Transcription

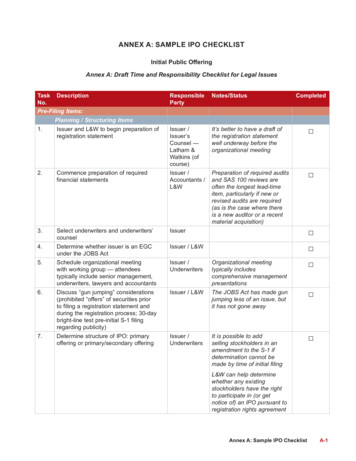

ANNEX A: SAMPLE IPO CHECKLISTInitial Public OfferingAnnex A: Draft Time and Responsibility Checklist for Legal usCompletedPre-Filing Items:Planning / Structuring Items1.Issuer and L&W to begin preparation ofregistration statementIssuer /Issuer’sCounsel —Latham &Watkins (ofcourse)It’s better to have a draft ofthe registration statementwell underway before theorganizational meeting 2.Commence preparation of requiredfinancial statementsIssuer /Accountants /L&WPreparation of required auditsand SAS 100 reviews areoften the longest lead-timeitem, particularly if new orrevised audits are required(as is the case where thereis a new auditor or a recentmaterial acquisition) 3.Select underwriters and underwriters’counselIssuer 4.Determine whether issuer is an EGCunder the JOBS ActIssuer / L&W 5.Schedule organizational meetingwith working group — attendeestypically include senior management,underwriters, lawyers and accountantsIssuer /UnderwritersOrganizational meetingtypically includescomprehensive managementpresentations6.Discuss “gun jumping” considerations(prohibited “offers” of securities priorto filing a registration statement andduring the registration process; 30-daybright-line test pre-initial S-1 filingregarding publicity)Issuer / L&WThe JOBS Act has made gunjumping less of an issue, butit has not gone away 7.Determine structure of IPO: primaryoffering or primary/secondary offeringIssuer /UnderwritersIt is possible to addselling stockholders in anamendment to the S-1 ifdetermination cannot bemade by time of initial filing L&W can help determinewhether any existingstockholders have the rightto participate in (or getnotice of) an IPO pursuant toregistration rights agreementAnnex A: Sample IPO ChecklistA-1

termine whether company or sellingstockholders will provide shares forover-allotment optionIssuer /SellingStockholdersKnown as the “Green Shoe,”the over-allotment option maybe exercised at any time byunderwriters within 30 days ofIPO; amount is always fixedat 15% of the base offering9.Consider pre-filing TTW meetings withinstitutional investorsIssuer / L&W / Information presented inUnderwritersTTW meetings must beconsistent with registrationstatement and will be requiredto be given to the SEC on anonpublic basis10.ONLY IF issuer is an EGC, discuss which Issuer / L&W / Most EGCs take advantage ofEGC accommodations, if any, issuerUnderwritersseveral of the following JOBSwould like to take advantage ofAct accommodations:Completed scaled financial disclosure; relief from SOX 404(b); reduced executivecompensation disclosure;or delayed requirement tocomply with new/revisedGAAP (or irrevocableopt-out)11.Consider whether a stock split will benecessaryIssuer /UnderwritersStock splits are typicallydetermined prior to printingred herring and commencingthe road show; financialstatements may need to berevised to give retroactiveeffect to the stock split andauditor’s report will likely belegended to reflect the stocksplit and re-dated12.Consider whether offering will include adirected share program for “friends andfamily”Issuer / L&WThis determination does notneed to be made by initialfiling13.Consider whether it is desirable toimplement a dual class stock structureIssuer / L&WUnder exchange rules, dualclass stock structures mayonly be implemented pre-IPO;typical structure is that ClassA shares are held by publicstockholders and have onevote per share and Class Bshares are held by existingstockholders and havemultiple votes (10) per shareA-2Latham & Watkins – US IPO Guide

