Transcription

Government Contractor’s Guide toIndirect Rates – Part 1 of 2April 7, 2021Presented by Becky RamseyPage 1

AgendaPart 1: Direct vs Indirect Costs Indirect Rate Structure Regulations that define indirect costs – FAR and CASPart 2: Indirect costs management Indirect costs monitoring - Forward pricing proposals, incurredcosts submissions, and audits; Compliance and ObjectivesPage 2

Why are Indirect Rates so important?A company’s indirect rates are its economic engine --they impact the company’s ability to win proposals, workcontracts profitable, and earn revenue. Thedevelopment and measurement of the indirect ratesprovides insight into a company’s financial operationsand how they are “really” performing. Indirect rates arevital to growing a business and remaining costcompetitive.Page 3

What is a Wrap Rate?A wrap rate (made up of indirect costs) is the factor youapply to a base hourly labor rate (direct cost) to arrive ata fully burdened labor rate (FBLR) (with or without fee).When the FBLR includes fee, it is the rate that you chargea customer for each hour of work.Page 4

I’m still trying to “wrap” my head around this!Page 5

It’s All in a Name!A wrap rate is also known by other similar terms: Burdens Loads Multiplier Overhead AdderPage 6

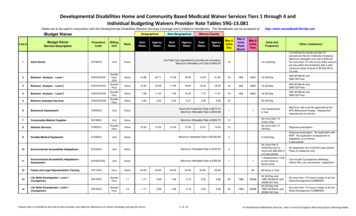

Types of Indirect Rates Budgeted RatesProvisional Billing RatesContract RatesIncurred Cost Submission RatesFinal RatesForward Pricing RatesPage 7

Indirect Rate StructureOrganizational considerations: Goods or Services Org Size Number of Employees Multiple locations Large about of Subcontractors Competitive AdvantagePage 8

Indirect Cost Pools and BasesIn FAR 31.203(c) two parts to indirect cost allocationprocess are identified:1) Indirect cost pools: collected in “logical costgroupings” (individual indirect cost centers), so as topermit distribution to all final cost objectives includedin an allocation base.2) Allocation base: should have a causal/beneficialrelationship to indirect cost allocated from indirectcost pool.Example: Fringe benefits to total labor.Page 9

Indirect Cost Flow ExamplePage 10

Common Indirect Cost Pools Overhead – company siteOverhead – customer siteGeneral & Administrative (G&A)Material HandlingPage 11

Indirect Rate Calculation1) Costs are estimated, accumulated and reportedeach year based on the contractor’s fiscal year2) Overhead Rate overhead costs / allocation base3) G&A Rate General and administrative costs /total cost of activity for the business.Page 12

Indirect Rate LifecyclePage 13

Cost BasicsTo understand and optimize your indirect rates you firstmust understand the basics of where they come from. Direct vs Indirect Costs Regulations Indirect Rate Pools Treatment of CostsPage 14

Final Cost ObjectiveA final cost objective (FCO) will have both direct andindirect costs and in the contractor's accumulationsystem, is one of the final accumulation points. FAR31.001.Page 15

Direct CostsDirect Costs can be specifically identified with aparticular cost objective. FAR 2.101 Labor Subcontractors Contract Travel Material ODCPage 16

Indirect CostsIndirect Costs are any cost not directly identified with asingle final cost objective but identified with two or morefinal cost objectives. FAR 2.101 PTO Payroll Taxes Executive Labor Facility Costs Non-contract TravelPage 17

Unallowable CostsAccording to FAR 31.201-2, unallowable costs arethose costs deemed unallowable by the governmentbased on:1. Reasonableness - A cost is reasonable if, in itsnature and amount, it does not exceed that whichwould be incurred by a prudent person in the conductof competitive business.”Page 18

Unallowable Costs (cont.)Allocability - A cost is allocable if it is assignable orchargeable to one or more cost objectives on the basis ofrelative benefits received or other equitable relationship.Subject to the foregoing, a cost is allocable to a Governmentcontract if ita. Is incurred specifically for the contract; (Direct)b. Benefits both the contract and other work, and can bedistributed to them in reasonable proportion to the benefitsreceived; (Overhead) orc. Is necessary to the overall operation of the business,although a direct relationship to any particular cost objectivecannot be shown.” (G&A)2.Page 19

Unallowable Costs (cont.)3. Standards promulgated by the CAS Board, ifapplicable, otherwise, generally accepted accountingprinciples and practices appropriate to thecircumstances.4. Terms of the contract.5. Any limitations set forth in this subpart.”Page 20

Unallowable Costs (cont.)Burden of Proof:Note the burden of proof when auditors question acost. Proving a cost is unallowable: Government Proving a cost is reasonable: Contractor Proving a cost is allocable: ContractorPage 21

