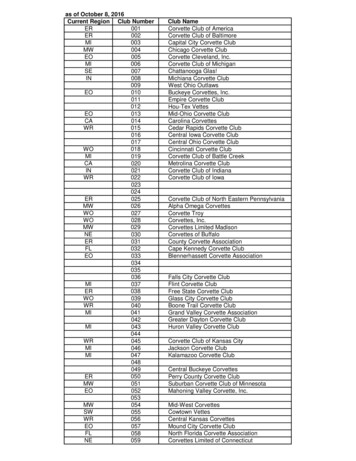

Transcription

Secure LifeStyles ClubNEWSLETTER AND EVENT SCHEDULE3 SPRING 2022

Mark YourCalendarAPRILThe Differenceis ResilienceDon Coffin,CEO & President22 Shred DayMAY8Des Moines Symphony FinaleEventReservationsReservations are required forALL events. Please register onlineat BankersTrust.com/SLC.You can also visit any branchor call (515) 271-1014.We look forward to seeingyou soon!Please note: Photos may be taken atSecure LifeStyles events for use byBankers Trust on Bankers Trust socialmedia pages, in the press, marketingmaterials, and more. By attendingSecure LifeStyle events, you consent toBankers Trust photographing and usingyour image and likeness.EVENT WALKING KEY. little or no walking. some walking. moderate walking. heavy walkingBankers Trust had yet another successful year. But what I am mostproud of doesn’t have a metric—our resilience. Our team memberswere resourceful and went to great lengths to meet customers’needs in this second year of the pandemic, and the bank’s financialstrength enabled us to make investments to support our operations,our customers, and our communities. In short, resilience, with afocus on deepening relationships, made a significant difference.“Resilience, with a focus on deepeningrelationships, made a significant difference.”For more than a century, Bankers Trust’s resilience has been building,enabling team members to serve and support our customersand communities through historic ups and downs. We havefocused on building strong relationships with our customers andcommunities—with trust, integrity, and outstanding service at thecenter. These qualities, along with the bank’s stability and focus onthe fundamentals, enabled us to support customers throughout 2021as they reset, rebuilt, and returned to a sense of relative normalcyduring the ongoing pandemic.Bankers Trust’s total assets grew to 6.0 billion, and we achieved 51.9 million in net income. Combined assets rose by 205 million.Bankers Trust was recognized as the “Best Bank” and “BestCommercial Lender” in Central Iowa for the seventh consecutiveyear, and our Phoenix location reached a milestone in becoming a 1 billion bank. While many differentiators contribute to the bank’ssuccess—longevity, service, security, technology, and relationships—in 2021, it was our resilience that helped us fulfill the Bankers TrustDifference.In 2021, we mourned the loss of Chairman Emeritus John Ruan III andhonored his legacy and lasting impact on Bankers Trust. Thanks tothe Ruan family and the bank’s strong succession planning, his son,John Ruan IV, was named Chairman of the Board. This signals theRuan family’s commitment to keeping the bank privately held andensuring our continued independence as a community bank.Visit any Bankers Trust office for a full copy of the annual reportor visit BankersTrust.com.

SPRING EVENTSBANKERS TRUST SHRED DAYFRIDAY, APRIL 22(Iowa branches only)Join Bankers Trust and celebrate Earth Day by properly disposing of your confidential papers.All customers are encouraged to visit any Bankers Trust location to drop off your personaldocuments. Papers are stored in a locked container before shredding. Not only does thisensure your private information remains private, it also protects our planet from waste.Before that, visit the Bankers Trust Education Center at education.bankerstrust.comfor information from Merso Jusic on what to save, toss and shred.DES MOINES SYMPHONY SEASON FINALE:PICTURES AT AN EXHIBITIONSUNDAY, MAY 8Experience the romantic thrill of Tchaikovsky’s First Piano Concerto played by virtuoso AlessioBax. The concert opens with Beethoven’s majestic Consecration of the House Overture; JessieMontgomery’s Starburst, commissioned in 2012 by the Sphinx Organization, dazzles with swirling,kaleidoscopic musical colors. Finally, experience the power and splendor as Mussorgsky’s Pictures atan Exhibition draws this program of masterpieces to a close with the magnificent Great Gate of Kiev.TIME2:30 – 3:30 p.m.LOCATIONCOST es Moines Civic CenterD221 Walnut St., Des MoinesFreeBEWARE OF THIS NEW GRANDPARENT SCAMThere’s a new twist on the grandparent scam circulating. Here are the warning signs you shouldwatch for, how to protect yourself and how to report suspected scams.WHAT IS THE GRANDPARENT SCAM?For many years, scammers have targeted seniorsby claiming to be their grandchild in a crisis and inneed of cash. They gather information about thegrandchild on social media or by other means andthen call, email or text the grandparent impersonatingthe child. They claim to be in a crisis — commonstories include being kidnapped, robbed, in a caraccident, jailed, or experiencing a medical crisis —and urge the grandparent to send money via wiretransfer or credit, debit or a prepaid card.A new twist to this scam involves the scammerstelling the grandparents a courier will come to theirhome to collect the funds. The couriers often poseas attorneys and other professionals and tell victimsthey’re subject to a gag order and cannot tell anyoneabout sending money. After the initial payment, thegrandparents often receive calls for additional fundsto be sent via USPS, FedEx or UPS.HOW TO PROTECT YOURSELF FROMGRANDPARENT SCAMSHere are a few ways you can protect yourself andyour loved ones from scammers: S et strict privacy settings on your social mediaaccounts so only people you know can accesspersonal information about you.

