Transcription

TUITION REMISSION PROGRAM

The Tuition Remission Program provides regular full-timeemployees with an outstanding education benefit. You andyour family can take advantage of a wide range of coursesand degree programs offered by the University.Eligibility for benefits for you begin on the first day of the semesteron or following your date of hire.Eligibility for benefits for your spouse and dependent children beginon the first day of the semester after you have completed theappropriate service requirements.10696

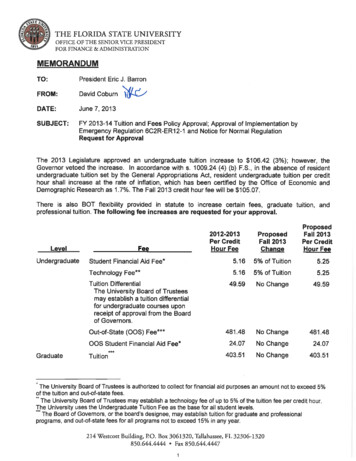

TUITION REMISSION PROGRAMEligibilityIf you are a regular full-time employeeand have an appointment of ninemonths’ or more duration you, yourspouse, and your dependent children are eligible to participate inthe Tuition Remission Program.Your eligible dependent children arethose whom you claim as exemptions on your federal income taxreturn during the calendar years inwhich they are enrolled in undergraduate degree programs at BostonUniversity. They include:Your unmarried dependentchildren or stepchildrenCertain age limits apply to eligibledependent children (see “Benefitsfor Your Dependent Children”).Employees whose percentage timeworked decreases below the eligibility requirements for the TuitionRemission Program will no longerbe able to participate in the TuitionRemission Program.How the Program WorksWhat Is Covered The Tuition Remission Program covers undergraduateand graduate courses taken by youor your spouse and undergraduatecourses taken by your dependentchildren.The Tuition Remission Programapplies only to courses offered byBoston University. No assistance isprovided for courses taken at othercolleges or universities.When to Apply Once you have registered for your class(es), if you wouldlike to apply for the tuition remissionbenefit for yourself, your spouse, oryour unmarried dependent children,you may apply online at EmployeeSelf Service at BUworks Centralat www.bu.edu/buworkscentral.Alternatively, you may complete aBenefits Enrollment Form available atwww.bu.edu/hr/forms-documents.Upon request, paper forms willalso be mailed directly to you byHuman Resources. Completed paperforms must be returned to HumanResources at 25 Buick Street. Youneed only use one method of application—online or paper—not both.Covered students under the TuitionRemission Program (employees,spouses, or children) register forclasses separately through theRegistrar’s Office and then receivecredit from the Tuition RemissionProgram on their student accountsfor approved credit hours.How Approval Works Employees,spouses, and children receiving benefits are registered for classes on aspace-available basis.Participating employees, spouses, ordependents are responsible for meeting admission requirements or prerequisites for any course or program.Tuition Remission Does Not CoverFees and Other Expenses, (e.g., Books,Lab Fees, Etc.) Registration fees andother fees, except the ContinuingStudent Fee, must be paid by covered students when they register forcourses as those fees and expensesare not covered by tuition remission.Covered students must also pay fortheir books, lab fees, late fees, andany necessary classroom materialsas those fees and expenses are notcovered by tuition remission. Tuitionremission also does not cover roomand board.Tuition Remission BenefitsTuition remission benefits aregranted on a semester basis. For thepurposes of the program, the twosummer sessions are treated as oneacademic semester.If a service requirement applies tothe tuition remission benefits foryour spouse or dependent children,only continuous and full-time servicewith Boston University is countedtoward fulfilling that requirement.Such service is measured fromthe date you become an eligibleemployee (see prior “Eligibility” section) up to and including the first dayinstruction begins.Full-time employees are only eligible to receive tuition remissionbenefits as “employees.” It is BostonUniversity’s policy that if you are afull-time regular employee you maynot be enrolled at Boston Universityas a full-time student. Full-timestudent status is 12 or more credits. If you are a full-time regularemployee, you are not eligible forbenefits as a spouse or dependentof another employee.An explanation of the benefits available to you, your spouse, and yourdependent children follows.Benefits for YouIf you were hired on or beforeJuly 1, 1981 As an eligible employeeyou are entitled to 100% tuitionremission for up to 8 credit hoursof courses you take each semester.This includes graduate and undergraduate courses (see discussionbelow regarding the taxability ofgraduate courses).10797

