Transcription

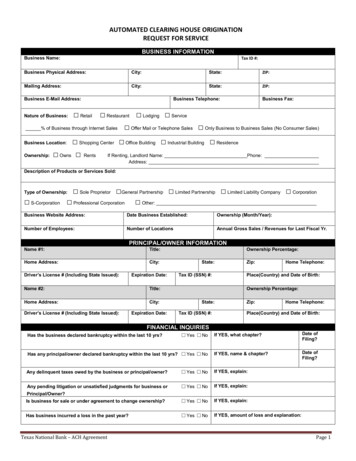

AUTOMATED CLEARING HOUSE ORIGINATIONREQUEST FOR SERVICEBUSINESS INFORMATIONBusiness Name:Tax ID #:Business Physical Address:City:State:ZIP:Mailing Address:City:State:ZIP:Business E-Mail Address:Business Telephone:Business Fax: Retail Restaurant Lodging Service% of Business through Internet Sales Offer Mail or Telephone Sales Only Business to Business Sales (No Consumer Sales)Nature of Business: Shopping Center Office Building Industrial Building Residence Owns Rents If Renting, Landlord Name: Phone:Business Location:Ownership:Address:Description of Products or Services Sold: Sole Proprietor General Partnership Limited Partnership Limited Liability Company Corporation Professional Corporation Other:Type of Ownership: S-CorporationBusiness Website Address:Date Business Established:Ownership (Month/Year):Number of Employees:Number of LocationsAnnual Gross Sales / Revenues for Last Fiscal Yr.PRINCIPAL/OWNER INFORMATIONName #1:Title:Home Address:City:Driver’s License # (Including State Issued):Expiration Date:Name #2:Title:Home Address:City:Driver’s License # (Including State Issued):Expiration Date:Ownership Percentage:State:Tax ID (SSN) #:Zip:Home Telephone:Place(Country) and Date of Birth:Ownership Percentage:State:Tax ID (SSN) #:Zip:Home Telephone:Place(Country) and Date of Birth:FINANCIAL INQUIRIES Yes No If YES, what chapter?Has the business declared bankruptcy within the last 10 yrs?Has any principal/owner declared bankruptcy within the last 10 yrs? Yes NoIf YES, name & chapter?Any delinquent taxes owed by the business or principal/owner? Yes NoIf YES, explain:Any pending litigation or unsatisfied judgments for business or Yes NoIf YES, explain:Is business for sale or under agreement to change ownership? Yes NoIf YES, explain:Has business incurred a loss in the past year? Yes NoIf YES, amount of loss and explanation:Date ofFiling?Date ofFiling?Principal/Owner?Texas National Bank – ACH AgreementPage 1

FINANCIAL INSTITUTION REFERENCES (OTHER THAN TNB)Financial Institution NameRouting and Account NumbersDate OpenedTelephone NumberREQUESTED DOCUMENTATION TO ACCOMPANY SERVICE REQUESTGeneral Information: Copies of organizational papers and business filing certificates Business federal income tax return for the prior fiscal year or CPA prepared financial statements Financial statement for DBA (doing business as)UNLAWFUL INTERNET GAMBLING NOTICE: Restricted transactions as defined in Federal Reserve Regulation GG are prohibited from beingprocessed through this account or relationship. Restricted transactions generally include, but are not limited to those in which credit, electronic fundtransfers, checks, or drafts are knowingly accepted by gambling businesses in connection with the participation by others in unlawful internet gambling.Identification Information:The Bank is required by federal law to obtain, verify and record information that identifies each individual or business opening an account to help thegovernment fight the funding of terrorism and money laundering activities. We will ask you at the time of opening an account, your name, address,date of birth and other information that allows us to properly identify you. We will also ask to see your driver’s license and other identifying documentsfor verification and recording purposes.CONSENT TO OBTAIN CONSUMER CREDIT REPORTI/We (“Applicant”) consent to Texas National Bank (“Bank”) obtaining one or more consumer credit reports on me from time to time in connection withthis Automated Clearing House Services Application. Bank may also investigate my background, income, credit or credit worthiness, assets or othermatters as it deems reasonably necessary or appropriate.Printed Name:Printed Name:Signature:Signature:Date:Date:BY SIGNING BELOW, I/WE (“APPLICANT”) CERTIFY THAT ALL INFORMATION PROVIDED ON AND WITH THIS FORM OR HEREAFTERFURNISHED BY US OR ON OUR BEHALF IS TRUE, CORRECT AND COMPLETE AND THAT I/WE ARE AUTHORIZED TO EXECUTE THIS FORMON BEHALF OF THE APPLICANT.Applicant(s) are aware that any knowing or willful false statements for purposes of influencing the actions of TEXAS NATIONAL BANK (“Bank”) can bea violation of federal law 18 U.S.C. sec. 1014 and may result in a fine or imprisonment or both. You are authorized to make all inquires you deemnecessary to verify the accuracy of this statement either directly or through any agency employed by the Bank for that purpose. Applicant authorizes theBank to obtain credit reports, and agrees to provide any additional information that the Bank may require to process this application. Applicant alsoauthorizes the Bank to obtain copies of its tax returns and information from the Internal Revenue Service and other taxing authorities, and agrees toexecute whatever forms the Bank requests to obtain such information.Required Signatures: Sole Proprietorship – Owner(s). Partnership - All general partners. Limited Liability Company - All member(s) or manager(s).Corporation - The persons named in the corporate resolution.XAuthorized SignatureXAuthorized SignaturePrinted NameTitleDatePrinted NameTitleDateUpon branch officer/bank review and approval for service, the following ODFI-Originator terms & conditions will apply.Texas National Bank – ACH AgreementPage 2

