Transcription

Welcome to our webinar seriesRisky Business: ManagingRisk for Produce SuccessWebinar #6Crop Insurance and theSmall Farm

Adam WatsonAppalachian Harvest Food HubAppalachian Sustainable Developmentawatson@asdevelop.org

This webinar made possible by the USDARisk Management Agency 2018 RiskManagement Education (RME)Partnership Program.

Crop Insurance and theSmall FarmMyrisa Christyfrom theKentucky Center for Agriculture & RuralDevelopment (KCARD)

Why are you considering cropinsurance? Do you need it due to terms of a loan? Do you need it to protect your investment in the farm?o Does the farm provide your main source of income?o Will losing farm income create a hardship for you?

Crop Insurance Background Crop Insurance was created in the 1930’s to help coverfarmers in the case of a disaster The federal government works with Approved InsuranceProviders to provide coverage.o Rates are determined by the Federal Crop InsuranceCorporation (FCIC), not individual insurers.o Premiums are subsidized by the federal government based oncost and if the insured is a member of any special groups Today, the federal government can subsidize from the 38%to 67% of your premium.

Key Concepts Yield versus Revenueo Yield is how much you harvest (APH Actual Production History)o Revenue is how much you earn through sales Production Practiceso Organic, irrigated, non-irrigated Coverage Levelso Varies from 50% to 85%, depending on the program

Key Concepts Premiumso The amount charged for insurance coverage Subsidieso The amount the federal government pays of your premium Claimso You file a claim when you realize you’ve had a loss. Indemnitieso The payout after your loss is approved

What “fits” small and diversifiedfarmers?Whole Farm Revenue Protectiono Good for farms with specialty or organic products, farms thatmarket locally to consumer, and farm-identity preservedo Requires a significant amount of recordkeepingFarm Service Agency Noninsured Crop Disaster AssistanceProgram (NAP)o Purchased through the Farm Service Agencyo Covers crops for which individual coverage isn’t available inyour countyo Won’t pay a premium for products

First steps for crop insurance Check the to see if you have the necessary records Contact FSA and/or a crop insurance agento Locate nearest FSA o Agent locator on USDA Risk Management Agency’s Agent-LocatorPage

Records NecessaryFarm serial numberName of the crop and variety/typeIntended use, such as fresh, processed, etc.Practice, for example irrigated vs. non-irrigated or organic vs.conventional Production history including planting dates and field location The total quantity of all crops harvested during the previous 5years Additional requirements for fruit trees (spacing, age of trees,etc)

What is available to me? For traditional crop insurance, your coverage availabilitydepends on where you are located, what you aregrowing, and how you grow it. For examples, check out :http://fsa.usapas.com/NAP.aspxo The resulting reports page also tell you important dates for yourselected plan.

Reasons for a claim Eligible causes of a losso Adverse weather – unusually hot, cold, wet, dry, wind, hail, etc.o Unusual natural causes (earthquake, volcano, insect infestationdue to unusual weather) Ineligible cause of a lossoooooFailure to follow good farming practicesNeglect or mismanagementWeedsChemical driftAnimal damage

Whole Farm Revenue Protection Everything on your farm is under one policy Available in every county Provides protection against a loss in Revenue, not Yield Revenue losses must be reported within 72 hours ofdiscovery Claims must be within 60 days of filing taxes Indemnities are generally paid after the end of thecalendar year Does not insure forest products or animals for sports orshows

Whole Farm Revenue ProtectionAdditional records required 5 consecutive years of Schedule F (2014 to 2018)o 3 may be used for a beginning farmer or rancher Information to support any farm expansiono Purchased or leased additional acreage, for example

Whole Farm Revenue ProtectionImportant DatesooooSales Closing, Cancellation, and Termination Date: March 15Revised Farm Operation Report: July 15Premium Billing Date: August 15Contract Change Date: August 31

Whole Farm Revenue ProtectionApproved Revenue, the amount you of revenue yourinsurance is based on, comes from the following Whole-Farm History Report (5 years of history) Farm Operation Report (Plans for current year) Farm expansion/growth taken into account Your coverage levelRevenue will be adjusted for any unsold inventory at theend of the year.

