Transcription

InformativoGerencialEdition 11February 2022Tracking the Trends 2022What does the mining industry expect in2022?Page 32022 Global Automotive Consumer StudyFor over a decade, Deloitte has been exploringautomotive consumer trends impacting arapidly evolving global mobility ecosystem.Page 5

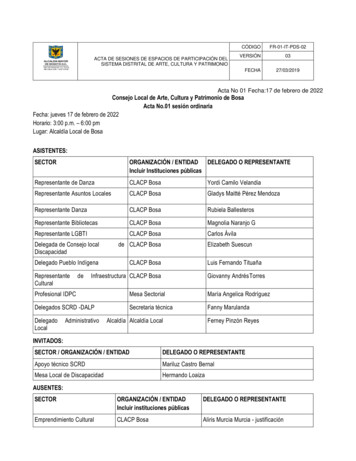

Informativo Gerencial ContentInformativo Gerencial ContentContentPage 3Page 5Deloitte refers to Deloitte Touche Tohmatsu Limited, a private liability company Limitedin the United Kingdom to your network of the signatures member and their relatedentities, each a of the them as a entity legal only e independent. See www.deloitte.comto learn more about our global network of member firms.Deloitte provides professional audit and assurance services, consulting, financial advice,advice in risks taxes and services legal related with our public and private clients fromvarious industries. With a global network of member firms in more of the 150 countriesDeloitte provides capabilities of the class world and service high quality to theircustomers providing the experience necessary for do front to the more complexbusiness challenges. Deloitte's more than 345,000 professionals are committed toimpact significant.Page 90309Tracking the Trends 20222022 Global Health CareOutlookWhat does the mining industryexpect in 2022?Are we finally seeing thelong-promised transformation?As used in this document, Lara Marambio & Asociados and Gómez Rutmann yAsociados, Law Firm, which have the exclusive legal right to get involved in, and limittheir businesses to, the provision of auditing, consulting, consulting services. tax, legal,risk and financial advice respectively, as well as other professional services under thename "Deloitte".This presentation contains only general information and Deloitte is not, through thisdocument, providing audit and accounting advice or services.This presentation no replaces these tips or services professional or must use as a basisfor any decision or action that may affect your business. Before taking any decision ortake any measure what can affect your business should consult to a advisor professional qualified. No provides no representation, warranty or promise (neither explicit norimplied) about the veracity or integrity of the information in this communication andDeloitte shall not be liable for any loss suffered by any person what trust in thispresentation. 2022 Lara Marambio & Asociados and Gómez Rutmann y Asociados, Law Firm,according to the service provided by each one.01052022 Global AutomotiveConsumer StudyFor over a decade, Deloitte hasbeen exploring automotiveconsumer trends impacting arapidly evolving global mobilityecosystem.02

Informativo Gerencial Tracking the Trends 2022Informativo Gerencial Tracking the Trends 2022Tracking theTrends 2022What awaits the mining industry in 2022? Explore thetop 10 trends that will shape the industry in the next12-18 months.The next decade will be ine of themost exciting and transformative inthe mining industry’s history. Howwill mining and metals companies succeedin a low-carbon, low-waste, purpose-drivenfuture?A convergence of factors has emphasizedthe need for change. Among them, ofcourse, is the ongoing impact of theCOVID-19 pandemic on the world of work,digitization, and the growing need tointegrate environmental, social andgovernance (ESG) commitments with corebusiness functions. But the biggestunderlying driver and transformationopportunity lies in the green energytransition.The 2021 United Nations Climate ChangeConfereence (COP26) held in Glasgow inNovember, highlighted the mining industry’s integral role in supplying the metalsand materials critical for a low-carbonfuture. The way in which mining companiesposition themselves today in preparationfor this change, will determine their03sustainability, and could make or breaktheir competitive advantage over the nextdecade.Change on this scale is undoubtablydaunting, which is why Tracking the Trends2022 has focused on effectingtransformation. The following 10 trendsprovide a toolkit to help mining companiesstart thinking through, and movingtowards, their vision of future success.In them, our global team of experts shareinsights and case studies designed to getideas flowing. We explore how to evolvetraditional mining and metals businessesthrough new business models, capitalallocation, agile work practices, anddata-driven technologies to createorganizations fit for the 21st century; onesthat can not only survive but profit fromwhatever the future might throw at themand leave a positive sociial impact in theirwake.Top 10 trends shaping the future ofmining1. Aligning capital allocation to ESGCreating an advantage portfolio with anESG lens2. Reshaping traditional value chainsLaying the foundations for a low-carbonfuture3. Operating in the new super-cycleNavifating the post-COVID regulatory andtax environment4. Embedding ESG into organizationsCreating operating models to supportESG commitments5. Envolving mining’s world of workPositioning organizations for anincreasingly competitive labor market6. Establishing a new paradigm forIndigenous relationsCreating partnerships for progress7. Continuing the journey towardinnovation-led organizationsMoving to action by embracing thechange8. Unlocking value through integratedoperationsUsing data to drive tthe long view9. Closing the IT-OT vulnerability gapThe next frontier in cybersecurity10. Preparing operations for climatechangeManaging physical risks through digitalinsightsRedefining miningWhat will successful mining andmetals companies look like in alow-carbon, low-waste,purpose-driven future?The beauty of this question is thatthere is no definitive answer.While the core objective of themining industry remainsunchanged going forward: toextract and provide metals andminerals to downstream sectors,many of the factors that haveinfluenced how mining companiesshould look, feel, and act in thepast, have shifted in reecent years.For more information, pleasevisit www.deloitte.com/ve04