If your employment ends before thefirst day instruction begins*, you willbe required to pay the full tuition forall courses taken that semester.If your employment ends after thefirst day instruction begins*, butbefore the final exam end date** forthe semester, your benefits will continue until the end of the semester.If you were hired on or before June30, 1985, but after July 1, 1981 As aneligible employee you are entitledto 100% tuition remission for thefirst 4 credit hours and 90% tuitionremission for the next 4 credit hoursof courses you take each semester.This includes graduate and undergraduate courses.If your employment ends before thefirst day instruction begins*, you willbe required to pay the full tuition forall courses taken that semester.If your employment ends after thefirst day instruction begins*, butbefore the final exam end date** forthe semester, your benefits will continue until the end of the semester.If you were hired on or after July 1,1985 As an eligible employee youare entitled to 100% tuition remission for the first 4 credit hours and90% tuition remission for the next4 credit hours of courses you takeeach semester. This includes graduate or undergraduate courses.If your employment ends before thefinal exam end date or the end ofsession date** for the semester, youwill be required to pay full tuitionfor all courses taken that semester.If you are involuntarily terminatedfrom your position, no payment willbe due.will continue until the end of thesemester.Courses Scheduled During Work HoursService RequirementIf a course you want to take is scheduled during normal working hours,you must have your department chairor supervisor sign your tuition remission form in order for the benefit tobe approved. The University reservesthe right to refuse to allow you toattend a class under the TuitionRemission Program if it conflicts withthe needs of your department.Your spouse will be eligible fortuition remission benefits once youhave completed 12 months of eligibleservice (i.e., continuous and full-timeservice) at Boston University.You must report all courses taken,not only courses covered by theTuition Remission Program, todetermine if there is a conflict withthe needs of your department.You will not receive pay whileattending a class during scheduledwork hours.If you are taking more than 8 credits, you must have the approval ofthe Dean or Vice President for yourunit before applying for the benefit.Benefits for Your SpouseOnce you have satisfied the servicerequirement described below, yourspouse will be granted 50% tuitionremission each semester for allcourses taken at Boston University.This includes graduate and undergraduate courses.If your employment ends before thefirst day of class, your spouse willbe required to pay full tuition for thecourses taken that semester. If youremployment ends before the last dayof classes, your spouse’s benefits*The first day “instruction begins” for the semester is defined as the date publishedin the Boston University Office of the University Registrar Official AcademicCalendar: Charles River.**The “final exam end” date or the “end of session” date for the semester is defined asthe date published in the Boston University Office of the University Registrar OfficialAcademic Calendar: Charles River. For the fall and spring semesters, it is the “finalexam end date”; for summer session, it is the Summer II “end of session” date.10898If you and your spouse are bothemployed at Boston University andare both eligible for tuition remission benefits, you and your spouseare individually eligible to receivetuition remission as employees. Youand your spouse are not eligible toreceive benefits as a spouse.Benefits for Your DependentChildrenOnce you have satisfied the servicerequirement described below, eachof your eligible unmarried dependent children may take up to eightsemesters through the TuitionRemission Program, as long as theyapply, are admitted to, and areenrolled in undergraduate degreeprograms at Boston University oras seniors at Boston UniversityAcademy. The amount of tuitionremission benefits granted fortheir courses depends upon yourlength of eligible service with theUniversity. Tuition remission is notavailable for any graduate coursestaken by dependent children.If your employment ends before thefirst day of classes, your dependentwill be required to pay full tuition forthe courses taken that semester. Ifyour employment ends before thelast day of classes, your dependent’sbenefits will continue until the endof the semester.Service RequirementsYour unmarried dependent childrenmay receive 50% tuition remissionfor courses taken once you havecompleted four months of eligible

