Transcription

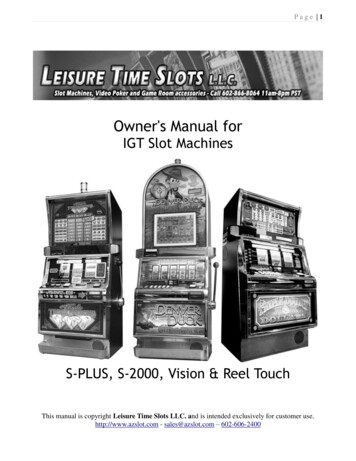

COIN-OPERATED AMUSEMENTMACHINE REGULATION ANDTAXATIONWHAT IS CONSIDERED A “COIN-OPERATED MACHINE”?A P R I L 2 015Glenn HegarTexas Comptroller ofPublic AccountsCoin-operated machines include all types of electronic devices that require the customerto insert a coin, bill, metal slug, token, electronic card or check to play a game, music orpleasure machine.The Coin-Operated Machines Law providescomprehensive and uniform statewide regulationof music and skill or pleasure coin-operatedmachines. Coin-operated machines includeall types of electronic devices that require thecustomer to insert a coin, bill, metal slug, token,electronic card or check to play a game, music orpleasure machine.Businesses thatoffer coin-operatedamusement machinesfor their customersLICENSES AND REGISTRATIONCERTIFICATESmust be licensedBusinesses that offer coin-operated amusementmachines for their customers must be licensedor registered by the Comptroller. The agencyalso collects a state occupation tax for eachmachine exhibited. An application for a license orregistration certificate must include payment forfees and tax.GENERAL BUSINESS LICENSEA general business license holder canmanufacture, own, buy, sell, rent, lease, trade,maintain, transport, exhibit or store coin-operatedamusement machines in Texas. A general businesslicense allows the holder to exhibit a machine inanother person’s business.Annual general business license fees are: 200 for 50 or fewer machines 400 for 51 to 200 machines 500 for 201 or more machinesor registeredby the Comptroller.IMPORT LICENSEAn import license holder can import, transport,own, buy, repair, sell or deliver coin-operatedamusement machines in Texas. An importlicense is necessary to purchase coin-operatedamusement machines from out-of-state to resellin Texas. Import license holders must have ageneral business license to offer coin-operatedamusement machines for play, except for machinesdemonstrated for free.The annual import license fee is 500.This publication is intended as a general guide and not as a comprehensive resource on the subjects covered.It is not a substitute for legal advice.FOR MORE INFORMATION,SEARCH OUR WEBSITE ATComptroller.Texas.Gov1

Coin-Operated Amusement Machine Regulation and TaxationREPAIR LICENSEANNUAL RENEWALSA repair license allows the holder to repair coin-Licenses and registration certificates are renewedoperated amusement machines for others. Arepair license holder can also transport or storeamusement machines in Texas.The annual repair license fee is 50. Machineowners can repair their own machines withoutobtaining a repair license.each year no later than Nov. 30. A renewalapplication received after the due date may resultin an expired license or registration certificate. Thelicense or certificate must be current to display acoin-operated amusement machine.Late fees for renewals 50 for a renewal application with a Decemberpostmark.REGISTRATION CERTIFICATEA person qualifies for a registration certificateinstead of a general business license if the person: owns or exhibits coin-operated amusementmachines only in that person’s own place ofbusiness;The deadline for has no machines in another person’s business;license and registration has no financial interest in the coin-operatedcertificate renewals isNov. 30.andmachine industry except for ownership ofmachines operated in that person’s business.The annual registration certificate fee is 150.EXEMPTIONSNo license, registration or occupation tax is dueon machines: operated exclusively in a private residence forpersonal use; transported or stored by common carrierregulated by the Texas Railroad Commission; owned by, leased or rented to organizationsoperated exclusively for charitable, educational,religious or benevolent purposes. (Eligibilityinformation, as described in Rule 3.602, mustbe submitted to the Comptroller. An organizationwith social or fraternal activities does notqualify.)License and registration certificate fees cannot beprorated. Fees cannot be refunded after a licenseor certificate is issued. 1.5 times the annual fee for renewal applicationspostmarked not more than 90 days after Dec. 31. Two times the annual fee for renewal applicationspostmarked more than 90 days but less thantwo years after Dec. 31.License and registration certificates lapsedfor two years or more cannot be renewed, so theholder must apply for a new license or registrationcertificate.The deadline for license and registrationcertificate renewals is Nov. 30.DENIAL OF LICENSE/REGISTRATION CERTIFICATEA general business license cannot be issued to aperson convicted of a felony within the past fiveyears, or who has been placed on probation orreleased on parole for a felony conviction withinthe past two years.A general business, import or repair license maynot be given to a person who fails to designate aThe coin-operated machine law doesnot authorize or permit the possession,operation or display of a machineprohibited by the Texas Constitution orPenal Code.FOR MORE INFORMATION,SEARCH OUR WEBSITE ATComptroller.Texas.Gov2

Coin-Operated Amusement Machine Regulation and Taxationownership. The license holder must also keep aseparate record showing the distribution of grossreceipts on collections from each machine.RECORD KEEPERThe license holder must maintain records at therecord keeper with records maintained at an officelocated in Texas and made available for inspectionby a representative of the Comptroller’s office.A license or registration certificate may notbe given to anyone who owes outstanding fees,penalties or taxes to the state.The above restrictions apply to officers, directors,members and shareholders owning 25 percent ormore of a company.ILLEGAL GAMBLING DEVICESThe coin-operated machine law does not authorizeor permit the possession, operation or display ofa machine prohibited by the Texas Constitution orPenal Code.RECORDS REQUIREDThe law requires an owner of a coin-operatedamusement machine to have complete anditemized records for each machine. The recordsmust be kept for at least four years. Recordsand supporting documentation must be keptfor more than four years if an owner has anyissues pending before the Comptroller that mayresult in tax, penalty or interest being assessed,collected or refunded by the Comptroller or whilean administrative hearing or judicial procedure ispending.A license holder must report to the Comptrolleridentifying information on each machine owned,possessed or controlled, including the locationof each machine and any change in machineTexas office of a designated record keeper. Therecords must be made available for inspection,upon request, by a member of the Comptroller’soffice or the Office of the Attorney General. The lawrequires the record keeper to be an owner, partner,officer, trustee, receiver or principal member of thelicensed business.A registration certificate holder is exempt fromthese record-keeping requirements.OCCUPATION TAX PERMITEach coin-operated amusement machine offeredfor use by customers must have an occupation taxpermit decal visibly and securely attached to themachine.Machine tax permits cost 60 per calendar yearbut can be prorated based on the calendar quarterthe machine is first exhibited in Texas. Tax permitsare reissued with the license and registrationcertificate renewals.To purchase permits for new machines acquiredduring the year, file the Texas Applicationfor Additional Coin-Operated Machine TaxPermit(s) (Form AP-141).Permits that are lost, stolen or destroyed maybe replaced by filing the Texas Applicationfor Duplicate Occupation Tax Permits (FormAP-140). Duplicate permits cost 5 each.Permits may be transferred with the sale ofa machine during the calendar year by filingthe Coin-Operated Machine Tax Permit(s)Ownership Transfer Statement (Form AP-212).There is no cost for the transfer.Each coin-operatedamusement machineoffered for useby customersmust have anoccupation taxpermit decal visiblyand securely attached tothe machine.FOR MORE INFORMATION,SEARCH OUR WEBSITE ATComptroller.Texas.Gov3

