Transcription

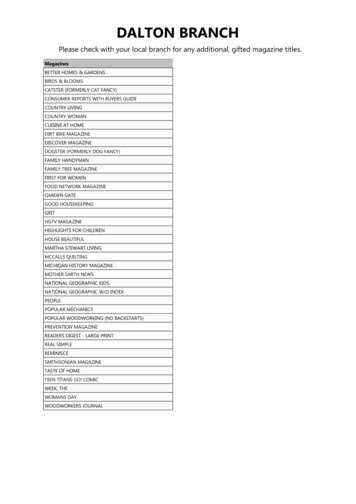

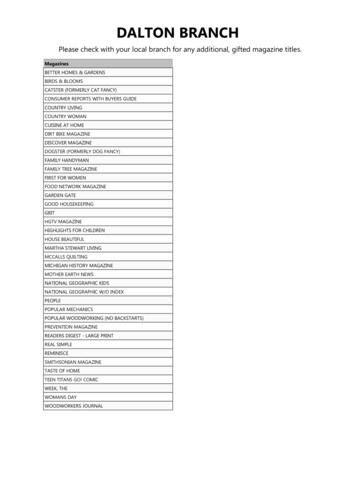

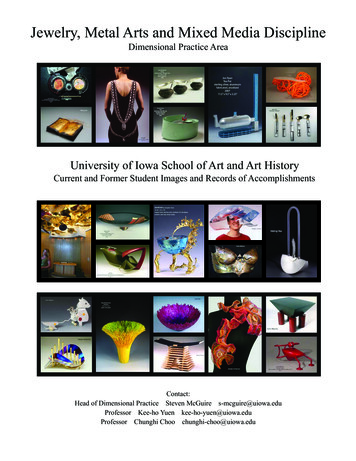

PORTRAITAnette Frumerie will takenewly listed Besqabto new heightsOPENING REPORTSavills paints a fair pictureof the autumn on the Swedishproperty marketSWEDISH INVESTMENTS ABROADSwedish investors are crossingthe bordersExtramagazineinside!Posttidning BTHE LEADING PROPERTY MAGAZINE IN THE NORDIC REGIONAvs. Fastighetssverige

Editorial // September 20143 2014 // Year 10publisherRolf Andersson, rolf@fastighetssverige.seIt feels like it was yesterday I sat down in my editor’s chair afterthe summer holiday. Yet the memory of leisurely and sunny days havefaded, along with the colour of my skin, and by now I am completelyimmersed in work again. When I went through my mailbox shortlyafter my holiday, I quickly became aware that there is somethingpositive about the Swedish property market this autumn. The majorconsultancy houses are talking about an increased trading volume andhigher transaction tempo, and alsoabout ever increasing interest frominternational actors in investing inSweden. The talk is primarily aboutactors from Asia and USA nowincreasingly finding their way toSweden. An example of the latteris that the American companyStarwood Capital bought seventrading centres from the Swedishcompany KF Fastigheter in November, for SEK 3.9 billion. If weare to believe the reports, this isonly the beginning. Exciting, and a promising start as far as Swedenis concerned for this year’s Expo Real.Fastighetssverige will,as usual, be atthe centre ofdiscussions atExpo Real.«Fastighetssverige will, as usual, be at the centre of discussionsat Expo Real, ready to capture any titbits and deliver them to you asreaders. We will also have exposure in all magazine racks, we will bevisible on the press stand and we will deliver daily newsletters with thelatest news, interviews and video clips straight from the expo floor. Inshort – all those who want it willbe updated on what is happening atthis year’s Expo Real via one of ourchannels.Editor-in-chief Eddie EkbergSee you on the Expo floor! editorial staffEddie Ekberg,eddie@fastighetssverige.seHenrik Ekberg,henrik@fastighetssverige.seNicklas Tollesson,nicklas@fastighetssverige.selayout and productionLokalförlaget i Göteborg ABJoanna Juteborn,joanna@fastighetssverige.seEva Mellergårdh Wernersson,eva@fastighetssverige.seguest authorMagnus Alvesson administrationClaudia Peters, info@fastighetssverige.seadvertising salesRolf Andersson, rolf@fastighetssverige.se printingBilles Tryckeri ABdistributionPosten and CityMail coverNiclas Liedberg/PixproviderOn the cover Anette FrumerieRead the interview on page 30.It’s authorised to quote from Fastighetssverige’sarticles if you adequately site the source. Thepermission from the publisher is required if youwish to reproduce articles or illustrations in full.The magazine is not responsible for receivedmaterial, which has not been ordered.We don’tbuildoffices.We buildbusinessresults.We want you and your co-workers to feel good at work. People who enjoy theirworkplace perform better, have lower rates of absence, and generates betterresults for the company.This is the basis for our research-based concept Future Office by NCC . Withyour input, we map your organization’s needs, based on factors such as location,communications, and finishes. With a modern, customized office, built just foryour operation, you will be able to attract and maintain the right competences,strengthen your brand, and develop the company in the right direction.Get in touch for more information on the office of the future.Visit us on ncc.se/futureofficeFoto: Casper HedbergHot Swedenat Expo Realpublishing companyFastighetssverige AB, Trädgårdsgatan 1,SE-411 08 Göteborg, SwedenPhone: 46 31 13 91 16e-mail: info@fastighetssverige.sewww.fastighetssverige.se

Contents // 3 2014Md Anette Frumerie will take newlylisted Besqab to new heights.3026Stockholmtop-ranked Stockholm attractive to investors.Investment TrendsSwedes are looking foropportunities abroad. 34 6182242ConferenceWorld congress toStockholm in 2016.Macro analysisNewsTransactionsSwedbank’s forecast manager: unsettled worldleads to some weakening.Latest news from theproperty sector.uS Starwood’s head on whythey like Sweden.

Macro analysismagnus alvesson // SwedbankFeelings and the economicPicture: SWedBANKliKes tourde FranceName: MagnusAlvesson.Age: 50 years.Profession:ForecastManager atSwedbank.»There are groundsfor relative optimismabout the development of the Swedisheconomic cycle.«At Swedbanksince: 2009.Leisure: “tourde Francefanatic, both inpractice andtheory.”suBdued GroWth. Swedbank’s Forecast Manager Magnus Alvesson foresees slightly subdued growth ahead, partly a result of a more unsettled world.6Fastighetssverige 3 2014cycle – looking slightly coolerMacro-economics is usually considered to be a science based on hard data, butin recent times, concepts such as sentiments, trust and views about the futurehave gained ever increasing space. Forecasts are also increasingly affected byassessments of the sentiments of various actors, and to a lesser degree by mathematical calculations and models. this is because forecasts have increasingly beenwrong in recent years. Also, when information is disseminated globally in real time,feelings are also disseminated more quickly. From this perspective, what can wesay about the economic cycle in the near future?Let us start by describing the role of feelings in the economic development. The underlying idea is that when various actorsfeel confidence and optimism, they act and make decisions aboutconsumption and investments. There is a self-reinforcing mechanism here: when others consume and invest, it impacts on demandand reinforces your own optimism, which results in further consumption and investments. The corresponding applies when thereis a downturn. As the British say: “Misery loves company”.In recent times, global development has been characterized byever greater uncertainty, which has its origin in a growing numberof trouble spots. In the Middle East, the Syrian conflict is continuing, while Israel’s Gaza conflict has flared up again, and Iraq is atrisk of falling to pieces. In concrete terms, this should primarilyimpact on the price of oil, but is also characterizes the generalfeeling that risks in the global economy are increasing. The Russia/Ukraine conflict can develop more concrete and close-to-handeffects, in particular if the mutual sanctions escalate and reallystart to bite. However, what is first noticeable is that the sentimentin German business is deteriorating, and with this deterioratingprospects for investments in the short term.Weaker German demand in turn impacts on how Swedishcompanies look at future demand. Swedish export industry isparticularly focused on input and investment goods, and Germanyis the most important market. This means that the sentiment ofSwedish business is eroded and the willingness to invest is sub-dued. Over the summer months, the Economic Tendency Surveyof the National Institute of Economic Research has indicated subdued sentiment, although one does, of course, have to be careful topoint at any direct causal link.With a weaker belief in the future, the willingness of companiesto take risks with recruitment also reduces. This, in turn, weakenshouseholds’ view of the labour market and the perceived risk ofunemployment rises. This causes a tendency for many to delaypurchases that are not regarded as necessary, for example socalled household durables. The Economic Tendency Survey showsslightly weaker sentiment for households too, and the view oftheir own finances has deteriorated in particular. The feedback tocompanies occurs via a reduction in expected demand, which givesfurther cause for delaying any investment decision.The slightly cooler feelings we have seen in recent times,which to some extent may be the result of a more unsettled worldaround us, will probably subdue economic growth in the shortterm. Companies and households are waiting to see. On the otherhand, sentiment may change, and give rise to a positive dynamic.Also, while feelings are all good and well, concrete measures in theform of an economic policy that is fit for purpose, and the underlying strength of the workforce and companies are what will becrucial for growth in the long term. In this, there are grounds forrelative optimism about the development of the Swedish economiccycle.3 2014 Fastighetssverige7

