Transcription

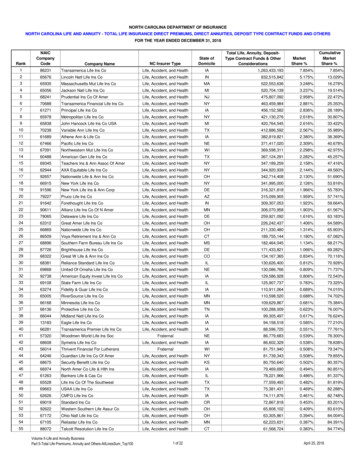

Contingent Annuity AnalysisContingent Annuity Work Group (CAWG)American Academy of ActuariesDecember 22, 2011December 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.1

Overview of Report Executive Summary Product Design and Value to Consumers Annuity or Financial Guaranty Product? Life Insurance or P/C Insurance? Consumer Need and Comparison to Similar Products Product Structure and Costs Consumer Issues Reserves, Capital & Other Risk Management Considerations ConclusionDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.2

Executive Summary Contingent Annuities (CAs) can be a valuable productchoice for many consumers as a way to protect againstlongevity riskFunctions in a very similar manner to the GuaranteedLifetime Withdrawal Benefit (GLWB) offered through avariable annuityBasic regulatory framework is in place Reserves (AG 43) RBC (C-3 Phase II) Need for: Disclosure in policy form filingsCoordinated and well-developed company risk managementDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.3

Product Design & Value to Consumers CA Basic Product Design A stand-alone GLWB Design With Covered Assets held outside the life insurancecompany Expands solutions for guaranteed lifetime income Enables use of existing accumulated assets for guaranteedlifetime income without requiring policyholders to transfertheir assets to an insurance companyDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.4

Annuity or Financial Guaranty Product? Financial guaranty products (e.g., bond insurance): Protect against specific types of financial losses Contain no life contingent element Life annuities:Protect for a lifetime and hence protect against outliving one’s assets Contain a life contingent element Relationship between market performance and CA payments isindirect: CA payments will be payable for a lifetime even if market does notdecline An early decline and later recovery in the market may mean no CApayments are made if insured dies before payments would beginDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.5

Life Insurance or Casualty Insurance? CAWG found no definitive guidance in state lawBut CAs provide a life contingent benefit A CAWG risk analysis starting on the next slidedemonstrates that CAs include a material life contingentcomponent CAWG finds life insurers, not P/C insurers, have theexpertise, data and demonstrated experience in lifecontingencies needed to manage these risksDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.6

CAWG Risk Analysis For the purpose of this risk analysis, longevityrisk is defined as “outliving one’s assets whensystematic withdrawals are intended to depletethe covered assets by the end of the insured’slifetime” Longevity risk is composed of two components– market return component and life contingentcomponentDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.7

CAWG Risk Analysis Developed a base simulation where the lifecontingent component stays constant at theaverage life expectancy of a 65-year old maleand only the market return component varies Expanded the base simulation to assume thelifetime of the 65-year old male varies(longevity risk simulation) Compared the two simulationsDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.8

CAWG Risk Analysis Assumes the following product: Initial covered assets and a guaranteed benefit base(GBB) of 150,000Value of GBB “ratchets up” yearly if the accountvalue increases above the current GBBIssued to a male age 65Withdrawals of 5% of GBB each yearDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.9

Base Simulation Results Approximately 20% chance of an individualoutliving their assets prior to life expectancy The average amount paid by the CA would beabout 40,000 In the most extreme case, the CA would pay outabout 92,000December 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.10

Longevity Risk Simulation Results Approximately 20% chance of an individualoutliving their assets (coincidently the same as thebase scenario) The average amount paid by the CA would beabout 67,000 – 68% more than the base simulation In the most extreme case, the CA would pay outabout 495,000 – 438% more than the basesimulationDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.11

CAWG Risk Analysis Summary The risk analysis shows that the life contingentcomponent is a material component of the riskscovered by this product The benefits of a CA to an individual can besignificant because the actual lifetime will fall within awide range of possible lifetimes, unknown at time ofpurchase The longer one lives after the assets are exhausted, thegreater the benefit of the CA product to the consumer A similar analysis could also be applied to a GLWBDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.12

