Transcription

Voya Investment Management2021 Tax GuideI N VEEMSETNMTE N T M A N AG E M E N TE N T M A N AG

Contents2021 Form 1099-DIV 42021 Form 1099-B 62021 Form 1099-R 82021 Form 1099-Q 102021 Form 5498 12Answers to Commonly Asked Questions 141

2

Dear Shareholder:We are pleased to provide Voya Investment Management 2021 Tax Guide.INGTAX15This guide provides a description and explanation of the tax documents you mayreceive from us and offers general information on how to report this informationon your Federal income tax return. In addition, our taxguide includes: sample tax forms important definitions you should know step-by-step instructions for key fields on each form answers to frequently asked questionsWe hope that you find our 2021 Tax Guide a valuable resource in the preparationof your 2021 tax return. You may also access your tax documents by loggingonto our website at www.investments.voya.com. Should you have any questions,please contact a Voya representative at the toll free number that is listed on yourtax form.This guide is not meant to be a substitute for professional tax advice.Please consult your tax advisor to determine your individual tax situation.Mutual fund shares are not insured by the FDIC and are not deposits or otherobligations of, or guaranteed by, any depository institution. Shares are subject toinvestment risks, including possible loss of principal invested.3

2021 Form 10 99 - D I VDividend and Capital Gain DistributionsEvery shareholder, with certain exceptions as provided in the InternalRevenue Code, who has received 10 or more in taxable dividends ordistributions receives a Form 1099-DIV. Form 1099-DIV is also sent toaccount holders for whom backup withholding was taken on certainreportable transactions.Your Form 1099-DIV lists all federally taxable dividend and capital gaindistributions of 10 or more paid to your mutual fund accounts. If youraccount is invested in more than one fund, the 1099-DIV information foreach fund has been consolidated and mailed to you in a single package.However, shareholders with more than one type of account—for example,an individual account and another account that is jointly owned—willreceive a separate package of tax forms for each account. The dividendsand capital gains shown on Form 1099-DIV need to be reported onyour 2021 federal income tax return, even if you reinvested yourdistributions in additional fund shares instead of receiving themin cash.If you have one of the following types of accounts, you will not receiveForm 1099-DIV: Individual Retirement Accounts and other tax-deferred accounts (includingRoth and Traditional IRAs, Rollover IRAs, SEP and SIMPLE IRAs, CoverdellEducation Savings Accounts and qualified tuition plan accounts) Pension, 403(b), profit sharing and money purchase plans Accounts owned by corporations, documented nonresident aliens andcertain tax-exempt organizationsForeign Investment DistributionsForm 1099-DIV may list a foreign tax credit that the Fund paid with grossdistributions. If an amount is shown in box 7, please refer to the instructionsfor filing your personal income tax return.4

