTORS PROTECTIVE LIABILITY COVERAGE PARTPRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PARTRAILROAD PROTECTIVE LIABILITY COVERAGE PARTA. The following exclusion is added:This insurance does not apply to:TERRORISM AND PUNITIVE DAMAGES"Any injury or damage" arising, directly or indirectly, out of:(1) "Other acts of terrorism", including any action taken in hindering or defending against anactual or expected incident of "other acts of terrorism"; or(2) Any act of terrorism:(a) that involves the use, release or escape of nuclear materials, or directly or indirectlyresults in nuclear reaction or radiation or radioactive contamination; or(b) that is carried out by means of the dispersal or application of pathogenic or poisonousbiological or chemical materials; or(c) in which pathogenic or poisonous biological or chemical materials are released, and itappears that one purpose of the terrorism was to release such materials;regardless of any other cause or event that contributes concurrently or in any sequence tothe injury or damage in (1) or (2) above; including(3) Damages arising, directly or indirectly, out of (1) or (2) above that are awarded as punitive damages.B. Exclusion h. under Paragraph 2. Exclusions of SECTION I – COVERAGE C MEDICAL PAYMENTS does not apply.C. The following definitions are added to the DEFINITIONS Section:For the purposes of this endorsement, "any injury or damage" means any injury or damage coveredunder any Coverage Part to which this endorsement is applicable, and includes but is not limited to"bodily injury", "property damage", "personal and advertising injury", "injury" or "environmental damage" as may be defined in any applicable Coverage Part."Certified act of terrorism" means an act that is certified by the Secretary of the Treasury, in concurrence with the Secretary of State and the Attorney General of the United States, to be an act of terrorism pursuant to the federal Terrorism Risk Insurance Act of 2002. The federal Terrorism Risk Insurance Act of 2002 sets forth the following criteria for a "certified act of terrorism":a. The act resulted in aggregate losses in excess of 5 million; andb. The act is a violent act or an act that is dangerous to human life, property or infrastructureand is committed by an individual or individuals acting on behalf of any foreign person or foreign interest, as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion.UCG2171-0904Contains material ISO Properties, Inc., 2002 with its permission.Page 1 of 2

"Other act of terrorism" means a violent act or an act that is dangerous to human life, property or infrastructure that is committed by an individual or individuals and that appears to be part of an effortto coerce a civilian population or to influence the policy or affect the conduct of any government bycoercion, and the act is not certified as a terrorist act pursuant to the federal Terrorism Risk Insurance Act of 2002. Multiple incidents of an "other act of terrorism" which occur within a seventy-twohour period and appear to be carried out in concert or to have a related purpose or common leadership shall be considered to be one incident.D. In the event of any act of terrorism or an "other act of terrorism" that is not subject to this exclusion,coverage does not apply to any loss or damage that is otherwise excluded under this Coverage Part.E. With respect to any one or more "certified acts of terrorism", we will not pay any amounts for whichwe are not responsible under the terms of the federal Terrorism Risk Insurance Act of 2002 (including subsequent acts of Congress pursuant to the Act).ALL OTHER TERMS AND CONDITIONS OF THE POLICY REMAIN UNCHANGED.UCG2171-0904Contains material ISO Properties, Inc., 2002 with its permission.Page 2 of 2

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.LIMITED TERRORISM EXCLUSION(OTHER THAN CERTIFIED ACTS OF TERRORISM)This endorsement modifies insurance provided under the following:FARM LIABILITY COVERAGE PARTA. The following exclusion is added:This insurance does not apply to:TERRORISM AND PUNITIVE DAMAGES"Any injury or damage" arising, directly or indirectly, out of:(1) "Other acts of terrorism", including any action taken in hindering or defending against anactual or expected incident of "other acts of terrorism"; or(2) Any act of terrorism:(a) that involves the use, release or escape of nuclear materials, or directly or indirectlyresults in nuclear reaction or radiation or radioactive contamination; or(b) that is carried out by means of the dispersal or application of pathogenic or poisonousbiological or chemical materials; or(c) in which pathogenic or poisonous biological or chemical materials are released, and itappears that one purpose of the terrorism was to release such materials;regardless of any other cause or event that contributes concurrently or in any sequence tothe injury or damage in (1) or (2) above; including(3) Damages arising, directly or indirectly, out of (1) or (2) above that are awarded as punitive damages.B. Exclusion g. under Paragraph 2. Exclusions of SECTION I – COVERAGE J MEDICAL PAYMENTS does not apply.C. The following definitions are added to the DEFINITIONS Section:For the purposes of this endorsement, "any injury or damage" means any injury or damage coveredunder any Coverage Part to which this endorsement is applicable, and includes but is not limited to"bodily injury", "property damage", "personal injury", "advertising injury", "injury" or "environmentaldamage" as may be defined in any applicable Coverage Part."Certified act of terrorism" means an act that is certified by the Secretary of the Treasury, in concurrence with the Secretary of State and the Attorney General of the United States, to be an act of terrorism pursuant to the federal Terrorism Risk Insurance Act of 2002. The federal Terrorism Risk Insurance Act of 2002 sets forth the following criteria for a "certified act of terrorism":a. The act resulted in aggregate losses in excess of 5 million; andb. The act is a violent act or an act that is dangerous to human life, property or infrastructureand is committed by an individual or individuals acting on behalf of any foreign person or foreign interest, as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion.UCG2171A-0904Contains material ISO Properties, Inc., 2002 with its permission.Page 1 of 2