Texas National BankODFI-Originator AgreementCOMPANY INFORMATION AND STATEMENTThis Agreement, dated as of 20 is between(Hereafter referred to as "Company") and Texas National Bank ("Financial Institution").RECITALSA. Company wishes to initiate [credit] [debit] [credit and debit] Entries, as defined below, by means of the AutomatedClearing House Network pursuant to the terms of this Agreement and the rules of the National Automated ClearingHouse Association and ePay Resources, as well as future changes or updates to (the Rules). The Rules andRegulations book can be purchased from the following web sites: www.nacha.org and www.epayresources.org . TheFinancial Institution is willing to act as an Originating Depository Financial Institution ("ODFI") with respect to suchEntries. The Company may only initiate transactions as provided in Section 2.B. Unless otherwise defined herein, capitalized terms shall have the meanings provided in the Rules. The term "Entries"shall have the meaning provided in the Rules and shall also mean the data received from Company hereunder from whichFinancial Institution prepares Entries.C. The Financial Institution’s Board of Directors has identified the following SEC Codes shall never be processed as theydo not adhere to the Boards’ Directive. The Company may, at no time, process Third Party Entries and the following SECCode(s): ARC, BOC, IAT, POP, RCK, TEL, and WEB.AGREEMENT1. Compliance. The Company will comply with the terms of this Agreement, the Rules, insofar as applicable, and willcomply with the provisions of the laws of the United States. Company agrees that it shall not violate Office of ForeignAssets Control (OFAC) enforced sanctions, and is not acting on behalf of, or transmitting funds to or from, any partysubject to such sanctions set forth in Schedule D attached hereto.a) NACHA Operating Rules and Guidelines (the Rules).The Company has access to a copy of the Rules,acknowledges receipt of a copy, or may purchase a copy if they so desire. The Company agrees to comply withand be bound by the Rules. In the event the Company violates any of the applicable Rules and NACHA imposesa fine on the Financial Institution because of the Company’s violation, the Financial Institution may charge thefine to the Company.b) Company shall be required to maintain a current edition of the ACH Rules. Texas National Bank will annuallymake the Ach Rules available for purchase by Company, or Company may present a written certification thatthey have obtained the current edition of the Ach Rules.2. Transmittal of Entries by Company. Company shall transmit [PPD] [and/or] [CCD] [credit/debit] Entries to FinancialInstitution in compliance with the formatting and other requirements set forth in the attached Schedule A.3. Security Procedure.a) Company and Financial Institution shall comply with the security procedure requirements described in ScheduleA attached hereto with respect to Entries transmitted by Company to Financial Institution. Companyacknowledges that the purpose of such security procedure is for verification of authenticity and not to detect anerror in the transmission or content of an Entry. No security procedure for the detection of any such error has beenagreed upon between the Financial Institution and Company.b) Company is strictly responsible to establish and maintain the procedures to safeguard against unauthorizedtransmissions. Company warrants that no individual will be allowed to initiate transfers in the absence of propersupervision and safeguards, and agrees to take reasonable steps to maintain the confidentiality of the securityprocedures and any passwords, codes, security devices and related instructions provided by Financial Institutionin connection with the security procedures described in Schedule A. If Company believes or suspects that anysuch information or instructions have been known or accessed by unauthorized persons, Company agrees tonotify Financial Institution immediately followed by written confirmation. The occurrence of unauthorized accesswill not affect any transfers made in good faith by Financial Institution prior to receipt of such notification and withina reasonable time period to prevent unauthorized transfers.Texas National Bank – ACH AgreementPage 3

4. Processing, Transmittal and Settlement by Financial Institution.a) Except as provided in Sections 5, On-Us Entries and Section 6, Rejection of Entries Financial Institution shall (i)process Entries received from Company to conform with the file specifications set forth in the Rules, (ii) transmitsuch Entries as an ODFI to the Federal Reserve Bank of Dallas (the “ACH”) acting as an Automated ClearingHouse Operator, and (iii) settle for such Entries as provided in the Rules.b) Financial Institution shall transmit such Entries to the ACH Operator by the deadline set forth in Schedule Battached hereto [one business day] [two business days] prior to the Effective Entry Date shown in such Entries,provided (i) such Entries are received by Bank’s related cut-off time set forth on Schedule B on a business day,(ii) the Effective Entry Date is at least 2 days after such business day, and (iii) the ACH Operator is open forbusiness day, e.g. excluding Federal Holidays. For purposes of this Agreement (x) a “business day” is a day onwhich Financial Institution is open to the public for carrying on substantially all of its business [other than Saturdayor Sunday] and (y) Entries shall be deemed received by Financial Institution, by electronic transmission, when thetransmission (and compliance with any related security procedure provided for herein) is completed as providedin Schedule A.c) If any of the requirements of clause (i), (ii) or (iii) of Section 4(b) is not met, Financial Institution shall usereasonable efforts to transmit such Entries to the ACH Operator by the next deposit deadline of the ACH followingthat specified in Schedule B which is a business day and a day on which the ACH is open for business.5. On-Us Entries. Except as provided in Section 6, Rejection of Entries, in the case of an Entry received for credit to anaccount maintained with Financial Institution (an "On-Us Entry"), Financial Institution shall credit the Receiver's accountin the amount of such Entry on the Effective Entry Date contained in such Entry, provided the requirements set forth inclauses (i) and (ii) of Section 4(b) are met. If either of those requirements is not met, Financial Institution shall usereasonable efforts to credit the Receiver's account in the amount of such Entry no later than the next business day followingsuch Effective Entry Date.6. Rejection of Entries. Financial Institution may reject any Entry which does not comply with the requirements of Section1, Transmittal of Entries by Company, or Section 2, Security Procedure, or which contains an Effective Entry Date morethan two days after the business day such Entry is received by Financial Institution. Financial Institution may reject an OnUs Entry for any reason for which an Entry may be returned under the Rules. Financial Institution may reject any Entry ifCompany has failed to comply with its account balance obligations under Section 11, The Account. Financial Institutionmay reject any Entry if Company does not adhere to security procedures as described in Schedule A. Financial Institutionshall notify Company by phone of such rejection no later than the business day such Entry would otherwise have beentransmitted by Financial Institution to the ACH or, in the case of an On-Us entry, its Effective Entry Date. Notices ofrejection shall be effective when given. Financial Institution shall have no liability to Company by reason of the rejectionof any such Entry or the fact that such notice is not given at an earlier time than that provided for herein.7. Cancellation or Amendment by Company. Company shall have no right to cancel or amend any Entry after itsreceipt by Financial Institution. However, if such request complies with the security procedures described in Schedule Afor the cancellation of Data, Financial Institution shall use reasonable efforts to act on a request by Company forcancellation of an Entry prior to transmitting it to the ACH or, in the case of an On-Us Entry, prior to crediting a Receiver'saccount, but shall have no liability if such cancellation is not affected. Company shall reimburse Financial Institution forany expenses, losses, or damages Financial Institution may incur in effecting or attempting to effect, Company's requestfor the reversal of an entry.8. Notice of Returned Entries. Financial Institution shall notify Company by fax or mail of the receipt of a returned entryfrom the ACH no later than one business day after the business day of such receipt. Except for an Entry retransmitted byCompany in accordance with the requirements of Section 1, Transmittal of Entries By Company, Financial Institution shallhave no obligation to retransmit a returned Entry to the ACH if Financial Institution complied with the terms of thisAgreement with respect to the original Entry. The Company Shall ensure that changes requested by Notifications ofChange are made within six (6) banking days of the Company’s receipt of the information or prior to initiating another Entryto the Receiver’s account, whichever is later.9. Payment by Company for Entries.a) Company shall pay Financial Institution the amount of each credit Entry (including On-Us Entries) transmitted byFinancial Institution pursuant to this Agreement at such time on the date of transmittal by Financial Institution ofTexas National Bank – ACH AgreementPage 4

