Transcription

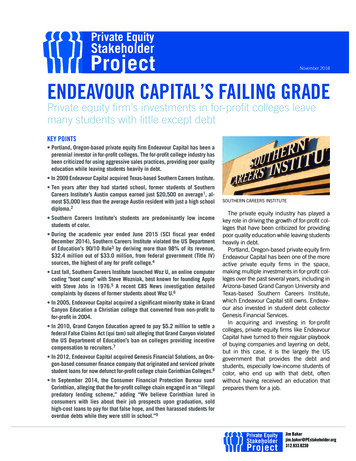

Private EquityStakeholderProjectENDEAVOUR CAPITAL’S FAILING GRADENovember 2018Private equity firm’s investments in for-profit colleges leavemany students with little except debtKEY POINTS Portland, Oregon-based private equity firm Endeavour Capital has been aperennial investor in for-profit colleges. The for-profit college industry hasbeen criticized for using aggressive sales practices, providing poor qualityeducation while leaving students heavily in debt. In 2009 Endeavour Capital acquired Texas-based Southern Careers Institute. Ten years after they had started school, former students of SouthernCareers Institute’s Austin campus earned just 20,500 on average1, almost 5,000 less than the average Austin resident with just a high schooldiploma.2 Southern Careers Institute’s students are predominantly low incomestudents of color. During the academic year ended June 2015 (SCI fiscal year endedDecember 2014), Southern Careers Institute violated the US Departmentof Education’s 90/10 Rule3 by deriving more than 98% of its revenue, 32.4 million out of 33.0 million, from federal government (Title IV)sources, the highest of any for profit college.4 Last fall, Southern Careers Institute launched Woz U, an online computercoding "boot camp" with Steve Wozniak, best known for founding Applewith Steve Jobs in 1976.5 A recent CBS News investigation detailedcomplaints by dozens of former students about Woz U.6 In 2005, Endeavour Capital acquired a significant minority stake in GrandCanyon Education a Christian college that converted from non-profit tofor-profit in 2004. In 2010, Grand Canyon Education agreed to pay 5.2 million to settle afederal False Claims Act (qui tam) suit alleging that Grand Canyon violatedthe US Department of Education’s ban on colleges providing incentivecompensation to recruiters.7 In 2012, Endeavour Capital acquired Genesis Financial Solutions, an Oregon-based consumer finance company that originated and serviced privatestudent loans for now defunct for-profit college chain Corinthian Colleges.8 In September 2014, the Consumer Financial Protection Bureau suedCorinthian, alleging that the for-profit college chain engaged in an “illegalpredatory lending scheme,” adding “We believe Corinthian lured inconsumers with lies about their job prospects upon graduation, soldhigh-cost loans to pay for that false hope, and then harassed students foroverdue debts while they were still in school.”9SOUTHERN CAREERS INSTITUTEThe private equity industry has played akey role in driving the growth of for-profit colleges that have been criticized for providingpoor quality education while leaving studentsheavily in debt.Portland, Oregon-based private equity firmEndeavour Capital has been one of the moreactive private equity firms in the space,making multiple investments in for-profit colleges over the past several years, including inArizona-based Grand Canyon University andTexas-based Southern Careers Institute,which Endeavour Capital still owns. Endeavour also invested in student debt collectorGenesis Financial Services.In acquiring and investing in for-profitcolleges, private equity firms like EndeavourCapital have turned to their regular playbookof buying companies and layering on debt,but in this case, it is the largely the USgovernment that provides the debt andstudents, especially low-income students ofcolor, who end up with that debt, oftenwithout having received an education thatprepares them for a job.Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

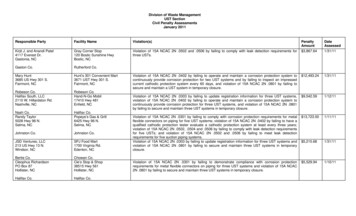

Endeavour Capital’s Failing GradeSOUTHERN CAREERS INSTITUTE DRAWS HEAVILY ON FEDERAL AID,PROVIDES POOR OUTCOMES FOR STUDENTSIn 2009 Endeavour Capital founded Tall Oak Learning LLC in partnership withformer Corinthian Colleges and Delta Career Education executive Joe Fox. In October2009 Tall Oak Learning acquired the seven campuses of Southern Careers Institute(SCI) in Texas.10Chad Heath and Dietz Fry of Endeavour Capital serve on the board of SouthernCareers Institute parent Tall Oak Learning.11Poor outcomes for Southern Careers Institute studentsEarnings of SCI-Austin student vs.high school student30,000 20,50020,00015,00010,0005,0000Southern Careers Institute’s growth under Endeavour Capital’s ownership has notpaid off for SCI students.Ten years after they had started school, former students of Southern CareersInstitute’s Austin campus earned just 20,500 on average12, almost 5,000 lessthan the average Austin resident with just a high school diploma.13 Just 18.9% ofSouthern Careers Institute-Austin students had paid back any of their federal studentloans three years after leaving school, compared to the national average of 46.4%.14By comparison, students at the public Austin Community College paid substantially less in tuition but earned an average salary of 35,700 ten years after they hadstarted school. 42% of Austin Community College students had started paying backfederal student loans three years after leaving school – lower than the nationalaverage but more than twice as high has at Southern Careers Institute.151Southern Careers Institute heavily dependent on low-income students of color0.95The impact of for-profit colleges like Southern Careers Institute is not distributedequally. Students from low-income backgrounds and students of color, particularlyAfrican-American and Latino students, make up a disproportionate share offor-profit college students.16Southern Careers Institute’s student population is made up of predominantly lowincome students of color.Two-thirds of Southern Careers Institute students rely on income-based federalPell grants intended for low-income students.17The majority of Southern Careers Institute students are Latino or AfricanAmerican.18 25,43725,000Median earningsof SCI-Austinstudent 10 yearsafter startingschoolMedian earningsof Austin, TXresident withjust a highschool diplomaShare of SCI Revenue fromFederal Sources (Title IV)(fiscal 0102011201220132014Southern Careers Institute violated federal rule in drawingon Department of Education fundsSouthern Careers Institute has aggressively drawn on federal student loan andgrant revenue (i.e. Title IV revenue) to fund its operations. US Department ofEducation Title IV revenue has accounted for at least 87% of Southern CareersInstitute’s revenue in all but one year since Endeavour acquired it.19During the academic year ended June 2015 (SCI fiscal year ended December2014), Southern Careers Institute violated the US Department of Education’s 90/10Rule20 by deriving more than 98% of its revenue, 32.4 million out of 33.0 million,from federal government (Title IV) sources, the highest of any for profit college.212Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Endeavour Capital’s Failing GradeSOUTHERN CAREERS INSITUTE REVENUE 40,000,000 33,056,181 35,000,000 30,000,000 26,503,681 17,450,378 20,000,000 15,000,000 32,777,090 33,030,464 32,343,745 25,000,000 10,000,000 33,897,902 15,398,757 11,617,621 5,000,000 02007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015 2015-2016Following early growth, Southern Careers Institute strugglesJoe Fox, who served as President and CEO of Southern Careers Institute, reportedthat he grew SCI’s student population by 170% in first 24 months. In line with thatgrowth, SCI’s revenue grew from 15.4 million in the 2009-2010 academic year to 32.3 million just a year later.22That rapid growth did not last, though. Southern Careers Institute’s revenuepeaked at 33.9 million in 2013-2014 and has since declined by 3.3% to 32.7million.23Southern Careers Institute President and CEO Joe Fox left the company in June2013.24SOUTHERN CAREERS INSTITUTE’S ONLINE CODING BOOT CAMP “WOZ U”DRAWS CRITICISMLast fall, Southern Careers Institute launched Woz U, an online computer coding“boot camp” with Steve Wozniak, best known for founding Apple with Steve Jobs in1976.25A recent CBS News investigation detailed complaints by dozens of former studentsabout the program. One former Woz U student, Bill Duerr, highlighted the students’concerns:“When you’re doing code and you’re following along, and there’s a typo, and youget an error, you don’t have any idea why you got the error,” Duerr said. “And you’relike how can – did somebody not proofread this? Did somebody not make sure itworked?”Duerr said typos in course content were one of many problems. So-called “livelectures” were pre-recorded and out of date, student mentors were unqualified, andat one point, one of his courses didn't even have an instructor.