Transcription

2022 Benefits At-A- GlanceHouse Staff Icahn School of Medicineat Mount Sinai Mount Sinai Beth Israel Mount Sinai Brooklyn The Mount Sinai Hospital Mount Sinai Queens Mount Sinai Morningside Mount Sinai West New York Eye and Ear Infirmaryof Mount Sinai

This brochure explains some of the features of the MountEmployment does not guarantee eligibility — this benefitSinai benefit plans. Complete details of each of the plansbrochure does not create a contract of employmentare contained in the official plan documents or insurancebetween Mount Sinai and House Staff members or anycontracts. If there is ever a conflict between this brochurecandidate for a Faculty or Staff position.and the official plan documents or insurance contracts,the plan document or insurance contract will prevail.

Benefits Dependent children, regardless of their studentThe Mount Sinai Health System’s health and welfareprogram is available to eligible House Staff and providesand/or marital status may be enrolled through thethe option to enroll in the plans that will best meet theend of the month in which they reach age 26.needs of you and your family members.Proof of dependent status is required. Uploaddocuments to Sinai Cloud, under Document RecordsWhat Benefits are Provided?on the Benefits home page.The benefits plan offered by Mount Sinai Health System(MSHS) is a comprehensive suite of benefits thatWhen can I enroll?include several options for medical and dental coverage.You will receive an email notification sent to your MountThe plan also offers vision,Sinai email account advising you when to access theprescription, short-termdisability, long-term disability,How do I enrollin theBenefits Plans?benefits enrollment website and elect benefits. Allelections must be made within 30 days of the date of hire.basic and supplementalHouse Staff members who do not elect or declinelife insurance.Who’s eligiblefor Benefits?Mount Sinai HealthSystem HouseStaff members whoare scheduled towork at least 60%of a normal workbenefits will receive defaultEnrollment is easy!coverage. (please see page 2)Log on to Sinai Cloud atOnce you select your benefits theyhttps://ejis.fa.us6. oraclecloud.com.will be in effect for theClick on the Me tab on your Sinai Cloud home page.remainder of the year, unless youClick on the Benefits icon. The Benefits home page opens.have a qualifying event.Click on the Enroll Here button to begin enrolling in benefits.Employees paid monthly will use Workforce Now athttps://workforcenow.adp.com to manage their benefits.What is the Benefits Centerand how does it helpHouse Staff members?The Benefits Center is theweek are eligible foradministrator of the benefits program.benefits. A House staff member is eligiblefor coverage on their date of hire.House Staff members may contact the BenefitsExamples:Center to ask questions about their plans and/orStart Date: 2/1/2022 Coverage Begins: 2/1/2022receive assistance with:Start Date: 2/15/2022 Coverage Begins: 2/15/2022 Enrolling in Benefits Adding or removing a dependentCan I enroll my dependents? Making mid-year plan changes (Qualifying event)House Staff members may enroll the Obtaining information regarding the Commuter Benefitfollowing dependents in the Benefit plans:Program and Debit Cards. Spouse: proof of marriage will be required.Upload documents to Sinai Cloud, under DocumentRepresentatives may be contacted at 646-605-4620Records on the Benefits home page.and are available Monday through Friday from 9:00 a.m.to 5:00 p.m.Continued1

