Transcription

Financial Management ProgramFinancial Policies, InternalControls and BudgetingPresented byDave Lakly, dlakly@uga.edu

NotForLong Charter SchoolThe Board of NotForLong Charter School iscalling a meeting to discuss the followingissues: A temporary borrowing is required due to lackof available cash to meet obligations in thenext two months Audit report with multiple findings related tofinancial reporting and compliance Appearance of fraudulent activity in one ofthe departments2

XYZ Charter SchoolXYZ Charter School has a regularlyscheduled monthly board meeting with thefollowing agenda items: Favorable audit results Strong quarterly financial statement Groundbreaking on new facility Recognition of the business office for theiradministration efforts related to purchasingcards3

4

FINANCIAL POLICYDEVELOPMENT5

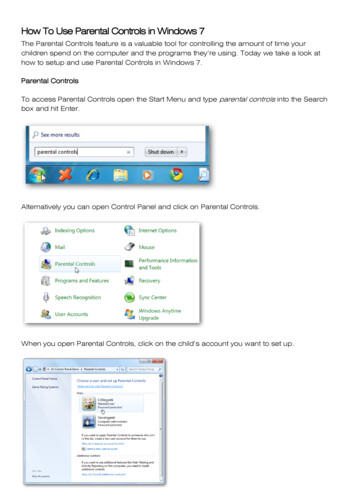

Learning ObjectivesAt the end of this section, you should beable to: Define financial policies and describe howthey differ from procedures Recall why financial policies are importantand common characteristics of effectivepolicies Describe the steps involved in policydevelopment6

Financial Policies Defined Financial policies are guidelines or a planof action for decisions as they relate tofinancial matters7

Policy versus Procedure Policies govern the operations of thegovernment Procedures dictate how the policy will beimplemented Policies GUIDE decision making, whileprocedures DRIVE actions8

Policy versus Procedure Policies leave some room for managerialdiscretion, while procedures are detailedand rigid Policies are an integral part oforganizational strategies, while proceduresare tactical tools Policies are generally formulated by topmanagement while procedures exist atlower organizational levels in line withpolicies9

Policy or Procedure?The budget shall be balanced for each andevery budgeted fund. Total anticipatedrevenues plus that portion of the fundbalance that is designated as a budgetfunding source shall equal total estimatedexpenditures for each fund.10

Policy or Procedure?The budget shall be balanced for each andevery budgeted fund. Total anticipatedrevenues plus that portion of the fundbalance that is designated as a budgetfunding source shall equal total estimatedexpenditures for each fund.11

Policy or Procedure?The investment program shall comply withall Georgia laws and federal/stateregulations for investing public funds andsafekeeping/security requirements.12

Policy or Procedure?The investment program shall comply withall Georgia laws and federal/stateregulations for investing public funds andsafekeeping/security requirements.13

Policy or Procedure?All bank statements and cancelled checkswill be opened, reviewed and initialed by theDirector of Operations upon receipt.14

Policy or Procedure?All bank statements and cancelled checkswill be opened, reviewed and initialed by theDirector of Operations upon receipt.15

Why Create Policy? Improves Awareness of FinancialCondition Improves School’s Financial Stability Contributes to Continuity Improves Public Confidence Helps to Prepare for a FinancialEmergency16

Role of the Board Establish policy with concentration onlong-term financial sustainability Financial policies are an integral partof long-term planning17

Role of the BoardCannata, Marisa, Thomas, Grant, and Thombre, Zaia. “Starting Strong,Best Practices In Starting a Charter School.”18

Role of the Board19

Effective Policy Characteristics Clear, SpecificCurrentCentrally availableComprehensive– Who, what, when, where (not how!)20

Steps to Policy Development Determine needed policies Obtain sample policies– other schools, GCSA Create a draft policy– Template for policies Legal review Board approval Distribute and train on policy21

Step 1: Determine Needed Policies Accounting and Financial ReportingBudgetRevenueExpendituresFund BalanceCapital AssetCash and InvestmentsPurchasing22