“I feel like this is a 13,000 e-book,” Duerr said. While it was supposed to be aprogram written by one of the greatest tech minds of all time, “it’s broken, it’s notworking in places, lots of times there’s just hyperlinks to Microsoft documents, toWikipedia,” he said.26CBS also spoke so Tim Mionske, one of the Woz U “enrollment counselors,” whowas charged with selling Woz U to prospective students. “It is drive, drive, drive thesales,” Mionske said.27When confronted by reporters, Wozniak dodged questions about his involvementin the school.28“It is drive, drive, drivethe sales.”Former Woz U enrollmentcounselor Tim Mionske,October 20183Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Endeavour Capital’s Failing GradeThe 33-week program cost Duerr 13,200 – including more than 7,000 infederal student loans.29According to Woz U’s 2018 catalog, “Woz U is unaccredited and is not eligiblefor federal financial aid programs.”30As of late 2017, Woz U’s board was chaired by Brent Richardson, formerchairman of Grand Canyon University, which Endeavour Capital previously investedin.31 As of February 2018, Richardson’s company, Exeter Education, owned WozU.32In October 2017, Richardson told the Arizona Republic that Woz U is routing itsstudents online through Southern Careers Institute, which is accredited by theCommission of the Council on Occupational Education.33Southern Careers Institute’s accreditation enables Woz U to draw on federalstudent loan and grant funds.34ENDEAVOUR CAPITAL HELPED LAUNCH GRAND CANYON UNIVERSITY’S STUDENTDEBT MACHINESouthern Careers Institute is not the first for-profit college that Endeavour Capitalinvested in.In 2005, Endeavour Capital acquired a significant minority stake in Grand CanyonEducation, the parent company of Grand Canyon University, a Christian college thatconverted from non-profit to for-profit in 2004.35Endeavour Capital managing directors Chad Heath and Mark Dorman served onGrand Canyon Education’s board of directors.36Grand Canyon Education went public in November 2008.37 Endeavour Capitalremained an investor in Grand Canyon Education until at least 2011.38Following Grand Canyon University’s conversion to for-profit status and Endeavour’s 2005 investment, the college’s enrollment skyrocketed, growing from 4,500students in 2004 to more than 42,000 in 2010. The vast majority of Grand CanyonUniversity’s students were enrolled in online programs.39Grand Canyon University’s breakneck growth was largely funded by drawing onincreasing amounts of US Department of Education federal student aid (Title IV)loans and grants. During the 2006-2007 award year, Grand Canyon Educationutilized 121 million in Department of Education student loan and grant funds. By2010-2011, the for-profit college chain utilized more than four and a half times that,or 564 million in Department of Education Title IV funds.40“Like many otherfor-profit colleges,Grand Canyonrecruiting documentstaught methods touncover prospectivestudents’ pain andpleasure points.”US Senate Committee of Health,Education, Labor and Pensionsanalysis, 2012ENROLLMENT AT GRAND CANYON EDUCATION, INC. 2011 - 713,4154,4910Fall 2001 Fall 2002 Fall 2003 Fall 2004 Fall 2005 Fall 2006 Fall 2007 Fall 2008 Fall 2009 Fall 20104Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Endeavour Capital’s Failing GradeFederal student loans and grants accounted for an increasing share of GrandCanyon Education’s overall revenue, growing from 74% of revenue during the 20072008 award year to 85 percent of revenue in 2010-2011.41Grand Canyon University spends heavily on marketingGrand Canyon Education spent heavily on marketing to recruit new students.A 2012 investigation by the US Senate Committee on Health, Education, Laborand Pensions found that in 2009, Grand Canyon allocated 32.6percent of its to revenue to marketing and recruiting, the second highGrand Canyon Education Federalest percentage of the fifteen for profit college companies the USStudent Aid (Title IV) RevenueSenate committee examined. On average, those fifteen for profit education companies spent 22.6 percent of their revenue on marketing 600,000,000 564,187,328in 2009.42 480,453,302 500,000,000The US Senate Committee report detailed Grand Canyon’s aggres 400,000,000 362,042,717sive recruiting: 300,000,000“Recruiters at Grand Canyon were expected to make 80-89 phone 198,437,853 200,000,000 121,102,477calls a day to prospective students. They were encouraged to create 100,000,000a sense of urgency and “assume that NOW is a good time to talk with02006-07 2007-08 2008-09 2009-10 2010-11the student.” Grand Canyon counseled recruiters to “use the FERN[Frustrations, Effects, Rewards, and Next Steps] technique to uncovera student[’s] motivation, the need for earning the degree and paint a picture of twofutures: with a degree and without a degree.” Like many other for-profit colleges,Grand Canyon recruiting documents taught methods to uncover prospective students’ pain and pleasure points. “The strongest, most basic force is avoiding or overcoming a threat or pain,” one training presentation tells employees, “For aprospective student to need a solution, this need must be propelled by