BenefitsHouse Staff members wishing to monitor their FSAQualifying Eventsand TRIP account contributions, submit claimsOnce benefits selections have been made, they willelectronically,* or order additional debit cards may logremain in effect until the end of the year unless theonto the HealthEquity Online Reimbursement site at:employee has a qualifying event. A qualifying eventwww.healthequity.com/wageworks.signifies a change in an employee’s family status* Paper claims are not acceptedfor Trip Transit expensesDefault CoverageHouse Staff members whodo not enroll within the 30 dayI have medical coverageunder my spouse’s plan;can I decline to enroll in themedical plans offered byMount Sinai?such as: marriage, divorce, birth, adoption ofa child, or if a dependent loses or gains newinsurance. A qualifying event allows House Staffmembers to make changes to their benefitswithin 31 days of the event.If you experience a Qualifying Event and youperiod will receive the followingwish to make benefit plan changes, logdefault coverage: United Health Care/UMR Traditional Plan, MedImpactYes, House Staff may waiveonto Sinai Cloud, click on the Benefitsprescription coverage, basic lifemedical coverage. You mayicon, select “Report a Life Event” andinsurance, basiconly waive coverage if you aremake your new elections. Proof of yourshort-term disability and basiccurrently enrolled in anotherlong-term disability. Dependentsmedical plan. You must provideare not covered when an employeereceives default coverageproof of this coverage byfamily status change is required; marriagecertificate, birth certificate and otherforms of proof must be uploaded toSinai Cloud, under Document Recordsuploading a completed waiveron the Benefits home page. If proof isDeclining Coverageform to Sinai Cloud, undernot received your coverage will not beHouse Staff members wishing toDocument Records on theupdated.decline enrollment in any of theBenefits home page.for all benefits). When waivingAnnual Open Enrollment& Medical Cost-Share PremiumSavingsmedical coverage, a waiver formDuring the Annual Open Enrollmentoffered plans may do so.(The “waive” option is not availablemust be completed and uploaded to Sinai Cloud,period, House Staff members are able to make benefitunder “Document Records” on the Benefits homeplan changes without having a qualifying event. Priorpage, within 30 days. If this is not received, youto open enrollment, House Staff members are askedwill be issued default medical coverage under theto see their primary care physician, between the datesUMR Traditional PPO Plan for the remainder of thespecified by the Benefits Administration Department.year and will not be able to change unless youContinuedhave a qualifying event. You will pay applicablepayroll deductions for the defaulted TraditionalMount Sinai Benefits Officemedical raclecloud.com

BenefitsThose who meet this criteria within the time frameallotted will receive a reduction in their medical costshare premium. The reduction is provided in the formof a monetary credit that is added to the employee’spaychecks in the following year.The notation “MED CREDIT” can be found on theemployee’s paystub and confirms that they arereceiving the credit. All new hires automatically receivethe credit for 2022.In order to receive the credit in 2023 and subsequentyears, House Staff members will be required to visittheir primary care physician by August 31 each year.Mount Sinai Benefits raclecloud.com3

AccoladeMount Sinai Health System has partnered withYou should direct all medical plan and claims questionsAccolade, a personalized advocacy partner thatto Accolade, instead of your insurance provider.will provide support for your health and benefits needsAccolade’s contact information will be listed on the backin 2022. This confidential service is provided atof your medical plan ID card, and you will be able tono additional cost to you and yourcovered family members.You and your family will have accessto an Accolade Health Assistant whoconnect with your Health AssistantQuestion:I have questions on selectingthe best medical plan for meand my family.can help you understand your benefits,answer your questions and evenresolve issues related to health care billsand insurance claims. Your Health Assistantwill have an in-depth understanding of yourvia phone, online or by using themobile app.Mount Sinai Health System andAccolade have joined forces to ensureAnswer:Call Accolade at844-287-3868that you and your family receive a levelof personalized health and benefitssupport not seen in other programs.Accolade does not practice medicine nor provide patientavailable benefits and choices to help youcare. It is an independent resource to support and assistselect the best care plans for you andyou as you use the health care system and receivemedical care from your own doctors, nurses and healthyour family.care professionals. If you have a medical emergency, pleasecontact 911 immediately.Accolade will work closely with United Health Care/UMR and MedImpact, so your Health Assistant canaccess your claims and benefits in real time to assistwith questions.In addition, Accolade will be available to answerbasic questions about your dental and visionhealth care benefits.Here are some questions Accolade can help with:Benefits and Claim Support Why did I get this bill? Does my plan cover this treatment?Provider Support Can you help me find a Top-Tier provider? Is this doctor In-Network? Where can I go to have my MRI? What questions should I ask my doctor?Care and Condition Support Is there a generic version of my prescription? Can you help me connect to clinical programs? Can you help me understand my condition? What are the side effects of my -844-287-3868Monday-Friday, 8am-8pm Eastern TimeDownload the Accolade mobile appon the App Store or Google Play