egotiate lock-up agreements (typically180 days for IPOs); distribute lockup agreements to directors, officers,stockholders and option holdersL&W /Underwriters’CounselUnderwriters will typicallyrequest that all lock-upagreements are signed anddelivered prior to commencingthe road show and sometimesprior to initial filing of theregistration statement15.Review and negotiate underwritingagreement and, if selling stockholdersare selling shares, power of attorney andcustody agreementL&W /Underwriters’CounselWhile the underwritingagreement is negotiatedpre-road show, it is typicallyexecuted on the day of pricingof the IPO16.Consider whether any stockholderL&Wconsents are required under stockholders’agreement or other agreementsStockholder agreementstypically (but not always) fallaway at the closing of theIPO, although registrationrights for controllingstockholders usually continuepost-IPO17.Reserve stock symbol — generally threeto four charactersStock symbols can bereserved on a confidentialbasis well in advance ofinitial filing of S-1 (note thatreserving a symbol on oneexchange also reserves it onthe other)18.Select stock exchange and confirm theIssuer / L&Wcompany will meet the applicable listingstandards (e.g., NYSE/Nasdaq GlobalSelect Market); conduct preliminaryconversations with NYSE/Nasdaq listingrepresentatives; prepare necessary listingapplications19.Select financial printerIssuer20.Select transfer agent and registrarIssuerTransfer agent can beselected post initial filing ofS-121.Select bank note companyIssuerMany transfer agents alsohave the ability to print stockcertificatesIssuer / L&WCompletedExchange does not need tobe selected prior to initialfiling. It is often a goodidea to engage both majorexchanges in a dialogueabout optionsDue Diligence and Related Disclosure Matters22.Assemble electronic data room forproviding due diligence materials tounderwriters and counsel; underwriters’counsel to deliver due diligence requestletter Issuer / L&WAnnex A: Sample IPO ChecklistA-3

istribute Directors and Officers(D&O), NYSE/Nasdaq and FINRAQuestionnaires to all officers, directorsand 5% securityholders (10% for FINRAQuestionnaires); provide completedquestionnaires to underwriters’ counselIssuer / L&WUnderwriters’ counsel willprepare FINRA Questionnaire 24.Review material contracts(i.e., registration rights agreements,stockholders agreements, loanagreements, if any) for potentialrestrictions that may require notice,consent and/or waivers prior to filingregistration statementIssuer / L&WAn IPO does not alwaystrigger a change of control,but it is a good idea to take ahard look at any requirementsin debt agreements for theexisting stockholders group tomaintain control 25.Evaluate potential disclosure problems(i.e., material litigation; materialcontingent liabilities; insider transactions)Issuer / L&W26.Review contracts to determine materialcontracts that will need to be filed asexhibits to the registration statementand the terms of which will need to bedisclosed in the registration statement;determine whether notice needs to begiven to 3rd parties and/or consentsobtained to disclose terms in theregistration statement; make preliminaryassessment of competitive harm andmateriality issuesIssuer / L&WItem 601(b)(10)(iv) ofRegulation S-K allows anissuer to redact provisions orterms of material contractsthat are not material and thatwould likely cause competitiveharm to the issuer if publiclydisclosed 27.Analyze related-party transactions during Issuer / L&Wthe current year and the last three fiscalyears that will need to be disclosedunder “Certain Relationships and RelatedParty Transactions” in the registrationstatement28.Determine whether any “conflicts ofinterests” disclosure is required inthe registration statement pursuant toapplicable FINRA rulesLatham & Watkins – US IPO Guide The SEC may requestsupplemental information tosubstantiate the redactionsSee SEC Division ofCorporation FinanceAnnouncement: New Rulesand Procedures for ExhibitsContaining Immaterial,Competitively elThis issue arises if, forexample, one of theunderwriters or its affiliateswill be receiving 5% or moreof the net proceeds of theoffering in connection with therepayment of a credit facilityor other indebtedness