thedesire to avoid or overcome an existing problem.” The training encouragedGrand Canyon University % of Revenueasking “probing questions, which slowly peel away pain layers.”43from Federal Student AidGrand Canyon spent 2,177 per student on instruction in 2009, comparedto 3,389 per student on marketing. In contrast, public and non-profit 4-year86.0 84.9%colleges and universities generally spend a higher amount per student on84.0%instruction while community colleges spend a comparable amount but82.0%82.5%charge far lower tuition than for-profit colleges. In 2010, with 42,30080.0%students, Grand Canyon employed 1,065 recruiters, 3 career services78.6%78.0%employees and 478 student services employees.4476.0%Grand Canyon pays 5.2 million to settle suit over marketing practices74.0%74.0%72.0%Grand Canyon Education’s aggressive marketing practices led a whistle70.0%blower, Ronald Irwin, to file a federal False Claims Act (qui tam) suit against68.0%the company in 2007 alleging that Grand Canyon Education violated the USDepartment of Education’s ban on colleges providing incentive compensationto recruiters.45Under Department of Education regulations, schools that receive federal financialaid are not allowed to tie recruiters’ pay to the number of students they enroll.The rules were designed to protect students from aggressive sales tactics and thegovernment from loan defaults.46In 2010, Grand Canyon Education agreed to pay 5.2 million to settle the FalseClaims Act suit.4769.0%2006-07 2007-08 2008-09 2009-10 2010-115Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Endeavour Capital’s Failing GradeHAVING SPURRED SUBSTANTIAL STUDENT DEBT, ENDEAVOUR CAPITALBOUGHT A DEBT COLLECTOREndeavour Capital has not only invested heavily in for-profit colleges, but also invested in a debt collector that serviced for-profit college student debt.In 2012, Endeavour Capital acquired Genesis Financial Solutions, an Oregonbased consumer finance company that originated and serviced private student loansfor now defunct for-profit college chain Corinthian Colleges.48 As of March 2014,about 74,000 students were enrolled at Corinthian Colleges’ Heald, Everest, andWyoTech schools.49Stephen Babson and Leland Jones of Endeavour Capital serve on Genesis Financial Services’ board.50In September 2014, the Consumer Financial Protection Bureau sued Corinthian,alleging that the for-profit college chain engaged in an “illegal predatory lendingscheme,” adding “We believe Corinthian lured in consumers with lies about theirjob prospects upon graduation, sold high-cost loans to pay for that false hope, andthen harassed students for overdue debts while they were still in school.”51According to internal Corinthian documents, most students lived in householdswith very low income.52In 2013, the tuition and fees for an associate’s degree at Corinthian Colleges wasbetween 33,000 and 43,000. The tuition and fees for a bachelor’s degree wasbetween 60,000 and 75,000. Tuition at a Corinthian school was much higherthan the federal loan limit, which left most students no choice but to take out privatestudent loans to make up the difference.53To close the gap, Corinthian offering students its own private “Genesis loans.”These loans were more than twice as expensive as federal student loans.54Corinthian admitted to stock analysts in February 2011 that it increased tuition11 percent in part to comply with the 90-10 rule. Students would have to turn toGenesis to cover the cost.55In September 2014, Consumer Financial Protection Bureau Director Richard Cordray said of Corinthian’s Genesis loans:“Unlike federal student loans and almost all private student loans, Genesis loanpayments were due immediately after starting classes. Students who fell behind onthese in-school payments, but wanted to complete their education, had to endureCorinthian’s harassing and bullying debt-collection methods at the same time. Thealternative was dropping out of college, which meant they would be left with all ofthe debt but with no degree to show for it.Getting students to repay these loans while they were still in school was importantto Corinthian’s business model. Our investigation found that Corinthian paid bonusesbased in part on how well its staff got students to pay up. Among their tactics, theyused public and private shaming such as pulling students from class, and informing instructors about the overdue debts. Students were asked to meet with campuspresidents to discuss why they were late on their payments. At one Georgia campus,a financial aid staff member was called the “Grim Reaper” for removing so manystudents from class.