AOSTAX2RPT 1099DIV;COR ;OMB NO. 1545-0110ARecipient's Name and Address:JOHN Q PUBLICJANE Q PUBLIC JT TEN99 MAIN STREETHOMETOWN MA 01908-10262021 FORM 1099-DIVDividends and DistributionsCopy B for RecipientRECIPIENT'S TINBFor additional information, please call:1-111-111-1111CDEFGHI1a. Total ordinary dividendsVKJLM NOPayer's TIN: 99-9999999Payer's Name: ACME INCOME FUND***-**-9999FATCA Filing RequirementCORRECTED (If Checked)Fund & Account Number: 0092 - ******9999 273.16 1b. Qualified dividendsP2a. Total capital gain distributions2b. Unrecap. Sec. 1250 gain2c. Section 1202 gain2d. Collectibles (28%) gain2e. Section 897 ordinary dividends2f. Section 897 capital gain3. Nondividend distributions4. Federal income tax withheld5. Section 199A dividends6. Investment expenses7. Foreign tax paid9. Cash liquidation distributions11. Exempt-interest dividends12. Specified private activity bondinterest dividendsQRT13. State14. State identification no15. State income tax withheldSUAOSTAX2FND 0092;ACT 9999999999;FAC 0092-9999999999;Payer's TIN: 99-9999999Payer's Name: ACME TRUSTS FUND1a. Total ordinary dividends2b. Unrecap. Sec. 1250 gain2e. Section 897 ordinary dividends 25.43 1b. Qualified dividendsFund & Account Number: 0095 - ******9999 25.19 2a. Total capital gain distributions2c. Section 1202 gain 0.97 2f. Section 897 capital gain4. Federal income tax withheld5. Section 199A dividends7. Foreign tax paid9. Cash liquidation distributions11. Exempt-interest dividends12. Specified private activity bondinterest dividends 53.302d. Collectibles (28%) gain3. Nondividend distributions 0.976. Investment expenses13. State14. State identification no15. State income tax withheldAOSTAX2FND 0095;ACT 9999999999;FAC 0095-9999999999;WFORM 1099-DIV (Keep for your records)A Account registration andI The Fund’s FederalForm 1099-DIV contains income distributions from the account(s) owned by you in2021.address000001 - 0002 of 0003 - YYNNN - 000002 - EHV 001 - JOB01156B Your TaxpayerIdentification Number;this information will bemaskedTaxpayer IdentificationNumberdividends distributedin 2021D Total amount of qualifiedL Section 897 CapitalSection 1250 gain fromcertain depreciable realpropertyF Section 897 OrdinaryDividends (Thisrepresents the amountincluded in box 1a(ordinary dividends) thatis section 897a gain fromdispositions of USRPI).Gain (This representsthe amount included inbox 2a (total long termcapital gain) that issection 897a gain fromdispositions of USRPI.)M Shows dividends eligiblefor the 20% qualifiedbusiness incomededuction under section199AN The amount of liquidationdistribution paid to youin 2021O Your Fund and accountH Box 7 lists yourP Total amount of long-proportionate share ofany foreign taxes youpaid in 2021Package Page 2 of 3R Lists any part of yourdistribution that isnontaxable because it is areturn of your cost or otherbasisS Your share of expensesof a nonpublicly offeredregulated investmentcompany, generallya nonpublicly offeredmutual fundT Shows State and StateIdentification number(state where state taxeswere withheld from)U Amount of state taxeswithheld if you weresubject to backupwithholdingV Amount of tax-exemptG Amount of taxes withheldif you were subject tobackup withholdingfrom sales or exchangesof collectiblesABC 27993333 100520210716J Amount of qualifiedK Section 1202 gainE Shows unrecapturedQ Shows 28% rate gainThis is important tax information and is being furnished to the IRS. If you arerequired to file a return, a negligence penalty or other sanction may be imposedon you if this income is taxable and the IRS determines that it has not beenreported.*0320001OU*C The Fund’s nameand non-qualifieddividends and short-termcapital gains distributedin 2021Department of the Treasury - Internal Revenue Servicenumber. This informationwill be maskedterm capital gainsdistributed in 2021interest, includingexempt interest dividendsfrom mutual fund, paidin 2021W Amount of tax-exemptinterest subject to theAlternative Minimum Tax(AMT)The information on your Form 1099-DIV is reported to the IRS.5

