Transcription

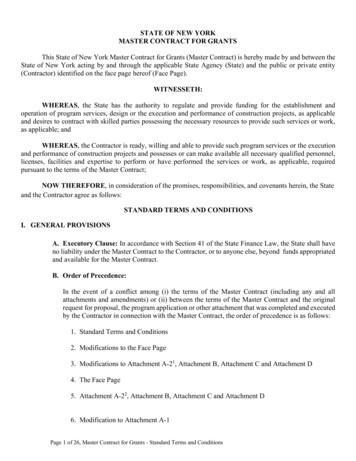

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE1VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 122.1-2-22.3 ***************State Route 5SACCT 152237BILL1122.1-2-22.3322 Rural vac 10County Tax114,400718.412096 Dennis, LLCLittle Falls Ce 210900114,400Town Tax114,400371.201 South Main StreetState Rt 5S114,400School Relevy3,725.70Dolgeville, NY 13329FRNT 2273.00 DPTHFD020 Danube fire prot #1114,400 TO M91.30ACRES56.30EAST-0405756 NRTH-1526251DEED BOOK 1318PG-743FULL MARKET VALUE128,539TOTAL TAX --4,906.61**DATE #101/31/13AMT ************** 127.2-4-1 ******************Johnnycake RdACCT 168713BILL2127.2-4-1322 Rural vac 10County Tax22,000138.16802213 Alberta LTDLittle Falls Ce 21090022,000Town Tax22,00071.38301 Mount Royal Place37.9 A22,000FD020 Danube fire prot #122,000 TO M17.56Nanaimo BC, Canada V9R6A4ACRES37.90EAST-0396265 NRTH-1507306DEED BOOK 1422PG-882FULL MARKET VALUE24,719TOTAL TAX --227.10**DATE #101/31/13AMT ************ 127.2-4-2 ******************Johnnycake RdACCT 168713BILL3127.2-4-2322 Rural vac 10County Tax27,000169.55802213 Alberta LTDLittle Falls Ce 21090027,000Town Tax27,00087.61301 Mount Royal Place41.3 A27,000FD020 Danube fire prot #127,000 TO M21.55Nanaimo BC, Canada V9R6A4ACRES41.30EAST-0395523 NRTH-1507453DEED BOOK 1422PG-882FULL MARKET VALUE30,337TOTAL TAX --278.71**DATE #101/31/13AMT ************ 122.3-1-10 *****************219 Lower Paradise RdACCT 080099733BILL4122.3-1-10270 Mfg housingCounty Tax32,000200.95Adams Timothy MLittle Falls Ce 2109006,400Town Tax32,000103.83219 Lower Paradise RdN B32,000School Relevy201.78Little Falls, NY 13365R-1 218X150FD020 Danube fire prot #132,000 TO M25.54Lo Paradise RdFRNT 210.00 DPTH 150.00EAST-0404020 NRTH-1517033DEED BOOK 920PG-362FULL MARKET VALUE35,955TOTAL TAX --532.10**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE2VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 127.2-1-1.1 ****************332 Newville RdACCT 080000570BILL5127.2-1-1.1120 Field cropsAG MKTS L 4172048,15748,157Adnet JosephLittle Falls Ce 210900125,000 AGRIC 10 Y 421009,0009,000Adnet EllaS B208,000County Tax150,843947.2616 Bartlett AveF 172Town Tax150,843489.45Norwalk, CT 06850Newville Rd.FD020 Danube fire prot #1159,843 TO M127.57ACRES 189.1048,157 EXMAY BE SUBJECT TO PAYMENTEAST-0396511 NRTH-1511262UNDER AGDIST LAW TIL 2016DEED BOOK 793PG-62FULL MARKET VALUE233,708TOTAL TAX --1,564.28**DATE #101/31/13AMT ************** 122.1-2-34.2 ***************155 North Gardinier RdBILL6122.1-2-34.2210 1 Family ResCounty Tax68,000427.03Alberico Deborah JLittle Falls Ce 21090014,500Town Tax68,000220.64Alberico Joseph WFRNT 157.00 DPTH68,000FD020 Danube fire prot #168,000 TO M54.27155 Gardinier RoadACRES5.20Little Falls, NY 13365EAST-0404866 NRTH-1524661DEED BOOK 1249PG-700FULL MARKET VALUE76,404TOTAL TAX --701.94**DATE #101/31/13AMT ************ 129.1-1-28.2 ***************1989 Fords Bush RdACCT 080099979BILL7129.1-1-28.2270 Mfg housingCounty Tax52,000326.55Albini Rudolf RFort Plain Cent 27300116,800Town Tax52,000168.73Albini Lisa MN B52,000FD020 Danube fire prot #152,000 TO M41.501989 Fords Bush RdR1 12.30 AFort Plain, NY 13339Fords Bush RoadACRES12.30EAST-0422821 NRTH-1506766DEED BOOK 1239PG-291FULL MARKET VALUE58,427TOTAL TAX --536.78**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE3VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 122.1-2-34.1 ***************153 North Gardinier RdACCT 080000030BILL8122.1-2-34.1240 Rural resCounty Tax98,000615.42Albrecht Betty JLittle Falls Ce 21090035,000Town Tax98,000317.98Alberico Deborah LF 33.5 A98,000FD020 Danube fire prot #198,000 TO M78.21153 North Gardinier RdKlock RdLittle Falls, NY 13365FRNT 310.00 DPTHACRES40.80EAST-0405180 NRTH-1524343DEED BOOK 1249PG-704FULL MARKET VALUE110,112TOTAL TAX --1,011.61**DATE #101/31/13AMT ************** 127.2-1-6.1 ****************Koziol (off) RdACCT 080005940BILL9127.2-1-6.1322 Rural vac 10County Tax25,000156.99Ali Darlene PLittle Falls Ce 21090025,000Town Tax25,00081.12127-02 Liberty AveSV25,000FD020 Danube fire prot #125,000 TO M19.95Richmond Hill, NY 11419F20Paines HolFRNT 1080.00 DPTHACRES27.90EAST-0394802 NRTH-1507802DEED BOOK 1207PG-146FULL MARKET VALUE28,090TOTAL TAX --258.06**DATE #101/31/13AMT ************ 127.2-1-9 ******************Boepple RdBILL10127.2-1-9311 Res vac landCounty Tax2001.26Almaviva JohnLittle Falls Ce 210900200Town Tax2000.65Almaviva Lorraine EFRNT95.00 DPTH70.00200FD020 Danube fire prot #1200 TO M.16155 Boepple RoadEAST-0394833 NRTH-1510201Mohawk, NY 13407DEED BOOK 1228PG-694FULL MARKET VALUE225TOTAL TAX --2.07**DATE #101/31/13AMT ***************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE4VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 122.1-1-17 *****************179 Finks Basin RdACCT 080000090BILL11122.1-1-17210 1 Family ResCounty Tax85,000533.78Aloisio FrancisLittle Falls Ce 2109009,700Town Tax85,000275.80Aloisio MaryAnnSB85,000FD020 Danube fire prot #185,000 TO M67.84179 Finks Basin RdR1 1.5Little Falls, NY 13365River RdACRES1.50EAST-0404823 NRTH-1528016DEED BOOK 00635 PG-00322FULL MARKET VALUE95,506TOTAL TAX --877.42**DATE #101/31/13AMT ************ 123.3-1-5.12 ***************2261 River RdBILL12123.3-1-5.12210 1 Family ResCounty Tax110,000690.78Alonso FidelSt Johnsville C 27380215,800Town Tax110,000356.9291 Chamber St, First Floor7.5a110,000School Relevy2,315.26Newark, NJ 07105ACRES7.50FD020 Danube fire prot #1110,000 TO M87.79EAST-0420700 NRTH-1519145DEED BOOK 1114PG-513FULL MARKET VALUE123,596TOTAL TAX --3,450.75**DATE #101/31/13AMT ************** 129.1-1-28.1 ***************480 Cronkhite RdACCT 080099684BILL13129.1-1-28.1270 Mfg housingCounty Tax24,000150.71Ardolino Diane EFort Plain Cent 27300116,000Town Tax24,00077.87PO Box 283Rlv 8.2A24,000FD020 Danube fire prot #124,000 TO M19.15Hampton Bays, NY 11946Fords Bush RdFRNT 246.00 DPTHMAY BE SUBJECT TO PAYMENTACRES10.33UNDER AGDIST LAW TIL 2018EAST-0423762 NRTH-1507890DEED BOOK 1146PG-346FULL MARKET VALUE26,966TOTAL TAX --247.73**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE5VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 129.1-1-29 *****************Cronkhite RdACCT 148984BILL14129.1-1-29105 Vac farmlandCounty Tax10,60066.57Ardolino Diane EFort Plain Cent 27300110,600Town Tax10,60034.39PO Box 283S V10,600FD020 Danube fire prot #110,600 TO M8.46Hampton Bay, NY 11946Rlv 10.23ACronkhite RoadMAY BE SUBJECT TO PAYMENTACRES10.23UNDER AGDIST LAW TIL 2018EAST-0423513 NRTH-1508016DEED BOOK 1299PG-588FULL MARKET VALUE11,910TOTAL TAX --109.42**DATE #101/31/13AMT ************ 129.3-1-1.2 ****************392 Klock RdBILL15129.3-1-1.2240 Rural resCounty Tax126,600795.02Armer Janice HFort Plain Cent 27300121,100Town Tax126,600410.78392 Klock Rd392 Klock Road126,600FD020 Danube fire prot #1126,600 TO M101.04Fort Plain, NY 13339Klock RoadACRES15.00EAST-0421683 NRTH-1503610DEED BOOK 1111PG-856FULL MARKET VALUE142,247TOTAL TAX --1,306.84**DATE #101/31/13AMT ************** 129.3-3-6 ******************929 Phillip RdACCT 169079BILL16129.3-3-6210 1 Family ResCounty Tax66,900420.12Arndt LindaFort Plain Cent 27300114,100Town Tax66,900217.07929 Phillip Rd5.1a66,900School Relevy1,271.53Fort Plain, NY 13339ACRES5.10FD020 Danube fire prot #166,900 TO M53.39EAST-0422754 NRTH-1500231DEED BOOK 1423PG-837FULL MARKET VALUE75,169TOTAL TAX --1,962.11**DATE #101/31/13AMT ************** 128.3-4-12 *****************1800 Travis RdBILL17128.3-4-12210 1 Family ResCounty Tax77,400486.06Averell David CLittle Falls Ce 2109005,300Town Tax77,400251.14Averell Margaret Akeychanged to 128.3-4-1277,400FD020 Danube fire prot #177,400 TO M61.771800 Travis RdFRNT 150.00 DPTH 180.00Mohawk, NY 13407ACRES0.59EAST-0362580 NRTH-1080810DEED BOOK 731PG-28FULL MARKET VALUE86,966TOTAL TAX --798.97**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE6VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 128.3-4-5 ******************Travis RdBILL18128.3-4-5314 Rural vac 10County Tax9,70060.91Averell HerbertLittle Falls Ce 2109009,700Town Tax9,70031.47Averell Carol9.3a Lot #149,700FD020 Danube fire prot #19,700 TO M7.741776 Travis RoadACRES9.30Mohawk, NY 13407EAST-0399528 NRTH-1504323DEED BOOK 931PG-311FULL MARKET VALUE10,899TOTAL TAX --100.12**DATE #101/31/13AMT ************ 128.3-4-13 *****************1776 Travis RdACCT 080099734BILL19128.3-4-13210 1 Family ResCounty Tax95,000596.58Averell Herbert J JrLittle Falls Ce 2109009,700Town Tax95,000308.25Averell Carol LE B95,000FD020 Danube fire prot #195,000 TO M75.82Attn: Averell Living TrustR-1 3A1776 Travis Rdkeychanged/map clarityMohawk, NY 13407ACRES2.00EAST-0362530 NRTH-1080465DEED BOOK 882PG-070FULL MARKET VALUE106,742TOTAL TAX --980.65**DATE #101/31/13AMT ************ 123.3-1-9 ******************2348 River RdACCT 080003480BILL20123.3-1-9240 Rural resCOMBAT CT 4113114,55014,550Balderston CharlesSt Johnsville C 27380217,600County Tax72,550455.60Kulla JosephinaMerger With 123.3-1-5.987,100Town Tax72,550235.412348 River RdR-1 1FD020 Danube fire prot #187,100 TO M69.51Fort Plain, NY 13339River RoadFRNT 326.00 DPTHACRES11.00EAST-0422169 NRTH-1517681DEED BOOK 00664 PG-00574FULL MARKET VALUE97,865TOTAL TAX --760.52**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE7VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 128.3-4-7 ******************191 Wanabe RdBILL21128.3-4-7322 Rural vac 10County Tax35,000219.79Barberi MichaelLittle Falls Ce 21090035,000Town Tax35,000113.57Barberi Tara40a Lot #1235,000FD020 Danube fire prot #135,000 TO M27.93138 Main StreetACRES40.00Germantown, NY 12526EAST-0401688 NRTH-1503989DEED BOOK 1281PG-221FULL MARKET VALUE39,326TOTAL TAX --361.29**DATE #101/31/13AMT ************ 128.3-4-10 *****************Travis RdACCT 167610BILL22128.3-4-10322 Rural vac 10County Tax13,20082.89Barberi MichaelLittle Falls Ce 21090013,200Town