“We believe Corinthianlured in consumerswith lies about their jobprospects upon graduation, sold high-costloans to pay for thatfalse hope, and then harassed students foroverdue debts.”Richard Cordray,Director, Consumer Financial Protection Bureau (CFPB),September 2014.6Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Endeavour Capital’s Failing GradeAt Corinthian schools, students were put in jeopardy of losing their education ifthey did not repay their private loans. Our investigation found that students weredenied computer access, blocked from signing up for classes, prevented from buying books, and they even had their diplomas held hostage unless they paid up.”The over-representation of students of color was even more extreme at CorinthianColleges that at for-profit colleges generally: an analysis of Corinthian’s 2014 enrollment numbers shows that people of color comprised the majority (62 percent) ofits students, women comprised 71 percent of its students, and African-Americanwomen comprised 26 percent.56Genesis founder Irving Levin minimized Genesis’ role, saying Corinthian wasalways obligated to buy all the Genesis loans originated by his company. AndCorinthian set the terms, he said. “We were strictly a contractor,” Levin said.“We got paid a few bucks for every loan we originated and serviced.”57In an November 2014 Oregonian article on Genesis Financial Services’ role in theCorinthian Colleges loans, Maura Dundon, an attorney for the Center for ResponsibleLending said, “Certainly anyone in the consumer finance industry knows that targeting subprime borrowers with a program that has a 60 percent default rate is aproblem,” she said. “The phrase is ‘debt trap.’”58In 2014, the US Department of Education restricted Corinthian Colleges’ accessto federal student loans.59Genesis Financial Solutions cut ties with Corinthian Colleges in 2014.60In early 2015, Zenith Education Group bought 56 of Corinthian’s locations acrossthe country. As a condition of the sale, Corinthian agreed to forgive 480 million instudent loan debt.61“Certainly anyone inthe consumer financeindustry knows thattargeting subprimeborrowers with aprogram that has a60 percent default rateis a problem. Thephrase is ‘debt trap.’”Maura Dundon,Center for Responsible Lending,November 2014.7Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Endeavour Capital’s Failing GradeEndnotes1VA GI Bill Comparison Tool profile for Southern Careers Institute-Austin, accessed June.332Based on estimated earnings of 25,437 in for a high school graduate in Austin, Texas,US Census Bureau American Community Survey 2015.“Woz U: AZ state regulators have questions, key paperwork unfinished,”Arizona Republic, Oct 28, 2017.343“New Analysis Finds Many For-Profits Skirt Federal Funding Limits,”US Dept of Education, Dec 21, 2016.“Woz U: AZ state regulators have questions, key paperwork unfinished,”Arizona Republic, Oct 28, 2017.35Grand Canyon Education prospectus, Nov 20, 2008.4Proprietary School Revenue Percentages Report for Financial Statements with Fiscal YearEnding Dates Between 07/01/14 –06/30/15, US Dept of Education.36Grand Canyon Education 2011 Form DEF 14A37“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.Grand Canyon Education prospectus, Nov 20, 2008.38Grand Canyon Education 2011 Form DEF 14A39Grand Canyon Education, US Senate Committee on Health, Education,Labor and Pensions, 2012.40Proprietary School Revenue Percentages Report for Financial Statements with FiscalYear Ending Dates Between 07/01/06 –06/30/11, US Dept of Education.41Proprietary School Revenue Percentages Report for Financial Statements with FiscalYear Ending Dates Between 07/01/06 –06/30/11, US Dept of Education.42Grand Canyon Education, US Senate Committee on Health, Education, Labor andPensions, 2012.43Grand Canyon Education, US Senate Committee on Health, Education, Labor andPensions, 2012.56“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.7“Grand Canyon University officially settles 5.2 mil lawsuit,”Arizona Republic, Aug 18, 2010.8“Corinthian, giant for-profit college with 900 local students, accused of running predatorystudent loan program,” The Oregonian, Nov 20, 2014.9“Prepared Remarks of CFPB Director Richard Cordray on the Corinthian EnforcementAction Press Call,” Consumer Financial Protection Bureau, Sept 16, 2014.10Joe W. Fox LinkedIn profile, accessed June 16, /, accessed Nov 7, 2018.4412VA GI Bill Comparison Tool profile for Southern Careers Institute-Austin,accessed Oct 14, 2017Grand Canyon Education, US Senate Committee on Health, Education, Labor andPensions, 2012.4513Based on estimated earnings of 25,437 in for a high school graduate in Austin, Texas,US Census Bureau American Community Survey 2015.