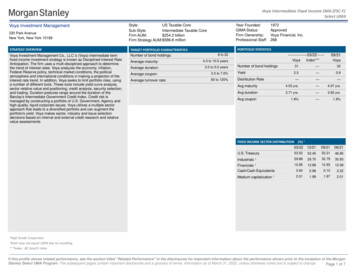

2021 Form 10 99 - BProceeds from Redemption or Exchange of SecuritiesAll redemptions (sales) or exchanges made in non-retirement mutual fundaccounts, except money market accounts, must be reported on Form 1099-B.Form 1099-B reports the gross proceeds from the sale or exchange of yourmutual fund shares in 2021 less any contingent deferred sales chargededucted from the gross proceeds of the transaction.The 1099-B Form is broken out into the following five sections based on thecategorization of the redemption and the cost basis information available:Section 1: Short-term transactions for which basis is reported to the IRS–Report on Form 8949, Part I, with Box A checked. If information is reportedin this section, the portion of the redemption is categorized as a short termcapital gain. The cost basis information listed in boxes 1e and 1g will bereported to the IRS. This information should be transposed onto Form 8949where further adjustments may be made, if necessary.Section 2: Short-term transactions for which basis is not reported to the IRS–Report on Form 8949, Part I, with Box B checked. If information is reported inthis section, the portion of the redemption is categorized as a short termcapital gain. The cost basis information listed in boxes 1e and 1g will not bereported to the IRS. This information can be used as a guide to helpdetermine your cost basis.Section 3: Long-term transactions for which basis is reported to the IRS–Report on Form 8949, Part II, with Box D checked. If information is reportedin this section, the portion of the redemption is categorized as a long termcapital gain. The cost basis information listed in boxes 1e and 1g will bereported to the IRS. This information should be transposed onto Form 8949where further adjustments may be made, if necessary.Section 4: Long-term transactions for which basis is not reported to the IRS–Report on Form 8949, Part II, with Box E checked. If information is reportedin this section, the portion of the redemption is categorized as a long termcapital gain. The cost basis information listed in boxes 1e and 1g will not bereported to the IRS. This information can be used as a guide to helpdetermine your cost basis.6

Section 5: Transactions for which basis is not reported to the IRS and forwhich short-term or long-term determination is unknown (to Broker)–Youmust determine short-term or long-term based on your records and report onForm 8949, Part I, with Box B checked, or on Form 8949, Part II, with Box Echecked, as appropriate. If information is reported in this section, there is notenough information available to determine the cost basis for your redemptionor exchange. Please consult your tax advisor for advice on the cost basisinformation needed for Form 8949 and Schedule D.AOSTAX2RPT 1099B;COR ;OMB No. 1545-0715Recipient's Name and Address:2021 FORM 1099-BJOHN Q PUBLICJANE Q PUBLIC JT TEN99 MAIN STREETHOMETOWN MA 01908-1026Proceeds From Broker and BarterExchange TransactionsCopy B for RecipientAEFGHIJKLQSection 1: Short-term transactions for which basis is reported to the IRS - Report on Form 8949, Part I, with Box A checked.(1a)DescriptionShares(1b)Date Acquired(1c)Date Sold orDisposedShare Price(1a) Description (Payer's Name)ACME INCOME FUND1,078.02407/31/202006/27/2021 10.80RECIPIENT'S TIN***-**-9999For additional information, please call:1-111-111-1111FATCA Filing RequirementON P(1d)Gross Proceeds(less commissions)(1e)Cost or OtherBasis(1g)Wash Sale LossDisallowedPayer's TIN99-9999999CUSIP Number999999999(3) Check if a QOF(5) Check if a Noncovered SecurityFund & Account Number0092 - ******9999CUSIP Number999999999(3) Check if a QOF(5) Check if a Noncovered SecurityFund & Account Number0095 - ******9999(4)Federal IncomeTax Withheld(14) State/(15) State ID Number(16)State IncomeTax WithheldCORRECTED(if checked) 11,642.66AOSTAX2FND 0092;ACT 999999999;FAC 0092-999999999;B(1a) Description (Payer's Name)ACME TRUSTS FUND214.79507/31/202008/21/2021Payer's TIN99-9999999 46.22D 9,927.82AOSTAX2FND 0095;ACT 999999999;FAC 0095-999999999; 999.99SECTION 1 TOTALSCMA Your TaxpayerIdentification Number; thisinformation will be maskedH NAV or price per shareredeemed for eachtransactionB The Fund’s nameI Gross proceeds (lesscommissions)from each*G330001O4*transaction made duringthe yearDepartment of the Treasury - Internal Revenue Service(Keep for your records)000001 - 0003 of 0003 - YYNNN - 000003 - EHV 001 - JOB01156C The Fund’s FederalTaxpayer IdentificationNumberD Your Fund and accountnumber. This informationwill be maskedE Number of sharesredeemedF Date shares were purchasedor “Various” or blank ifmultiple purchase datesG Date of each transactionmade during the yearM This will be checked ifshares were acquired priorto January 1, 2012This is important tax information and is being furnished to the IRS. If you arerequired to file a return, a negligence penalty or other sanction may be imposedon you if this income is taxable and the IRS determines that it has not beenreported.N State (state where statetaxes were withheld from)ABC 27993333 100520210716Package Page 3 of 3J Shows the cost or otherbasis of securities soldO State Identification number(identification numberfor state where state taxeswere withheld from)K Amount of sale pricethat is disallowed due topurchase and redemptionwithin 30 daysP Amount of state taxeswithheld if you weresubject to backupwithholdingL Amount of federaltaxes withheld if youwere subject to backupwithholdingQ FATCA Filing RequirementThe box will not be checkedas it does not apply to U.S.based Mutual FundsThe information on your Form 1099-B is reported to the IRS with the exception of cost basisinformation that may be displayed within Section 2 and Section 4, and Section 5.7