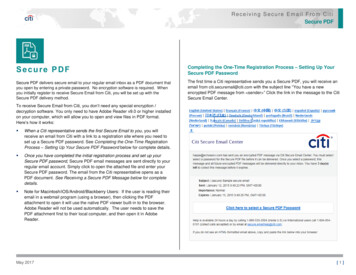

TAKE ADVANTAGE OF THE NEWBankers Trust 10-year HELOC2.99% forfirst 5 of10 yearsYou’ve done the hard work in paying your mortgage down, sotake advantage of it. Using the equity you’ve built in your homeis a smart way to fund major purchases. A Home Equity Line ofCredit (HELOC) allows you to take out as much as you need,up to a predetermined limit, and only pay for what you use. Actnow to take advantage of a low rate. Bankers Trust is offeringa 10-year HELOC with the first five years at 2.99% promotionalAPR fixed, and a variable rate thereafter, currently at 3.50%APR. This special offer also includes no closing costs orannual fees. Lock in now to avoid rising interest rates.*WHAT CAN YOU DO WITH A HELOC? I mprove and upgrade your home – remodel your kitchenwith all the modern conveniences or install the soaking tubyou’ve wanted in your private bathroom. C onsolidate debt – pay off debt from credit cards, or otherunexpected expenses. F und one-time discretionary purchases – give your daughterthe wedding of her dreams or take the vacation of yours. Pay for education expenses – for your children or grandkids.Connect with any Bankers Trust team member or CustomerService at 800-362-1688 to discuss your options.* All loans subject to credit approval. Certain restrictions may apply.Rate subject to change. The maximum APR of 21% and the floor rate of2% are specific to HELOCs only. Bankers Trust requires homeowner’sinsurance. Cost of appraisal is not included. Borrower will be responsiblefor appraisal cost ( 450 - 1,000) if appraisal is required. I f you receive a call urging you to send money,verify the caller’s identity by asking questions astranger couldn’t possibly answer. D on’t panic. Scammers use urgency as a tactic. Nomatter how urgent the crisis seems, resist the urgeto act quickly and think through your options first. D on’t keep it a secret. Call the family member’sgenuine phone number to confirm they are OK. S hare these tips with others. Scammers are countingon their victims not being aware of common scamsand warning signs! R eport scams to your state’s Attorney General.If you’re in Iowa, that contact information isconsumer@ag.iowa.gov or 515-281-5926.Visit BankersTrust.com/SLC to learn more.