Step 2: Obtain Sample Policies Look at what policies exemplary schoolsare using Check with SCSC, GCSA, GFOA, GaDOE– www.gfoa.org/financialpolicies– s/Financial-Review/Pages/LUASManual.aspx CVIOG Course23

Step 3: Create Draft Policy Create and use a consistent template24

Step 4: Legal Review Access to attorney services through othergovernments Pay for services25

Step 5: Board Approval The board can request staff todevelop specific policies Board can devote as many worksessions as needed to review thepolicies Potential for public input26

Step 6: Distribute & Train All relevant staff needto be aware of thepolicy Without propertraining, policies canoften bemeaningless!27

Review and Maintain! Policies should be reviewed regularly Review and revise/reaffirm atpredetermined intervals28

POLICY EXAMPLES29

Budget Policy Policy should establish balanced budgetrequirement– XYZ Charter School will adopt a balancedbudget for each and every budgeted fund.Total anticipated revenues plus that portion ofthe fund balance that is designated as abudget funding source shall equal totalestimated expenditures for each fund.30

Budget Policy Policy should address legal level ofadoption– The budget shall be adopted at the legal levelof budgetary control which is thefund/department level (i.e., expenditures maynot exceed the total appropriation for anydepartment within a fund without the board’sapproval).31

Budget Policy Policy should establish the parameters ofbudget amendments and adjustments– The Board shall authorize funding sourcesincreases or decreases as well as associatedchanges in the expenditure budget at thelegal level of authority.32

Budget Policy Policy should establish the parameters ofbudget amendments and adjustments– The budget is a dynamic rather than staticrevenue and spending plan which requiresadjustment from time to time as circumstanceschange. Approval of the Board is required forincreases in total department or fund budgets,increases or decreases in the personal servicesbudget total of a department or fund, increases inthe level of authorized positions, or changes tocapital outlay.33

Budget Policy Policy should set contingency goals– XYZ Charter School shall include acontingency amount in the General Fundbudget for emergency type expenditureswhich cannot be foreseen when the budget isadopted. The goal of the contingency shall be5% of the total General Fund budget, and thisshall be subject to annual appropriation.34

Fund Balance Policy Policy should address unassigned fundbalance– XYZ Charter School shall establish anunassigned fund balance in the General Fund.The purpose is to pay expenditures caused byunforeseen emergencies, handle shortfallscaused by revenue declines, and to eliminate anyshort-term borrowing for cash flow purposes. Thisreserve shall accumulate and attempt to beretained at an amount which represents 2 monthsof operating expenditures.35

Fund Balance Policy Policy should address unassigned fundbalance– Should the School’s unassigned andcommitted fund balances at fiscal yearend fallbelow the established goal, the School willdevelop a plan to restore and maintain theminimum fund balance.36

Fund Balance Policy Policy should address unassigned fundbalance– The general fund committed, assigned,unassigned fund balances is limited to 15% ofthe next year's budgeted general fundexpenditures.37

Reporting Policy Policy should establish importance ofongoing monitoring:– XYZ Charter School will develop an ongoingsystem of financial reporting to meet theneeds of the board, school leaders, andcontributing local governments. The reportingsystems will promote budgetary control andcomparative analysis.38

Reporting Policy Other notes on reporting – Report at the legal level of control– Require monthly reporting– Budget to actuals and variances– Policy should also specify Superintendent’sauthority to spend39

INTRODUCTION TO INTERNALCONTROLS40

Internal Controls Defined A coordinated set of policies andprocedures Ensure that management’s objectives areachieved Practical techniques employed bymanagement to meet its responsibilitiesContinued on next slide41

Internal Controls Defined Inextricable part ofhow managementconducts its businessContinued on next slide42

Internal Controls DefinedAs defined by (COSO), internal control is“a process, effected by an entity’s board ofdirectors, management and otherpersonnel, designed to provide reasonableassurance regarding the achievement ofobjectives in the following categories:– Effectiveness and efficiency of operations– Reliability of financial reporting– Compliance with applicable laws andregulations.”43