Sweden todayPicture: eddie eKBerGin the middle of aOff icial name: the Kingdom ofSweden.Political system: constitutional Monarchy, with parliamentary government.stronGmarKetHead of State: King carl XVi Gustaf.Language: Swedish.Population: 9.5 million (85% live inurban areas).Area: 450.000 sq.km 174 000 sq.mi.Time zone: GMt 1 hour.Currency: 1 krona 100 öre.Largest cities: Stockholm (capital),Gothenburg, Malmö.Noteworthy memberships: eu since1995, WtO, Oecd.reduced repo interest rate, pressure onthe Swedish krona and favourable financingare some of the parameters that indicate agood future for investments in Swedish property. Anders Nyström is acting Md at Savillsin Sweden, and he paints a fair picture of theautumn on the Swedish property market.Most important export industries:Mechanical engineering, automotive, information and communication technology, pulp & paper,power generation, pharmaceuticals, iron and steel, transportservices and tourism.Most important importgoods and services:Foodstuffs, raw materialsand fuels, chemicalproducts, machinery,electrical equipment,information & communication productsand services, roadmotor vehicles, textileproducts & apparel,tourism.Text: eddie ekbergSeveral reports and rankings published in recent weekspoint in the same direction; increasing interest in investing onthe Swedish property market, and a growing reputation for theSwedish market.The market is deemed to be liquid, and the risk to be low. Evenreports that measure whether markets are over or under-pricedassess Stockholm and Göteborg to be “hot”.Overall, the assessment is that demand for properties in Swedenwill continue to be strong over the next 18 months.Anders Nyström is acting MD at Savills in Sweden sinceautumn 2013. He has worked in the property sector for 19 years,mostly on the consultancy side, and has managed pension capitalfor companies such as Folksam Fastigheter (formerly Gyllenforsen) and Newsec Asset Management.For most of the time since Anders Nystrom joined as MD forSavills, the company has worked in a goal-oriented way to widenits range of services to become fully comprehensive.The goal is to become the foremost international adviser inSweden.8Fastighetssverige 3 2014Key factsSwedenMost importantexport and importmarkets: europe,North America andAsia.Source: invest SwedenFootBall trainerseeinG increased demand. Anders Nyström is acting MD atSavills Sweden. He tells us that they have noted increased demandfor their services, not least from international investors who wantto buy properties in Sweden.Name: Anders Nyström.Age: 41 years.Family: Wife and two children.Car: BMW X5.Lives: in central Stockholm.Leisure: Football trainer for son’s football team. diY at the country house inthe Stockholm archipelago.