Medical PlansEach medical plan option provides comprehensive(MSB) and New York Eye and Ear Infirmary (NYEEI) ofhealth care coverage allowing House Staff membersMount Sinai.flexibility in choosing a healthcare provider.The Enhanced In-Network Tier includes providersthat currently participate in the UMR Network. TheHouse Staff members may select one of the followingEnhanced In-Network Tier provides greater accessThree (3) United Health Care/UMR medical plans listedto physicians and hospitals systems that cover outerbelow. The plans differ by the amount of deductible,geographic areas (for example, standalone communitycoinsurance, co-pay and Out-of-Network benefits.hospitals). Copays, coinsurance, deductibles, and Traditional Plan Choice Plan High Deductibleout-of-pocket maximums are lower than the UMRHow can I locate aTop Tier Provider?Commercial Network. A list of Enhanced In-NetworkTier providers can be found on the intranet atHealth Plan ces/Benefits/index.asp.(For additional informationsee plan comparison charton the next page).Special Featuresof the PlansA list of Top Tier providerscan be found at:https://toptier.mountsinai.org/toptier.A list of Top Tier Facilitiescan be found at:https://toptier.mountsinai.org/facility.The In-Network Tier is United HealthCare/UMR commercial network. UMRhas a broad provider network and is a costeffective option for benefits eligible staffresiding outside of Manhattan.Out-of-Network (OON) Providersthat do not participate in either the Top Tier or theThe Tier Systemcommercial provider network sponsored by UMR.All plans are comprised of threecomponents: (1) A Top Tier, (2) In-Network, (3)House Staff who use Out-of-Network providers willand an Out-of-Network option. The price points andpay out of pocket first and then submit a claim to UMRemployee cost share requirements vary by plan.for reimbursement.Top Tier consists of participating providers across theThis plan uses a provider network. You will pay less ifMSHS. This includes providers from: The Icahn Schoolyou use a provider in the plan’s network. You will payof Medicine at Mount Sinai (ISMMS), The Mount Sinaithe most if you use an Out-of-Network provider, andHospital (MSH), Mount Sinai Queens (MSQ), Mountyou might receive a bill from a provider for theSinai St. Lukes (MSSL), Mount Sinai West (MSW),difference between the provider’s charge andMount Sinai Beth Israel (MSBI), Mount Sinai Brooklynwhat your plan pays. This is called balance billing.* The High Deductible Health Plan (HDHP) will not beavailable starting January 1, 2023.Mount Sinai Benefits raclecloud.com5

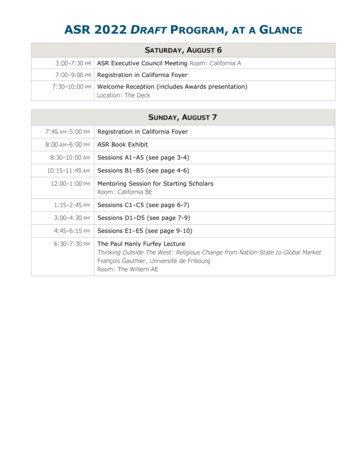

2022 Medical Plan Comparisons At A Glance*Mount Sinai Top TierChoice PlanHDHPTraditionalDeductible (EE/Fam) 0 2,000/ 4,000* 0PCP/Specialist/Dependent Child copay 0Deductible 30/ 40/ 30Urgent Care/Dependent Child Copay 75/ 40Deductible 75/ 40Hospital Inpatient/Outpatient Copay 50/ 50Deductible 200/ 50 150Deductible 150Labs/Radiology - (Physician, Outpatient Adv Imaging,Freestanding (NonLabCorp)Lab: 10 Rad: 25DeductibleLab: 50 Rad: 65Labs/Radiology - FacilityLab: 0 Rad: 40DeductibleLab: 0 Rad: 65Labs/Radiology - Freestanding (LabCorp)Lab: 10 Rad: 25DeductibleLab: 10 Rad: 25 1,000/ 2,000 3,000/ 6,000** 1,500/ 3,000Enhanced In-NetworkChoice PlanHDHPTraditionalDeductible (EE/Fam) 750/ 1,750 2,000/ 4,000 350/ 1,00010%5%0% 40/ 50/ 25Deductible/Coinsurance 40/ 50/ 25Urgent Care/Dependent Child Copay 75/ 40Deductible/Coinsurance 75/ 40Hospital Inpatient/Outpatient CopayDeductible & Coinsurance 400/Deductible & CoinsuranceDeductible/CoinsuranceDeductible 200/Deductible 150Deductible/Coinsurance 150 60/ 75Deductible/Coinsurance 60/ ctible/Coinsurance 10/ 25Deductible/Coinsurance 10/ 25 6,850/ 13,700 3,500/ 7,000 2,250/ 7,000Emergency Room CopayOOP Limits (EE/Fam)CoinsurancePCP/Specialist/Dependent Child CopayEmergency Room CopayLabs/Radiology - (Physician, Outpatient Adv Imaging,Freestanding (NonLabCorp)Labs/Radiology - FacilityLabs/Radiology - Freestanding (LabCorp)OOP Limits (EE/Fam)**Note: If Family coverage is elected, the full family out-of-pocketmaximum amount must be met before the Plan will begin paying coveredexpenses in full.* Note: If Family coverage is elected, the full family deductible amountmust be met before the Plan will begin paying at the Plan participation level.6