Consumer Need and Comparison to SimilarProducts CAs, GLWBs and longevity annuities (paid-updeferred annuities) all meet the need for guaranteedlifetime income CAs provide guaranteed lifetime income based onthe value of independently held assets GLWBs provide guaranteed lifetime income basedon the value of insurance company-held assets Longevity annuities provide guaranteed lifetimeincome beginning at a pre-selected age, often aroundage 85December 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.13

CA Product Structure and Costs Group fixed annuities are issued to assetmanagement firms Individual customers of the asset managementfirm receive group participant certificatesAsset options and other terms are set forth ingroup annuity contract and certificatesOther CA product structures are offered byinsurers, but less common than the groupannuity structureDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.14

CA Product Structure and Costs CA covered assets differ from those of a GLWB in thatthey are external to the life insurance company The group annuity contract sets the terms to ensureassets are managed as expected, including establishmentof: Acceptable investment strategiesAppropriate data sharingRisk monitoring systemsSynthetic GICs require similar contractual arrangementsDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.15

CA Product Structure and Costs CA investment options and allocation limitations arecomparable to those of GLWBs CAs have a need similar to GLWBs for coveredassets to be “hedgeable” with reasonable precisionand at reasonable costDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.16

CA/GLWB Product Structure and Costs A traditional Variable Annuity GLWB productconstruct has more elaborate fee structure than a CA The more elaborate VA GLWB structure covers additionalcosts associated with base variable annuity contract featuressuch as guaranteed death benefits and commissionsLife insurers can use the fees (i.e., profits) from the base VAproduct to fund shortfalls in the GLWB, whereas the onlysource of revenue for CAs is the CA fee.The CA product fee must cover all costs associatedwith the productDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.17

Consumer Issues Tax Treatment - In several private letter rulings, the IRSruled that CAs are considered annuities for tax purposes SEC Treatment - CAs, like GLWBs, are generallyregistered as securities (except for certain qualifiedretirement plans) Nonforfeiture Treatment - Paid-up nonforfeiture benefitsare not required since the premiums do not accumulate todetermine a payout, but are in the nature of risk charges fora longevity contingency riskDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.18

Consumer Issues Portability – If the guarantee is not portable, suchrestriction should be fully disclosed in the CA groupcontract and participant certificate State Guarantee Fund Coverage – Expect to be similarto GLWBs Suitability – Suitability safeguards are important andshould be reviewed by the NAIC with assistance from abroad range of experts on the topicDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.19

Reserves, Capital and Other RiskManagement Considerations Reserves - Statutory reserve guidelines for CAs are thesame as for GLWBs and are addressed under AG 43 Capital - Statutory RBC requirements for CAs are alsoaddressed by current requirements Hedging – For both GLWBs and CAs, life insurersgenerally manage the risks through capital marketshedging programsDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.20

Reserves, Capital and Other RiskManagement Considerations Reinsurance – When life insurers reinsure CAs andGLWBs, similar risk transfer arrangements are established Unique Risks – Life insurers should be able todemonstrate, as part of the product approval process, thatrobust and effective risk management systems are in placeto mitigate CA’s unique risks, e.g.: Potential for accelerated growthOperational issues related to third party asset ownershipDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.21

Conclusion CAs can be a beneficial product for many consumers Much of the regulatory framework is already in place, especiallyto the extent that: Most states follow the NAIC models for reserves and capital for GLWBsAll states have procedures in place for approval of GLWBs Any differences and similarities to GLWBs should be disclosedin product filings CAs present life insurers with risks similar to those of GLWBs,as well as certain unique risks, all of which demand strong,comprehensive ERM practices by the life insurer andappropriate regulatory oversight by the stateDecember 22, 2011 NAIC PresentationCopyright 2011 by the American Academy of ActuariesAll Rights Reserved.22

Contingent Annuities (CAs) can be a valuable product choice for many consumers as a way to protect against longevity risk Functions in a very similar manner to the Guaranteed Lifetime Withdrawal Benefit (GLWB) offered through a variable annuity Basic regulatory framework is in place Reserves (AG 43) RBC (C-3 Phase II) Need for: