Transcription

Aetna Student HealthPlan Design and Benefits SummaryThe Pennsylvania State UniversityPolicy Year: 2015 - 2016Policy Number: 846513www.aetnastudenthealth.com(855) 546-5412

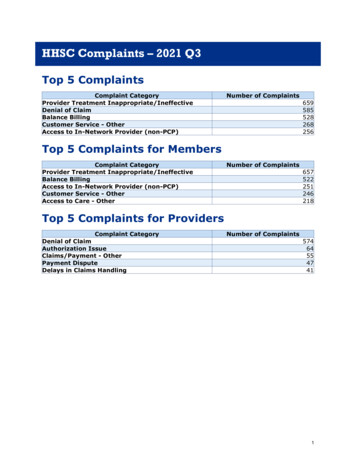

This is a brief description of the Student Health Plan. The Plan is available for The Pennsylvania State University studentsand their eligible dependents. The Plan is underwritten by Aetna Life Insurance Company (Aetna). The exact provisionsgoverning this insurance are contained in the Master Policy issued to the The Pennsylvania State University and may beviewed online at www.aetnastudenthealth.com. If any discrepancy exists between this Benefit Summary and thePolicy, the Master Policy will govern and control the payment of benefits.Penn State University Health ServicesUniversity Health Services (UHS) provides nationally accredited medical care and health promotion services that helpstudents achieve and maintain optimal health. In addition to medical treatment for illness and injury, on-site servicesinclude lab, X-ray, pharmacy, a nutrition clinic and physical therapy. Located on Penn State’s University Park campus, UHSis adjacent to the Eisenhower Parking Deck and the Bank of America Career Services Building off Bigler Road. UHS is openMondays, Tuesdays, Thursdays, and Fridays from 8:00 a.m. to 5:00 p.m., Wednesdays from 9:00 a.m. to 5:00 p.m., andSaturdays from 11:00 a.m. to 3:00 p.m. (fall/spring semesters urgent problems only; no appointments required onSaturdays). Students can schedule appointments online at http://studentaffairs.psu.edu/health/myUHS or call(814) 863-0774. Additional information is available at http://studentaffairs.psu.edu/health.University Health Services at University Park Campus:The Deductible will be waived and benefits payable at 100% for Covered Medical Expenses rendered by Penn StateUniversity Health Services (including University Park and the campus-based clinics for all other campuses) EXCEPT asnoted below.Please Note: Mandatory immunizations for international students and their dependents (Measles, Mumps and RubellaVaccinations and Tuberculosis tests) are covered at 100% after deductible when provided by a participating providerin the community at a non-University Park campus. Please see the schedule of benefits below for more details.Allergy Testing and Treatment Expenses (sera) rendered by Penn State University Health Services are payable at 80%.Covered Prescribed Medicines Expense at Penn State University Health Services Pharmacy or the Hershey Medical CenterPharmacy will be paid at 100% of the Negotiated Charge.For students on the Hershey Campus:The Deductible will be waived and benefits payable at 100% for Covered Medical Expenses rendered by Penn StateHershey Medical Group - Fishburn Road location ONLY. The Annual Deductible will apply at all other locations.845 Fishburn RoadHershey, PA 17033Tel: (717) 531-5998Fax: (717) 531-0129Hours:M-F 8:00 a.m. – 5 p.m.Walk In Clinic:M-F 5:00 p.m. – 9:00 p.m.Sa & Su Noon – 6:00 p.m.Allergy Testing and Treatment Expenses (sera) rendered by Penn State Hershey Medical Group – Fishburn Road locationONLY are payable at payable at 80%.The Pennsylvania State University 2015-2016Page 2

Coverage PeriodsStudents: Coverage for all insured students enrolled for coverage in the Plan for the following Coverage Periods.Coverage will become effective at 12:01 AM on the Coverage Start Date indicated below, and will terminate at 11:59 PMon the Coverage End Date indicated.Eligible Dependents: Coverage for dependents eligible under the Plan for the following Coverage Periods. Coverage will,will become effective at 12:01 AM on the Coverage Start Date indicated below, and will terminate at 11:59 PM on theCoverage End Date indicated. Coverage for insured dependents terminates in accordance with the TerminationProvisions described in the Master Policy.Undergraduates and Graduate Students, Graduate Assistants*, and Graduate Fellows*:Coverage PeriodCoverage Start DateCoverage End DateEnrollment 19/2016Summer I5/1/20168/9/20165/23/2016Summer II6/15/20168/9/20167/7/2016*Graduate Assistants and Graduate Fellows: Please visit the University Health Services website for payroll breakdownsand for directions on adding dependents or declining coverage(s): http://studentaffairs.psu.edu/health. The Fall 2015deadline is September 8, 2015 and the Spring/Summer 2016 deadline is January 19, 2016.Visiting Scholars:Coverage PeriodCoverage Start DateCoverage End DatePeriod 18/10/20159/9/2015Period 29/10/201510/9/2015Period 310/10/201511/9/2015Period 411/10/201512/9/2015Period 512/10/20151/9/2016Period 61/10/20162/9/2016Period 72/10/20163/9/2016Period 83/10/20164/9/2016Period 94/10/20165/9/2016Period 105/10/20166/9/2016Period 116/10/20167/9/2016Period 127/10/20168/9/2016The Pennsylvania State University 2015-2016Page 3

Hershey College of Medicine:Coverage PeriodCoverage Start DateCoverage End DateEnrollment DeadlineAnnual (1st Year 2016Summer5/1/20167/31/20165/23/2016RatesThe rates below include both premiums for the student health plan underwritten by Aetna Life Insurance Company, aswell as The Pennsylvania State University’s administrative fee. The Pennsylvania State University’s administrative fee is 30 for Annual coverage, 11 for Fall coverage, 19 for Spring/Summer coverage, 15 for Summer I coverage, 10 forSummer II coverage, 2 for monthly coverage.Undergraduates and Graduate Students, Graduate Assistants*, and Graduate Fellows*:AnnualFallSpring/SummerSummer ISummer IIStudent 3,054 1,279 1,775 852 474Spouse 3,054 1,279 1,775 852 474One Child 3,054 1,279 1,775 852 474Two or More Children 6,108 2,558 3,550 1,704 948*Graduate Assistants and Graduate Fellows: Please visit the University Health Services website for payroll breakdownsand for directions on adding dependents or declining coverage(s): http://studentaffairs.psu.edu/health. The Fall 2015deadline is September 8, 2015 and the Spring/Summer 2016 deadline is January 19, 2016.Visiting Scholars:Each Coverage PeriodStudent 254.50Spouse 254.50One Child 254.50Two or More Children 509.00Premiums will be charged for each monthly coverage period, with a start date of the 10th of one month and ending onthe 9th of the following month. For example the period of September 10, 2015 to October 9, 2015 shall constitute onemonth of premium, the period of September 10, 2015 to November 9, 2015 shall constitute two months of premium,etc. Visiting Scholars must purchase a full monthly period of coverage despite the arrival or departure dates.The Pennsylvania State University 2015-2016Page 4

Hershey College of Medicine:1st Year AnnualAnnualSpring/SummerSummerStudent 3,195 3,054 1,773 770Spouse 3,195 3,054 1,773 770One Child 3,195 3,054 1,773 770Two or More Children 6,390 6,108 3,546 1,540Student CoverageEligibilityAll undergraduates taking 3 or more credit hours, graduates taking 1 or more credit hours or enrolled in a departmental601, 610 or 611 course, non-graduate assistant/graduate fellow students, all Hershey Medical Students, all GraduateAssistants and Graduate Fellows, all International students, visiting scholars, students enrolled in the Intensive EnglishCommunication program and students who participate in a Co-Op Work Experience program as part of their requiredacademic program, who are enrolled at The Pennsylvania State University, and who actively attend classes for at leastthe first 31 days, after the date when coverage becomes effective.Home study, correspondence, Internet classes, and television (TV) courses, do not fulfill the eligibility requirement thatthe student actively attend classes. If it is discovered that this eligibility requirement has not been met, our onlyobligation is to refund premium, less any claims paid.EnrollmentTo enroll online for voluntary coverage, log on to www.aetnastudenthealth.com and search for your school, then clickon Enroll to complete the online enrollment with Aetna Student Health.Aetna Student Health reserves the right to review, at any time, your eligibility to enroll in this plan. If it is determinedthat you did not meet the school's eligibility requirements for enrollment, your participation in the plan may berescinded in accordance with its terms.If you withdraw from school within the first 31 days of a coverage period, you will not be covered under the Policy andthe full premium will be refunded, less any claims paid. After 31 days, you will be covered for the full period that youhave paid the premium for, and no refund will be allowed. (This refund policy will not apply if you withdraw due to acovered Accident or Sickness.)A person who is eligible for Medicare at the time of enrollment under this plan is not eligible for medical expensecoverage and prescribed medicines expense coverage. If a covered person becomes eligible for Medicare after he or sheis enrolled in this plan, such Medicare eligibility will not result in the termination of medical expense coverage andprescribed medicines expense coverage under this plan. As used within this provision, persons are “eligible forMedicare” if they are entitled to benefits under Part A (receiving free Part A) or enrolled in Part B or Premium Part A.WAIVER PROCESS/PROCEDURE FOR INTERNATIONAL STUDENTSAll international students (F-1 and J-1 visa holders) have a mandatory requirement to provide proof of healthinsurance for themselves and their dependents that must meet all of the Penn State waiver standards or to purchasethe Penn State student health insurance plan. To be able to waive the Penn State student health insurance plan, theThe Pennsylvania State University 2015-2016Page 5

other policy must be effective the date of arrival into the United States or by the Penn State student health insuranceplan effective dates as reflected under the “RATES” section of this brochure. If a student, spouse, domestic partner, ordependent arrives later in the semester, their policy is to be effective the date of arrival into the United States andproof must be provided to the Student Health Insurance office within ten days of their arrival. The other policy mustbe effective for the full academic year. If the above requirement is not met by either purchasing the Penn Statestudent health insurance plan or by waiving the Penn State student health insurance plan by the deadlines notedbelow, a hold will be placed on the student’s account and a late fee will be applied. The late fee is 50 the first year adeadline is missed and 100 each subsequent year the deadline is missed going forward. Waiver submissions must besubmitted online through Aetna Student Health at www.aetnastudenthealth.com.*After deadline noted below, a late fee will apply. The Penn State administrative late penalty fee will be collected directlyby The Pennsylvania State University.CategoryEnrollment/Waiver irst Six Week Summer Session5/23/2016Second Six Week Summer Session7/7/2016If the policy does not meet the Penn State waiver requirements, you will be required to purchase the Penn StateStudent Health Insurance Plan at www.aetnastudenthealth.com.Waiver submissions may be audited by Pennsylvania State University, Aetna Student Health, and/or their contractors orrepresentatives. You may be required to provide, upon request, any coverage documents and/or other recordsdemonstrating that you meet the school's requirements for waiving the student health insurance plan. By submitting thewaiver request, you agree that your current insurance plan may be contacted for confirmation that your coverage is inforce for the applicable policy year and that it meets the school's waiver requirements.Dependent CoverageEligibilityCovered students may also enroll their lawful spouse, same-sex domestic partner, and dependent children under age 26.If, while you are covered by this plan, you have a covered dependent child who is called up for active duty (stateNational Guard or reserves) while he or she is a full time student, Aetna Student Health will extend this child’s coverageupon his or her return until you are no longer covered by this plan. This dependent coverage will be available at the firstFall or Spring enrollment period after the dependent child has 1) returned from duty and 2) returned to full time studentstatus. The offered coverage for this dependent child will continue until A) you are no longer a student covered by thisplan; or B) the dependent child is no longer a full time student or a period of time equal to the duration of the child’smilitary duty has passed.EnrollmentTo enroll the dependent(s) of a covered student, please complete the enrollment application online by visitingwww.aetnastudenthealth.com and selecting Penn State University to view the plans & products offered, or by callingPenn State Student Health Insurance at (814) 865-7467 and requesting that an Enrollment Form be sent to you. The Fallenrollment deadline is September 8, 2015. Dependent enrollment applications will not be accepted after September 8,The Pennsylvania State University 2015-2016Page 6