service (i.e., continuous and fulltime service) and:If you were hired prior to January 1,1995, they may receive 100% tuitionremission for courses taken afteryou have completed 16 months ofeligible service.If you were hired on or after January 1,1995, they may receive 90% tuitionremission for courses taken afteryou have completed 16 months ofeligible service.In the event your unmarried dependent children have received eightsemesters of tuition remission benefits and need an additional semester to complete their undergraduatestudies, it may be possible to repaythe University for one semester oftuition remission benefits that werepreviously received in exchange fortuition remission benefits for a prospective semester. Please contactHuman Resources for additionalinformation regarding this provision.Proof of Relationship RequirementFull-time employees are only eligibleto receive tuition remission benefitsas an employee. You are not eligiblefor additional benefits as a dependent child of another employee eligible for tuition remission benefits.Proof of relationship to the employeemust be provided for eligibleunmarried dependent children. Theemployee must provide the following: A copy of the dependent’sbirth certificate, or A copy of the adoptioncertification, or A copy of the most recent taxreturn listing your dependent(s)These documents will be keptin confidential files in HumanResources.Age Limit for Dependent ChildrenDependent children are no longereligible for benefits under this program after the end of the semesterin which they reach age 27. Theexceptions to this provision are:Military Service For unmarrieddependent children who are honorably discharged veterans, the periodof eligibility will be extended beyondage 27 by the number of months oftheir military service, up to a maximum of 48 months.Disability Dependent children whosedisabilities prevent them fromcompleting undergraduate workwithin eight semesters by the timethey reach age 27, must submit awritten request for an extension oftuition remission eligibility to HumanResources. A physician’s statementindicating diagnosis, period of disability, and prognosis must accompany the request, along with a letterof recommendation from BostonUniversity’s Disability Servicesregarding the student status of yourdependent child.Special Provisions Protecting Benefitsfor Dependent ChildrenOnce Your Dependent Children BeginReceiving Benefits If you retirefrom the University at age 55 orlater and have completed 10 ormore years of continuous full-timeservice with the University afterage 45, your eligible unmarrieddependent children may continueto receive tuition remission benefits in an undergraduate degreeprogram at the University pursuantto terms specified herein.If you should die while employed atthe University, or are receiving disability benefits from the University’sLong-Term Disability Plan, youreligible unmarried dependentchildren may continue to receivetuition remission benefits throughthe semester in which your deathoccurred, subject to the Program’slimits, as long as they remain eligible.In subsequent semesters, your yearsof continuous full-time service up tothe time when you became disabledor died, will be used to determine thenumber of additional semesters upto a maximum of eight semesters forwhich each child is eligible in accordance with the following table:Employee’s years ofcontinuous full-timeserviceNumber ofsemestersper child3 but less than 626 but less than 949 but less than 10610 or more8For example, if you died with 10 ormore years of continuous full-timeservice with Boston Universityand at the time of your death, yourdependent child had received sixsemesters of tuition remission, heor she