2022 Medical Plan Comparisons At A Glance (Continued)UMR In-NetworkChoice PlanHDHPTraditional 2,000/ 4,000 2,000/ 4,000* 1,000/ 3,00050%20%30%NoYesNo 50/ 75/ 35N/A 50/ 75/ 35Urgent Care/Dependent Child Copay 75/ 40N/A 75/ 40Hospital Inpatient/Outpatient CopayDeductible & Coinsurance 600/Deductible & CoinsuranceN/ADeductible & Coinsurance 400/Deductible & Coinsurance 150Deductible/Coinsurance 150Lab 85 Rad 100Deductible/CoinsuranceLab 85 Rad uctible/CoinsuranceLabs/Radiology - Freestanding (LabCorp)Lab 10 Rad 25Deductible/CoinsuranceLab 10 Rad 25OOP Limits (EE/Fam) 8,000/ 16,000 3,500/ 7,000 5,000/ 12,000Out-of-NetworkChoice PlanHDHPTraditionalDeductible (EE/Fam) 10,000/ 20,000 4,000/ 7,500* 4,000/ 11,00050%50%50%Deductible & Coinsurance 600/Deductible & CoinsuranceDeductible/CoinsuranceDeductible & Coinsurance 600/Deductible & CoinsuranceOOP Limits (EE/Fam) 22,500/ 45,000 12,500/ 25,000** 12,500/ 37,500Out-of-Network Reimbursement Level100% of Medicare100% of Medicare100% of MedicareDeductible (EE/Fam)CoinsuranceOffice Visit/Deductible CoinsurancePCP/Specialist/Dependent Child copayEmergency Room CopayLabs/Radiology - (Physician, Outpatient Adv Imaging,Freestanding (NonLabCorp)Labs/Radiology - FacilityCoinsuranceHospital Inpatient/Outpatient Copay**Note: If Family coverage is elected, the full family out-of-pocketmaximum amount must be met before the Plan will begin paying coveredexpenses in full.* Note: If Family coverage is elected, the full family deductible amountmust be met before the Plan will begin paying at the Plan participation level.Notes: To find a provider or facility in the Top Tier, Enhanced or UMR All three plans (Choice, HDHP, Traditional) include four Tiers:network please visit: umr.com.Mount Sinai Top Tier, Enhanced In-Network Tier, In-Network,and Out-of-Network. Each Tier (Top Tier, Enhanced In-Network, In-Network, andOut-of-Network) has a specific deductible and out-of-pocket limits. There are separate copays for dependents.7

Medical PlansThe Choice PlanThe Traditional PlanThe Choice Plan’s signature advantage is at the TopThe Traditional Plan is a suitable option for HouseTier level. All services provided within the Mount SinaiStaff members who want the freedom to chooseNetwork are covered at 100%, except for emergencyservices in any of the three tiers: Mount Sinai Top Tier,room and urgent care visits. Emergency room visits areUMR In-Network and Out-of- Network. This plan wouldsubject to a 150 copay. Urgent care visits are subjectalso be suitable if the majority of your providers do notto a 75 copay. The Choice Plan provides access toparticipate in the Mount Sinai Top Tier Network. SomeMount Sinai Top Tier, UMR In-Network and Out of-Traditional Plan employee co-pays for In-NetworkNetwork providers. House Staff who elect to enroll inand Out-of-Network services are equal to or lowerthe UMR Choice Plan will benefit from a reduced costthan the Choice plan.share premium.The High Deductible Health PlanThe High Deductible Health Plan (HDHP) option requiresenrollees to meet a high deductible* before eligiblemedical services are covered by the plan. The HDHPmay protect against catastrophic medical bills and has alower medical cost-share premium than the TraditionalPlan. The HDHP provides access to Mount Sinai TopTier,UMR In-Network and Out-of-Network providers.Enrollees may experience tax advantages by opening aHealth Savings Account or by participating in the Limitedpurpose Health Reimbursement Account.* View 2022 Medical Plan Comparisons At A Glance on page 6.For detailed information on all plan offerings, including theHealth Savings Account and Health Care ReimbursementAccounts, see the 2022 Summary Plan Description located inthe Benefits section of the Human Resources website at:http://intranet1.mountsinai. iday, 8am-8pm Eastern TimeDownload the Accolade mobile appon the App Store or Google Play