Coin-Operated Amusement Machine Regulation and TaxationOPERATING WITHOUT A PERMITSALES TAX ON MACHINESAnyone who displays or exhibits a coin-operatedState and local sales tax is due on the purchaseamusement machine without a valid tax permitattached is subject to a civil penalty of 50 to 2,000. The Comptroller can assess the penalty foreach day a violation occurs.of all machines, unless purchased exclusively forresale.A license or registration certificate holder whodoes not engage in the business of selling taxableitems can sell two machines in a 12-month periodwithout collecting sales tax. Sales tax is due onthe third and subsequent sales. The license orregistration certificate holder must obtain a generalbusiness or import license before selling a thirdmachine.For information on applying for a sales anduse tax permit and filing tax returns, visit anyComptroller field office or call 1-800-252-5555.Information is also available on the Comptroller’swebsite.LOCAL GOVERNMENT OCCUPATION TAXCities and counties may impose a coin-operatedmachine tax in addition to the state tax.Anyone who displaysor exhibits a coinoperated amusementmachine without a validtax permit attached issubject to acivil penaltyof 50 to 2,000.OWNER REIMBURSEMENTThe first money earned on the exhibition of acoin-operated machine may be paid to reimbursethe owner for that year’s machine occupation taxpermit. Each year, enough money is taken from acoin-operated machine to reimburse the owner forthe following year’s machine occupation tax permit.By law, the owner cannot waive this reimbursement.DISTRIBUTION AND REFUNDS OF RECEIPTSA general business license holder cannot offera business more than 50 percent of the grossreceipts from a coin-operated amusement machineafter tax reimbursement. A business owner cannothave keys or other access to a machine’s cash boxunless the machine has an income meter.Refunds for a malfunctioning machine can bepaid to a business owner only when the licenseholder is given the name, address and telephonenumber of the person who deposited money in themachine and the amount of money deposited.State and local sales tax is due onthe purchase of all machines, unlesspurchased exclusively for resale.FOR MORE INFORMATION,SEARCH OUR WEBSITE ATComptroller.Texas.Gov4MACHINE RECEIPTS EXEMPT FROM SALESTAX, EXCEPT FOR PURCHASEMachine receipts are exempt from sales taxesexcept when used as payment for the purchase ofa machine, including an agreement in which thelicense holder is guaranteed a minimum paymentregardless of the actual income from the machine.CHANGES IN MACHINE LOCATIONA registration certificate holder must notify theComptroller within 10 days of moving a machineto a different location by filing the MachineLocation Amendment for RegistrationCertificate Holders (Form AP-142). The holdershould complete a separate form for each locationwhere machines are moved.TAX CODE ADMINISTRATIVE PROCEDURESThe law allows the use of administrativeprocedures in the Texas Tax Code for the recoveryof delinquent taxes, penalties and permit fees.The procedures can include collection activities,tax liens, administrative hearings, and taxpayerlawsuits.

Glenn HegarTexas Comptroller of Public AccountsThis publication is intended as a general guide and not as a comprehensive resource on the subjects covered. It is not a substitute for legal advice.WE’RE HERE TO HELP!If you have questions or need information, contact us:For more information,search our website atComptroller.Texas.GovTexas Comptroller of Public Accounts111 East 17th StreetAustin, Texas 78711-1440Sign up to receive email updates onthe Comptroller topics of your choice 11 Emergency Service/Equalization SurchargeAutomotive Oil FeeBattery FeeBoat and Boat Motor Sales TaxCustoms BrokerMixed Beverage TaxesOff-Road, Heavy-Duty DieselEquipment SurchargeOyster FeeSales and Use Taxes1-800-531-5441In compliance with the Americans with DisabilitiesAct, this document may be requested in alternativeformats by calling the appropriate toll-free numberlisted or by sending a fax to 512-475-0900.Cement TaxInheritance TaxLocal RevenueMiscellaneous GrossReceipts TaxesOil Well Servicing TaxSulphur Tax1-800-442-3453WebFile Help1-800-252-1381Bank FranchiseFranchise Tax1-800-252-7875Spanish1-800-531-1441Fax on Demand (Most frequently requestedSales and Franchise tax forms)1-800-252-1382Clean Vehicle Incentive ProgramManufactured Housing TaxMotor Vehicle Sales Surcharge,Rental and Seller Financed Sales TaxMotor Vehicle Registration Surcharge1-800-252-1383Fuels TaxIFTALG DecalsPetroleum Products Delivery FeeSchool Fund Benefit Fee1-800-252-1384Coastal ProtectionCrude Oil Production TaxNatural Gas Production Tax1-800-252-1387Insurance Tax1-800-252-1385Coin-Operated Machines TaxHotel Occupancy Tax1-800-252-1386Account StatusOfficer and Director Information1-800-862-2260Cigarette and Tobacco1-888-4-FILING (1-888-434-5464)TELEFILE: To File by Phone1-800-252-1389GETPUB: To Order Forms and Publications1-800-654-FIND (1-800-654-3463)Treasury Find1-800-321-2274Unclaimed Property ClaimantsUnclaimed Property HoldersUnclaimed Property Name Searches512-463-3120 in Austin1-877-44RATE4 (1-877-447-2834)Interest RatePublication #96-256 Revised April 2015

200 for 50 or fewer machines 400 for 51 to 200 machines 500 for 201 or more machines. IMPORT LICENSE. A. n import license holder can import, transport, own, buy, repair, sell or deliver coin-operated amusement machines in Texas. An import license is necessary to purchase coin-operated amusement machines from out-of-state to resell in .