What You Should Know AboutMarket Uncertainty, InterestRates and InflationWith ongoing pandemic challenges,rising inflation and interest rates, andinternational conflict, the marketshave been off to a rough start in2022 with declining equity pricesand fixed income/bond markets.One of the worst things for securitiesmarkets—and investors’ peace ofmind—is uncertainty. Here are afew insights into how we arrivedat this state, what might happennext and how you can manage yourfinances to address the uncertainty.HOW WE GOT HEREIn the spring of 2020 during theemergence of COVID-19, the FederalReserve slashed interest rates torecord lows to combat the economicdecline. As our economy emergedfrom a widespread lockdown in 2021,the Federal Reserve made it clearthey would start raising interestrates in 2022, although at the timeit was not clear by how much orhow fast this would happen.Rising inflation added to the sense ofuncertainty. Inflation was anticipatedat the start of 2021 as a result ofmultiple rounds of stimulus checkssent to most Americans duringthe pandemic and the difficulty ofrestarting a global economy afternearly 10 months of widespreadlockdown. At the start of 2021, theFederal Reserve said inflationJason Egge (515) 245-2892Vice President, BTC Financial Services7000 University Ave., Windsor Heights, IA 50324would be “transitory,” meaningit would be temporary. However,that has not been the case. In the12 months leading up to February2022, inflation was 7.9%—the highestit’s been since January 1982. Keepin mind, in February 2021, we werejust emerging from lockdown.Therefore, inflation numbers for the12-month period ending in June, Julyand August will provide a clearerpicture if inflation is under control.The prices of fixed income securitieswill likely face pressure in the nearterm in a rising rate environment,but a rise in interest rates has beensomewhat priced into the fixedincome markets since they startedto decline in August 2021. Keepin mind fixed income securitiescontinue to pay their scheduledincome payments and prices willlikely stabilize once the futureof inflation comes into focus.The Russia-Ukraine conflict is anadditional hindrance to the fightagainst inflation. Rising fuel costsand pending international conflictcertainly add more pressure to analready uncertain future. Pleasenote the references to the RussiaUkraine conflict in this article arean economic analysis. Like all ofyou, I’m deeply saddened by thehumanitarian crisis unfolding.For the remainder of 2022, thekey to the equity and fixed incomemarkets will be inflation. If inflationgets down to a manageable3% to 4%, I could see securitiesmarkets responding positively.WHAT’S NEXTWhile all these events areconcerning, there is also reasonfor optimism. In February, the U.S.economy added 678,000 jobsand unemployment fell to 3.8%—the lowest since the pandemic. Ifthe U.S. economy can add jobsat a substantial pace, that shouldalleviate some of the supply chainconcerns contributing to inflation.Additionally, on March 16, theFederal Reserve announced a 0.25%increase with up to six additionalincreases scheduled for later thisyear and potentially more raises in2023. This signals the economy isgrowing, which is typically a goodsign for the equity markets. I wouldbe more concerned if the FederalReserve stopped raising interestrates in 2022 because that couldindicate they are concerned aboutdeclining economic growth.WHAT YOU CAN DOAs always, a good investment planconsiders your personal financialneeds like expenses, tolerance forrisk and income needs. A stronglong-term plan should always factorin periods of market and economicuncertainty. If you would likeassistance putting together a longterm investment plan, please call ouroffices. We are always happy to help.Jason Egge is a Financial Advisorwith Securities America, Advisors,Inc. Securities offered throughSecurities America, Inc., memberFINRA/SIPC. Advisory servicesoffered through Securities AmericaAdvisors, Inc. Bankers Trust, BTCFinancial Services, a division ofBankers Trust, and Securities Americaare separate companies. SecuritiesAmerica and its representatives donot provide tax advice; it is importantto coordinate with your tax advisorregarding your specific situation.Not FDIC Insured. No BankGuarantees. May Lose Value.Not a Deposit. Not Insured byAny Government Agency.

453 7th StreetDes Moines, IA 50309Bankers Trust LocationsALTOONA3820 8th St. SW, Altoona, IA 50009(515) 957-8989AMES3725 Stange Road, Ames, IA 50010(515) 233-4424ANKENY1925 N Ankeny Blvd., Ankeny, IA 50023(515) 965-2497CLIVE11111 University Ave., Clive, IA 50325(515) 222-2000DEERFIELD13731 Hickman Rd., Urbandale, IA 50323(515) 222-2014DOWNTOWN717 7th St., Des Moines, IA 50309(515) 245-2426EAST150 E. Euclid Ave., Des Moines, IA 50313(515) 245-2432EDGEWATERWINDSOR HEIGHTSGRIMESCEDAR RAPIDS MAINNORTHCEDAR RAPIDS BLAIRS FERRY9225 Cascade Ave.West Des Moines, IA 50266(515) 222-20147000 University Ave.Windsor Heights, IA 50324(515) 271-1000110 SE Main St., Grimes, IA 50111(515) 986-3606201 1st St. SE, Cedar Rapids, IA 52401(319) 896-77773905 Merle Hay Rd., Des Moines, IA 50310(515) 245-2440SKYWALKPHOENIX453 7th St., Des Moines, IA 50309(515) 245-29192525 E Camelback Rd., Ste. 100Phoenix, AZ 85016(602) 224-2020SOUTH655 E Army Post Rd., Des Moines, IA 50315(515) 245-2977WEST DES MOINES400 Blairs Ferry Rd. NECedar Rapids, IA 52402(319) 221-1230SAGEWOOD4555 E Mayo Blvd., Phoenix, AZ 85050(602) 224-2035620 S 60th St., West Des Moines, IA 50266(515) 248-1320SUN HEALTH GRANDVIEW TERRACE14515 W Granite Valley Dr.Sun City West, AZ 85375(602) 224-2046BankersTrust.com/SLC2

Bankers Trust's total assets grew to 6.0 billion, and we achieved 51.9 million in net income. Combined assets rose by 205 million. Bankers Trust was recognized as the "Best Bank" and "Best Commercial Lender" in Central Iowa for the seventh consecutive year, and our Phoenix location reached a milestone in becoming a 1 billion bank.