Medical PlansMedical Plan CostIdentification CardsThe Choice plan is offered to House Staff and theirOnce you enroll in any of the United Health Care/family members at no cost. The chart on the next pageUMR plans, your enrollment and demographicshows the annual cost of the other medical plans. Toinformation will be received by the carriers within twodetermine the per pay period cost, locate the salaryto three weeks.band that contains your salary under the medical planOnce you enroll, it will take up to three weeks for you tooption. Select your coverage level: single, employee receive insurance cards. Insurance cards will be mailed1 dependent, or employee family. Divide the annualto the address that is in Sinai Cloud.amount by the number of times you are paid weekly orbiweekly; 52 if you are paid weekly, 26 if you are paidbiweekly. The resulting amount is the per-pay perioddeduction. All medical plan costs include MedImpactPrescription coverage. All new hires selecting a medicalplan in which they will pay premiums, will receive themedical cost-share credit for the year they are hired.However they will be required to havea physical in order to receive the credit the followingyear. (The credit is included in the figures shownon the next 287-3868Monday-Friday, 8am-8pm Eastern TimeDownload the Accolade mobile appon the App Store or Google Play9

2022 Annual Benefits Cost Matrix* 1 Medical w/Prescription(Employee Pre-Tax Deduction)Coverage LevelChoiceHDHPTraditionalSingle 0.00 149.88 390.88Employee 1 0.00 299.76 781.77Employee 2 0.00 473.20 1,217.78Single 0.00 261.72 614.56Employee 1 0.00 523.44 1,229.12Employee Family 0.00 830.43 1,913.55Single 0.00 351.21 816.24Employee 1 0.00 702.43 1,632.47Employee Family 0.00 1,107.24 2,539.23Single 0.00 505.23 1,179.10Employee 1 0.00 1,010.46 2,358.19Employee Family 0.00 1,591.13 3,666.71Single 0.00 750.30 1,577.69Employee 1 0.00 1,500.60 3,155.37Employee Family 0.00 2,363.28 4,908.54Single 0.00 1,012.54 2,361.37Employee 1 0.00 2,025.08 4,722.74Employee Family 0.00 3,191.63 7,347.72Single 0.00 1,113.79 2,597.51Employee 1 0.00 2,227.58 5,195.01Employee Family 0.00 3,510.79 8,082.49Salary up to 30,000Salary 30,001 to 40,000Salary 40,001 to 60,000Salary 60,001 to 80,000Salary 80,001 to 135,000Salary 135,001 to 175,000Salary 175,001 *Includes Medical Cost-Share Credit1A new hire occupying a part-time position or a current employee experiencing a reduction in hours from full-time to part-time – (but are stillworking enough hours to be eligible for benefits), the cost-share rate will be pro-rated using a full-time equivalent salary.Therefore, a part-time employee will pay the same for benefits as a full-time employee occupying the same position.10