2015, unless there is a significant life change that directly affects their insurance coverage. (An example of a significantlife change would be loss of health coverage under another health plan.)The Spring enrollment deadline is January 19, 2016.The enrollment must be completed online atwww.aetnastudenthealth.com.*Graduate Assistants and Graduate Fellows: Please visit the University Health Services website for payroll breakdownsand for directions on adding dependents or declining ontinuation of CoverageA covered student who has graduated or is otherwise ineligible for coverage under this Plan, and has been continuouslyinsured under the plan offered by the Policyholder (regular student plan), may be covered for up to 1 month providedthat: (1) a written request for continuation has been forwarded to Aetna by the applicable deadline date, and (2)premium payment has been made. Coverage under this provision ceases on the date this Plan terminates.Contact Aetna Student Health at (855) 546-5412 for additional information regarding premium rates and deadline dates.Enrollment will be available online through www.aetnastudenthealth.com.Preferred Provider NetworkAetna Student Health has arranged for you to access a Preferred Provider Network in your local community. Tomaximize your savings and reduce your out-of-pocket expenses, select a Preferred Provider. It is to your advantage touse a Preferred Provider because savings may be achieved from the Negotiated Charges these providers have agreed toaccept as payment for their services.Pre-certification ProgramYour Plan requires pre-certification for certain services, such as inpatient stays, certain tests, procedures, outpatientsurgery, therapies and equipment, and prescribed medications. Pre-certification simply means calling Aetna StudentHealth prior to treatment to get approval for coverage under your Plan for a medical procedure or service. For preferredcare and designated care, the preferred care or designated care provider is responsible for obtaining pre-certificationSince precertification is the preferred care or designated care provider’s responsibility, there is no additional out-ofpocket cost to you as a result of a designated care provider’s or a preferred care provider's failure to precertify services.For non-preferred care, you are responsible for obtaining pre-certification which can be initiated by you, a member ofyour family, a hospital staff member or the attending physician. The precertification process can be initiated by callingAetna at the telephone number listed on your ID card.If you do not secure pre-certification for the below listed inpatient and outpatient covered medical services andsupplies obtained from a non-preferred provider your covered medical expenses will be subject to a 500 per service,treatment, procedure, visit, or supply penalty.Pre-certification for the following inpatient and outpatient services or supplies is needed: All inpatient admissions, including length of stay, to a hospital, skilled nursing facility, rehabilitation facility, hospicefacility, or a residential treatment facility for the treatment of mental disorders and substance abuse, or a residentialtreatment facility;All inpatient maternity care, after the initial 48 hours for a vaginal delivery or 96 hours for a cesarean section;All partial hospitalization in a hospital, residential treatment facility, or facility established primarily for thetreatment of mental disorders and substance abuse;Outpatient complex imaging;Inpatient and outpatient comprehensive infertility services;Inpatient and outpatient cosmetic and reconstructive surgery;The Pennsylvania State University 2015-2016Page 7