would be eligible for twomore semesters of tuition remission, for a maximum of eightsemesters.Before Your Dependent Children BeginReceiving Benefits If you retire fromthe University at age 55 or later andhave completed 10 or more yearsof continuous full-time service withthe University after age 45, theUniversity will provide your eligibleunmarried dependent children witheight semesters of tuition remissionbenefits in an undergraduate degreeprogram at the University pursuantto terms specified herein.If you should die while employedat the University, or are receiving disability benefits from theUniversity’s Long-Term DisabilityPlan, the University will provideyour eligible unmarried dependentchildren with up to eight semestersof tuition remission benefits in an10999

Unpaid Leaves of Absenceundergraduate degree program atthe University depending upon youryears of continuous full-time serviceat the point of your disability ordeath, in accordance with thefollowing table:Employee’s years ofNumber ofcontinuous full-time degree programsemesters atundergraduateserviceper childundergraduatedegree programatthe University dependingupon100 ars of continuous full-time serviceyearsofcontinuousat6 butthelesspointdisabilityorthan9 of your full-time4 serviceatthe pointof your disabilityordeath,inaccordancewiththe9 but less than 106death,in accordancewith thefollowingtable:10 or more table:8followingEmployee’s years ofNumber ofcontinuous full-timesemestersEmployee’syears ofNumber ofBenefitsDuring Authorizedserviceper childcontinuous full-timesemestersAbsencesfrom Work per childservice3 but less than 62The3 butfollowingless than 6 applies to tuition26 but less than 94remissionbenefitsforyou,your6 but less than 949 but less than6 chilspouse,and10your dependent9 but less than 106drenwhile you are on an approved10 or more810 or more8leaveof absence or sabbatical.Paid Leavesof Absenceand SabbaticalsBenefitsDuringAuthorizedAbsencesfrom ts conAbsencesWorktinuewhilefromyou areon an approvedThe following applies to tuitionleaveof missionbenefitsfor nefitsfor you, yourspouse, andyour spouse,yourchildrenaredependentonan approvedapprovedsabbaticalwithpay.Thedrenyou arean approvedleavewhileof absenceoronsabbatical.periodoftimeyouareon leaveleave of absence or sabbatical.PaidLeaves ofand countsSabbaticalsof bbaticalsTuitioncontoward remissionany ewhilearebenefitson an approvedspecifiedin youthe program.tinueyou areonpay.an approvedleave whileof absencewithTuitionUnpaidLeavesof Absenceleaveofabsencewithpay.Tuitionremission benefits also eif you are abenefitsfaculty alsomemberon anResources,tuitionbenifyou are asabbaticalfacultyremissionmemberonanapprovedwith withTheperiod of timeyou areon pay.leaveanapprovedunpaidofcountsabsenceperiodof timeyouleaveare onleaveof absenceor sabbaticalthatis takenforonerequirementsof thefollowingofabsencesabbaticalcountstowardany orservicereasons:towardanyrequirementsspecifiedin servicethe program.specifiedintheprogram.1. Research purposesUnpaid Leaves of AbsenceUnpaidLeavesof AbsenceWithpriorapprovalfrom Human2.Instruction110100Withprior approvalfrom HumanResources,tuition remissionben3. Government or other serviceResources,remissionefits may betuitioncontinuedduringbenandeemed by the University toefitsmay becontinuedduringanapprovedunpaidleave ofabsencebe in the public interestapprovedunpaidleaveof absencethat is takenfor oneof thefollowingthatis takenfor oneasofmaythe ed by the University1. Research purposes1. Research purposes2. Instruction2. Instruction3. Government or other serviceWith prior approval from HumanResources, tuition remission benefits may be continued during anapproved unpaid leave of absencethat is taken for one of the followingreasons:Withof thereasonsIf you thetakeexceptionan approvedleaveof1. Research purposesstatedabove,tuitionremissionabsence without pay for any reason2.Instructionbenefitswillterminatefor theotherthanthoseexplainedabove,durationof your unpaidleaveoftuitionremissionbenefitswilltermi3. Government or other serviceabsence.If youtake aofmedicalnateforthedurationyourleavedeemed by the University toleavea resultof afollowingwork relatedon betheasof theinearlierthe publicinterest dates:incident or personal medical condi1.beginning ofasa maysemester fol4. TheOthertion,youractivitiestuition remissionbebenefitlowingor coincidentwith nIf youtake anbyapprovedleave