Sweden todaystronG pressure. Now that the banks have opened thetaps and several new financing models have started to beused, at the same time as the supply on the market is relatively small, the pressure on the Swedish property markethas increased. According to Anders Nyström at Savills, thispressure will continue for at least another year and a half.»I would start by looking through the propertyportfolio of the City of Stockholm, and tryto work loose something from there.«26,000 emploYees› How do you think the Swedish property sector has developed inrecent years?– If you look back a number of years, international advisers suchas Savills, CBRE and several others have established themselves inSweden. It is part of globalization. And it is clear that the sectorhas been affected by this; in several ways, Swedish consultancy hasbecome even more professional, and it today regarded as a perfectly self-evident and important part of the international propertymarket.› And the Swedish property market – how do you think it hasdeveloped?– From an international perspective, you could say that Swedishproperty is felt to be more expensive than a few years ago. Propertyhas increased in value markedly over the last few years. The actorson the buying side have in particular been Swedish institutionsand private and listed property companies. In many ways, it hasbeen a market driven by domestic capital, where capital has alsobeen added indirectly from the institutions (headed by Rikshem,Willhem, Hemfosa, Lönnbacken and others). But only during thelast year, we have seen changes, and international capital is reallyon its way back. In recent times, we have seen property investments from Germany, USA as well as the United Kingdom.› Why is this?– On the one hand, it has become easier to borrow capital;previously, the banks were not that keen on lending. Since sometime back, some competing financing models have also emerged,such as various forms of bond loans, stock market introductionsand preference shares. At the same time, it is a fairly limitedrange of properties for sale. No-one, or very few, have to sell theirproperties, after all. We are feeling this pressure, not least as weare beginning to receive quite a few buying assignments, which is10Fastighetssverige 3 2014Savills plc is a global property servicessupplier, quoted on the London Stockexchange. the company has aninternational network with more than26,000 employees at 700 officesand partner companies in North andSouth America, europe, Asia and thePacific rim, Africa and the Middle eastthat offer a broad range of specialistadvice, management and transaction services to customer all over theworld. in Sweden, Savills has around90 employees. Savills is the fourth largest consultancy firm with propertyrelated services in the world, and willin 2015 have been present in Swedenfor ten years.Three tips forinternationalinvestors1Ally yourself with someone whoknows the Swedish market.2Focus on segments that are notprioritized by domestic institutions (such as retail and storage/industry).3Buy development objects, however on condition that the “right”partner and capital are in place.3 2014 Fastighetssverige11