leted29.Prepare back-up binder of all factualstatements included in the registrationstatementIssuer / L&W 30.Conduct legal and accounting duediligence meetings/callsIssuer /Underwriters’Counsel 31.Background checks of directorsand executive officers conducted byunderwritersUnderwriters’Counsel Accountants Auditor Items32.Confirm schedule for preparation ofaudited financials (three years of auditedfinancial statements and five years ofselected financial data will be required tobe included in registration statement)ONLY IF issuer is an EGC, issuer may gopublic with two, rather than three years,of audited financial statements and asfew as two years of selected financialdata 33.Determine whether quarterly financialdata for prior two fiscal years will becalled for in the MD&AUnderwritersThis is not required bythe SEC rules but is oftenrequired for marketingpurposes34.Assess SOX 404 compliance — reviewinternal control over financial reportingand disclosure controls and procedures(if issuer is an EGC, issuer is exemptfrom auditor attestation requirementsof SOX 404(b) for so long as issuer isan EGC; non-EGC issuers have untilthe 2nd annual report to comply withSOX 404(b))Issuer /Accountants /L&WIdentify and remediate anymaterial weaknesses and/or significant deficienciespre-initial filing of S-135.Meet with accountants to discussrequired financial statements and anynecessary changes in accountingprocedures due to the companybecoming a public companyAccountants 36.Determine whether any of the company’soperations must be reported as separatesegmentsAccountants /L&W 37.Discuss use of non-GAAP financialmeasuresIssuer /Accountants /Underwriters’Counsel Annex A: Sample IPO Checklist A-5

��Cheap stock” analysisAccountantsCheap stock comments bythe Staff cannot be resolveduntil a price range is providedto the Staff39.Determine “significant subsidiaries” under IssuerRule 1-02 of Regulation S-X40.Underwriters’ counsel and auditorsdiscuss comfort letterUnderwriters’Counsel /AccountantsIf quarterly financial data forprevious fiscal years will beincluded in the MD&A, besure to discuss comfort onthat data41.Obtain draft of accountant’s consentL&W /AccountantsIt is not necessary tosubmit a signed consent ina confidential submission,but verbal approval fromaccountants to file is alwaysadvisable Be thoughtful aboutintellectual property issues inthe event of a name change Frequently used in connectionwith reps and warranties inunderwriting agreementGeneral Corporate MattersCompleted 42.Consider whether a name change of theissuer is desiredIssuer43.Consider whether it is desirable torestructure the capitalization of thecompany; consider whether a leveragedre-cap is desirableIssuer /Underwriters44.Consider whether there is a need torevise or enter into:Issuer / L&WIt is customary for the boardto revisit managementcompensation arrangementsconcurrently with the IPO,usually with the advice of acompensation consultant Issuer /Accountants /L&WBoard resolutions typicallyprovide that publiccompany governancedocuments becomeeffective in connection withconsummation of the IPO employment agreements employee benefit matters (i.e., stockoption plans, employee stock purchaseplans) renegotiation of any covenants in loanagreements that restrict or limit theuse of proceeds in a public offering, asapplicable45.Revise organizational/constitutionaldocuments as necessary for publiccompanies: certificate of incorporation bylaws registration rights agreements stockholders agreement otherA-6Latham & Watkins – US IPO GuideStockholders agreementstypically terminate inconnection with an IPO

leted46.Conduct NYSE / Nasdaq / SOX director“independence” analysis; board ofdirectors to make independencedetermination; determine whetheradditional directors need to be appointedto the board of directors to meetindependence requirementsIssuer / Board Consider whether board ofof Directors / directors is going to avail itselfL&Wof the “controlled company”exemption; phase-in rulesfor the independencerequirements do apply inconnection with an IPO 47.Review composition of board committees, Board ofconsider:Directors /L&W heightened independencerequirements for audit andcompensation committee membersDirectors who are notplanning to remain on theboard post-IPO shouldresign prior to the filing of theregistration statement to avoidliability for the registrationstatement Board ofDirectors /L&WDetermine whether any auditcommittee members qualifyas “audit committee financialexperts” Board ofDirectors /L&WBoard resolutions typicallyprovide that public companygovernance policies becomeeffective in connection withthe consummation of the IPO “outside director” and “non-employeedirector” requirements forcompensation committee members staggered terms mandatory retirement age separation of Chairman / CEO roles48.Designate board committees; prepareNYSE/Nasdaq compliant: audit committee charter nominating and corporate governancecommittee charter compensation committee charter49.Prepare corporate governance policies code of business conduct and ethics corporate governance guidelines insider trading policy Regulation FD policy related-party transaction policy communications with stockholders disclosure controls and procedures whistleblower policy50.Consider formation of a disclosurecommitteeIssuer / L&W Issuer disclosure committee charter51.Confirm appropriate levels of D&OinsuranceAnnex A: Sample IPO ChecklistA-7

TaskNo.DescriptionResponsibleParty52.Consider entering into stand-aloneIssuer / L&Windemnification agreements with directorsand executive officersPreparation of S-1 Registration Statement53.Prepare registration statement (mustmeet the requirements of Form S-1 orF-1 for foreign private issuers) Prospectus SummarySummary Financial DataRisk FactorsForward-Looking StatementsUse of ProceedsDividend PolicyCapitalizationDilutionSelected Financial DataManagement’s Discussion andAnalysis of Financial Condition andResults of Operations Industry OverviewA-8Latham & Watkins – US IPO GuideIssuer /Underwriters /CounselNotes/StatusThis is advisable under thelaw of most states. The formof indemnification agreementneeds to be filed as an exhibitto the registration statementCompleted

leted Business Products Sales and Marketing Research and Development Competition Intellectual Property Manufacturing Regulatory, if applicable Employees Facilities Legal Proceedings Management Board of Directors/Board Committees Compensation Discussion andAnalysis not required for EGCs Compensation of Directors Executive Compensation Benefit Plans Employment Agreements/Change ofControl Agreements Certain Relationships and RelatedParty Transactions Principal Stockholders (and SellingStockholders, if applicable) Description of Indebtedness, ifapplicable Description of Capital Stock Shares Eligible for Future Sale Material US Federal Income TaxConsequences to Non-US Holders ofthe Common Stock Underwriting Legal Matters/Experts Financial Statements Part II Expenses of Issuance andDistribution Indemnification of Directors andOfficers Recent Sales of UnregisteredSecurities (past three years) Exhibits Signature Pages/Power of Attorney54.Prepare cover art graphics for prospectus Issuer /(coordinate with financial printerUnderwritersregarding proper format; lead timerequired)SEC will review graphicsAnnex A: Sample IPO Checklist A-9

erform S-1 form check of registrationstatement to confirm registrationstatement meets all applicablerequirementsL&W 56.Edgarize / typeset registration statementL&W / Printer57.Edgarize exhibitsL&W 58.Prepare confidential treatment request (ifapplicable)L&W59.Review and revise company websiteas appropriate (gun-jumping concerns,information inconsistent with thedisclosures in the registration statement)Issuer / L&WFrequently a long lead-timeitem; ideally have Wordversions of documents toEdgarizeThe SEC will typically reviewa company’s website andother public announcementsregarding the companyBoard Items60.Prepare pre-filing board resolutionsauthorizing initial filing of registrationstatement, listing application withexchange, establishment of pricingcommittee and other IPO-related matters61.Distribute registration statement for board Issuer / Boardto reviewof Directors62.Hold board meeting to approve pre-filingIPO resolutionsCompleted Board ofDirectors /L&W Board ofDirectors Miscellaneous Items63.Distribute signature pages to theregistration statement and power ofattorney to directors and appropriateofficers; obtain executed signature pagesL&W 64.Obtain CIK and CCC EDGAR filingcodes on behalf of the company and thedirectors, Section 16 officers and 10%securityholders (confirm none of theseindividuals/entities already possessCIK/CCC codes)L&W 65.Have financial printer make a “test” filingand confirm CIK and CCC codes areacceptedL&W 66.Prepare Rule 134 press release to beissued at time of filing of registrationstatementIssuer / L&WInitial Filing of Registration Statement:67.A-10Confirm receipt of executed signaturepages to registration statement from alldirectors and officersLatham & Watkins – US IPO GuideIssuer / L&WIssuers are extremely limitedin what they can include inthe press release regardingthe IPO

