Transcription

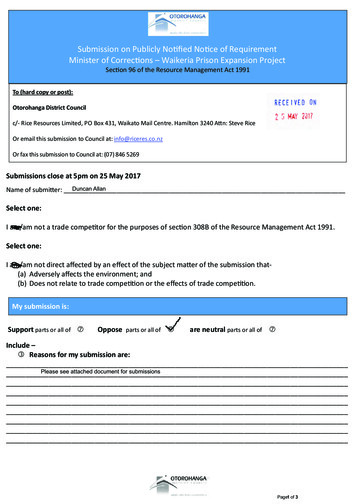

SUBMISSION COVER SHEETRegistered Entity Identifier Code (optional) LCHDate:Sept 25, 2012I M P O R T A N T : CHECK BOX IF CONFIDENTIAL TREATMENT IS REQUESTED.ORGANIZATION LCH.Clearnet LimitedFILING AS A:ECM/SPDCDCMSEFDCOSDRTYPE OF FILINGRules and Rule AmendmentsCertification under § 40.6 (a) or § 41.24 (a)“Non-Material Agricultural Rule Change” under § 40.4 (b)(5)Notification under § 40.6 (d)Request for Approval under § 40.4 (a) or § 40.5 (a)Advance Notice of SIDCO Rule Change under § 40.10 (a)ProductsCertification under § 39.5(b), § 40.2 (a), or § 41.23 (a)Swap Class Certification under § 40.2 (d)Request for Approval under § 40.3 (a)Novel Derivative Product Notification under § 40.12 (a)RULE NUMBERSFCM Regulations – amendments throughoutFCM Procedures – amendments throughoutDefault Rules – amendments throughoutDefault Fund Rules - Rules F9 and F12General Regulations – Amendment to Definitions, Regulation 39B, Regulation 47 and Regulation 104Section 2G Procedures - Amendment to reflect FCM Nodal proceduresDESCRIPTIONAmendments to rules to admit Futures Commission Merchants (FCMs) to join the EnClear and Nodalservice and clear transactions on behalf of their clients.

LCH.Clearnet Rule SubmissionSUBMISSION OF AMENDMENTS TO THE CLEARINGHOUSE RULESTO THECOMMODITY FUTURES TRADING COMMISSIONSUBMITTED BYLCH.Clearnet Limitedan English limited companyFILING AS A REGISTERED DERIVATIVES CLEARING ORGANIZATIONPursuant to Commission Regulation § 40.6Submission of Amendments to the Clearing HouseProcedures:FCM RegulationsFCM ProceduresDefault RulesDefault Fund RulesGeneral RegulationsSection 2G ProceduresSubmitted: September 25, 2012

LCH.Clearnet Rule SubmissionLCH.CLEARNET LIMITED SELF-CERTIFICATION OF AMENDMENTS TO RULES TOIMPLEMENT FCM CLEARING FOR NON-DELIVERABLE FORWARDSLCH.Clearnet Limited (“LCH.Clearnet”), a derivatives clearing organization registered withthe Commodity Futures Trading Commission (the “CFTC”), is submitting for self-certification,pursuant to CFTC Regulation §40.6, amendments to LCH.Clearnet’s Rulebook. The amendedRulebook will be implemented and become effective on October 12, 2012.Part I: Explanation and AnalysisThe operation, purpose and effect of the amendments to the Rulebook is to introduce aclient clearing service for the US market to further expand LCH.Clearnet’s coverage andservices in OTC Energy, Freight and Power clearing, utilising the services EnClear and Nodal.The EnClear and Nodal client clearing service has been designed to allow clients of FuturesCommission Merchants (FCMs) to have access to the respect services.The EnClear and Nodal client clearing model described in this document is based onSwapClear’s current FCM model adopted for US-based client clearing.In light of new US Dodd-Frank rules due to take effect on 8th November 2012, which willrequire amendments to LCH.Clearnet’s existing US FCM model in relation to segregation ofclient assets, EnClear and Nodal (and SwapClear and ForexClear) will be required to furtheramend its US FCM model prior to November 2012 to ensure regulatory compliance. Theseamendments will be self certified to the CFTC in due course.The EnClear and Nodal client clearing service will share the same operational infrastructure,operating hours and product coverage of the existing EnClear and Nodal General Clearingservice.Participation by FCMs as clearing members in LCH.Clearnet is governed by a set of New Yorklaw governed FCM Regulations and FCM Procedures, separate to the English law governedUK General Regulations.Differences to the existing SwapClear FCM serviceThe client clearing aspects of the proposed EnClear FCM and Nodal FCM service aredesigned to follow the existing SwapClear FCM service closely. Amendments have beenmade to the FCM Regulations to segregate FCM Nodal Contracts in acknowledgement thattheir status as Swap Contracts is uncertain. In summary, the amendments:separate FCM EnClear and FCM Nodal into separate accounts (rather than combinedas “general business” previously);require the actual physical separation of the Nodal customer accounts (both at theFCM and LCH level) from all other account types. In particular, Nodal customeraccount types and Nodal customerNodal contracts on a combined basis: see FCM Regulation 4(g), for example.collateral must be segregated both on the books and in different physical accounts.eliminate net margining of FCM EnClear contracts and FCM