2021 Form 10 99 - RDistributions from Retirement PlansForm 1099-R reports both full and partial distributions from your mutualfund retirement plan accounts. If you have more than one retirement plan account with a taxabledistribution in our family of mutual funds, you will receive oneconsolidated Form 1099-R. If you have more than one type of retirement account with us—for example, a Traditional IRA and a Roth IRA—separate Forms1099-R will be produced for distributions from each type ofretirement account.Please note that we do not report distributions from retirementaccounts held by other custodians.You will receive a Form 1099-R if you withdrew assets from your retirementplan account, even if you rolled them over and reinvested them in anotherretirement plan account within 60 days. You will also receive a Form 1099-Rif you took your retirement account dividend distributions in cash, but notif they are reinvested into your retirement account. If you took more thanone distribution from your retirement account in 2021, the distributions havebeen aggregated according to the type of distribution as defined by theIRS distribution code. You will receive a Form 1099-R if you converted yourtraditional IRA to a Roth IRA in 2021.You will not receive a Form 1099-R if you arranged to move your IRAaccount as a trustee-to-trustee transfer of assets directly to another IRAaccount without taking possession of the funds.You will receive a year-end statement in January 2022 that reports the valueof your account as of December 31, 2021.Please consult your tax advisor for guidance on reporting the informationfrom Form 1099-R on your tax return.8