Sweden todayOffice yields and rents, StockholmGoinG Well. The Swedish property market is liquid,and the risk is deemed to be low. The assessment is thatdemand for properties in Sweden will continue to bestrong for a long time to come.often a sign of a good market. We assess that this pressure on themarket will remain for at least another year and a half.› What is the financial situation in Sweden like, compared tothe rest of Europe?– Sweden is one of a handful of countries in Europe, for example the United Kingdom and Ireland, that are doing really well.In Spain and Italy, for example, things are much slower, but eventhere a turnaround is on the way.› And if you compare our property market with the Europe?– What we have noticed is that it is possible to find buyers allover Sweden, even in smaller places. This provides security for investors, as they can feel that it is always possible to get out when itis time to sell. Our principals also state that they want to buy moreproperty here, and this also means different types of properties,such as housing property. This characterizes a belief in the future.› Which segment do you think foreign investors will look tonext?– Hotel properties have been hot for some time now. We haveseen major deals with Norwegian investors, for example. Seen12Fastighetssverige 3 2014from a lifecycle perspective, hotel properties are a good asset. Longcontract periods, minimal risk of vacancies and limited maintenance investment create secure cash flows.› Are there any segments that have been missed?– It think that retail is an undervalued segment. We have had adurable price adjustment since the financial crisis in 2008. Valueshave not risen as quickly.› From where will future investments come in the first instance?– Probably from Germany, England and the USA. We will alsobe seeing Norwegian capital, and I do not think we have seen thelast of the Danes either.› So who have missed out on Sweden then?– There should really be more from Asia and the Middle East.Our sister company CordeaSavills has, it is true, started to receivemore capital, to invest in Sweden.› What are the challenges facing the property market in Swedenin the near future?– A large part will be to succeed in attracting the best talent tothe property market. It is unfortunately still the case that manyyoung, good newly qualified stars are not tempted by the propertysector, but instead seek out the finance sector. This is a pity, asthese sectors are in many ways linked these days.› What characterizes people in the Swedish property sector?– The image of Swedish property consultants is that we arehard-working and reliable. I would like to claim that we have agood reputation in Europe.› If you were to tip off an international investor about a reallygood investment in Sweden, what would that be?– I would expand their views to outside Stockholm, Gothenburg and Malmö. Pass on chasing the same objects as Swedishinstitutions.› Finally, what do you think about the consultancy market inSweden – is it saturated, or is there room for more companies?– It seems as though there is room for more; many propertyowners manage many parts themselves, after all, such as lettingand transactions. I would like to see the big property companiesdelegating some of the services to external consultants. I thinkthere is a great potential there.Prime YieldPrime rent2003 Q16,50 %4 0002003 Q26,50 %3 9002003 Q36,75 %3 7002003 Q46,50 %3 500Prime YieldPrime rent2004 Q16,25 %3 6002004 Q26,25 %3 7002004 Q36,00 %3 8002004 Q46,00 %3 800Prime YieldPrime rent2005 Q15,75 %3 9002005 Q25,50 %4 0002005 Q35,50 %4 0002005 Q45,00 %4 000Prime YieldPrime rent2006 Q15,00 %4 0002006 Q24,75 %4 1002006 Q34,75 %4 1002006 Q44,75 %4 200Prime YieldPrime rent2007 Q14,50 %4 2002007 Q24,50 %4 2002007 Q34,50 %4 3002007 Q44,50 %4 300Prime YieldPrime rent2008 Q14,50 %4 4002008 Q24,75 %4 5002008 Q35,25 %4 5002008 Q45,50 %4 300Prime YieldPrime rent2009 Q15,50 %4 0002009 Q25,75 %3 8002009 Q35,75 %3 7502009 Q45,50 %3 750Prime YieldPrime rent2010 Q15,50 %3 8502010 Q25,50 %4 0002010 Q35,25 %4 2002010 Q45,00 %4 500Prime YieldPrime rent2011 Q15,00 %4 5002011 Q25,00 %4 7002011 Q35,00 %4 7002011 Q45,00 %4 700Prime YieldPrime rent2012 Q15,00 %4 6502012 Q24,75 %4 6002012 Q34,75 %4 6002012 Q44,75 %4 600Prime YieldPrime rent2013 Q14,75 %4 6002013 Q24,75 %4 6002013 Q34,50 %4 8002013 Q44,50 %4 800Prime YieldPrime rent2014 Q14,50 %4 10201120122013MSEK85 00095 000117 000155 000151 000162 00058 000116 00098 000108 000100 02000400011000130009000Total 0013000140001700014000Source: Savills3 2014 Fastighetssverige13