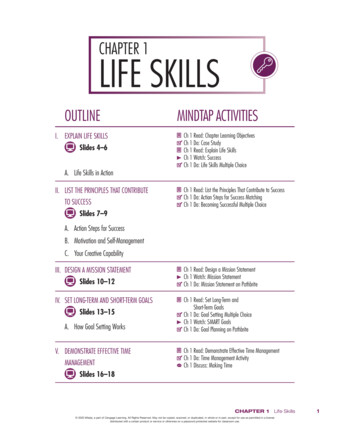

WFRP Premium SubsidiesCoverage Level50%55%60%65%70%75%Basic SubsidyOne Commodity67%64%64%59%59%55%Whole-FarmSubsidyTwo le-FarmSubsidyThree or morecommodities80%85%71%56%

Get an online estimate of WFRP Go Estimates/QuickEstimate.aspx Enter your data Click get estimate

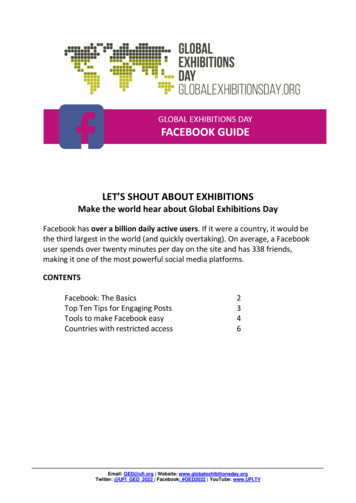

Premium lityamount 82,960 78,080 73,200 68,320 63,440 58,560 53,680 48,800TotalPremium 10,453 8,433 6,808 5,466 4,250 3,572 3,060 2,586Subsidy 5,854 5,987 5,446 4,373 3,400 2,858 2,448 2,069Producerpremium 4,599 2,446 1,362 1,093 850 714 612 517

Whole Farm Revenue ProtectionExample Scenario: Kelly bought 70% coverage with an Approved Revenue of 97,600 for a premium of 1,093. Kelly loses 25,000 of revenue because a pumpkin fieldflooded and 15,000 due to hail in tomatoes and peppers. Expected Revenue was 97,600 and actual revenue was 60,000. Insured at 70% ( 68,320), Kelly should receive a 8,320indemnity

Noninsured Assistance Program (NAP) NAP protects farmers with uninsurable crops from disastersthat reduce yield or prevent planting NAP is available for crops not covered in your county.o Example: In eastern KY, pumpkins are not covered undertraditional crop insurance. Insurance is purchased for each individual crop Cannot purchase NAP for crops available to be insured inyour county

Noninsured Assistance Program Application fees are 250 per crop, up to 750 perproducer per county. To check on premiums and indemnity payments, usehttp://fsa.usapas.com/NAP.aspx

NAPExample:Cropinformation

NAP Example: Coverage

NAPExample:Indemnity

NAP Example Scenario Kelly bought 65% coverage with an anticipated revenueof 2,286 per acre. However, coverage is based onharvested pumpkins of 16,000 lbs per acre, not revenue. Kelly loses 25,000 of revenue because a pumpkin fieldflooded, but had 5,000 in pumpkin revenue.o If Kelly only harvested about 4,000 lbs per acre, she shouldreceive around an 8,000 indemnity.o The tomatoes and peppers are considered separately andrequire separate policies.

Comparing WFRP and NAP Whole Farm Revenue Protection was a single premiumthat covered all insured cropso You can have small losses from each area that contribute alarger overall loss. NAP covered only one crop with each premiumo If you are looking for catastrophic coverage for a few importantcrops, this may work well.

Why buy crop insurance? Helps cover the cost of inputs for next year in case of cropfailure Assists in getting financing Provides some peace-of-mind for a minimum amount ofrevenue Mitigates the risks for what you cannot control – theweather, for example

Resources WFRP FAQ Sheet:o -Sheets/WholeFarm-Revenue-Protection-2018 NAP FAQ Sheet:o afiles/FactSheets/2017/nap for 2015 and subsequent years oct2017.pdf NAP Premium Estimatoro http://fsa.usapas.com/NAP.aspx WFRP Premium Estimatoro timates/QuickEstimate.aspx

Thank you!Myrisa Christymchristy@kcardky.com606-765-0915Kentucky Center for Agriculture and Rural Developmentkcard@kcard.info859-550-3972

o Rates are determined by the Federal Crop Insurance Corporation (FCIC), not individual insurers. . dry, wind, hail, etc. o Unusual natural causes (earthquake, volcano, insect infestation due to unusual weather) Ineligible cause of a loss o Failure to follow good farming practices . flooded and 15,000 due to hail in tomatoes and peppers .