LCH.Clearnet Rule SubmissionMembership criteriaThe membership criteria for EnClear and Nodal FCMs will follow the membership criteria forSwapClear FCMs, which are set out at FCM Regulation 3. In summary, an applicant forEnClear or Nodal FCM membership status must: be registered with the CFTC as an FCM;be incorporated in a US state;have a net capital of US 50 million or more;have evidenced the operational and technical capabilities required byLCH.Clearnet;have, within its corporate group, at least one banking, credit or investmentinstitution licensed in the US or an EU member state, or an equivalent inanother jurisdiction;complete all relevant documentation; andcomplete all necessary testing and training as required by LCH.Clearnet.EnClear or Nodal places no access criteria upon clients of FCMs. FCMs are free to take onthe business of clients based on their own due diligence and analysis and becomeresponsible for the performance of the trades upon registration.LCH.Clearnet will record each client trade received in an FCM’s Client account in the name ofthe underlying counterparty to the trade. However, LCH.Clearnet will have no directrelationship with the clients of FCMs.Arrangements for holding client businessEnClear and Nodal FCMs are set up with two main account types:House Account (H) – holds proprietary business. Under the FCM Regulations, anFCM is permitted to clear for affiliates through its proprietary accounts.Client Account (C) – holds client business. Each Client account can have multiplesub-client accounts whose liabilities will be aggregated and reported at the level ofthe Client account, and will be a separate obligation from the House Accountliability. Client positions will be registered in the name of the underlying client. Aclient can have relationships with more than one EnClear or Nodal FCM.Currently, the US FCM regulations allow for a Gross Omnibus client account structure, withan LSOC (Legally Segregated, Operationally Comingled) account structure to be mandatoryby 8th November 2012.CollateralAll Nodal client collateral will be in a separate omnibus account and furthermore, willrequire the actual physical separation of the Nodal customer accounts (both at the FCM andLCH level) from all other account types. In particular, Nodal customer account types andNodal customer collateral must be segregated both on the books and in different physicalaccounts.All EnClear client collateral (including excess collateral) will be in a separate EnClear omnibusaccount. However, this can be used to cover the loss of any client in the same BusinessCategory in the event of an FCM default. Client collateral cannot be used to cover losses in

LCH.Clearnet Rule Submissionthe House Account, and can only be used to cover the Client account losses in anotherBusiness Category (ie FCM SwapClear, FCM ForexClear, or FCM EnClear) where caused bythe failure of the same client – see below.In the case of a BAU client porting, clients will initiate a portfolio transfer via a manualinstruction. The transfer will have the same effect as an unwind against the outgoingaccount and new trade positions against the incoming account. Both activities will beprocessed within a single margin run and will only register as cleared when sufficient marginhas been pledged. Collateral release to the outgoing FCM will not take place until sufficientcollateral has been provided by the incoming FCM.Risk managementRisk management for EnClear or Nodal FCM does not present novel risk issues.LCH.Clearnet will be porting US clients related to the Nodal and EnClear business from theexisting GCMs to new FCMs.There is no change to the margin methodology. The margin model remains the same untilthe LSOC solution is delivered so that client margin is calculated gross.Under CFTC regulations, FCMs are required to collect initial margin from their customers, fornon-hedge positions, at a level that is greater than 100 percent of LCH.Clearnet’s usual initialmargin requirements. The initial published rate will be 10% above the usual requirement.FCMs will not be required to pay this additional margin to LCH.Clearnet but rather use it as acushion in relation to future adverse market movements.Size and composition of default fundThere is a minor change to Default Fund, which clarifies the calculation of net sums underthe default rule.Description of changes to rulesIn summary, the following changes have been made to legal documentation.FCM RegulationsThe original FCM Regulations were SwapClear and ForexClear specific. To facilitate theaddition of EnClear and Nodal (and any future services), the structure of the FCMRegulations has been changed to mirror more closely the structure of the UK GeneralRegulations. That is, there is a set of generic regulations (FCM Regulations 1 to 26) that areapplicable to all services, followed by a series of chapters applicable to SwapClear (FCMRegulations 30 to 33) and ForexClear (FCM Regulations 40 to 43). EnClear (FCM Regulations50 to 53), and Nodal (FCM Regulations 60 – 64).