Ambulance (emergency transportation by airplane);Home hemodialysis and home peritoneal dialysis equipment and medical supplies;Injectables, (immunoglobulins, growth hormones, Multiple Sclerosis medications, Osteoporosis medications, Botox,Hepatitis C medications);Kidney dialysis;Bariatric surgery (obesity);Outpatient back surgery not performed in a physician’s office;Sleep studies;Inpatient or outpatient Transplant services;Inpatient or outpatient knee surgery; andInpatient or outpatient wrist surgery.Pre-certification DOES NOT guarantee the payment of benefits for your inpatient stays, certain tests, procedures,outpatient surgeries, therapies and equipment, and prescribed medicationsEach claim is subject to medical policy review, in accordance with the exclusions and limitations contained in the MasterPolicy. The Master Policy also includes information regarding your eligibility criteria, notification guidelines, and benefitcoverage.Pre-certification of non-emergency admissionsNon-emergency admissions must be requested at least fifteen (15) days prior to the date they are scheduled to beadmitted.Pre-certification of emergency admissionsEmergency admissions must be requested within twenty-four (24) hours or as soon as reasonably possible after theadmission.Pre-certification of urgent admissionsUrgent admissions must be requested before you are scheduled to be admitted.Pre-certification of outpatient non-emergency medical servicesOutpatient non-emergency medical services must be requested within fifteen (15) day before the outpatient services,treatments, procedures, visits or supplies are provided or scheduled.Pre-certification of prenatal care and deliveryPrenatal care medical services must be requested as soon as possible after the attending physician confirms pregnancy.Delivery medical services, which exceed the first 48 hours after delivery for a routine delivery and 96 hours for acesarean delivery, must be requested within twenty-four (24) hours of the birth or as soon thereafter as possible.The Pennsylvania State University 2015-2016Page 8

Description of BenefitsThe Plan excludes coverage for certain services and contains limitations on the amounts it will pay. While this PlanDesign and Benefits Summary document will tell you about some of the important features of the Plan, other featuresmay be important to you and some may further limit what the Plan will pay. To look at the full Plan description, which iscontained in the Master Policy issued to The Pennsylvania State University, you may access it online atwww.aetnastudenthealth.com. If any discrepancy exists between this Benefit Summary and the Policy, the MasterPolicy will govern and control the payment of benefits. All coverage is based on Recognized Charges unless otherwisespecified.This Plan will pay benefits in accordance with any applicable Pennsylvania Insurance Law(s).DEDUCTIBLEThe policy year deductible is waived for preferred care coveredmedical expenses that apply to Preventive Care Expense benefits.In compliance with Pennsylvania mandate(s) the policy yeardeductible is also waived for: Cervical Cytologic Screenings. Child Immunization Services. Nutritional Supplement Services.Preferred CareNon-Preferred CareStudents: 250 per policy yearSpouse: 250 per policy yearChild: 250 per policy yearFamily: 500 per policy yearIn addition to state and federal requirements for waiver of theAnnual Deductible, this plan will waive the Annual Deductible forPrescribed Medicines Expense, Preferred Care Pediatric PreventiveDental and Vision Services.Per visit or admission Deductibles do not apply towards satisfyingthe Policy Year Deductible.COINSURANCECoinsurance is both the percentage of covered medical expensesthat the plan pays, and the percentage of covered medical expensesthat you pay. The percentage that the plan pays is referred to as“plan coinsurance” or the “payment percentage,” and varies by thetype of expense. Please refer to the Schedule of Benefits for specificinformation on coinsurance amounts.OUT OF POCKET MAXIMUMSOnce the Individual or Family Out-of-Pocket Limit has been satisfied,Covered Medical Expenses will be payable at 100% for theremainder of the Policy Year.The following expenses do not apply toward meeting the plan’s outof-pocket limits: Non-covered medical expenses; Referral penalties because a required referral for the service(s) orsupply was not obtained; and Expenses that are not paid or precertification benefit reductionsor penalties because a required precertification for the service(s)or supply was not obtained from Aetna.The Pennsylvania State University 2015-2016Covered Medical Expenses are payable at theplan coinsurance percentage specified below,after any applicable Deductible.Preferred CareIndividual Out-ofPocket: 1,300Non-Preferred CareIndividual Out-ofPocket: 15,000Family Out-of-Pocket: 2,600Family Out-ofPocket: 30,000Page 9