Prescription CoverageIf you enroll in any of the medical plans you will also beenrolled in a MedImpact prescription plan. Each of our fourmedical plans are bundled with a specific pharmacy plan. Thecost of the prescription plan is included in your medical costshare premium. You will receive a prescription ID card fromMedImpact for you and your dependents. Insurance cardswill be mailed to the address that is in Sinai Cloud. The chartbelow provides a summary of the prescription plans.Note: Prescription expenses will count toward the MedicalPlan out-of-pocket limits.2022 Pharmacy Benefits (Generic / Preferred / Non-Preferred)MedImpact Prescription Plan(Choice and Traditional plans)High Deductible Health PlanIn House PharmacyGeneric 520% ( 5 min / 10 max)Preferred Brand 1520% ( 10 min / 20 max)Non-Preferred Brand 2020% ( 15 min / 30 max)90 Days90 DaysMaximum Days SupplyRetail (MedImpact and In-Network Pharmacies) 1020% ( 10 min / 20 max)Preferred Brand25% ( 40 min / 80 max)20% ( 30 min / 60 max)Non-Preferred Brand25% ( 60 min / 120 max)20% ( 45 min / 135 max)30 Days30 DaysGenericMaximum Days SupplyMail Order or Refills at a MedImpact PharmacyGeneric 2520% ( 25 min / 55 max)Preferred Brand25% ( 100 min / 150 max)20% ( 75 min / 150 max)Non-Preferred Brand25% ( 150min / 300max)20% ( 110 min / 335 max)90 Days90 DaysMaximum Days SupplyIn-House Pharmacy (Icahn Specialty Pharmacy)In-House Pharmacy*Generic 20Preferred 50Non-Preferred 75Generic 20% ( 20 min / 40 max)Preferred 20% ( 40 min / 80 max)Non-Preferred 20% ( 70 min / 140 max)None 2,000 Individual / 4,000 FamilyDeductiblesDeductible(Combine Medical/Rx)*All specialty medications must be filled at the MSHS SpecialtyPharmacy. Exceptions: HIV, Transplant, Anti-Coagulation, Fertility,Limited Distribution Medications, etc.11Please de?MSS01202201to see if your medication is covered under the MedImpact formulary.

Dental PlansHouse Staff members are offered a choice of three (3)The DPPO Network Scopedental plans: two (2) Dental PPO Plans and one (1) DMOIf you utilize the DPPO Network, you will have accessPlan. While the three (3) plans provide different levelsto over 6,000 In-Network provider locations practicingof dental care benefits, each plan gives you and yourwithin the New York, New Jersey, Connecticut, andfamily access to affordable and quality dental care.Pennsylvania area.The dental plan options are:See Cigna Dental Plan Highlights on page 12 Cigna PPO – Basicfor additional plan information. Cigna PPO – Plus Aetna DMOThe Aetna DMO PlanThe Cigna PPO Basic and Plus options provide bothThe Aetna Dental Maintenance Organization (DMO)In-Network and Out-of-Network coverage. The Aetnais similar to an HMO for medical care. For services toDMO Plan provides In-Network coverage only.be covered, you must use the dentists who participatein the Aetna DMO network. There are no annualCigna Dental Plansdeductibles, no annual benefit maximums, and noCigna Basic and Plus PPO plans provide three (3)claim forms.ways for you to access dental services:When you enroll in a DMO, you must select a DMO Advantage Network ProvidersPrimary Care Dentist to manage your dental care. DPPO Network ProvidersYou may choose one dentist for yourself and your Out-of-Network Providersenrolled dependents–or each dependent may chooseThe plans provide coverage for preventive care,a different dentist. In addition, you can change dentistsbasic care, major restorative services, and orthodontiaby calling the DMO member services line shown below.services. Coverage levels are based on negotiatedIf you need to see a specialist, your dentist will refer you.rates or reasonable and customary rates. If you choosePreventive services are covered in full by the plan.this plan, you must meet the annual deductible beforeFor all other services, you pay only a copayment.the plan begins to pay for services. However, there isA list of current required copayments and services cannever a deductible when utilizing the plan forbe obtained on the Aetna website at www.aetna.com.preventive services.Cigna and Aetna Dental do not mail ID cards to itsmembers. You may log on to their website and printThe Advantage Network Scopeout your ID card.If you are looking to have the greatest amount ofcoverage with the lowest out-of-pocket expenses, youSee Cigna Dental Plan Highlights on page 12may wish to utilize dental providers who belong to thefor additional plan information.Advantage Network. The Advantage Network providesthe deepest discounts for employees and has over15,000 provider locations within the New York, NewJersey, Connecticut and Pennsylvania area.ContactInfo12Cigna DentalAetna CIGNA-24mycigna.com877-238-6200www.aetna.com