ACORRECTED (if checked)AOSTAX1TAX 111223333;MGT ABC;RPT 1099R;DLR 099259;BRC FXC002;CORRECTED (if checked)AOSTAX2RPI 50461;TYR 2020;RDT 20201125;CON 11111111;AOSTAX2BCK 99RCB9;COR ;FILE ;AUD Y;AOSTAX1TAX 111223333;MGT ABC;RPT 1099R;DLR 099259;BRC FXC002;CORRECTED (if checked)AOSTAX2RPI 50461;TYR 2020;RDT 20201125;CON 11111111;AOSTAX1TAX 111223333;MGT ABC;RPT 1099R;DLR 099259;BRC FXC002;AOSTAX2BCK 99RCB9;COR ;FILE ;AUD Y;AOSTAX2RPI 50461;TYR 2020;RDT 20201125;CON 11111111;Recipient's Name and Address:AOSTAX2BCK 99RCB9;COR ;FILE ;AUD Y;AOSTAX1TAX 111223333;MGT ABC;RPT 1099R;DLR 099259;BRC FXC002;00001EHV001CORRECTED(if checked)AOSTAX2RPI 50461;TYR 2020;RDT 20201125;CON IRA FBOAOSTAX2BCK 99RCB9;COR ;FILE ;AUD Y;Recipient'sName00001EHV001and Address:JOHN Q PUBLICAOSTAX1TAX 111223333;MGT ABC;RPT 1099R;DLR 099259;BRC FXC002;00001 TRUSTEHV001CO CUST IRA FBOACMEAOSTAX2RPI 50461;TYR 2020;RDT 20201125;CON ss:ACMECOIRA FBOAOSTAX2BCK 99RCB9;COR ;FILE ;AUD Y;JOHNQTRUSTPUBLIC00001HOMETOWNST 99999-9999JOHNQ EHV001PUBLIC1234STREETACMETRUSTNAMECO CUST IRA FBO1234 9-9999JOHNQ PUBLICHOMETOWN00001EHV001ST 99999-99991234 STREETNAMEACME TRUST CO CUST IRA FBOHOMETOWN ST 99999-9999JOHN Q PUBLIC1234 STREET NAMEHOMETOWN ST 99999-9999DGPage 1 of 1Page 1 of 1OMB NO. 1545-0119Page 1 of 1OMB NO. 1545-0119Page 1 of 1For additional information, please call:1-111-111-1111For additional information, please call:For additionalinformation, please call:20211-111-111-1111FORM1099-R1-111-111-1111For irementorProfit-SharingPlans,2021 FORM1099-RDistributionsfrom tributionsfromPensions,Annuities,For t-SharingPlans,2021 FORMB 1-1111IRAs, InsuranceContracts,etc.Distributionsfrom Pensions,Annuities,IRAs, Insurance Contracts,etc.BRetirement or CopyProfit-SharingPlans,2021RECIPIENT'SFORMCopy B 1099-RTINIRAs, InsuranceContracts,etc.Distributions from Pensions, Annuities,***-**-1111Copy B TINRECIPIENT'SRetirementor Profit-SharingPlans,RECIPIENT'S TINIRAs, IENT'SCopy B TINCITY NAME ST 99999-9999BOMB NO. 1545-0119OMB NO. 1545-0119HI***-**-1111EFNA The Fund’s mailing addressB Account registration andaddressOPJI An “x” here indicatesyour Funds are unableto determine thetaxable amount of yourdistribution(s)QKRL000001-00030001of0003-0003- EHV000001- EHV001- JOB42919000001000001- NNNN0001000001- YNNNN-of000001-0003---YNNNN001000001EHV- JOB42919001--EHV000001- JOB42919001- EHV- JOB42919001 - JOB42919RECIPIENT'S TINPayer's NamePayer's TINFund & Account Number***-**-1111ACME HIGH INCOME FUND-CLASS A09-99999990514 - 1111111111Payer's NamePayer's TINFund & Account NumberNamePayer'sTINFund& AccountNumber1. Gross Distribution2a.Payer'sTaxableAmount2b. TaxableAmount Total 09-9999999DistributionEmployee/4. Federal IncomeACME HIGHINCOMEFUND-CLASSA0514- 5.1111111111ACME HIGH INCOME FUND-CLASSNotA Determined09-9999999Designated RothTax Withheld 0514 - 1111111111Payer'sNameTINFund & AccountNumber1. Gross Distribution 2a.TaxableAmount2b. Taxable Amount TotalPayer'sDistribution5. ContributionsEmployee/4. Federal IncomeACME Employee/Roth1. Gross ribution4.FederalIncomeNotDeterminedDesignatedTax Withheld 1,800.00XDesignated RothNot DeterminedTax WithheldContributions1. Gross Distribution 2a.TaxableAmount2b. Taxable Amount TotalPayer'sDistribution5. Employee/4. Federal IncomePayer'sNameTINFund&AccountNumber11. 