such credit Entry as Financial Institution, in its discretion, may determine.b) The Company shall pay the Financial Institution the amount of each debit Entry returned by a Receiving DepositoryFinancial Institution pursuant to this Agreement.c) The Financial Institution shall pay the Company the amount of each debit Entry (including On-Us Entries)transmitted by the Financial Institution pursuant to this Agreement at such time on the Settlement Date with respectto such debit Entry as the Financial Institution, at its discretion, may determine.d) The Financial Institution shall promptly pay the Company the amount of each credit Entry returned by a ReceivingDepository Financial Institution pursuant to this Agreement.10. The Account. Financial Institution may, without prior notice or demand, obtain payment of any amount due andpayable to it under this Agreement by debiting the account(s) of Company identified in Schedule G attached hereto (the"Account"), and shall credit the Account for any amount received by Financial Institution by reason of the return of an Entrytransmitted by Financial Institution for which Financial Institution has previously received payment from Company. Suchcredit shall be made as of the day of such receipt by Financial Institution. Company shall, at all times maintain a balanceof available funds in the Account sufficient to cover its payment obligations under this Agreement. In the event there arenot sufficient available funds in the Account to cover Company's obligations under this Agreement, Company agrees thatFinancial Institution may debit any account maintained by Company with Financial Institution or any affiliate of FinancialInstitution or that Financial Institution may set off against any amount it owes to Company, in order to obtain payment ofCompany's obligations under this Agreement.Upon request of the Financial Institution, the Company agrees to promptly provide to the Financial Institution informationpertaining to the Company’s financial condition. The Financial Institution reserves the right to pull a credit report at anytime to evaluate the Company’s ongoing financial condition.11. Account Reconciliation and Periodic Statement. Entries transmitted by Financial Institution or credited to aReceiver's account maintained with Financial Institution will be reflected on Company's periodic statement issued byFinancial Institution with respect to the Account pursuant to the agreement between Financial Institution and Company.Company agrees to notify Financial Institution promptly of any discrepancy between Company's records and theinformation shown on any such periodic statement. If Company fails to notify Financial Institution of any discrepancywithin 30 days of receipt of a periodic statement containing such information, Company agrees that Financial Institutionshall not be liable for any other losses resulting from Company's failure to give such notice or any loss of interest or anyinterest equivalent with respect to an Entry shown on such periodic statement. If Company fails to notify FinancialInstitution, of any such discrepancy within 30 days of receipt of such periodic statement, Company shall be precluded fromasserting such discrepancy against Financial Institution.12. Company Representations and Agreements; Indemnity. With respect to each and every Entry initiated byCompany, Company represents and warrants to Financial Institution and agrees that (a) each person shown as theReceiver on an Entry received by Financial Institution from Company has authorized the initiation of such Entry and thecrediting of its account in the amount and on the Effective Entry Date shown on such Entry, (b) such authorization isoperative at the time of transmittal or crediting by Financial Institution as provided herein, (c) Entries transmitted toFinancial Institution by Company are limited to those types of Credit Entries set forth in Section 1, Transmittal Of EntriesBy Company (d) Company shall perform its obligations under this Agreement in accordance with all applicable laws andregulations, including the sanctions laws administered by OFAC, and (e) Company shall be bound by and comply withthe Rules as in effect from time to time, including without limitation the provision thereof making payment of an Entry bythe Receiving Depository Financial Institution ("RDFI") to the Receiver provisional until receipt by the RDFI of finalsettlement for such Entry. Company specifically acknowledges that it has received notice of that Rule regarding provisionalpayment and of the fact that, if such settlement is not received, the RDFI shall be entitled to a refund from the Receiver ofthe amount credited and Company shall not be deemed to have paid the Receiver the amount of the Entry. Companyshall indemnify Financial Institution against any loss, liability or expense (including attorneys’ fees and expenses) resultingfrom or arising out of any breach of any of the foregoing representations or agreements.13. Financial Institution Responsibilities; Liability; Limitations on Liability; Indemnity.a) In the performance of the services required by this Agreement, Financial Institution shall be entitled to rely solelyon the information, representations, and warranties provided by Company pursuant to this Agreement, and shallnot be responsible for the accuracy or completeness thereof. Financial Institution shall be responsible only forperforming the services expressly provided for in this Agreement, and shall be liable only for its negligence inperforming those services. Financial Institution shall not be responsible for Company's acts or omissionsTexas National Bank – ACH AgreementPage 5