LCH.Clearnet Rule SubmissionThe EnClear and separately Nodal FCM Regulations largely mirror the EnClear and NodalRegulations in the UK General Regulations, save for FCM-specific provisions. The FCMspecific provisions follow the pre-existing SwapClear FCM Regulations, save that:FCM ProceduresAs with the FCM Regulations, the FCM Procedures have been amended to enable theinsertion of procedures for EnClear and Nodal. Minor amendments have been inserted intoSection 1 (Membership), the addition of a new Section 2C (EnClear), and 2D (Nodal).The new FCM Procedures Section 2C largely mirrors Section 2E of the UK Procedures, exceptfor FCM specific amendments (particularly relating to accounts) that have been importedfrom the existing SwapClear model. Section 2D largely mirrors the pre-existing Section 2G ofthe UK Procedures, which will be deleted. Cross-referencing has been written into the newSection 2D for those Nodal CMs who remain covered by the UK rulebook (i.e. doing Housebusiness only). Other specific amendments for Section 2D relate to accounts.Default RulesThere are minor amendments to the body of the Default Rules, specifically section 10amended to reflect the revised omnibus account structure for Nodal and EnClear.Default Fund RulesThere is a minor amendment to the Default Fund Rules.UK General RegulationsThere are consequential amendments to the UK General Regulations to amend thedefinitions and cross-references.Part II: Certification by LCH.ClearnetLCH.Clearnet certifies to the CFTC, in accordance with CFTC Regulation §40.6, that theamendments to its rules comply with the Commodity Exchange Act and the CFTCRegulations promulgated thereunder. In addition, LCH.Clearnet certifies that LCH.Clearnethas posted a notice of pending certification with the CFTC and a copy of the submission onLCH.Clearnet’s website athttp://www.lchclearnet.com/rules and regulations/ltd/proposed rules.aspA signed certification is attached to this submission as Exhibit B.Part III: Compliance with Core PrinciplesLCH.Clearnet complies, and will continue to comply, with all of the Core Principles.Part IV: Opposing ViewsThere were no opposing views expressed to LCH.Clearnet by governing board or committeemembers, members of LCH.Clearnet or market participants that were not incorporated intothe rule.

LCH.Clearnet Rule SubmissionExhibit A-1FCM RegulationsSee Attached

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012CONTENTSFCM REGULATIONS OF THE CLEARING HOUSE . 1Definitions . 2PART I – REGULATIONS OF GENERAL APPLICABILITY . 1215Regulation 1Obligations of the Clearing House to each FCM Clearing Member . 1215Regulation 2Performance by the Clearing House of its Obligations under theTerms of an Open Contract . 1316Regulation 3FCM Clearing Member Status of the Clearing House and Applicationof LCH Regulations . 1417Regulation 4FCM Client Business and Proprietary Account Trading . 1620Regulation 5Treatment of Accounts at LCH . 1923Regulation 6Designation . 2125Regulation 7Trading Information . 2226Regulation 8Transfer . 2327Regulation 9Margin and Cover for Margin; Other Obligations . 2731Regulation 10Official Quotations and Reference Price . 3135Regulation 11Market Disorders, Impossibility of Performance, Trade Emergency . 3236Regulation 12Force Majeure . 3337Regulation 13Invoicing Back . 3438Regulation 14Currency Conversion . 3539Regulation 15Disclosure . 3640Regulation 16Fees and Other Charges . 3741Regulation 17Records . 3842Regulation 18FCM Procedures . 3943Regulation 19Alteration of FCM Regulations and the FCM Procedures . 4044Regulation 20Interpretation of these FCM Regulations . 4145Regulation 21Waiver . 4246Regulation 22Validity of FCM Regulations and Action . 4347REGULATION 23 GOVERNING LAW AND JURISDICTION . 4448REGULATION 24 EXCLUSION OF LIABILITY . 4549Regulation 24ANetting . 4650Regulation 24BDistribution of Assets . 4852Regulation 25Rules Relating to FCM OTC Client Segregated Accounts . 4953Regulation 26Acknowledgements and Agreements of FCM Clients and Affiliates . 5660PART II – REGULATIONS APPLICABLE TO FCM SWAPCLEAR CONTRACTS . 5963Regulation 30Registration of FCM SwapClear Contracts; Novation and PostNovation Compression; SwapClear Accounts . 5963Regulation 31Daily Marking to Market . 6469-iSC1:3240128.43306280.5

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012Regulation 32The reset rate for, and the net present value of, an FCM SwapClearContract . 6570Regulation 33Withdrawal of the FCM SwapClear Service by the Clearing House . 6671PART III – [RESERVED] . 73PART IV – REGULATIONS APPLICABLE TO FCM FOREXNCLEAR CONTRACTS . 6874Regulation 4050 Registration of FCM ForexEnClear Contracts; ForexClear Accounts . 6874Regulation 41Cancellation of 51 . FCM ForexEnClear Contracts7375Regulation 42Variation Margin . 7452Daily SettleRegulation 4353 Withdrawal of the FCM ForexEnClear Service by the Clearing House 7578PART V – REGULATIONS APPLICABLE TO FCM NODAL CONTRACTS . 80Regulation 60Presentation, Allocation of Nodal Transactions and Registration ofNodal Contracts . 80Regulation 61Nodal Contracts . 82Regulation 62Daily Settlement or Marking to Market . 84Regulation 63Exercise of Options; Delivery Contract Arising upon the Exercise of anOption and Event Protection Contracts . 86Regulation 64Obligation to Make and Accept Tender under Cleared ExchangeContracts; Delivery Contracts; Open Contracts Subject to Tender;Open Contracts Subject to Tender; Restrictions on Clearing House’sObligations and Liability; Arbitration; Cover in Event of a Claim;Default of a Member; Substituted Obligation . 88SCHEDULE A – FCM SWAPCLEAR CONTRACT TERMS AND PRODUCTELIGIBILITY CRITERIA.A-1SCHEDULE B – [Reserved] .B-1SCHEDULE C – FCM FOREXNCLEAR CONTRACT TERMS AND PRODUCTELIGIBILITY CRITERIA. BC-1- ii SC1:3240128.43306280.5

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012LCH.CLEARNET LIMITEDFCM REGULATIONS OF THE CLEARING HOUSEScopeSave where expressly stated to the contrary in these FCM Regulations or the FCMProcedures, these FCM Regulations govern the clearing of FCM Contracts by FCM ClearingMembers through LCH.Clearnet Limited. They do not govern any other clearing servicesprovided by LCH.Clearnet Limited nor do they cover clearing services provided by,LCH.Clearnet SA or any other affiliates of LCH.Clearnet Group, Ltd, all of which aregoverned by a separate sets of rules.-1SC1:3240128.43306280.5

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012DefinitionsIn these FCM Regulations and the FCM Procedures, except where the context otherwiserequires, the following words and expressions shall have the following meanings:Account Assets- Means all cover, cash, margin, securities, receivables,rights, intangibles and any other collateral or assetsdeposited with or transferred to an FCM ClearingMember, by its FCM Clients and deposited with ortransferred to the Clearing House by ansuch FCMClearing Member, if applicable, in connection with anaccountthe accounts carried by such FCM ClearingMember on behalf of anits FCM Clients, as cover for andin respect of the clearing of FCM Contracts for such FCMClients.Affiliate- Means, with respect to an FCM Clearing Member, anyentity that controls, is controlled by or is under commoncontrol with such FCM Clearing Member, and theaccount of which, when carried by the FCM ClearingMember, would be considered a proprietary accountpursuant to CFTC Regulation 1.3(y) (or any suchsuccessor or replacement regulation).Approved Broker- A person authorized by the Clearing House to participateas a broker in the LCH EnClear OTC Services (as suchterm is used in the UK General Regulations), includingthe FCM EnClear Clearing Services as the context mayrequire.Auction Portfolio- Has the meaning assigned to it in either (i) theSwapClear DMP Annex of the Default Rules or (ii) theForexClear DMP Annes of the Default Rules, asapplicable.Business Category of FCMContract- Means the categoriesa category of FCM Contractsone ormore Products which the Clearing House treats s for purposes of calculating theamount of cover owed by an FCM Clearing Member (asset forth in the FCM Procedures) within respect to suchofthe FCM Contracts in each such categories,y and, exceptto the extent otherwise set forth in the FCM Procedures,such separate margin categories consist of: (1) FCMSwapClear Contracts (referred to in the FCM Rulebookas the “SwapClear Business Category”), (2) FCMEnClear Contract (referred to in the FCM Rulebook asthe “EnClear Business Category”) and (2) 3) FCMForexClearNodal Contracts. (referred to in the FCMRulebook as the “Nodal Business Category”).Business Day- Means, in respect of an FCM Contract (except wherespecified otherwise in the relevant FCM SwapClearContract Terms or the FCM ForexClear, FCM EnClearContract Terms or FCM Nodal Contract Terms, as-2-SC1:3240128.43306280.5