1st Year of14. State Tax15.ContributionsState /7. DistributionAmount X 1,800.00 IRA / SEP / SIMPLE 10. NotDesignated RothTax Withheld 0514 - 1111111111ACME HIGH INCOME FUND-CLASS A Determined09-9999999Code(s) 1,800.00AllocableXto IRRDesignated RothWithheldPayer's State Number11.Contribution1st Year of14. State Tax15.ContributionsState / /7. DistributionIRA / SEP / SIMPLE 10.withinAmount5 Years1.GrossDistributionTaxableTaxableAmount TotalDistribution5.Income 1,800.00 2a.7.Code(s)DistributionIRA/ SEPX/AmountSIMPLE 2b.10.AllocableAmountX1stYear ofRoth 4.14.FederalState Tax15.EmployeeState/ /Numberto IRR ignatedRothTaxWithheldCode(s)Allocableto IRRDesignated RothWithheldPayer'sState Number5 Years11.Contribution1st Year of14. State Tax15.ContributionsState / //7.DistributionIRA / SEP / SIMPLE D 0514;ACT 1111111111;FAC 0514-1111111111;Code(s)77 sStateNumberXXwithin 5 YearsContribution/.Payer'sPayer's11. 1stYear ofTIN14. State Tax Fund & Account15. StateNumber/7.IRA/ SEPName/ SIMPLE 10. AmountAOSTAX2FND 0514;ACT 1111111111;FAC 0514-1111111111;. Distribution7 ACME GLOBALXINCOMECLASS A09-99999990524 - 1111111111AOSTAX2FND 0514;ACT 1111111111;FAC 0514-1111111111;Code(s)Allocable to IRRDesignated RothWithheldPayer's State NumberPayer'sNamePayer'sTINFund&AccountNumber.5 YearsContribution//NamePayer'sTINFund& AccountNumber1.Gross leAmount TotalDistributionEmployee4. Federal IncomeACME GLOBALINCOMECLASS09-99999990524- 5.1111111111AOSTAX2FND 0514;ACT 1111111111;FAC 0514-1111111111;7 ACME GLOBAL INCOMEXCLASS ANot Determined09-9999999Designated RothTax Withheld 0524 - 1111111111Payer'sNameTINFund & AccountNumber1. Gross Distribution 2a.TaxableAmount2b. Taxable Amount TotalPayer'sDistribution5. ContributionsEmployee/4. Federal Income. 1. Gross DistributionACME GLOBALINCOMECLASS2b.ANot09-99999990524 - 11111111112a. TaxableAmountTaxable5.DesignatedEmployee D 0514;ACT 1111111111;FAC 0514-1111111111; 2,800.00XAmount Total DistributionNot DeterminedDesignated RothTax WithheldContributions1. Gross Distribution 2a.TaxableAmount2b. Taxable Amount TotalPayer'sDistribution5. Employee/4. Federal IncomePayer'sNameTINFund&AccountNumber7. DistributionAmount X11. 1st Year of14. State Tax15.ContributionsState / 2,800.00 IRA / SEP / SIMPLE 10. NotDeterminedDesignated RothTax Withheld 0524 - 1111111111ACME GLOBAL INCOME CLASS A09-9999999Code(s) 2,800.00AllocableXto IRRDesignated RothWithheldPayer's State NumberContributions7. DistributionIRA / SEP / SIMPLE 10.withinAmount11.Contribution1st Year of14. State Tax15. State / /5 Years1.GrossDistributionTaxableTaxableAmount TotalDistribution5.Income 2,800.00 2a.7.Code(s)DistributionIRA/ SEPX/AmountSIMPLE 2b.10.AllocableAmountX1stYear ofRoth 4.14.FederalState Tax15.EmployeeState/ /Numberto IRR 11.DesignatedWithheldPayer'sState7Not eto IRRDesignated RothWithheldPayer'sState Number5 Years7.DistributionIRA / SEP / SIMPLE 10.withinAmount11.Contribution1st Year of14. State Tax15.ContributionsState / //within5YearsContribution.XAOSTAX2FND 0524;ACT 1111111111;FAC 0524-1111111111;Code(s)77 sStateNumberXXwithin 5 YearsContribution/.7.IRA / SEP X/ SIMPLE 10. Amount11. 