(including without limitation the amount, accuracy, timeliness of transmittal or authorization of any Entry receivedfrom Company) or those of any other person, including without limitation any Federal Reserve Financial Institution,ACH or transmission or communications facility, any Receiver or RDFI (including without limitation the return ofan Entry by such Receiver or RDFI), and no such person shall be deemed Financial Institution agent. To theextent allowed by law, Company agrees to indemnify Financial Institution against any loss, liability or expense(including attorneys' fees and expenses) resulting from or arising out of any claim of any person that FinancialInstitution is responsible for any act or omission of Company or any other person described in this Section 13(a).b) Except where the likelihood of the damages was known or contemplated by the Financial Institution shall not beliable for any consequential, special, punitive or indirect loss or damage which Company may incur or suffer inconnection with this Agreement.c) Without limiting the generality of the foregoing provisions, Financial Institution shall be excused from failing to actor delay in acting if such failure or delay is caused by legal constraint, interruption of transmission orcommunication facilities, equipment failure, war, emergency conditions or other circumstances beyond theFinancial Institution control. In addition, Financial Institution shall be excused from failing to transmit or delay intransmitting an Entry if such transmittal would result in Financial Institution having exceeded any limitation uponits intra-day net funds position established pursuant to present or future Federal Reserve guidelines or in FinancialInstitution reasonable judgment otherwise violating any provision of any present or future risk control program ofthe Federal Reserve or any rule or regulation of any other U.S. governmental regulatory authority.d) Subject to the foregoing limitations, Financial Institution liability for loss of interest resulting from its error or delayshall be calculated by using a rate equal to the average Federal Funds rate at the Federal Reserve FinancialInstitution of New York for the period involved. At Financial Institution option, payment of such interest may bemade by crediting the Account resulting from or arising out of any claim of any person that Financial Institution isresponsible for any act or omission of Company or any other person described in Section 13(a).14. Compliance with Security Procedure.a) If an Entry (or a request for cancellation or amendment of an Entry) received by Financial Institution purports tohave been transmitted or authorized by Company, it will be deemed effective as Company's Entry (or request)and Company shall be obligated to pay Financial Institution the amount of such Entry (or request) even thoughthe Entry (or request) was not authorized by Company, provided Financial Institution accepted the Entry in goodfaith and acted in compliance with the security procedure referred to in Schedule A with respect to such entry. Ifsignature comparison is to be used as a part of that security procedure, Financial Institution shall be deemed tohave complied with that part of such procedure if it compares the signature accompanying a file of Entries (orrequest for cancellation or amendment or an Entry) received with the signature of an authorized representative ofCompany (an "Authorized Representative") and, on the basis of such comparison, believes the signatureaccompanying such file to be that of such authorized representative.b) If an Entry (or request for cancellation or amendment of an Entry) received by Financial Institution was transmittedor authorized by Company, Company to pay Financial Institution the amount of the Entry, whether or not FinancialInstitution complied with the security procedure referred to in Schedule A with respect to that Entry and whetheror not that Entry was erroneous in any respect or that error would have been detected if Financial Institution hadcomplied with such procedure.15. Inconsistency of Name and Account Number. Company acknowledges and agrees that, if any Entry describesthe Receiver inconsistently by name and account number, payment of the Entry transmitted by Financial Institution to theReceiving Depository Financial Institution may be made by Receiving Depository Financial Institution (or by FinancialInstitution in the case of an On-Us Entry) on the basis of the account number supplied by the Company even if it identifiesa person