Contract Cost – what is included?.G&AOverhead(s)DirectPage 22

Consistency in the Treatment of CostsIt is very IMPORTANT to be consistent in how similar costsare treated. When a cost is incurred: Classify the cost – is it direct or indirect? If indirect, determine the pool the costs should be inbased on what the cost is for and who benefitted fromit. Is it allowable? FAR 31.201.2 When does the cost apply --- current period ordeferred? Is the cost controllable or noncontrollable?Page 23

What is my fair share?Because indirect costs are “shared” over multiplecontracts by allocation, how can the government ensurethat each contract gets its fair share of the costs? That’swhat the regulations are for!Page 24

FAR Part 31 – Contract Cost andProceduresEstablishes boundaries and parameters regardingallowable costs that can be negotiated and/or claimedunder government contracts or subcontracts. Government will only share costs from which itderives a benefit Leads contractors to incur costs more prudently Defines what costs are unallowablePage 25

Certified Cost or Pricing DataFAR 52.215-12 Certified Cost or Pricing dataFAR 52.215-13 Certified Cost or Pricing data Mod.FAR 52.215-20 Subk Certified Cost or Pricing dataFAR 52.215-21 Subk Certified Cost or Pricing data Mod.Must certify that indirect rates used to price proposal is mostcurrent. There are exceptions found in 15.403-1.One such exception is the threshold was raised to 2.0M forcontracts awarded after 7/1/2018.Page 26

Certified Cost or Pricing DataPage 27

Allowable Cost and PaymentFAR 31.216-7 Applies to Flexibly Priced Contracts Invokes Far Part 31 Requires ICCPage 28

Cost Accounting Standards (CAS) RelatedFAR 52.230-1 CAS Notices and CertificationsFAR 52.230-2 CASFAR 52.230-3 Disclosure and Consistency of CostAccounting PracticesFAR 52.230-5 CAS Educational InstitutionFAR 52.230-6 Administration of CASFAR Part 31 incorporates CAS for measuring allowablecosts.Page 29

Page 30

CAS 401 – Consistency in Estimating,Accumulating and Reporting Costs How I price is how I perform. The practices I used to book or report the cost, mustbe consistent with what I priced. FAR 31.201-1 Incorporates conceptsPage 31

CAS 402 – Consistency in Allocating CostsIncurred for the Same Purpose Prevent double counting costs Same purpose in like circumstances CAS Disclosure Statement defines cost accountingpractices Minor amounts may be indirect FAR 31.203 incorporates provisionsPage 32

CAS 405 – Accounting for UnallowableCosts Identify and exclude from billings, claims and proposals:Expressly unallowable costsMutually agreed to be unallowable costsDirectly associated unallowable costsDisputed costsUnallowable costs allocated in same manner as allowablecostsUnallowable costs must be included in cost allocation baseFAR 31.201-6, Accounting for unallowable costsPage 33

CAS 406 – Cost Accounting Period Contractor’s fiscal year is cost accounting period Exceptions: transition periods, one-timecircumstances (e.g., new cafeteria at mid-year) Monthly true-up not okay unless representative of fullfiscal year FAR 31.203, Indirect costsPage 34

CAS 403 – Allocation of Home OfficeExpenses Beneficial or causal relationship between supporting and receivingactivitiesDirect allocation to maximum extent practicalLogical and homogeneous poolsCentralized service functionsStaff managementResidual expensesRepresentative of total activity of segmentsThree-factor formula Payroll Revenue AssetsPage 35

Payments under T&M and LH ContractsFAR 52.232-7 Incorporates the Allowable Cost and Payment clause forMaterial costs at 52.232-7(b)(4) Materials cost allowability IAW FAR 31.2 FAR 52.232-7(b)(5) limits allocable indirect costs Costs excluded from hourly rates Allocated IAW contractor cost accounting practices No indirect costs on subcontracts paid at the hourlyratesPage 36

Limitation of Costs/FundsFAR 52.232-20 Limitation of CostFAR 52.232-22 Limitation of FundsFAR 52.216-16 Limitation on Payments Limitation of Costs / Limitation of Funds Applies to cost-reimbursable contract types LOC Fully funded contracts LOF Incrementally funded contracts Requires written notice on sufficiency of funds (60 days /75% cost) Failure to comply may result in contractor performing “atrisk” Limitation of Payments Applies to Fixed Price incentive contracts Progress Payments based on costPage 37

Contractor Business SystemsDFARS 252.242-7005 Accounting systemsEstimating systemsPurchasing systemsEarned value management systems (EVMS)Material management and accounting systems(MMAS) Property management systemsPage 38

ConclusionNext week join us for Part 2: Indirect costs management Indirect costs monitoring - Forward pricing proposals,incurred costs submissions, and audits; Compliance and ObjectivesPage 39

How can we help you?The BMSS team can help you develop andmanage your indirect rate structure.Questions?Please let me know your comments about today’sdiscussion.Contact info: Becky Ramsey, rramsey@bmss.comPage 40

A wrap rate (made up of indirect costs) is the factor you apply to a base hourly labor rate (direct cost) to arrive at . Government will only share costs from which it derives a benefit Leads contractors to incur costs more prudently Defines what costs are unallowable