Informativo Gerencial 2022 Global Automotive Consumer StudyInformativo Gerencial 2022 Global Automotive Consumer Study2022 GlobalAutomotiveConsumerStudyFor over a decade, Deloitte has been exploringautomotive consumer trends impacting a rapidlyevolving global mobility ecosystem.The Global Automotive ConsumerStudy informs Deloitte’s point ofview on the evolution of mobility,smart cities, connectivity, transportation,and other issuees surrounding themovement of people and goods.From September through October 2021,Deloitte surveyed more than 26,000consumers in 25 countries to exploreopinions regarding a variety of criticalissues impacting the automotive sector,including the development of advancedtechnologies. The overall goal of thisannual study is to answer importantquestions that can help companiesprioritize and better position their businessstrategies and investments.05Willingness ot pay for advanced techremains limitedA majority of consumers are unwilling topay more for advanced technologies inmost global markets as they have beentrained to expec new vehicle features as acost of doing business for brands lookingto differentiate themselves from theircompetitors.Interest in EVs driven by lower runningcosts and beter experienceConsumer interest in electrified vehicles(EVs) centers in the perception of lowerfuel costs, environmental consciousness,and a better driving experience. However,driving range and lack of available charginginfrastructure remain barriers to adoption.06

Informativo Gerencial 2022 Global Automotive Consumer StudyIn-person purchase experience stillpreferred by manyMost consumers would still prefer topurchase a vehicle at an authorizeddealership. However, a perception ofincreased convenience and ease of use willlikely support continued growth of virtualpurchase processes.Personal vehicles continue as thepreferred modee of transportationShared mobility services like ride-hailingand car sharing have been slow to returnto their prepandemic pace of growth aspeople prefer using personal vehicles tosatisfy their transportation requirements.Informativo Gerencial 2022 Global Automotive Consumer StudyAdvanced technologies and vehicleconnectivityConsumer willingness to pay for advancedtechnologiees, including alternativepowertrains and vehicle connectivity, islimited in most global markets.Depending on the market, consumers willshare personal data in exchange for lesscongested and safer routes, and vehicleshealth reporting/lower maintenance costs.Vehicle electrificationConsumer interest in BEVs is highest inSouth Korea, China, and Germany whileJapanese consumers prefer HEVs. ICE stilldominates future intentions in the US.For the most part, people are drawn to anEV because of an expectation of lower fuelcosts, or they are concerned about climatechange and want to reduce emissions.In most countries, consumers who plan topurchase virtually would prefer to buy fromdealers (except Japan, where consumerswould buy direct from tthe OEM).More people in Japan, India, and the USplan to charge their PHEV/BEVs at home,while demand forr public charging is high inSouth Korea and the SEA region.Convenience coupled witth ease of use andspeed are the main reasons for consumersto consider a virtual process for acquiringtheir next vehicle.Among those who plan to charge ttheirPHEV/BEV at home, consumers in India,China, and the SEA region plan to use bothregular grid and renewable power.Mobility servicesPersonal vehicles are the preferred mobilitychoice across markets, particularly in theUS. Public transport is the second mostpreferred mode in South Korea and Japan.Consumers not planning to charge aPHEV/BEV at home say they either can’tinstall a charger or the cost of installing acharger is prohibitive.Potential incrreases in the price ofelectricitty may sway a significant numberof consumers away from a PHEV/BEVpurchase in most global markets.The idea of a vehicle subscriptiton service issignificantly more interesting to consumersin China and India as compared to othermajorr global auto markets.About the studyThe 2022 study includes morre than26,000 consumer responses from25 countries around the world.Study methodologyThe study is fielded using an onlinepanel methodology whereconsumers of driving age are invitedto complete the questionnaire(translated into local languages) viaemail.For more information, pleasevisit www.deloitte.com/veConsumers would most prefer asubscription service that focuses onconvenience, flexibility, and availability ofvehicles.Consumers who said they are notconsidering an EV as their next vehiclecited range anxiety and a lack of publiccharging infrastructure as their biggestconcerns.US consumers expect fully charged BEVdriving range to be north of 500 miles,while those in China, Japan, and India arecontent with a range of around 250 miles.Twice as many consumers in the SEAregion see BEVs as having a lowerenvironmental impact than ICE vehicles ascompared to South Korea.Future vehicle intentionsCOVID-19 has had a relatively higherimpact on Indian and SEA consumers. Thayplan to buy their next vehicle to avoidpublic transport.Consumers would most prefer anin-person experience to purchase theirnext vehicle. Having said that, there issignificant potential for virtual salesprocesses to grow.07A perception of increasedconvenience and ease of usewill likely support continuedgrowth of virtual purchaseprocesses.08

