Transcription

icf.com/aviationwe areBig Data: The race is on! Butwhat is the end goal?Martin HarrisonAirline & MRO Aviation ConsultingNovember2018

INTRODUCTIONA brief introduction to ICF – Formerly SH&EServing theAviationCommunitySince 1963ICF Aviation Comprehensive Services:Airlines - Fleet and network planning, pricing andrevenue management, OTP and operational efficiencyAirports - Strategic planning, policy, route development,concessions planningAircraft - Valuations, cash flow forecasts, portfoliodue diligence, market analysis, technical servicesAerospace & MRO - Operations assessment,M&A support, market analysis , MRO ITICF proprietary and confidential. Do not copy, distribute, or disclose.BROAD PERSPECTIVE.COMPELLING RESULTS.Visit us online at icf.com/aviation.ICF is a proud member of both ISTAT and theIATA Strategic Partnerships Program.

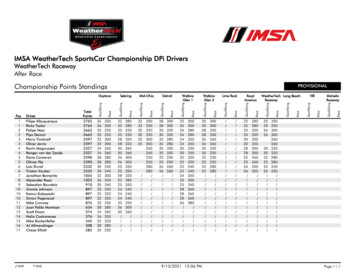

INTRODUCTIONFor the past three years, the digital race has accelerated in theAirline industry world as all the heavyweights stepping igital borationCentre in chnologiesDigital Division*Now called GoDirect Flight FlightSense2017R2 Data Labs2017AnalytX2017FlightPulseBOEINGSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.3

INTRODUCTIONSeveral airlines are seeing the first tangible benefits of their aircrafthealth monitoring trialsResults of Delta’s Predictive Maintenance approachAvoided Engine Events1,000(Over 1-year timespan)easyJetDelta achieved a 100% completionfactor for 241 days in 2017, with a98% reduction in maintenancerelated cancellations31 EventsCathay PacificDrop in maintenance-related cancellations of Southwest to install AHM on complete 737 NG31 instances of Skywise correctly predictingfleet to improve performancefaults before they occurred in service,allowing the carrier to intervene and removecomponents before they failedCancellation reduction98%(Over 2010 - 2016)51%Cathay Pacific reduced APU-related delayminutes by 51% using Honeywell’spredictive maintenance trial programSource: MRO-NetworkICF proprietary and confidential. Do not copy, distribute, or disclose.4

INTRODUCTIONICF estimates that digitisation could enable airlines to save inexcess of 5B/yearHealth Monitoring and Predictive MaintenanceAirline Industry savings: 3B(conservative estimate)Driven by improved dispatchreliability, No Fault Found reduction,Inventory reduction and Improvedlabour productivityFuel Cost SavingsAirline Industry savings: 1.7B(conservative estimate)Continuous flight optimisationthrough live weather updates,speed and altitudeoptimisation Delay ReductionAirline Industry savings: 0.8B(conservative estimate)Improved turnaroundprocess, in-flight routingoptimisationSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.5

INTRODUCTIONAgenda for today:1Review the current industry context2Review the latest market developments3Implications for your business of this digital raceICF proprietary and confidential. Do not copy, distribute, or disclose.6

IndustryContextICF proprietary and confidential. Do not copy, distribute, or disclose.7

INDUSTRY CONTEXTThe air transport fleet is set to grow to 39,000 aircraft by 2027, withdelivery of 17,000 “new technology” aircraft over the decadeAIR TRANSPORT FLEET DEVELOPMENT BY MATURITY 39k 35k2022 Next generation fleet includes 787,A350, A320NEO, 737MAX, 777X,EJet E2, MRJ and CSeries This category will grow hugely overthe next decade, with significantimplications for MRO suppliers 29k2017OBSERVATIONS2027Source: ICF; Excludes TurbopropsICF proprietary and confidential. Do not copy, distribute, or disclose.8

INDUSTRY CONTEXTThe level of digitization across the nine categories varies;Maintenance is the least digitised activity at this timeFlight Planning ( 0.6B)Departure ( 46B)Maintenance( 68B)Post Flight ( 0.2B) 500BArrival ( 20B)Landing ( 20B)KeyMore digitisedDeparture Taxi ( 97B)En-route ( 171B)Approach ( 79B)Less digitisedSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.9

INDUSTRY CONTEXTWithin the MRO world, Aircraft Health Monitoring – The analysis ofaircraft data health data – is the key initiativeAIRCRAFT HEALTH MONITORING SCHEMATICOEM TechSupport CentreAdvice/FeedbackOEM Tech SupportCentreData Transmissioneither in-flight (ACARS)or on-ground (wireless)Airline MaintenanceControl CenterAirline MaintenanceControl CentreData Transmissioneither in-flight (ACARS)or on-ground (wireless/manual)Fix repair either inflight/ on-ground basedon nature of faultMaintenanceEngineering Ops.Source: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.10

INDUSTRY CONTEXTAHM can be viewed as a subset of data management value chain Aircraft Data Management Value ChainAircraft Health Monitoring is inferring the stateof the aircraft.Aircraft Health Management is extracting valuefrom this information.Acquisition g whetherthe component isperforming itsfunctionDiagnosticPrognosticTroubleshoot whilethe aircraft is inflight or after it landsCustomisemaintenance programto prevent redicting theremaining life of acomponentMROActionRecordsKeepingAircraft Health Management goesbeyond predicting and replacingcomponents, it incorporates flightoperations and helps airlines in fleetand inventory managementSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.11

LatestDevelopmentsICF proprietary and confidential. Do not copy, distribute, or disclose.12

LATEST DEVELOPMENTSThe MRO industry has entered the ‘expand’ phase of the digitalmaturity lifecycle; numerous suppliers are developing digital toolsthat provide a solution for a single issueLaunchDevelopAutomation dEarlymajorityLate Majority LaggardsConsolidateChallengeSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.13

LATEST DEVELOPMENTSOEMs & MROs are embracing partnerships to cover the MRO datavalue chain DATA VALUE CHAIN PARTNERSHIP EXAMPLESAcquisition OActionRecordsKeepingBOEINGEngine HealthMonitoringPartnershipDigital ce: ICFFlightOpsICF proprietary and confidential. Do not copy, distribute, or disclose.MxTrainingEtc.14

LATEST DEVELOPMENTS Though the level of partnership varies across the various partsof the data value chainOVERVIEW OF AIRCRAFT DATA VALUE CHAIN PARTNERSHIPSAcquisition &SynthesisAirbusFOMAX (RC)BOEINGTeledyne nningMROActionMRO seACARS /Gate Wi-FiMicrosoftBOEINGAnalytXBOEINGBOEING-ACARS /Gate Wi-FiIBMIBM providesaccess to WatsonAMOSIn-houseFlyDocs-ACARS /Gate Wi-Fin/an/aIn-house--ACARS /Gate Wi-Fi-Source: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.15

LATEST DEVELOPMENTS. in a market already containing ‘a lot’ of independentMRO solutions . Different marketfootprints Different digitalcapabilities andFunctionalitySource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.16

LATEST DEVELOPMENTS and a lot of options to ‘bolt on’ Paperless Manuals and Tech Pubs Electronic TechLogs (ETL/ELB) Paperless Task / Job Cards Electronic Technical Records Paperless Lease Returns Maintenance Planning Inventory Management Mobile Apps Lots more bespoke solutionsSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.17

LATEST DEVELOPMENTS and a new promises of ‘transformation’ Blockchain Digital Twins Predictive Maintenance Big Data Analytics Artificial Intelligence Augmented Reality Maintenance Drones Voice Recognition Internet of Things Robotics RFIDSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.18

IMPLICATIONSFor OEMs & MRO providers, the question is whether digitisation is aproduct to sell or a tool to exploit“Airlines loathe paying substantial hourly fees for AHM services. Typicalfees are 1 per hour, sometimes more, when airlines are willing to pay.This means that if the service were purchased for every jetliner, theaggregate revenue would be just 100 million.”– Kevin MichaelsSource: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.19

ImplicationsICF proprietary and confidential. Do not copy, distribute, or disclose.20

IMPLICATIONSAs the aviation digital technology matures, the MRO landscape willcontinue to evolveM&AWhere OEMs have previously focused their ServicesM&A efforts on R&O investments, focus is now onacquiring IT expertiseDigital PartnershipsWhen M&A is not possible, more “giant partnerships”(BOEING-Microsoft) are to comeNew Players /CompetitionNon aviation incumbents are disrupting the markets(e.g. Amazon in the cargo market)Source: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.21

IMPLICATIONSThere are a number of key questions that will impact all parts of theairline including flight ops:1.Where are the cost savings to pay for all these new systems,data scientists and data storage? Component maintenance orinventory, people, delays and cancellations? Who benefits?2.Are the basics in place to exploit data? Tech log joined upEFB? Shop report data being considered?3.How are you going to join up all these different systems? Isthere one IT Road Map or every department is doing their ownthing?4.How will the new competitive environment play out? Who isbest positioned to gain? Should you build it yourself, go withthe ‘agile’ little guy or the ‘safe’ OEM?Source: ICFICF proprietary and confidential. Do not copy, distribute, or disclose.22

Martin HarrisonVice Presidentmartin.Harrison@icf.comThank You!

operations and helps airlines in fleet and inventory management. Acquisition & Synthesis. Trans-mission. Storage. Analysis. MRO Planning. MRO Action. Records Keeping. Aircraft Data Management Value Chain