Tax13,20042.83Barberi Tara12.6a Lot #1013,200FD020 Danube fire prot #113,200 TO M10.53138 Main StreetACRES12.60Germantown, NY 12526EAST-0400857 NRTH-1503439DEED BOOK 1414PG-131FULL MARKET VALUE14,831TOTAL TAX --136.25**DATE #101/31/13AMT ************ 128.4-3-2 ******************645 West Fiery Hill RdACCT 159832BILL23128.4-3-2322 Rural vac 10County Tax22,000138.16Bayer Living Trust Louise MOwen D Young21500122,000Town Tax22,00071.38PO Box 48Mohawk Estates22,000FD020 Danube fire prot #122,000 TO M17.56Jordanville, NY 13361Lot 2, 301'Fiery HillPRIOR OWNER ON 3/01/2012ACRES23.20Bayer Living Trust Louise MEAST-0411342 NRTH-1502663DEED BOOK 1363PG-918FULL MARKET VALUE24,719TOTAL TAX --227.10**DATE #101/31/13AMT ************ 122.1-1-36 *****************Route 5S Fall Hill SouthACCT 174252BILL24122.1-1-36314 Rural vac 10County Tax4,40027.63Beacraft Daniel CLittle Falls Ce 2109004,400Town Tax4,40014.28Beacraft Krista ASV4,400FD020 Danube fire prot #14,400 TO M3.51PO Box 553Rl-V4Little Falls, NY 13365Fall HillACRES4.50PRIOR OWNER ON 3/01/2012EAST-0397184 NRTH-1524817JMBDEED BOOK 1457PG-84FULL MARKET VALUE4,944TOTAL TAX --45.42**DATE #101/31/13AMT ****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE8VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 122.1-1-7 ******************251 Finks Basin RdACCT 080001500BILL25122.1-1-7281 Multiple resCounty Tax79,200497.36Becker NatalieLittle Falls Ce 21090010,600Town Tax79,200256.98Becker MildredSB79,200FD020 Danube fire prot #179,200 TO M63.21251 Finks Basin RdR-1 2 1/2Little Falls, NY 13365River RdACRES2.60EAST-0403672 NRTH-1528913DEED BOOK 678PG-269FULL MARKET VALUE88,989TOTAL TAX --817.55**DATE #101/31/13AMT ************ 128.3-2-16.2 ***************West Fiery Hill RdBILL26128.3-2-16.2322 Rural vac 10County Tax25,500160.13Bergen TammyLittle Falls Ce 21090025,500Town Tax25,50082.74Bergen WilliamHoke To Dubuque25,500FD020 Danube fire prot #125,500 TO M20.35658 Johnnycake Rd1/2 InterestMohawk, NY 13407Fiery HillACRES34.00EAST-0408444 NRTH-1503345DEED BOOK 849PG-662FULL MARKET VALUE28,652TOTAL TAX --263.22**DATE #101/31/13AMT ************ 128.3-2-12 *****************West Fiery Hill RdACCT 080099693BILL27128.3-2-12314 Rural vac 10County Tax12,30077.24Bergen WilliamLittle Falls Ce 21090012,300Town Tax12,30039.91Helmer-Bergen TammyS.v.12,300FD020 Danube fire prot #112,300 TO M9.82658 Johnnycake RdRlv.1.5aMohawk, NY 13407Fiery Hill RdACRES12.50EAST-0407271 NRTH-1503254DEED BOOK 830PG-556FULL MARKET VALUE13,820TOTAL TAX --126.97**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE9VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 128.1-1-27 *****************658 Johnnycake RdACCT 080004110BILL28128.1-1-27210 1 Family ResCounty Tax45,000282.59Bergen William WLittle Falls Ce 2109003,500Town Tax45,000146.01Bergen Helmer Tammy LS B45,000FD020 Danube fire prot #145,000 TO M35.91658 Johnnycake RdR1 1/4 AMohawk, NY 13407Johnnycake Rd.FRNT 140.50 DPTH 165.00ACRES0.42EAST-0397604 NRTH-1506776DEED BOOK 690PG-258FULL MARKET VALUE50,562TOTAL TAX --464.51**DATE #101/31/13AMT ************ 128.3-2-5 ******************West Fiery Hill RdACCT 080099689BILL29128.3-2-5322 Rural vac 10County Tax29,000182.11Bergen William WLittle Falls Ce 21090029,000Town Tax29,00094.10Bergen TammyE V29,000FD020 Danube fire