Informativo Gerencial 2022 Global Health Care OutlookInformativo Gerencial 2022 Global Health Care OutlookI2022 Global HealthCare OutlookAre we finally seeing the long-promised transformation?s the long-awaited seismic shift inhealth care finally here? A collision offorces - a global pandemic of historicproporttions; exponential consumers; anda movement from disease care toprevention and well-being - proving to betthe catalyst for the clinical, financial, andoperational transformation that health carehas long promised tto the world.2022 marks the second full year of theCOVID-19 pandemic, and it continues todominate health systems’ attenttion andresources: Global COVID-19 cases have climbedabove 270.9 million as of Decemberr 14,2021, and the death toll has exceeded 5.31million. Low vaccination rates have hamperedmany countries’ ability to contain thepandemic. Recognizing the interconnectedness ofourr global populations, The World HealthOrganization (WHO) and other aid groupshave appealed to leaders of the world’s 20biggest economies to fund a 23.4 billionplan to bring COVID-19 vaccines, tests, anddrugs to poorer countries in the next 12months. Health care workers are experiencingincredible emotional, physical, andprofessional stress from responding toCOVID-19. The pandemic has also decreased accessto and consumer demand fornon-COVID-19-related medical care.Despite COVID-19’s many devastatingimpacts, it does presentt the health caresector witth a powerful opportunity toaccelerate innovation and reinvent ittself.As we have been envisioning the Future ofHealth and what the ecosystem may looklike in 2040, we had anticipated manychanges that are occuring today. What wehadn’t predicted, was that the globalpandemic would be the catalyst to kickstart and accelerate those changes soquickly.09COVID-19 has accelerated numerousexisting and/or emerging health caretrends; among them, shifting consumerprreferences and behavior, the integrationof life sciences and health care, rapidlyevolving digital health technologies, newtalent and care delivery models, and clinicalinnovation. As sector stakeholders and theconsumers they serve face an unfamiliarworld of remote working, virtual doctorvisits, and a supply chain marked byshortages of medical supplies, personnel,and services, the sector is transforming tomeet the new challenges. This sector isalso elevating the human experience of theworkforce and reshaping what, how, andwhere worrk is performed; swiftly scalingvirtual health services for COVID-19 andnon-COVID-19 patients alike; and formingnew partnerships to produce desperatelyneeded vaccines, and supplies.Despite continuing challenges on multiplefronts, there is a growing optimism thatmany nations are now better equipped tomanage the impact of COVID-19.AnalysisIn our Health Care Sector Outlook2022 study, we analyzed 6 topicsthat we consider essential to designresilient health systems and,therefore, obtain better results in thecare of the population. Health equity Mental health and wellness The future of medical science How to reimagine public health The environmental, sustainabilityand governance agenda for thesector Digital transformation and healthcare modelsFor more information, pleasevisit www.deloitte.com/ve10

Deloitte refers to Deloitte Touche Tohmatsu Limited, a private liability company Limited in the United Kingdomto your network of the signatures member and their related entities, each a of the them as a entity legal only eindependent. See www.deloitte.com to learn more about our global network of member firms.Deloitte provides professional audit and assurance services, consulting, financial advice, advice in risks taxes andservices legal related with our public and private clients from various industries. With a global network ofmember firms in more of the 150 countries Deloitte provides capabilities of the class world and service highquality to their customers providing the experience necessary for do front to the more complex businesschallenges. Deloitte's more than 345,000 professionals are committed to impact] significant.As used in this document, Lara Marambio & Asociados and Gómez Rutmann y Asociados, Law Firm, which havethe exclusive legal right to get involved in, and limit their businesses to, the provision of auditing, consulting,consulting services. tax, legal, risk and financial advice respectively, as well as other professional services underthe name "Deloitte".This presentation contains only general information and Deloitte is not, through this document, providing auditand accounting advice or services.This presentation no replaces these tips or services professional or must use as a basis for any decision oraction that may affect your business. Before taking any decision or take any measure what can affect yourbusiness should consult to a advisor professional qualified. No provides no representation, warranty or promise(neither explicit nor implied) about the veracity or integrity of the information in this communication andDeloitte shall not be liable for any loss suffered by any person what trust in this presentation. 2022 Lara Marambio & Asociados and Gómez Rutmann y Asociados, Law Firm, according to the serviceprovided by each one.

2022 Global Automotive Consumer Study Page 5 What does the mining industry expect in 2022? . al qualified. No provides no representation, warranty or promise (neither explicit nor implied) about the veracity or integrity of the information in this communication and . organizations fit for the 21st century; ones that can not only survive .