offirstdayofyourleave;or ofIfyouan approvedofyourtakeunpaidleaveof leaveabsence.absencewithoutpay forany reasonabsencewithoutpayfor oseexplained2. At thantheendof efor beginthebenefitsdurationof termiyourtuitionremissionwillwhichyouyour urationearlierofofthefollowingnate fortheyourleaveWhile you are on approved leavenateforearlierthe durationof your leavedates:on theof the followingdates:of absence without pay, you canon the earlier of the following dates:1.The 1.Thebeginningof Program’sa semesterlowingor coincidentwith t dayyour leave;or theservicerequirement.first day of your leave; or2. At theMilitaryend of anysemester yourleave.If yougo youon anextendedmilitarywhichyoubeginyourleave.leave,you arewillonaccrueserviceWhile uareonapprovedof absence without pay, encewithoutpay,youaccrueservice(up to24months)periodoftheleave,providedaccrue24 months)toward servicemeeting(upthetoProgram’syoureturnto regular,full-timetowardmeetingthe vice requirement. rvice andExtendedMilitaryLeave yourmilitaryIfyou goan extendedwithintheontimewhenvetIfyou an’sre-employmentrightsareleave,youwill accrueservicetowardmeetingthe Program’sprotected.towardmeeting the Program’sservice requirementsfor the entireMedicalLeaveof Absenceservicerequirementsfor the entireperiod of the leave, ovidedyou return to regular, full-timeabsenceduetotemporarydisyoureturn to withregular,employmentthe employmentwith servicethe Universityfollowing militaryanddependentchildrenuntiltheend offollowingservicewithin themilitarytime whenyourandvetaeran’ssemesterin whichyoucompletewithinthe chleavewitheran’sre-employment rights areprotected.outpay. You can accrue up to sixprotected.Medicalof Absencemonths Leaveof servicetoward meetingMedicalLeaveofAbsenceDuringanapprovedofthe Program’s enceto temporarydiswhile on duea temporarydisability.absenceduetotemporaryability, benefits continue fordisyourability,benefitscontinuefor yourBostonUniversityCoursesdependentchildrenuntil theend ofExcludedthe Tuitiondependentchildrenuntilthe end ofa semesterfromin whichyou completeRemissionProgramasixsemesterin whichyou completemonths ofsuch leavewithsixmonthsofsuchleavewithoutpay. Youcangrantedaccrue upBenefitsare notforto sixoutYoucan accrueto sixmonthsofservicetowardupmeetingthe pay.following:monthsof servicetowardmeetingthe Program’sservicerequirements hileon a temporarydisability.whileon a temporarydisability. Coursesoffered throughtheBostonUniversityCoursesSchoolof Medicine(except forExcludedfrom the CoursesTuitionBoston UniversityRemissionfromProgramExcludedthe TuitionRemission ProgramBenefits are not granted fordependent children until the end ofa semester in which you completesix months of such leave without pay. You can accrue up to sixmonths of service toward meetingthe Program’s service requirementswhile on a temporary disability.BostonUniversitycoursesoffered Coursesin the DivisionExcludedfromtheTuitionof Graduate MedicalSciencesRemission Programand master’s degree chool oftheHealth)following:Applied music Coursesofferedfeesthrough theGoldman School of Dental Courses offered through theMedicinecoursesin theDivisionSchool ivisionGraduateMedicalSciences ofCoursesofferedallexecutiveof GraduateMedicalSciencesandmaster’sdegree suchprogramgraduateprograms,as theandmaster’sdegreeprogramcoursesin Masterthe Schoolof PublicExecutiveof Businesscourses in the School of PublicHealth)AdministrationHealth) CoursesofferedthroughtheNon-creditcoursesor courses GoldmanCourses offeredthroughtheSchoolof DentalawardingContinuingEd UnitsGoldman School of DentalMedicine(CEUs)Medicine Coursesoffered for all executiveOnline courses graduateCourses offeredfor allexecutiveprograms,suchas the Room, board, and non-tuitiongraduate programs,as theExecutiveMaster of suchBusinessportion of study abroad programExecutiveMasterofBusinessAdministration(for example, air fare and books)Administration Non-credit courses or courses Courses not offered for credit, awardingNon-creditContinuingcourses orEdcoursesUnitssuch as the courses offered atawarding Continuing Ed Units(CEUs)the Center for English Language(CEUs) OnlinecoursesPrograms,& Orientation ContinuingOnline coursesEducation, and Room, board, and non-tuitionsomeCertificateProgramsat portionRoom, board,andnon-tuitionof studyabroadprogramMetropolitanCollege.portionof studyprogram(forexample,airabroadfare andbooks)(for