I/C Importance Designed to provide reasonableassurance regarding the achievement ofobjectives in the following categories:– Effectiveness and efficiency of operations– Reliability of reporting– Compliance with applicable laws andregulationsContinued on next slide44

I/C Importance Importance of Internal Control– Internal controls can Reduce or prevent errors in a cost-effectivemanner Reduce opportunities for fraud, waste and abuse Protect employees Provide for the security of assetsContinued on next slide45

I/C Importance Importance of Internal Control– Internal controls can Provide appropriate checks andbalances Reduce opportunities for misuse ofassets Prevent or detect inaccurate orincomplete financial information Ensure compliance with laws,regulations, policies and proceduresContinued on next slide46

I/C Importance Importance of Internal Control– Internal controls can Establish standards of performancePreserve integrityReduce the likelihood of adverse publicityEnsure public confidenceProvide for accountability of elected and appointedofficials47

Costs Versus Benefits of I/C Cost versus benefits ofInternal Controls– The cost should not exceed thebenefits– Identify and weigh tangible andintangible costs Poor public perception48

I/C Components Five internal control components:– Control environment– Risk assessment– Control activities– Information and communication– Monitoring activities49

Control Environment Control Environment– Sets tone of an entity– Influences people’sconsciousness ofcontrols– Foundation of all othercomponents– Pervades anorganization’s activitiesContinued on next slide50

Control EnvironmentControl Environment comprised of 1.2.3.4.5.Commitment to integrity and ethical valuesIndependent oversightAssignment of authority and responsibilityCompetent staffAccountability51

Risk Assessment Risk is defined as– Possibility an event will occurand adversely affect theachievement of objectives Risk assessment is– An ongoing process– Critical component of internalcontrolContinued on next slide52

Risk Assessment Precondition to risk assessment isestablishment of objectives– Operations objectives– Compliance objectives– Reporting objectives External financial reporting External non-financial reporting Internal financial and non-financial reportingContinued on next slide53

Risk Assessment Risk analysis includes Estimating the likelihood and frequency ofoccurrence High, medium or low risk Identification of risks includes AuditsEvaluationsTestingAssessment54

Control Activities Control Activities– Component of internal control– Methods used to reduce risk– Control activities are Tools – both manual and automated Policies and procedures Preventive or detective55

Information and CommunicationInformation and Communication Important element of internalcontrol Must flow up, down and acrossorganization Accurate, reliable and continuous56

Monitoring ActivitiesMonitoring Activities Component of internal control Ensures internal controls operate as intendedover time Accomplished through– Routine (ongoing) activities– Separate evaluations– Combination of bothContinued on next slide57

Monitoring ActivitiesMonitoring Activities Ongoing monitoring activities– Management and supervisory activities Separate evaluations– Conducted by internal or external auditors– Focus on specific event or time– Findings reported to appropriate level of managementfor resolution58

Ethics A Code of Ethics should include prohibitionagainst:– Conflict of interest– Unfair financial or other opportunistic advantages toany member of the governance board, their familymembers, associates, or individual constituents.– Accepting gifts from vendors– Use of government contracts for personal use– Allowing vendors to pay for meals/entertainment Purchasing departments should be especiallycareful and follow this code since many of theactions of the department are open to the public59

Purchasing EthicsDealing with the Media Respond quickly Research answer No guessing No such thing as “off the record” Expect to be misquoted Helpful/courteous without providing unnecessaryinformation60

Crime in Purchasing Collusion Fraudulent companies and documents Illegitimate businesses61

Legal Considerations: ComplianceE-Verify – it is an Internet based system operated by the Department ofHomeland Security in partnership with the Social Security Administrationthat allows participating employers to electronically verify the employmenteligibility of their newly hired employees.-- Contracting for the “physical performance of services” with a county /city.Annual Reporting Requirements1. E-Verify Compliance Report due December 31. It will include the workauthorization program verification number and the date of authorizationfor both the public employer and the contractors, as well as the date ofthe contract between these two parties.2. Occupational Tax Certificate (Business License) Report – won’t discussin this class.62

Legal Considerations: SAVEProgramSAVE – it is a federal program used to verify that applicantsfor certain “public benefits” are legally present in the UnitedStates.A list of these public benefits can be found on the State’sAttorney General website.Annual Reporting Requirements Report must be filed with the Department of CommunityAffairs no later than January 1. DCA has an onlinePublic Benefits Reporting System (PBRS) and is the solemethod by which public entities can meet thisrequirement.63

BUDGET ROLES ANDPROCESS64

Learning ObjectivesAt the end of this section, you should beable to: Recall the role budgeting and majorbudget rules Recognize the roles of the board and staffin the budget process Discuss the basics of financial planningand the budget process and calendar65

Role of Budgeting A plan for spending money A document which translates financialresources into human resources A series of goals with the price tagsattached A craft-like activity involving analyses andjudgments about the worth of things66

Role of Budgeting It involves the allocation of scarceresources among various competingalternatives The budget drives the other financialmanagement systems such as accountingand reporting, capital programming,purchasing, debt management andtreasury management67

Role of Budgeting Allocates resources to achieveestablished mission statement andstrategic objectives68

Role of the Board Establish budget policy Approve strategic plan and accompanyingobjectives– should establish and communicate a sharedpurpose and direction for improving theperformance of students and the effectivenessof the school Approve budget Hold school leader accountable69

Role of Charter Staff Recommend budget policy to the board Develop procedures to implement budgetpolicy Participate in the strategic planningprocess Develop budget necessary to achievestrategic objectives Monitor budget for compliance70

Role of Charter StaffCannata, Marisa, Thomas, Grant, and Thombre, Zaia. “Starting Strong,Best Practices In Starting a Charter School.”71

Budget Rules Budget can be adopted in form which isdeemed the most efficient– Line-item– Activity– Program– Performance– Zero-base72

Budget Rules Adopt and operate under an annualbalanced budget for all funds– (OCGA § 20-2-167) Balanced when the sum of estimatedrevenues and appropriated fund balancesis equal to appropriations Advertise the budget two weeks prior toformal adoption to allow public input Adopted by board73

Process or Product Budgeting is as much a process as aproduct! An efficient budget preparation processensures– All participants should know what is expectedof them– The public should be informed– All items which make up an efficient budgetprocess should be present74

Budget Process Elements of a successful process– Goals and objectives (sense of direction)– Assessing stakeholder needs (sense ofpriority)– Administrative plan– Budget calendar75

Budget Process Goals and objectives– Goals desired outcome or state– Objectives steps taken to achieve the goal– Budget requests should support goals andobjectives– Budget requests not consistent with goals andobjectives unfunded budget requests76

Budget Process Assessing stakeholder needs– Develop a list of priorities for the school– Additions and cuts can be made based onpriorities– Tough choices must be made!77

Budget Process Administrative Plan– Describes the various steps involved– Describes the persons responsible– It is a policy statement78

Budget Process Budget Calendar should answer:– Who Is responsible for the task– What Is to be accomplished within the task– When Is the task to be completed79

Budget Process Budget Calendar should include when– Budget request forms, instructions andguidelines will be distributed,– Budget forms are due,– Budget requests compiled into a singlebudget document,– Budget will be presented to the board fordiscussion,– Budget will be adopted, and– New fiscal year will begin80

Budget Calendar November – Establish budget calendar. December – Leadership meets with department heads,principal, teachers, and school councils for needsassessments. January – Set school-wide goals and budgetary parameters. February - Departments prepare and submit line-itemrequests based on the needs of the individual departments March/ April - Superintendent/staff prepare tentative budget.Board holds work sessions as needed. May - Tentative budget is adopted by the Board. TentativeBudget is advertised with the date, time and meeting place foradoption of the final budget. Must hold two public hearings(different weeks) prior to adoption of the final budget. June – Adopt final budget prior to June 30.81