AnalysisWhat is happening to the rates, the vacanciesand the return levels on the Swedish market?in short, how is the market affected by thefinancial situation? We asked three expertson the field to give their opinions.how will the market develop› What will be the trends in the key interestrate (repo rate) in the coming year?– The repo interest rate will remain at thecurrent extremely low level as a result of weakinflationary pressure. The downside of this is that the risk of assetbubbles increases, in particular in the housing market, but themarket for commercial property is also impacted.› What will be the trends in vacancy rates in the coming year?– Business in Stockholm is continuing to develop well, whichleads to more job opportunities. The winners are, in particular,subsidiary office markets, with a high proportion of modern officesand good communications. In Stockholm CBD, several of themajor banks have started or completed relocalization of the entireoperation, or parts of it, to centrally located suburbs. But this is notexpected to affect vacancy levels noticeably over the next few years,as property owners in several cases have chosen to initiate majorprojects for the properties affected.› What will be the trends in rental levels in the coming year?– Rents are expected to rise marginally, in a one-year perspective. However, there are a number of subsidiary marketswhere the rental potential is clear. Office premises that havebeen modernized, in locations close to communications in the14Fastighetssverige 3 2014western City area and outside Stockholm CBD, have seen greatlyincreased rents. This development is expected to continue, as theopportunities for new construction in Stockholm CBD and itsproximity are extremely limited. Subsidiary markets too, such asArenastaden, Hagastaden and central Sundbyberg, where communications will improve over time and new production objectsare being completed, are expected to show rising rents over thenext year.› What will be the trends in yield levels in the coming year?– Low interest rates and good access to capital mean that yieldsare at low levels. But these levels are historically low, and will bepushed upwards as interest rates rise andthe extraordinary monetary policy stimulation will reduce over time. It is mainly in theperipheral areas where the chances of further yield reductions arethe greatest. Here, yields have already declined to a large extent,but there is some potential in good suburban locations to pushthem further downwards.› What will be the trends in international investments in thecoming year?– We will be seeing continued great interest from foreign investors over the next year. The interest is aimed primarily at propertiesoutside the prime segment, where yields are low in internationalcomparison. Trade and logistics, also outside Stockholm, aresegments that are much in demand. Despite this interest, foreigninvestments will remain at a modest level, due to great competitionfrom domestic investors.Picture: SAViLLSPicture: NeWSeculriKa lindmarKNewsecin the coming year?peter WimanSavills› What will be the trends in the key interestrate (repo rate) in the coming year?– At the July meeting of Riksbanken, the interest rate was reduced to 0.25 %, which meansthat there is only very limited room to play with in the future. Instead, it is probable that the interest rate trajectory will be adjusted,which means that we will see a longer period of low interest rates.› What will be the trends in vacancy rates in the coming year?– The level of vacancies is stable at around 5 %. We assess that itwill remain stable in the short term. Despite the fact that a number of major relocalizations from Stockholm CBD will take place,these vacancies are relatively well distributed over time, whichmeans that we will not see a major increase in vacancies duringany individual year for the next few years.› What will be the trends in rental levels in the coming year?– The vacancy level is assessed to be stable, upcoming additionsare few and there is stable demand; three factors that indicate thatmarket rents will be stable in central Stockholm over the shortterm. However, the major office moves will give tenants in thecity the opportunity to consider their premises use, as alternativeswill be available. Some subsidiary markets are, however, in a muchmore difficult situation, such as Frösunda and Kista, for example,where the markets are much weaker and the vacancy levels arehigh, which is putting pressure on rents.› What will be the trends in yield levels in the coming year?– The lack of supply is still obvious within nearly all segments,which indicates continued low yield levels for all but the very mostattractive objects. For lack of “perfect” investments, many buyersare forced to widen their preferences, which should create continued pressure on secondary objects. The significantly improvedfinancing situation should also mean that portfolio transactionscontinue to increase in number.› What will be the trends in international investments in thecoming year?– Since the financial crisis in 2008, international investments havevaried within the interval 10–15 %. There is no lack of interest in investments in Sweden – instead rather the opposite – but Sweden isperceived as being relatively expensive, financing costs are relativelyhigh and there is also the added cost of currency hedging for nearlyall of the buyers. The international actors will probably continue tobe successful in acquiring trading properties and logistics.»The lack of supply isstill obvious within nearlyall segments.«3 2014 Fastighetssverige15