leted68.Confirm receipt of executed signatureIssuer / L&Wpages to lock-up agreements and provideto underwriters’ counselUnderwriters will typicallyrequest that all lock-upagreements are signed anddelivered prior to commencingthe road show and sometimesprior to initial filing of theregistration statement69.Confirm receipt of executed auditor’sconsentIssuer /AccountantsIt is not necessary tosubmit a signed consent ina confidential submission,but verbal approval fromaccountants to file is alwaysadvisable 70.Consider submitting draft registrationstatement confidentially via EDGAR fornonpublic SEC reviewIssuer / L&WIssuer / L&WNo SEC filing fee is requiredfor a confidential submission Underwriters’CounselPayment of FINRA filing fee isdue within one business dayfollowing the initial filing withFINRA Note: issuer must publicly file initialsubmission plus all amendments at least15 days before conducting traditionalroad show71.If issuer is not submitting confidentially,calculate SEC filing fee; coordinate wiretransfer of fee to the SEC; have financialprinter confirm filing fee has beenaccepted prior to filingFiling fee is due at the time of the firstpublic filing72.Calculate FINRA filing fee; coordinatepayment of fee to FINRA Underwriters’ counsel willcalculate the fee and providewire instructions, but theissuer will submit the paymentto FINRANote that FINRA requires thefiling fee to be paid based ona “preliminary estimate” ofthe offering size even if theregistration statement hasbeen confidentially submittedto the SEC73.Conduct bring-down due diligence callwith CFO and general counsel priorto (day of) initial filing of registrationstatementIssuer /Underwriters /CounselAnnex A: Sample IPO Checklist A-11

f underwriters request, conduct “Testingthe Waters” meetings with QIBs and/orIAIsIssuer /Underwriters 75.Confirm acceptance of the company’sCIK and CCC EDGAR filing codesL&W 76.Publicly file or confidentially submitregistration statement with SEC (EDGARfiling deadline of 5:30 p.m. (EasternStandard Time))L&WUnless S-1 is confidentiallysubmitted, S-1 will be publiclyavailable as soon as it is filedwith SEC through EDGAR.SEC comment letters aremade public approximately20 business days afterregistration statement isdeclared effective77.Make initial filing through FINRA PublicOffering SystemUnderwriters’CounselFINRA filings must be madewithin three business days ofany filing with or confidentialsubmission to the SEC78.Submit registration statement toNYSE/Nasdaq for reviewUnderwriters’CounselIf submitting to NYSE,schedule company for reviewby Clearance Committee79.Accountants to deliver draft comfort letterto underwritersAccountants 80.Confirm quantities of registrationstatement to be distributed to variousparties of the working group; coordinatedistribution with financial printerL&W Post-filing of Initial Registration Statement:Completed 81.Within a week of filing the registrationstatement, contact SEC and determinewho the SEC examiner will be for theoffering and when the company canexpect to receive comments on the filing(typically 30 days following initial filing /submission date)L&W 82.Receive and respond to SEC comments;file / submit necessary amendments toregistration statement (SEC typicallytakes approximately two weeks to revieweach amendment to the registrationstatement)Issuer /Accountants’ consent will beUnderwriters / required to be filed with eachCounselamendment filing Receive and respond to SEC commentson confidential treatment request,if applicable (SEC typically takes atleast 30 days to respond to initial CTRapplication)Issuer / L&W83.A-12Latham & Watkins – US IPO GuideAttorney-in-fact will sign onbehalf of all directors