“Grand Canyon University officially settles 5.2 mil lawsuit,”Arizona Republic, Aug 18, 2010.4614VA GI Bill Comparison Tool profile for Southern Careers Institute-Austin,accessed Oct 14, 2017.“Grand Canyon University officially settles 5.2 mil lawsuit,”Arizona Republic, Aug 18, 2010.4715College Scorecard, US Dept of Education, accessed Nov 16, 2018.“Grand Canyon University officially settles 5.2 mil lawsuit,”Arizona Republic, Aug 18, 2010.16“Do Students of Color Profit from For-Profit College?”Center for Responsible Lending, Oct 2014.48“Corinthian, giant for-profit college with 900 local students, accused of running predatorystudent loan program,” The Oregonian, Nov 20, 2014.17College Navigator, National Center for Education Statistics, accessed Nov 8, 2018.4918College Navigator, National Center for Education Statistics, accessed Nov 8, 2018.“Prepared Remarks of CFPB Director Richard Cordray on the Corinthian EnforcementAction Press Call,” Consumer Financial Protection Bureau, Sept 16, 2014.19During the 2010-2011 award year, federal Title IV revenue accounted for 84.3% ofSouthern Careers Institute Revenue. Proprietary School Revenue Percentages Reportfor Financial Statements with Fiscal Year Ending Dates Between 07/01/10 –06/30/11,US Dept of nd-jones/, accessed Nov 7, 2018.51“Prepared Remarks of CFPB Director Richard Cordray on the Corinthian EnforcementAction Press Call,” Consumer Financial Protection Bureau, Sept 16, 2014.20“New Analysis Finds Many For-Profits Skirt Federal Funding Limits,”US Dept of Education, Dec 21, 2016.52“Prepared Remarks of CFPB Director Richard Cordray on the Corinthian EnforcementAction Press Call,” Consumer Financial Protection Bureau, Sept 16, 2014.21Proprietary School Revenue Percentages Report for Financial Statements with FiscalYear Ending Dates Between 07/01/14 –06/30/15, US Dept of Education.53“Prepared Remarks of CFPB Director Richard Cordray on the Corinthian EnforcementAction Press Call,” Consumer Financial Protection Bureau, Sept 16, 2014.22Proprietary School Revenue Percentages Report for Financial Statements,US Dept of Education.54“Prepared Remarks of CFPB Director Richard Cordray on the Corinthian EnforcementAction Press Call,” Consumer Financial Protection Bureau, Sept 16, 2014.23Proprietary School Revenue Percentages Report for Financial Statements,US Dept of Education.55“Corinthian, giant for-profit college with 900 local students, accused of running predatorystudent loan program,” The Oregonian, Nov 20, 2014.24Joe W. Fox LinkedIn profile, accessed June 16, 2018.5625“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.Analysis of National Center for Education Statistics, “Integrated Postsecondary EducationData System,” available at https://nces.ed.gov/ipeds/datacenter (last accessed October2016), examining 12-month 2014 enrollment by race/ethnicity.26“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.57“Corinthian, giant for-profit college with 900 local students, accused of running predatorystudent loan program,” The Oregonian, Nov 20, 2014.27“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.58“Corinthian, giant for-profit college with 900 local students, accused of running predatorystudent loan program,” The Oregonian, Nov 20, 2014.28“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.59“Sale of controversial for-profit college Corinthian includes massive student debt forgiveness,” The Oregonian, Feb 3, 2015.29“Some former students, employees say Apple co- founder's Woz U doesn't live up topromises,” CBS News, Oct 1, 2018.60“Corinthian, giant for-profit college with 900 local students, accused of running predatorystudent loan program,” The Oregonian, Nov 20, 2014.61“Sale of controversial for-profit college Corinthian includes massive student debtforgiveness,” The Oregonian, Feb 3, 2015.30Woz U 2018 catalog, effective Feb 1, 2018.31“Woz U: AZ state regulators have questions, key paperwork unfinished,”Arizona Republic, Oct 28, 2017.32Woz U 2018 catalog, effective Feb 1, 2018.8Private EquityStakeholderProjectJim Bakerjim.baker@PEstakeholder.org312.933.0230

Grand Canyon Education's board of directors.36 Grand Canyon Education went public in November 2008.37 Endeavour Capital remained an investor in Grand Canyon Education until at least 2011.38 Following Grand Canyon University's conversion to for-profit status and Endeav-our's 2005 investment, the college's enrollment skyrocketed, growing .