Transcription

2 0 0 6 A N N U A L R E P O RT

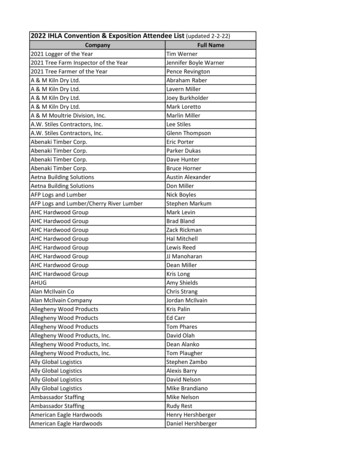

FINANCIAL HIGHLIGHTS(amounts in thousands, except per share data)Years Ended June 30th,200620052004200320022001(financial data have been adjusted to give effect to the two-for-one stock split effective October 18, 2001)OPERATIONSNet sales 63,411 51,063 59,761 64,854 94,880 75,278Net earnings (loss) fromcontinuing operations 541 (526) 2,402 911 6,079 4,257Net earnings (loss) 426 (592) 2,038 (379) 4,389 3,072PER COMMON SHARE / DILUTED EARNINGS (LOSS)Net earnings (loss) fromcontinuing operations 0.17 (.17) 0.79 0.30 1.97 1.42Net earnings (loss) 0.14 (.20) 0.67 (0.13) 1.43 1.02Shares outstandingWeighted average – basic3,0673,0283,0032,9962,9782,947Weighted average – diluted3,1353,0283,0443,0133,0803,002 22,930 20,272 20,529 17,771 17,755 14,6152.032.312.391.831.731.54Shareholders’ equity 25,917 24,290 24,673 22,311 22,515 17,693Book value per share YEAR END FINANCIAL CONDITIONWorking capital8.278.008.197.447.535.99 65 68 18 60 63 36 5101 02 03 04 05 0601 02 03 04 05 06SALESSHAREHOLDERS'EQUITY(millions of )(millions of ) 40 40 14.50 24 11.85 75 22 26 11.05 23 25 16.99 95 17.80 23.95Current ratio 34 3401 02 03 04 05 06BACKLOG(millions of )01 02 03 04 05 06STOCK PRICE(dollars)

DEAR SHAREHOLDERSOur financial performance improved throughout Fiscal YearThe collective efforts of the Company were recognized in the2006 as management continued to develop and implement afinancial marketplace as the price of our Common Stock increasedplan to rejuvenate the Company by focusing on adding value to65%, ending Fiscal Year 2006 at 23.95 per share.the changing markets we serve. We are committed to buildinga growth company with a young and dynamic culture whileBUSINESS UNITScontinuing to benefit from the established strengths of a seasonedand experienced company. Although there is still importantUnderlying this financial performance was an increasing levelwork to be done, we have made great strides in accomplishingof business activity throughout the Company, which will servethis transformation.to fuel our growth in Fiscal Year 2007. Specifically, in the firstquarter, we have continued to benefit from favorable naturalPeerless now offers a broader product line, serving customers ongas market conditions. The primary driver is the continueda global basis in multiple industries. We currently offer threeexpansion of natural gas pipeline infrastructure required to meetdistinct products: Separation equipment, Filtration equipment,the increasing demand for energy worldwide. The opportunityand Selective Catalytic Reduction (SCR) Systems. We offer thesein the U.S. alone is substantial. The U.S. natural gas pipelineproducts to eight primary market segments - Environmental, Gas,network consists of 41,000 miles of field gathering lines, 250,000Chemical, Petrochemical, Oil, Marine, and Power, includingmiles of interstate transmission pipelines, and 75,000 miles ofNuclear power generation. We believe that this diversity ofintrastate transmission pipelines. The interstate transmissionproducts serving multiple industries provides us with a distinctnetwork is made up of about 80 systems. Another 60 systemsadvantage as the Company can better exploit specific marketoperate strictly within individual states. These interstate andopportunities and is also better insulated from an economic slowintrastate transmission pipelines feed over 1.1 million miles ofdown in any single market segment we serve.regional lines in 1,300 local distribution utility networks.We believe that Peerless is now well positioned to enjoy a periodCollectively, the U.S. natural gas pipeline network deliversof solid growth, while delivering strong financial performance tonatural gas to 62 million customers. These systems, along withour shareholders.many other distribution points in the network, represent ongoingopportunities for installation of a Peerless product. The expansionSUMMARY OF FINANCIAL RESULTSof the natural gas pipeline infrastructure outside the United Statesis perhaps even more ambitious given the demands for energy inRevenues for Fiscal Year 2006 increased 24.2% to 63.4 millionemerging economies around the world. Peerless is well positionedcompared to 51 million in Fiscal Year 2005. Net earningsto win a growing share of this vibrant international market.for Fiscal Year 2006 were 541,000, an increase of 1,067,000compared to net loss of 526,000 in Fiscal Year 2005, a robustSEPARATION AND FILTRATION SYSTEMSincrease of over 200%.Revenue for the Separation and Filtration Systems business wasOur backlog at the end of Fiscal Year 2006 exceeded 40 million, 43.6 million in Fiscal Year 2006, an increase of 13.2 million orcompared to a 34 million backlog at year-end Fiscal Year 2005.43% over Fiscal year 2005. Our traditional business, separation andOf our backlog at June 30, 2006, 85% is scheduled for completionfiltration equipment serving the gas processing, gas transmissionduring our next fiscal year, compared to 74% at June 30, 2005.and petrochemical industries, is benefiting long term from the

increased demand for natural gas worldwide. Higher oil and gasexceptional people, excellent management, technical expertise,prices, the volatility of the supply chain from both natural andgrowth capacity, strong cash flow, a debt-free balance sheet andgeo-political events, and increased use of natural gas as a loweran exceptional reputation in each of the markets we serve.emitter of greenhouse gasses over other fossil fuels, has resultedin increased orders both domestically and internationally. WeWe are grateful for the support and confidence expressed byexpect continued growth in this market segment throughoutour customers, shareholders, directors and employees as weFiscal Year 2007.move forward with this great opportunity for further growthand continued improvement in financial performance andENVIRONMENTAL SYSTEMSshareholder value.Environmental Systems revenue was 19.8 million for Fiscal Year2006. The Environmental System products segment is comprisedprimarily of Selective Catalytic Reduction (SCR) Systems thatare used to control nitrogen oxide (NOx) emissions. ExistingPeter J. BurlageSherrill Stoneenvironmental laws in the U.S. govern emissions for new plantsPresident andChairman of the Boardthat burn fossil fuels, such as coal burning power plants, andChief Executive Officermay require retrofits of existing industrial and power generatingfacilities.Electric generating plants using combustion turbine combinedcycle and combustion turbine simple cycle represent the mostsignificant market applications for our SCR technology. Wedeliver fully integrated “flange to stack” systems for the simple cyclecombustion turbine power plants. New coal fired power plantswill provide the Company additional revenue opportunities asproducers expand capacity to meet future electric power needs.We continue to believe these SCR products offer us a growthopportunity as a result of increasing government regulation ofemissions, the anticipated construction of new power generatingplants both domestically and internationally as well as thecontinued retrofit of existing facilities.CONCLUSIONWe continue to add significant value to the markets we serve andhave the expertise and product lines to compete effectively inour target markets. We believe we enter Fiscal Year 2007 with

GENERAL CORPORATE INFORMATIONSenior Corporate OfficersCorporate HeadquartersInvestor RelationsPeter J. BurlagePresident andChief Executive OfficerPeerless Mfg. Co.2819 Walnut Hill LaneDallas, Texas 75229214-357-6181Internet: www.peerlessmfg.comCameron Associates1370 Avenue of the AmericasSuite 902New York, NY 10019212-245-8800Stock Exchange ListingAnnual Report on Form 10-KTicker Symbol: PMFGPeerless Mfg. Co. common stock islisted on the NASDAQ exchange.A copy of our Annual Report on Form10-K for the year ended June 30, 2006,filed with the Securities and ExchangeCommission may be obtained withoutcharge by writing to Peerless Mfg. Co.,Investor Relations, 2819 Walnut HillLane, Dallas, Texas 75229, or by visiting the “Investor Relations” section ofour website at www.peerlessmfg.com.A copy of our Annual Report onForm 10-K and other filings with theSEC may also be obtained from theSEC’s website at www.sec.gov.Henry G. SchopferChief Financial Officer andVice President of AdministrationG. Darwyn CornwellVice President – ManufacturingSean McMenaminVice President –Environmental SystemsDavid TaylorVice President – SeparationFiltration SystemsBoard of DirectorsSherrill StoneChairman,Retired CEOPeerless Mfg. Co.Peter J. BurlagePresident andChief Executive OfficerPeerless Mfg. Co.Kenneth R. HanksExecutive Vice President,Chief Financial OfficerSWS Group, Inc.Bernard S. LeeRetiredJ.V. Mariner, Jr.RetiredR. Clayton MulfordPartnerJones DayHoward G. Westerman, Jr.Chairman,Chief Executive OfficerJ-W Operating CompanyAnnual MeetingThe 2006 Annual Meeting ofShareholders will be held onNovember 16, 2006 at 10:00 A.M.at Peerless Mfg. Co., 2819 WalnutHill Lane, Dallas, Texas 75229.Stock Transfer AgentMellon Investor Services LLC480 Washington BoulevardJersey City, New Jersey r.com/isdIndependent AccountantsGrant Thornton LLP1717 Main StreetSuite 1500Dallas, Texas 75201214-561-2300

Peerless Mfg. Co.2819 Walnut Hill Lane, Dallas, Texas 75229Phone: 214-357-6181 Fax: 214-351-0194www.peerlessmfg.com

Peerless Mfg. Co. 2819 Walnut Hill Lane Dallas, Texas 75229 214-357-6181 Internet: www.peerlessmfg.com Stock Exchange Listing Ticker Symbol: PMFG Peerless Mfg. Co. common stock is listed on the NASDAQ exchange. Annual Meeting The 2006 Annual Meeting of Shareholders will be held on November 16, 2006 at 10:00 A.M. at Peerless Mfg. Co., 2819 Walnut