prot #129,000 TO M23.14658 Johnnycake RdRlv 41 AcMohawk, NY 13407Fiery HillACRES38.00EAST-0407303 NRTH-1504222DEED BOOK 924PG-673FULL MARKET VALUE32,584TOTAL TAX --299.35**DATE #101/31/13AMT ************ 128.1-2-7.1 ****************Creek RdACCT 080099985BILL30128.1-2-7.1433 Auto bodyCounty Tax45,300284.47Bladek KarlLittle Falls Ce 2109007,000Town Tax45,300146.99360 Creek RdIncludes Parcel 8.345,300FD020 Danube fire prot #145,300 TO M36.15Little Falls, NY 13365FRNT 260.00 DPTH 171.00ACRES0.90EAST-0408757 NRTH-1512001DEED BOOK 688PG-50FULL MARKET VALUE50,899TOTAL TAX --467.61**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE10VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 128.2-1-1.5 ****************360 Creek RdBILL31128.2-1-1.5210 1 Family ResCounty Tax50,000313.99Bladek KarlLittle Falls Ce 21090010,600Town Tax50,000162.24360 Creek RoadBAR 2009 - Partial50,000FD020 Danube fire prot #150,000 TO M39.90Little Falls, NY 13365FRNT 612.00 DPTHACRES2.30EAST-0409100 NRTH-1511912DEED BOOK 1210PG-199FULL MARKET VALUE56,180TOTAL TAX --516.13**DATE #101/31/13AMT ************ 128.2-1-1.7 ****************Creek RdBILL32128.2-1-1.7314 Rural vac 10County Tax1,0006.28Bladek KarlLittle Falls Ce 2109001,000Town Tax1,0003.24360 Creek RoadFRNT65.00 DPTH 146.001,000FD020 Danube fire prot #11,000 TO M.80Little Falls, NY 13365EAST-0409135 NRTH-1512098DEED BOOK 1210PG-203FULL MARKET VALUE1,124TOTAL TAX --10.32**DATE #101/31/13AMT *********** 128.1-2-8.2 ****************335 Creek RdBILL33128.1-2-8.2210 1 Family ResCounty Tax83,600524.99Bladek KarliLittle Falls Ce 2109008,800Town Tax83,600271.26335 Creek RdN B83,600FD020 Danube fire prot #183,600 TO M66.72Little Falls, NY 13365R1 1.AcCreek RdACRES1.30EAST-0408496 NRTH-1511798DEED BOOK 1279PG-225FULL MARKET VALUE93,933TOTAL TAX --862.97**DATE #101/31/13AMT ************ 128.2-1-1.3 ****************Creek RdBILL34128.2-1-1.3314 Rural vac 10County Tax6,50040.82Bladek KarliLittle Falls Ce 2109006,500Town Tax6,50021.09335 Creek Rdsplit 1.56,500FD020 Danube fire prot #16,500 TO M5.19Little Falls, NY 13365FRNT 348.00 DPTHACRES4.50EAST-0408917 NRTH-1511625DEED BOOK 1229PG-239FULL MARKET VALUE7,303TOTAL TAX --67.10**DATE #101/31/13AMT ****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE11VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 128.2-1-1.1 ****************286 Creek RdACCT 080010710BILL35128.2-1-1.1240 Rural resCounty Tax102,000640.54Bladek Roger ALittle Falls Ce 21090033,000Town Tax102,000330.96Bladek Beverly Pmerged w/128.1-2-8.1,9,10102,000FD020 Danube fire prot #1102,000 TO M81.40286 Creek RdFRNT 2861.00 DPTHLittle Falls, NY 13365ACRES47.70EAST-0409624 NRTH-1511133DEED BOOK 792PG-304FULL MARKET VALUE114,607TOTAL TAX --1,052.90**DATE #101/31/13AMT ************** 128.2-1-1.4 ****************430 Creek RdACCT 172304BILL36128.2-1-1.4210 1 Family ResCounty Tax63,000395.63Bladek Roger ALittle Falls Ce 21090012,300Town Tax63,000204.42Bladek Beverly PSplit From 128.2-1-1.163,000School Relevy1,211.37286 Creek RdFRNT 190.00 DPTHFD020 Danube fire prot #163,000 TO M50.28Little Falls, NY 13365ACRES4.30EAST-0410366 NRTH-1512250PRIOR OWNER ON 3/01/2012DEED BOOK 1444PG-476Bladek BarbaraFULL MARKET VALUE70,787TOTAL TAX --1,861.70**DATE #101/31/13AMT ************** 128.2-1-1.2 ****************388 