Transcription

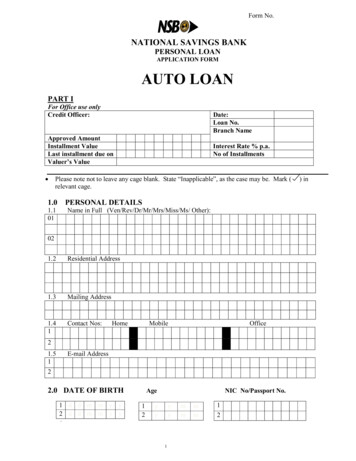

Form No.NATIONAL SAVINGS BANKPERSONAL LOANAPPLICATION FORMAUTO LOANPART IFor Office use onlyCredit Officer:Date:Loan No.Branch NameApproved AmountInstallment ValueLast installment due onValuer’s Value Interest Rate % p.a.No of InstallmentsPlease note not to leave any cage blank. State “Inapplicable”, as the case may be. Mark (relevant cage.1.01.101PERSONAL DETAILSName in Full (Ven/Rev/Dr/Mr/Mrs/Miss/Ms/ Other):021.2Residential Address1.3Mailing Address1.41Contact Nos:HomeMobileOffice21.51E-mail Address22.0 DATE OF BIRTH1 d d m m y y2 d d m m y y Age12NIC No/Passport No.yyyy1mmmm12) in

3.0 agedIf mortgaged, name of the mortgagee .4.0 EDUCATIONPrimarySecondaryDiplomaGraduate4.1Specify profession/Other (Professional Body)Post GraduateProfessionalOther 5.05.11CURRENT EMPLOYMENTName of the Employer5.2125.315.412Employer’s Address2Business Registration No.Designation5.5 Period of Employment1 Y Y M M2 Y Y M M6.0 PREVIOUS EMPLOYMENT (If current employment is of less than 3 yrs)6.11Name of the Employer6.2 Employer’s Address1226.3 Business Registration No.16.4Designation126.5 Period of Employment27.0 MONTHLY REMUNERATIONBasicFixed AllowancesNet Salary122Other regular Income

Other regular income specify1. 2 Irregular income for the past 6 months(Total)1 Amount(Rs.)2 Amount(Rs.)8.0 No. of dependents including self/selvesNo. ofAdultsNo. of Children below10 yearsNo. of Children between10 and 18 yearsTotalNo.9.0 DETAILS OF SPOUSE (If joint with spouse – go to item 10)NameDate ofBirthOccupationNIC No.EmployerSpouse’s Monthly Net Income (regular income)9.1Contact Nos:9.2E-mail AddressHomeRsMobile.Office10.0 ASSETS OWNED BY THE APPLICANT/S (as at date)10.1Immovable Property, if anyTypeLocationExtentValueRs.If mentsTypeName and Address ofInstitutionValueRs.If pledged againstloans - loanamountBank Accounts with NSB & other Banks/InstitutionsTypeName of theAccountBalanceBank/InstitutionNo.as at dateRs.Insurance PoliciesTypeName of Insurer3If pledgedagainst loansLoan amountValue of PolicyRs.Loan Balance(Rs.)LoanBalanceRs.Surrender ValueRs.

10.5 Existing Liabilities of the ApplicantName Ref. No. Security Purpose RepayofmentLenderPeriod11.Balance Amountperiod to BorrowedcompleteRs.repaymentBalancepayableas atdateRs.Installment value Rs.DETAILS OF THE VEHICLETypeCondition*MakeCountry of originModelCubic CapacityYear of MakeChassis NoSeating CapacityEngine No.Fuel* Brand New Un registered, Reconditioned Unregistered, Registered11.1 If Registered, Registration No11.2 Date of first RegistrationDDMMYY12.0 Dealer/Seller/Original Lender .12.1Original Loan Amount (Rs.)12.2 Balance outstanding (Rs.)14.0 LOAN DETAILS14.1Market ValueRs.,,14.1Purchasing PriceRs.,,14.2Loan Amount requiredRs.,,14.3Repayment PeriodMonths15.0 INSURANCE15.1Name of the Insurer .15.2Insured Value15.3Premium for the 1st year Rs.Rs.,,,4