AnalysisYOUDECIDEPicture: dtzKarin WitalisDTZ Sweden› What will be the trends in the key interestrate (repo rate) in the coming year?– The Swedish economy is graduallystrengthening but at the same time inflation isvery low. The repo rate was lowered to 0.25 per cent in July and according to the Riksbank, the repo rate needs to stay low for sometime to support the recovery to ensure that inflation rises towardsthe target. The most likely scenario is for the Riksbank to keeprates unchanged until late 2015, before starting a gradual increase.› What will be the trends in vacancy rates in the coming year?– The Swedish labour market is improving and employment isnow forecast to rise by around 1 per cent per year in 2014–2018.Stockholm’s labour market may well perform stronger, being theengine of growth. Occupier demand is focused mainly on highquality space in good locations. This speaks in favour of fallingvacancy rates in the inner city and in attractive suburban locations.Across Greater Stockholm outdated offices are turned into residential and this helps keeping the overall vacancy rate from rising.› What will be the trends in rental levels in the coming year?– The outlook for rental growth in Stockholm, and the CBDin particular, is good. Construction activity will return over thecoming years, but since office space is also taken off the market,16Fastighetssverige 3 2014the net new supply in 2014–2016 is only 2.8 per cent. Our basecase scenario is for prime office rents to rise in the years to come.However, demand is patchy and in less attractive locations rentsare more likely to remain stable than rise.› What will be the trends in yield levels in the coming year?– Debt lending is possible and alternative financing is alsoavailable. There are currently more buyers than sellers. Prime assetsare in short supply, and as a result we expect investors to be increasingly willing to consider stock with more active managementpotential, at least in the core markets. We expect prime yields toremain broadly stable but yields on good secondary stock to comein.› What will be the trends in international investments in thecoming year?– In terms of nationality the Swedish investors were clearlyover-represented with 87 per cent of the capital invested in the firsthalf of 2014. Although the proportion of Swedish buyers remainshigh, there is a strong interest from foreign investors, particularlywhen larger deals are coming out on the market.»The outlook for rentalgrowth in Stockholm, and theCBD in particular, is good.«For many companies, the office is just a place to complete worktasks. We know it can be much more than that. Weknow because we’ve tried it ourselves. We would even say that the office is a tool for change and development.When today’s IT solutions disconnect us from the physical space, completely new possibilities are born. In the activitybased office, you are the one to choose what is best for the moment. Is it the sofa, desk or a quiet room? Each company’schallenges are different, but above all - each person is unique. Being able to choose where and how they want to work,efficiency and workdesire is increasing. The right office design also provides opportunities for employees to create new andexciting things together.We simply think that you should give the office the attention it deserves. By visiting vasakronan.se you can find more information on how workplace strategy lays the foundation for a smarter office.

NEWS IN BRIEFsKansKa is sellinG in hunGarYTRANSACTIONS Skanska is selling the office property GreenHouse in Budapest, Hungary, for around SeK 323 million.the buyer is the Hungarian property fund torony realestate investment Fund, which is managed by diófa FundManagement, part of FHB Group.Green House is Skanska’s sixth office investment in Budapest. the property, which is located in central Budapest,has 17,800 square metres of letable office space and wascompleted in december 2012.by eddie ekberg:SretuPicP i cture:NicKTRANSACTIONS Fabege has sold the site leasehold duvan 6to Mengus and the site leasehold LamSO NLe Smet 17 to Slussgården. the valueOLStALof the deals amounts to SeK 853million.duvan 6 is located on KlaraSödra Kyrkogata 1 in Stockholm and covers a letablearea of 9,670 square metres,consisting mainly of offices.– this investment suits usperfectly, as it is our businessconcept to acquire office propertiesHenric From.in Stockholm with potential for valuecreation, says Henric From, Md ofMengus.TRANSACTIONS Aviva investors and Lasalle investment Management are buying the trading property Stansen 1 in Häggvik, Sollentuna.it is the duo’s first purchase of a trading property in Sweden.the duo is buying the 17,500 square metre property via an open-ended fund. the selleris the uSB fund 3Sector real estate europe Fund, which bought the property from BonnierFastigheter in 2008. Genesta is acting as the “local operating partner” for Aviva/Lasalle.the major tenants are coop, Jysk, Jula and Blomsterlandet.the fund is looking for investments in the core-plus segment.Skanska selling forhalf a billion in USAThe jury’s choice fell on the proposal bythe US

Starwood Capital bought seven trading centres from the Swedish company KF Fastigheter in No-vember, for SEK 3.9 billion. If we are to believe the reports, this is only the beginning. Exciting, and a promising start as far as Sweden is concerned for this year's Expo Real. Fastighetssverige will, as usual, be at the centre of discussions