Creek RdACCT 164191BILL37128.2-1-1.2322 Rural vac 10County Tax24,600154.48Bladek William IIILittle Falls Ce 21090024,600Town Tax24,60079.82Bladek Susan31.2 A24,600School Relevy801.165021 State Route 167Creek RoadFD020 Danube fire prot #124,600 TO M19.63Little Falls, NY 13365FRNT 1096.00 DPTHACRES31.20EAST-0409895 NRTH-1511721DEED BOOK 1393PG-38FULL MARKET VALUE27,640TOTAL TAX --1,055.09**DATE #101/31/13AMT *******************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE12VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 128.1-2-48.1 ***************265 West Fiery Hill RdACCT 166263BILL38128.1-2-48.1210 1 Family ResAG MKTS L 4172022,30322,303Blake Carol ALittle Falls Ce 21090040,000County Tax107,697676.31265 West Fiery Hill RdFRNT 978.00 DPTH130,000Town Tax107,697349.45Little Falls, NY 13365ACRES38.60FD020 Danube fire prot #1107,697 TO M85.95EAST-0406954 NRTH-150494822,303 EXMAY BE SUBJECT TO PAYMENTDEED BOOK 764PG-349UNDER AGDIST LAW TIL 2016FULL MARKET VALUE146,067TOTAL TAX --1,111.71**DATE #101/31/13AMT ************** 122.2-1-31.1 ***************849 Lower Paradise RdACCT 080006180BILL39122.2-1-31.1210 1 Family ResCounty Tax65,000408.19Blodgett ToddSt Johnsville C 27380214,100Town Tax65,000210.91Williams KennethW B65,000FD020 Danube fire prot #165,000 TO M51.88849 Lower Paradise RdR1-7.7ALittle Falls, NY 13365Lo Paradise RdACRES5.30EAST-0414352 NRTH-1520760DEED BOOK 788PG-638FULL MARKET VALUE73,034TOTAL TAX --670.98**DATE #101/31/13AMT ************ 128.1-2-40 *****************781 Newville RdACCT 169768BILL40128.1-2-40210 1 Family ResCounty Tax55,000345.39Boepple Anthony GLittle Falls Ce 21090010,600Town Tax55,000178.46Boepple Cara JSB55,000FD020 Danube fire prot #155,000 TO M43.89781 Newville RdR-1 1/4Little Falls, NY 133651.3 acres calculatedACRES2.10EAST-0405094 NRTH-1509774DEED BOOK 1428PG-472FULL MARKET VALUE61,798TOTAL TAX --567.74**DATE #101/31/13AMT *****************************************

STATE OF NEW YORKCOUNTY - HerkimerTOWN- DanubeSWIS- 2122002 0 1 3T O W NT A XR O L LT A X A B L E SECTION OF THE ROLL - 1OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 089.00PAGE13VALUATION DATE-JUL 01, 2011TAXABLE STATUS DATE-MAR 01, 2012TAX MAP PARCEL NUMBERPROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION -CURRENT OWNERS NAMESCHOOL DISTRICTLANDTAX DESCRIPTIONTAXABLE VALUECURRENT OWNERS ADDRESSPARCEL SIZE/GRID COORDTOTALSPECIAL DISTRICTSTAX ********* 122.3-1-30 *****************Newville RdACCT 080000780BILL41122.3-1-30105 Vac farmlandAG MKTS L 4172010,60210,602Boepple FrankLittle Falls Ce 21090043,000County Tax32,398203.45468 Newville RdN V43,000Town Tax32,398105.12Little Falls, NY 13365F 63.7AFD020 Danube fire prot #132,398 TO M25.86Lease w/Lipiec10,602 EXMAY BE SUBJECT TO PAYMENTACRES63.70UNDER AGDIST LAW TIL 2016EAST-0399846 NRTH-1513475DEED BOOK 1104PG-633FULL MARKET VALUE48,315TOTAL TAX --334.43**DATE #101/31/13AMT *****************************

current owners name school district land tax description taxable value current owners address parcel size/grid coord total special districts tax amount . 1989 fords bush rd acct 080099979 bill 7 1989 fords bush rd r1 12.30 a fort plain, ny 13339 fords bush road acres 12.30 east-0422821 nrth-1506766 deed book 1239 pg-291 full market value .