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012applicable), a day on which the Clearing House is openfor business as set forth in the FCM Procedures.Carrying FCM ClearingMember- Means an FCM Clearing Member carrying an account foran FCM Client, and in respect of which the FCMContracts and Account Assets held in such account maybe transferred to a Receiving FCM Clearing Memberpursuant to FCM Regulation 8 of these FCM Regulationsand in accordance with the FCM Procedures.CEA- Means the U.S. Commodity Exchange Act.CFTC- Means theCommission.CFTC Regulations- Means the rules and regulations promulgated by theCFTC.Cleared Swap- Means “Cleared Swap” as such term is defined in CFTCRegulation 22.1 (which, for the avoidance of doubt, shallfor the purposes of the FCM Rulebook be deemed toinclude FCM Contracts).Cleared Swaps Account Class- Means the account class for cleared swaps accounts (asdefined in CFTC Regulations 190.01(a)(i) and190.01(pp)) for purposes of Part 190 of the CFTCRegulations and Section 4d(f) of the CEA.Clearing House- Means LCH.Clearnet Limited whose registered office islocated at Aldgate House, 33 Aldgate High Street,London EC3N 1EA, United Kingdom.Closing-out Contract- Means, for the purposes of these FCM Regulations, anFCM Contract effected by or on behalf of the ClearingHouse and registered in an FCM Clearing Member’sname, being an FCM Contract on the same terms(except as to price) as an Open Contract in the FCMClearing Member’s name, save that where the ClearingHouse has position “X” under the terms of such openFCM Contract (where such FCM Contract consists ofpositions “X” and “Y”), the Clearing House shall haveposition “Y” under the terms of such closing-out FCMContract, and vice-versa.Contribution- Means, in relation to the Default Fund Rules, themeaning assigned to it in rule 17 of the Default FundRules.cover- Means an amount determined by the Clearing House ofcash or, with the approval of the Clearing House, securityin a currency and a form acceptable to the ClearingHouse as prescribed by the FCM Procedures.defaulter- Has the meaning attributedassigned to it in rule 4 of theDefault Trading

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012Default Fund Rules- Means the Clearing House’s Default Fund Rules fromtime to time in force.Default Rules- Means the Clearing House’s Default Rules from time totime in force pursuant to part II of schedule 21 to the UKCompanies Act 1989.Economic Terms- Means that part of the FCM SwapClear Contract Termsor the FCM ForexEnClear Contract Terms designated asEconomic Terms by the Clearing House from time totime.Exchange- Means an organization (whether an exchange,association, company or otherwise) responsible foradministering a futures, options, stock or other market, towhich the Clearing House provides FCM ClearingServices.exchange contract- Means a class of contract (1) on the terms publishedfrom time to time by an Exchange and permitted to bemade by a member of such Exchange on the marketadministered by that Exchange or otherwise inaccordance with Exchange Rules, or (2) eligible forsubmission to the Clearing House for registrationpursuant to the Exchange Rules. For the purposes ofthese Regulations “exchange contract” shall not includeany class of contract capable of being made on theLondon Stock Exchange.Exchange Rules- Means the rules, regulations, administrative procedures,Memorandum and Articles of Association or by-laws (orsimilar constituent documents) which regulate anExchange and the market administered by it as notifiedfrom time to time to the Clearing House and, withoutprejudice to the generality of the foregoing, anyregulations or directions made by its Board and anyprocedures, practices and administrative requirements ofthe Exchange.Excess Margin- Means cover delivered to the Clearing House by an FCMClearing Member in respect of its FCM Contracts whichis in excess of the Required Margin in respect of suchFCM Contracts.Executing Party- Means any party to a swap transaction with respect towhich at least one party to such transaction applies tohave its side of such transaction registered with theClearing House (through its FCM Clearing Member or onits own behalf as an FCM Clearing Member, asapplicable) as an FCM Contract, and the other party tosuch transaction applies to have its side of suchtransaction registered with the Clearing House either asan FCM Contract (through its FCM Clearing Member oron its own behalf as an FCM Clearing Member, asapplicable) or as a Non-FCM Contract (through its NonFCM Clearing Member or on its own behalf as a NonFCM Clearing Member, as applicable), as the case may-4-SC1:3240128.43306280.5