1st Year of14. State Tax15. State /AOSTAX2FND 0524;ACT 1111111111;FAC 0524-1111111111;. Distribution7AOSTAX2FND 0524;ACT 1111111111;FAC 0524-1111111111;Code(s)Allocable to IRRDesignated RothWithheldPayer's State NumberReport this income on your federal tax return. If this form shows federal income tax withheld in box 4, attach this copy to your return.within 5 YearsContribution/AOSTAX2FND 0524;ACT 1111111111;FAC 0524-1111111111;Thisinformationthe IRS.XReportthis 7incomeisonbeingyour furnishedfederal taxtoreturn.If this form shows federal income tax withheld in box 4, attach this copy to your GL**0310001GL*ACME FAMILY OF FUNDSP.O. BOX 9999ACMEFAMILYOF FUNDSCITYNAMEST 99999-9999ACMEFAMILYP.O.BOX9999 OF FUNDSP.O. BOX9999CITYNAMEST 99999-9999ACMEFAMILYOF FUNDSCITY NAME ST 99999-9999P.O. BOX 9999CITY NAME ST 99999-9999ACME FAMILY OF FUNDSCORRECTED(if checked)P.O. BOX9999N Indicates if your accountis a Traditional, SEP, orSIMPLE IRAO Amount allocable to IRRwithin 5 yearsC Your TaxpayerReport this income on your federal tax return. If this form shows federal income tax withheld in box 4, attach this copy to your return.Form1099-Ris a summaryall distributionsfrom the retirement account(s) in which you owned shares in 2020.Thisinformationis being offurnishedthe IRS.IdentificationNumber;thistaxtotoreturn.J An “x” here indicatesThis informationfurnishedthe IRS.Reportthis income isonbeingyour federalIf this form shows federal income tax withheld in box 4, attach this copy to your return.The 1stRevenueyearyou madeFORM1099-RDepartment of theServiceForm1099-Ris a summary of all distributions from the retirementaccount(s)in which you ownedofshares in 2020.PTreasury-Internala bea summaryof all distributionsfrom the retirement account(s) in which you owned shares in 2020.This informationis being furnishedto the IRS.a contributionFORM 1099-RDepartment of the Treasury-InternalRevenue Service to theaccountassetsasReportthisincomeon youroffederaltax return. fromIf thistheformshows federalincometax withheldinofbox4, attachthis copy to ePackage Page 1Rothof 3ABC 11111111 DFSRR80R JOB42919 112520200838designatedaccount12/31/2021 (There is no Department of the Treasury-InternalD The Fund’sThisnameinformation is being furnished to the IRS.FORM 1099-RRevenue ServicePackage Page 1 of 3ABC 11111111 DFSRR80R JOB42919 112520200838Formis a summaryof allJOB42919distributionsfrom the retirementin which youowned shares in 2020.shareaccount(s)balanceleft)Package Page 1 of 3ABC 1099-R11111111DFSRR80R112520200838of State taxesQ AmountFederalFORM1099-R DFSRR80R JOB42919 112520200838Department of the Treasury-InternalRevenuePackagePageService1 of 3ABC11111111E The Fund’swithheldfromtheAmountofFederalKTaxpayer Identificationdistribution,if applicablePackage Page 1 of 3ABC 11111111 DFSRR80R JOB42919 R The state and state ID thatF Your Fund and accounttaxes were paid toL The portion that is yournumber. This informationbasis in a designated Rothwill be maskedaccountG Total dollar amount of theM Distribution codes identifydistribution(s) from yourthe type of distribution(s)retirement account in 2021you received (A completelist of distribution codesH Taxable amount of yourappears on the back ofdistribution(s)the form)AOSTAX2FND 0524;ACT 1111111111;FAC 0524-1111111111;The information on your Form 1099-R is reported to the IRS.In some cases, a copy of Form 1099-R must be filed with your tax return.9