Balanced Budget Revenues Expenditures Revenues Fund Balance Expenditures Fund Balance– Use for one time, non-recurring expenditures– Once spent, must balance by increasingrevenues or decreasing expenditures82

Financial Sustainability Develop a budget that allows for fundingservices in the current and future years83

Financial Planning Good financial planning involves – Developing current service priorities,– Developing and implementing a strategicplan,– Seeking to determine priorities for the future,– Determining your ability to fund these servicepriorities.84

Stakeholders Key element in the planning process isstakeholder involvement– Board members– Parents– Elected officials– Department directors85

Methods of Involvement Focus groups Surveys (paper, telephone and webbased) Interviews Community meetings86

Submission Initial and final budget shall be transmittedto GaDOE per OCGA § 20-2-167 and §20-2-32087

Two Components Operating budget– Ongoing costs for staffing, materials, supplies Capital budget– Equipment and vehicle replacement andadditions– New facilities88

Key Point: Facility Planning If new facilities are planned, make sure theoperating costs have been determined– Especially donated facilities! Ongoing operating costs are problematic89

Considerations Condition of current facilitiesPotential facilitiesCondition of equipmentDemographicsInstructional delivery methodsProgramming opportunities90

Ongoing Facilities Costs Staff required Utilities cost per square foot Maintenance cost for cleaning, grounds,repairs91

Capital Replacement Maintain listing of all items such ascomputers, servers, printers, HVAC, andother costly equipment Include original purchase date and cost Estimated date for replacement withassociated costs Include in annual budget costs of thosecapital assets to be replaced in the currentyear92

Capital Replacement Determine funding options– Local governments’ capital budget– Grants– Bonds– Leases Include cost escalations93

Financial Projections Recommend 5 year projection– Revenues– Expenditures Include– Anticipated salary increases– Benefits changes– Strategic priorities– Inflation– Changes in user fees based on increased use94

Current Year ExpenditureProjections Determine average monthly expenditure– Expenditure to date/months to date– Adjust for any unusual fluctuations Multiply average monthly expenditure byremaining months95

Future Year ExpenditureProjections Consider changes in your expenditures bycategory– Salary/benefits– Components of operations Include an inflation adjustment factor96

Deficits Not legal without remediation per 20-2-67 Remediation requires that LEAs prepare andsubmit a Deficit Elimination Plan to theGaDOE, signed by each member of the localboard Submit a monthly financial report to theGaDOE, signed by each member of the localboard Advertise in the official county organ(newspaper) a statement of ActualOperations97

BUDGET ADMINISTRATIONAND EXECUTION98

Learning ObjectivesAt the end of this section, you should beable to: Recall the basics of budget maintenance Identify key policies that contribute tofinancial health99

Budgetary Control Budget Administration– Monitoring the actual spending of the schoolagainst the budget Budget Execution– Managing the resources in the budget in orderto meet goals and objectives100

Monitoring the Budget Verification of funds availabilityEncumbrance accountingReview all audits and monthly reportsAdjust within authorized level of controlAmend when revenue or expenditure totalincreases or decreases– Always align to the strategic plan!101

Encumbrances Encumbrance Accounting/ReportingControl– Component of budget administration– Allows governments to commit budgetappropriations– Initiated by a purchase order, contract or othercommitment of funds– Amount of encumbrance is subtracted fromavailable balance102

Budget Reporting Financial/Budgetary Reporting System– Provides management with periodic reportson revenues, expenditures andencumbrances compared with the adoptedbudget Should be timely, user friendly and easy tounderstand103

Budget Adjustment Director-level approval Adjustments within authority given inBudget Policy104

Budget Adjustment105

Budget Amendments Change the total revenues and/orexpenditures Must be approved by Board106

Budget Amendments107

Amended Budget108

Supporting Documentation Personnel – payroll reports, memos frombenefit providers Operations – historical data, costestimates of goods or services Adjustments or amendments – reportsused in calculating amounts109