Law Governing ApplicantCommon Law/Kandyan Law/Thesawalama Law/Muslim Law1.2.3.4.5.I/We confirm that each of the statements stated above is true and correct.I/We confirm the vehicle will be used only for personal usage and not for commercial purposes.I/We confirm that I/We have not obtained any loan for the purpose mentioned in this applicationduring the past three year period from the National Savings Bank.In the event of this loan being defaulted, I/We authorize National Savings Bank to set off any suchover due amount against balances lying in to the credit of any other account that I/We maintainwith the National Savings Bank.I/We confirm that I/We will keep the National Savings Bank informed of any changes to theinformation provided in this application.Conditions1. If the customer doesn’t have a savings account with NSB, an account should be opened with aminimum amount of Rs. 1,000/-.2. Customer should be a confirmed and salaried employee in the public or at a reputed private sectororganization or a tax payer.(National Savings Bank will have a list of so recognized institutions)3. Maximum age should be 60 years by the time the loan is fully settled4. The maximum repayment period is 5 years and the minimum repayment period is 1 year5. Maximum loan amount is Rs. 8 Mn.6. 1st instalment should be credited to the loan account prior to the disbursement of the loan7. Comprehensive insurance cover to be obtained and assigned to the Bank8. Insurance to be obtained only through the Bank from one of the following Insurers.Eagle Insurance Co. Ltd.Sri Lanka Insurance Corporation Ltd.Union Assurance Co. Ltd.HNB Assurance plcAmana Takaful9. Only one loan can be obtained by the same person within a period of three years10. Processing Fee to be paid at the time of forwarding the application.A nominal fee will be charged as decided by the management. In addition if the applicantwithdraws the application after submitting no refund of the processing fee charged will be made.(All other costs such as vehicle valuation, registration, insurance, stamp fees and anyGovernment levy should be borne or reimbursed by the customer.)11. Two witnesses should attest the signature of the applicant/s to the Mortgage Bond.12. LC customers should enter into a personal loan agreement with two guarantors to cover the periodfrom the date of opening LC and registering the vehicle making NSB as absolute owner.12.1 Clearing should be done through an Agent appointed by the Bank at the expense of theapplicant and will be at the risk of the loan applicant.12.2 Vehicle registration to be carried out by the Bank appointed Agent at a fee to be borne by theapplicant.12.3 Customer should deposit his portion of capital with NSB12.4 Any losses due to delay in clearing / incomplete documentation / invoice or any other reason will notbe borne by the Bank.13. A valuation report by an Authorized Agent of the Bank should be forwarded for all types of vehicles otherthan for a Brand New Vehicle.14. The original of the Registration Book and the duplicate key should be kept in the custody of the Bank untilthe loan is fully settled.15. Vehicle should be shown to the Bank.5

Documents required1. Duly completed application form2. Copy of National Identity Card along with the original3. Letter of Confirmation from the employer4. Salary slips for the past 6 months copies5. Bank statements for the past 6 months copies6. Latest EPF statement7. NSB Savings A/C No.8. Pro-forma Invoice9. Valuation Report if applicable10. If non-employment, tax computations (returns), tax payment receipts for the past 03 years copies11. If the employer of the applicant is not registered with NSB Audited Accounts for the past 03 yearsand any other document that the Bank may require in evaluating the employer.12. If redemption, balance confirmation from the original lender or the sales agreement with the seller.In all instances the seller should confirm to the Bank that the difference between the loan amountand the purchase price has been paid by the applicant.13. Disbursement of the loan will be made only by way of an A/C payee cheque written in favour ofthe seller’s name.Documents to be signed by the customer01. Loan application02. Standing Order03. Loan Agreement / Mortgage BondApproving the loan and the amount of the loan shall be at the sole discretion of the Bank. Bank has theright either to approve a loan in full, in part or reject in full with no reasoning thereof.Bank has the right to add, amend or remove any of the above mentioned conditions with no priornotification.I/We have read, understood and agree on all of aforesaid conditions applicable to this loanSignature of the Applicant/sNameDate:6

13. Disbursement of the loan will be made only by way of an A/C payee cheque written in favour of the seller's name. Documents to be signed by the customer 01. Loan application 02. Standing Order 03. Loan Agreement / Mortgage Bond Approving the loan and the amount of the loan shall be at the sole discretion of the Bank. Bank has the