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012be.Means each person described as a party to an FCMTransaction in the details submitted to the ClearingHouse via the relevant FCM Approved Trade SourceSystem.FCM- Means a futures commission merchant, as defined underthe CEA that is registered in such capacity with theCFTC.FCM Approved Trade SourceSystem- Means a system or facility, such as an Exchange, aclearing house, a swap execution facility, a designatedcontract market or other similar venue, approved by theClearing House for executing FCM SwapClearTransactions, and/or submitting or presenting such FCMForexClear Transactions, to the Clearing House. For theavoidance of doubt, the “SwapClear API” is not an FCMEnClear Transactions or FCM Nodal Transactions, asapplicable, by the Clearing HouseApproved TradeSource System.FCM Clearing End-UserNotice- Means the “FCM Clearing End-User Notice” as specifiedby the Clearing House from time to time and aspublished by the Clearing House on its website orotherwise.FCM Clearing Member- Means an FCM that has been approved by the ClearingHouse for the clearing of one or more categories of FCMContracts on behalf of FCM Clients, in accordance withan FCM Clearing Membership Agreement and the FCMProcedures, and pursuant to these FCM Regulations,and as such is a “Clearing Member” for all purposesunder the Default Rules, the Default Fund Rules and theFCM Default Fund Agreement, unless otherwisespecified in these FCM Regulations.FCM Clearing MembershipAgreement- Means the agreement so designated under which, interalia, the Clearing House agrees to make availableclearing services to an FCM Clearing Member in respectof FCM Contracts together with any ancillaryagreements.FCM Clearing Services- Means the FCM SwapClear Clearing Services, the FCMEnClearClearingServicesandtheFCMForexClearNodal Clearing Services, collectively.FCM Client- Means a client of an FCM Clearing Member (but notincluding Affiliates of such FCM Clearing Member) withpositions in Cleared Swaps, (including FCM Contracts,)or in FCM Nodal Contracts on behalf of which the FCMClearing Member provides FCM Clearing Services andclears FCM Contracts; provided, that any such client isonly an FCM Client with respect to its positions inCleared Swaps and/or FCM Nodal Contracts.FCM Client Business- Means the provision of FCM Clearing Services by anFCM Clearing Member to its FCM Clients.-5-SC1:3240128.43306280.5

Clearing House: FCM RegulationsS&C draft dated 08.0524.09.2012FCM Contract- Means an FCM SwapClear Contract, an FCM EnClearContract or an FCM ForexClearNodal Contract. “FCMContracts” means FCM SwapClear Contracts, FCMEnClear Contracts and FCM ForexClearNodal Contracts,collectively.FCM Contract Terms- Means the FCM SwapClear Contract Terms, the FCMEnClear Contract Terms and the FCM ForexClearNodalContract Terms, collectively.FCM Default Fund Agreement- Means an agreement in a form prescribed by theClearing House, entered into between an FCM ClearingMember and the Clearing House relating to the ClearingHouse’s default fund.FCM Default ManagementProcess AgreementFCMEnClear Clearing Services- Means an agreement entered into between the ClearingHouse andservices provided by an FCM ClearingMember, pertaining to the Clearing House’s defaultmanagement process in connection with FCM EnClearContracts cleared on behalf of its FCM Clients or itsAffiliates, as the case of a default of an FCM ClearingMember or a Non-FCM Clearing Membermay be.FCM ForexEnClear ClearingMember- Means an FCM Clearing Member approved by theClearing House (in accordance with the FCMRegulations and the FCM Procedures) to clear ear Contracts.FCM EnClear Contract- Means a contract that is registered for clearing and isentered into by the Clearing House with an FCM ClearingMember on the FCM EnClear Contract Terms, and whichis governed by these FCM Regulations.

the Commodity Futures Trading Commission (the "CFTC"), is submitting for self-certification, pursuant to CFTC Regulation §40.6, amendments to LCH.Clearnet's Rulebook. The amended . In the case of a BAU client porting, clients will initiate a portfolio transfer via a manual instruction. The transfer will have the same effect as an .