leted84.Prepare and deliver listing application,requisite copies of the registrationstatement and any other requireddocuments to NYSE/NasdaqL&W85.Prepare road show presentation;Underwriters / Information provided in roadmanagement, investment bankers andIssuershow must be consistent withlawyers to review pre-recorded roadinformation provided in redshow; company must make the electronicherringroad show available without restriction toUnderwriters frequently useany person (i.e., post the road show onnetroadshow.comits website, or on a commercial websiteapproved for such purposes, and grantunrestricted access or file road show withSEC)86.Finalize negotiation of underwritingagreement, power of attorney, andcustody agreementL&W /Underwriters’Counsel87.Obtain executed copies of anyoutstanding lock-up agreementsIssuer / L&W 88.Finalize listing application withNYSE/Nasdaq; deliver appropriatedocumentationIssuer / L&W 89.Finalize any necessary “corporateL&W / Issuerhousekeeping” and corporate governancedocuments (e.g., post-IPO certificate ofincorporation and bylaws; adoption ofcommittee charters/governance policies) 90.Prepare and have board authorizeresolutions adopting: Underwriters will want powerof attorney and custodyagreement to be executedand shares placed in custodyprior to commencement ofroad show; transfer agenttypically acts as custodian L&W / Boardof Directors L&W public company certificate ofincorporation public company bylaws committee composition committee charters Section 16 officers and “executiveofficers” lists governance policies stock split91.Prepare any necessary stockholderconsentsAnnex A: Sample IPO ChecklistA-13

dvise banknote company of offeringschedule; obtain specimen stockcertificate; determine lead time forprinting of stock certificatesL&WSpecimen stock certificatemust be filed as an exhibit tothe registration statement93.Prepare certificate of appointment ofL&Wtransfer agent and other necessarydocuments (typically transfer agent needsexecuted certificate of appointment priorto effective date of registration statement)94.Obtain CUSIP number from CUSIPService Bureau (www.cusip.com)L&W95.Prepare Form 8-A for Exchange ActregistrationL&W96.Determine any changes to the proposedMaximum Aggregate Offering Priceto be included in the fee table ofthe registration statement (considerconverting to Rule 457(a) fee table)Issuer /Underwriters /L&W 97.Determine price range of offering andsubmit supplemental price range letterto SEC if there are potential cheap stockissuesIssuer /Underwriters 98.If issuer is submitting confidentially,L&Wpublicly file all confidential submissions atleast 15 days prior to the road show99.Update FINRA filing to reflect initial public Underwriters’filing and pay additional FINRA filing fees, Counselas applicable100.Effectuate stock split, if applicableIssuer /Accountants /L&W101.Confirm no further SEC comments onS-1 and confidential treatment requestL&W 102.Prepare and deliver preliminary blue skymemoUnderwriters’Counsel A-14Latham & Watkins – US IPO GuideCompleted The 8-A registrationstatement registers thecompany’s common stockunder the Exchange Act andis effective immediately uponthe Securities Act registrationstatement being declaredeffective by the SEC Additional FINRA filing feeswill be required based ontotal aggregate dollar amountof securities registered(including over-allotmentoption)

leted103.File and print preliminary prospectus(referred to as the red herring)L&W / PrinterAdditional FINRA filing feesmay be required based ontotal aggregate dollar amountof securities registered(including over-allotmentoption) 104.Prepare road show slides (confirm nomaterial departures from the registrationstatement disclosure)Underwriters/ Issuer /Counsel105.Road show commencesUnderwriters / Road show typically lastsIssuertwo weeks; CEO and CFOtypically participate; firstday of road show will bepresentations to underwriters’sales force teams 106.Launch press release under Rule 134L&W / Issuer107.Post pre-recorded road show on websiteUnderwriters / Netroadshow.comIssuerBetween Commencement of Road Show and Effectiveness of Registration Statement:108.Prepare pricing committee resolutionsL&W109.Prepare Form 3s and Form 4s fordirectors, Section 16 officers, and 10%securityholders (obtain any remainingCIK/CCC codes)L&W110.FINRA matters:Underwriters’Counsel Underwriters to obtain “no objections”clearance from FINRA regardingreasonableness of underwriting termsand arrangementsSEC will not declareregistration statementeffective without FINRAclearance Provide underwriters’ counselwith name and telephonenumber of SEC examiner FINRA notifies SEC of “no objections”determination 111.Confirm that underwriters’ counsel hasresolved any outstanding blue sky issuesand completed blue sky registration andqualificationL&W /Underwriters’Counsel112.Analyze need to distribute and fileany FWPs (updating disclosure frompreliminary prospectus)L&W 113.Prepare and deliver to SEC company’sL&Wrequest for acceleration of the registrationstatement (48 hours prior to desiredeffectiveness time) 114.Underwriters to deliver to SEC letterjoining the company’s accelerationrequestWill only apply if securitieswill not be listed on a nationalsecurities exchange UnderwritersAnnex A: Sample IPO ChecklistA-15