2021 Form 10 99 - QPayments From Qualified Education ProgramsForm 1099-Q reports distributions made from Coverdell Education SavingsAccounts (“Coverdell ESAs”) (formerly known as Education IRAs). If youreceived more than one type of distribution from a Coverdell ESA in 2021,you will receive a consolidated Form 1099-Q showing the amount for eachtype of distribution.Although Form 1099-Q has boxes for reporting the earnings (or loss) onthe distribution, as well as the cost basis of the shares sold, Coverdell ESArecordkeepers and trustees generally do not have the information requiredto calculate these amounts. Instead, in accordance with guidance issued bythe Internal Revenue Service, we are providing you with the fair market valueof your Coverdell ESA as of December 31, 2021. We suggest that you reviewIRS Publication 970, Tax Benefits for Education for more information on howto calculate the earnings portion of the gross distribution.Please consult with your tax advisor for additional guidance onreporting this information to the IRS.10

OMBNO.NO. 1545-17601545-1760OMBOMB NO. 1545-1760ACME TSP.O.BOX9999P.O.BOX9999RIPROVIDENCERI 0294002940PROVIDENCEACME INVESTMENTSPROVIDENCERI 02940P.O. BOX 9999ACMEINVESTMENTSPROVIDENCERI 02940P.O. BOX 9999PROVIDENCE RI 02940CORRECTED (if(if checked)checked)CORRECTEDCORRECTED (if checked)BHLEIFPayer's 9993. BasisBasis Payer's TIN3.3. Basis 01-9999999Payer's TIN3. Basis01-9999999Distribution CodeCodeDistribution3. BasisDistribution CodeDistribution Code111Distribution Code1M1AOSTAX2FND 0473;ACT 1111111111;FAC 0473-1111111111;B Account registration andaddressG Total dollar amount ofthe distribution(s) fromyour Coverdell EducationSavings Account in 2021FairMarketMarketValueValue ngs.IfIfaaFair***-**-9999Account // ReferenceReference NumberNumberAccount04731111111111Account/ ReferenceNumber0473-- 11111111110473 - stee-to-TrusteeTransfer/ ReferenceNumber4. Trustee-to-TrusteeTransfer0473 - 1111111111Account / Reference Number4. Trustee-to-TrusteeTransferXX0473 - 1111111111XFairMarket ValueValue asasof:FairMarketof:4. sof:X12/31/2112/31/21Fair Market Value as of: 0.00 0.00X12/31/21 0.00Fair Market Value as of: 0.0012/31/21N 0.00J000001-of0001of- 0001-- NNNNN000001- 001001 - JOB42859000001000001--0001- 0001of0001--NNNNNNNNNN- 000001---EHV- EHV001-EHV- JOB428590000010001of00010001000001NNNNN- 0001of-0000010000010001- NNNNNEHV001- 000001-JOB42859JOB42859- EHV 001 - JOB42859Payer's Name1. Gross Distribution 3,145.12 3,145.12 2. Earnings (*)ACME EQUITY INVESTOR SHRS 3,145.125. PlanPlan TypeType6. If thisthis boxbox isis checked,checked, thethe5.6.1. Gross Distribution2. IfEarnings(*)recipientnotthe designateddesignated5. Plan TypeIf this boxchecked,theisisisnotthe 3,145.12 6. recipientCoverdellbeneficiaryrecipient is not the designatedCoverdellbeneficiary5. Plan Type6. beneficiaryIf this box is checked, the XXESACoverdellESA 3,145.12recipient is not the designatedAOSTAX2FND 0473;ACT 1111111111;FAC 0473-1111111111;XESAAOSTAX2FND 0473;ACT 1111111111;FAC 0473-1111111111;AOSTAX2FND 0473;ACT 1111111111;FAC 0473-1111111111;5.Plan Type Coverdell6. Ifbeneficiarythis box is checked, theESArecipient is not the designatedXAOSTAX2FND 0473;ACT 1111111111;FAC 0473-1111111111;CoverdellbeneficiaryXESAA The Fund’s mailing addressC***-**-9999RECIPIENT'S TINPayer's NameNamePayer'sACME SACME EQUITY INVESTOR SHRS1. GrossGross DistributionDistribution2.Earnings (*)(*)1.EarningsPayer's2.Name1. Gross Distribution2. Earnings SHRS(*)ACME EQUITY INVESTORKPage 1 of 1Page 1 of 1For additionaladditional information,information, pleaseplease call:call:ForFor additionalinformation, please 2021additionalinformation,please ualifiedEducationFor additionalinformat

13. State 14. State identification no 15. State income tax withheld AOSTAX2FND 0092;ACT 9999999999;FAC 0092-9999999999; Payer's Name: ACME TRUSTS FUND Payer's TIN: 99-9999999 Fund & Account Number: 0095 - *****9999 1a. Total ordinary dividends 25.43 1b. Qualified dividends 25.19 2a. Total capital gain distributions 53.30 2b. Unrecap. Sec .

![The DaVita Retirement Savings Plan [401(k)]](/img/16/enrollment-guide.jpg)