REFERRAL REQUIREMENTS (Applies to students on the University Park Campus only)University Park students and their covered spouse/domestic partner must obtain a referral from University HealthServices before receiving any medical care outside of the student health center. If the covered student or their coveredspouse/domestic partner does not obtain a referral from University Health Services, no benefits will be payable.Referrals are needed for each diagnosis/condition, and a new referral must be obtained each academic/policy year.Exceptions: Treatment is for an Emergency Medical Condition (a referral from University Health Services is necessary forfollow-up care), The student is more than 25 miles away from the University Health Services, The University Health Services is closed, When service is rendered at another facility during break or vacation periods, Medical care obtained when a student is no longer able to use University Health Services due to a change instudent’s status, Maternity care and OBGYN care, Mental health and substance abuse treatment, Treatment of dental injury to a sound, natural tooth, Extraction of impacted wisdom teeth, Pediatric Care, or Preventive/Routine Services (services considered preventive according to Health Care Reform and/orservices rendered not to diagnosis or treat an Accident or Sickness).Dependent children are not eligible to use the services of the University Health Services and are therefore not subjectto the referral requirements and penalties.INPATIENT HOSPITLALIZATION BENEFITSPreferred CareNon-Preferred CareRoom and Board Expense90% of the Negotiated 70% of theThe covered room and board expense does not include any charge in ChargeRecognized Chargeexcess of the daily room and board maximum.for a semi-privateroomIntensive Care90% of the Negotiated 70% of theThe covered room and board expense does not include any charge in ChargeRecognized Chargeexcess of the daily room and board maximum.Miscellaneous Hospital Expense90% of the Negotiated 70% of theIncludes but not limited to: operating room, laboratory tests/X rays, ChargeRecognized Chargeoxygen tent, drugs, medicines and dressings.Licensed Nurse Expense90% of the Negotiated 70% of theIncludes charges incurred by a covered person who is confined in aChargeRecognized Chargehospital as a resident bed patient and requires the services of aregistered nurse or licensed practical nurse. Not more than the DailyMaximum Benefit per shift will be paid. For purposes of determiningthis maximum, a shift means 8 consecutive hours.Well Newborn Nursery Care90% of the Negotiated 70% of theChargeRecognized ChargeNon-Surgical Physicians ExpenseIncludes hospital charges incurred by a covered person who isconfined as an inpatient in a hospital for a surgical procedure for theservices of a physician who is not the physician who may haveperformed surgery on the covered person.The Pennsylvania State University 2015-201690% of the NegotiatedCharge70% of theRecognized ChargePage 10