ctive Date of Registration Statement:Completed115.SEC declares registration statementeffectiveSEC 116.Conduct pricing call with pricingcommitteeUnderwriters/ PricingCommittee 117.Pricing committee resolutions adoptedBoard ofDirectors118.Finalize and execute underwritingagreementIssuer /Underwriters119.Price offering and issue press releaseannouncing pricingL&W / Issuer 120.Accountants deliver comfort letterAccountants121.File Form 3s with SEC (directors, Section L&W16 officers, and 10% securityholders) 122.File Form 8-A registration statementfor Exchange Act registration (effectiveimmediately upon filing)123.Post corporate governance guidelines,Issuercommittee charters and code of businessconduct and ethics on company’s websiteas required by SEC and NYSE/Nasdaqrequirements124.Provide required link on company’swebsite to Section 16 filings and futureperiodic Exchange Act reportsIssuer 125.Conduct bring-down due diligence callUnderwriters/ Issuer /Counsel 126.Prepare final prospectusL&W L&WIf NYSE, file NYSE 303ACorporate GovernanceCertification no later than thenight before the initial tradingdateReferred to as 424(b)prospectusDay Following Effectiveness of Registration Statement:127.File 424(b) prospectus with the SECL&W128.File effectiveness notice, 424(b)prospectus, and final underwritingagreement with FINRA within threebusiness days of SEC filingUnderwriters’Counsel129.Prepare and deliver final blue sky memoUnderwriters’Counsel130.Trading commences on Nasdaq/NYSEN/AA-16Latham & Watkins – US IPO GuideAdditional FINRA filing feesmay be required based ontotal aggregate dollar amountof securities registered(including over-allotmentoption)

TaskNo.DescriptionResponsibleParty131.Finalize closing documentsL&W /Underwriters’Counsel officers’ certificate secretary’s certificateNotes/StatusCompleted legal opinions other132. Prepare summary “funds flow memo” forclosingClosing: 133.Conduct bring-down due diligence callUnderwriters /Issuer /Counsel134.Confirm no stop orders have been issued L&W /on registration statementCounsel135.Confirm receipt of executed copies of allclosing documentsL&W /Underwriters’Counsel136.File public company certificate ofincorporation with applicable secretary ofstateL&W 137.Underwriters to wire funds to company(and selling stockholders, if applicable)Underwriters 138.File Form 4s, if applicableL&W139.Deliver final copies of prospectus toapplicable parties (i.e., FINRA, NYSE/Nasdaq, CUSIP bureau, transfer agent)L&W /Underwriters’Counsel 140.Issue press release regarding closing ofofferingIssuer / L&W 141.File S-8 registration statement coveringstock option plans (effective immediatelyupon filing)L&W If NYSE, deliver final NYSEListing Application within30 days of initial listing dateAnnex A: Sample IPO ChecklistA-17

34. Assess SOX 404 compliance — review internal control over financial reporting and disclosure controls and procedures (if issuer is an EGC, issuer is exempt from auditor attestation requirements of SOX 404(b) for so long as issuer is an EGC; non-EGC issuers have until the 2nd annual report to comply with SOX 404(b)) Issuer / Accountants / L&W