example, air fare and books)IncomeTaxnotConsiderations Coursesoffered for credit, suchCoursesnotcoursesoffered offeredfor credit,as theatThesuchtuitionremissionbenefitsyou,as thecoursesofferedatthe s,drenreceivemaybesubjecttofed& tinuingincome taxes,MassachusettsEducation,and atsome CertificateProgramsstateincometaxes, andFICA .MetropolitanUndercurrent taxCollege.laws, the followIncomeTax Considerationsing provisionsapply:Income Tax currenttax use,or yourchilJanuary1, 2002,up dependentto 5,250inyourspouse,oryourdependentchildrenmay betuitionsubjectremisto fedvaluereceivefor graduatedrenincomereceivetaxes,maybesubject toare,federalMassachusettssionbenefitsfor employeeseral incometaxes,Massachusettsstateincometaxes,and come taxes,and FICAtaxes.ableGraduatetuitionUnder current tax laws, the followremissionin excessof 5,250Undercurrenttax laws,the followingprovisionsapply:percalendaryearforing provisions apply: employeesUndertaxtuitionlaw effectiveand all eJanuary1,2002,upto 5,250inbenefits for spouses are generallyJanuary1,2002,upto eral, state,FICAvalueforgraduatetuitionremissionbenefits for employees are,taxation.sion onable income.Graduatetuitionremissionin excessof 5,250remissioninexcessof 5,250per calendar year for employeesstate income tUnder currenting provisionsUnder currentJanuary 1, 200value for gradsion benefitsgenerally, notable income. Gremission in eper calendar yand all graduabenefits for spsubject to fedtaxation.

ue for yourtil the end ofou completeve withue up to sixard meetingrequirementsdisability.ursesitioned forrough the(except fordren receive may be subject to federal income taxes, Massachusettsstate income taxes, and FICA taxes.Under current tax laws, the following provisions apply:Under current tax law effectiveJanuary 1, 2002, up to 5,250 inTuitionremissionbenefitsvalue forgraduatetuitionforremisundergraduatecoursesare genersion benefits foremployeesare,allytax-free.generally,not considered taxable income. Graduate tuitionDue to nearly continuous changes inremission in excess of 5,250the tax laws, please contact Humanper calendar year for employeesResources for the current statusand all graduate tuition remissionconcerning the taxability of tuitionbenefits for spouses are generallyremission benefits. You may alsosubject to federal, state, and FICAwant to consult with a tax advisor.taxation.AdministrativeTuition remissionInformationbenefits forAbouttheProgramundergraduate courses are generally tax-free.Type of ProgramDue to nearly continuous changes inTheBostonTuitionthe taxlaws,Universityplease contactHumanRemissionProgramisanResources for the Itconcerning thetaxabilityof tuitionisnotsubjecttotheprovisionsofremission benefits. You may alsotheRetirementwantEmployeeto consultwith a taxIncomeadvisor.Security Act (ERISA) of 1974. AnydeterminationsBoston UniversityAdministrativebyInformationAbout theeligibilityProgramregardingfor the TuitionRemission Program or benefitsthereunderare final, binding, andTypeof Programconclusive.The Boston University TuitionRemission Program is an unfundededucational assistance program. Itis not subject to the provisions ofthe Employee Retirement IncomeSecurity Act (ERISA) of 1974. Anydeterminations by Boston Universityregarding eligibility for the TuitionRemission Program or benefitsthereunder are final, binding, andconclusive.Program Amendment orTerminationBoston University intends to continue the Tuition Remission Programindefinitely; however, the Universityreserves the right in its discretion toamend, suspend, or terminate theprogram at any time.For Additional InformationProgramAmendmentor concernFor additionalinformationTerminationing the Tuition Remission Program,contactHuman Resources.Boston Universityintends to continue the Tuition Remission Programindefinitely; however, the Universityreserves the right in its discretion toamend, suspend, or terminate theprogram at any time.For Additional InformationFor additional information concerning the Tuition Remission Program,contact Human Resources.111101

Human Resources. Completed paper forms must be returned to Human Resources at 25 Buick Street. You need only use one method of appli-cation—online or paper—not both. Covered students under the Tuition Remission Program (employees, spouses, or children) register for classes separately through the Registrar's Office and then receive