SURGICAL EXPENSESSurgical Expense (Inpatient and Outpatient)When injury or sickness requires two or more surgical procedureswhich are performed through the same approach, and at the sametime or immediate succession, covered medical expenses onlyinclude expenses incurred for the most expensive procedure.Preferred Care90% of the NegotiatedChargeNon-Preferred Care70% of theRecognized ChargeAnesthesia Expense (Inpatient and Outpatient)If, in connection with such operation, the covered person requiresthe services of an anesthetist who is not employed or retained bythe hospital in which the operation is performed, the expensesincurred will be Covered Medical Expenses.Assistant Surgeon Expense (Inpatient and Outpatient)90% of the NegotiatedCharge70% of theRecognized Charge90% of the NegotiatedChargePreferred CareAfter a 10 copay pervisit, 100% of theNegotiated Charge70% of theRecognized ChargeNon-Preferred Care70% of theRecognized Charge90% of the NegotiatedCharge90% of the NegotiatedCharge90% of the NegotiatedCharge70% of theRecognized Charge70% of theRecognized Charge70% of theRecognized Charge90% of the NegotiatedCharge70% of theRecognized ChargeAmbulatory Surgical ExpenseCovered medical expenses include expenses incurred by a coveredperson for outpatient surgery performed in an ambulatory surgicalcenter. Covered medical expenses must be incurred on the day ofthe surgery or within 24 hours after the surgery.90% of the NegotiatedCharge70% of theRecognized ChargeWalk-in Clinic Visit ExpenseAfter a 10 copay pervisit, 100% of theNegotiated Charge70% of theRecognized ChargeOUTPATIENT EXPENSESPhysician or Specialist Office Visit ExpenseIncludes the charges made by the physician or specialist if a coveredperson requires the services of a physician or specialist in thephysician’s or specialist’s office while not confined as an inpatient ina hospital.Laboratory and X-ray ExpenseHospital Outpatient Department ExpenseTherapy ExpenseCovered medical expenses include charges incurred by a coveredperson for the following types of therapy provided on an outpatientbasis: Radiation therapy; Inhalation therapy; Chemotherapy, including anti-nausea drugs used in conjunctionwith the chemotherapy; Kidney dialysis; and Respiratory therapy.Pre-Admission Testing ExpenseIncludes charges incurred by a covered person for pre-admissiontesting charges made by a hospital, surgery center, licenseddiagnostic lab facility, or physician, in its own behalf, to test a personwhile an outpatient before scheduled surgery.The Pennsylvania State University 2015-2016Page 11

OUTPATIENT EXPENSES (continued)Emergency Room ExpenseCovered medical expenses incurred by a covered person for servicesreceived in the emergency room of a hospital while the coveredperson is not a full-time inpatient of the hospital. The treatmentreceived must be emergency care for an emergency medicalcondition. There is no coverage for elective treatment, routine careor care for a non-emergency sickness. As to emergency careincurred for the treatment of an emergency medical condition orpsychiatric condition, any referral requirement will not apply & anyexpenses incurred for non-preferred care will be paid at the samecost-sharing level as if they had been incurred for preferred care.Preferred CareNon-Preferred CareAfter a 150 copayper visit (waived ifadmitted), 90% of theNegotiated ChargeAfter a 150 copayper visit (waived ifadmitted), 90% of theRecognized Charge90% of the NegotiatedCharge70% of theRecognized ChargeImportant Note: Please note that Non-Preferred Care Providers donot have a contract with Aetna. The provider may not acceptpayment of your cost share (your deductible and coinsurance) aspayment in full. You may receive a bill for the difference betweenthe amount billed by the provider and the amount paid by this Plan.If the provider bills you for an amount above your cost share, youare not responsible for paying that amount. Please send Aetna thebill at the address listed on the back of your member ID card andAetna will resolve any payment dispute with the provider over thatamount. Make sure your member ID number is on the bill.Durable Medical and Surgical Equipment ExpenseDurable medical and surgical equipment would include:Artificial arms and legs; including accessories; Arm, back, neck braces, leg braces; including attached shoes (butnot corrective shoes); Surgical supports; Scalp hair prostheses required as the result of hair loss due toinjury; sickness; or treatment of sickness; and Head halters.PREVENTIVE CARE EXPENSESPreventive Care is services provided for a reason other than to diagnose or treat a suspected or identified sickness orinjury and rendered in accordance with the guidelines provided by the following agencies: Evidence-based items that have in effect a rating of A or B in the current recommendations of the United StatesPreventive Services Task Force uspreventiveservicestaskforce.org. Services as recommended in the American Academy of Pediatr

Aetna Student Health . Plan Design and Benefits Summary The Pennsylvania State University . Policy Year: 2015 - 2016 Policy Number: 846513 . www.aetnastudenthealth.com (855) 546-5412 . The Pennsylvania State University 2015-2016 Page 2 This is a brief description of the Student Health Plan. . Penn State University Health Services .