Contingency Surpluses and Contingencies– Contingency – a line-item included in abudget to be used for unforeseen, emergencytype expenditures Rarely in excess of 5% of the appropriatedbudgets Spending requires board approval110

AUDIT111

Annual Audit OCGA § 20-2-2065 (b)(7)– (b) In determining whether to approve a charterpetition or renew an existing charter, the localboard and state board shall ensure that acharter school, or for charter systems, eachschool within the system, shall be: (7) Subject to an annual financial audit conducted bythe state auditor or, if specified in the charter, by anindependent certified public accountant licensed in thisstate; provided, however, that a separate audit shall notbe required for a charter school if the charter school isincluded in the local school system audit conducted bythe state auditor pursuant to Code Section 50-6-6112

Annual Audit OCGA § 50-6-6– (a) It shall be the duty of the Department of Audits andAccounts thoroughly to audit and check the booksand accounts of the county superintendents ofschools and treasurers of local school systems, ofmunicipal systems, of the several units of theUniversity System of Georgia, and of all other schoolsreceiving state aid and making regular and annualreports to the State School Superintendent, showingthe amount received, for what purpose received, andfor what purposes expended. All such funds held byofficials must be kept in banks separate from theirindividual bank accounts.113

Annual Audit 50-6-6– (b) Notwithstanding any other provisions of thischapter, the local boards of education of theseveral county, independent, and area publicschool systems of this state shall be authorized tohave an additional audit made of the books,records, and accounts of the public schoolsystem over which any such board hasjurisdiction. The local boards of education shallbe authorized to employ certified publicaccountants of this state to make the audits andto expend funds for the audits which are receivedby any such board for educational purposes.114

Annual Audit 50-6-6– (c) All audits of such public school systems shall beconducted in conformity with generally accepted standardsand principles of governmental accounting and auditingand shall be subject to the standards, rules, and ethicspromulgated by the Georgia Society of Certified PublicAccountants and the American Institute of Certified PublicAccountants. The audit report shall include the auditor'sunqualified opinion upon the presentation of the financialposition and the results of the operations of the publicschool system which is audited. If the auditor is unable toexpress an unqualified opinion, he shall so state and shallfurther detail the reasons for qualification or disclaimer ofopinion including recommendations necessary to makepossible future unqualified opinions.115

Audit Responsibility Superintendent and the Board– adopt sound accounting policies– establish and implement appropriate levels ofinternal controls that control the transactionsthat are included in the financial statements– evaluate financial risks and controls whichhave been put in place to mitigate those risks116

Audit Purpose The purpose of the audit is to express anopinion as to whether the financialstatements are presented fairly– Does not certify that every expenditure islegal and appropriate117

Audit Results Auditor’s Opinion on the FinancialStatements The Audited Financial Statements withrequired supplementary information Reports on Internal Controls andCompliance with Major Programs118

Audit Findings An audit finding is a disclosure ofinstances of non-compliance ofestablished regulations/ guidelines ordeficiencies in Internal Controls Types:– Financial Statement– Federal Awards– Management Letter119

Top Findings Financial Statement Findings– Inadequate Controls over Financial Reporting– Inadequate Controls over School ActivityAccounts– Failure to Adequately Maintain Capital Assets Federal Awards Findings– Unallowable Expenditures– Inadequate Internal Control Procedures– Time and Attendance Records not Utilized120

Top Findings Management Letter Findings– Internal Control Process Documentation– Excessive Fund Balance– School Activity Accounts– Financial Statement Preparation Process121

Findings Proactively prevent findings Address all findings122

123

www.vinsoninstitute.org 2015 The Carl Vinson Institute of Government. All rights reserved.

Policies leave some room for managerial discretion, while procedures are detailed and rigid Policies are an integral part of organizational strategies, while procedures are tactical tools Policies are generally formulated by top management while procedures exist at lower organizational levels in line with policies 9