"Other act of terrorism" means a violent act or an act that is dangerous to human life, property or infrastructure that is committed by an individual or individuals and that appears to be part of an effortto coerce a civilian population or to influence the policy or affect the conduct of any government bycoercion, and the act is not certified as a terrorist act pursuant to the federal Terrorism Risk Insurance Act of 2002. Multiple incidents of an "other act of terrorism" which occur within a seventy-twohour period and appear to be carried out in concert or to have a related purpose or common leadership shall be considered to be one incident.D. In the event of any act of terrorism or an "other act of terrorism" that is not subject to this exclusion,coverage does not apply to any loss or damage that is otherwise excluded under this Coverage Part.E. With respect to any one or more "certified acts of terrorism", we will not pay any amounts for whichwe are not responsible under the terms of the federal Terrorism Risk Insurance Act of 2002 (including subsequent acts of Congress pursuant to the Act).ALL OTHER TERMS AND CONDITIONS OF THE POLICY REMAIN UNCHANGED.UCG2171A-0904Contains material ISO Properties, Inc., 2002 with its permission.Page 2 of 2

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.CERTIFIED ACTS OF TERRORISM AND OTHER ACTSOF TERRORISM EXCLUSIONThis endorsement modifies insurance provided under the following:COMMERCIAL GENERAL LIABILITY COVERAGE PARTLIQUOR LIABILITY COVERAGE PARTOWNERS AND CONTRACTORS PROTECTIVE LIABILITY COVERAGE PARTPRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PARTRAILROAD PROTECTIVE LIABILITY COVERAGE PARTA. The following exclusion is added:This insurance does not apply to:TERRORISM AND PUNITIVE DAMAGES"Any injury or damage" arising, directly or indirectly, out of:(1) "Certified acts of terrorism" or "other acts of terrorism", including any action taken in hindering or defending against an actual or expected incident of "certified acts of terrorism"or "other acts of terrorism"; or(2) Any act of terrorism:(a) that involves the use, release or escape of nuclear materials, or directly or indirectlyresults in nuclear reaction or radiation or radioactive contamination; or(b) that is carried out by means of the dispersal or application of pathogenic or poisonousbiological or chemical materials; or(c) in which pathogenic or poisonous biological or chemical materials are released, and itappears that one purpose of the terrorism was to release such materials;regardless of any other cause or event that contributes concurrently or in any sequence tothe injury or damage in (1) or (2) above; including(3) Damages arising, directly or indirectly, out of (1) or (2) above that are awarded as punitive damages.B. Exclusion h. under Paragraph 2. Exclusions of SECTION I – COVERAGE C MEDICAL PAYMENTS does not apply.C. The following definitions are added to the DEFINITIONS Section:For the purposes of this endorsement, "any injury or damage" means any injury or damage coveredunder any Coverage Part to which this endorsement is applicable, and includes but is not limited to"bodily injury", "property damage", "personal and advertising injury", "injury" or "environmental damage" as may be defined in any applicable Coverage Part."Certified act of terrorism" means an act that is certified by the Secretary of the Treasury, in concurrence with the Secretary of State and the Attorney General of the United States, to be an act of terrorism pursuant to the federal Terrorism Risk Insurance Act of 2002. The federal Terrorism Risk Insurance Act of 2002 sets forth the following criteria for a "certified act of terrorism":a. The act resulted in aggregate losses in excess of 5 million; andb. The act is a violent act or an act that is dangerous to human life, property or infrastructureand is committed by an individual or individuals acting on behalf of any foreign person or foreign interest, as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion.UCG2175-0904Contains material ISO Properties, Inc., 2002 with its permission.Page 1 of 2

"Other act of terrorism" means a violent act or an act that is dangerous to human life, property or infrastructure that is committed by an individual or individuals and that appears to be part of an effortto coerce a civilian population or to influence the policy or affect the conduct of any government bycoercion, and the act is not certified as a terrorist act pursuant to the federal Terrorism Risk Insurance Act of 2002. Multiple incidents of an "other act of terrorism" which occur within a seventy-twohour period and appear to be carried out in concert or to have a related purpose or common leadership shall be considered to be one incident.D. In the event of an act of terrorism, a "certified act of terrorism" or an "other act of terrorism" that isnot subject to this exclusion, coverage does not apply to any loss or damage that is otherwise excluded under this Coverage Part.ALL OTHER TERMS AND CONDITIONS OF THE POLICY REMAIN UNCHANGED.UCG2175-0904Contains material ISO Properties, Inc., 2002 with its permission.Page 2 of 2

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.CERTIFIED ACTS OF TERRORISM AND OTHER ACTSOF TERRORISM EXCLUSIONThis endorsement modifies insurance provided under the following:FARM LIABILITY COVERAGE PARTA. The following exclusion is added:This insurance does not apply to:TERRORISM AND PUNITIVE DAMAGES"Any injury or damage" arising, directly or indirectly, out of:(1) "Certified acts of

terrorism underwriting guidelines -tria 2004 coverage end with conditional wording & exclusions and war exclusions for policies with expiration dates after 12/31/05 business unit trigger form new name lob and use comments cn am eo env sc ic accept ucg2171-0904, replacement for 1102 edtion and cg 00 62 12 02 war exclusion (iso) or cg 0063 12 02 war