different from the named Receiver, and that Company's obligation to pay the amount of the Entry to FinancialInstitution is not excused in such circumstances.16. Notifications of Changes. Financial Institution shall notify Company of all notifications of changes received byFinancial Institution related to Entries transmitted by Company by fax no later than one banking day after receipt thereof.The Company shall ensure that changes requested by Notifications of Change are made within six (6) banking days ofthe Company’s receipt of the information or prior to initiating another Entry to the Receiver’s account, whichever is later.17. Payment for Services. Company shall pay Financial Institution the charges for the services provided for herein setforth in Schedule C attached hereto. All fees and services are subject to change upon 30 calendar day’s prior writtennotice from Financial Institution to Company. Such charges do not include, and Company shall be responsible for paymentof, any sales, use, excise, value added, utility or other similar taxes relating to the services provided for herein, and anyTexas National Bank – ACH AgreementPage 6

fees or charges provided for in the agreement between Financial Institution and Company with respect to the Account (the"Account Agreement").18. Amendments. From time to time Financial Institution may amend any of the terms and conditions contained in thisAgreement, including without limitation, any cut-off time, any business day, and any part of the Schedules attached hereto.Such amendments shall become effective upon receipt of notice by Company or such later date as may be stated inFinancial Institution notice to Company.19. Notices, Instructions, Etc.a) Except as otherwise expressly provided herein Financial Institution shall not be required to act upon any notice orinstruction received from Company or any other person, or to provide any notice or advice to Company or anyother person with respect to any matter.b) Financial Institution shall be entitled to rely on any written notice or other written communication believed by it ingood faith to be genuine and to have been signed by an Authorized Representative, and any such communicationshall be deemed to have been signed by such person. The names and signatures of Authorized Representativesare set forth in Schedule E attached hereto. Company may add or delete any Authorized Representative bywritten notice to Financial Institution signed by at least two Authorized Representatives other than that beingadded or deleted. Such notice shall be effective on the second business day following the day of FinancialInstitution receipt thereof.c) Except as otherwise expressly provided herein, any written notice or other written communication required orpermitted to be given under this Agreement shall be delivered, or sent by United States registered or certifiedmail, postage prepaid, or by express carrier, and, if to Financial Institution, addressed to:Texas National BankP.O. Box 4650Edinburg, Texas 78540And, if to Company, addressed to:Company Name:Attention:Address:City, State, Zip:20. Data Retention. Company shall retain data on file adequate to permit remaking of Entries for three business daysfollowing the date of their transmittal by Financial Institution as provided herein, and shall provide such Data to FinancialInstitution upon its request.21. Records. All Entries, security procedures and related records used by Financial Institution for transactionscontemplated by this Agreement shall be and remain Financial Institution property. Financial Institution may at its solediscretion, make available such information upon Company’s request. Any expenses incurred by Financial Institution inmaking such information available to Company shall be paid by Company.22. Authorizations. The Company will obtain Authorizations for PPD Entries in accordance with the Rules and U.S. law.The Company will retain record of the Authorization for a period of two (2) years from the termination or revocation of theAuthorization. Upon request from Bank or any RDFI, Company shall provide a copy of the Receiver’s Authorization forPPD Entries.23. Termination. Company may terminate this Agreement at any time. Such termination shall be effective on the secondbusiness day following the day of Financial Institution receipt of written notice of such termination or such later date as isspecified in that notice. Financial Institution reserves the right to terminate this Agreement immediately upon providingwritten notice of such termination to Company if any terms and conditions to this Agreement and all Schedules attachedhereto are not complied or for any other reason that Financial Institutio

a) NACHA Operating Rules and Guidelines (the Rules).The Company has access to a copy of the Rules, acknowledges receipt of a copy, or may purchase a copy if they so desire. The Company agrees to comply with and be bound by the Rules. In the event the Company violates any of the applicable Rules and NACHA imposes