Dental Plans2022 Cigna Dental Plan HighlightsAnnual Dental PlanAnnual Dental Plan CostDetailed information for the dental plans is provided inTo determine the per pay period cost of the dentalthe 2022 Summary Plan Description booklet located inplans, log on to Sinai Cloud.the benefits section on the Human Resources websiteat: efits/index.asp.2022 Cigna Dental Plan HighlightsCigna DPPO Basic PlanAdvantageDPPO 75 / 225Type A (Preventive)Cigna DPPO Plus PlanOut-of-NetworkAdvantageDPPO 2Out-of-Network 100/ 300 100/ 300 50 / 150 75 / 225 75 / 225100%of NegotiatedFee80%of NegotiatedFee80%of Reasonable& Customary100%of NegotiatedFee100%of NegotiatedFee100%of Reasonable& CustomaryType B(Basic Restorative)80%of NegotiatedFee60%of NegotiatedFee60%of Reasonable& Customary80%of NegotiatedFee60%of NegotiatedFee60%of Reasonable& CustomaryType C(Major Restorative)60%of NegotiatedFee50%of NegotiatedFee50%of Reasonable& Customary60%of NegotiatedFee50%of NegotiatedFee50%of Reasonable& CustomaryType D (Orthodontia)50%of NegotiatedFeeN/AN/A50%of NegotiatedFee50%of NegotiatedFee50%of Reasonable& CustomaryType E (TMJ)60%of NegotiatedFee50%of NegotiatedFee50%of Reasonable& Customary60%of NegotiatedFee50%of NegotiatedFee50%of Reasonable& CustomaryAnnual Maximum(Type A, B, C & E) 1,500 1,500 1,500 3,000 3,000 3,000Orthodontia LifetimeMaximum 1,500N/AN/A 2,000 2,000 2,000Deductible(EE/Family) 12Notes:1. Deductibles only apply to Type B, Type C, andType E Services.2. Cigna offers two networks: the Advantage Network and theDPPO Network. The Advantage Network features deeperdiscounts. Members who visit providers in the DPPONetwork will be covered at the same benefit level asOut-of-Network and will not be balance billed.13

Vision PlansTo help House Staff members with the cost of visionAnnual Vision Plan Costcare for themselves and their family, the BenefitsTo determine the per pay period cost of the Vision plan,program offers the UnitedHealthcare Vision Plan.log on to Sinai Cloud. Detailed information for the visionThe plan helps you pay the cost of an annual eyeplan is provided in the 2022 Benefits Summary Planexamination, eyeglass frames, prescription lenses orDescription booklet located in the benefits section oncontact lenses, and is available for use at In-Networkthe Human Resources website at:or Out-of-Network providers. House Staff ces/will pay the lowest out-of-pocket cost when using anBenefits/index.asp.In-Network provider.(See plan highlights on the next page).UnitedHealthcare Vision does not mail ID cards to itsmembers. You may log on to their website and printout your ID card.ContactInfoUnited Healthcare VisionPolicy/Group # 298784800-638-3120myuhcvision.com14

United Health Care Vision Plan HighlightsComprehensive Vision Exam( 10 Co-pay; once every 12 months)Materials ( 10 Co-pay)The material copay is a single payment that applies to the entire purchase of eyeglasses(lenses and frames), or contacts in lieu of eyeglasses.Pair of Lenses(for eyeglasses; once every 12months) Standard single vision,lined bifocal, lined trifocal,standard scratch-resistant coatingFrames (once every 24 months)Receive a 130 wholesale frame allowance (approximate retail value of 120 to 150)at private practice providers, and retail chain providers. Additionally, many UHC providersoffer a 30% discount on the balance if the allowance is exceeded.Covered-in-full electivecontact lensesThe fitting/evaluation fees, contacts (including disposables), and up to two follow up visitsare covered-in-full (after applicable copay) for many popular brands, such as Acuvue byJohnson & Johnson and Optima by Bausch & Lomb. If covered disposable contact lensesare chosen, up to 6 boxes (depending on prescription) are included when obtained froma network provider. It is important to note that UnitedHealthcare’s covered-in-full contactlenses may vary by provider.All other elective contact lensesA 150 allowance is applied toward the fitting/evaluation fees and purchase of contact lensesoutside of UnitedHealthcare’s covered-in-full contacts (materials copay does not apply).Toric, gas-permeable, and bifocal contacts are all e

Benefits Contact Info Mount Sinai Benefits Office 646-605-4620 https://ejis.fa.us6.oraclecloud.com Yes,House Staff may waive medical coverage. You may only waive coverage if you are currently enrolled in another medical plan. You must provide proof of this coverage by uploading a completed waiver form to Sinai Cloud, under Document Records on the